Biden’s New Student Loan Forgiveness Plan Estimated to Cost $84 Billion, Adding to the Already Massive $475 Billion

Joe Biden’s recent proposal for student loan forgiveness is advancing as a proposed regulation, presenting him with a renewed opportunity to rally young voters for the upcoming November election. The Education Department filed paperwork for the new regulation on Tuesday, marking a significant step towards implementing the announced loan cancellation. However, it will undergo a 30-day public comment period and further review before reaching finalization.

How Much Does It Cost?

A recent analysis by the Penn Wharton Budget Model (PWBM) suggests that Biden’s new student debt relief plan could incur approximately $84 billion in costs if put into action. This amount is in addition to the $475 billion previously estimated for Biden’s prior SAVE plan.

The report states “We estimate that the New Plans will cost $84 billion in addition to the $475 billion that we estimated for President Biden’s SAVE plan, for a total cost of about $559 billion across both plans.”

The New Plans contain 5 main provisions

#1 Waived Accrued and Capitalized Interest

Up to $20,000 in interest will be waived, irrespective of borrower’s income levels. Single individuals earning under $120,000 or couples earning under $240,000 annually are eligible for a complete waiver of all balances exceeding the initial balance under any Income-Driven-repayment (IDR) plan. No application is necessary as automatic relief will be applied.

Estimated cost of $57.75 billion

#2 Forgiving Student Debt For Borrowers In Repayment For 20 Years

Those who began repaying loans on or before July 1, 2005 (or July 1, 2000 for those with graduate debt) will have all undergraduate debt eliminated. No enrollment in IDR plans is necessary for this relief, although other application requirements for borrowers are yet to be clarified.

Estimated cost of $19.07 billion

#3 Automatic Debt Relief

Automatically relieving debt for eligible borrowers not enrolled in specific forgiveness programs. Those who meet forgiveness criteria but aren’t enrolled will benefit from favorable repayment rules, including those of the SAVE plan or closed school discharge. No application is required as automatic relief will be applied.

Costs already included as part of the prior SAVE loan forgiveness.

#4 Assisting Borrowers From Low Value Programs or Institutions

Debt relief will be extended to those who accrued debt from programs or institutions that did not provide “sufficient value” in terms of post-graduation earnings.

Not enough details have been provided by the administration to calculate the cost.

#5 Loan Repayment Hardships

Relief will be tailored to each borrower’s situation, though whether it will cover partial or full debt is unspecified. The department’s hardship proposal aims to provide loan cancellation to borrowers facing a high risk of loan default. Additional details are pending on this proposal.

Breakdown of the Budget Cost Estimates

The Penn Wharton Budget Model breaks down the budgetary impact of each of the 5 provisions including the number of individuals benefitting along with their average household income. One of the biggest criticisms of the New Plan is the benefit provided for about 750,000 households making over $312,000 in average household income.

Ranking Member Cassidy Slams Biden’s Backup Student Loan Scheme

Sen. Bill Cassidy, R-La., the ranking member of the Senate Health, Education, Labor and Pensions Committee said, “The Supreme Court already ruled the Biden administration doesn’t have the authority to unilaterally take student debt from those who willingly took it on and transfer it to taxpayers who chose not to go to college or already worked to pay their loans off. Now, the Department of Education is completely rewriting the Higher Education Act piece by piece to resurrect this unconstitutional student loan scheme. Where is the relief for the guy who didn’t go to college but is working to pay off the loan on the truck he takes to work? What about the woman who paid off her student loans, but is now struggling to afford her mortgage? Instead, the Biden administration is sticking these Americans with the bill of someone else’s student debt.”

Court Challenges Ahead

The U.S. Supreme Court struck down a student loan cancellation proposal last year. Utilizing a different legal basis, the new proposal aims to forgive loans for over 25 million Americans. Opponents view it as unjust burden for taxpayers and have vowed to contest it legally.

Like Financial Freedom Countdown content? Be sure to follow us!

National Debt Exceeds Previous Projections, Signaling Troubling Times Ahead for the U.S. Economy as per CBO March report

The Congressional Budget Office (CBO) performs nonpartisan analysis for the U.S. Congress. The latest Budget and Economic Outlook released March 2024, offered dire projections for the country’s fiscal and economic landscape over the upcoming decades. Unfortunately the national debt is higher than initially anticipated and is projected to hit $141 trillion by 2054.

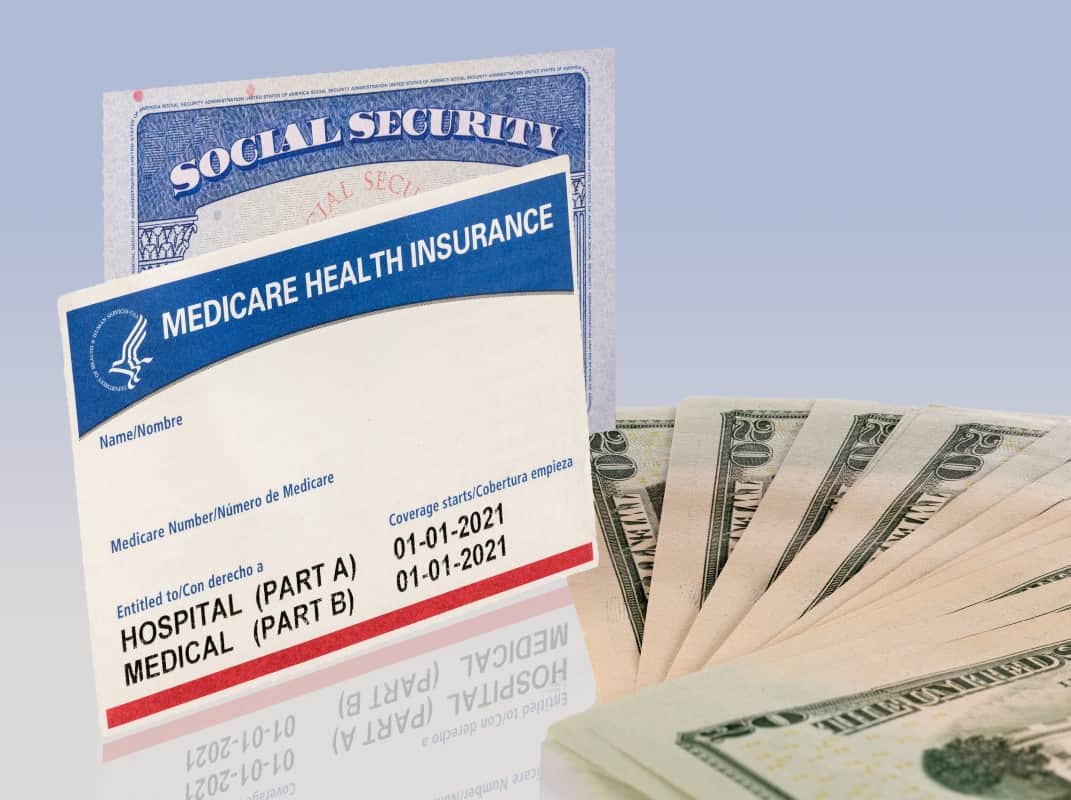

The 9 States Taxing Social Security in 2024 and the 2 That Just Stopped

As 2023 tax filing season draws to a close, retirees across the nation are adjusting their financial plans for 2024, but a crucial detail could drastically alter the landscape of retirement living: the taxing of Social Security benefits. While many bask in the belief that their golden years will be tax-friendly, residents in nine specific states are facing a reality check as their Social Security benefits come under the taxman’s purview. Conversely, a wave of relief is set to wash over two states, marking an end to their era of taxing these benefits. This shift paints a complex portrait of retirement planning across the U.S., underscoring the importance of staying informed of the ever changing tax laws. Are you residing in one of these states? It’s time to uncover the impact of these tax changes on your retirement strategy and possibly reconsider your locale choice for those serene post-work years. Here are the 9 states taxing social security benefits.

The 9 States Taxing Social Security in 2024 and the 2 That Just Stopped

Top 10 Cities Where Home Sellers Are Losing Big, With San Francisco Seeing 20% Take a Loss, Quadruple the National Average

In San Francisco, a significant number of home sellers are experiencing financial losses at levels not seen in over a decade. This uptick in losses can be attributed to home prices normalizing after a period of steep increases. Currently, nearly 20% of sellers in the city are selling their homes for less than their purchase price, with average losses around $155,500. In contrast, the national scene is less bleak, with only 4% of home sellers across the United States facing losses, as home prices generally continue to hover near peak levels. The typical loss for those unlucky few is about $40,000. Redfin conducted an analysis of the top 50 metros to narrow down the cities where the seller sold the home for less than they bought it for. Here are the top 10 cities where home sellers are facing losses

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.