Can American Families Afford These Classic Holiday Movie Homes

As snow blankets the streets and festive decorations adorn houses, we often find ourselves immersed in the magic of classic Christmas movies. From the heartwarming “Home Alone” to the enchanting “Miracle on 34th Street,” these films showcase the cozy abodes where characters celebrate the season’s joys. But as we dream of living in these picture-perfect homes, the question remains: Can the average American today afford these cinematic dwellings?

Challenges in Realizing Home Ownership Aspirations

Today, the affordability of homes, particularly those depicted in classic Christmas movies, faces several challenges compared to the past. One primary factor contributing to this disparity is the significant increase in real estate prices relative to household incomes. Over the years, housing costs have surged exponentially, outpacing the growth of incomes for many families. Simultaneously, high interest rates on home mortgages present a notable obstacle. Although homes are not considered a liquid asset, they make up a large part of the average American net worth.

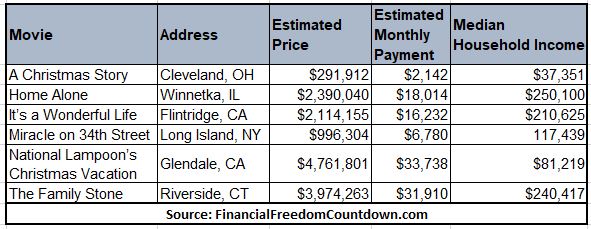

We compared six classic holiday movie home prices with the average income to determine affordability.

Home Alone

Address: 671 Lincoln Avenue, Winnetka, IL

“Home Alone” follows the misadventures of eight-year-old Kevin McCallister, accidentally left behind during the Christmas vacation. Initially reveling in his newfound freedom, Kevin soon faces a pair of bumbling burglars, devising elaborate traps to protect his home. Filled with comedy, heartwarming moments, and Kevin’s ingenious schemes, the film showcases the power of resourcefulness and family, delivering a holiday classic embraced for its humor and heart.

All parts of the movie, including the famous airport scene, were filmed in Illinois, and the Gregorian home on an ½ acre lot has an estimated price of $2.39 million. Although Winnetanka is home to billionaires, the estimated monthly payments of $18,014 are unaffordable for the average American residing in the city with a median income of $250,100.

The Family Stone

Address: 144 Riverside Ave, Riverside, CT

“The Family Stone” portrays the Stone family’s eventful holiday reunion as the eldest son, Everett, brings his girlfriend, Meredith, home to meet his eccentric and tight-knit family. However, Meredith’s attempt to fit in with the Stones encounters numerous challenges, leading to humorous and touching moments as family dynamics unravel.

The Connecticut home has an estimated $3.9M value, resulting in a whopping monthly payment of $31,842. The median household income in Riverside is only $250,000. In the movie, Everett Stone has made it on Wall Street by investing in stocks. Meredith is portrayed as a successful businessperson, and since starting a business is one of the best ways to get rich, they could afford to buy a similar home.

A Christmas Story

Address: 3159 W. 11th Street, Cleveland, OH

A Christmas Story” portrays the nostalgic and humorous tale of young Ralphie Parker’s quest for the ultimate Christmas gift, despite warnings about potential danger. Set in 1940s Indiana, the film follows Ralphie as he navigates school, family dynamics, and his persistent campaign to secure the coveted present. With a blend of humor and heartwarming moments, the movie captures the essence of childhood dreams and the joys and challenges of the holiday season.

Although the movie is set in Indiana, the iconic home is in Cleveland, Ohio, where the median income is $37,351. The home depicted in the movie was last sold in 2005 for $150,000. Although the home is off-market, the current estimated price of $291,912 is unaffordable in a county with a median household income of $37,351.

It’s a Wonderful Life

Address: 4587 Viro Rd, La Cañada Flintridge, CA

“It’s a Wonderful Life” unfolds the story of George Bailey, a compassionate and dedicated banker managing the Bailey Building and Loan in a small town. Facing personal struggles and disillusionment, George finds himself on the brink of suicide on Christmas Eve. However, a guardian angel intervenes, revealing George’s profound impact on his community. Through a heartfelt journey of self-discovery and redemption, the film celebrates the significance of kindness, love, and the effect of one’s life on others.

Although Flintridge, CA has a higher household income of $210, 625 the home featured in the movie has an estimated value of $2.1 million, making it unaffordable.

Miracle on 34th Street

Address: 24 Derby Road, Port Washington, Long Island, NY

“Miracle on 34th Street” tells the heartwarming story of Susan Walker, a skeptical young girl who encounters Kris Kringle, a man claiming to be Santa Claus, at Macy’s department store during the Christmas season. As Susan’s disbelief in Santa Claus is challenged, her wish for a house and a father figure becomes entwined with Kris Kringle’s mission to restore belief in the holiday spirit.

Homes similar to the ones Susan had on her wishlist are listed for a million dollars and are barely affordable for Long Island residents.

National Lampoon’s Christmas Vacation

Address: 727 West Kenneth Road, Glendale, CA

“National Lampoon’s Christmas Vacation” chronicles the misadventures of the Griswold family as they eagerly prepare for an extravagant Christmas celebration. Clark Griswold, played by Chevy Chase, anxiously anticipates his holiday bonus from his boss, Frank Shirley, hoping to install a swimming pool for his family. However, when Frank unexpectedly suspends the bonuses, chaos ensues, and Clark’s plans for the perfect holiday are thwarted, leading to a series of hilarious and chaotic mishaps.

Although most of the movie was filmed at the Warner Brothers Studio set, the home of Griswold’s boss, Frank, is in Glendale, CA. The home has a monthly payment of $33,678 based on the current estimated purchase price of $4.7 million. Although specific details of Frank’s high-level executive position are not revealed in the movie, the home would be unaffordable today based on the average income.

Economic Realities Limit Access to Iconic Christmas Movie Houses

In examining the affordability of iconic Christmas movie homes, it’s evident that the dream of owning these nostalgic residences remains elusive for many middle-class Americans today. The soaring home prices, compounded by high mortgage interest rates, stand as formidable barriers, while household incomes struggle to keep pace with the rapid rise in property costs. This financial reality leaves only a select few of these cinematic dwellings within reach, highlighting the widening gap between the charming celluloid representations and the challenging economic landscape faced by families striving to achieve such holiday magic in their homes.

Methodology

The current home price estimates are based on Redfin data as of Dec 10, 2023

Monthly payments were calculated based on a 30-year fixed mortgage with 7% interest was considered. Monthly payments included property taxes at 1.1% and insurance at 0.5%. HOA fees were not included in the monthly payment.

Affordability was calculated based on the housing cost-to-income ratio. Typically, financial advisors suggest that housing expenses should be around 28-30% of gross monthly income to maintain financial stability and comfort.

United States Census Bureau data was used to determine the median household income (in 2022 dollars)

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.