Ultimate guide to Emergency Fund including how to get 8%+ risk free returns

Why have an emergency fund?

The basic purpose of an emergency fund as the name implies is to be available for use during unforeseen circumstances to avoid going into debt. All debt is not necessarily bad.

In fact debt can be used strategically to accelerate Financial Freedom Countdown. However, we need to ensure that lack of planning for an emergency does not cause us to spiral into debt.

Falling into unplanned debt usually means borrowing money at the last minute out of desperation which results in unfavorable lending terms.

The most egregious lending term is usually the high interest rate risk. This high interest rate acts as a shackle and prevents us from accelerating our Financial Freedom Countdown.

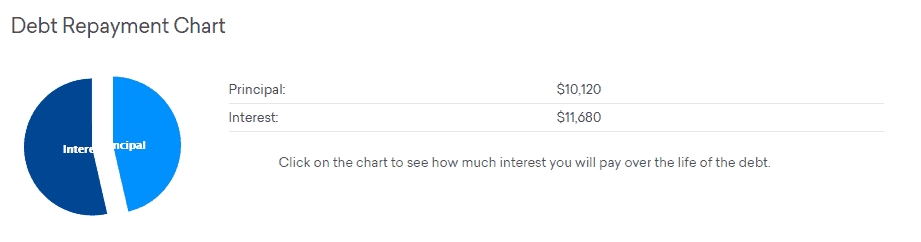

Consider a scenario where due to an emergency I need to borrow $10,000. If I do not have an emergency fund and borrow this from a credit card, the typical rate offered is 20% APR.

Credit cards would let you make a small minimum payment of a fixed amount $50 or 1% of the balance due every month. Credit card companies also charge late fees but we will ignore that for now and assume you can pay twice the minimum amount due expected by the credit card company.

| Balance Owed | $10,000 |

| Interest Rate | 20% |

| Expected Monthly Payment | $200 |

| Fees | $0 |

Do you know how much interest you would pay compared to the actual money you borrowed?

Yes, the interest in the above scenario would be more than what you actually borrowed.

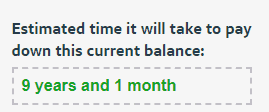

And can you guess how long it would take to repay if you just made the above payments?

While there is a time and place to use credit cards and rack up travel points for expensive travel; putting all expenses on a credit card when you cannot pay off your balances in full by the due date is not a good strategy. If you have a credit card make sure to pay the statement balance every month.

Hopefully you are now convinced why emergency fund is important and why build an emergency fund.

What should an emergency fund cover?

Now that we have understood the perils of not having an emergency fund; let us dive into when to use an emergency fund.

Some personal finance blogs consider the following scenarios where the emergency fund can be used

- Roof repair

- Car breakdown

- An unplanned trip to visit a relative in poor health

- Major health expense

- Emergency pet care

While each of these circumstances arise unexpectedly; they always need to be planned for in your regular budget.

The challenge with considering these as emergencies and using your emergency fund is that these can occur on a fairly regular basis and you would then be depleting your emergency fund frequently.

If your roof is 15 years old then you should plan for a roof repair in the next 5 years. However, if you replaced your roof 4 years ago, then you would not need to plan for a replacement soon. Similarly, depending on the age and condition of your car; you can anticipate it needing repairs or replacement and budget accordingly.

Of course, personal finance is personal; and what should an emergency fund cover, is best left to your comfort level.

What constitutes a real emergency?

As we covered in our post on leveraging Human Capital; when you are working, your job provides a steady stream of income which can be used for various expenses including saving and investing. However, when you no longer have a job; you need to be able to fend for yourself until you can find another job.

[bctt tweet=”Job loss is the only reason you should consider using your emergency fund to pay your bills; while you are searching another job.”]

When to establish an emergency fund?

I disagree with a few aspects which Dave Ramsey preaches; namely investing assumptions and methods; but the one I can get truly behind is

Dave Ramsey Baby Step 1 – $1,000 to start an Emergency Fund

Start your emergency fund as soon as you have any income and before you even begin paying off any debt. Once you have at least saved $1,000 in your emergency fund; go ahead and tackle your debt. Also, continue adding to your emergency fund so it reaches the appropriate size. It might need to be more than $1,000 but get started. Here are some ideas to how to save $10,000 over a period of time.

How much emergency fund is needed?

The size of your emergency fund depends on your job security. Your job provides a monthly cash flow. When you are no longer employed you need to cover your regular expenses which would directly influence the size of your emergency fund

- Do you work in the private sector or you have a government job?

- Is your industry one of the hot sectors always in demand?

- How relevant are your skills to find a new job if you are laid off?

- Are you in a growing city with jobs being added or do you live in a dying city with job loses every year (is your city more like Detroit or is it like San Francisco)

- How willing are you to move for a job across states or even countries?

If I worked in the government sector; I would have a 3 month emergency fund because the possibility of losing job is remote.

I work in the private sector and my job can be kicked out with a day’s notice. I am comfortable with a smaller 6 month emergency fund since I would have already built the required network for a job search.

Others may feel better with a slightly larger 6-9 month emergency fund. It all depends on the 5 factors outlined above.

Where not to keep your emergency fund

The obvious question on everyone’s mind is where to store emergency fund? Where should emergency fund be invested to beat inflation?

An emergency fund should always be available at a moment’s notice in case of an emergency. The worst thing that you can do is to plan and save for an emergency and then have it lose value since you invested in a risky asset class for an additional yield. Stock markets over a long period do offer higher returns but having your emergency funds stored in the stock market would be the worst idea.

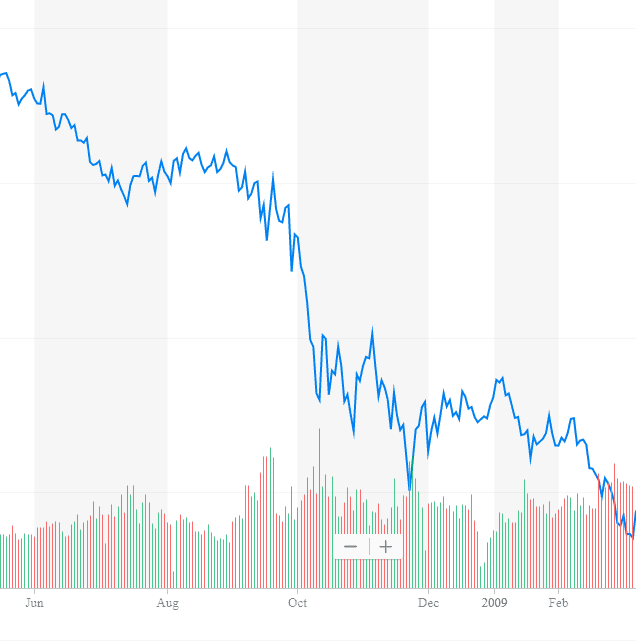

In case anyone suggests stock market to park your emergency fund; let us go back to the great financial crisis of 2007-2008. Jobs were lost at an alarming pace and that is when you most need your emergency fund to pay your bills.

Watching the stock market brutally get chopped in half would have made even the most ardent fans of roller coasters puke at the volatility..

Asset backed investments like real estate, art or legal investments might feel safer and yield decent returns but they all have a lockup period ranging from 6 months to 5+ years. So funds are not immediately available as needed.

While FDIC insured accounts are currently the safest way to store the funds; the challenge is always watching the emergency fund not provide any return on investment.

In fact, after accounting for inflation you might even be losing a bit of money every day.

How to get highest safe return on your emergency fund?

The best of both worlds would be to have a way to park your emergency fund in a FDIC insured account and at the same time earn 8+% returns.

The Magic is Bank Bonus

Several banks and credit unions offer a sign-up bonus when signing-up for a new account.

[bctt tweet=”Bank Bonuses offer safety, liquidity and high return on your emergency fund”]

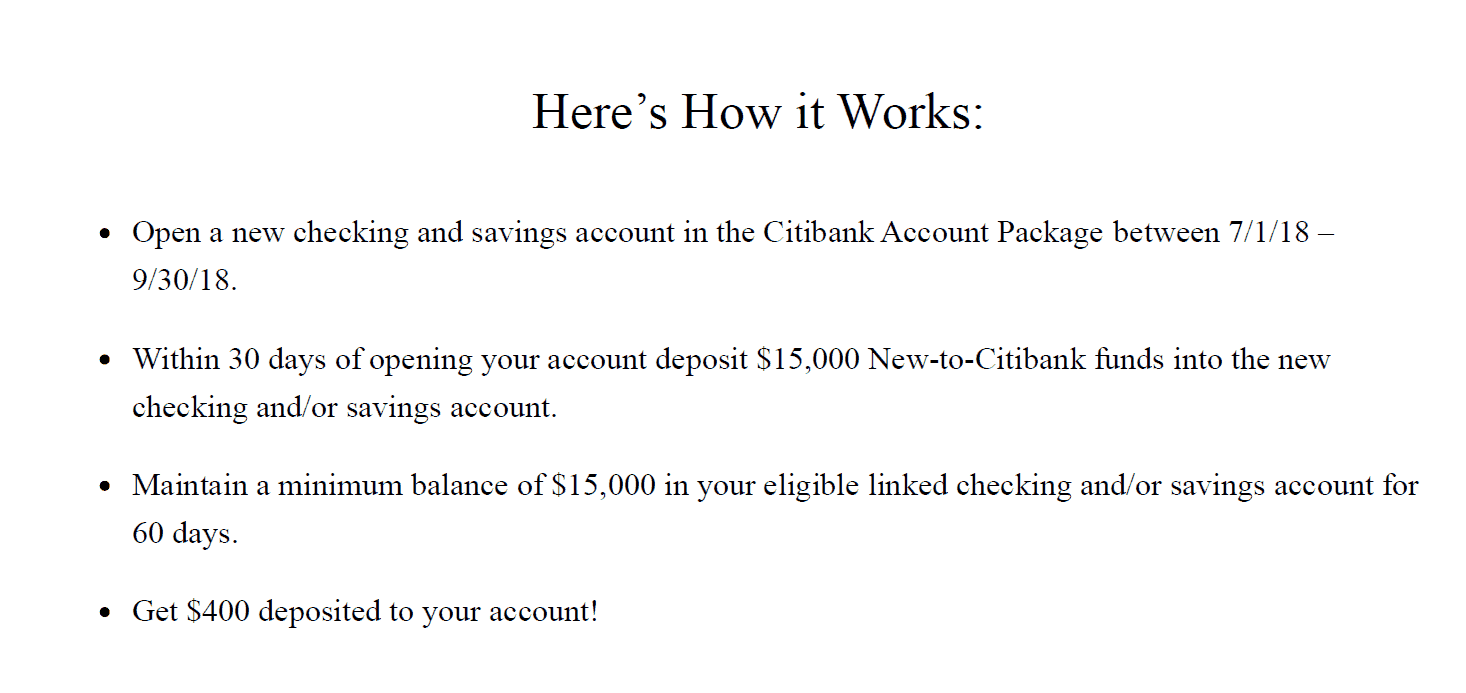

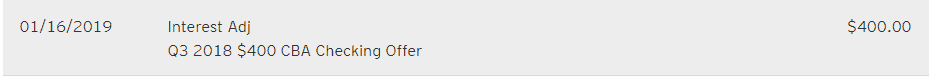

Check out this recent Citibank offer which needed $15,000 deposited for a cool $400.

I completed the offer and had the bonus deposited without any issues into my account

The ROI is a cool 10%. Isn’t that the best return on your emergency fund with ultimate security of not only your funds but also your ROI being protected?

Why do banks offer a bonus?

The reason most banks and credit unions offer a bonus is to give you an opportunity to try their services and then cross sell you other products like loans, credit cards, brokerage accounts, etc.

Also bank accounts are usually quite “sticky” in the sense that people rarely change their bank accounts and hence this additional incentive is usually needed to get people to switch from their existing bank to the new bank.

Some banks have absolutely zero requirement and only need you to park the money for a period (typically 3 months) to get the bonus. See the Citibank offer above. I also availed of a recent Chase offer which needed a deposit of $15,000 deposited for 3 months to get a $225 bonus. There is a better offer of $300 but since I had already availed of that offer last year I was not eligible for it and only received the lower $225 offer.

Instead of rate chasing for a paltry sum; I usually park my funds in various banks based on bonus conditions availing of the security of FDIC insurance while earning a very high interest rate (in the form of bonus)

Some banks however impose certain requirements such as Direct Deposit or Debit card transactions or Bill Payments. The purpose of these requirements is to get you used to actually using the account so after the bonus is posted you still continue using it and don’t switch.

Most of these requirements are quite easy and can be usually done all online from the comfort of your couch. Even if your couch is not as fancy as Jennifer Aniston’s $754,000 sofa 😊

Let us examine each requirement in detail and how it can be satisfied

Direct Deposit

If banks have any requirements for bonus; it is usually Direct Deposit. The reason is that the bank assumes you would switch your paycheck to the new bank and then use it going forward.

They are hoping you then start using this new bank as your primary bank.

You do not need to switch your entire direct deposit. Most firms allow you to split your paycheck among various accounts.

If you have this option, go ahead and send whatever is the minimum needed to satisfy the direct deposit bonus.

If this is not an option; consider ACH of funds from one bank to the target bank and this usually satisfies the direct deposit bonus requirement.

Whatever you do; DO NOT CALL the bank to ask this question. Bank systems usually can’t distinguish between ACH and an actual Direct Deposit but a human looking at your account will know the difference.

Debit card transactions

Some banks impose requirements for either a certain number of transactions or a dollar value of transaction. If you have this requirement it should be easy to meet with your regular purchase.

Although I usually prefer to use reward earning credit cards for all transactions including paying federal taxes; this is one instance where you could use the debit card for only meeting this minimum threshold.

Bill Payments

This should be an easy requirement to meet since you can pay any utility bill or even other credit card bills using bill payment.

What do I need to consider?

- You need to systematic in keeping track of the requirements to get the bonus and ensuring you met them. Else you can lose the entire bonus. Take screenshots of the offer and put reminders in your calendar when you open an account, when you need to meet the various requirements and most importantly when you close the account. A good way to gamify this is to consider it as a challenge between you and the banks.

- Make sure you read the terms and conditions carefully since they outline when the initial deposit can be withdrawn, how to keep the account fee free and when you can close the account.

- Just like you have a credit bureaus maintaining reports of your credit cards; banking information is typically available on ChexSystems. Some banks may notice you frequently applying for new bank accounts and deny it. Although it is a rare occurrence and would not have a significant impact; this is something you should be aware of. ChexSystems is a nationwide specialty consumer reporting agency under the federal Fair Credit Reporting Act (FCRA) so you should request your free copy every 12 months and review it.

- Bank bonues are taxable so you will be issued a 1099-INT by the bank. Make sure you include it when filing your tax returns.

Summary

- Bank bonuses offer a great way to store and invest your emergency fund in a secure manner earning a high rate of return with almost zero risk

- Be systematic wrt tracking the bonus requirements so you get your high returns.

Readers, where do you store your emergency fund? Have you considered bank bonuses to juice up your returns and if yes; what has been your experience?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

I’m confused… 400 / 15000 = 0.026. That’s 2.6%, not 10%. How did you calculate 10% ROI?

You are correct in the calculation but that 2.6% is only for 3 months. Some banks give you the bonus as soon as you meet the deposit requirements. But you need to look at the terms and generally the requirements to maintain the deposit are capped at 3 months. So the annual return is 2.6%*4 which results in 10.4% annually.

I conservatively estimate 8% annual returns which is quite good considering you spend only 20 mins every quarter to open accounts, deposit and withdraw funds online.

Hello, so once you’ve received the bonus do you close the account or use the account for another purpose?

I close the account based on the terms and conditions. Some banks give you the bonus as soon as the money is deposited and expect you to keep it open for 6 months. Others have no such requirement. I would say always save a copy of the offer terms when you apply and close accounts accordingly.

Love these bank bonuses. Are you able to get the bonus from Chase even if you have a current account with them?

Yes, the bonus is a great way to compensate for our low interest rates.

You can get the Chase bonus as long as it has been 24 months since you last had the bonus and not a current account holder. So if you have a business account it might be possible to get a personal account bonus depending on the terms and conditions.

In in the same boat. About to buy a house and I’m afraid 3 months isnt enough, going to try to have 9 mnths to a year in cash…

Having more cash provides peace of mind. And if you use these techniques you can also get a higher return.

Thanks for sharing the Citibank info, that’s the best bonus I’ve seen. I like it because there aren’t a lot of strings attached and the rate is fantastic.

Thanks Debbie. In case you did not get in the Citibank offer has now been extended to end of the year and they increased the $600 offer to $700.