5 Best Retirement Calculators Which Are Totally Free

Early retirement is a fun aspirational goal. Planning for retirement is challenging. One needs to make a set of assumptions for more than 30 years in the future.

Calculating how to generate retirement income from several accumulated income producing assets is not easy. Each of the assets would have a different expected return.

When can I retire? Exploring the question led us to the four areas of financial, emotional, social, and retirement activities. Focusing on the financial aspect, let us evaluate several early retirement calculators to determine the best retirement calculator.

You should have at least 25 times your planned annual spending saved as a retirement nest egg at a basic rule of thumb. The ultimate retirement planning calculator needs to consider retirement age, taxes, pensions, social security benefits, annual inflation rate, average annual return, withdrawal sequence from retirement accounts.

Best Retirement Calculator Selection Criteria

To meet our retirement goal, we need to have income more than or equal to our expected expenses. Since we tackled various income options and calculated expenses in retirement, let us analyze different early retirement calculators. I looked at several calculators and picked the five best retirement calculators. Each retirement calculator has some pros and cons

| Selection Criteria | Description |

|---|---|

| Ease of setup | The calculator needs to be easy to use. And not involve complicated data entry. Preferable to be dynamically updated as your investments rise and fall with the market. |

| Individual asset class returns | Since expected returns vary widely by asset class; each asset class return needs to be calculated. |

| Individual expense ratios | Some investments have high expense ratios, which reduce the returns investors receive. |

| Historical data or Monte Carlo | Although past performance is no guarantee of future performance, it is the best available data point. The calculator needs to simulate several possible outcomes. |

| Current valuations incorporated | Future expected returns are often dependent on starting valuations. |

| Social Security included | In the U.S.; most individuals will receive some form of Social Security. |

| Distinction between Pre and Post Tax | Each account needs to be individually analyzed based on the tax treatment. E.g., $100 invested in a Roth account will be more than $100 invested in an IRA. The IRA will be subjected to taxes. |

| Mortality probability | Calculator needs to consider the probability of death. Else we would end up working longer than needed sacrificing time for money. |

| Add one-time extra expenses | Retirement would not progress linearly. You might have one-time expenses such as kid’s college or kitchen remodel after retirement. |

Early Retirement Now Calculator

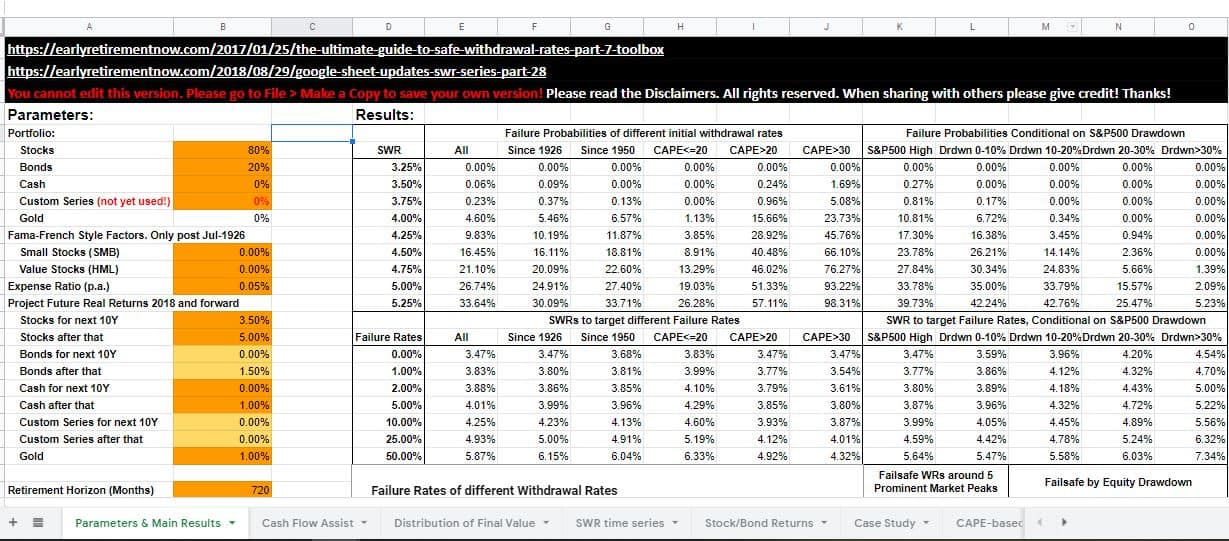

Karsten, who blogs at Early Retirement Now is a member of the early retirement community. With a Ph.D. in economics and working at the Federal Reserve Bank of Atlanta, he has an excellent grasp not just on retirement but also on the state of the economy. Big Ern has created a custom-built excel spreadsheet based on the Safe Withdrawal Rate Series.

Pros:

- The early retirement calculator is highly customizable, and you can modify the expected rate of returns for each asset class.

- If your portfolio has small-cap value stocks, the calculator includes the Fama-French Style Factors returns.

- Lists the historic returns of each asset class on an annual basis.

- Incorporates CAPE based rules to determine Safe Withdrawal Rates.

- In software, we have a saying, “eat your own cooking.” Big ERN uses the calculator to plan his retirement. The calculator is updated regularly.

Cons:

- You do need to spend time reading the entire series to utilize the calculator optimally.

- Expense ratios of your funds are not taken into consideration. The calculator has a single expense ratio, which can be customized.

- No ability to add Social Security income or additional lumpy one time retirement expenses.

- Doesn’t distinguish between pre-tax and post-tax funds. In a high tax state like C.A. or N.Y.; you need to continue year end tax planning even after you retire.

- You are required to make your copy. Any future updates made by Big Ern will need to be manually incorporated into your version.

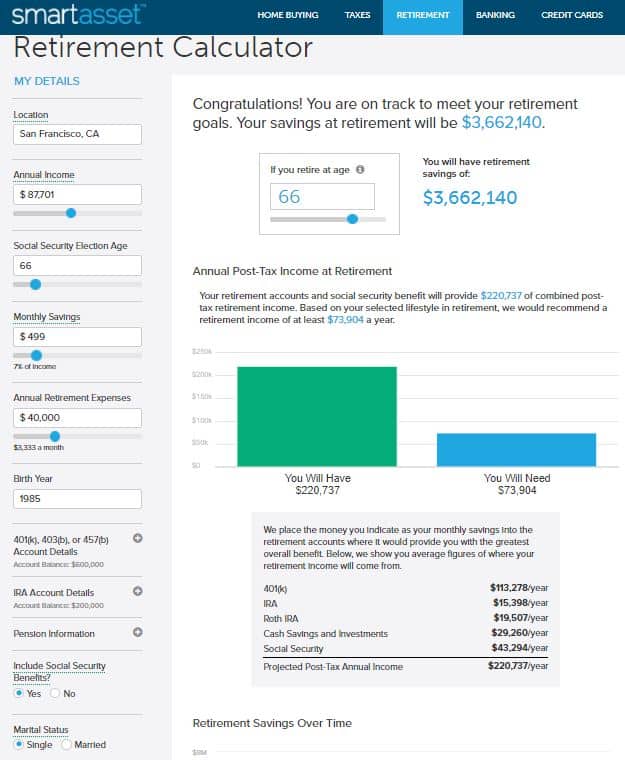

Smart Asset Retirement Calculator

The Smart Asset Retirement Calculator has a user-friendly interface.

Pros:

- Takes into consideration the taxation aspect of various accounts. You can enter the current totals for your 401(k) and Roth separately.

- Includes Social security in the calculation.

- Intuitive to use and visually appealing.

Cons:

- Doesn’t breakdown returns by asset classes. You can only select a blended return, which is hard to calculate if your portfolio consists of stocks, bonds, gold, etc.

- Expense ratios of your funds are not taken into consideration.

- Doesn’t take into account current market valuations.

- Does not take into consideration the historical volatility of returns or run any Monte Carlo simulations.

- No ability to add additional lumpy one time retirement expenses.

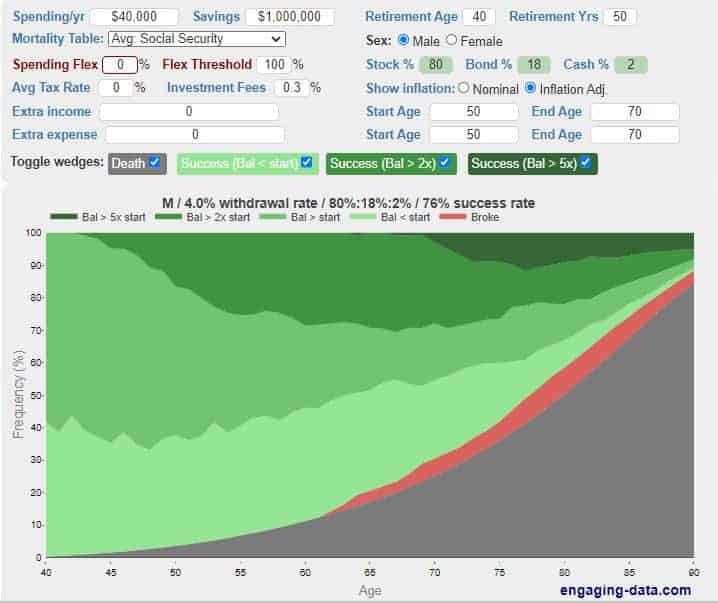

Engaging Data Post-Retirement Calculator

The Engaging Data Post retirement calculator is unique because of the way it approaches retirement. Most calculators optimize for the scenario of not running out of money. While being poor in retirement is a concern, we should also realize that we have finite time. We might even run out of time before we run out of money. The 5 Regrets Of The Dying indicate why Financial Freedom is the answer.

The post-retirement calculator uses the average social security mortality credits to calculate the probability of death. The calculator might seem morbid, but it provides a great reminder to step off the hedonistic treadmill. Often we are caught up in the “one more year” syndrome and continue working even when we have enough.

The retirement calculator looks at the question of whether your retirement savings can last long enough to support your retirement spending. And combines it with average U.S. life expectancy values to get a fuller picture of the likelihood of running out of money before you die.

Pros:

- Intuitive to use and visually appealing. Indicates the probability of rich, broke or dead.

- Tackles a unique aspect of retirement not found in other retirement calculators by using mortality tables. As you get older, the retirement calculator indicates how the likelihood of dying is much higher than running out of money.

- The probabilities are calculated based on stock, bond, and cash returns from historical cycles between 1871 and the present.

- Does not include Social Security earnings directly. But you could add extra income with start and end age.

Cons:

- Doesn’t distinguish between pre-tax and post-tax funds.

- Expense ratios of your individual funds are not taken into consideration.

- Doesn’t take into account current market valuations.

- Does not take into consideration the historical volatility of returns or run any Monte Carlo simulations.

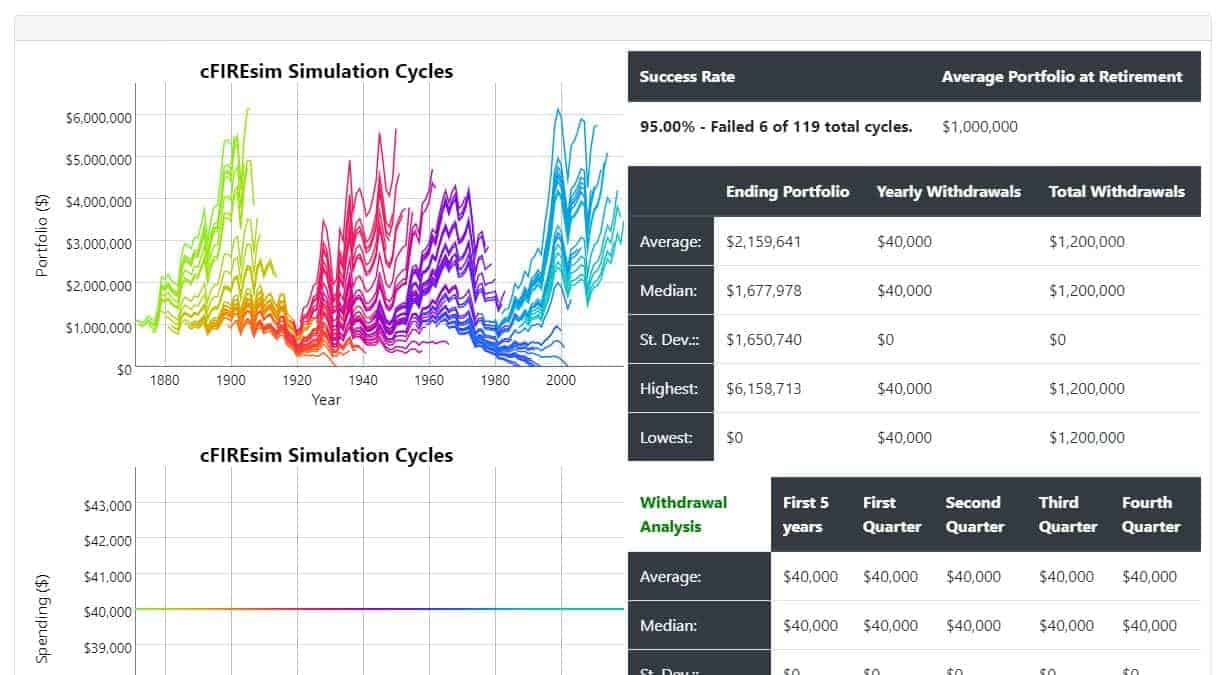

cFIREsim Retirement Calculator

The cFIREsim Retirement Calculator has been a favorite since it is created by a member of the early retirement community. The website lists upcoming features. If there is a unique feature you find missing, then you can also email Lauren.

Pros:

- Includes equities, bonds, gold, and cash as distinct asset classes with the ability to either keep allocation constant or set a glide path.

- The simulation is executed with historical data.

- Social security can be included in your retirement projections.

Cons:

- Doesn’t distinguish between pre-tax and post-tax funds.

- Expense ratios of your individual funds are not taken into consideration.

- Doesn’t take into account current market valuations.

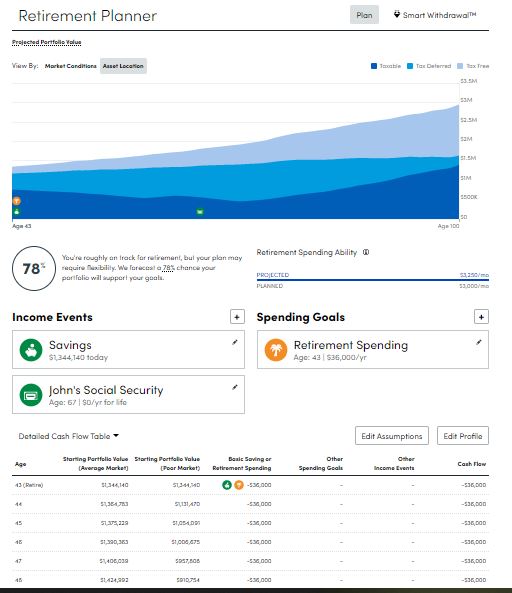

Personal Capital Retirement Calculator

Personal Capital is a free tool with many different features. I use it to track my net worth regularly. It also alerts me if there are hidden fees in my portfolio, and has a budget tracker included. The best part is the setup is easy. To use all the features, just sign up for a free account and link up all your bank, credit cards, and investment accounts. Check out my step-by-step guide to signing up and the in-depth Personal Capital review of all the features.

Pros:

- Unlike all other tools, you do not need to enter any data. The calculator is dynamic and automatically incorporates all your assets from the various accounts.

- You can add one-time additional retirement expenses such as kids’ college education or roof replacement.

- The retirement calculator runs 5,000 Monte Carlo simulations to deliver a robust, personalized retirement projection.

- The simulations incorporate expected return and volatility, annual savings, income, spending goals, retirement spending, social security, and tax rules for taxable, tax-deferred, and tax-free investment accounts.

- Required Minimum Distributions (RMDs) are assessed from tax-deferred accounts at age 72, according to the IRS RMD table

- State tax rates are incorporated in the retirement calculation.

Cons:

- The retirement calculator does not look into the likelihood of running out of money before you die. Only the Engaging Data post-retirement calculator incorporates that aspect.

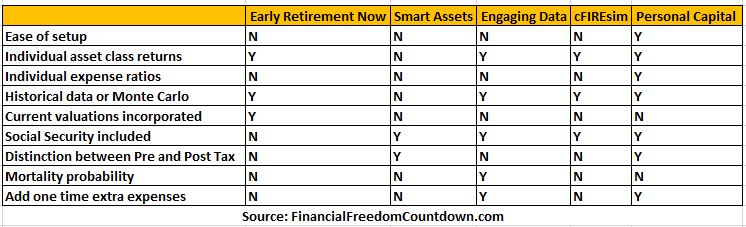

Ranking Early Retirement Calculators

Based on the selection criteria and each calculator’s analysis, here are the summarized rankings for the best retirement calculator.

Final Thoughts On Best Retirement Calculators

There are several early retirement calculators available that make retirement planning easy. Try all of them to see which one works best for your situation.

I do like the Engaging Data Post-Retirement Calculator. It gets rid of the anxiety many early retirees have that they would run out of money. Time is also a valuable commodity.

Early Retirement Now Calculator and cFIREsim Retirement Calculator are also great options since Big ERN and Lauren use their calculators. And as members of the community, they will keep updating with new features. Each of their calculators has a lot more features compared to even the larger brands like Vanguard.

At this point, I would rank the Personal Capital as the best retirement calculator since it has a lot of positive aspects. The main advantage is that no additional setup is needed. After you have linked all your accounts together, everything from budgeting to retirement planning occurs seamlessly. Inertia in planning for retirement is one of the significant reasons that individuals never get started.

Personal Capital also automatically tracks any changes in your portfolio, unlike other calculators where you need to enter your numbers every time.

Readers, have you used early retirement calculators in the past? Which one did you consider as the best retirement calculator? What did you like about it, and what improvements would you like to see added?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.