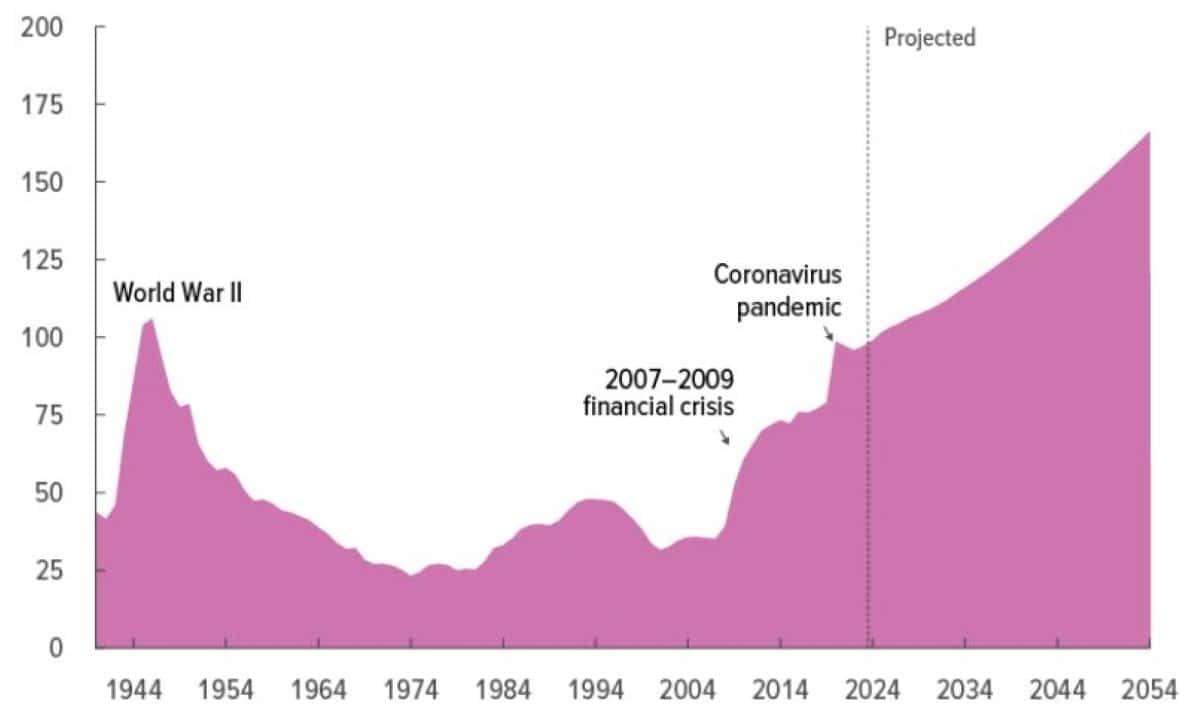

National Debt Exceeds Previous Projections, Signaling Troubling Times Ahead for the U.S. Economy as per CBO March report

The Congressional Budget Office (CBO) performs nonpartisan analysis for the U.S. Congress. The latest Budget and Economic Outlook released March 2024, offered dire projections for the country’s fiscal and economic landscape over the upcoming decades. Unfortunately the national debt is higher than initially anticipated and is projected to hit $141 trillion by 2054.

Record High Budget Debt

The federal debt’s proportion of the U.S. economy is on track to reach 107% of the GDP by 2029 and is expected to keep climbing for the following three decades, highlighting the country’s significant long-term fiscal challenges.

The debt is expected to swell to 166 percent of GDP by 2054.

Federal Budget Deficit Increasing

The deficit is expected to increase from the current high levels of 5.6% of GDP in 2024 to 8.5% of GDP by 2054.

Gap Between Spending and Revenue Increasing

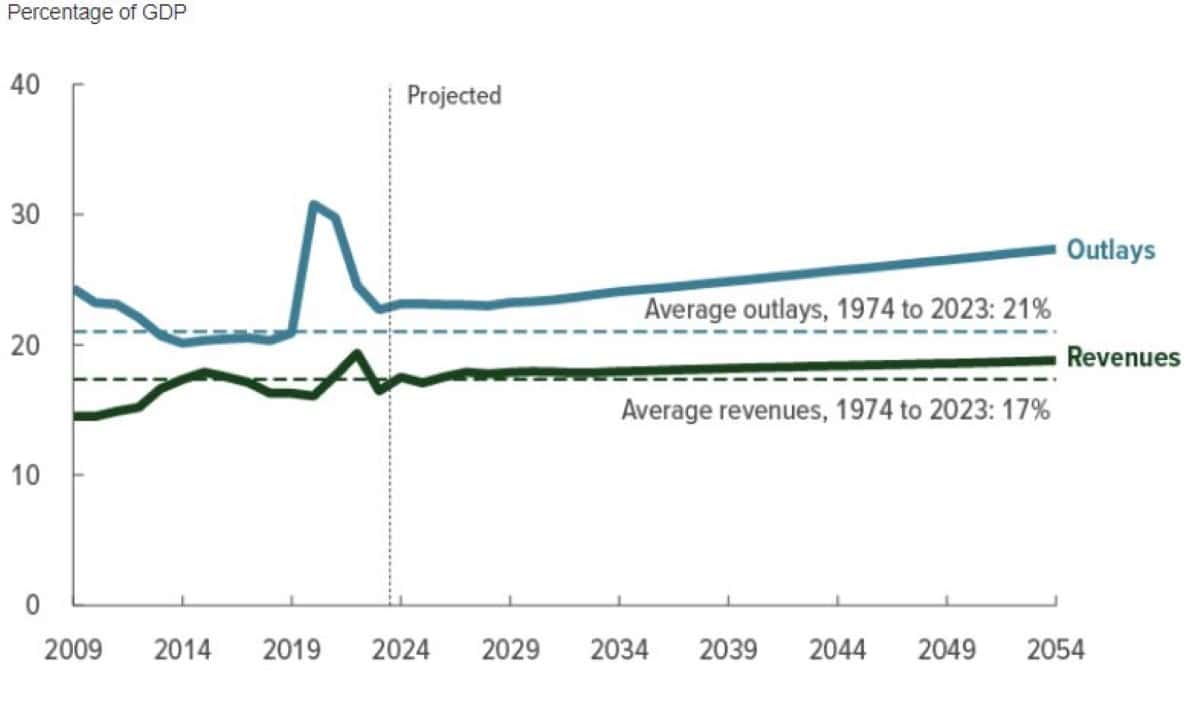

Between 2024 and 2054, the average growth rate of federal spending outpaces that of revenues, with both metrics constituting a larger share of GDP than their average presence over the previous 50 years. This trend suggests that spending and revenues will occupy a more significant portion of the economy over this 30-year horizon, compared to historical averages.

Interest Cost Will Soar

The budget office has issued a warning that the escalating debt presents “significant risks” to the future economic outlook of the U.S., increasing interest payments to foreign bondholders and hindering economic growth in the upcoming years.

By 2054, interest payments on the national debt are projected to surge to 6.3 percent of the Gross Domestic Product (GDP), while expenditures on social safety net programs will constitute over half of the nation’s remaining spending.

Trust Funds Approaching Insolvency

Critical trust funds face looming insolvency. The Highway Trust Fund is anticipated to exhaust its reserves by 2028, the Social Security retirement trust fund by 2033, and the Medicare Hospital Insurance trust fund is on track to deplete its funds by the mid-2030s. The insolvency of these funds would trigger automatic, across-the-board reductions in their payouts.

Social Security Insolvency

The CBO projects that the Social Security Old-Age and Survivors Insurance (OASI) trust fund will run out of funds by 2033, coinciding with the moment when individuals currently aged 58 reach the official retirement age and the youngest of today’s retirees hit 71. Consequently, all recipients will experience an automatic 25 percent reduction in benefits, irrespective of their age or financial situation. The solvency analysis by CBO matches the projections included in the Social Security Trustees Report.

Economic Growth Slows as Unemployment Increases

In 2024, economic growth decelerates, and unemployment rises, partly due to a tight monetary policy. The Federal Reserve is expected to respond to the economic challenges of 2024 by reducing interest rates.

U.S. Government Accountability Office Warning on Fiscal Health

The CBO report is not the only agency sounding the alarm bells. The U.S. Government Accountability Office published a report last month on the nation’s fiscal health. The report states, “The federal government faces an unsustainable long-term fiscal path that poses serious economic, security, and social challenges if not addressed.”

The only silver lining in the CBO report is that the federal debt as a share of GDP in 2053 is now estimated to be 17 percentage points lower compared to projections last year. The decrease in projected deficits can be largely attributed to a cut in discretionary spending, which results from the annual budget caps established by the Fiscal Responsibility Act of 2023 and further enforced by the Further Continuing Appropriations and Other Extensions Act, 2024.

Bleak Outlook Based on the CBO Analysis

The Congressional Budget Office (CBO) Economic Outlook, projects significant fiscal challenges for the U.S. over the next decade. Federal debt is expected to reach a record 166% of GDP by 2054. The gap between government spending and revenue continues to widen, with interest costs on the rise. Additionally, critical trust funds, including those for Social Security and Medicare, are approaching insolvency, threatening across-the-board cuts. Economic growth is anticipated to slow in 2024, leading to increased unemployment. With the U.S. consumer already under pressure, the upcoming decade looks challenging.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.