How Much You Need To Earn To Be in the Top 1% in Each State

SmartAssets released a study indicating what it takes to be the top 1% in each state, highlighting the stark differences between the cost of living among various states. Surprisingly, New York is not in the top five.

Coastal States Top the Charts

1. Connecticut

Connecticut, known as the Constitution State, is first on the list. To attain membership in the top 1% of taxpayers, residents have to earn approximately $952,902

2. Massachusetts

In Massachusetts, individuals must earn at least 903,401 to belong to the top 1% of taxpayers. This particular tax bracket is subject to the fourth-highest tax rate in the country.

3. California

The state with the highest population in the country has the third-highest income requirement to be categorized as a top 1%. California residents who surpass the income threshold of $844,266 are subject to an average tax rate of 26.95%, placing the state among the top five states with the highest rates.

4. New Jersey

To qualify as a top 1% taxpayer in New Jersey, an individual must have an income threshold of $817,346, with the top earners subject to the third highest tax rate nationwide.

5. Washington

Washington requires households to have a minimum annual income of $804,853 to qualify as the top 1%. Notably, these high-income earners are subject to an average tax rate of 25.99%, lower than the other top states due to the absence of state income tax.

6. New York

Residents of New York earning above $776,662 fall into the category of top 1% taxpayers. The average tax rate for the top 1% of taxpayers in New York is 28.29%, the second-highest nationwide.

Southern States Have Lower Income Thresholds

Certain Southern states exhibit lower income thresholds, necessitating a relatively lesser income to qualify in the top 1%. Residents of West Virginia require a mere $367,582 to be in the top 1%, denoting the lowest income level within the study.

Among the Southeast states, six out of the 10 have the lowest income thresholds. The top 1% income disparity between states is so huge that to be classified in the top 1%, an individual must earn nearly three times the income in Connecticut compared to West Virginia highlighting the difference between HCOL vs. LCOL areas.

The bottom five are West Virginia, Mississippi, New Mexico, Kentucky, and Arkansas.

What Does It Take To Be in the Top 1%

Individuals need to earn more than $500,000 to be part of the top 1% in all except 12 states. It is essential to adopt a strategic approach to increase your income to qualify for the top 1%

Invest in Yourself

Assess your current earning potential and identify skill gaps that must be addressed to advance your career. Explore job opportunities with higher earning prospects or negotiate a salary increment with your current employer. Investing in yourself by acquiring high-income skills is the best approach to maximizing your human capital.

Pursue Side Hustles That Can Turn Into Businesses

Becoming a billionaire is more accessible by owning a business, a common trait many of the world’s wealthiest individuals share. Owning your own business gives you total control over your income potential and the direction of your enterprise.

This entrepreneurial path often starts modestly, with a simple side hustle. The beauty of a side hustle is that it can be launched while still maintaining the security of your full-time job. Over time, as your side hustle grows and becomes profitable, you can transition from an employee to a business owner.

Your side hustle allows you to test the waters, refine your business model, and ultimately shift to full-time entrepreneurship when right. Your side hustle could be the springboard that propels you into the elite club of business owners and, possibly, billionaires.

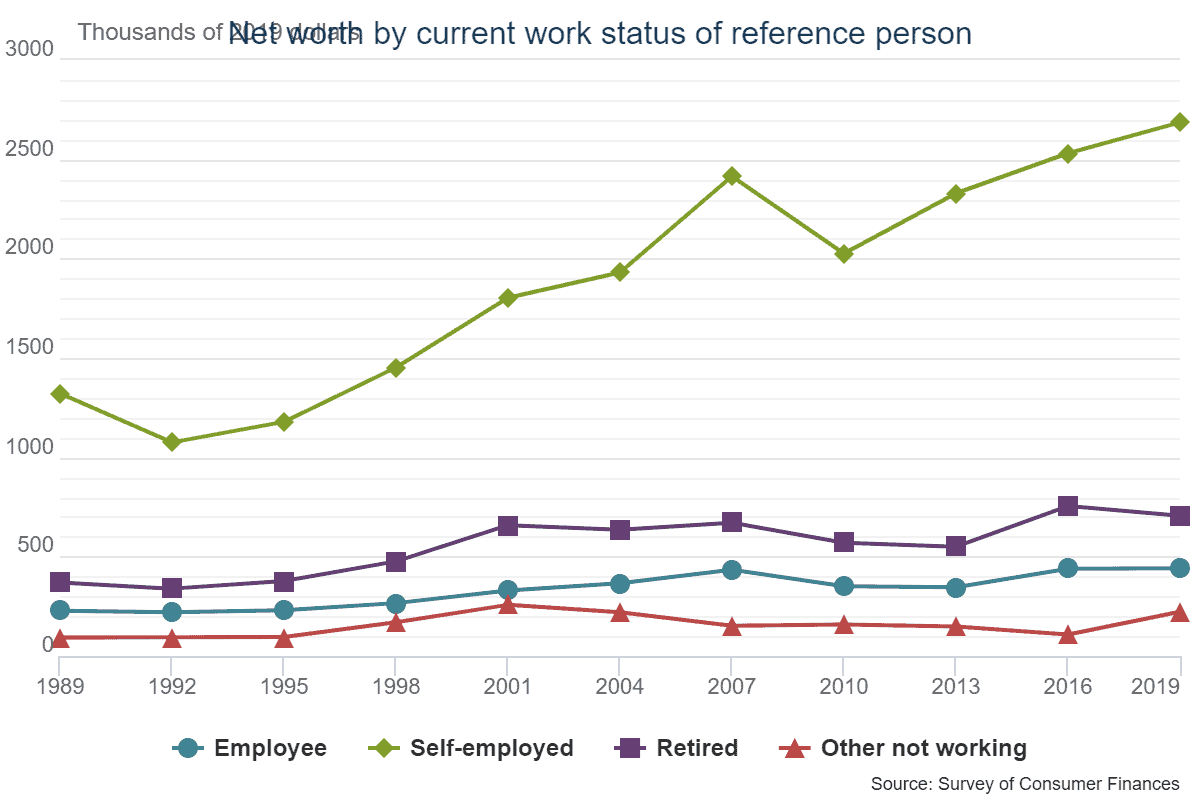

As per the latest Survey of Consumer Finance results released by the Federal Reserve, work status plays a huge role in the average net worth.

The decade-long chart shows that the net worth trend favors self-employed individuals more than employees. The best way to increase your net worth is to start a business.

When we evaluate the various types of businesses, online business is the best due to the risk/reward ratio.

- The low cost of starting an online business and the opportunity for passive income make it an ideal diversified income source.

- Besides, you can avail of several tax exemptions and live in a low-cost country/state to make it even more profitable.

- Given the digital economy, more and more of our world will move online. Automated tools make it easy to start a website in 10 minutes with zero computer programming skills.

Unlike physical business, it is effortless and cheap to create a website. You can start a website for a low monthly fee of $4.95/month.

Setting up a website or blog is considered active initially because you need to produce content. But, the internet provides infinite leverage in terms of audience. The content created once can be sold repeatedly, with no extra cost.

Contrast online with a physical business where you have ongoing manufacturing costs to generate extra sales. Also, the one-time effort to create content pays off in the long run. You no longer need to create new content. Marketing the already-created content will result in a passive income stream for the future.

And you do not need to be an expert. Everyone loves to learn from their peers.

The topic does not need to be complex, either. Make money from your hobby.

My friend started a kitchen herb garden and now sells e-books on herb gardening from her website. Another friend is offering keto recipes on his website. With low costs to start an online business, there is no reason not to start. Check out my guide on how to create a website in 10 minutes.

Christopher Clepp, Financial Planner, says, “A fundamental principle for these clients is the reinvestment in themselves and their businesses, their most significant assets. They often invest in ongoing education, skill enhancement, and reinvestment in their business as part of their wealth generation strategy.”

Buy Assets

High-income owners should also consider exploring investment opportunities to maintain their lifestyle. They should also aim to balance risk and reward, considering their financial goals and risk tolerance.

To secure a steady income stream, they can diversify their investment portfolio across various income-producing assets, including stocks, bonds, real estate, and alternative investments. Reinvesting the returns from these investments is crucial, as compound interest can significantly increase wealth over time.

Regular reviews of investment strategies and adjustments based on market conditions can further optimize earnings. Lastly, consulting with financial experts or using investment management services can help high-income owners make informed decisions for creating generational wealth.

Higher Tax Rates in Top-Earning States

When discussing income thresholds, it is crucial to consider the effective tax rates applicable to high-income earners across various states.

Connecticut, which has the highest income needed to be in the 1%, also has the highest effective tax rate of 28.4%, followed by New York at 28.29%

- Connecticut – 28.40%

- New York – 28.29%

- New Jersey – 28.01%

- Massachusetts – 27.15%

- California – 26.95%

- Illinois – 26.35%

Incidentally, the states with the highest tax rates are also the states losing population as per the latest annual trends.

Although some states have lower tax rates, even for their top 1% income earners, the lowest tax rate is above 21%. Arkansas, which ranks 46th in terms of the 1% income qualifier, has the lowest rate of 21.11 %.

There are several strategies available to reduce tax liability within a fiscal year. Maximizing contributions to 401(k) or comparable pre-tax accounts can decrease taxable income by $22,500 in 2023.

Additionally, individuals enrolled in high-deductible health plans can make tax-deductible contributions of $3,850 to a health savings account for triple tax advantages.

Furthermore, investing in real estate also provides several tax advantages, such as accelerated depreciation, QBI for rental properties, and 1031 exchanges. When deciding between Airbnb or rental property, note that Airbnb can be used to generate losses to be written off against W2 income. Work with experienced real estate tax planning professionals to ensure you meet the IRS material participation rules.

Rumblings in Washington, DC

No matter how one analyses the data, the income gap between the top 1% and the remaining population has been increasing. According to the US Census Bureau report on income and inequality, the average American household earned a median income of approximately $70,784 in 2021. The Congressional Budget Office reported last year that the top 1% of wealthy US families held more than a third of the country’s total wealth.

As America heads to the polls next year, inequality in income and wealth is expected to dominate the debates.

Ironically, the elite 1% residing in our nation’s capital topped the charts regarding income. If Washington DC were to be recognized as a state, it would have secured the top position in SmartAsset’s ranking, with an individual needing an annual income of $1,013,698 to be in the top 1% category.

Readers, are you planning to reach the top 1% income bracket in your state? What additional steps are you planning to ensure you reach your goal?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

![30 High-Income Skills Worth Learning [Without College Education] 6 High-Income Skills](https://financialfreedomcountdown.com/wp-content/uploads/2022/07/High-Income-Skills-768x432.jpg)