Student Loan Forgiveness Sparks 27% Surge in Federal Budget Deficit Based on CBO Report

The Congressional Budget Office (CBO) performs nonpartisan analysis for the U.S. Congress. The latest Budget and Economic Outlook released June 2024, offered dire projections for the country’s fiscal and economic landscape over the upcoming decades.

Unfortunately the federal deficit jumped 27% more than the estimates provided in February.

The budget deficit for fiscal 2024, which ends Sept. 30, is now expected to be $1.9 trillion.

4 Major Factors Responsible

The majority of the rise in the fiscal 2024 deficit results from four factors projected to increase spending.

1. Student Loan Forgiveness – $145 Billion

2. Costs for “deposit insurance” – $70 Billion

3. Additional legislation – $60 Billion

4. Higher-than-expected Medicaid costs – $50 Billion

$145 Billion Spike Due to Biden’s Student Loan Forgiveness

The majority of the rise in the fiscal 2024 deficit results from four factors projected to increase spending. The largest contributor is a $145 billion increase, attributed in part to adjustments made by the Biden administration to student loan repayment plans and a proposed forgiveness program that aims to waive accrued interest for millions of borrowers.

Although the forgiveness program is still pending finalization, it could potentially be implemented as early as this fall.

Judges Block Parts of Biden’s New Student Loan Forgiveness Plan

Biden’s new student loan repayment plan faces uncertainty following injunctions from two federal judges on Monday, halting further implementation and loan forgiveness pending lawsuits challenging the policy. The rulings raise questions about enrollment and loan cancellation for millions of affected borrowers.

The CBO Report was published prior to the rulings and will be subsequently adjusted based on court cases.

$70 Billion Spike Due to Deposit Insurance

The CBO’s report outlines that costs for deposit insurance have increased by approximately $70 billion. This is because the Federal Deposit Insurance Corporation (FDIC) is not recovering payments made during bank failures in 2023 and 2024 as quickly as the CBO had previously anticipated.

$60 Billion Due to Additional Legislation

Third, additional legislation has resulted in a further $60 billion in cost increases.

$50 Billion Due to Medicaid cost increases

$50 billion in increased spending is due to higher-than-expected Medicaid costs.

The CBO found that most of the payment and delivery demonstrations launched by the Centers for Medicare and Medicaid Innovation (CMMI) from 2011 to 2020 did not save money as intended.

Instead, they cost the government $5.4 billion more than they saved, including administrative costs. The CBO also projected that CMMI would continue to be a net cost for Medicare through 2030.

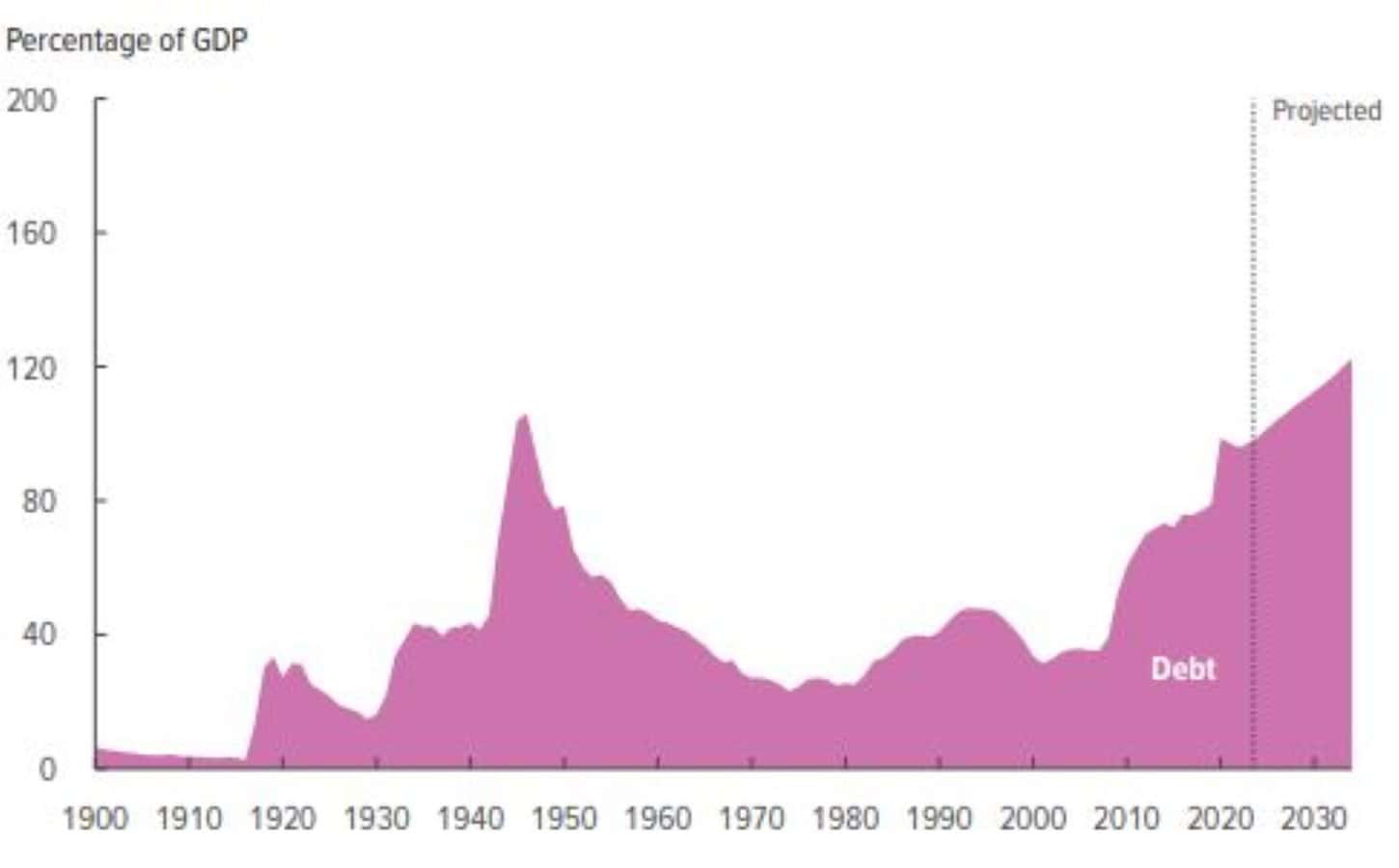

Record High Federal Debt

Debt held by the public rises in each year, from 99 percent of GDP in 2024 to 122 percent in 2034 – higher than at any point in history.

The Federal debt is now totaling $34 trillion—approximately $6 trillion more than the nation’s gross domestic product (GDP), which represents the value of all goods and services produced by America’s 330 million residents in a year.

Including Social Security and Medicare liabilities, the total debt is several times larger than GDP.

Federal Deficit Increasing

The deficit for the period from 2025 to 2034 is expected to reach $22.1 trillion, which is $2.1 trillion higher than the CBO’s February projection.

This increase is partially due to recent legislation, including emergency supplemental appropriations allocated in 2024.

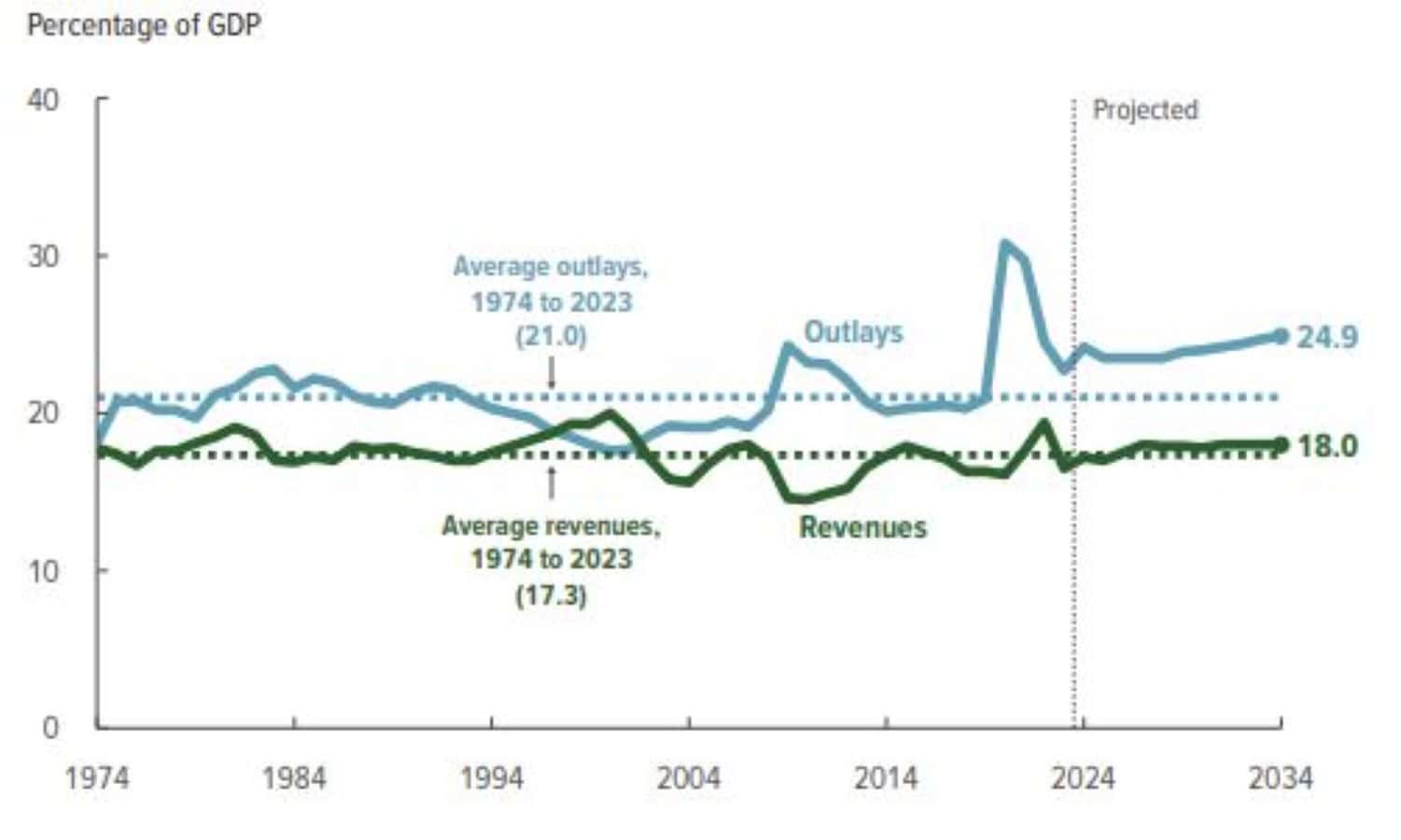

Gap Between Spending and Revenue Increasing

Federal expenditures as a percentage of GDP surpass their 50-year average every year from 2024 to 2034 in the CBO’s projections.

Meanwhile, revenues remain below their 50-year average in 2024 and 2025.

Interest Cost Will Soar

Rising interest rates and growing debt lead to higher net interest payments.

Starting in 2025, interest costs relative to GDP are higher than at any time since at least 1940 (the first year for which the Office of Management and Budget reports such data), surpassing expenditures for defense and nondefense programs and activities.

The U.S. government is projected to pay nearly $900 billion this year solely in interest on the national debt.

According to Congressional Budget Office (CBO) projections, assuming an ideal scenario with no major conflicts, recessions, or financial crises, debt service costs will steadily rise to about $5.3 trillion by 2054.

Interest payments this fiscal year will be larger than defense spending.

Trust Funds Approaching Insolvency

Critical trust funds face looming insolvency. The Highway Trust Fund is anticipated to exhaust its reserves by 2028, the Social Security retirement trust fund by 2033, and the Medicare Hospital Insurance trust fund is on track to deplete its funds by the mid-2030s. The insolvency of these funds would trigger automatic, across-the-board reductions in their payouts.

Social Security Insolvency

The CBO projects that the Social Security Old-Age and Survivors Insurance (OASI) trust fund will run out of funds by 2033, coinciding with the moment when individuals currently aged 58 reach the official retirement age and the youngest of today’s retirees hit 71. Consequently, all recipients will experience an automatic 25 percent reduction in benefits, irrespective of their age or financial situation. The solvency analysis by CBO matches the projections included in the Social Security Trustees Report.

Outlook Worsened Drastically in Just 4 Months

For the 2025–2034 period, CBO now projects that if current laws generally remained unchanged, the cumulative deficit would be $22.1 trillion.

That amount is $2.1 trillion (or 10 percent) more than the $20.0 trillion the agency projected this past February.

Measured in relation to the size of the economy, federal debt at the end of 2034 is now projected to equal 122 percent of gross domestic product (GDP).

In February, debt at the end of that year was projected to equal 116 percent of GDP.

U.S. Government Accountability Office Warning on Fiscal Health

The CBO report is not the only agency sounding the alarm bells. The U.S. Government Accountability Office published a report in February on the nation’s fiscal health. The report states, “The federal government faces an unsustainable long-term fiscal path that poses serious economic, security, and social challenges if not addressed.”

The projected growth of debt outpaces economic expansion, expected to reach 200% of GDP by 2050 without changes to revenue and spending policies.

Persistent large budget deficits are fueled by rising Medicare and Social Security expenditures exceeding revenue.

Interest payments by the government as a percentage of GDP are set to peak by 2030, driven partly by increasing interest rates.

Bleak Outlook Based on the CBO Analysis

The Congressional Budget Office (CBO) Economic Outlook, projects significant fiscal challenges for the U.S. over the next decade. Deficits for this year equal $1.9 Trillion and the debt is 99% of the GDP.

The gap between government spending and revenue continues to widen, with interest costs on the rise. Additionally, critical trust funds, including those for Social Security and Medicare, are approaching insolvency, threatening across-the-board cuts. Economic growth is anticipated to slow in 2024, leading to increased unemployment. With the U.S. consumer already under pressure, the upcoming decade looks challenging.

Like Financial Freedom Countdown content? Be sure to follow us!

11 Low-Stress Retirement Jobs to Keep You Happy and Healthy

After working so many years, it feels great to be able to retire. All those years playing with the best retirement calculators and planning how to retire early have finally paid off. So many plans, like travel, relaxing, working in the yard and doing other things you’ve put off for years. But after a while, many retirees get bored. Getting a job after retiring is a great way to stay active physically and mentally. Most retirees want to stay stress-free while still working at a new job. Retirees have a lot of knowledge and skills to offer. There are many low-stress jobs that retirees can do. Thankfully, some of the best low-stress jobs are some of the more exciting jobs a retiree can do. Before we jump into the list of retirement jobs, there are 5 benefits of finding a low-stress job for retirees.

11 Low-Stress Retirement Jobs to Keep You Happy and Healthy

Exodus From California and Massachusetts to Florida and Texas Continues

2023 saw booming demand for U-Haul equipment from California, Massachusetts, Illinois, and New Jersey as citizens chose to flee the West Coast and Northeast. On the U-Haul Growth Index, which shows net losses of one-way trucks in various states that year, California, Massachusetts and Illinois ranked 50th, 49th and 48th, respectively – marking their third consecutive year at the bottom positions. But what could be causing such a mass exodus from states like California, New York, and Illinois?

Exodus From California and Massachusetts to Florida and Texas Continues

Top 10 Housing Markets Where Soaring Prices Leave Locals Priced Out, Defying Historical Norms

Real estate economists at Florida Atlantic University analyzed average expected home values based on historical data against current list prices across the nation’s 100 largest metro areas. The study used publicly available data from online real estate portal Zillow or other providers from January 1996 through the end of last month, for single-family homes, townhomes, condominiums and co-ops. The research aims to pinpoint cities with significant price disparities, shedding light on the challenges faced by long-time residents priced out of their neighborhoods amidst soaring real estate costs. Besides home owners, the findings are also important for real estate investing to identify pockets of exuberance and analyze if the higher priced metros deserve the price jump compared to historical trends. Here are the top 10 cities where current prices are much higher compared to their historical prices.

Top 10 Housing Markets Where Soaring Prices Leave Locals Priced Out, Defying Historical Norms

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.