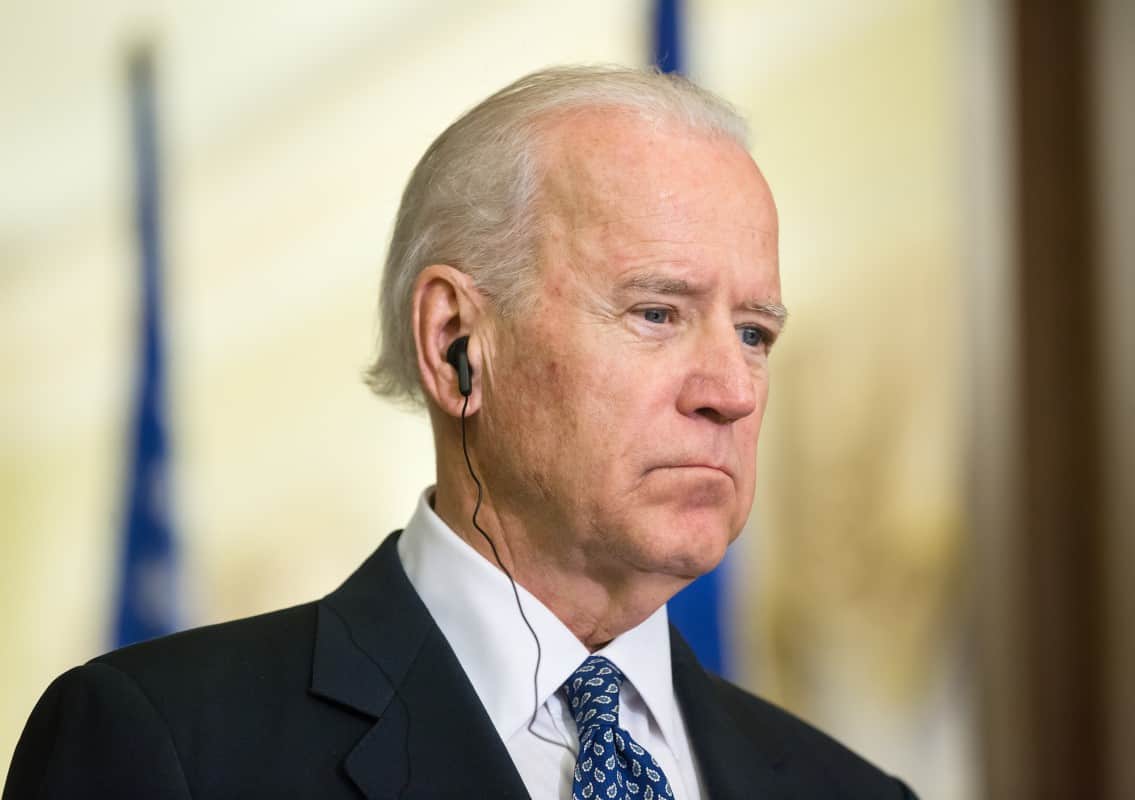

Biden’s Bold $7.3 Trillion Budget Blueprint: A Game Changer for His Election Campaign?

President Biden has unveiled a $7.3 trillion budget, echoing last year’s proposal with significant tax hikes and expanded social program spending.

The budget outlines approximately $5 trillion in new taxes targeting corporations and affluent individuals over the span of a decade. Administration representatives mentioned that these hikes would be evenly distributed between corporations and the wealthiest citizens. They also indicated that individuals earning below $400,000 annually would receive tax reductions amounting to $750 billion as part of their proposals.

Given the current divide in Congress, this proposal is unlikely to see immediate action. However, it may offer insights into the Democratic strategy for the coming year.

$4.7 Billion For Border Security

The budget plan allocates a $4.7 billion emergency reserve for border security. This fund is designed to bolster the Department of Homeland Security’s ability to intensify its operations “when responding to migration surges along the

Southwest border”. The provision allows DHS to utilize these funds as necessary when the number of migrants at the southern border exceeds a certain, yet unspecified, limit. Should these funds remain unused for surge purposes, they would be redirected to the general budgets of Customs and Border Protection (CBP), Immigration and Customs Enforcement (ICE), and the Federal Emergency Management Agency (FEMA).

In response to unprecedented numbers of migrant and asylum seeker crossings, the Biden administration’s proposal seeks to enhance border security by adding 1,300 new Border Patrol agents, 1,000 more Customs and Border Protection officers, and expanding the team with 1,600 additional asylum officers and support staff. Furthermore, the plan includes the creation of “375 new immigration judge teams” aimed at reducing the backlog of immigration cases.

National Security Priorities – Ukraine, Israel, and Indo-Pacific

Restates the Administration’s Call for Prompt Funding to Address Critical National Security needs in Ukraine, Israel, and the Indo-Pacific Region. In October 2023, the Administration sought urgent funding from Congress, amounting to $92 billion, to address critical national security concerns up to the end of 2024. This request included allocations of $58 billion for the Department of Defense, $32 billion for the Department of State and the U.S. Agency for International Development, and $2 billion for the Department of the Treasury. Key areas of focus were providing $61.4 billion in support of Ukraine in its defense against Russian aggression, $14.3 billion for Israel to combat terrorism, $10 billion for humanitarian aid including support for the Palestinian people, $3.4 billion to bolster the Submarine Industrial Base, and $4 billion for various other national security initiatives.

Biden suggests allocating $895 billion for military programs in the upcoming fiscal year, a slight increase from the anticipated $886 billion for the current year.

Child Tax Credit

The Child Tax Credit (CTC) isn’t a new tax credit; it has existed since the 1990s. However, in 2021, legislators extended the $2,000 credit to reach as high as $3,600. In this expansion, families received half of the CTC in monthly installments over six months, granting them up to $300 per child for each of those months. Biden’s proposal would increase the child tax credit to $3,600 for children under six and $3,000 for older children, compared to the previous $2,000, returning to the more generous version enacted in 2021.

Earned Income Tax Credit

Additionally, the plan would broaden the earned income tax credit, which supports low-income workers, to include individuals without children.

Biden’s proposal aims to enhance the Earned Income Tax Credit (EITC), which targets workers earning below approximately $64,000 annually. His proposal seeks to broaden eligibility to include more individuals without children and senior citizens.

Presently, the EITC predominantly benefits low- and middle-income families with children. For instance, workers without children are eligible for the EITC but are restricted to a maximum credit of $600. Conversely, families with three children can receive up to $7,430, according to IRS regulations.

Under the Biden plan, the EITC would encompass more low-wage workers without children and older Americans. On average, this expansion would reduce taxes by $800 for approximately 19 million working individuals and couples, as stated by the White House. This group would include 2 million workers aged over 65 and 5 million adults between 18 and 25 years old.

Affordable Child Care

Introduce a fresh initiative aimed at families with incomes below $200,000, ensuring accessible childcare from infancy to kindergarten. According to the White House, the majority of households would incur daily costs of $10 or lower, benefiting over 16 million children’s parents.

Establish a voluntary, cost-free preschool option for all 4-year-olds.

Starter Home Tax Credit

Offer $10,000 tax incentives to individuals purchasing their first homes or current homeowners dealing with “starter homes,” aiming to mitigate the expenses associated with home acquisition or property sale.

Carried Interest Tax Break Eliminated

Under the Biden plan, the carried-interest tax break, employed by private equity fund managers to reduce their tax liabilities, would be scrapped. Currently, investment fund managers can benefit from a 20% capital-gains rate on a segment of their earnings that would otherwise be taxed at the top individual-income rate of 37%.

Increased Capital Gains

The budget proposal aims to raise the capital gains tax rate to align the taxation of investment and wage income. This adjustment would result in a base rate of 39.6% for capital gains earned by individuals making at least $1 million, up from the current rate of 20%.

Increased Medicare Taxes

Biden is suggesting raising the Medicare tax from 3.8% to 5% for individuals earning over $400,000 to bolster the program’s trust fund. This adjustment would result in the wealthiest taxpayers paying a federal rate of 44.6% on investment income and other earnings.

As per the CBO projections, Medicare Hospital Insurance (HI) trust fund is on a countdown to insolvency, with just eight years left before depleting its reserves in 2031.

Increased Income and Corporate Taxes

Biden’s proposal involves increasing the highest personal-income tax rate to 39.6% for individuals earning over $400,000, up from the current 37%.

The corporate tax cut enacted during Trump’s presidency in 2017 would undergo substantial reversal, with the top rate reverting to 28% from its current 21%. Additionally, the plan proposes doubling the tax rate on foreign earnings of US companies to 21%, compared to the 10.5% rate set by Trump’s tax legislation.

This adjustment would overturn a tax reduction implemented during the Trump administration.

Death Taxes

The proposal also includes taxing assets upon the owner’s death, eliminating the benefit that previously allowed unrealized appreciation to remain untaxed when transferred to an heir.

Critics of the estate tax in the United States often argue that it imposes a heavy financial burden on family-owned businesses and farmland, potentially forcing them to liquidate assets to pay the tax bill. They also contend that it constitutes double taxation, as assets that have already been subject to income tax during the owner’s lifetime are taxed again upon death. Additionally, opponents argue that the estate tax discourages savings and investment, as individuals may be motivated to spend or give away their assets to avoid the tax, rather than reinvesting them in the economy. Some critics also argue that the estate tax is unfair or inequitable, as it disproportionately affects certain demographics, such as small business owners or farmers, and can lead to the dissolution of family enterprises.

Related: How To Setup a Revocable Living Trust

Billionaire Tax

Biden’s proposal entails implementing a 25% minimum tax rate on households valued at $100 million or more. This move would impose substantial tax increases on many of the wealthiest Americans, who currently benefit from tax preferences, allowing them to lower their tax bills to an 8% rate on their incomes.

Democrats have tried to implement various forms of wealth tax in the past but have not been successful.

Quadruple Stock Buyback Tax

The proposal seeks to quadruple the tax on stock buybacks, originally introduced in Biden’s Inflation Reduction Act, from 1% to 4%. Overall, buybacks can offer stock investors tax advantages, flexibility, potential share price appreciation, and a signal of confidence from the company, making them more favorable compared to dividends for some investors.

This adjustment aims to narrow the tax gap between share repurchases and dividends, encouraging companies to allocate funds towards wages or equipment instead.

Real Estate

The budget proposal aims to remove a tax loophole called “like-kind exchanges,” which permits real estate investors to evade taxes on the profits from property sales by reinvesting those gains into another real estate. 1031 exchanges are widely used when investing in real estate.

Related: 20 Ways To Invest In Real Estate With Little Or No Money

Missing Several Key Details

The budget proposal contains certain gaps, leaving areas unspecified. It advocates for extending tax cuts for the majority of households beyond 2025 without specifying the funding source. Additionally, it proposes a temporary restoration of the expanded child tax credit, integrating it into the larger tax discussion for 2025.

It outlines principles to strengthen Social Security without outlining a specific strategy. With Social Security headed towards insolvency in less than 10 years, Americans are wary of any proposals which do not solve the retirement crisis.

No Improvement in Federal Deficit

Despite this, the nation would still face historically high budget deficits, averaging about $1.6 trillion annually over the next decade according to administration projections. While deficits would decrease as a percentage of the economy during this period, the total government debt relative to the economy would see a slight increase.

Divided Congress

As the U.S. navigates the 2024 fiscal year without an approved comprehensive budget, a result of ongoing partisan deadlock, Congress has resorted to temporary spending measures to maintain government operations. Recently, it achieved partial progress by passing several essential budget bills, with a deadline looming on March 22 to finalize the remaining legislation. This stalemate shows little sign of easing, especially after House Republicans outlined a contrasting budget plan for 2025. Their proposal aims to slash $14 trillion in government expenditures, targeting areas like green energy incentives and student loan forgiveness, alongside tax cuts, to project a debt-free government within a decade.

Speaker Johnson released the following statement on the release of the House Budget Resolution for Fiscal Year 2025:

“At a time when the state of our union is in sharp decline, President Biden has proven he is unwilling to make the tough decisions to confront the reality of our nation’s unbalanced budget and weak economy. The reckless spending and economic damage done by this Administration and years of Democrats’ control has increased everyday costs for the American people.

We commend the early action taken by Chairman Arrington to release the House’s budget plan for Fiscal Year 2025 ahead of the President’s budget proposal. The House’s budget blueprint reflects the values of hard-working Americans who know that in tough economic times, you don’t spend what you don’t have — our federal government must do the same.

House Republicans have been long sounding the alarm on the fiscal challenges facing our nation and this budget plan takes steps to put the nation on the track to fiscal sanity.”

Senate Budget Committee Ranking Member Chuck Grassley (R-Iowa) issued the following statement, ”

“This administration’s irresponsible fiscal and regulatory record have wreaked havoc on our economy. Thanks to Bidenomics, families will pay thousands of dollars more every year just to cover higher costs of living. Meanwhile, President Biden plans to shelve tax relief for hardworking American families. And soon, the federal government will have to funnel more tax revenue towards interest than beneficial programs.

“The American Dream is farther out of reach with every passing year of Biden’s presidency. We must reverse course and address the nation’s ballooning debt, to rescue future generations from even greater economic harm.”

Like Financial Freedom Countdown content? Be sure to follow us!

Social Security Faces Insolvency in Just 10 Years

The Trustees of Social Security and Medicare unveiled their yearly financial forecasts for both programs, looking ahead over the next 75 years. The newly released projections for Social Security paint a grim picture of rapid progression towards insolvency in 10 years, underscoring the urgent need for trust fund remedies to avert widespread benefit reductions or sudden adjustments in taxes or benefits.

Social Security Faces Insolvency in Just 10 Years

U.S. National Debt Soars, Adding $1 Trillion Every 100 Days – Why It Matters

The US National Debt began the year at $34 trillion and surged to $34.47 trillion by the end of February, piling on $470 billion in merely two months. With the debt continually compounding, it’s on a trajectory to swell by $1 trillion every roughly 100 days. At this rate of borrowing, the National Debt is projected to balloon by $2.8 trillion over the course of this year. With Federal Debt spirally out of control, what lies ahead for Americans and the US economy?

U.S. National Debt Soars, Adding $1 Trillion Every 100 Days – Why It Matters

Homeownership Crisis: How the American Dream Slipped Away in Just 4 Years

Today, aspiring homeowners face a daunting financial reality: earning over $106,000 is now a prerequisite for affording a home comfortably—an 80% increase from January 2020. Median income has risen only 23% in the same time frame putting the dream of homeownership out of reach for many Americans as per the latest report from Zillow.

Homeownership Crisis: How the American Dream Slipped Away in Just 4 Years

Why 1 in 5 Retirees Are Returning to Work? The Surprising Reasons Behind the Unretirement Wave

In recent years, the concept of retirement has begun to evolve beyond traditional expectations of leisure and relaxation. A surprising trend has emerged, reshaping our understanding of work and retirement’s roles in life’s later stages. As this phenomenon unfolds, we’re left to wonder: What’s drawing so many retirees back into the workforce?

Why 1 in 5 Retirees Are Returning to Work? The Surprising Reasons Behind the Unretirement Wave

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.