Budget Template: How To Easily Save Money and Keep Track of Your Spending

You want to get your finances in order, but you don’t know where to start. It’s easy to feel overwhelmed when juggling bills, keeping track of expenditures, and attempting to save money. But it’s not! You just need the right tools.

It’s hard to get started on a budget because there are many different ways to do it and many conflicting opinions.

We’ve reviewed several budget templates that make it easy for you to get started on your budget without all the confusion. Experts designed each budgeting template, and some of them are free.

You can customize them to fit your unique needs, and with a budget in place. You can now relax and enjoy life without having to worry about money.

What Is a Budget Template?

Creating and sticking to a budget can be challenging, but it’s an essential step in getting your finances in order. Many people give up making a budget because it seems too complicated or time-consuming.

When you’re on a budget, it’s essential to keep track of where your money is going. It can be tricky, especially if you’re not used to tracking every penny.

That’s where budget templates come in. With pre-made templates, you can quickly get started and customize as you go. They help you organize your finances and make sure you’re staying within your set limits. Budget templates make it simple to create and maintain a budget.

A budget template will allow you to track trends in your spending over time. You may notice that certain months of the year, such as holidays, are more expensive than others. A budget will better equip you to prepare for your future.

A budget is a key to financial success. But creating a budget from scratch can be difficult and time-consuming. We’ve highlighted budget templates that make it easy to get started on your budget today.

Why Are Budget Templates Necessary?

Well, the fact is that you may not need this help. If you have taken financial literacy classes or already mastered personal finance basics, you probably have a good handle on your finances.

The problem is that most people don’t have a good handle on this. It is estimated that about 40 percent of Americans face severe financial strain.

Maybe you’re in the group of Americans who have less than three months of emergency funds in their bank accounts. Three months is not enough to deal with a financial emergency. One medical emergency or car trouble could wipe out that kind of cash.

One truth that many folks can’t escape is financial stress. Ninety percent of folks say that money is their most significant stressor. That is a large number, and the likelihood of you being in that group is substantial.

Budgeting is not about deprivation. Utilizing a budget planner is all about staying organized. With a more significant amount of cash in your savings and enough money to pay for your necessities, you reduce the stress linked to finances, which is excellent.

A Quick Overview of Some of the Best Budget Templates

Okay, now you know why I think it’s important to consider these templates.

The next thing you need to do is figure out which one is for you. Technically, the goal of these templates is to help you take control of your finances, but the way each goes about it is a bit different. The following are quick overviews of some options available to you.

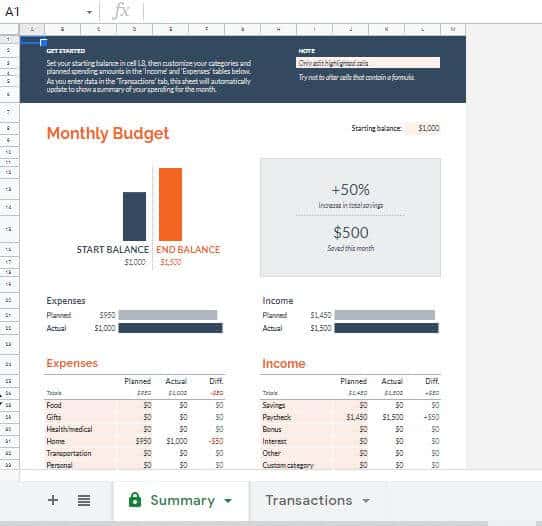

Google Budget Template

Google has a lot of budget planner options for you, and most of them are pretty straightforward. It’s all about choosing the one that you feel most comfortable with. Some of the options are labeled as budgeting spreadsheets, but you could also construct your own if you have a vision in your mind.

The Google budget template is blank. It would be best to spend time and effort defining the various line items in your budget and allocating a certain percentage or dollar value to each category of your monthly budget.

Google also has an annual budget tracker template with individual tabs for income, expenses, and auto-generated summaries, which can track your yearly budget. It is most effective when used together with the monthly budget template. Transfer the totals for each category from the monthly budget template to the annual budget template every month to better view your finances.

Keep in mind that the Google sheets option requires that you do most of the work. Yes, everything is neat and organized for you, but the result is very much up to you. The data input, the calculations, and the financial goals are all based on you. If you love total control, Google sheets is a good place.

The good thing about Google is that it’s all connected. If you have something like Google wallet or other Google products, syncing information and sharing it amongst family members should be easy.

Excel Budget Template

Microsoft does something similar to Google and provides a personal monthly budgeting spreadsheet. The company is known for spreadsheets, data entry, and everything associated with household and office needs. It makes sense that they would have a budgeting spreadsheet option for you, and they have several Excel templates for you to choose from.

If you don’t like the available spreadsheet options, you also have the power to make your template and modify it in whatever way you see fit. One of the neat things about the templates available is that they can get pretty specific.

While you’re probably focusing on the templates that help you with your finances throughout the year or your monthly expenses, they have other templates.

The Microsoft budget template, like Google Sheets, requires you to enter the data manually.

The second disadvantage is that if you don’t already have Microsoft 365, you have to pay for the Excel budget spreadsheet.

Of course, you can just use a regular excel document and create your monthly budget template.

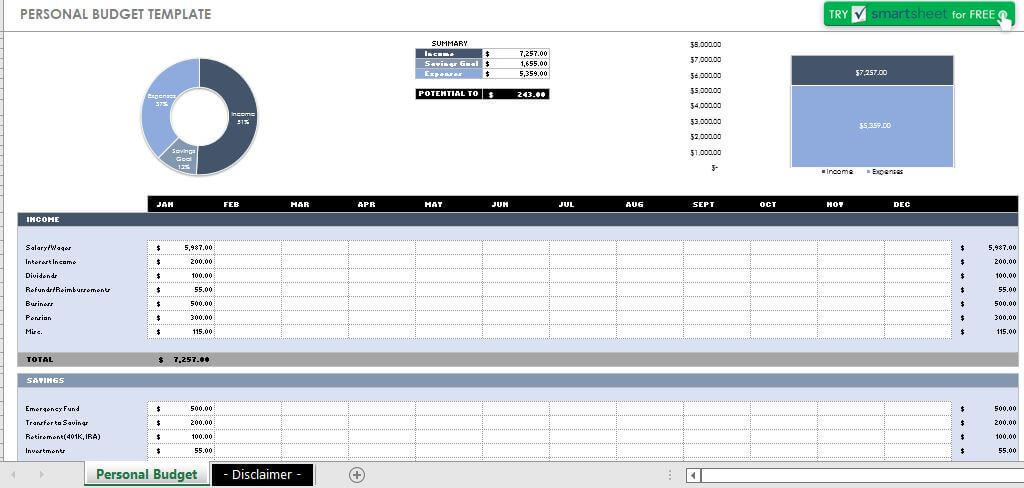

Weekly Budget Worksheet by Smartsheet

Smartsheet provides several budget templates on its website. You can sign up to use Smartsheet or download the template and use it offline.

The Smartsheet template is geared toward helping you keep track of your spending every week, which is ideal for those who get paid once a week.

50/30/20 Simple Budget Template

The conventional 50/30/20 method of budgeting suggests that you spend 50 percent of your anticipated take-home money on needs, 30% on desires, and 20% on savings and debt reduction.

Although you do not have a ready template, the 50/30/20 method of allocating your money is favored to start tracking your finances in terms of monthly income and savings goals.

Mint

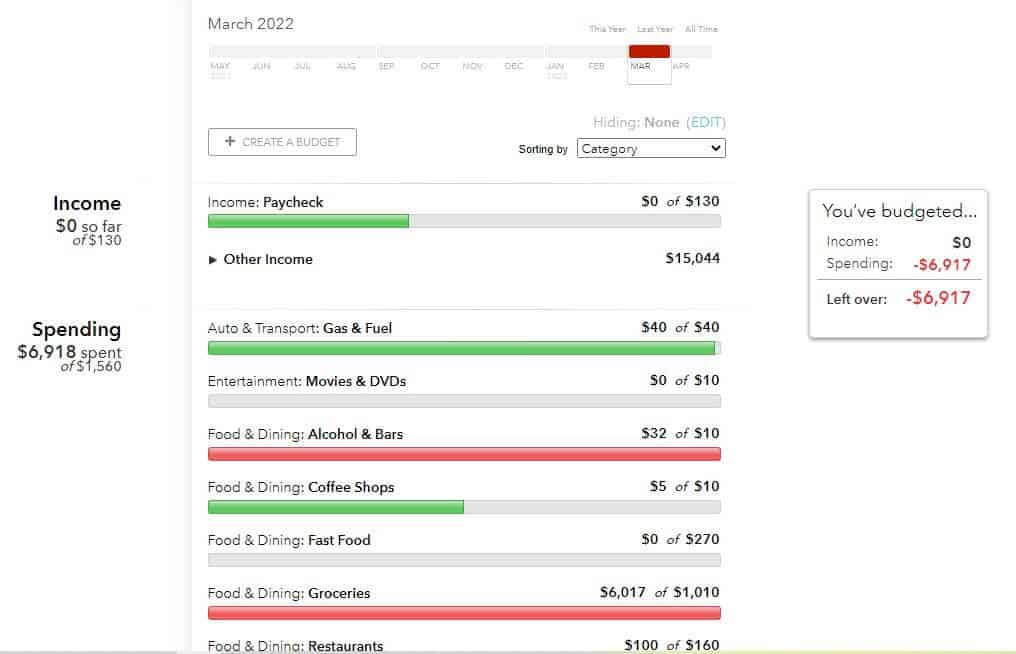

If you want something hands-off, you want Mint. It is an entirely free way to budget your money. The Mint Budget template automatically tracks your income and expenses to always be on top of it.

You know that entering all that data yourself can be a little annoying. You have to keep receipts or log into your account to see what you spent that day. It can be overwhelming. Mint solves this problem by asking you to provide all the login information for your various bank accounts, credit cards, and investment accounts and pull all the app transactions.

Mint goes beyond tracking your spending for the day, week, month, and year. It also helps you see your money flow. It follows the money that comes into your account and how it leaves, helping you make better financial decisions.

Meeting your financial goals starts with coming to terms with how you make and spend money.

Mint also provides free credit monitoring of your Equifax credit report.

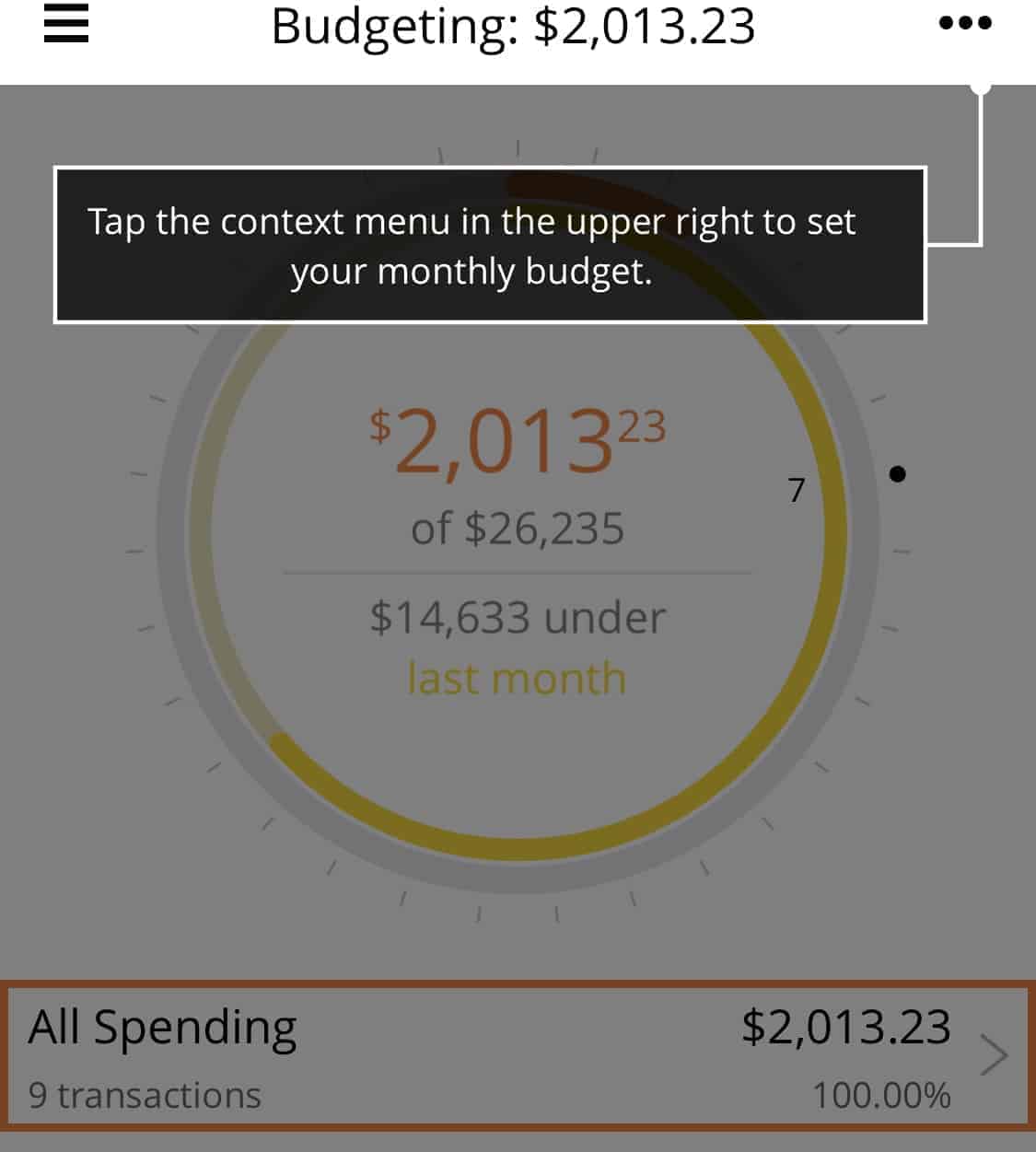

Personal Capital

Personal Capital is another free and effective budget template for you to use. Like Mint, you need to link your accounts for Personal Capital to work optimally. Once you have linked your accounts, Personal Capital analyses your various transactions and automatically creates a budget for you based on your spending patterns.

Personal Capital also offers a way to track your monthly or annual expenses. The tool goes beyond following your costs because it also provides tools to help you understand your investments and overall liquid net worth.

Those kinds of things will be necessary at some point. For example, your retirement will be important at some point in your life. It’s best to know where you stand now that you can make the necessary adjustments. You can retire a little more comfortably. I don’t want to be a pessimist, throwing sad news your way, but most Americans fall behind on their retirement plans. Most of us will get old and will need the cash. Figuring out “when can I retire” is vital for us, and Personal Capital makes it more accessible.

The focus on investments and cash flow is why I use Personal Capital as my primary financial barometer. I hate having multiple tools, and the fact that Personal Capital manages not just the budget but also other financial aspects like retirement planning, cash flow, and fee analyzer for free has me sold. You can read my Personal Capital review for how I use the tool personally.

Qube

Every budgeting tool has something unique for you, and Qube is no different. While the goal is still the same, which is to help you control your spending and help you understand your monthly and yearly budget, this template excels in helping you fight impulse spending. Folks have to worry about this, primarily because of this modern world.

The program divides your money into “qubes,” digital replicas of the paper envelopes used in cash-envelope budgeting. Make a qube for each category—food, travel, and utilities, and fill it with the amount you want to spend. Instead of calculating how much money you have for the trip, open the app and choose the appropriate qube, and the app will send the funds to your linked Qube Card.

The free tier offers up to 10 Qubes and includes bill pay. The premium version costs $6.50/month.

Vertex42 Endless Spreadsheets

Vertex42 is a great place filled with many templates for you to use. Part of what makes Vertex42 unique is that the number of templates will seem endless. If you want a lot of choices, you’ll love this site. The issue is that it can also feel a little overwhelming.

Going through pages of options can make it hard to figure out which one is for you. If you have the time, go ahead because several great gems could make a big difference in your life. The descriptions can help you find what you’re looking for, from a family budget planner or a template for household expenses.

Those who want something specific can find that here. Once you’ve found the templates you think will make the most significant difference in your life, all you have to do is download them. The rest is up to you, but you’re on your way to a version of yourself that’s more in control.

You Need A Budget (YNAB)

The YNAB budget template layout is easy to understand, so you’ll know what you’re spending and how it’s negatively affected your overall goal. The goal of YNAB is to give every dollar a purpose. You’ll be able to assign every last penny to a category using the budget you create. Every one of your dollars will have its classification.

Those who have some control and only need help organizing finances might not need something like this, but this can be helpful for some people. Hopefully, you will develop better financial habits and can stop using this app after a while, but if you must, then don’t hesitate to try it.

I wish every tool or template that can help you budget was free, but that isn’t the case. Some will cost you some cash, which is okay. You have to pay $14.99 every month to use this software, but there’s a good reason to use the service.

You’re downloading intelligent software that will help you take control of your spending habits. It won’t allow you to forget your household budget goals. This template is for those who have little to no self-control.

EveryDollar Budget Template

EveryDollar offers a paid app. In true Dave Ramsey style, once you enter all the money coming in this month, you have to make a plan for every dollar.

While it’s not too expensive, you have to pay for it, but you get to track your spending on your phone. The template is ideally suited for use on the phone, and it’s easy to understand. It’s so easy to understand that most people can create everything they need to budget their cash in less than 10 minutes, which is impressive.

It is a big deal. You don’t want to use a template that’s too confusing to understand. I purposely left complex templates off this list, but that doesn’t mean all the ones I mentioned are easy to use. Some of the templates mentioned before, especially Google Sheets and Microsoft spreadsheet, can take a long time to complete.

If you want something easy and fast, then this is what you want, but you will have to pay for it. Those who are okay with that have found a good option. Those who aren’t may have to settle for some of the other free templates mentioned here, like Mint or Personal Capital. The app focuses on what you’d expect, like making sure you know your monthly or yearly expenses.

Mvelopes Budgeting

Budgeting is a spectrum. What works for some won’t work for others. One of the most effective budgeting templates is the envelope system, and Mvelopes capitalizes on that fact. This one isn’t free. It will cost you $10 every month to use this system, but if it works for you, then this is what you need.

It is based on Dave Ramsey’s budget envelope system. Everything you need to worry about, such as the money you’ve earned, the money you spent, and the money you’ve budgeted, comes to you in a separate envelope. For some reason, seeing these in separate envelopes feels a little easier to digest.

Some folks feel overwhelmed by spreadsheets, seeing all those numbers simultaneously. When you’re overwhelmed, information that may be easy to understand won’t be. You might get confused, and you don’t want that. What was supposed to make things easier for folks gives them anxiety? The goal of using these tools is to use them. If you feel overwhelmed and anxious when you do, then you probably won’t use them. Look at an example and figure out if this way of budgeting is for you before deciding.

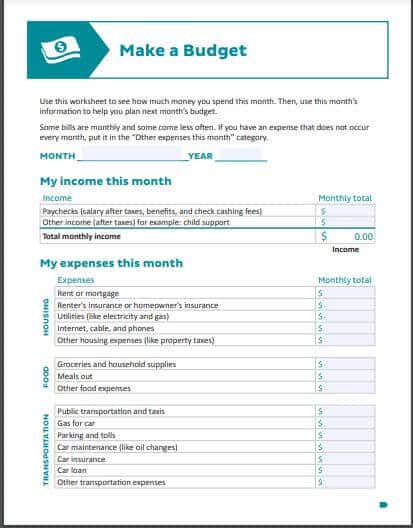

Federal Trade Commission Budget Printable

The Federal Trade Commission (FTC) offers a fantastic printable budget template on its consumer.gov website.

The two-page template is simple to follow: compute your income and expenses, then tally them up. Your budget is balanced if income minus expenditures equal 0. If you have a surplus, you may invest it or save it. You must increase your salary or decrease your expenses if you are in deficit.

This template does not have a savings category. If that’s one of your objectives, you’ll need to reserve funds somewhere on the page.

Since it is very rudimentary, it does not focus on saving for other goals like investing in stocks or real estate investing.

Pocket Guard Budget Template

Overspending is a big deal. It’s one reason people don’t have a savings fund or drown in debt. Sometimes you’re in debt through no fault of your own. Maybe you aren’t making enough, or you made a financial mistake. Still, overspending has to be dealt with, and Pocket Guard does that.

The program can be linked to other financial products you might be using, like Mint. It helps create a more unified look at your finances, which can be somewhat helpful. Pocket Guard allows you to separate incomes if the house has more than one income. It helps clarify how each member of your household is spending money. Maybe one person in your family overspends at the grocery store while another at a retailer. Knowing how each person spends cash helps you plan things more effectively.

While it may feel like you or someone else in the house is being put on the spot, that isn’t the case. The hardest step to overcome when budgeting is coming face to face with the way money is spent. Confronting this isn’t easy, but it has to be done. Pocket Guard also has tools like automated reminders to pay bills, and it also shows you your progress regarding any outstanding debt. In essence, it gives you hope. It tells you that you’re getting closer to being debt-free. You have to pay to use this app, so look over the price and then decide.

Comparison of the Best Budget Templates

Budget templates are helpful tools to help organize and keep track of spending, but some are easier to use than others. The Google sheets and Microsoft budget templates can be long and challenging to complete, while Mint and Personal Capital are easier with access to your bank account. Mvelopes is based on the envelop system, which some find helpful. Pocket Guard is suitable for those who overspend and want to understand better where money is being spent in the household. The budget templates range in price from free to several dollars a month.

I think it’s great that people can find free tools online to take control of their lives. I’m not saying that paid templates and tools aren’t suitable investments. They can be.

I feel those tools are for folks who have some control over their finances and don’t mind spending a little extra to keep that control.

| Budget Template | Features | Cost |

|---|---|---|

| Google Budget Template | Can be customized Need to manually enter all details | Free |

| Excel Budget Template | Can be customized Need to manually enter all details | Need to pay for Office subscription or license |

| Weekly Budget Worksheet by Smartsheet | Several templates available Need to manually enter all details | Need to pay for Smartsheet subscription |

| 50/30/20 Simple Budget Template | Simple to use Need to manually enter all details | Free |

| Mint Budget Template | Automatically updates all account transactions Free Equifax credit report | Free |

| Personal Capital Budget Template | Automatically creates a budget based on your existing spending. Automatically updates all account transactions Also has an investment focused approach Great for retirement planning | Free |

| Qube Template | Divides your money into digital envelopes | The free tier offers up to 10 Qubes and includes bill pay. The premium version costs $6.50/month |

| Vertex42 Endless Spreadsheets | Several templates available Need to manually enter all details | Free. |

| YNAB | Puts every dollar into a category | $14.99/month |

| EveryDollar Template | Perfect for Dave Ramsey followers | Free version does not sync bank accounts. Plus version for $129.99/year |

| Mvelopes Budgeting | Envelope system of budgeting | Basic for $5.97/month Premier for $9.97/month Plus for $19.97/month |

| FTC printable | Very basic Need to manually enter all details | Free |

| Pocket Guard Template | Best for individuals struggling with overspending | Free. Premium features for $4.99/month or $99.99/lifetime. |

Which Budget Template Is the Best?

There is no one “best” budget template, as everyone’s needs and preferences vary.

The focus on investments and cash flow is why I use Personal Capital as my primary financial barometer. I hate having multiple tools, and the fact that Personal Capital manages not just the budget but also other financial aspects like retirement planning, cash flow, and fee analyzer for free has me sold. You can read my Personal Capital review for how I use the tool personally.

Keep in mind that these are only some of the templates and budgeting tools available to you, but there are many more. You have to be completely comfortable with the choice you make. If you aren’t, you might not use the template, which defeats the whole purpose.

What To Look For When Choosing a Budget Template?

There are a few things you should always look for when choosing a budget template.

First, the template should be easy to use. If it’s not, you’re going to have a hard time sticking to it. Remember, the goal is to use the template to pursue your long-term financial goals and not feel overwhelmed.

Second, the template should be adaptable to your situation. One size doesn’t fit all when it comes to budgeting. What works for one person won’t work for others. If you have been following Dave Ramsey’s baby steps to get out of debt, an envelope system like Mvelopes might work. Else the purchase might feel like overkill.

Finally, make sure the template is updated. Budgeting changes as your life does, so your template should change with it. If it doesn’t, you’re going to run into some trouble.

Final Thoughts on Budget Templates

A budget template helps you keep track of all of the little expenses in your life.

Many people think that creating a budget means giving up all the fun things in life, but that doesn’t have to be the case. In fact, with the right tools and resources, you can create a budget that works for you and your lifestyle.

Every store or site you visit is rigging everything against you. The advertisements, the placement of products, and the subtle reminders to buy more things break down your defenses and make you buy something you didn’t intend to purchase. If it sounds like they’re manipulating you, they are.

Budget templates put your finances into perspective to understand why it’s crucial to resist impulse purchases. It puts debt under a microscope so that you know how far you are from financial freedom. Carrying around debt is like carrying around chains. It makes it hard to breathe. Any money you make goes to paying your debt down, making it feel like you’re working for nothing. The budget template will help you tackle all that effectively.

You can tackle any goal, from living on passive income-producing assets to creating generation wealth, starting with a budget.

There are several different budget templates to choose from, so you can find the one that best suits your needs. Some people prefer using spreadsheets, while others find it easier to use software or apps. Whichever route you decide to take, make sure the template is easy for you to use and understand. If you’re not comfortable with it, you won’t use it, defeating the purpose.

FAQs on Budget Templates

How do I create a budget?

Keeping track of your spending is the key to maintaining a budget. You can get an accurate picture of your money and where you’d want it to go by tracking it regularly.

1. Select a budget template or an application to use. I prefer Personal Capital, but there are several options to choose from.

2. Collect all of your financial paperwork, especially bills which need to be paid

3. Calculate how much money you make each month.

4. Make a list of your monthly expenditures. Don’t forget annual expenses like property taxes and insurance.

5. Define your goals.

6. Create categories and assign spending amounts for each category based on your goals. It’s all about priorities. Perhaps it’s as simple as the 50/30/20 budget template: 50% for necessities, 30% for desires, and 20% for savings and debt repayment.

7. Don’t forget to include investing in the savings category for your retirement. Investing can be as simple as early retirement with your 401(k) or as complex as investing in Crypto IRA. While I-bonds are safe, they don’t grow your wealth.

8. Adjust your budget when your income or expenses change.

What should I include in a budget?

Your budget spreadsheet should include categories for each of your income streams and expenses. Subtract total expenses from total income to get the difference.

If the difference is a positive number, you are spending less than you earn, which is good. You can allocate your monthly surplus to the savings and investment category.

If the difference is negative, you need to earn more money with passive income ideas or improve your human capital at work.

How does a budget template work?

Take your earnings minus your expenses to see where your money is going. And how much you have left at the end of the month in minutes.

You can learn all you want about budgeting, but the essential thing is to discover a simple system to use. You MUST know how to budget your money to live a stress-free life.

Budget templates are programs that assist you in managing your monthly earnings and expenses. They aid in tracking your money so that you can make the most of what you have. Many templates include

1) A place to note all your monthly earnings and expenses.

2) A way to calculate the difference between the income and expenses

A budget template may be as basic or as complex as you want it to be. Check to see that it accomplishes the task and is suitable for you. If you’re searching for something more substantial, one of the budget templates on this page would undoubtedly be a good start.

What does a budgeting app do?

You may use budgeting apps to help keep track of your finances and give you a broad perspective on how much income you bring in, how much you spend, and what adjustments you need to make.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.