Real Estate Investing: How To Start Investing in Real Estate

Investing in real estate is a dependable way to increase income and make the most of opportunities. Compared to various income-producing assets, real estate tops the list. However, many people wonder how to begin real estate investing. With our experience in real estate investing, a few recommendations stand out above the rest.

It’s important to remember that it takes strategy and determination when navigating a real estate investing system. From our experience, we know real estate investing is a brilliant choice. However, if you don’t understand how to start real estate investing, remember that you’re not the only one. With the guide outlined below, you will obtain a deeper understanding of how to start investing in real estate, and by the end, you will learn a few of our personalized real estate investing tips.

Why Invest in Real Estate?

First, consider your reasons for why you want to want to invest in real estate.

Yes, real estate investing is a proven and dependable way to access and acquire wealth. Many millionaires worldwide have become rich with real estate investments or have diversified their assets later into real estate. For example, Bill Gates made his fortunes in technology and is now the largest private farmland owner in the U.S by investing in farmland.

Real estate is also great for building generational wealth.

There are lots of tax advantages of real estate investments.

Real estate investment allows you to diversify your portfolio with exposure to different markets, earn additional income, and obtain tangible assets. Additionally, you can have more flexibility with your lifestyle.

But before you pursue investing in real estate, define your personal why. It could be one of the reasons above or something more individual, such as funding your children’s education. Having a clear idea of why you want to begin investing in real estate will make it easy to stick to your plan when the going gets tough.

Yes, real estate seems glamorous, but it does involve lots of difficult choices. You defining your “why” will help you along the journey.

5 Steps To Begin Investing in Real Estate

Investing in real estate provides leverage and control over assets if done correctly. Beginning investing in real estate is a fantastic way to grow a financial portfolio. However, getting started in real estate investing does not happen overnight and requires a level of dedication and patience. Here are the 5 steps.

1. Organizing Finances

- Excellent Credit Scores

- Increasing Savings and Eliminating Debt

- Tracking Net Worth

2. Gather Information and Education

- Understanding Real Estate Investing Technical Terms

- Understanding Risks and Taxes

3. Exploring the different Types of Property Options

- Single Family Homes

- Small or Large Multi-Family Homes

- Investing in Properties With Vacant Land

- Explore Notes and Paper Investing

- REITS

- Investing With Commercial Properties

- Real Estate Crowdfunding

4. Beginners Strategies for Real Estate Investing

5. Commencing The Investing Journey

Organizing Finances

To get started with real estate investing, we needed to figure out our current financial stage and organize our personal finances.

Finding the income to provide for real estate investing is intimidating at first. The finances may stop some people from investing or moving forward with the goals because they don’t have the money on hand.

Comparing stocks vs. real estate, we know that the only advantage of real estate is using leverage or other people’s money (OPM). So you do not need to have all the money to buy properties since you can raise capital for real estate investing. But you need your finances to have the ability to borrow.

Excellent Credit Score

- No delinquencies

- Emergency fund

- Great credit score

A well-funded emergency fund will ensure you never ruin your credit when unforeseen incidents come up.

The credit score is the most crucial aspect since it drives the rates at which banks will lend you money. A bad score could cost thousands more for the same investment property than an investor with excellent credit scores. A bad credit report could also result in you losing the property since the seller may prefer another individual who is confident of closing the deal.

Often, our credit reports also have mistakes which is why it is imperative to monitor your credit reports and set up alerts. I use Credit Karma (free service) and Transunion (paid) to monitor my credit, including potential mistakes or credit hacks. Make sure you sign up and enable alerts.

Increasing Savings and Eliminating Debt

It is possible to invest in real estate with little or no money, but there are many risks involved. Getting started with lower leverage provides stability and a cushion if things go wrong as you are just getting started.

Increasing your savings rate will ensure you have adequate reserves for all your operating expenses and capital reserves. The other advantage of having cash on hand is getting better deals with cash offers eliminating any competition.

When we discuss finances or consider strategies revolving around debt, we want a plan to eliminate it. Those who want to know how to start investing in real estate evaluate your debt to income (DTI) ratios. The more I learned how to start property investing by eliminating my debt; I accomplished my goals faster. All banks and lending institutions rely on the DTI ratio before approving loans.

Interest rates have come down a lot lately. If you have been paying high interest on credit cards, car financing, etc., check out personal loan rates from up to 10 vetted lenders on Credible in 2 minutes for options to lower interest costs. There is no point in paying higher interest rates when you can use that money towards wiping out your existing loans.

Having adequate savings also means not needing excessive leverage when you start real estate investing. Of course, after you are more experienced, you can opt for strategies like cash-out refinancing to extract the equity out of your houses; but it is better to wait till you have some experience.

Tracking Net Worth

If you do not already have a good picture of your net worth, make sure you strengthen your financial position. I use the free Personal Capital software to watch my liquid net worth. Read my Capital review and sign up, so you monitor your cash flow every month.

Gather Information and Education

The next step is to educate ourselves on every resource available in the real estate industry. There are many free online and offline resources to familiarize ourselves with the real estate requirements. One of the cheapest sources of education is books. For only $15, you can get a wealth of knowledge from leading industry experts. The list of best real estate books for beginners should help investors understand the industry and decide on the best approach to real estate investing.

Understanding Real Estate Investing Technical Terms

The words in real estate are interchangeable and can confuse those who may not understand the differences. Learn all the basics and technical terms since you will come across a lot of jargon. Understand the real estate metrics used to evaluate a rental property.

Understanding Risks and Taxes

Real estate investing is not without risks in terms of leverage or borrowing money for investment options. There are several real estate investment risks so one should have an appropriate risk mitigation plan in place.

When you buy a property, the market can change, and you might have to sell it at a lower price due to unpredictable external conditions. Lots of factors can affect the real estate market. A few of them are

- Changing local regulations can alter the best states for real estate investors.

- Rising interest rate environments can make note investing unprofitable.

- Changes to the neighborhood can impact your triple net lease renewal.

- Lending restrictions can affect investors adversely when flipping houses.

- Expiration of the Tax and Job Cuts Act provisions could kill the QBI deductions of rental property.

So, while the economy fluctuates each year, we also need to watch for other risk factors to prepare ourselves against unwanted surprises better.

While real estate investment has many tax advantages, including 1031 exchange, depreciation, opportunity zones, etc., investors need to understand the tax provisions to structure their real estate operating companies. Two of the best books are The Book On Tax Strategies For The Savvy Real Estate Investor and The Book On Advanced Tax Strategies For The Savvy Real Estate Investor By Amanda Han and Matthew MacFarland.

Contrary to belief, property taxes are also a part of real estate expenses and can influence your investment choices. Taxes for every property are determined by using the property and classifying it. If you begin real estate investing, understanding the implications behind taxes will give you an advantage.

Discuss your options with a tax professional who knows about real estate investing versus a generic tax preparer. Seek references from real estate investment groups to find a qualified tax professional.

Exploring the Different Types of Property Options

Our next goal is to explore different real estate options and reliable investing strategies. The investing strategy in real estate helps determine which direction we want to focus on. There are many different strategies to obtain real estate and build wealth.

Depending on your dreams and financial stage, some options and strategical advantages might differ from the next. The one that gave you confidence in finding investment properties depends on your level of preparation in understanding the type of real estate niche you want to focus on.

Single Family Homes

Single-family homes are fantastic for beginners. There are always families looking to rent good houses in an area with a decent school district. In addition, single-family homes offer reliable long-term investment opportunities. Families are more likely to continue renting and not be opposed to increasing rent each year since they have kids in school and are settled in the community.

Choosing a single-family home in your local real estate market is an excellent choice due to the easier learning curve. You already might be familiar with buying your primary residence, so the process will be similar.

Please make sure you use real estate agents who work with investors. or have several real estate properties themselves. The critical difference is that residential real estate agents working with typical home buyers focus on aesthetics like granite countertops. In contrast, agents who own rental properties themselves will understand you want a profitable deal based on market data.

Single-family homes provide a steady income while you can build more significant equity with the tenants paying down your mortgage. Often beginning in real estate investment, consider acquiring multiple single-family homes at once, then sell them together for a more significant investment return a few years later.

A good location attracts quality tenants who are more likely to stay in the house for the long run. Depending on your neighborhood, you can remodel and increase the property value by raising rents after stabilizing the property. Consider hiring a property manager to make your income-producing rentals genuinely passive.

Make sure you account for all expenses, including capital reserves, when deciding on the price at which you buy the property. As seen in the example below, if you do not run the numbers when purchasing the property, you will barely obtain any cash flow.

Consider a Single Family House with 3 bedroom and 2 bath in the Bernal Heights neighborhood of San Francisco (Zip Code 94110).

| Purchase Price | $1,300,000 |

| TOTAL INCOME (Monthly Rent) | $8,000 |

| Monthly Mortgage (20% down payment and 30 year fixed) | $4,385 |

| Monthly Taxes | $1,321 |

| Insurance | $238 |

| Vacancy (10% assumption) | $800 |

| Maintenance (5% assumption) | $400 |

| Capital expenses (5% assumption) | $400 |

| Property Manager fee (5% which is lower than average) | $400 |

| TOTAL EXPENSES | $7944 |

The property is not over leveraged as the landlord has invested a large 20% down payment of $260,000.

The landlord barely makes a monthly positive cash flow of $56.

The down payment’s Cash on Cash Return is a terrible 0.26%.

When buying a property, make sure you run the numbers, and the buy price makes sense.

Small or Large Multi-Family Homes

Small multi-family homes are homes with four or fewer units. A duplex, triplex, or fourplex are good options because you can obtain residential mortgages on these properties. The lender considers the income from the other units as income towards your mortgage payment. You can live in one unit while renting out the other units enjoying price appreciation as the tenants pay your mortgage.

The Federal Housing Administration allows an investor to buy a multi-family property with a 3.5% down payment versus a 20% down payment with a conventional mortgage loan.

Acquiring larger multi-family homes with five or more units is considered multi-family commercial real estate. Commercial real estate loans have shorter terms (typically only five years) and have higher interest rates. The initial investment is a lot higher than small multi-families. Hence, it makes sense for beginners to buy the physical property with four or a lower number of units.

Large multi-family can span from apartment buildings to mobile home parks. Although one could leverage limited real estate partnerships to acquire these properties, they involve a lot of specialized asset class knowledge. It is more complicated to value large multi-family units based on cap rates and IRR.

You can use value add real estate strategies to create additional income streams.

Investing in Properties With Vacant Land

Vacant land property investments are great for developing neighborhoods. You can find low-cost vacant land in an area where the market and economy are predicted to grow.

In addition, we know that with vacant land, investments take time. So if you don’t mind waiting for the region to grow, you could sell the property at a higher value in the long term.

The most significant risk with vacant land is that you need to be in the “path of progress,” else you could be stuck with the vacant land for decades. Vacant land does not yield any real estate passive income and has all the associated expenses, including property taxes.

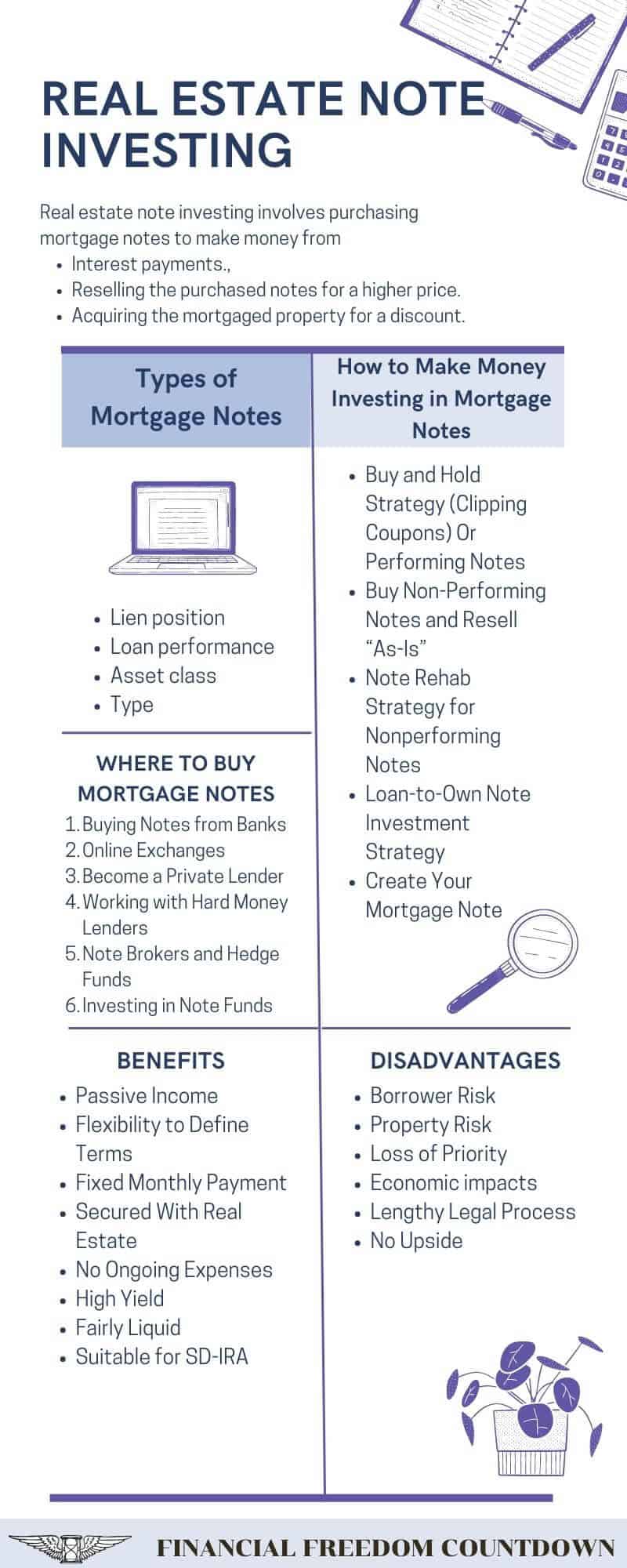

Explore Notes and Paper Investing

Real estate note investing is a way to buy the real estate and property debt at a discounted price to acquire the property. Investors find note investing very profitable as they can buy a property at a lower cost, cover the debt accumulated, and resell it at a higher price.

Essentially the investor is the bank for the individual purchasing the property. When exploring investment properties, note that this type of property investment follows specific rules and regulations; however, it is a profitable strategy. Experienced investors can navigate note investments to have high returns.

Most note investing opportunities are restricted to investors meeting the accredited investor qualifications.

PeerStreet has several debt options on their platform where you essentially provide hard money loans for others to buy the property. The advantage of PeerStreet is that you can filter debt deals by Loan To Value (LTV) and also stressed LTV. PeerStreet has a low $1,000 minimum and has an optional automated investing feature that automatically places you into investments that match your criteria. I use Automated Investing since the good deals are filled within minutes on their platform. PeerStreet also allows investors to review the performance of every past investment, which is helpful for due diligence.

Consider REITs

Real estate investment trusts (REITs) are a great way to start real estate investing passively with a high level of diversification.

REITs own, operate, or finance income-producing real estate across many property sectors. REITs allow anyone to invest in real estate assets by purchasing individual company stock or through a mutual fund or exchange-traded fund (ETF). The stockholder of a REIT earns a share of the income produced without actually having to go out and buy, manage or sell the property.

With REITs, you get the benefit of diversification across several properties for relatively smaller amounts. You can buy publicly-traded REITs using no-fee platforms like M1 Finance for as low as $10. Check out my M1 Finance review for more details on dollar-cost averaging your REIT purchases. The large fund families like Vanguard, Schwab, Fidelity all have Real estate index ETFs trading under the following ticker symbols – VNQ, SCHH, FREL, respectively.

Investing With Commercial Properties

Commercial property investments usually purchase more prominent and established office buildings, malls, warehouses, etc. The lease is generally locked away for many years with long-term tenants. When learning how to start property investing, remember that commercial real estate investments can lead to cash flow opportunities but are subject to market fluctuations. However, it is hard to begin with, commercial and industrial real estate when beginning real estate investing.

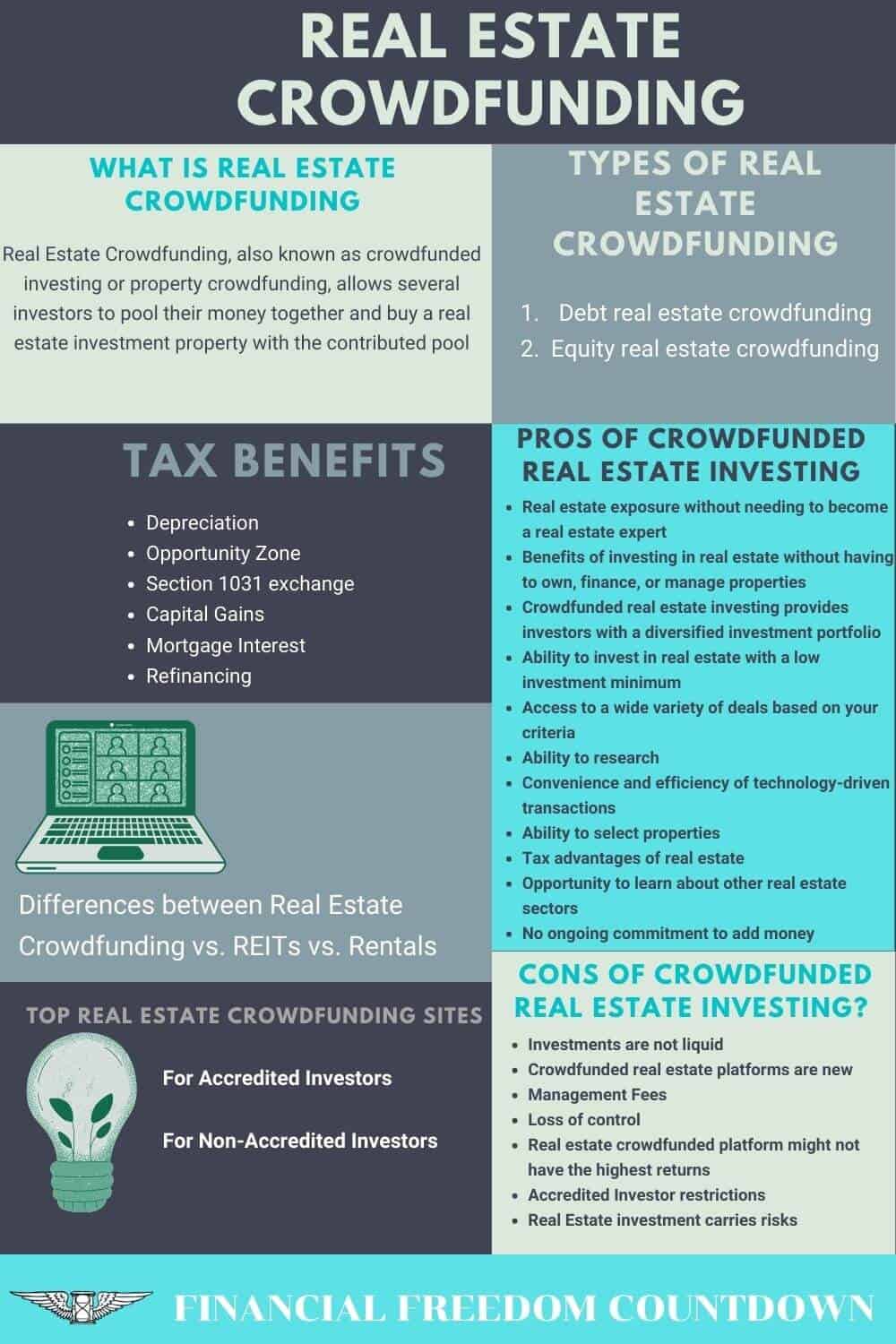

Real Estate Crowdfunding

Real estate crowdfunding provides opportunities for investors to get involved with commercial properties. Crowdfunding allows several investors to pool their money together and buy a real estate investment property with the contributed pool.

Crowdfunding for real estate investors is a way to diversify their investments and own multiple properties with less risk than if they were doing it alone. The process gives individual investors access to the real estate market without owning, financing, or managing properties.

With the passage of the JOBS Act followed by the passage of Title III, non-accredited investors were allowed to participate online in the real estate market (Regulation A+) but only on specific offerings.

Fundrise: Most real estate crowdfunding platforms are restricted to only accredited investors. Fundrise has a unique structure that permits equity crowdfunding for accredited and non-accredited investors. Also, Fundrise has one of the lowest minimums (only $10 for the Fundrise Starter Portfolio and $1,000 for the Basic level).

DiversyFund is similar to Fundrise in offering a REIT structure. It offers a low $500 minimum and is available for accredited and non-accredited investors. You can’t withdraw your money until the five-year investment term is over because DiversyFund reinvests the dividends and earnings your investment generates until the real estate asset is sold.

Streitwise is similar to Fundrise in offering a fund structure and is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals.

EquityMultiple is a real estate investing platform that gives accredited investors direct access to individual commercial property, allowing you to review, compare, and personally choose the deals that meet your investment criteria. EquityMultiple has a low minimum of only $5,000 investment. They are one of the few sites that claim to co-invest in every investment, ensuring “skin in the game” and the most significant incentive to do maximum due diligence. EquityMultiple has many different asset types: office buildings, industrial, senior housing, retail, residential, self-storage, student housing, data centers, etc.

Beginners Strategies for Real Estate Investing

The beginning steps of your investing journey matter the most. There are unforeseen events and changes to be best prepared for. Fortunately, you could attack those changes and continue the momentum for your long-term investing goals due to the solid preparation.

The beginners’ strategy is a safe and stable way to begin real estate investing. It takes a little more hard work and has smaller steps, but the process is successful when getting started in real estate investment with fewer finances. When first starting, stability is essential. Some of the techniques used as a beginner can include:

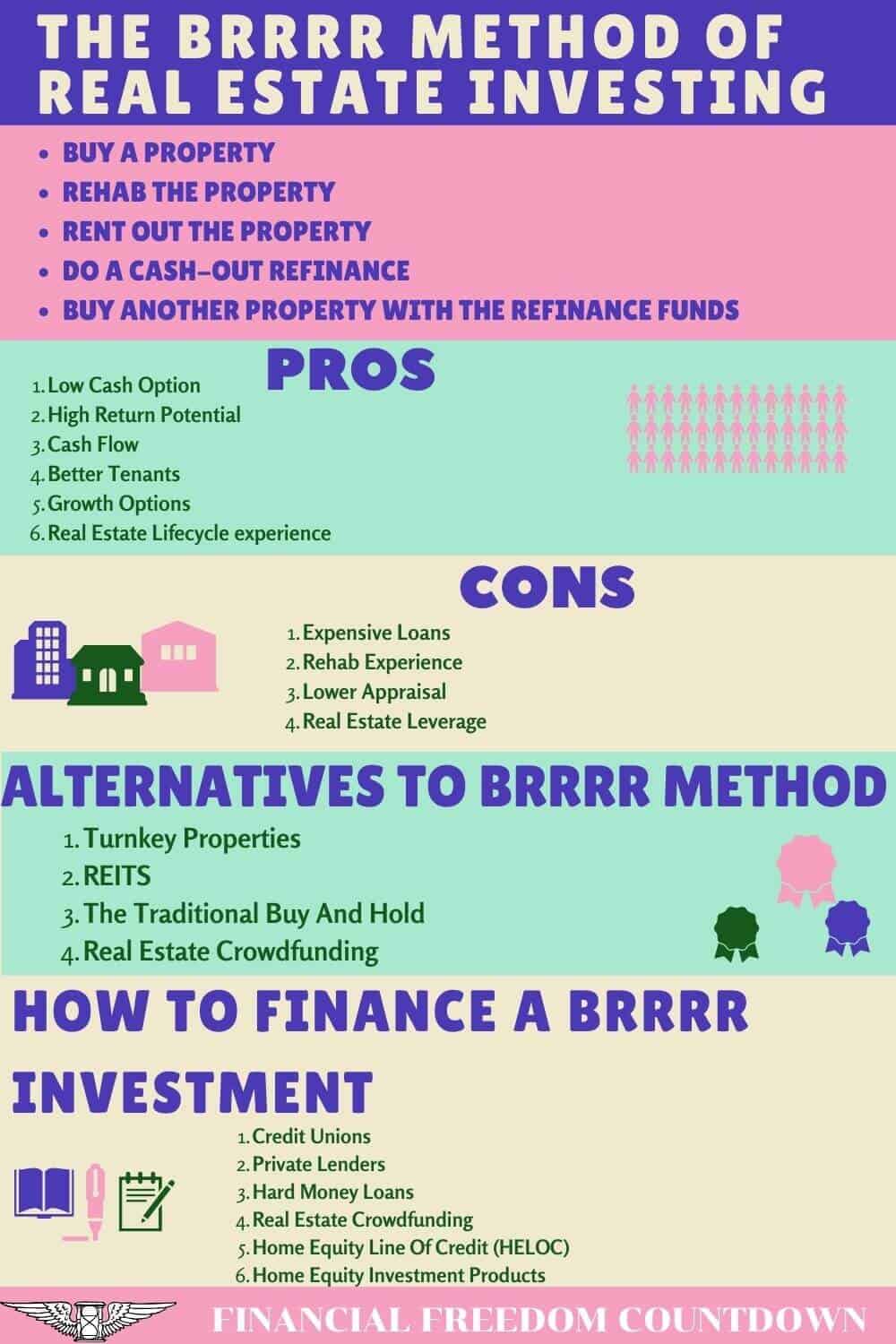

House hacking using the BRRRR method is a real estate investment technique in which you purchase a distressed property, fix it up, rent it, cash out refinance it to fund your next BRRRR rental investment property.

Real estate wholesaling is when you buy the property with the intent to sell it to someone at a higher price immediately. Unlike flipping, the wholesaler doesn’t renovate or put money in the deal. The wholesaler acquires the contract from the property’s seller and assigns that contract to a buyer for a fee.

Wholesaling real estate isn’t selling the property but selling the right to buy the property.

Flipping houses involve buying a home, fixing it up, and selling for a profit. Ensure you have strict timelines on the project and estimate your rehab costs accurately. Incorrect estimates are the reason most flippers get into trouble. One of the best books on the topic is Estimating Rehab Budget by J Scott.

Buy and hold rental properties such as single-family or multi-family homes.

Learning how to start property investing with beginner strategies will help you later when doing more significant real estate syndication deals.

Commencing the Investing Journey

We designed an outline of goals during this point in our roadmap, including what niche to focus on, what types of properties we wanted, and if we wanted to do paper real estate investing or own actual properties. As a result, it was easier to focus on the plans and take them step-by-step to make wise real estate decisions.

Our real estate investing experience found that real success came from learning from past mistakes. But, of course, it doesn’t mean we didn’t learn from other real estate investors but rather gained the insights, so we avoided potential mishaps.

We sought out partnerships when we began our real estate investing industry journey. We continued to ask for an expert’s advice. Local real estate meetups are a great place to network with other investors. Of course, one must be cautious when entering any financial arrangements, especially with strangers.

The journey into real estate investing requires due diligence, implementing multiple exit strategies, and setting realistic goals. In addition, being a successful real estate investor requires strong professionalism and creativity.

Final Thoughts on Real Estate Investing

The first thing to understand is that real estate investing is a journey, not an overnight destination. Real estate investors should start by creating goals and implementing investment strategies step-by-step.

Real estate investing requires flexibility to produce results. It is not an overnight success but rather a marathon.

There are several ways to invest in real estate. Make sure you stick to one property type and learn everything before moving to another niche.

We encourage those who want to start investing in finding a strategy that aligns with their goals.

Readers, have you considered how to start with real estate investing? Any success stories or lessons learned along the way?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.