My 4 Worst Investments And How You Can Learn From My Mistakes

People always talk about their best stock picks. It’s more fun to talk about buying Facebook at IPO or picking up Netflix before it’s meteoric rise.

Investing in Moonshot companies is fun. However we like to keep it real at Financial Freedom Countdown. In fact, I believe you can learn more from failures than your successful picks.

Let us dive into my biggest investment mistakes. I have certainly made more than 4 horrible investments; but to keep it simple, I only included the ones where I lost more than $50,000 each time.

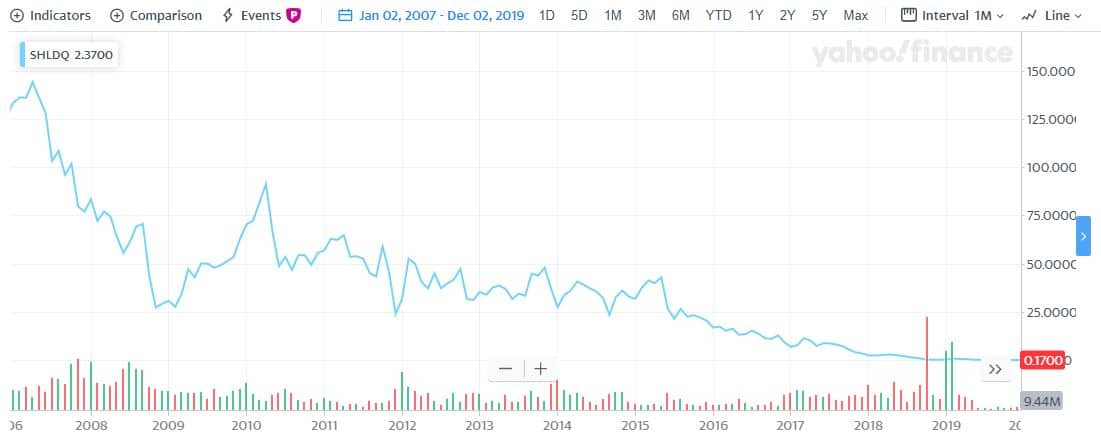

Sears Holding (SHLD) – 2007

As you know from my immigrant story, I came to this country by myself. Everything from emergency fund to bank accounts to credit cards to renting an apartment was a learning experience.

Stocks were not even on my radar the first few years. In fact, I never contributed to my 401(k) for the first 2 years. And this was with a 50% match. Yikes!!

Part of the reason was I was not sure if I would continue to live in the US or go back home. And the other part was due to my ignorance with respect to stocks, ETFs and mutual funds.

It is no surprise that my first foray into stocks was switching on CNBC and watching Jim Cramer on Mad Money.

One stock which he highly recommended was Sears Holding. In my defense, I did not immediately buy although Jim Cramer was yelling BUY BUY BUY.

I researched the stock. Although not a fan of retail, Eddie Lambert was a Wall Street legend with a great track record as a hedge fund manger. He had gained a reputation for spotting opportunities where others did not. He began acquiring Kmart stock in 2003 and Sears in 2004. Lampert was featured on Time 100 list for being one of the “brightest minds on Wall Street”. He was the richest person in Connecticut in 2006 with a net worth of $3.8 billion. Even if he failed, many stores still held tremendous potential value in the form of real estate on which Kmart and Sears stores were located.

I came to the same flawed comparison as Jim Cramer. Surely a successful hedge fund manager would know how to run Sears Holdings.

Wrong!!

Lesson Learned:

Don’t take stock tips from Jim Cramer lol. It is wrong to assume success in one field translates into expertise in another. Lampert’s hedge fund success was extrapolated to his expertise as the CEO and Chairman of Sears. Also the backstop was the real estate on which the stores were located. The Great Financial Crisis decimated the real estate market and retailers.

In fact, besides Sears a lot of others retailers have been struggling due to the onslaught of technology firms entering this space and changes in consumer behavior with respect to shopping.

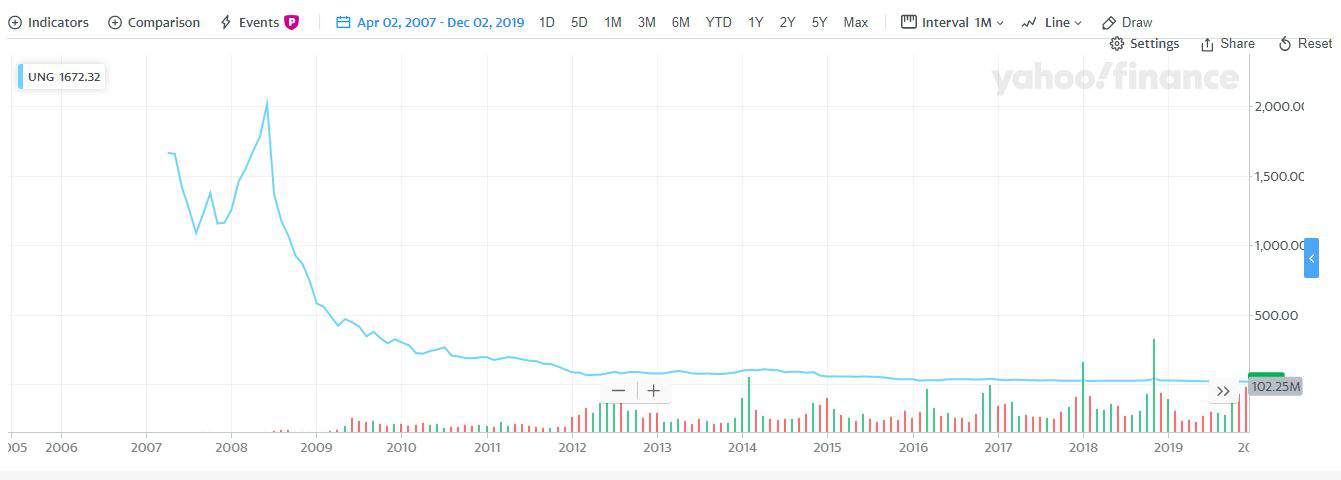

United States Natural Gas Fund (UNG) – 2008

Natural gas was all the rage in 2008. While the thesis was right what crushed me was not realizing that UNG was a poor proxy for the actual price of Natural Gas.

One of the biggest challenges in any oil or natural gas commodities fund is the contango and backwardation. Since these ETFs are futures contracts; one needs to watch the spot and futures price. What complicates it further is the storage costs for these commodities; which eats up any revenue generated.

With natural gas dropping, an increasing skew of the price curve, called a contango, gets more extreme. Futures contracts are monthly instruments. UNG is forced to move its exposure every 30 days to the next monthly contract. With a skewed price curve, the fund is literally forced to pay a deep premium to roll their contracts, inevitably dropping the value of the fund intrinsically every month.

The other major mistake was not anticipating the change in technical advancements. If you told anyone in 2008, that USA would achieve energy independence in a decade and in fact would be a net energy exporter; they would have laughed at you. And yet here we are 10 years later.

Lesson Learned:

When investing make sure you anticipate any technological changes that may result in your thesis not being valid in the future.

Also make sure you understand the instrument used in order to invest/speculate. The usage of futures contract turned out to be my undoing.

Initial Coin Offerings (ICO)s – 2017

Once I went down the rabbit hole of Bitcoin, it was only a matter of time I decided to delve deeper into other Cryptocurrencies. A lot of tokens came into existence and were offered as ICOs. These were known as “altcoins” and once they failed the moniker changed to “shitcoins”.

The premise of these tokens was that it could be used for a variety of use cases. Some for accessing a decentralized internet, others for accessing file store and few were blockchains themselves used for inter-operatability.

Needless to say during the Crypto winter from 2018 onwards; a lot of these firms ran into funding issues. Most of them are worthless now and unable to deliver their roadmap. Some founders genuinely tried and failed. Quite a few founders did an exit scam. Shopin was one of the ICOs I had invested whose founder pleaded guilty. The ICO scams became so blatant that the SEC has a spotlight section on their website highlighting the cases.

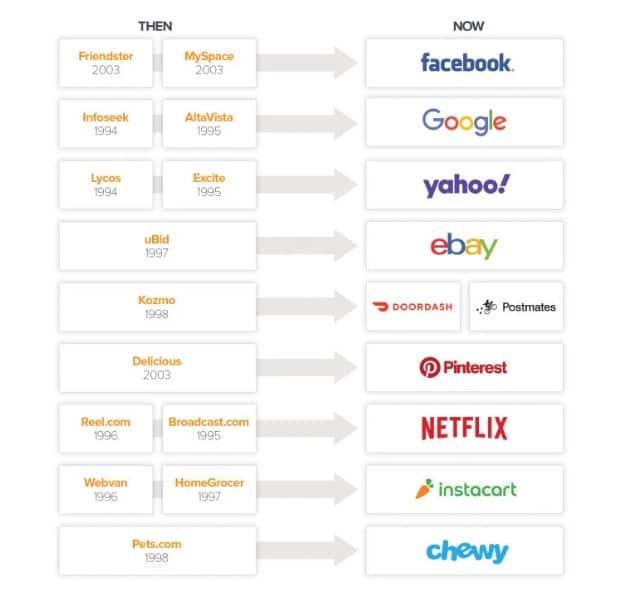

The other problem could be that these are too early in the game and we need failures in order for the next wave to succeed. Just like with the dot com burst.

“There are no bad ideas in tech, only bad timing.”

– Marc Andreessen

Here are some examples of the right idea coming at the wrong time, along with subsequent proof points on the quality of the ideas

We are so early with respect to Bitcoin and cryptocurrencies that maybe in hindsight these will look to be viable ideas. Or maybe I am using this to justify all my dumb investment ideas.

Lesson Learned:

In hindsight, most of these tokens did not have a strong business case. Since Bitcoin is already decentralized money; you could just use Bitcoin to pay for all these services. I could see a case with respect to decentralized and anonymous internet being a good use case since Bitcoin does not offer anonymity yet. The lack of adoption should have been a major red flag.

Lithium stocks – 2017

I invested in clean energy mining stocks, specifically lithium based on the expected demand for Electric vehicles. However I failed to anticipate the flood of new supply set to come to the market.

Morgan Stanley forecasts that new supply from Argentina, Australia, and Chile, could add 500,000 tonnes of lithium to the market per year by 2025. That’s more than twice as much as the current annual supply of approximately 215,000 tonnes. One of the analysts said, “We expect these supply additions to swamp forecast demand growth”.

Lithium spot prices fell more 70 percent during that last 14 months over concerns that supply is out growing demand, according to spot prices for lithium carbonate, 99.5% Li2CO3 min, battery grade, traded in China.

Does anyone want to guess when I started buying Lithium stocks?

The sharp drop in prices expected has a lot to do with the sheer abundance of lithium in the Earth’s crust. Thus, as prices have risen on growing demand, new producers can easily jump into the market to get a piece of the action. Most notably, China has begun to develop its own lithium deposits.

Another challenge with these mining stocks is that they are all located in jurisdictions which have tons of issues. Imagine owing a mining operation in Mali. Yes, those are the risks we need to consider.

Since I initiated this position at the end of 2017; I have not yet booked losses. I believe in the long term EV market and hence have Tesla in my Moonshot portfolio. Will wait and see how this thesis plays out. Buckle up!

Lesson Learned:

Not anticipating the new supply was my biggest mistake. Commodities is a market I have limited knowledge and need to do more research before investing going forward. Also need to consider jurisdiction risks and the fact that assets outside of the developed world do not have much protection.

[bctt tweet=”As they say in poker, if you’ve been in the game 30 minutes and you don’t know who the patsy is, you’re the patsy” username=”FFCsocial”]

Summary

Do not invest in sectors you do not know or have an edge. Always consider who is on the other side of the trade. Anyone who invests in their spare time has no advantage over professionals who have tons of data, subject matter experts and number crunching capability.

As they say in poker, “If you’ve been in the game 30 minutes and you don’t know who the patsy is, you’re the patsy”

I lost a significant net worth with all these mistakes, but staying disciplined with respect to position sizing ensured that I was not ruined, losing everything.

Having the bulk of my net worth in index funds and local property helped me stay anchored.

Readers, what has been your worst investment and what lessons did you learn?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

My worst investment was buying a home on the west coast. Stock-wise, we prefer index funds to smooth out the risk between individual companies.

I guess timing matters more wrt houses. I consider my west coast property to be my best “investment”

I was burnt by commodities in 2017 and 2018 because I wanted to diversify outside my standard index funds. After all, the world needs resources to keep the global ticking, right? I still have some gold streaming stocks but I’m avoiding the natural gas suppliers and raw material producers.

Instead, what individual stocks I have are blue chips with a steady dividend history.

For a long time there have been rumors wrt precious metals markets being manipulated. News of 3 J.P. Morgan precious metals traders charged as criminal probe continues will be interesting to watch.