The 9 States Taxing Social Security For 2024 and the 3 That Just Stopped

While many bask in the belief that their golden years will be tax-friendly, residents in nine specific states are facing a reality check as their Social Security benefits come under the taxman’s purview.

Conversely, a wave of relief is set to wash over three states, marking an end to their era of taxing these benefits. This shift paints a complex portrait of retirement planning across the U.S., underscoring the importance of staying informed of the ever changing tax laws. Are you residing in one of these states? It’s time to uncover the impact of these tax changes on your retirement strategy and possibly reconsider your locale choice for those serene post-work years. Here are the 9 states taxing social security benefits.

Colorado

In Colorado, individuals younger than 65 by the end of the tax year can deduct either $20,000 or their taxable pension/annuity income included in the federal taxable income, whichever is less.

For those aged 65 and above by the end of the tax year, Social Security benefits are not subject to state taxes.

Connecticut

For Connecticut residents, Social Security benefits become taxable when your adjusted gross income (AGI) exceeds $75,000 (single filers), or $100,000 for those filing jointly, head-of-household or surviving spouse.

Beyond this income threshold, 25% of Social Security income becomes taxable at the state level.

Minnesota

Social Security income in Minnesota is subject to state taxes for individuals with an AGI over $82,190, or $105,380 for joint filers, and $52,690 for those married but filing separately.

Montana

Montana includes Social Security income in state taxable income to the same extent it is included in federal taxable income.

New Mexico

For New Mexicans, Social Security benefits are taxable for those earning more than

– $100,000 if filing status is single,

– $75,000 for those married filing separately,

– and $150,000 for surviving spouses or those filing as head of household or jointly.

Rhode Island

Social Security benefits in Rhode Island are taxable if retirement benefits are received before reaching full retirement age (typically 67) or if the AGI exceeds

$104,200 for singles or heads of household,

$130,250 for joint filers,

or $104,225 for those married filing separately for the 2024 tax year.

Individuals below these income thresholds may exempt up to $20,000 of their retirement income.

Utah

Utah imposes taxes on Social Security benefits for individuals earning more than $45,000, or $75,000 for heads of household or those married filing jointly, and $37,500 for married filing separately.

Those under these income levels may be eligible for a nonrefundable tax credit.

Vermont

In Vermont, Social Security is taxable for individuals with AGIs above $60,000, or $75,000 for those married filing jointly.

A partial exemption applies for incomes between $50,000 and $59,999 ($65,001 and $74,999 for joint filers).

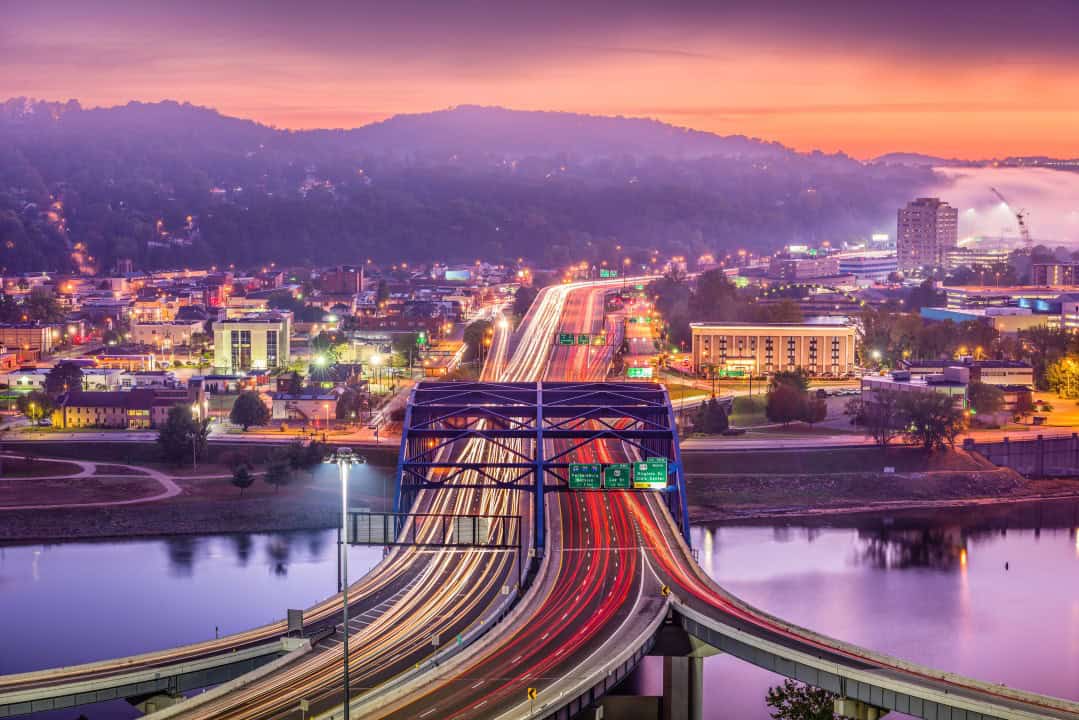

West Virginia

West Virginia passed a law to progress from partially taxing Social Security to completely eliminating taxation in 3 years.

West Virginia won’t tax your Social Security benefits if your federal adjusted gross income is $100,000 or less for married couples filing jointly or $50,000 or less for all other taxpayers

However, if your income is greater than the applicable dollar amount, West Virginia will levy a state income tax on your Social Security payments to the same extent you must pay taxes on that income to the federal government.

Good news for West Virginia residents is the bill phasing out tax on Social Security benefits has been signed into law. It applies to 35% deduction for 2024, 65% for 2025 and 100% deduction on Social Security income for 2026 taxes and beyond.

Kansas Finally Ended Social Security Taxation

In Kansas, Social Security income was taxable for individuals whose AGI exceeds $75,000.

If your Federal Adjusted Gross Income (AGI) was $75,000 or less, there was no state tax on your Social Security Income.

In Oct, 2024, new legislation passed and Kansas no longer taxes income from Social Security retroactive to 1st Jan, 2024. The new law provides welcome relief for seniors who no longer have to worry about keeping their income below certain thresholds to escape state taxes on Social Security.

Welcome Relief for Missouri and Nebraska

In July, 2023, the Governor of Missouri signed legislation which eliminated state taxes on Social Security income starting from the 2024 calendar year.

In May 2023, the Governor of Nebraska signed legislation which eliminated state taxes on Social Security income starting from the 2024 calendar year.

As of 2024, Missouri and Nebraska joined the list of states that no longer tax social security income.

Balancing Taxes and Lifestyle

In the ever-evolving landscape of tax laws and retirement planning, staying informed and consulting with a tax advisor for the most current information is paramount. While the tax implications of where you choose to retire are significant, remember that taxes are just one piece of the puzzle.

Quality of life, access to healthcare, proximity to loved ones, and recreational opportunities also play critical roles in selecting your ideal retirement haven.

As you navigate the complexities of retirement tax planning, balance these considerations with the fiscal realities. By doing so, you’ll ensure that your retirement years are not only financially sound but also rich in the experiences and connections that truly matter.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.