What Is ESG Investing And 5 Reasons Why It Is A Bad Idea

Prudent asset allocation and diversification involve owning multiple non-correlated assets. Historically, stocks have been one of the best assets to buy due to their liquidity, returns, and availability.

However, with the rise of social media, no one wants to invest money. We also want to beat the index and feel good about it.

As a result of greater awareness of companies’ impact on society, investments are now no longer ranked only based on returns. An increasing number of investors also want to encourage companies to focus on environmental and social issues making a positive impact on the world.

Let us take a look at ESG and SRI investing to determine if they hold promise.

What Is ESG Investing?

Environmental, social, and governance, or ESG investing, is a way to build a more ethical portfolio based on your beliefs. Individuals invest in companies upholding the ESG principles striving to make the world a better place.

For example, if you believe Chevron is polluting the earth, you would avoid buying any Chevron stock. You would also not invest in any ETFs or mutual funds holding Chevron stock. ESG Investing simplifies this process with the creation of ESG funds. Only companies which have a high ESG score qualify for inclusion in ESG funds or ESG ETFs

Difference Between ESG Investing And Socially Responsible Investing?

Socially Responsible Investing (SRI) is similar to ESG investing, with a lot of overlap in their ideologies. SRI is also called “ethical” investing and relies on Sustainable (S), Responsible (R) Impact (I) principles.

Sustainable implies that the company is making the best possible use of resources and replenishing any resources. For example, a lumber company would conduct logging sustainably and plant other trees. Most of the overlap between ESG and SRI companies is due to the Environmental and Sustainability aspects.

Responsible means that the company has a social duty to its fellow human beings. We all know that smoking is detrimental to one’s health. Hence any Socially Responsible Investing portfolio will exclude cigarette manufactures like Altria even if they have perfect environmental records.

Impact considers the specific impact a company is having on society. Since SRI is a subset of ESG investing, we will focus on ESG investing for the remainder of the article.

How Does ESG Investing Work?

ESG Investing works by creating a list of companies based on their ESG scores and investing in companies with a high ESG score.

How Are ESG Scores Calculated?

Companies are ranked based on their environmental, social, governance impacts and assigned a score known as the ESG score.

Let us break down each of these factors in detail.

Environment: What kind of impact does the company have on the environment? Do they create a lot of pollution and release toxic chemicals? Are they efficient with their usage of natural resources? Is there a lot of wastage in their manufacturing process?

Social: How does the company meet its social responsibility. Are they discriminatory in their hiring practices? Do they make marginalized communities feel unwelcome? Are they demonstrating diversity not only among their staff but also among the executive teams? Is their customer satisfaction rating the best? What is the track record of their supplier’s usage of child labor?

Governance: Does the company have transparent leadership in dealings with stakeholders such as customers, workers, communities they operate, and shareholders. Do they communicate and drive positive change? Do they shun bribery and corruption? Are they involved with lobbying efforts? Do they use political contributions to influence outcomes for their benefit favorably?

ESG Investing Trends

In 1970, Milton Friedman penned an essay for The New York Times titled “A Friedman Doctrine: The Social Responsibility of Business is to Increase Its Profits.” He argued that a company has no social responsibility to the public or society; its only commitment is its shareholders.

Times have changed.

Many clients are concerned with environmental and social impacts. So naturally, they want to also invest in line with their principles. As a result, ESG Investing has exploded.

Companies realizing that a high ESG score has a favorable impact on consumer behavior have started including more information about their ESG programs.

List Of ESG Investing Funds Or ETFs

Based on assets under management here are the 5 largest ESG equity funds

| # | Name | Assets ($ Billions) | Inception date | Fund Type |

|---|---|---|---|---|

| 1 | Parnassus Core Equity | 23 | 1992 | Active |

| 2 | iShares ESG MSCI USA Equity | 15 | 2016 | Index |

| 3 | Vanguard FTSE Social | 12 | 2000 | Index |

| 4 | Stewart Investors APAC Leaders Sustainability | 8 | 2003 | Active |

| 5 | Vontobel Fund MTX Sustainable Emerging Markets | 10 | 2011 | Active |

What Are The Benefits Of ESG Investing?

Some of the most commonly mentioned benefits of ESG investing are

- Helping environmental and ecological causes.

- Holding companies accountable for their actions

- Rewarding ethical companies based on their principles

- Ensuring a positive impact on the local communities

- Obtaining decent returns while making a difference.

However, matching the actual impact of ESG Investing to the touted benefits is challenging.

Reasons Why ESG Investment Funds Are Not Effective

I am sure everyone must be wondering if investing in ESG funds is profitable. If we all can feel good and make money simultaneously, isn’t that the best of both worlds?

Where do I sign up?

Not so fast!

Here are five reasons why I believe ESG investment funds are not good

ESG Principles Are Not Cheap

I am not convinced that companies with the highest ESG scores can generate more profit than lower ESG scores.

Over the long run, stock prices tend to reflect the amount of profit a company makes. As a result, one cannot adhere to the ESG principles and outperform your peers in the same sector. We might not like to admit it, but profitability comes at a cost.

Have you bought an article locally sourced and manufactured and then found the same item at Walmart at a lower price? I’d bet no. And that is why I do not believe ESG funds will outperform.

Everyone, including the government, is aware of this issue. Hence subsidies are often provided to alter the balance. However, if the grants are taken away or reduced, it can be hard to make a case for ESG stocks not underperforming.

In fact, here is a research paper from the Journal of Financial Economics that investing in sin stocks is more profitable.

ESG Funds Are Actively Managed

Although ESG funds track their respective indexes, the index itself is actively managed.

Based on the ESG scores, a fund manager actively makes buying and selling decisions. Besides the tax implications, you also have higher fees to pay for the active management efforts. Academic research has shown that actively managed funds underperform passive index funds after expenses.

Of course, you might believe the fund manager is as talented as the Medallion Fund. But Jim Simmons and Medallion fund is an outlier money printing machine.

Reduced Diversification

The criteria of ESG scores exclude entire sectors such as energy. Oil companies drills for oil. No matter how green they try to make the extraction process, I do not see a possibility of them meeting the ESG guidelines currently.

Similarly, if you use the SRI criteria, you would exclude tobacco, alcohol, casino stocks. Thus, you would be reducing exposure to several sectors following ESG or SRI scores.

Sector diversification reduces risks. Some parts of the economy do well while others falter. There is a reason the best retirement calculators assume you have a diversified portfolio.

Secondary Market Price Impacts Behavior To A Minimal Extent

A fundamental concept ESG advocates fail to realize is that lack of appetite for stocks on the secondary market has no significant impact on a companies operations.

Let us take Exxon as an example. If you don’t buy Exxon shares, it does not affect the company because it already issued stocks during IPO and obtained the necessary funding. Shares that are currently trading on the secondary market may fall in price if no one buys them, but that exchange is between existing holders of the stocks and future sellers. The company (Exxon in this case) is not involved in this transaction in any manner.

Of course, if Exxon wanted to raise additional capital and make a secondary offering (like AMC did recently), then the “boycott” due to low ESG scores makes sense. Or if the company is at the early stages of fundraising. Lack of demand for shares in the secondary market has minimal impact on the operational capital of the “offending” company.

If the stock price falls below the intrinsic worth, the company may buy back its shares.

Definition Of ESG Is Subjective

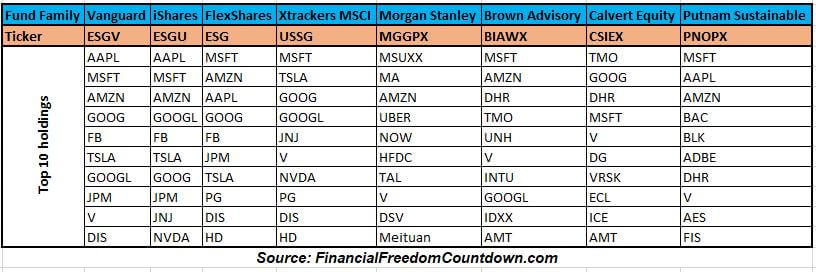

Although ESG scores are available, fund managers have tremendous latitude in interpreting ESG factors and the construction of ESG funds.

Let us take Calvert Equity Fund as an example of subjective ESG investing. As per their fact sheet, the top 10 holdings include Mastercard and Visa. Calvert invested in credit-card companies because “they can reduce inequality by promoting access to financing for people worldwide.”

I worked in the private label credit card industry as a strategy consultant. Credit cards have exorbitant interest rates and are designed to trap folks in debt. I use credit cards for travel rewards and pay my entire statement balance every month. In fact, some of the cards in my travel wallet provide benefits even when I am not traveling. But for people who do not have their financial house in order, are credit cards adhering to the ESG philosophy?

Performance Of ESG Investment Funds

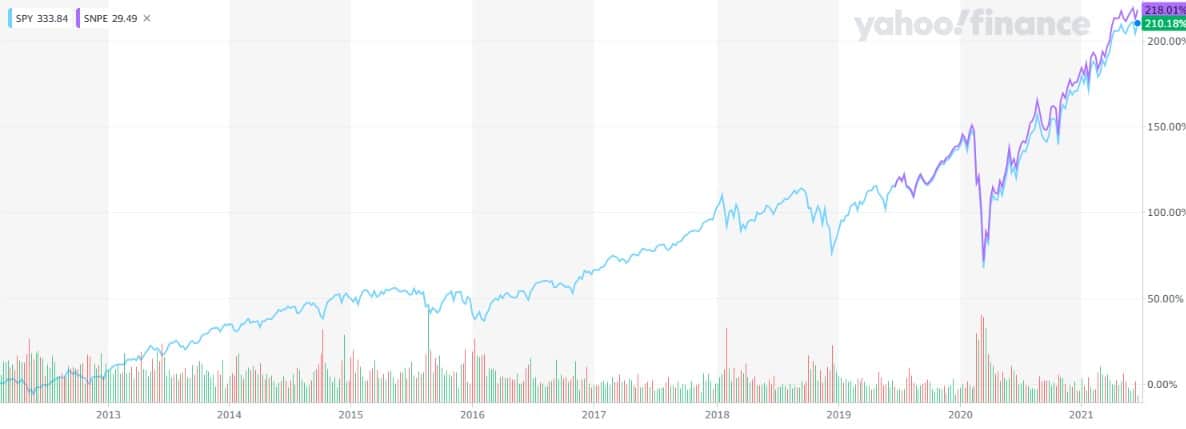

Now that I laid out the case for why ESG investing is not all roses let us look at the performance of ESG funds. To simplify the analysis, I am picking the S&P 500 ESG fund. Since its inception, the S&P 500 ESG fund has closely tracked the S&P fund performance and has not lagged.

Looking under the hood, we can better understand the reasons.

If we look at the ten most prominent companies in the S&P 500 ESG index since the launch, we see the most notable tech names – Apple, Microsoft, Amazon make up a large part of the fund. Technology has had an outsized performance compared to all other sectors in the last decade. Energy has the worst performance.

So in effect, any fund irrespective of ESG scores that is overweight in technology and underweight in energy would do exceptionally well.

But if we eliminate the sector bias, would ESG still outperform? Is there a point at which technology firms get so expensive they crash, dragging the ESG funds with them? Conversely, is there a price at which energy funds become so cheap they outperform the broader market?

What Are Good ESG Investments?

Based on the various ESG funds and the different companies included in each fund, it is hard to categorize any particular fund as a good ESG investment.

If you mean performance by good ESG investment, we have already determined that a proper sector-neutral ESG investment might underperform a similar index without the ESG filter.

If by good ESG investment, you meant a fund that adheres to the basic ESG principles, then again, it is a hard choice to pick one particular fund. Because what might be a good ESG company to you might not mean the same to me.

Let us look at Tesla, which was the most significant addition to the S&P 500 ESG index in 2021. Elon Musk has electric cars and solar panels as part of Tesla. But, unfortunately, he frequently virtue signals that Bitcoin uses too much energy without understanding that Bitcoin represents freedom to individuals living under oppressive regimes.

The electric cars made by Tesla need lithium. I have a sizeable investment in various lithium mining companies. And lithium mining companies rank as one of my four worst investments. The process to extract lithium is not “green.” Most of the mines are located in war-torn regions of the world. The labor used to extract lithium also does not meet my SRI criteria.

If I wanted to invest in an ESG fund, I definitely would not consider Tesla to be included in that list. Don’t get me wrong. I am not a Tesla short seller. I had selected Tesla in my moonshot portfolio, and it had a monstrous run. But it was chosen only for the potential price appreciation and not as part of an ESG investment.

Based on my concerns with lithium, would you still consider Tesla to be a good ESG candidate? What about the sources of electricity used to power Tesla? Although hydroelectric plants are supposed to produce energy in an environmentally friendly manner, there ecological considerations for building dams.

Another example of a stock where I am conflicted is Apple. I use Apple products and love the entire ecosystem built around their products and app store. However, when I struggled to find an accountability partner for my fitness, I relied on the Apple Watch.

Apple has outsourced its entire manufacturing operations to some questionable operatives. The controversy over Foxconn’s practices to Uyghur labor makes one wonder if Apple qualifies for many ESG funds.

Therefore, I believe it is hard to pick a good ESG investment ETF when considering all the ESG principles.

How To Buy ESG Funds

There are two ways to buy ESG Funds.

Pick an Index fund

You can look at the various ETFs already created by multiple firms, review the top holdings and criteria for inclusion and exclusion. And pick one ETF or a basket of various ESG ETFs.

Create Your Index

If none of the existing ETFs meet your criteria, you can also create your custom ESG investing index based on your pick of companies.

You can start by looking at the holdings of various ESG ETFs. And then pick the exact stocks which meet your criteria. For example, if you agree with my concerns on Tesla, you could choose to exclude it accordingly.

No matter which option you select, tools like M1Finance now permit you to create your basket of individual companies or ETFs to invest in for free with no fees. My M1Finance review article provides additional details on how the auto-balance feature enables one to dollar cost average into your ETFs or stocks without suffering the consequences of market timing.

Final Thoughts On ESG Investing

ESG is an excellent concept to invest in as per your belief system. After all, we should vote with our money.

However, be prepared for the underperformance of ESG funds compared to broad-based index funds.

Wall Street has created several ESG funds to take advantage of the investor interest in ESG. However, the criteria for inclusion and exclusion in ESG ETFs are still murky. The U.S. Securities and Exchange Commission (SEC) has taken notice and announced it was creating a Climate and ESG Task Force to “proactively identify ESG-related misconduct” such as inaccurate or incomplete disclosures by funds and companies.

If you want to invest in ESG funds, look at the various ETFs already created. Review the top holdings and criteria for inclusion and exclusion. And pick one or a basket of multiple ESG ETFs. Or create your own customized ESG index by choosing stocks meeting your criteria. In either case, be mindful that you are reducing sector diversification. At least make sure you are “time diversified” with dollar-cost averaging using a platform like M1Finance.

Readers, do you consider ESG investing to be part of your investment philosophy at this point? What are your favorite ESG funds? Which companies you believe are ESG friendly and should be added to the indices and excluded?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.