Why Residential Rental Property Investment Is No Longer A Good Idea

It is always great to have many streams of income, some active and some passive. After all, accumulating assets and avoiding liabilities is the secret to getting rich.

Rental Property investment has been high on the list of passive income investments since automation will eventually result in robots taking your job.

I currently have a house and also a rental. With my cash out refinancing, my original plan was to buy another rental property as investment. Based on all the work from home trends, I evaluated whether San Francisco Real Estate is still a Good investment?

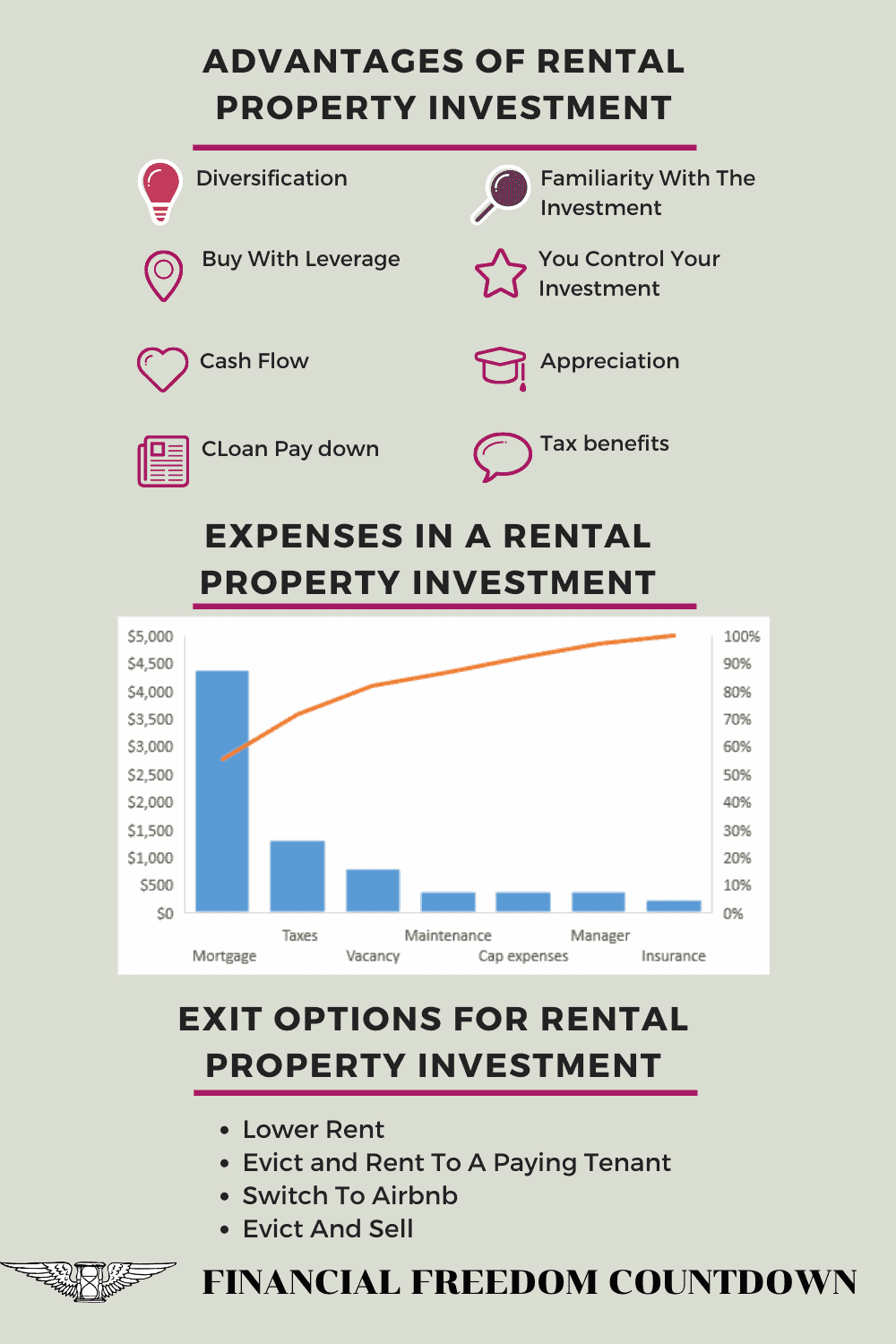

Advantages Of Rental Property Investment

There are many benefits to buying rental property as an investment. When you consider the three types of income – earned, capital gains and passive; we find that real estate passive income ranks higher than earned income.

Diversification

Rental property is not co-related to the stock market. One can achieve a fair level of diversification with stock like returns. Of course, Bonds allow you to diversify; with much lower returns.

Familiarity With The Investment

If one has already purchased their home; then it is a quick learning curve with rental investment properties.

Buy With Leverage

Rental property investments are great because you can borrow money and leverage it to buy property. The down payment is a fraction of the purchase price providing you leverage. When you have a 30 year fixed rate mortgage and make the monthly payments; the bank doesn’t care about the value of the property. This enables you to ride out the downturn in the property market. In fact, you can use several strategies to buy real estate with little or no money down.

You cannot use leverage to buy stocks in a similar manner. The brokerage firm values your stock portfolio daily. If you use leverage and the value drops; a margin call is triggered. The brokerage will either ask you to add more funds to the account or sell your stocks immediately.

You Control Your Investment

When you buy a rental property as an investment; YOU are directly responsible for the investment returns. Rental property investment returns depends on your skills to find a great deal, negotiate a deal. Or fix up the property increasing the value. Or use value add real estate strategies to create additional income streams. Or your photography and copy writing skills to attract a great tenant. Or your management skills in keeping a great tenant. Or all of the above.

Contrast this with stocks where you have no control on the returns. I could do all the research and pick Tesla as part of my Moonshot Investing portfolio. But Elon could send a tweet causing the price to drop. Nothing is in my control with stocks.

Cash Flow

Rental properties provide a steady cash flow. Rental income generates a passive income stream .

Appreciation

House prices typically increase at the rate of inflation. As a result of applying leverage; you come out ahead. Of course, if you pick a neighborhood undergoing re-devlopment; your gains could be higher.

You could also get lucky. Since the best place for Technology Jobs is still San Francisco; an investment here would have led to enormous gains.

Loan Pay Down

Typically you would buy the rental investment property with a loan. The tenants with their monthly rent payments are paying down the loan for you. If you hold the property as a long-term investment, your loan would be paid down. And you now hold the property free and clear. This again increases your cash flow.

Tax Benefits

Rental property investment offers many unique tax advantages. IRS provides a mechanism for recovering your cost in an income-producing property. This depreciation must be taken over the expected life of the property. You can also use accelerated depreciation if you follow cost segregation.

You do have to payback the depreciation when you sell. IRS has rules for Depreciation Recapture to be taxed as ordinary income. Taxes can be deferred as per the IRS with section 1031 exchanges.

The Tax and Jobs Cut Act also provided for QBI deductions for rental properties.

Expenses In A Rental Property Investment

When buying a rental property as an investment; inexperienced landlords only focus on rent vs mortgage payment.

But there are several expenses which one needs to consider when buying a rental property investment.

Consider a Single Family House with 3 bedroom and 2 bath in the Bernal Heights neighborhood of San Francisco (Zip Code 94110). Assume we buy the house which our flipper was considering in Flipping Houses: How To Flip A House Profitably at 3% interest rate. The sale price of a median home in San Francisco is $1.3M.

I looked at rental prices in that neighborhood using Stessa. As a landlord if you do not already have Stessa, I recommend signing up for their free service.

| Purchase Price | $1,300,000 |

| TOTAL INCOME (Monthly Rent) | $8,000 |

| Monthly Mortgage (20% down payment and 30 year fixed) | $4,385 |

| Monthly Taxes | $1,321 |

| Insurance | $238 |

| Vacancy (10% assumption) | $800 |

| Maintenance (5% assumption) | $400 |

| Capital expenses (5% assumption) | $400 |

| Property Manager fee (5% which is lower than average) | $400 |

| TOTAL EXPENSES | $7944 |

This landlord has been very diligent in anticipating all the costs involved in owning a rental property. Also the property is not over leveraged as the landlord has invested a large 20% down payment of $260,000. They evaluated the rental property using standard metrics and bought it

Unfortunately the landlord barely makes a monthly positive cash flow of $56.

The Cash on Cash return of the down payment is a terrible 0.26%.

In fact, if the landlord had adopted my strategy of investing Emergency Funds at 8% return they would at least have a better ROI.

One of the biggest mistakes landlords make; is not running their rental properties as a business. I use Stessa for tracking my time and expenses. Very useful during tax filing to ensure you do not miss any tax benefits.

Exit Options For Rental Property Investment

Rental property investment is not very liquid like stocks. Also you cannot dollar cost average to reduce price volatility when buying a rental property investment. Thus, you need to have many exit strategies planned in advance.

There are several real estate investment risks. One of the biggest risks with rental property investment is that the tenant is unable to pay the agreed upon rent. Landlords should always build contingencies in their estimates for a few months of vacancies. And also for lost money and time due to evictions.

There are several exit options to consider in such cases.

Lower Rent

Always run the numbers assuming you can still pay the mortgage, property tax, insurance etc with 70% lower rent. In case of job losses and high unemployment; the best strategy is to always have an open line of communication with your tenant. Offer them reduced rent if possible.

Rent To A Paying Tenant

If you end up with a non-paying tenant; the other option is to file eviction. And then rent to another tenant who has the ability to pay.

Switch To Airbnb

Most long term tenants move to a new property depending on the school year. If you need to evict during a time which is not attractive for long term renters; Airbnb could be one of the options. Before buying rental property as an investment; check to see if your local jurisdiction permits Airbnb.

Sell

Many mom and pop landlords are accidental landlords. They are unaware of the intellectual and emotional work needed to be a landlord. Selling the property provides them a way to recoup most of their investment.

As you can see, rental property investment offers many benefits. As long as you run the number and have a few exit options available. But, when facts change, it is time to change my opinion. Why do I now consider residential rental property to be the worst investment?

Changes To My Rental Property Investment Assumptions

Impact On Unemployment Rates

The pandemic caused the unemployment rate to exceed the Great Financial Recession era. As a result a lot of renters lost their income source.

Positive Actions By The Government

The government acted immediately with Fiscal and Monetary Stimulus. The joint actions by the Federal Reserve, Treasury Secretary and Congress resulted in stabilizing the economy. The worst was averted.

The Fed expanded its balance sheet by trillions of dollars and backstopped corporate debt markets by buying corporate bonds.

The $1,200 stimulus checks and the additional unemployment payment of $600 by the CARES Act provided benefits to millions.

In fact, the poverty rate fell by 2.3 percentage points. It was 10.9% in the months leading up to the pandemic (January and February) and fell to 8.6% in the two most recent months (April and May).

Negative Actions By The Government

Unfortunately the provisions of the CARES act ended. With Congress in a deadlock, CDC issued an order halting residential evictions.

The Federal order was in addition to State and Local restrictions halting evictions. California for example has a much more stringent state order halting evictions.

The impact of all the negative actions is that the government has shirked it’s responsibility. The tenants and the landlords have been put in a loose-loose situation.

Why Rental Property Is Now A Challenging Investment

As a result of the deadlock in Congress, affected tenants and landlords no longer receive any extra payments.

Most of the mom-and-pop landlords have also been affected by unemployment.

The tenant has no ability to pay and stops paying

The tenant cannot be evicted due to Federal and state moratoriums. The mom-and-pop landlord had several exit options in each of the last recessions. None of the exit options listed above would work.

The ban on foreclosures doesn’t extend uniformly as the ban on evictions does.

Even if the landlords don’t need to pay the bank now; they eventually need to make the balloon payment. Or risk foreclosure to the property.

Meanwhile property taxes, insurance and utilities continue. Landlord needs to maintain the property or could get in trouble with the law for not providing a habitable dwelling.

None of the local governments, that I am aware of, have offered relief from Property taxes.

Assume the world goes back to normal in 2021.

Even after the tenant starts working; it will be be hard for the tenant to pay the six to ten months of missed rent. The renter will end up most likely getting evicted.

The eviction record will make it hard for the tenant to rent another place. The unpaid rent sent to collections will impact the tenant’s credit. Credit cards, car loans, housing loans, etc will be more expensive for the evicted tenants to obtain.

Landlords will have to foot the bill for six to ten months of missed rent. As you see in my example above; the mom and pop landlord is barely receiving any cashflow.

Landlords expect missed rent payments for 3 months when investing in rental properties. Current eviction moratorium will result in over eight to ten months of missed rent payments.

Delinquent mortgages are already soaring and many landlords and homeowners will again lose their property.

What Should Ideally Have Happened

Instead of government abdicating responsibility and expecting the landlord to shoulder the burden; the government should have continued with some level of support to everyone impacted.

Provided vouchers to tenants which can only be used for rental payment.

Future of Rental Property As An Investment

Of course, everyone will assume the current pandemic is a once in a 100 year event. And extraordinary situations call for extraordinary measures.

I believe that once the genie is out of the bottle, hard to put it back in.

Next recession, I am sure the government will use the same playbook. Landlords will be again made to bear the brunt, whether it is a a pandemic or not.

So, I see small landlords exiting the business. After all, there are only so many times you can take a punch to the gut before being knocked down.

Residential rental market will be dominated by crowdfunded larger players. Mom and pop retail investors would be better suited to investing in real estate crowdfunding. There will still be investment opportunities as long as you know how to evaluate crowdfunded real estate deals.

Since residential real estate will face challenges going forward, most of my real estate investment is now moved to real estate syndication deals. Here are some of my choices.

PeerStreet can be used for hard money loans on debt deals. It has low $1,000 minimum which allows for better diversification for accredited investors. You can define the criteria based on rate, LTV, duration, etc. and their Automated Investing feature automatically places you into investments that match your criteria. I personally use the Automated Investing since the great deals are filled within minutes on their platform.

EquityMultiple is a real estate investing platform that gives accredited investors direct access to individual commercial real estate investment opportunities, allowing you to review, compare, and personally choose the deals that meet your investment criteria. Join EquityMultiple with low minimums of only $5,000 investment. I don’t see the government overreach in commerical as much as residential.

Farmlands continue to generate handsome returns even in recession since people need food. Also I do not anticipate any negative policy actions affecting farmers. FarmTogether provides accredited investors with an option to invest in farmland at the click of a button. You get the benefit of an experienced team evaluating various options before it is available on the platform. A crew takes care of farm management aspects such as insurance, accounting, leasing the farm, and working with the farmer. And finally to sell the farmland.

Fundrise: Most of the real estate crowdfunding platforms are restricted to only accredited investors. Fundrise has a unique structure which permits non-accredited investors to invest. Also Fundrise has a low minimum (only $100).

The trade-off with Fundrise is that you cannot select one particular property; but rather an eREIT which is invested in several properties. If you are a fan of diversification as I am; the investment spread over multiple properties reduces the risk.

| Investment Platform | Open to | Type of Investment | Minimum |

|---|---|---|---|

| PeerStreet | Accredited Investors | Hard money loans | $1,000 |

| EquityMultiple | Accredited Investors | Commercial | $5,000 |

| CrowdStreet | Accredited Investors | Commercial | $25,000 |

| AcreTrader | Accredited Investors | Farmland | $10,000 |

| FarmTogether | Accredited Investors | Farmland | $15,000 |

| Fundrise | Accredited and non-Accredited Investors | Residential | $100 |

Readers, how do you expect the government would react during the next recession?

Do you still consider residential real estate investment as a good opportunity for Financial Freedom Countdown? Is commercial real estate a better option for the future?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

I like how you think opposite of me. I just think that the cash flow is way more valuable now than a year ago, yet, rental property prices have not appreciated nearly as much as the value of the cash flow has increased.

Are you having a difficult time with your tenants currently? Maybe it’s because my tenants have so far paid on time during the entire pandemic, and I found another great set of tenants for my new rental property that I’m feeling bullish.

But the fact of the matter is, cash flow is so valuable now. I really just wanna on them for the next 20 to 25 years until my kids grow up. I think it would be great for them to manage and learn about the business. And if they need some place to stay, even better as well.

What did you end up doing with your cash out refinance several months ago?

Sam

Hi Sam, my tenants have paid every single month. But the populist government actions with no push back make me nervous for the future. One of the reasons I believe everyone needs some assets like bitcoin to protect against government confiscation.

I am in several Facebook groups where landlords are currently struggling to make ends meet since rentals was their only source of income.

I did not find great local cash flowing properties to execute the cash out refinancing. The $8K rent for the Bernal property would be a stretch. Are you able to cash flow locally?

Most cash flowing rentals are in Midwest and out of state would complicate my life. Prefer simplicity and to travel again once borders open up.