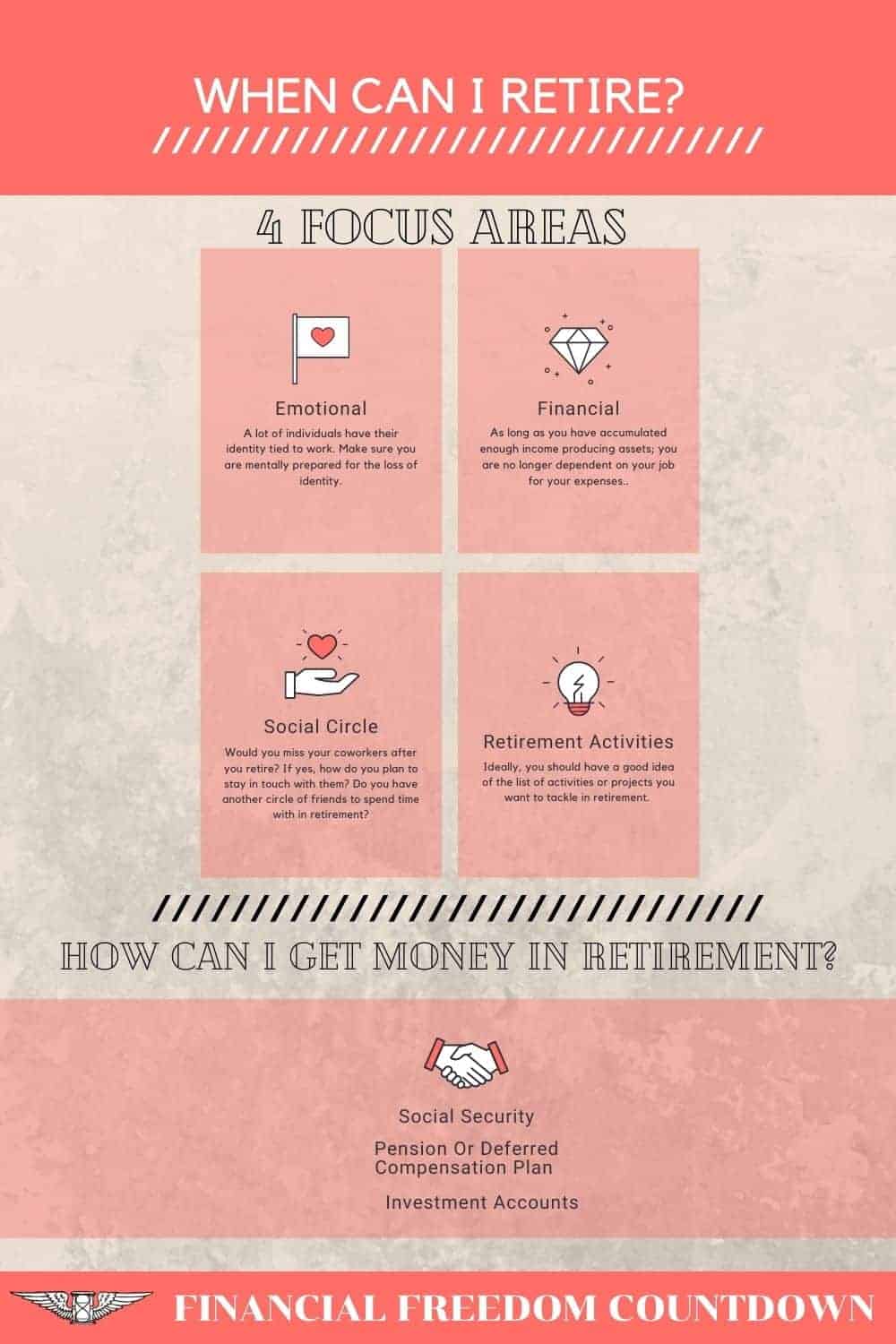

When Can I Retire? 4 Focus Areas To Help You

All of us have had bad days at work when nothing seems to go right. Frustrated with everything, we begin to wonder, “when can I retire?”. Before you go storming into your boss’s office, have a plan in place for retirement. Run your numbers through the best retirement calculators and figure out what you want to do in retirement.

How To Decide When To Retire

The answer depends on several factors.

Financial

As long as you have accumulated enough income-producing assets, you are no longer dependent on your job for your expenses. The income generated from a combination of your assets, pension (if you have one), and social security (depending on your retirement credits) should help you tackle retirement’s financial aspect.

Emotional

Many individuals have their identity tied to work. When you meet strangers at a party, the first few questions revolve around “what do you do for work.” Make sure you are mentally prepared for the loss of identity. When I am often asked this question, I mention that I am working on a stealth startup. After all, The Start-Up Of You by Reid Hoffman is one of my favorite books,

Social Circle

Given that we spend most of our waking hours at work, we often spend more time with our coworkers than our family. Consider the 8 hours we spend at our job versus the few hours after work we barely manage to eke out with our spouse or kids. Would you miss your coworkers after you retire? If yes, how do you plan to stay in touch with them? Do you have another circle of friends to spend time in retirement?

Retirement Activities

Although you want to run away from your job towards retirement, the answer to when can you retire should also be based on what you want to do in retirement. Ideally, it would be best to have a good idea of the list of activities or projects you want to tackle in retirement. Retirement should not be running away from something; instead, retirement should involve running towards something. Your hobbies, passion projects, time with loved ones could be some of the options for your retirement activities.

Sitting on a beach all day or playing golf will get boring after some time. Trust me, I have been there and done that. Decide on what hobbies you want to pursue. Some of these could be fun or passion projects. And you might end up even making some money like my friend Betty who started an online website related to herb gardening.

How Much Do I Need To Retire

Will you have income after you retire? The most crucial question is holding back people from quitting. To answer that question, you need to figure out your retirement income and expenses.

What Will Be My Expenses in Retirement

Anticipate how much you will spend in retirement using the 3 step approach

Current Expenses

First, start by looking at your current expenses.

If you do not already know your current expenses, I highly recommend linking all your accounts (credit cards, banks, brokerage accounts, etc.) to Personal Capital. I use it to track all my expenses for free, and it creates a budget for you automatically based on your current spending. Check out my step-by-step Personal Capital review.

Additional Expenses In Retirement

Second, make a list of your additional expenses in retirement which you do not currently have.

A typical example in the U.S. is healthcare. Most of us received subsidized healthcare through our work. As you grow older or have pre-existing conditions, your premiums stay the same since a risk pool is built of all employees. However, when you seek individual health insurance, you would be shocked at the costs of the premiums and the co-pays and deductibles. As part of the Affordable Care Act, healthcare exchanges based on each state have been created. Look at the various plans and the premiums associated with them on Healthcare.gov.

The other expense could be your hobbies, which you would now have more time to pursue. Add additional costs to your budget since you would now be spending more time golfing, skiing, or traveling worldwide.

Add all these anticipated additional expenses to your current budget.

Work-Related Expenses No Longer Needed In Retirement

Third, subtract any work-related expenses.

Any money you currently spend on commuting or daily eating out can be subtracted. If your job required you to dress professionally, you no longer need to maintain an expensive wardrobe.

Your income taxes should also decrease in retirement since you would be earning less after you retire.

Following the above three steps will give you a good handle on how much will be your approximate expenses in retirement.

How Can I Get Money In Retirement?

How Much Will I Get From Social Security?

Before deciding to retire in the U.S., make sure you check your social security credits. You must earn at least 40 Social Security credits to qualify for Social Security benefits. Social Security Administration also uses your earnings and work history to determine your eligibility for retirement or disability benefits or your family’s eligibility for survivor benefits when you die. I would strongly advise getting the 40 credits before considering when you can retire. Sign up for a free My Social Security account to check your estimated benefits.

You can start receiving your Social Security retirement benefits as early as age 62. If you are wondering, how much will I get if I retire at age 62; you would need to use the Social Security Calculator. The benefits would be reduced if you claim early. However, you are entitled to full benefits when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

Unless you are close to 55, I will not count on receiving the full benefits from Social Security. The program is expected to run out of money soon, and tough choices will need to be made. It is better to plan for reduced benefits and then be pleasantly surprised if you receive more.

Will I Receive Pension?

Great news if you are eligible for a pension. At present, very few non-government jobs pay pensions. Find out when you start receiving the money and what is the criteria to be eligible for a pension.

If you are not eligible for a pension, create your pension using the deferred compensation plan. As a high-income earner, the deferred compensation plan is also the best way to reduce taxes.

How Much Additional Retirement Funds Do I Need To Retire?

The money you have saved in pre-tax accounts such as 401(k) or post-tax accounts like Roth can be used to fund your retirement income. Don’t also forget to include your taxable accounts.

If all your investments are in a broad-based U.S. stock index fund, the 4% rule of thumb can be used to guesstimate how much income your portfolio will generate. For example, if you have $1,000,000 invested in the S&P500, you can expect to receive $40,000 annually on average. Remember, this is the stock market. You could also lose money for several years. Be prepared for the volatility, and don’t expect the annual returns to be consistent like clockwork. Some years, you could receive a lot more, and some years you could obtain none. I have laid out my criticism of the 4 percent rule and would plan for lower withdrawals. I reduced my safe withdrawal rate to 3% instead of 4%.

So the retirement income will be dependent on your social security amount, your pension, and your retirement funds invested.

For example, Terry calculated that in retirement, she needs $4,000 to lead a comfortable life. She is a public school teacher with a generous pension of $3000/month. Due to her pension covering most of her retirement needs, she only needs her retirement funds to generate an additional $1,000/month. Her stock portfolio of $300,000 can bridge that gap.

Her neighbor Patrick worked in the private sector. He is not yet eligible for Social Security. He also has no pension and did not enroll in the deferred compensation plan when working. Consequently, he will need a stock portfolio of $1,200,000 to generate his monthly income of $4,000 in retirement.

Bottom line, if you do not have a pension, be prepared to save aggressively during your working years to accumulate a larger nest egg funding your retirement.

How Can I Retire Early?

The best-kept secret to growing rich is to accumulate assets and avoid liabilities. To retire early, you need to shorten the time required to accumulate the desired assets, develop additional income sources, invest aggressively.

Early retirement requires a significantly larger nest egg compared to regular retirement. Because someone retiring at 40 would need a retirement portfolio to sustain themselves for 60 years compared to someone who retires at 70 and requires only 30 years of retirement income.

Also, early retirement would reduce your Social Security earnings. Since you would be contributing less to social security, your monthly benefits when eligible for Social Security would also be lower.

Higher Paying Job

Earn more money than the average person by improving Human Capital. If you earn $50,000 more every year than your neighbor, you will retire earlier than your neighbor. Moving for a career opportunity is not a bad idea. I still consider the San Francisco Bay Area as the best place for technology jobs. Similarly, look into what are the hubs for your industry.

Saving More

Ramp up your Savings Rate. You need to save more than you earn, but you need to save faster to retire early. The magic of compounding will give your money time to grow.

Investing Aggressively

Automate your investing. Investing is challenging due to a myriad of factors ranging from behavioral to psychological. Getting started with investing and continuing with investing should ideally be automated, so we do not second guess ourselves, trying to time the market or chase the next hot sector. I use M1 Finance to automate all my investing. Read my in-depth M1 Finance Review comparing M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront, and Betterment.

Besides my regular index funds, I also have my moonshot portfolio. Note that this is not a recommendation to buy or sell the specific stocks listed in the article. It would be best if you did your research.

Look at investments that use leverage. In the U.S., having a fixed-rate loan with a low down payment for buying houses is an excellent example of leverage. Currently, I don’t think a rental property is a good investment. But if conditions change, I would be open to adding more rental properties.

Instead I am now investing in real estate crowdfunding deals. Fundrise has a unique structure which permits non-accredited investors to invest for a low minimum (only $100).

Depending on your risk tolerance, consider asymmetric bets in your portfolio. These are investments which if they fall to zero, would have no impact on your life. Bitcoin is one of my asymmetric bets. My reasons for investing in Bitcoin are not financial. But rather stem from witnessing government persecution in the past.

When Can You Retire

Answering when can you retire depends on having a financial, emotional, and social plan in place.

Each of the retirement calculators can help you plan for retirement. However, none of the calculators can guarantee the future. The key to a successful retirement is flexibility. Live your life outside of spreadsheets and be ready to pick up part-time work or cut spending if something drastically wrong happens to derail your plans.

Early retirement is possible only through aggressive earning, saving, and investing. I hope some of the ideas presented can help you carve your path.

Readers, have you ever wondered when can I retire? Do you have a specific date in mind, or is it based on a certain net worth number?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.