Financial Freedom Checklist To Track Your Early Retirement

As America celebrates it’s freedom; it is time for us to pause and reflect on our own personal Financial Freedom Countdown journey. This post should help you create your own Financial Freedom Checklist to keep you on track for Early Retirement.

4th July is the perfect time since it is the midpoint of the year. All of us would have made New Year’s Resolutions and need help to gauge how we are progressing.

This has been a particularly tough year across the globe. With the pandemic, recession, protests it has been a challenge To Get Stuff Done Even When You Don’t Feel Like It.

The Financial Freedom Checklist reviews the main areas of earning, saving investing, tax planning and asset protection.

Keep Your Job During Layoffs

Layoffs usually involve corporations needing to trim fat. In good times; you can generally coast along and you won’t get pushback. However when the managers are required to cut; you can be sure they will force rank all members of their team.

Your goal is to be in the top quartile so your peers get the axe; and not you.

If you have already survived the first round of cuts, do not get complacent. Stocks markets have almost recovered; but the business sentiment is still weak.

It is a good idea to double down and see how you can make yourself valuable; not just to your team but also demonstrate value to your coworkers.

We have covered several strategies on How To Improve Human Capital And Accelerate Financial Freedom.

ACTION STEP: Complete a honest assessment where you are with respect to your peers. Is your division or company doing great? If not, review the strategies mentioned in the Human Capital post. Don’t wait till it is too late.

Create Multiple Sources Of Income

Unfortunately, many business were not lucky enough to just survive by reducing their workforce. Some industries such as hospitality, travel, retail, etc were totally decimated.

Do not beat yourself up. Even though you did everything right, just by virtue of being in the wrong industry you suffered. Analyze your current high-income skills, If you need to transition to another industry do you have the necessary skills? Checkout this free list from Coursera

While you continue to look at gaining skills and possibly switching industries, now is the time to consider alternate streams of income.

Software is eating the world. The entire world has moved online. Even my ethnic Indian grocery store now has a website to order things online.

There is a lot of money being made by everyone moving online. Even something like fitness coaching to doctor visits can be done online. After this pandemic ends and we are able to resume our normal activities; the online behaviors developed will continue. At a minimum, learn to start building a website. There are lots of free lance gigs to help local businesses transition online.

ACTION STEP: Turn your hobbies into income generating businesses. Follow this step-by-step guide on how to start a website in 10 minutes. Learn from the examples on how you create an additional source of income.

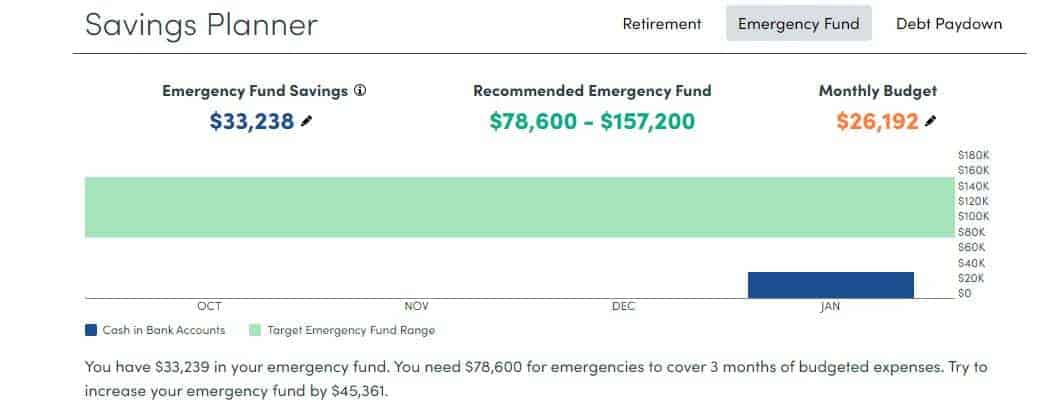

Validate Your Emergency Fund

The pandemic and the government ordered closures across the globe have shown how business have been crushed for lack of funds. Individuals who have been ordered to shelter in place also suffered loss of wages.

This is a great time to look at your emergency fund and determine if it is adequate.

With interest rates at an all time low, it is very difficult to keep your emergency fund safe while getting a safe and high return on your money.

Make sure you read the Ultimate guide to Emergency Fund including how to get 8%+ risk free returns. I follow this strategy every year and have managed to get 8% to 10% return on approximately $75,000 in Emergency Fund.

ACTION STEP: Log into your Personal Capital and check if your emergency fund can sustain your living expenses for at least a year. Make sure you deploy it such that you earn 8%+ risk free.

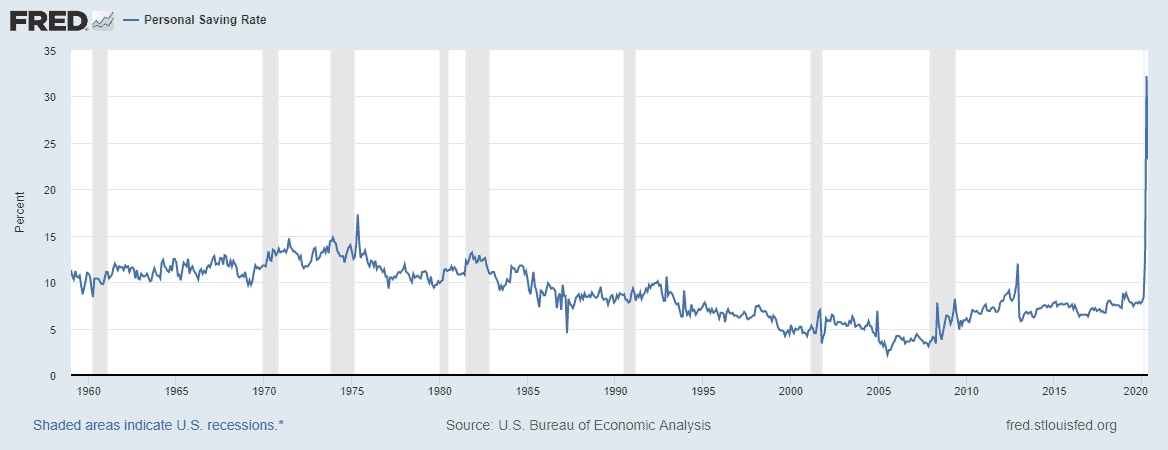

Increase Your Saving Rate

The St. Louis Fed publishes a helpful chart updated every month. The US savings rate has hit an all time high of 33 in April%.

Saving rate is dependent on what you spend and what you earn. We already talked about ways to earn more at your job and also how to develop additional streams of income outside of your day job.

Let us now focus on expenses.

Given the uncertainty in the economy, we should all tighten our belts and eliminate any non-essential expenses.

ACTION STEP: Learn how to calculate your Saving Rate and 3 ways to increase it.

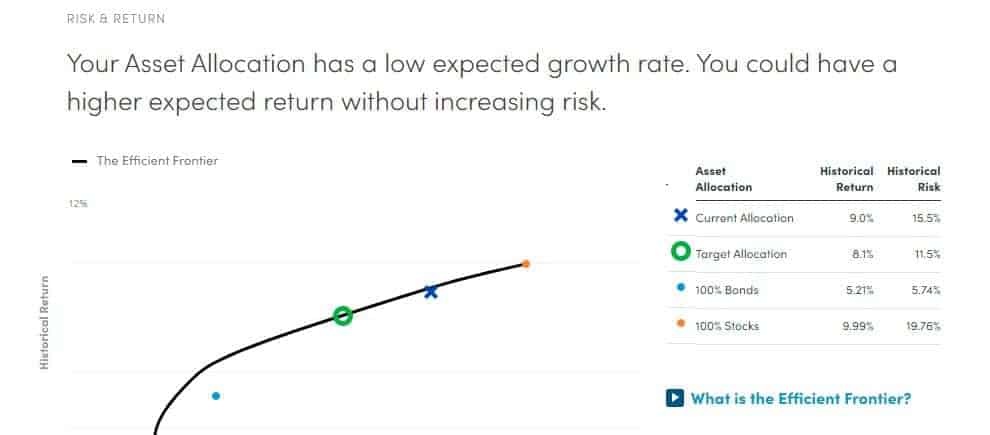

Determine Your Asset Allocation

We talked about accumulating income-producing assets. Now is a good time to check your asset allocation.

Are there some assets missing in your portfolio you wish to add for diversification?

Is your portfolio balanced as per your risk profile?

While the markets go higher, everyone wants to be 100% into stocks. Luckily the market has recovered for NOW.

Think about the vicious stock market drop in March. How did it made you feel?

If the markets would continue to drift lower or stay 40% down for over a year; would you buy more or throw in the towel and sell?

Would you be able to hold on to your stocks watching your hard earned money evaporate before your eyes?

Personal finance is personal for a reason. My risk tolerance would be different from yours.

I can tolerate maybe a 30% drop but would panic if it dropped 60%. Others may sleep soundly like a baby no matter the gyrations of the market.

Log into your Personal Capital account which aggregates all your investment accounts. Look at your asset allocation and decide what is your risk allocation. Based on the efficient frontier, you can decide your stock/bond mix

This is a good time to analyze and plan accordingly.

ACTION STEP: Perform the Investment Checkup in your Personal Capital account. Review the recommendations and see if you need to make any adjustments. Refer to my Personal Capital Review on how to use this free financial software.

Track Retirement Goals

The basic goal of targeting Financial Freedom is Early Retirement.

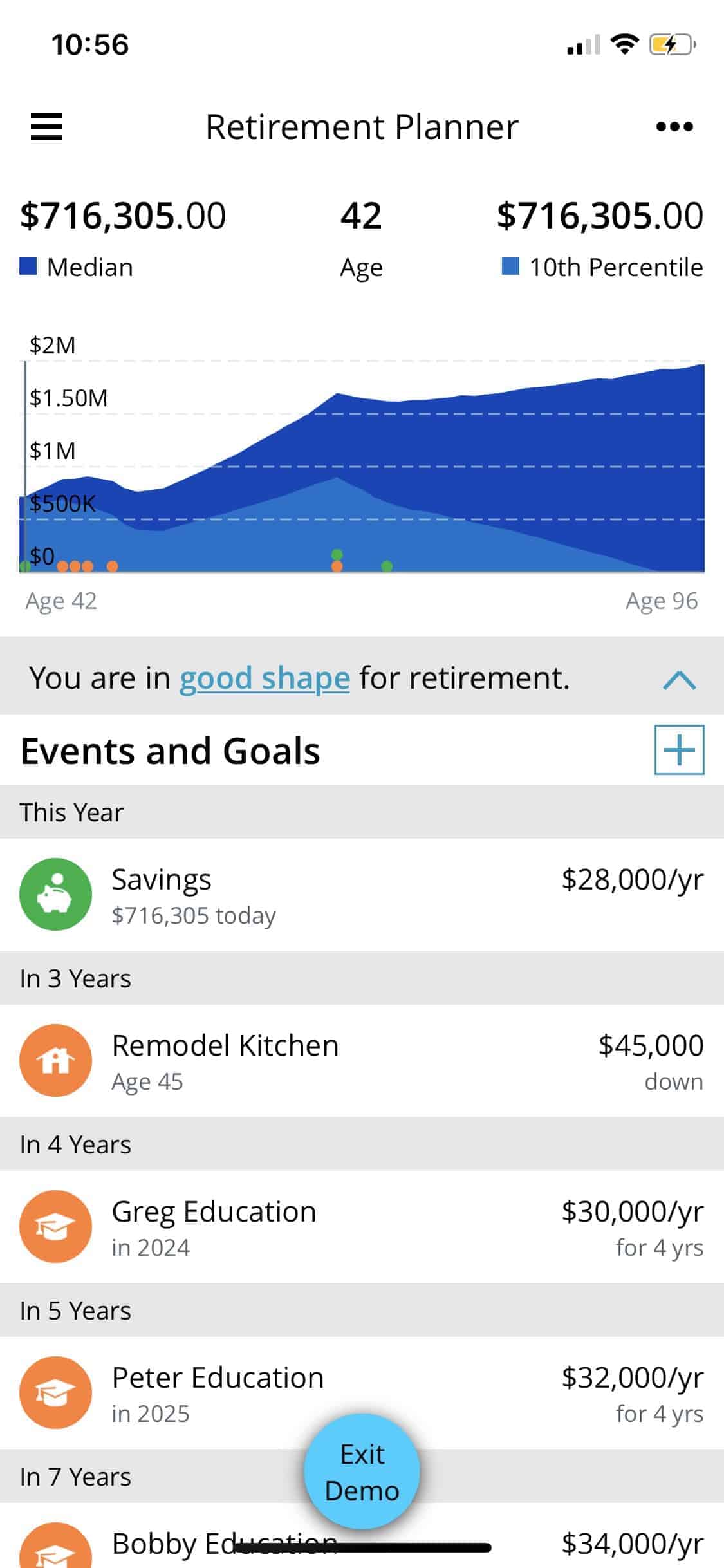

While planning for early retirement, you also need to consider future goals such a child’s education or a kitchen remodel. If you are using the Personal Capital Retirement Planner, enter future goal amounts in the planner.

The Retirement Planner also takes into account the fact that some of your money is in Taxable accounts and some is in Tax deferred accounts such as IRAs and 401(k).

Your Federal and State taxes are also considered when running the various Monte Carlo simulations.

ACTION STEP: Although this is a mid year checklist, plan long term and calculate if there are any upcoming major unavoidable expenses. Use the Retirement Planner to analyze if you are on track based on all your assets and liabilities.

Start Tax Planning

We usually think of Tax Planning Strategies only while filing taxes. By then it is too late.

Give that you would have just completed filing taxes for last year, check your returns. Discuss with your CPA what other ways you can save.

Are you maxing out all tax advantaged accounts?

Did you claim all your rental property deductions?

Are you keeping track of all your business expenses and write-offs?

ACTION STEP: Analyze your last year’s tax returns, What do you need to do differently so that you pay minimum taxes?

Review Your Insurance

In order to protect yourself you need to make sure you carry the appropraite level of insurance.

This could be Health insurance, business insurance, landlord insurance, umbrella insurance, etc.

We live in a very litigious society. You do not want someone coming after your assets.

Ensure your assets are segregated from each other. Make sure no judge can pierce the corporate veil. Carry appropriate levels of liability insurance.

ACTION STEP: Review your insurance and asset protection plan.

Readers, do you believe in a mid year checklist to ensure you are on track?

Final Thoughts On Financial Freedom Checklist

Any particular areas you are lagging in your early retirement planning?

Are there more items which would be beneficial to add to the Financial Freedom Checklist?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

One Comment