Asset Allocation: Why Is It Important and How To Determine Your Asset Allocation

You’ve probably heard that you should be diversifying your investments, but what does that mean, and how do you do it?

Diversifying your investments is one of the most important things to protect your money. But it’s not always easy to figure out how to do it.

Asset allocation is the key to successful diversification. You need to figure out how much of your money should go into various asset categories like stocks, bonds, cash, cash equivalents, real estate, private equity, and other alternative investments. With a proper asset allocation plan, you can sleep well at night knowing that your money is working hard for you even when you’re not.

What Is Asset Allocation?

Asset allocation refers to how and where individuals allocate their money across different financial markets.

Asset allocation can change based on various factors, including risk tolerance, investment goals, the purpose of funds, and the current state of the economy. Ultimately, asset allocation is a critical component of economics, and it is vital to your overall investment strategy.

Asset allocation can happen across your entire investment portfolio. You can make sure that you allocate your funds over numerous different financial markets. It can include stocks, bonds, and cash. You can also consider other asset classes like real estate and alternative investments.

Asset allocation involves diversification across different assets and within each asset class. You will want to ensure appropriate asset allocation within a particular financial investment instrument.

For example, when investing in stocks you could invest across various metrics such as industries, risks, growth, value, foreign, emerging, developed stocks, and more. With the advent of low-cost index mutual funds, one can easily have exposure to all parts of the stock market.

What Are the Major Asset Classes?

When you consider buying assets, there are six broad asset categories.

- Paper Assets

- Stocks

- Fixed Income (US Treasury, CDs, Bond Funds, P2P Lending)

- REITs

- Asset-backed Lending

- Real Estate

- Primary Home

- Rental Property

- Business Assets

- Physical Business

- Online Business

- Collectibles

- Commodities

- Currency Assets

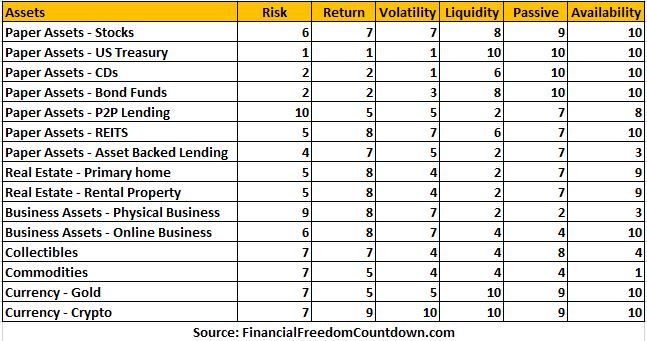

The best assets to buy will depend on your risk profile, time, knowledge, and unique circumstances. Let us evaluate every investment depending on the anticipated risk and volatility, anticipated return, liquidity (how easy is it to sell and get our money back), passive nature, and availability (can anyone buy it).

Each asset is scored on all these areas from 1 to 10, with 10 being the highest to determine the best income-producing asset. So a rating of 10 for risk means that the investment is the riskiest.

Stocks are classified as medium to high for risk, return, volatility and liquidity. They are also the most passive investment assets and available to anyone to buy. Stocks typically form the major asset categories in a typical portfolio.

Bonds, Certificates of Deposits (CDs), or Peer-to-Peer lending typically provide cash flow in the form of interest payment because you have lent the money and are considered as fixed income investments.

U.S. Treasury has the lowest risk, return, and volatility out of all the assets. And the highest liquidity, availability, and most passive. I-Bonds match inflation while other treasury bonds often lag inflation

Certificates of Deposits (C.D.s) are slightly riskier than U.S. treasuries. Also, they are not very liquid since most of them are locked for a fixed duration. Some C.D.s allow you to withdraw your money with a pre-payment penalty.

Bond Funds are more liquid than C.D.s since they are traded regularly. They are more volatile compared to U.S. Treasury or C.D.s. Bond mutual funds usually contain a mix of corporate and municipal bonds.

P2P Lending is the riskiest asset since you are lending money to strangers with no collateral. Also, it is not liquid since the money is locked up for the loan duration. I would avoid it.

REITs provide a high return and are relatively passive like stocks. REITs are a great source of passive income since, by law, most of their profits are distributed every year.

Asset-Backed Lending has low risk since the assets back the loan, and you earn passive income. The most common example is loaning against real estate.

You could be the hard money lender on a fix and flip property. Or you could invest in an equity real estate deal. You could also make real estate note investing as a passive income strategy backed by real estate as collateral.

Real estate projects are very capital intensive; you can spread your investment dollars across many properties using crowdfunded real estate. Before allocating your money to any real estate project, read the 10-point checklist to evaluate crowdfunded real estate deals.

Real estate syndication is the easiest method to obtain all the benefits of real estate while having professionals manage it for you.

Besides real estate, you can also lend against other assets. The most common are rare wine collections, art, farmland, etc.

However, since most of these are restricted to individuals meeting the accredited investor qualifications, the availability is low.

Real estate in the form of a primary home or rental property has a great return to risk ratio since you can use leverage with fixed interest rate loans. Make sure you understand how to evaluate a rental property before purchasing one.

If you cannot afford a rental property, there are several ways to invest in real estate with little or no money.

Real estate is not passive although IRS considers it passive. And it is not liquid either. All transactions take time, and if the real estate market is in a downturn, you could be waiting for a few years.

Physical Business has a high risk since you cannot diversify. Your laundromat or restaurant could run into trouble. Also, these businesses are hard to sell immediately in a recession.

Require a lot of time and energy, so not passive. The physical location leads to high fixed costs. Also, the availability is low since you need specialized business knowledge. And not everyone would be qualified to run a physical business.

Online Business has a lower risk than a physical business since you can diversify income streams. For example, a website could make money from ads, affiliate sales, and e-book sales. Operating costs are negligible. Barriers to entry are low since anyone can set up a website in an hour.

Unlike physical business, it is effortless and cheap to create a website. You can create a website to get started for a low monthly fee of $3.95/month using my Bluehost affiliate link. Check out my step-by-step guide for beginners on how to start a website.

Collectibles generally are not liquid. Also, it is hard to predict what could be the future price.

Commodities are more liquid than stocks since they are traded on a global basis. However, the availability is low since you need deep subject matter expertise.

Currencies like gold and crypto are liquid since they are universally accepted. Also very passive since we are using it as a store of value. Cryptocurrencies are very volatile compared to other assets, including gold. But they have a high return potential since they represent an asymmetric bet on the future. Most crypto investments like DeFi, Metaverse, or NFTs are not purely currencies and represent a combination of several asset categories.

I have made several assumptions when ranking the best assets to buy. It should help you form your ranking to determine your current asset allocation. As your life circumstances change, continue to use this framework to make adjustments.

Please note that these asset categories are used as examples and should be considered a recommendation to buy, sell, or trade. Always consult a licensed professional. Nothing in this article should be construed as financial or tax advice. The author or Financial Freedom Countdown are not licensed professionals or investment advisors.

Why Is Asset Allocation Important?

Asset allocation is essential for numerous reasons.

Risk Reduction

First, it can help to reduce risk. There are times when an individual stock will crash or an entire sector will struggle. Your portfolio may incur significant losses if you are overinvested in that sector. At times of economic turmoil, people will typically invest in a safer asset category, like bonds or treasury bills. By diversifying your portfolio, you can ensure that you are not too heavily invested in a specific area, thus giving you the chance to protect your entire portfolio or retirement savings program.

Diversification

Second, it can ensure that you don’t miss out on any potential gain within the market. A diversified portfolio makes sure that you can grab gains in different sectors if they begin to show significant improvements. Investing in several asset categories can help ensure that you have these opportunities.

Tax Strategy

Third, it can have significant tax consequences. Capital gains and dividends are taxed at different rates, and various types of accounts can have dissimilar tax impacts on your bottom line. By owning the right mix of individual assets, you can make sure that you are minimizing your overall tax liability.

The Difference Between Asset Allocation and Diversification

Asset allocation and the diversification of your investment portfolio are tied together, and while there is extensive overlap between the two, they are not the same.

Diversification refers to how you spread your money across various asset classes. You diversify your portfolio within the different financial instruments to reduce your risk.

Asset allocation refers to the amount of your money in the three most critical elements of your investment portfolio: stocks, bonds, and cash. How much money you have in these three areas determines your asset allocations.

For example, you can diversify between stocks or real estate. And your asset allocation is 30% real estate and 70% stocks.

Tools To Measure Your Current Asset Allocation

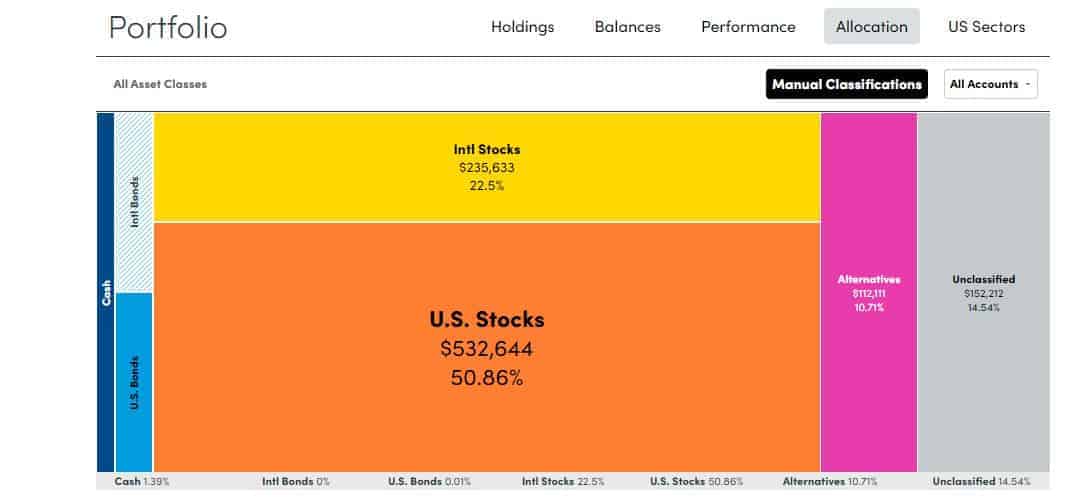

Suppose you have several accounts spread out among several brokerages. In that case, it can be tedious to map out your asset allocation and update it constantly as the value of your assets in the overall portfolio change.

I use Personal Capital to link all my accounts, and the free software automatically displays the asset allocation across my portfolio. Of course, Personal Capital also has a free budget monitoring software and average net worth calculator.

If I click on stocks, it shows a different breakdown level between the U.S. and international stock funds. Global stocks are further broken down by emerging and developed markets. Similarly, I can see the breakup of U.S. stocks along the small, midcap, large-cap, and growth and value factors. Stocks can also be broken down by industry sectors, such as oil and natural gas, pharmaceuticals, consumer goods, technology, and health care.

Alternatives include all the real estate investments.

Unclassified are my art, farmland, and SPAC investments. You could manually classify these if you wanted.

You can read my Personal Capital Review and sign up for a free account at Personal Capital.

How Does Asset Allocation Work?

Asset Allocation & Time Horizon

Time horizon is one of the three most critical factors that impact how an individual should steer their investments. Generally, younger investors can afford to be riskier with their investments. They can invest more in stocks and growth stocks, giving them a chance to make significant gains that can serve as the basis for continued growth later in their life.

There is a simple reason for this: The longer a person has, the more chance they can potentially recover any losses. Greater risk, of course, means a more significant opportunity for failure. If a person requires money over a short period, they won’t have a chance to make up any losses if the value of their portfolio goes south. A shorter time horizon is typically associated with principle preservation rather than risky growth efforts. It also explains the specific asset allocations of people with shorter time horizons: Individuals will invest in more conservative instruments, including bonds or treasury bills.

Asset Allocation & Risk Tolerance

Risk tolerance refers to how much risk an individual is willing to take as part of their overall investment strategy. Asset allocation can encompass a wide range of risks, including treasury bills, cryptocurrency, and everything in between.

Various deeply personal factors ultimately decide risk tolerance for the investor in question. Some investors may not have the stomach to handle wild swings in the value of their portfolio, preferring stable growth to the possibility of massive gains or significant losses. Other investors are more willing to accept risk and thus put portions of their portfolio into riskier investments.

However, risk tolerance is about much more than just personal preference. It also comes down to what someone is investing for and how that investment goal impacts asset allocation. For example, say someone is investing to save up for a luxury purchase, like a new television or a boat. In this instance, the asset isn’t vital to the investor’s survival or financial future. They may be more willing to embrace riskier methods: Even if they lose their investment, the individual will continue to live a happy and healthy life, albeit without the luxury item they wanted.

Risk tolerance should change when discussing investing for more essential items, like a college education or retirement. In this instance, “riskier” investments may be appropriate (depending on the investor’s age or timeframe of the asset needs), but even then, much of that risk is couched. No financial advisor would ever recommend that individuals put all of their retirement savings into crypto and hope for the best. “Risk,” in these instances, may mean allocating 10% of your stock portfolio to a mid-cap growth stock.

Asset Allocation & Age

The final factor that impacts asset allocation is the age of the investor. This item is closely related to the time horizon of the actual investment: The closer you get to retirement, the less risky your portfolio and asset allocation should become.

There are some rules with investments. For example, if you plan to only invest in stocks and bonds, a simple rule of thumb to determine asset allocation based on age is the Rule of 100. This rule of thumb instructs you to subtract your age by 100 to obtain your stock exposure level in your portfolio. For example, a 60-year-old should have 40% of their assets in equities (100 minus 60 equals 40).

However, given the recent increases in life expectancy and low bond yields, some experts think that subtracting from 120 is a more appropriate number today. So the above example would have a 60-year-old with 60% stocks and the remainder in bonds.

The simple age-based asset allocation has given rise to several “target date” funds. The lifecycle fund investor picks the appropriate target-date fund based on their retirement age. The mutual fund manager performs the rebalancing act every year by lowering the stock percentage and increasing the bond percentage in the lifecycle funds.

Of course, rebalancing is a taxable event, and hence it is advisable to have the target-date mutual fund in a tax-advantaged account. Also, rebalancing frequently involves transaction fees.

No matter what rule of thumb you use for your initial asset allocation, it needs to be further refined as you add more asset classes or tailor it based on goals and risk tolerance.

It would be best to speak with a financial professional for more specific and customized advice related to your financial situation. However, there is no question that your asset allocation should become less risky as you get older.

Examples of Asset Allocation Scenarios

As you should now understand, different plans call for different asset allocation combinations. For more examples, consider the following scenarios:

Scenario One: Jose is a 25-year-old male looking to buy a house as quickly as possible.

His need is obvious: He has a growing family, wants to have kids shortly, and needs to buy a home. Also, Jose’s profile is a natural risk-aversion. Jose needs this house and cannot afford to lose his limited investments.

In a scenario like this, two factors push Jose towards a less risky asset allocation: A short time horizon (meaning less than five years) and low-risk tolerance. Jose’s young age is offset by the need to buy a home within the next five years. Jose cannot afford to lose his money.

What does that mean? The answer is clear: A less risky asset allocation. In this scenario, Jose would likely keep most of his money in more secure investments, like treasury notes or government bonds. These are safe investment vehicles that are unlikely to lose principal and likely to show secure, stable profits. The returns on these investments will not be exceptionally high, but he will preserve the principle, and there will be some gains on the assets. Jose’s bond holdings relative to his stock mutual funds will be higher than others in his age group as he cannot risk losing money.

Scenario Two: Joanna is a thirty-year-old who needs to start to plan for retirement.

She is beginning to invest her money and has a high-risk tolerance.

It is almost the ideal scenario for engaging in riskier investments. All three factors favor a riskier portfolio:

- High personal risk tolerance.

- A long time horizon (likely at least thirty-five years).

- A relatively young age.

So, what would Joanna’s portfolio look like? It may lean heavily into riskier allocations as she can afford to be an aggressive investor. Even with all of these factors at play, Joanna wouldn’t risk and throw all of her money into some wild investment scheme. A responsible risky portfolio still has a healthy mix of more conservative investments. It is vitally important, considering that the assets are for retirement.

A sample investment allocation would lean heavily towards stocks — perhaps as much as 70%. The stocks may be balanced more towards small and medium-capitalization stocks within that allotment with high growth potential. Bonds would be an under weighted asset category.

The remaining 30% would likely be divided between bonds and real estate investing. It guarantees some level of growth at a lower risk and ensures that some amount of the principle would be preserved, even if the market were to crash.

Having a market of 70% stocks is a risky potential portfolio. There are unquestionably riskier investments available, such as investing in cryptocurrency, and in this scenario, Joanna could undoubtedly choose to invest some of her money in those markets. However, since we are dealing with a retirement portfolio, the only appropriate degree of investment here is to invest a minimal amount in these markets such as crypto IRA. If the goal were not as important, risking more would make more sense.

Scenario three: Michael is sixty-five-year-old planning to retire within five years.

As such, he has a short timeframe. However, there is a catch: Michael has a high-risk tolerance.

It is a much more difficult decision to make. On the one hand, the goal is crucial: Retirement. And Michael has a mere five years to gain as much as he can to retire and live off of his investments for the rest of his life. However, Michael has a high-risk tolerance.

You’d likely be looking at a 50/50 split between stocks and bonds/money market in a scenario like this. It would be a more medium-risk scenario. Furthermore, within the equities portfolio, you’d likely be looking at a mixture of income-generating, stable, growth-oriented, or moonshot stocks. A 50/50 split between those types of stocks would be more appropriate. It would create a portfolio that had a chance to show real growth while also allowing for a limited degree of income preservation and generational wealth.

When To Change Your Asset Allocation

Investors should try to keep their asset allocation the same regardless of how one or more categories in that allocation perform. For example, raising the proportion of stocks in their portfolios is not a good reason to change your asset allocation when the stock market is hot.

However, an investor has valid reasons to change their asset allocation. Here are the three most common causes.

Change in Time Horizon

A shift in their time horizon causes most investors’ asset allocation changes. To put it another way, when you approach your investment goal, you’ll likely need to adjust your asset allocation.

As they approach retirement age, many investors gradually shift from equities to bonds and cash equivalents. A 20-year-old might be okay with an 80% stock portfolio since their human capital is high and the current job or business income can meet their living expenses.

In contrast, an 80-year-old retiree needs to rely on their nest egg to provide their living expenses. With a high concentration of stocks, they could see their retirement portfolio cut in half with an untimely recession. Also, they might not always wonder, “should I sell my stocks now” with the stock market’s volatility.

Change in Risk Tolerance

Another reason to change your asset allocation is if your risk tolerance is modified. For example, an individual working as a real estate agent might not have a stable income, depending on the real estate market and the economy. They have a low-risk tolerance.

Now, suppose the same individual gets a government job at the DMV. In that case, the steady paycheck and lower probability of getting fired could be a factor in the investor changing their asset allocation in favor of riskier assets.

Change in Financial Conditions

A final reason to change your asset allocation is if your financial condition changes or the financial objective changes.

Suppose you have been preparing to retire with 401(k) and reduced your stock allocation accordingly when nearing retirement age. Suddenly you realize that the online business you started is doing quite well and generating steady cash flow for your living expenses. Or your passive income can sustain most of your daily needs.

Or you receive generation wealth from your parents through their revocable living trust.

In these situations, you may adjust your asset allocation.

How To Change Your Asset Allocation

The first step is to determine the reason for changing your asset allocation.

Suppose you have a valid reason to change your asset allocation, not based on momentary panic or chasing the next hot asset. In that case, the second step is to decide your current asset allocation and what asset allocation you would like to have.

The third and final step is to rebalance your portfolio to reflect the new asset allocation that you have chosen.

To find out your current asset allocation, you will need to look at your investment accounts and determine the percentage of each asset class you own.

For example, let’s say you have $100,000 invested and it is currently allocated as follows:

$40,000 in stocks (40%)

$30,000 in bonds (30%)

$15,000 in cash equivalents (15%)

$15,000 in real estate (15%)

Let’s say you want to have a portfolio that is 55% stocks and 45% bonds.

To rebalance your portfolio, you will need to sell some of your real estate position and use the proceeds to buy more stocks. You might also need to buy bonds with your existing cash to align your current asset allocation with your targeted asset allocation.

When rebalancing, you will also need to consider the fees associated with selling and buying investments and the taxes that you may owe on any gains. It is always preferable to do any rebalancing using tax-advantaged accounts. One of the main advantages of asset location is to avoid any substantial tax bills resulting from rebalancing. If the above portfolio was entirely based within an IRA, you would not be paying any taxes due to rebalancing.

If you want to rebalance to desired asset allocation in taxable accounts, the optimal tax strategy is to divert only new money to the new asset. For example, if you have a 60/40 stock-bond portfolio and you want a 50/50 stock-bond portfolio, you could redirect only your new contributions to buying bonds. Also, you should use any dividends generated by stocks to buy bonds until you are at your desired asset allocation.

The benefit of this approach, besides tax optimization, is also dollar-cost averaging.

While changing your asset allocation using the above strategy can be executed manually, a more straightforward approach is to use the software.

One of the many reasons I use M1Finance. After your asset allocation is set, you can let the software automatically invest the new contributions or dividends to get your asset allocation back in order. You can read my M1Finance review for details on how I use it.

Final Thoughts on Asset Allocation

Asset allocation is an essential tool that all investors should use to help them reduce risk and reach their financial goals. Proper asset allocation ensures that someone is not too heavily invested in a specific sector that then tanks, costing them the entire value of their portfolio.

When determining your asset allocation, it is essential to consider your time horizon, risk tolerance, and financial condition. There is no best asset allocation for everyone.

In the end, you’ll be making a very personal selection by creating your own asset allocation model. There is a reason personal finance has the word personal in it. There is no one-size-fits-all asset allocation strategy that works for every financial goal. You’ll need to pick one that works best for you.

You can change your asset allocation by rebalancing your portfolio. It is essential to consult with your tax advisor before changing your asset allocation, especially in taxable accounts.

FAQs on Asset Allocation

What is a good asset allocation?

There is no “good asset allocation” that works for everyone. The answer depends on the individual’s goals, risk tolerance, and time horizon.

A well-balanced portfolio should have a mix of stocks, bonds, and cash appropriate for the individual in question. It will protect the person from potential declines in the stock market while also ensuring that they are well-positioned to be protected from risk.

What is the purpose of asset allocation?

The purpose of asset allocation is two-fold: It reduces your risk while giving you the chance to make gains over numerous sectors.

If you appropriately diversify your portfolio over multiple mediums, you will be able to make gains in industries that you may not have invested in otherwise. Furthermore, if a particular sector performs poorly, you will protect yourself from the risk of overexposure in one area.

What should my asset allocation be?

There is no single asset allocation model that works for everyone. It depends on various factors, including the purpose of your investment, your overall timeframe, risk tolerance, and the financial instruments you prefer.

These calculations can be complicated to make on your own. It is always best to speak with a financial advisor who understands your financial goals. They should have a broad array of knowledge in mutual fund investment, money market funds, individual stocks, etc.

They can speak with you about the financial goals of your investment portfolio, help you understand various asset classes, and asset you in developing a strategy that will stop you from losing money and is in line with your overall investment goals. This, in turn, can help build an appropriate asset allocation model that works for your purposes.

What are the three important elements of asset allocation?

The three most essential elements of any asset allocation strategy are goal factors, risk tolerance, and time horizon. These three elements can ultimately impact how you decide to invest your money and influence the development of reasonable asset allocation strategies that work for you.

Your time horizon refers to how much time you have before you need to access the money. Shorter time frames generally mean taking less risky strategies and using an asset class that focuses on preserving wealth.

Your goal means how you are using the money. It can also impact the asset class you ultimately select and the overall risk you are willing to incur.

Finally, risk tolerance is a vitally important factor. Some people simply cannot stand high amounts of risk with their assets, some are willing to accept medium levels of risk, and some are willing to risk it all. It depends on your financial situation and what you have the stomach to endure. Some investments lose money, of course, which you have to be prepared for. Financial professionals can help you determine an appropriate risk level, given your personal preferences.

What are asset allocation strategies?

The specific asset allocation strategies depend on the mix of the above three elements you use. You must work to determine your asset allocation model that incorporates your time horizon, goals, and risk tolerance. Everyone should develop an original asset allocation mix that considers these factors.

Looking at the issue more specifically, asset allocation strategies will incorporate some elements of the following:

1. The overall mix of mutual funds, individual stocks, and cash equivalents you own. 2. Different mutual fund companies will have different levels of diversification within their funds, so you must account for those before making any investment decisions in terms of mutual funds.

2. The specific mix of bonds includes how many high-yield or government bonds.

3. The percentage of cash or cash equivalents within your portfolio, including money market deposit accounts.

4. Your initial asset allocation should then be monitored and charged based on adjustments in the overall market.

How does asset allocation reduce risk?

Asset allocation reduces risk by ensuring that someone is not overly invested in a sector that then tanks, taking their entire investment portfolio.

For example, let’s say that someone has a heavily invested portfolio in an individual stock, like Enron. Let’s say that there is then a massive corporate scandal that results in Enron losing its entire value and going bankrupt. The investor would lose most or all of their money, thus costing them the total value of their portfolio.

It is an extreme example, of course. A more likely scenario is that an investor will be losing money, but not the entire portfolio. However, the idea behind it is the same. It is why asset allocation is so important: You need to make sure that you invest your money in areas that will give you the chance to make gains and protect you from losses.

As you can see, asset allocation is critical. Many factors ultimately impact how a portfolio is arranged, including goals, age, and the individual risk tolerance of the person in question.

Speaking with a financial advisor can help ensure that you get your asset allocation right and prepare appropriately for your end financial goal. It can also help ensure that you don’t make a critical financial mistake that costs you for decades to come

What are the different types of asset allocation methods?

The three different asset allocation methods are strategic, tactical, and dynamic.

Strategic asset allocation establishes static standards for each asset class based on an investor’s risk profile and long-term financial objectives. It does not consider market conditions or the current valuations of any asset class.

Given the current market conditions, tactical asset allocation adjusts the asset mix based on the current risk/return profiles of each class of assets. Many would consider tactical asset allocation a form of market timing. So investors would look at macro factors and if they should deviate from their strategic asset allocation by going overweight or underweight certain assets.

Dynamic asset allocation is similar to tactical asset allocation but follows a trend approach. So if stocks are not doing well, the fund manager will reduce stock exposure and increase fixed income securities in the portfolio.

Tactical and dynamic asset allocation involves active fund management with no guarantee of outperforming a strategic asset allocation. Switching between major asset categories could result in a buy high and sell low scenario. Over weighted asset categories can add risk to your portfolio. And you may need to pay additional fees to financial advisors in addition to the tax bill for frequent trades.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.