Farmland Investing: Is It Worth It And How To Get Started?

The financial independance journey has two parts. Accumulating wealth and preserving wealth. Both of these phases involve investing in income-producing assets but with different risk characteristics. In the accumulation phase, your human capital is high, and you can afford to take risks with moonshot investing or asymmetric bets like cryptocurrency investing or SPACs.

Once you accumulate significant wealth, it is time to shift gears into preservation mode. There is no point in continuing to play risky games when you have already won. It is now time to earn steady returns with asset-backed securities like crowdfunded real estate or farmland investing. Let us focus today on how to start investing in farmland.

Is Farmland A Good Investment?

Farmland investing has a long history of producing stable returns. The returns are due to increasing farmland values and the profit from the cash crops.

Farmland Value Increases

No one is making more land. As the population keeps increasing, we need to build more houses, acquire more land for transportation, shopping, etc., reducing the amount of farmland available. Also, with the increased global population, demand for food increases, making the existing shrinking supply of farmland more valuable.

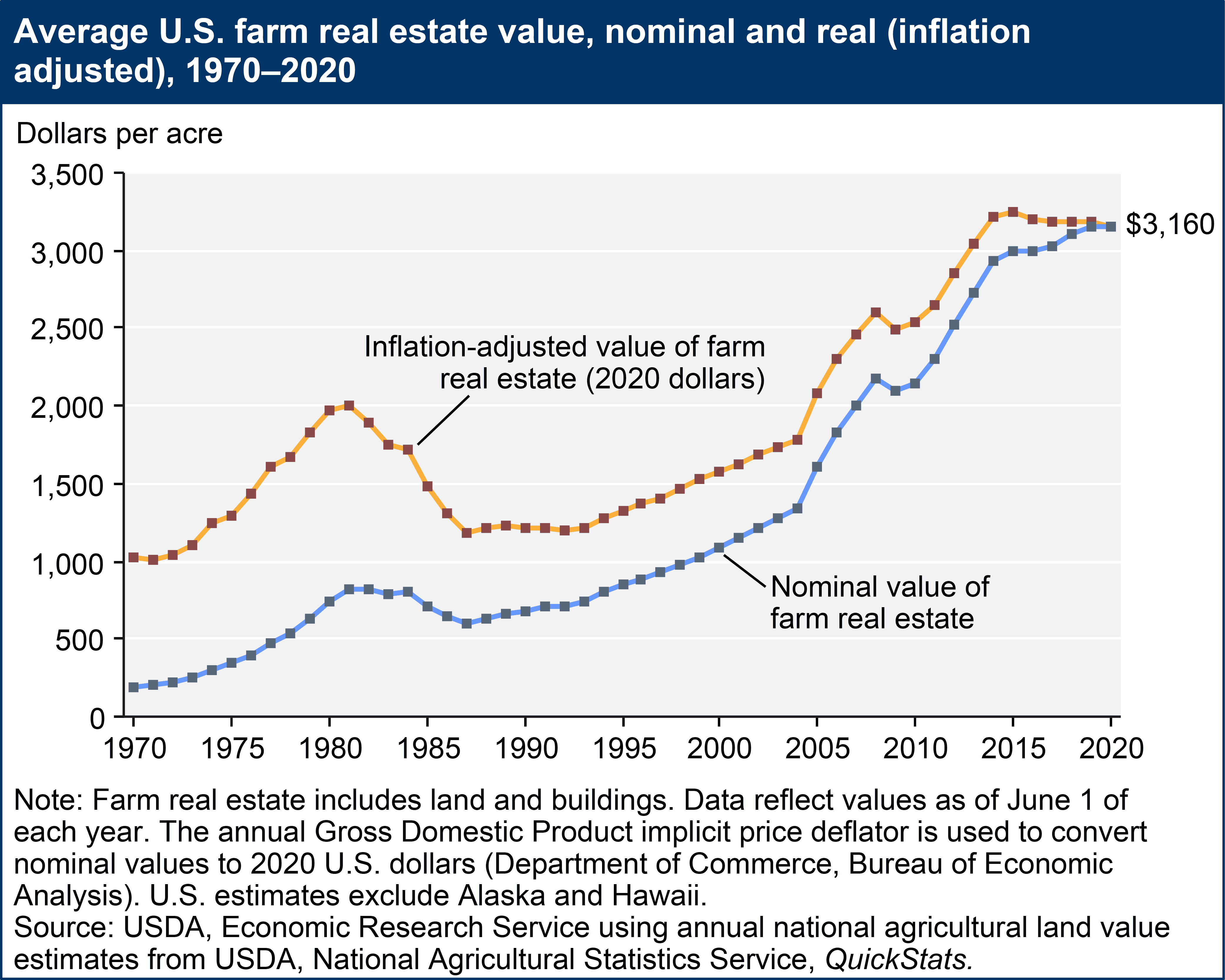

Data from the USDA indicates an upward trend for farm real estate’s nominal value.

Farms Produce Cash Crops

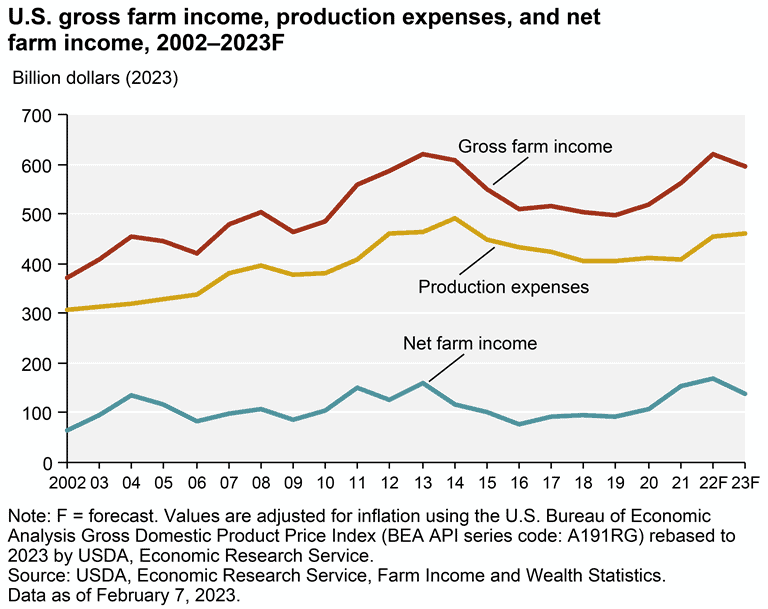

Crops grown on farmland are sold for profit. The income produced by farmland investing can be considered similar to rent. Gross farm income reflects the total value of agricultural output plus Government farm program payments. The U.S. gross cash farm income (GCFI) is forecast at $618.0 billion in the calendar year 2022 and $575.4 billion in 2023. In 2002, GCFI was $354.6 billion and has increased over time primarily due to higher cash receipts. .

As per the USDA, inflation-adjusted net farm income is forecast to be $167.3 billion in calendar year 2022, an 8.3-percent increase from 2021 and the highest level since 1973. .

The combination of reduced expenses with increased income provides a greater return on investment.

Is Land A Better Investment Than Stock?

Land should be considered more similar to real estate than stocks. The best part about investing in farmland is that it is not subject to government interference like rental properties. Or the vagaries of the economy like the stock markets. Investing in Farmland has five key advantages over stock market investments.

Diversification

As part of prudent asset allocation, it is best to have several non-correlated assets in your portfolio. Investing in farmland provides diversification compared to stocks. The advantage of diversification is that when stocks are falling, the portion of your portfolio invested in farmlands is steady.

Low Volatility

Farmland returns are less volatile than other asset classes like stocks, bitcoin, or even rental properties. No matter what happens to the economy, people still need food to eat. Even if we have a recession or a war, farms continue to produce food. Farmland investing results in increased food production, providing a valuable function to society. And it is also beneficial to your portfolio with reduced volatility.

Asset Backed

Farmland investing can offer investors a consistent income while providing the safety of capital preservation. Real estate investment risks do exist. However, it is much easier to imagine a stock’s value going to zero compared to a 100-acre plot of productive farmland. But when you invest in farmland, you have a tangible asset backing your investment.

Stable Returns

When stocks are at record levels in the current environment and bonds provide no return, farmlands offer stable returns. Of course, there are variations based on the price of crops, weather, crop production, environmental factors, and so on, but returns are more comfortable to predict within a range.

Inflation Hedge

With all the central bank money-printing, including the unleashing of Modern Monetary Theory (MMT), we might soon see runaway inflation. Farmland is a hard asset that produces food as a commodity and acts as an inflation hedge. Farmland investing benefits from inflation since the price of food and the land value will increase as well.

Trusted By Institutional Investors

Although this asset class is now available to individual investors, it is not a new asset class. Large institutional investors have favored farmland for a long time. The top U.S. university endowment funds have invested billions in cropland.

How Can I Invest In U.S. Farmland?

You can invest in farmland in four ways.

Buy Non-agricultural Land And Convert It

You can buy land and convert it to be used as farmland after obtaining the necessary approvals. Then just like a rental property, you can lease it to farmers for growing crops on your land. The farmer will pay you rent and also provide a certain percentage of the profits to you.

This approach provides the maximum return on your farmland investment. The challenge is with trying to find land suitable for agriculture that is available for sale. The soil quality, weather, and water sources are important factors to consider when purchasing land. After you buy the land, you need to make sure that necessary irrigation and drainage systems are installed. And finally, leasing it to the farmer who is experienced enough to turn your farmland investment into a profitable venture.

Because of the complexities involved in this approach, I would not recommend it unless you are highly experienced. The cost of the mortgage to purchase land and convert it for agricultural usage is very high. Also, banks want to see your track record in farming before approving the loan.

Buy Agricultural Land

Buying agricultural land is a more comfortable option since it is currently used for farming purposes, and irrigation is available. You don’t need additional approvals. Farming is generally a family business. You would sometimes find farms available for sale where the owners are older, and the children are not interested in the family farm business. Buying agricultural land from farmers who want to retire and leasing it to new farmers is easier to get started with farmland investing.

Similar to the above approach, again, the mortgage cost is very high. Also, banks want to see your track record related to your experience in farmland before lending. If the farmer owns the land with no mortgage, you could ask them if they are interested in seller financing options. In this case, the farmer selling you the farm acts as the bank, and you make periodic payments to them. They may still be wary of your lack of experience, but it is easier to convince the seller vs. the bank. Also, note that the interest rate may be higher in these cases than directly obtaining a loan from the bank.

Crowdfunded Farmland Investing

- The crowdfunded farmland investing platform selects parcels based on their selection criteria and places each farm in its legal entity, such as an LLC.

- The farm is presented on the platform for individuals to evaluate based on land values, income potential, and other assets.

- You purchase shares in the entity which owns the farm.

- The platform takes care of farm management aspects such as insurance, accounting, leasing the farm, and working with the farmer.

- The platform distributes excess income from the farm periodically.

- Distribution of final sales proceeds when the farm is finally sold after 5+ years.

As per the SEC, only accredited investors can invest in crowdfunded farmland projects. To be an accredited investor, a person must have

- an annual income exceeding $200,000 ($300,000 for joint income) for the last two years.

- Or net worth exceeding $1 million (excluding your primary residence).

- Or specific professional certifications, designations, or credentials such as Series 7, Series 65, or Series 82 license.

FarmTogether does mention that they intend to offer their services to non-accredited investors in the future with access to Regulation A+ investments. However, that is not yet available today. You should sign up now so you can be notified when they begin to accept non-accredited investors.

If you do not qualify as an accredited investor based on financials, you can still meet the accredited investor qualifications based on knowledge.

Farmland REITs

Farmland investing for non-accredited investors can be accomplished via a “real estate investment trust” or REIT. It is a company created to acquire and hold farmland. Although farmland REITs are not a perfect method, they are an option for non-accredited investors to invest in farmland. By investing in a farmland REIT, investors get exposure to farmland investing and avoid the responsibilities of owning a farm.

REITs are traded on stock exchanges just like stocks and are highly liquid. You can use a platform like M1 Finance to dollar cost average with no fees when buying REITs. There are several listed farmland REITs. Gladstone Land Corporation (LAND) and Farmland Partners Inc. (FPI) are the two most popular publicly traded farmland REITs.

One major disadvantage of REITs compared to directly investing in farmland via FarmTogether is that with the REITs, you do not know in which exact properties you are investing. You have no control over selecting a particular farm or cash crop to support.

The other disadvantage of REITs is tax treatment. REITs are supposed to pay back their earnings in the form of dividends. Since dividends are taxed as ordinary income, you might pay higher taxes compared to other stocks. When investors sell their REITs, it is treated as capital gains.

How To Invest In Crowdfunded Farmland

Farmland investing platforms like FarmTogether make it easy to invest in farmland in a crowdfunded manner. They offer you the opportunity to make direct investments in specific parcels of United States farmland and pays you an annual distribution from the farmer.

Some key factors to note are

- The minimum investment ranges from $5,000 to $20,000.

- A team of market experts performs due diligence on farmland investments before offering them on the site.

- The time horizon is 5 to 10 years.

- There is rarely a secondary market to sell shares, meaning you should expect to hold on for the duration. FarmTogether is working on creating a secondary market in the future.

- You pay fees to the company for facilitating deals and taking care of all the paperwork.

- You are typically buying shares of an LLC that owns the farmland.

Buy land they’re not making it anymore.

Mark Twain

How Do You Evaluate Farmland As an Investment?

Evaluating farmland requires the expertise of a team that understands the asset. Several factors determine the value of farmland.

Land Value

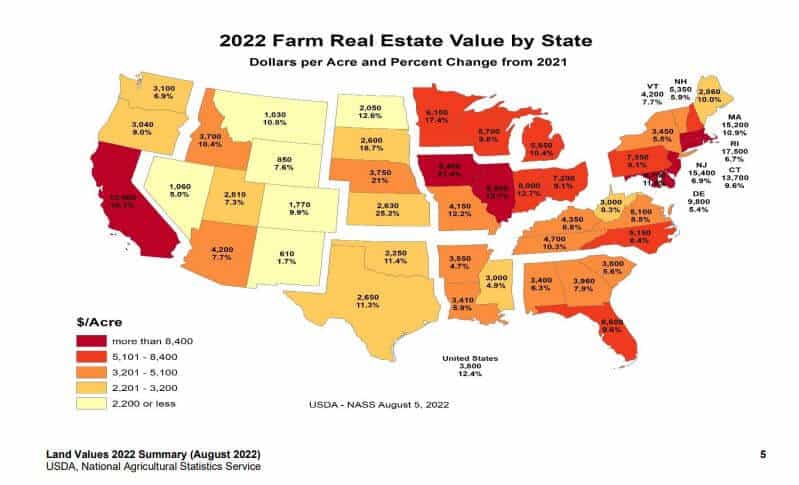

Like real estate, you can determine land-based value on comparable sales in that geographic area in the recent past. As seen from the USDA farm real estate value by state graph, the average land price varies widely from one state to another. The chart was an eye-opener for me. I always knew that residential real estate was more expensive in California. The farm real estate values are also costly in California.

Besides the average value of land, each farm is further evaluated based on the

- soil quality: what kind of crops can be grown

- terrain: hilly or flat

- water: water rights, water table, salinity

- access: how close to the freeway and railroads for transportation.

The NCREIF Farmland Index is a quarterly time series composite return measure of investment performance of a large pool of individual farmland properties acquired in the private market for investment purposes only.

Farm Income

Depending on the type of crops grown and the consistency with which the particular farm has produced crops, we can use the current average values to determine farm income.

- Row crops: They are planted and harvested annually. Common examples include grains and oilseeds such as corn, soybeans, and wheat.

- Permanent crops: Permanent crops are not grown annually and have a long lifespan, typically 25 years or more. Common examples include wine grapes, tree nuts, citrus, apples, and avocados.

Other Assets

- Is the irrigation equipment new, or does it need to be replaced in the future?

- Any structures on the farmland such as houses, barns, windmills that add value

- hunting leases depending on hunting rights on the land

- farming equipment such as tractors, tillers, etc.

Final Thoughts On Investing In Farmland

Farmland investing provides a non-corelated asset class to invest in with the benefits of low volatility, stability, and diversification. Since investing in farmland is backed by a tangible asset, the risk is lower.

Crowdfunded websites like FarmTogether provide accredited investors with an option to invest in farmland at the click of a button. You get the benefit of an experienced team evaluating various options before it is available on the platform. A team to take care of farm management aspects such as insurance, accounting, leasing the farm, and working with the farmer. And finally to sell the farmland.

Payments depend on type of deal structure and one can have monthly periodic payments or no initial cash flow with a lumpsum at the end. The payment frequency could be an important factor when individuals are evaluating investments that generate monthly income.

Readers, have you considered investing in assets like farmland? If yes, what kind of farms would you prefer – staples like corn or something more unique like almonds?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

You guys are setting yourselves up for many lawsuits regarding all the false info in this article. Input costs about doubling in farming and in many areas little if any irrigation water. Groundwaters are drying up.

As in every situation, buyers beware!

Can you clarify what is the “false info” in the article? All data in the article is linked to government sources such as USDA and BEA. Happy to take a look if you have better sources of information or find the USDA data incorrect.

Every investor needs to evaluate each deal based on the factors of the farm – and water, soil etc. are some of the factors listed in the article. No two farms are alike and the article only presents farmland as an alternative asset class to invest which is now open to accredited investors. In the past only billionaires could invest which is why Bill Gates is the largest owner of farmland in America.

I am also not sure about your comment regarding input cost increasing. In any business, if the input cost increases, the output cost correspondingly increases. I hope that farm operators are not operating farmland in losses or for charity. Growing food is a business and the consumers should be prepared to pay higher prices if input costs increases or the government might need to step in and subsidize.

Also this article was published in January. Exactly 11 months later the Federal Reserve Bank of Kansas published their report titled Farmland Values Surge Alongside Strength in Agriculture https://www.kansascityfed.org/agriculture/ag-credit-survey/farmland-values-surge-alongside-strength-in-agriculture/ As per The Kansas Fed “the value of all types of farmland increased by roughly 15% year over year due to a robust agricultural economy and historically low-interest rates” which seems to validate the article hypothesis. But since I am not a farmer would be happy to hear your thoughts on the Federal report or any local insights you can share.

Thanks for the very informative post. I found it very helpful as a novice to Farmland investing. I am wondering if you need to be a US citizen to be able to invest through FarmTogether. Can H1B visa folders also invest through FarmTogether?

I used to invest when I was on H1B, of course that was years ago when farmland was not an option. I don’t see why that would have changed. My understanding is that as long as you are a file US taxes you should be able to access most investments. Create an account and browse the opportunities. I don’t recollect them asking for documents besides income proof and SSN.

Great article. I’ve been thinking more and more about making an investment with Acretrader. I’m thinking I’ll end up pulling the trigger on an investment with them this year.

Keep us posted on what you pick. The pecan orchard currently available looks interesting due to the additional benefit of opportunity zone.