Is Now a Good Time To Buy a House? What Are the Factors To Consider for Home Ownership

You’re probably wondering if now is a good time to buy a house. It is a seller’s market out there right now. Home prices are at all-time highs. At the same time, moves by the Federal Reserve to tamp down inflation are raising interest rates, impacting mortgage rates. Mortgage rates just hit 13-year highs, and higher mortgage rates seem to be likely going forward.

As such, people who are purchasing a home have doubts. The Fannie Mae Home Purchase Sentiment Index hit the lowest in two years. Three out of four respondents to Fannie Mae’s poll said that now is the wrong time to buy a home. A historically low number of individuals said that this is a good time to buy a home in Gallup’s annual economy poll. However, this same personal finance poll also showed that Americans still essentially believe in the power of homeownership. 70% predicted the average housing prices would increase over the next year. Individuals still believe that homeownership is a positive goal and a sound long-term investment.

Which brings up the critical question: Is now a good time to buy a house?

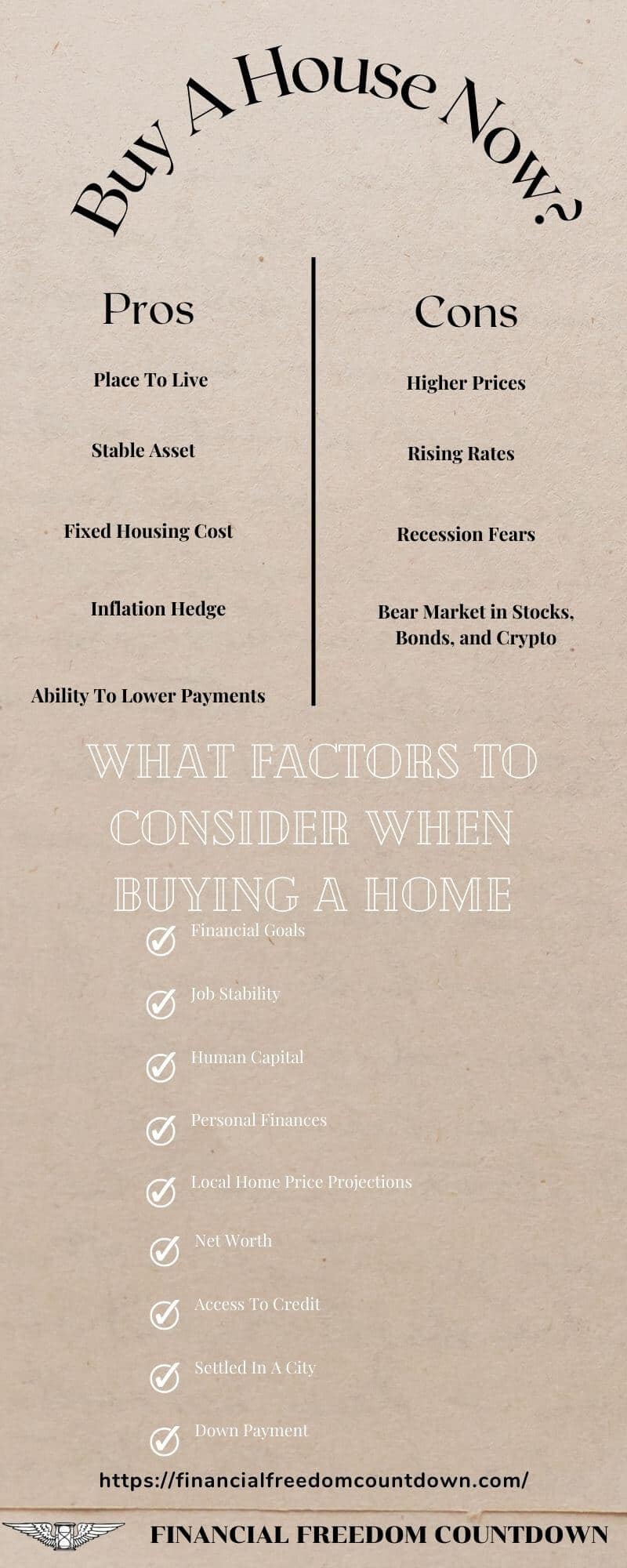

Pros of Buying a Home in 2022

Despite the significant challenges to the market today, there is no question that homeownership still has real benefits.

Place To Live

Everyone needs a place to live. If you do not already own a home, you are renting. Homeownership is a form of imputed rent.

Assuming your landlord has used all the right metrics to evaluate a rental property, they are very few instances where you can rent for less than a mortgage payment. Of course, the landlord might have other reasons to buy real estate, but it would be wise to run your numbers and check the difference between buying and renting.

Stable Asset

Despite the occasional ups and downs, the housing market remains stable long-term. Home prices continue to rise year-over-year, with surveys showing that home prices and the housing market are still sound investments. There are significant challenges with the market today, but that shouldn’t force a wholesale rethinking of home sales in general.

Higher housing prices can present real challenges, but they can be good for savvy investors. In the same Gallup poll, where only 30% agreed it is a good time to buy a house, 70% predicted the average housing prices would increase over the next year. After all, real estate has been the best long-term investment among various income-generating assets.

Fixed Housing Cost

A fixed-rate mortgage provides you with certainty on your monthly housing cost. You can easily forecast your living expenses budget with a mortgage payment. Your rent is not fixed and will most likely increase unless you live in a rent-controlled apartment.

If you plan to retire early, having a good handle on your housing cost will help answer your question, “when can I retire.” Housing expenses are an essential component used in most retirement calculators for planning purposes.

Inflation Hedge

Owning a house with a 30-year fixed interest rate mortgage is the best hedge against inflation. As seen in 2022, rising inflation puts pressure on all goods and services.

With a fixed-rate mortgage, your monthly payments to the bank remain the same. And you are paying the bank with cheaper dollars in the future.

Ability To Lower Payments

Homes will still be expensive thanks to high-interest rates, but one can always refinance mortgage rates later. It means that young adults, urban residents, and suburban residents will still be able to afford a house in the long run.

Over 30 years, we can expect to have several bull and bear markets. The Fed typically lowers rates when economic conditions worsen. Refinancing to a lower rate will reduce your monthly mortgage payment, or you could opt for a cash-out refinance to extract the equity from your home.

Indeed, the idea that homeownership can be the best long-term investment is a bedrock principle of the American financial system. And it has not changed, even as the country continues to experience significant financial difficulties. The value of homes always increases in the long run. This home appreciation has made home buyers even more likely to consider their long-term purchase options over time.

It is also important to remember that housing market conditions tend to fluctuate with the economy. As interest rates rise, higher housing prices are likely to slow. Furthermore, a home purchase is still a sound investment. That much hasn’t changed, even in this seller’s market and in the face of rising mortgage rates and a turbulent real estate market.

Cons of Buying a Home in 2022

Price increases, rising interest rates, and limited home inventory have made buying a home out of reach for even more Americans. As a result of the subprime mortgage crisis, houses are no longer seen as sound or necessary investments as they once were.

Negative assessments of the current economic conditions and pushing prices to previously unseen highs make it almost impossible for many Americans — even upper-income Americans — to afford a home. These negative assessments are creating a complicated reality for many on the ground, and all have made it clear that current market conditions are less than ideal for buying a home at the moment.

Higher Prices

First, it is essential to remember that the limited supply of housing and the overall housing shortage in the United States is creating a bidding war for homes previously unseen.

Home prices are up 20% in the last 12 months, according to the S&P CoreLogic Case-Shiller National Home Price Index.

Existing homeowners who have locked in a sub-3 % interest rate mortgage do not want to move and buy a new house for more than two percentage points higher.

Housing inventory is starting to improve, finally, but this is only because of rising mortgage rates reaching their highest point in almost a decade. While it is likely that this will result in a slower pace of price increases, this has not made homes any more affordable.

Rising Rates

Rising interest rates and inflation has outpaced an increase in pay for most Americans. Low rates from lenders are rapidly becoming a thing of the past, meaning homeownership is even less affordable.

As a result of rising mortgage rates, the monthly payment for a home has increased substantially.

Recession Fears

A year of loose fiscal and monetary policy based on MMT experiments has resulted in persistently high inflation. In the last 75 years, every single time the Fed raised rates to reduce inflation by more than 4%, it led to a recession.

Of course, it could be different this time, and we might have a soft landing, but the odds are not in our favor. Buying a home with impending worries of recession is always scary.

Bear Market in Stocks, Bonds, and Crypto

A 60/40 portfolio allocation of stocks and bonds is usually a bell-weather asset allocation such that the bond portfolio helps to weather any stock market crashes. However, in 2022, both stocks and bonds have crashed and are down year to date.

The bear market in stocks creates significant difficulties for homebuyers who have invested in stocks and increases pressure on them to wait. No one wants to make an important decision like buying a house when your liquid net worth is lower than six months ago.

Everyone expected crypto investments to buffer the rising inflationary trends, but they have not acted as a diversifier.

By waiting, buyers can always decide on a time to purchase a home at a later date. They can concentrate on other financial goals, like saving even more for a down payment or building up credit to reduce interest rates in the long term. Indeed, many buyers have found that they can spend their limited money better elsewhere, reducing the demand for lenders to give credit to homeowners.

What Factors To Consider When Buying a Home

The above lays out the pros and cons of home buying right now, but everyone’s personal situation is different. As such, here are some factors to consider when buying a home.

- What are your financial goals? Does homeownership fit in with where you are at your current stage in life?

- Are you satisfied with your career trajectory? Do you believe you can earn more money by switching careers or improving your human capital?

- Is your job stable, and is your industry recession-proof? Slowing economic conditions could result in layoffs. A public school teacher would have a different risk capacity than a college graduate working in a startup.

- These are turbulent economic times. You must ask yourself this question: What do your personal finances look like right now? Can you afford a mortgage and all the related housing costs?

- Are you settled in a particular city or state, or do you want to move to another location? Of course, if you buy a house and move, you could be a long-distance landlord, but are you ready for the responsibility?

- What are your home prices right now? Housing prices are on the rise across the nation, but are they likely to get better or worse in your area in the near future? Conduct your own research and not rely solely on the National Association of Realtors.

- Have you saved up enough for a down payment? With interest rates rising, you may be able to find some suitable saving mechanisms that can help you earn interest for such a down payment. Fixed income investments like I-Bonds tend to be safer for storing your down payment.

- How does your local market look? Is it getting more or less expensive? Are there other nearby markets that may present you with a better option? Do not rely only on your real estate agent but instead analyze various markets on your own.

- How will homeownership improve your average net worth? Will home values help your financial future, and are there other opportunities?

- The difficulties facing anyone who wants to buy a house differ across the nation. Midwest residents will face very different burdens than people on the west coast. As such, your ability to buy a house may vary depending on where in the country you live.

- What is the demand like in your specific neighborhood? Market demand fluctuates from place to place, and you must consider the impact of the local market on your overall home buying strategy.

- What sort of access to credit do you have, and what can lenders offer you regarding interest rates?

- What is the trajectory of your long-term take-home pay? Will you be able to afford a home in the future? Is your income likely to rise? If so, you should consider that when making a real estate purchase, as the odds are good, your mortgage payment will be more affordable as you make more money.

- What is your credit score? Are there actions you can take to improve your credit score before making a home purchase?

Should You Buy a House in 2022?

Before the great financial crisis, Americans have been firm believers in the power of homeownership. Indeed, for many, this is the epitome of the American dream. Buyers want robust housing options and the ability to own a home. It helps to explain why older adults and other major subgroups of the American population are actively seeking homeownership.

However, the country is experiencing severe economic difficulties, making it harder to buy a house. Many are reconsidering if the need to buy a house is still necessary for their long-term financial future.

Everyone has a different financial situation. Housing prices are on the rise, and it can be tough to find a home that fits your budget. Higher prices, higher interest rates, and a shortage of housing supply across the United States will unquestionably impact everyone’s ability to become home buyers. Indeed, the wildly turbulent economy is making more of an impact on homeownership than the great recession.

The current housing market is unquestionably challenging to navigate, but there is also no doubt that homeownership could be a solid long-term financial plan.

So, should you buy a house? There is no set answer to this question, and while this may not be the perfect time to buy a home, there are still positives.

Keep this in mind: It doesn’t matter if you are solidly working class or an upper-income American. Everyone’s situation will be different, and the current economic turmoil, limited housing supply, and stiff competition for buying will make life difficult.

It’s hard to know if now is a good time to buy a house. Buying a home is a big decision.

If you are not ready to buy a home but want to benefit from the advantages of real estate investing, you can consider real estate crowdfunding. One can find several options, from investing in apartment buildings to single-family houses to commercial real estate for accredited and non-accredited investors. Platforms like Fundrise have a minimum of $100, to get you started.

Homeownership should be approached with more caution now than at perhaps any other time in American history. However, weighing the pros and cons of homeownership and understanding the local market and economic conditions and one’s financial situation can help prospective buyers decide if a home purchase is right for them.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

Now is not the time to buy. Just wait for the coming housing market too crash then buy for a much cheaper home. The way things are going it won’t be long.

It is hard to time the housing market for a primary home especially since it is location dependent. Unlike stocks where one could delay the purchase, one needs to spend money every month on either rent or mortgage.