15 vs. 30-Year Mortgage: How To Determine Which Is Better?

One of the most important decisions when buying a home is getting a 15 vs. 30-year mortgage. Both options have their pros and cons. We will discuss the differences between these two mortgage options and some of the factors you should consider.

We will also analyze with real numbers if prepaying a 30-year mortgage in 15 years is the same as opting for a 15-year mortgage. Or if you make more money by choosing a 30-year instead of a 15-year mortgage and investing the difference.

How Does a Mortgage Work?

A mortgage is relatively simple: If you qualify, you can take on a loan from a bank. That loan principal and the interest on the loan is the mortgage. You will make monthly payments until you pay back the value of the mortgage. Once you do that, you own the house – until then, the bank is the homeowner, and if you stop paying for the house, the bank can take possession of the home.

In most cases, people who buy homes will make a down payment, then borrow the rest of the money.

If the down payment is relatively low – 20% or less – you may also have to take out a property mortgage insurance (PMI). Don’t worry because the equity in your home will eventually exceed 20%. Either by paying down your mortgage or an increase in the home value. You can then apply to have the PMI removed.

A few factors will ultimately determine your monthly payment. They are:

- The overall amount that you borrowed.

- The interest rate. The higher the interest rate, the higher your monthly payments will be to pay off the loan over a 15 or 30-year period.

The interest rates on a home are usually determined by a series of factors, including your credit score and federal interest rates. As of this writing, average interest rates are around 7% for excellent credit scores.

Identity theft can destroy your credit, and low scores can prove extremely expensive when applying for a mortgage.

Credit Karma partners with Equifax and TransUnion and offers free credit reports and free credit scores updated weekly. It also provides alerts when it detects unusual activity on your credit files. Follow the Credit Karma recommendations on improving your credit.

You can also sign up with Transunion with a paid subscription for additional monitoring and peace of mind.

Interest rates rise and fall. If interest drops, you can refinance your home later for a lower interest rate. You can then lower your monthly payments or apply more of your payment to the loan balance. It may enable you to get rid of your mortgage faster.

Interest rates also vary depending on conventional or jumbo loan usage.

- Conventional loans are what most people who get a mortgage wind up using. There are conforming and non-conforming loans and the type of loans used here is ultimately related to whether or not these loans adhere to standards enacted by the Federal Housing Finance Agency. These loans require a 620 credit score or higher and have specific requirements for the down payment and debt-to-income (DTI) ratio.

- Jumbo loans have higher price limits and are helpful for individuals looking to sign up for large mortgages. These loans will require a much higher down payment and more documentation.

- Government-issued loans, including an FHA loan, USDA loan, or VA loan, can help put home ownership within reach for first-time home buyers or individuals who may not otherwise meet credit, down payment, or debt-to-income requirements. However, they may have higher monthly mortgage payments.

Types of Mortgages

Mortgages come in many different types and over many different lengths.

Fixed-Rate Mortgages

These mortgages will have the same interest rate during the loan duration. These mortgages are commonly available for a 30 or 15-year period.

Adjustable Rate Mortgages

Commonly known as ARM, the interest rate on these loans is fixed for a short period and then rises and falls depending on the market conditions. For example, a 5/1 ARM will have a fixed rate for the first five years of the mortgage term, while a 7/1 ARM will have a fixed rate for the first seven years.

Some individuals may opt for an Adjustable Rate Mortgage (ARM) since the interest rate is generally lower than a 30 or 15-year fixed-rate mortgage. But a fixed-rate mortgage usually works out better if you plan to stay in your home for longer than five years and are risk averse.

Difference Between a 15 vs. 30-Year Mortgage

As the name implies, a 15-year mortgage repays over 15 years rather than 30. However, the most significant difference between a 15 vs. 30-year mortgage is that the 15-year mortgages generally have lower interest rates and higher monthly payments.

Most people will take out a 30-year mortgage when they get their mortgage payment. A standard 30-year loan means you will pay off your mortgage in 30 years, barring any cash-out refinancing or payment delays. A 30-year mortgage is the most popular form of a mortgage.

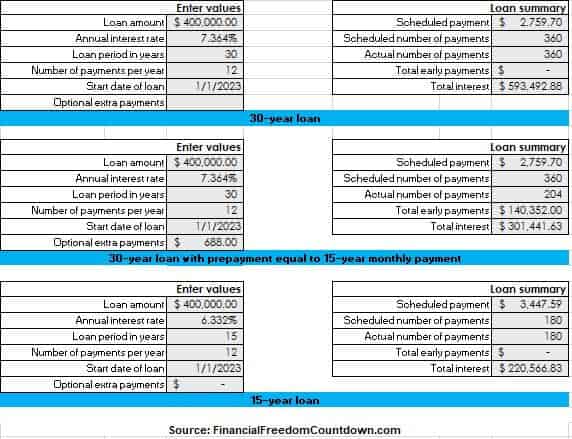

Assuming a conventional fixed-rate mortgage term with 20% down and no PMI, here are the monthly payments for a 15 vs. 30-year mortgage for a $400,000 loan.

| Mortgage Term | 15-year | 30-year |

| Interest Rate | 6.332% | 7.364% |

| Monthly Payment | $3,448 | $2,760 |

| Total Interest | $220,567 | $593,493 |

As a result of the compounding interest, the total interest paid over the life of a 30-year mortgage is often higher than the initial loan amount.

The most significant difference, of course, is the time of repayment. One will pay off a 30-year mortgage in 30 years, which is twice as much time as it takes to pay off a 15-year mortgage. On the surface, you would be perfectly correct in thinking that the 15-year mortgage was preferable. However, many complicated factors determine which payment method is better for you.

Interest Rate

The average interest rate of a 15-year mortgage is lower than the average interest rate of 30-year mortgages.

Compound interest is excellent at helping our best compound interest investments grow, but it hurts us when we owe money. It takes more time to pay the loan principal down, as the loan interest negatively impacts our ability to get rid of the loan principle. One of the many reasons the basics of personal finance advocate signing up for credit cards only if you can pay the entire balance every month.

Mortgage rates are a massive driver of the amount of money you will ultimately pay to the bank, and you need to keep this in mind when making a mortgage decision.

Monthly Payment

The biggest reason that most people ultimately select a 30-year mortgage is that it results in lower monthly payments. It ensures you have more cash, allowing you to improve your lifestyle. Of course, there are other factors to consider: The smaller monthly payment means you will take more time to pay off the loan’s principal balance.

Number of Payments

A 15-year loan means you can make fewer payments: 180 over the loan’s lifetime, as opposed to the 360 payments you will need to make over the life of a 30-year loan. So, yes, you’ll have to pay higher monthly payments with a 15-year loan, but you’ll be done with those payments in half the time, thus allowing you to be debt-free sooner.

Build Equity

The more money you put into your home, the more equity you build. A 15-year loan means you create more equity faster because you pay your principal more quickly than a 30-year loan.

Equity in a home means you can pull that equity out via a home loan or HELOC, thus enabling you to borrow money any time you need it. You can use this money for various projects, including funding other real estate ventures like the BRRRR method or house hacking.

Alternatively, you can refinance your home and lower your loan’s monthly payments and interest rate. Finally, if you sell your home, you can turn that equity into pure profit.

Income Qualifications

Fifteen-year mortgages have higher monthly payments, but this may mean that banks are more nervous about lending you that amount. As such, there are more rigid monthly payment qualifications that you will have to hit to get such a loan.

Since the monthly payments are higher, banks expect a higher income for a 15 yr vs. a 30-year mortgage.

| 15-year | 30-year | |

|---|---|---|

| Duration | 15-year | 30-year |

| Interest rate | Lower | Higher |

| Total interest paid | Lower | Higher |

| Monthly payments | Higher | Lower |

| Income to qualify | Higher | Lower |

| Risk due to loss of income | Higher | Lower |

| Building equity | Faster | Slower |

| Fees | Lower | Higher |

| Tax deduction | Lower | Higher |

Pros of a 15-Year Mortgage

- You will save money by paying a lower interest rate.

- You will save money by borrowing for a shorter duration.

- You will own your home faster.

- Reduced fixed costs like housing can eliminate some of your how-to FI worries.

- If you need help following a budget template, the higher monthly payments can be a forced saving mechanism to avoid overspending.

- Lower fees since loan level price adjustments (LLPA) are applied only to loans greater than a 15-year term. Unless they are portfolio or seller-financed loans, lenders resell most loans to government agencies like Fannie Mae, which define the LLPA matrix.

Cons of a 15-Year Mortgage

- The higher monthly payment can put a strain on your finances. If most of your income goes to mortgage payments and you have no money left for other investments, you could become house poor.

- Losing your job can make it harder to make monthly payments, and you could end up in foreclosure. Ensure you have a large reserve in safe investments to fund your mortgage in preparation for a recession.

- Most of your net worth would be trapped in the house, reducing your liquid net worth.

- If the interest rate of your mortgage is lower than your alternative investments, you are mathematically not optimizing your money.

Pros of a 30-Year Mortgage

- Low monthly payment leaves you with more flexibility in your budget. You will need a smaller emergency fund and not stress about losing your job.

- Get breathing room in your budget for funding your passive income ideas.

- You can take advantage of tax strategies such as mortgage interest deductions for extended periods.

- If you plan to convert your home into a rental property later, a 30-year mortgage provides higher cash flow.

Cons of a 30-Year Mortgage

- You pay more interest over the lifetime of a loan compared to a 15-year mortgage.

- If your home is not paid off, you need to factor in housing costs when planning how to retire early.

- You might buy a bigger house than you can afford due to the lower monthly payments. Try to stick to the 50/30/20 budget rule.

What Is the Impact of Paying a 30-Year Mortgage in 15 Years?

As long as your mortgage does not include prepayment penalties, you can make extra payments on your 30-year mortgage and pay it sooner.

Paying a 30-year mortgage on a 15-year schedule can be the best of both worlds.

- You obtain payment flexibility if you can’t make a higher monthly payment in a particular month.

- You get all the benefits of a 15-year mortgage and pay less total interest.

However, you will still pay more interest when you pay your 30-year mortgage in 15 years than if you had taken the 15-year mortgage at the start.

The reason is the lower interest rate for the 15-year mortgage.

Let us run the numbers on our $400,000 mortgage.

| Mortgage Term | 15-year | 30-year |

| Interest Rate | 6.332% | 7.364% |

| Monthly Payment | $3,448 | $2,760 |

The 15-year mortgage has an additional monthly payment of $3,448 – $2,760 = $688.

Let us opt for the 30-year mortgage for flexibility and prepay the $688 monthly as additional principal. The prepayment reduces the term of the loan at the back end to 204 months from the scheduled 360 months.

However, you would still be better off with opting for a 15-year mortgage at the start. The cost of the payment flexibility is the higher total interest payment.

What Is the Best Method To Prepay a Loan?

Due to the amortization table, it is always better to make additional payments at the start of the loan term versus at the end. Because when the loan starts, a more considerable percentage of the monthly payment is applied to interest. And towards the end of the mortgage term, more is applied towards the principal.

Making additional payments toward the principal at the start of the loan can reduce the balance of the loan.

Is It Better To Invest the Difference in a 30-Year Mortgage Over a 15-Year One?

Astute readers must wonder if they should sign up for a 30-year mortgage instead of a 15-year and invest the difference between the lower and the higher monthly payment.

You can pay off a 15-year mortgage sooner than a 30-year mortgage. Getting rid of your mortgage payment is a good thing for your finances! However, there may be better uses for your money.

The extra capital you can save by having lower payments with a 30-year mortgage can be invested elsewhere.

First, you have to consider the interest rate of your mortgage. The past fifteen years have seen near record-lows in mortgage rates, leading many to have a very low-interest rate loans. If this is the case, it may make more sense for you to concentrate on another debt-reduction method, like paying off credit cards or high-interest student loans.

Second, it is essential to note that taxes may play a key influence in deciding whether or not to get a 15 or 30-year mortgage. The American tax system helps subsidize the monthly cost of owning a mortgage.

You can deduct the interest you pay on your mortgage up to a certain amount. It allows you to keep your monthly cost much lower. It also means that you can take your time paying off your mortgage since this tax break goes away once you do so.

The third is the role of inflation as you pay off your mortgage. Remember, when you borrow money, you are borrowing money based on the value of your house at that moment.

Most homes increase in value over 30 years, but you are still paying off the amount you borrowed, not the home’s current worth. It means you are paying off a lower-cost loan for thirty years. As such, there isn’t necessarily a significant rush to pay the loan off: Inflation helps keep the loan’s cost low for you.

Fixed 30-year mortgage debt is the best inflation hedge. Your monthly payments are fixed while you pay your mortgage with “cheaper” dollars. Homeowners who obtained a 4% or lower mortgage rate before 2021 can use investments that provide monthly income, such as I-Bonds yielding an 8% interest rate to pay off their mortgage and still come ahead.

This is why some people argue that you should never make extra payments on your mortgage, as you can spend your money more efficiently in other places, like investing in stocks or real estate investments.

I did some sample calculations and ran the numbers for Bob with investment returns of 10%. I’m also assuming a 0% capital gains tax rate for the investment fund and 0% tax savings on the mortgage.

| Loan amount | $400,000 |

| 15-year interest rate | 6.332% |

| 30-year interest rate | 7.364% |

| Monthly payment on 15-year loan | $3,448 |

| Monthly payment on 30-year loan | $2,760 |

| Monthly payment difference available for investment | $688 |

| Investment annual rate of return | 10% |

| After 15 years, Bob’s investment fund value | $274,086 |

| After 15 years, Bob’s net worth with 15-year mortgage | $400,000 |

| After 30 years, Bob’s net worth with 30-year mortgage and investing the difference | $373,890 |

With a 15-year mortgage, Bob has a paid off house worth $400,000.

Investing the difference yields only $274,086. If we add the equity from the paid off loan after 15 years, Bob’s total net worth is only $373,890. So he still is worse off by $26,110 after 15-years

Even if the investment yields a rate higher than the mortgage interest, in the first 15 years, Bob would be better off directly taking the 15-year mortgage instead of the 30-year and investing the additional amount.

The reason is the interest difference between the 15-year and the 30-year. Also the current high interest rates have only a small margin between average stock market returns and the interest rates.

If we assume interest rates go back towards normal, the investment fund can catch up sooner.

| Loan amount | $400,000 |

| 15-year interest rate | 2.750% |

| 30-year interest rate | 3.375% |

| Monthly payment on 15-year loan | $2,714 |

| Monthly payment on 30-year loan | $1,768 |

| Monthly payment difference available for investment | $946 |

| Investment annual rate of return | 10% |

| After 15 years, Bob’s investment fund value | $376,968 |

| After 15 years, Bob’s net worth with 15-year mortgage | $400,000 |

| After 30 years, Bob’s net worth with 30-year mortgage and investing the difference | $527,464 |

Even with the low mortgage rates, the first 5 years shows the 15-year mortgage is a better deal.

Only after a decade does the investment fund catch up and Bob’s net worth is higher by $32,778 when opting for the 30-year mortgage and investing the difference.

After 15 years, Bob has an extra $127,464 by following the borrow the 30-year and invest the difference strategy.

One can see that taking a 30-year mortgage and investing in S&P 500 results in a higher average net worth over a longer period.

Is It Worth Paying Extra on 15 Year Mortgage?

There are multiple other ways of getting rid of your mortgage payment sooner. You can pay off your mortgage in 5 years or less, but it does involve creating extra income through side hustles or improving your human capital at work by leveraging your high-income skills.

Saving up to make one extra payment a year can allow you to shave years off of your loan, thus saving tens of thousands of dollars in the long run. You can also make biweekly payments instead of making mortgage payments every month.

Depending on how your existing loan is calculated, you may pay off the same amount but reduce the levels of interest that you pay. However, this ultimately depends on how your loan provider or financial institution calculates interest payments, and you’ll have to check with the provider before making these payments.

Remember, you don’t have to make this decision alone. Various financial experts and real estate agents can help you determine what type of mortgage is best for you.

Keep the idea of a retirement fund in mind when trying to figure out if it is worth paying extra. You could take the amount of money you would otherwise plow into your mortgage debt with a 15-year mortgage and put it into your retirement fund.

Yes, you’ll be making more interest payments over the life of your mortgage. Yes, you’ll be paying a higher fixed interest rate. However, if you put your money elsewhere, you may make more money in the long term.

Should You Go for a 15 vs. 30-Year Mortgage?

There are pros and cons to a 30 or 15-year mortgage. With the current high interest rates, the more difficult decision is if it is a good time to buy a house now.

Our “borrow the 30-year and invest the difference strategy” indicates the outsized impact of higher interest rates.

As you can see, the decision about whether or not you should use a 15 or 30-year mortgage is a difficult one. Many factors come into play, including your cash flow, financial goals, and your financial needs over the life of the loan.

You’ll also have to consider other factors, including your likelihood of experiencing financial hardship and whether or not you are planning to use the property as an investment property or your primary mortgage.

Your financial situation – where you are and where you hope to be – will be the ultimate driver of your decision.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.