First timer FinCon recap including a delightful surprise

I spent the better part of last week in DC at a financial blogger conference most commonly known as FinCon. The conference had humble beginnings 9 years ago and has since grown thanks to the vision of PT Money to now cater to 2500+ attendees, 200+ speakers, 100+ exhibitors and countless volunteers

I’ve always been interested in Personal Finance but never considered attending since I was not a creator …. yet. That changed this year when I launched my blog 6 months ago.

Meeting my friend unexpectedly at FinCon

It is said that at FinCon you get to meet your internet friends in real life. While this was true for me; what was even funnier was meeting my friend in real life who I never knew was a regular attendee at FinCon. As I settled into my seat on the red eye from San Francisco to DC; I get a text from my friend Bobby.

Before I could respond, we were asked to switch off our mobile phones. All through the 5+ hour flight, I’m wondering about the mysterious text.

After the plane landed; Bobby and I caught up and figured we are going to the same conference. How crazy is that! I’ve know Bobby for several years as a freelancer but did not realize he was also into Personal Finance. Incidentally he is one of the few select folks who has attended every single FinCon since inception. He blogs at https://www.2minutefinance.com/

In case you are wondering what I did for 4 days, here is a breakdown of the key activities by day with important takeaways.

Wednesday

As I completed the checkin on Wednesday, decided to attend the first timer orientation. Unfortunately it was full and so I spent time walking around the expo. None of the sessions were interesting and if I had to do it all over; I would skip Wednesday and arrive later.

I had a chance to meet with Joshua Sheats of Radical Personal Finance (RPF) for an hour long chat. Joshua’s podcast, true to the name, is quite radical wrt the topics covered. I do enjoy listening to alternative perspectives as long as they are respectfully presented. Incidentally Joshua was one of the first to interview Paula Pant, Brandon (Mad Fientist), JL Collins etc in 2013.

To be honest I have always been diligent wrt finances. However it was only after listening to Radical Personal Finance interview of Jacob Lund Fisker author of Early Retirement Extreme and the OG of the FIRE movement; that I knew what should be my next goal. The tag line of Radical Personal Finance is “Financial Freedom in 10 years or less”. Although it took me 12 years to achieve Financial Freedom; Joshua was interested in the story of a first generation immigrant from a third world country coming to USA; not knowing anyone or the financial system with only $1,000. I went more into my backstory and the risks taken along the way. When recounting my story; I was reminded how scared I was the first few months, hoping that I get paid on time or I would not even have money to get a flight back home. All said and done, it was a fun trip down memory lane.

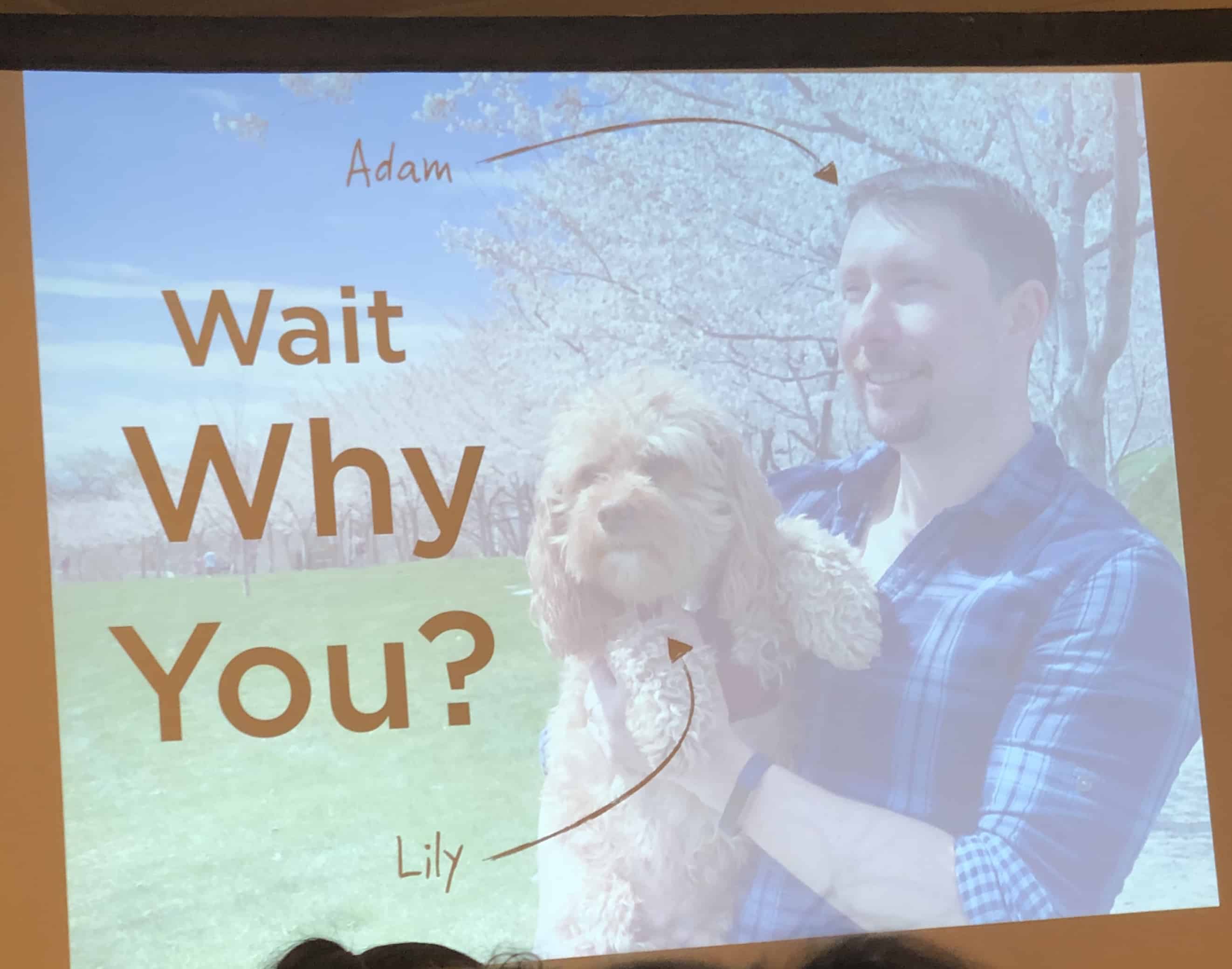

The advantage of FinCon is you get paired with a more experienced mentor. I was lucky enough to be paired with Adam who blogs on Student Loan Law. I got some valuable advice from him wrt my nascent blog.

Wednesday evening was the kickoff party by Robinhood at the Smithsonian. An epic location with the rooftop view of the Washington monument. And they had a donut wall. Yes! a wall of yummy donuts 🙂

Thursday

Thursday kicked off bright and early with the Big Idea presentation by Tanya, author of Work Optional: Retire Early the Non-Penny-Pinching Way in the historic International Ballroom of the Washington Hilton. This is the same location immortalized by Obama’s mic drop moment at the 2016 White House Correspondents’ Dinner.

Tanya did a fantastic presentation complete with wardrobe props to drive home the point that we bloggers have a responsibility to be authentic to our audience.

The Big Idea was followed by the Opening Keynote presented by Ramit Sethi, New York Times best selling author of I Will Teach You To Be Rich. I’ve been following Ramit since he blogged about his Scrooge strategy and scripts to negotiate cable bills. He has since moved on to create high value products such as Zero to Launch, Mental mastery, etc . His talk focused on developing a unique point of view which would differentiate you from others. He provided several examples from his personal journey also encouraging story telling by the audience what a rich life would look like. His point of view is

10x your spending on things you love; while ruthlessly eliminating expenses on activities you do not enjoy.

Ramit Sethi

I was lucky enough to win a copy of his book and got to chat with him briefly. While I broadly agree with most of the book; the crypto section is something I have a different point of view. I promised to write my thoughts and send him a link.

Networking for introverts was presented by Jillian Johnsrud where she emphasized principles to connect with others based on The 5 love languages: The Secret to Love that Lasts

In the evening I attended a LGBTQ community meetup organized by the Debt Free Guys. I’ve interacted with David and John online and they are as fabulous in real life; as they are online. After the meetup I ran into Piggy and Kat from BitchesGetRiches; Tanya and her husband Mark, Hadassah, Lynne. As a first time attendee; FinCon seemed overwhelming. Sharing stories and a few laughs over dinner with this great group left me energized.

Friday

10 breakthroughs that 3x’d my blog by Nick Loper, author of The Side Hustle. The session focused on Mindset, Marketing and Monetization.

How 2 average guys build multiple blogs. This was the most unique session where the speaker handed everyone in the audience $1 bills. The only condition was that if we obtained at least a $1 worth of information from the presentation; we would return it. Needless to say their session was jam packed with knowledge and also highly entertaining. All the dollar bills returned by the audience; were awarded to a random member of the audience who needed the most help with his blog. How cool is that!

900 to 12,000 email subscribers was presented by Chad Carson, author of Retire Early With Real Estate. He chronicled his journey from blogging rookie to online entrepreneur over a 4-year period. I’ve followed Chad since 2013 lurking on Bigger Pockets forums; so it was a treat to listen to him. He built his community organically by sharing knowledge through meetups. His earliest subscribers were gathered the old school way; via signup sheets.

Fri evening was the Plutus Awards. A rapid fire award presentation ceremony with no speeches. The highlight of the evening was Jordan Cox and Sandy Smith entertaining the crowd with their rap battle. Pictured above are Brad and Jonathan (Chose FI podcast hosts) accepting their awards.

Saturday

7 lessons learned from growing a blog by Harry Campbell author of The Rideshare Guide. He started his blog for Uber and Lyft drivers in 2014 when the companies were just getting started. What started out as a niche blog about driving for Uber and Lyft has now turned into over 600,000 page views a month, 75,000 e-mail subscribers and a full team to help run things.

24 strategies to create sticky content presented by Adam focused on how to lure readers back, again and again, providing value each time while also increasing virality. Style, organization, discovery and tools for the readers were the key points

How to go from Popular to Profitable Tai and Talaat McNeely, authors of Money Talks: The Ultimate Couple’s Guide to Communicating about Money talked about creating content from the audience viewpoint and building an inclusive community. They also mentioned to focus on your niche since it’s impossible to serve everyone.

Between the various sessions, I also had the pleasure of meeting Lief who retired from medicine at 43. He blogs at Physician on Fire. There are very few blogs dedicated to high income earners and PoF fills this niche amazingly well by catering to physicians.

Closing Big idea was presented by Cat Alford who talked about giving yourself permission and overcoming the impostor syndrome. She also stressed; not to be discouraged by “No”. In fact,

No + Feedback = Yes

Cat Alford

Closing Keynote was by CNBC senior personal finance correspondent Sharon Epperson who is also the author of The Big Payoff: 8 Steps Couples Can Take to Make the Most of Their Money–and Live Richly Ever After. She shared her personal story of suffering from a sudden brain aneurysm to drive home the point that we all need to ensure we have the appropriate insurance coverage for various life circumstances

FinCon Marketplace

FinCon also has a pretty active marketplace. This is an arena for content providers to explore what are the new and interesting products and services which would benefit their audience.

I spoke to some of the founders and account managers to understand the features of the following products.

M1 Finance

I had heard about M1 Finance and wanted to understand what was different between the M1 FInance platform compared to the incumbents like Vanguard, Schwab, Fidelity, Wealthfront and Betterment.

I decided to rank all the providers based on the features I would want in my Perfect Investment Platform.

M1 came on top due to its zero fees, very low minimums, automated investment with automatic rebalancing, Pre-built asset allocations and fractional shares. You can read my complete review in M1 Finance Review

I also use the platform for investing in Moonshot Companies.

Personal Capital

I have always struggled to maintain a budget and never track my spending. I would track my net worth religiously though.

Talking to the Personal Capital staff I figured that it can auto create a budget based on your existing spending patterns.

You can also use it to track your net worth and as a retirement planner. It also alerts me wrt hidden fees and has a budget tracker included. Here is my in-depth review

Stessa

As a rental property owner I have a vested interest in checking out any solutions which make my landlord life easier. One of the biggest mistakes landlords make; is not running their rental properties as a business.

Stessa is used for tracking the time and expenses over the course of property ownership. You can see how your rental properties are performing. Check out my Stessa review.

Crowdstreet

Crowdstreet is a real estate investing platform that gives investors direct access to individual commercial real estate investment opportunities, allowing you to review, compare, and personally choose the deals that meet your own investment criteria.

Since investments in residential real estate have become challenging, it is great to have access to commercial real estate as a diversifier.

FarmTogether

If you are interest in farmland investing, FarmTogether offers several options. You can select various farms and then pick your investment. Given the growing world population it offers an alternative investment for individuals looking to diversify away from record high stock markets. Read about my farmland investing review here.

Summary

The 4 days spent at FinCon gave me a lot of perspective wrt how to serve the audience and create content that helps the readers.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.