CPAs make mistakes on your tax returns and how to avoid errors

Today, April 15th is Tax Day in USA. I hope most of you would have already filed your taxes or at least an extension. I found a few glaring mistakes in my tax returns which inspired this post. CPAs do make mistakes on tax returns inadvertently. Sometimes these errors are noticed by the IRS but often they do go unnoticed. We will address 8 tips on how to avoid common errors.

I am sure your heads must already be spinning after completing your own returns; so before we delve too deep into my numbers; here are some fun historical facts

Fun tax ice breakers for a party

- Prior to the early 20th century, most federal revenue came from tariffs rather than taxes.

- The Revenue Act of 1861 had introduced the first federal income tax, motivated by the need to fund the Civil War. That tax was repealed in 1872

- The 1894 Wilson–Gorman Tariff Act contained an income tax provision, but the tax was struck down by the Supreme Court in the case of Pollock v. Farmers’ Loan & Trust Co. For several years after Pollock, Congress did not attempt to implement another income tax, largely due to concerns that the Supreme Court would strike down any attempt to levy an income tax.

- In 1909, Congress proposed the Sixteenth Amendment to the states. Shortly after the amendment was ratified, Congress imposed a federal income tax with the Revenue Act of 1913.

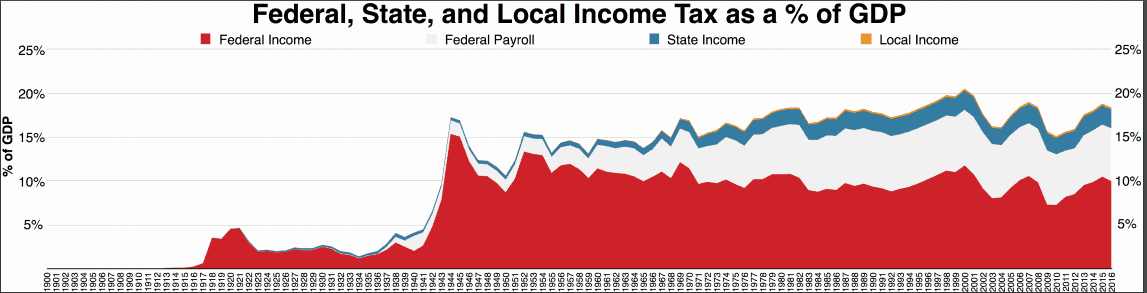

Here is a graphic representation of how Federal, State and Local income taxes have changed over the years as a % of the GDP

Why Should You Worry About Your CPA Prepared Tax Returns

Vicki Robin in her famous book Your Money or Your Life equates money with life energy. Trusting someone else with money is equivalent to trusting that individual with your life.

Based on this, would you really trust your CPA or an investment adviser or a money manager with your life? If not, why would you trust them with your money?

To clarify, I am not a DIY person. I outsource everything from grocery shopping to gardening. I am a firm believer in division of labor and trust others with most activities; except money. One might even say I have trust issues with relying on others to have my best interest at heart wrt money. And maybe you should as well!

You have worked hard for your money. Sacrificed blood, sweat and tears to earn it. Make sure you guard it just like Smaug. OK! that was a bit extreme but you get the picture.

I have always used a CPA from my first year of filing taxes in the USA. The tax code is complicated and made up of over 70,000 pages. Not sure I would bother reading all of it. I rely on CPAs to stay current and updated wrt all the nuances of the tax code given that this is their core skill set.

One of the salient features of the TCJA was capping the SALT deduction to only $10,000 and increase in the limits of standard deduction. There were other provisions wrt limits on the mortgage interest deduction, child tax credit and Sec 199A to name a few.

When I reviewed my tax returns what do I notice

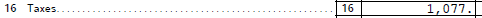

Bonus points for anyone who guesses what is wrong with this picture

For many folks living in HCOL areas, the best strategy was to take the standard deduction for federal and itemize for state. Of course, depending on your strategy this would vary widely. Imagine my horror when I noticed that my CPA had taken the lesser of the 2 deductions for my federal taxes. The optimal approach would have been to take the standard deduction and now my corrected returns have

The second error I noticed was an incorrect tax amount was used for Schedule E deductions on my rental property.

The correct amount should be

While I do not assume any willful negligence or malice on part of my CPA; this reinforces my desire to continue to outsource but double check the work of others who touch my money.

[bctt tweet=” Trust but verify is my motto; and should also be yours. Especially when dealing with money”].

I do not mean to pick on my CPA or other CPAs; but these errors are quite common. Over the last 13 years, I have noticed errors in my own returns every other year. And yes, these are different CPA firms as well so it is not an indication of quality or lack of; for a particular firm.

A friend over the weekend in passing mentioned she used a CPA to file her taxes. Since she also has a rental property, I asked her about the deductions. Turns out her CPA had not calculated depreciation. Anyone who has ever owned a rental property knows that the best gift the IRS provides is wrt depreciation. In fact, even if you do not claim the depreciation every year; the IRS will do a depreciation recapture when you sell the property. Hence you should always calculate depreciation and include in your schedule E.

How To Avoid Errors In Your Tax Returns

I do not have any magic wand or special software but here are the typical steps I follow.

- Study the high-level details of what are the changes when a major tax change occurs; and identify in advance how it might impact you. The limitations to SALT deductions, mortgage interest caps, changes in limits of standard deduction and Sec 199A were adequately covered in the press. I ignored the child tax credit since it was not relevant to me and did a slight deep dive in the areas I was affected. You should do the same.

- Make sure you maintain a list of all your financial accounts so you can validate that you have at least received some tax document from each of them. I have accounts at several institutions so that is always a challenge; especially banks and brokerage firms. Nothing looks worse in an audit when it turns out your 1099 was lost in the mail and the IRS knows your interest income and it was not included in your returns.

- Handover your documents to your CPA in advance so you have adequate time to validate the returns before they are filed. You can of course file an amendment but if possible, try to avoid it.

- Validate your 1040 (usually if you have wages), Schedule E (rental) and Schedule C (business). The forms are quite simple but typically they would cross reference other worksheets in which case you need to simply ensure that all details have been accurately captured. The IRS website does a pretty decent job of listing how to calculate each line on every form in case you have questions.

- Add up all your sources of income on the above 3 forms and make sure it is accurately reflected.

- Look at every line in the form for deduction and check if you have something for that particular line and if not; you should be asking your CPA about it. For example, Schedule E has several lines for expenses including depreciation. If all those lines are blank then alarm bells should be going off in your head.

- Make sure you take every possible deduction you are legally entitled. Often people are too worried about a potential audit and skip several eligible deductions. I have never undergone an audit but I am sure if you are required to substantiate a deduction; the IRS would either allow it or disallow. As long as you have done your best attempt at filing returns accurately and paying on time; I do not believe they would not throw you in Alcatraz.

- Pick a CPA who does taxes for similar demographic clients. If you work for a company and have ESPP, options or RSUs; find a CPA who has similar clients so they would be aware how to adjust the basis for your ESPP shares. If your CPA only relies on the 1099-B; you might be double taxed. Similarly, if you have a rental property; make sure your CPA has other clients who also have rental properties. I would assume that they can use the same tax saving strategies which they have already used with thousands of their other clients.

- While you are reviewing your current year tax returns; pay close attention to the deductions so you can plan accordingly on how to structure your income and expenses for the current year to reduce your tax liability going forward. Often people expect their CPA to find deductions for them when filing taxes. It is already too late by then because the actions which impact taxes; generally need to be carried out January to December. If you are an employee, use this information to compare offers when you switch jobs to improve human capital and accelerate financial freedom. If you are a real estate investor or run a business; similar planning wrt timing your income and expenses could help you stay in an appropriate tax bracket.

- Don’t worry if all this seems overwhelming to you. The tax code is complex but as you get started understanding one or two simple forms this year you would be better prepared for next year. The key is to start small and gradually build up over the next few years. Remember, this is a marathon and not a sprint and you would be hopefully filing taxes for a very long time.

Readers, do you believe that checking the work of your CPA is an overkill?

What other areas of your financial life are outsourced and how do you validate that they are as diligent with your money as you would expect them to be?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.