Social Security Faces Insolvency in Just 10 Years

The Trustees of Social Security and Medicare unveiled their yearly financial forecasts for both programs, looking ahead over the next 75 years. The newly released projections for Social Security paint a grim picture of rapid progression towards insolvency in 10 years, underscoring the urgent need for trust fund remedies to avert widespread benefit reductions or sudden adjustments in taxes or benefits.

What Are the Various Social Security and Medicare Trust Funds?

Social Security and Medicare program revenues are deposited into four separate trust funds. These trust funds utilize their asset reserves and income from specific funding sources, like the payroll tax, to disburse benefits for their respective programs. Each trust fund is legally bound to disburse only those benefits it is legally authorized to pay. Established by Congress, these trust funds are overseen by the Secretary of the Treasury.

The four trust funds include:

– Old-Age and Survivors Insurance (OASI) Trust Fund

– Disability Insurance (DI) Trust Fund

– Hospital Insurance (HI) Trust Fund

– Supplementary Medical Insurance (SMI) Trust Fund

Although the OASI and DI Trust Funds are independent legal entities with separate operations, they are often jointly considered as OASDI. This combined view helps represent the overall health of the Social Security program.

How Are OASI and DI Trusts Funded?

The Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) programs are primarily funded through payroll taxes, taxation of Social Security benefits, and interest earned on the reserves of their trust funds.

These programs primarily draw their funding from payroll taxes, which are contributions made by employees, employers, and self-employed individuals. Self-employed individuals pay a rate that combines both the employer’s and employee’s contributions.

The payroll taxes for OASI and DI are levied on earnings up to a yearly cap ($160,200 in 2023), which typically rises annually in line with increases in the national average wage.

How Are Medicare HI and SMI Trusts Funded?

The Hospital Insurance (HI) program, which supports Medicare, is funded through payroll taxes, income taxes on Social Security benefits, beneficiary premiums, and interest earned on its trust fund reserves.

Much of HI’s funding comes from payroll taxes, set by federal law without an upper limit on taxable earnings. This includes an additional HI tax of 0.9 percent on incomes exceeding $200,000 for individuals and $250,000 for couples filing jointly. Additionally, HI benefits from monthly premiums from those voluntarily enrolled in Medicare Part A.

The Supplementary Medical Insurance (SMI) program, covering Medicare Parts B and D, is financed through government contributions, premiums from enrollees, state payments, and reserve interest. Government contributions, determined in advance based on estimated yearly program costs, are the primary funding source for SMI.

Enrollees in Medicare Parts B and D contribute through monthly premiums designed to cover the remaining costs not covered by government contributions. These premiums are adjusted upwards in response to increases in the programs’ estimated costs under current legislation.

Programs Current Paying Out More Than the Receipts

In 2022, the expenses of the Old-Age and Survivors Insurance (OASI) Trust Fund, amounting to $1,097.5 billion, surpassed its revenues by $40.7 billion. On the other hand, the Disability Insurance (DI) Trust Fund saw its revenues of $165.1 billion outstrip expenses by $18.6 billion.

When considering the activities of both funds together, Social Security’s overall expenditures exceeded its income by $22.1 billion.

Social Security Is Grappling With Significant and Escalating Financial Shortfalls

The 2023 Trustees’ report indicates that the Old Age and Survivors Insurance (OASI) trust fund will exhaust its reserves by 2033. The program is unable to provide full benefits under current legal stipulations for the majority of today’s retirees. When considering the Social Security Disability Insurance (SSDI) alongside OASI, the combined trust funds are expected to run dry by 2034. This timeline coincides with the moment today’s 56-year-olds reach full retirement age, and the youngest of current retirees hit 73.

The Old-Age and Survivors Insurance (OASI) Trust Fund is projected to cover all scheduled benefits until 2033 fully.

Once the fund’s reserves are exhausted, the program’s ongoing income will only be able to cover 77% of the planned benefits.

Social Security Used To Run a Surplus Until 2021

For more than thirty years, Social Security amassed a substantial trust fund reserve, providing a financial resource to support benefit payments. Throughout this extended period, the program consistently generated a surplus from payroll taxes and other income, surpassing its expenditures on benefits and other costs.

This surplus was judiciously invested by the Treasury in interest-bearing Treasury securities, culminating in a total of $2.9 trillion in trust fund reserves.

Redeeming these reserves to assist in funding benefits commenced in 2021 when the program’s total cost surpassed its income. These trust fund reserves will act as a financial bridge, covering the gap between income and expenses until their anticipated depletion in approximately a decade.

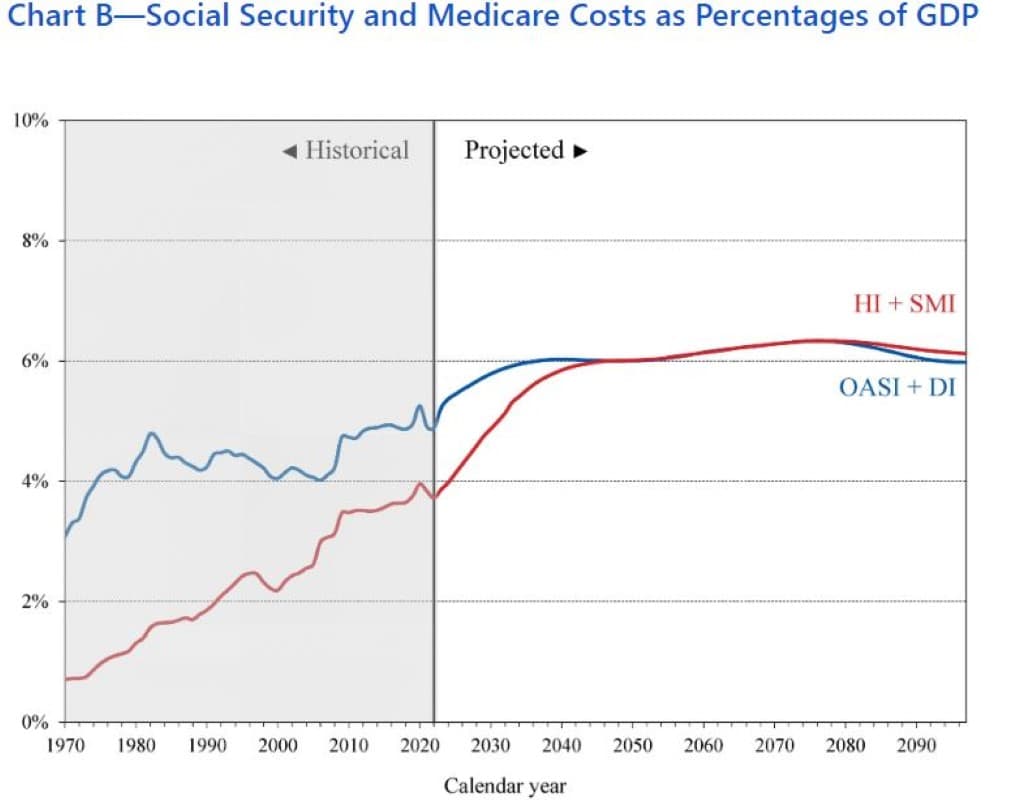

Social Security and Medicare As Percentage of GDP

Over the upcoming decade, Social Security is projected to experience cash shortfalls of $2.8 trillion, representing 2.4 percent of taxable payroll or 0.9 percent of the Gross Domestic Product (GDP). These annual deficits are expected to increase to 3.5 percent of payroll (1.3 percent of GDP) by 2040 and rise to 4.4 percent of payroll (1.5 percent of GDP) by 2097. The program’s 75-year fiscal discrepancy is calculated to be 3.6 percent of payroll, equivalent to 1.3 percent of GDP, or $23.6 trillion in today’s dollars.

In 2023, Medicare’s yearly expenses constitute approximately 74 percent of the annual expenditures of Social Security. By 2048, it is projected that Medicare’s costs will reach or surpass those of Social Security, maintaining this level through 2097.

The growth in expenses for both programs is expected to outpace GDP until the mid-2030s, primarily driven by the swift aging of the U.S. population.

The Rise in Inflation Has Worsened the Situation

Social Security’s financial situation is on a declining path. A recent spike in inflation has further weakened Social Security’s financial health compared to the 2022 report, hastening the path to insolvency by a year and adding 0.2 percentage points of payroll to the 75-year actuarial deficit. This shortfall is nearly double in terms of payroll share, which was anticipated back in 2010.

No Time To Lose

The window to safeguard Social Security is rapidly closing. With just 10 years remaining to ensure the program’s solvency, policymakers’ delays will only escalate the magnitude and expense of the required reforms. Prompt action opens up a broader range of strategies, permits smoother implementation, and affords workers ample opportunity to prepare and adapt.

Medicare Also Running Out of Funds

At the same time, the Medicare Hospital Insurance (HI) trust fund is on a countdown to insolvency, with just eight years left before depleting its reserves in 2031. This situation means that Social Security and Medicare are at risk of being unable to provide full benefits to many of today’s beneficiaries and future beneficiaries.

CBO Projections Corroborate the Social Security Trustee’s Report

The results reported by the Social Security Administration Trustees align with recent projections by the Congressional Budget Office (CBO) released in Feb 2024. The CBO estimated that the Old-Age and Survivors Insurance (OASI) and Hospital Insurance (HI) trust funds would face insolvency by 2032, while the combined reserves of the Social Security trust funds would be depleted by 2033.

Delays in Fixing Social Security Will Prove To Be Costly

Necessary adjustments are imperative to secure Social Security’s solvency, and the urgency of such changes cannot be overstated.

In their report, the trustees advocate for lawmakers’ timely intervention to address projected trust fund shortfalls. This approach allows for the gradual implementation of necessary changes, providing workers and beneficiaries with ample time to adapt. Swift action empowers policymakers to make targeted adjustments, improve benefits for vulnerable populations, and ensure that reforms contribute to economic growth.

Postponing action until 2034 would amplify the required tax increases or benefit reductions by about one-fifth compared to taking action today. Acting promptly mitigates the financial strain and facilitates a smoother transition.

Funding Issues Were Fixed in 1983

In 1983, Social Security encountered a significant financing challenge, leading to comprehensive reforms that resolved the immediate crisis and secured the program’s stability for the ensuing decades. Several key actions were taken promptly, including

– delaying the cost-of-living adjustment for benefits by six months,

– speeding up the implementation of planned increases in payroll taxes,

– expanding Social Security to include new federal and non-profit employees,

– and introducing taxes on benefits for those with higher incomes.

Additionally, the normal retirement age—the age at which one is eligible for full benefits—was increased, and Social Security benefits became taxable.

These reforms were projected to maintain the program’s solvency until 2060.

In 1983, the national debt was in better shape than it is currently.

Dire Projections on the National Debt

The CBO report, which indicated the Social Security and Medicare Trust Fund shortfall, offers no respite and has dire projections for the National Debt.

Federal debt is poised to hit a historic high, reaching 116 percent of GDP by 2034. According to CBO estimates, the public debt will surge by $21 trillion under the existing legal framework within the next ten years, totaling $48 trillion by the fiscal year end of 2034.

Interest expenses are set to soar. Interest costs, having nearly doubled from $345 billion in 2020 to $659 billion in 2023, are expected to double again, reaching $1.3 trillion by 2031 and hitting a record $1.6 trillion, or 3.9 percent of GDP, by 2034. Interest expenses have surpassed Medicaid costs and are projected to exceed the expenditures on defense and Medicare within the year.

The soaring National Debt is now adding $1 trillion every 100 days.

Why Is Social Security Important?

What remains indisputable is that Social Security stands as one of the nation’s most triumphant, efficient, and well-received programs. Serving as a bedrock of income, Social Security offers a platform for workers to construct their retirement plans, extending valuable social insurance protection to those facing disability and families affected by the loss of their primary earner. The benefits bestowed by Social Security play a crucial role in poverty reduction, elevating more individuals above the poverty line than any other program in the United States.

How To Address the Social Security Trust Fund Gap

Policymakers must confront the issue, opting for solutions such as reducing benefits, increasing taxes, or employing a combination of both. Neither option is popular with Americans who have contributed to both programs for decades with the promise of receiving payments at retirement age.

The Social Security Administration has already started preparing Americans for the worst by stating in its marketing material, “Social Security was never intended to be a person’s sole source of income in retirement. It is designed to provide economic security in retirement along with savings and employer-sponsored retirement benefits.”

How Can You Supplement Your Social Security?

Americans have few choices in their golden years. They can either sacrifice their quality of retirement life or continue to work longer. Younger Americans must start saving and investing aggressively, assuming the current dire projections worsen as they retire.

While financial experts suggest setting aside 10% to 15% of your yearly income, initiating your savings journey with a modest amount and progressively increasing it is a viable approach, particularly if you carry outstanding debts from credit cards, healthcare expenses, or student loans. Use a free tool like Personal Capital from Empower to automatically create a budget based on your current spending.

Prioritizing your employer-matched 401(k) contributions is crucial, as it essentially translates to free money. Many employers extend matching contributions, typically ranging from 2% to 4% of an employee’s annual salary which can be invested in stocks.

Once you’ve maximized your 401(k) employer match, exploring additional avenues like an individual retirement account (IRA) becomes a consideration. An IRA, separate from your employer, offers options such as the traditional retirement account and Roth IRA, both popular choices for long-term savings.

Besides stocks, one can also invest in real estate. If you do not want to be a landlord dealing with tenants and toilets, crowdfunded real estate platforms offer options to invest with General Partners managing the deals.

Social Security Is Popular

As per a recent Gallup poll, among individuals in the United States who have not yet retired, 50% anticipate receiving a benefit from the Social Security system when they retire. In comparison, 47% hold the opposite expectation.

Moreover, 53% of current U.S. retirees believe they will continue receiving their complete Social Security benefits—an increase from 37% in 2010 to 49% in 2015. Conversely, 43% of retirees believe their benefits will eventually be reduced.

Despite the enhanced optimism observed among retirees and those yet to retire, neither cohort expresses a more positive outlook regarding the future of their Social Security benefits than sentiments in the 1980s, 1990s, and early 2000s.

Individuals who have yet to retire are inclined to view a 401(k) plan as a significant income source in their retirement, surpassing their consideration for Social Security.

However, for current retirees, Social Security stands out as the predominant source of income, emphasizing its significance among the elderly population in the United States.

According to the survey, the youngest adults, aged 18 to 29, exhibit a split opinion, with 50% anticipating Social Security benefits and 48% not expecting them.

In terms of political affiliation, Democratic non-retirees (60%) are more likely than their Republican (50%) and independent (45%) counterparts to expect Social Security benefits in retirement.

Notably, significant partisan variations emerge when considering current retirees’ confidence in preserving their Social Security benefits.

Democratic retirees (69%) display considerably more confidence compared to Republican retirees (39%) regarding the avoidance of cuts to their Social Security benefits.

Americans anticipate Social Security becoming one of the focal points in the 2024 presidential campaign.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.