Behind The Scenes Look At How I Invest In Moonshot Companies

Picking individual stocks is not for the faint of heart. In fact, the bulk of your investments should be in well-diversified, low-cost index ETFs. Knowing which stocks will be winners or losers in the future is tough to predict.

But most of us can’t resist the urge to pick stocks. I am not infallible to this human trait. Today, I will take you behind the scenes to show you how my method of Moonshot Investing.

Since I embarked on picking moonshots over two years ago, it is only appropriate to update my moonshot portfolio performance and any changes I am making for the upcoming year.

I have made plenty of mistakes in the past and lost money on individual stock picks. Here are my four worst investments. Now I typically stick to sectors or companies I understand; and believe would do better than the average market.

To reiterate, investing in Moonshot stocks is less than 10% of my portfolio. It is an asymmetric risk like my Bitcoin and other cryptocurrency investments. If it all goes to zero, I have no regrets. At the very least, I would be entertained and learn not only about investing; but also about my risk tolerance.

What Is Moonshot Investing?

Moonshot investing is investing in companies you believe will have a meteoric rise. It is based on identifying a trend and knowing that the market will eventually rate the companies much higher.

Invest wisely but don’t be afraid to take some risks. I often see investors pile into old and safe companies without paying attention to how the world is changing around them.

Skate to where the puck is going, not where it has been.

Wayne Gretzky

Most headlines focus on early-stage technology companies, angel investors, accelerators, incubators, entrepreneurial founders, and Silicon Valley Venture capital firms when we think of meteoric investments.

But there are also unicorns in the public markets accessible to everyone. Most of them have founders who still execute like start-up companies. And not all of them are based in the sexy areas of artificial intelligence, machine learning, biotech, crypto, etc.

A classic example is when cars started shifting from gas guzzlers to more environmentally friendly options. When California began issuing carpool stickers to environmentally friendly vehicles, it indicated the trend was here to stay. And if you caught that trend, it was easy to invest in companies at the forefront of that revolution.

What Are Moonshot Companies?

Moonshot companies are the basket of companies or a single company that you believe will capture the lion’s share of the new trend.

If we continue with the environmentally friendly vehicle trend, there is a clear sign that hybrids and electric vehicles would benefit. Investing in those options over the last decade would have rewarded you.

Similarly, there was a trend with energy drinks. Individuals wanted a canned drink that would help them throughout the day. Or when performing certain activities. Red Bull, Monster energy, etc., came on the scene. Monster Beverage Corp was $0.87 in 2005. It skyrocketed to over $180.

Today, we have a trend of remote working. Employees prefer to work remotely and not spend time commuting daily. Employers can avoid expensive office space by providing employees work from home options. It is a win-win situation for both employees and employers.

We can invest in companies that help employees work from home based on the remote working trend. Of course, the downtown commercial office space REITs are the losers. So you can avoid them. Instead, you can invest in real estate crowdfunding explicitly focused on retail housing in some of the best states for real estate investors.

Please note that I am only showing this behind-the-scenes look to give you a better idea with examples of how I invest. It is in no way, shape, or form a recommendation on what you should buy, sell or hold. Past performance is no guarantee of future performance. Consult a licensed investment professional.

Avoiding Price Volatility in Moonshot Companies

One of the biggest challenges of Moonshot companies is that they suffer from tremendous price volatility. Moonshots are established companies, but it is hard to value the business. They tend to function more like start-ups. They are continuously pivoting based on the changing business environment and their understanding of future growth trajectories. Moonshot companies have several bets that might or might not pan out into the future. Hence the name Moonshot.

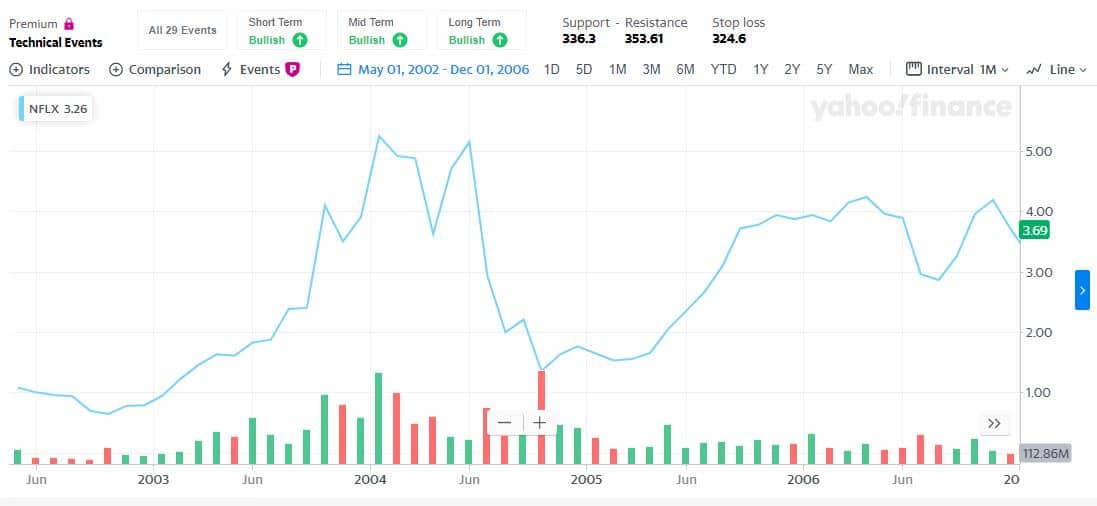

Let us take Netflix as an example. Initially, they started with mail-order DVDs. Then they moved into streaming. Now they are like a movie studio producing Original Content. Netflix had a monstrous decade, but you can see the price volatility even if we exclude that period.

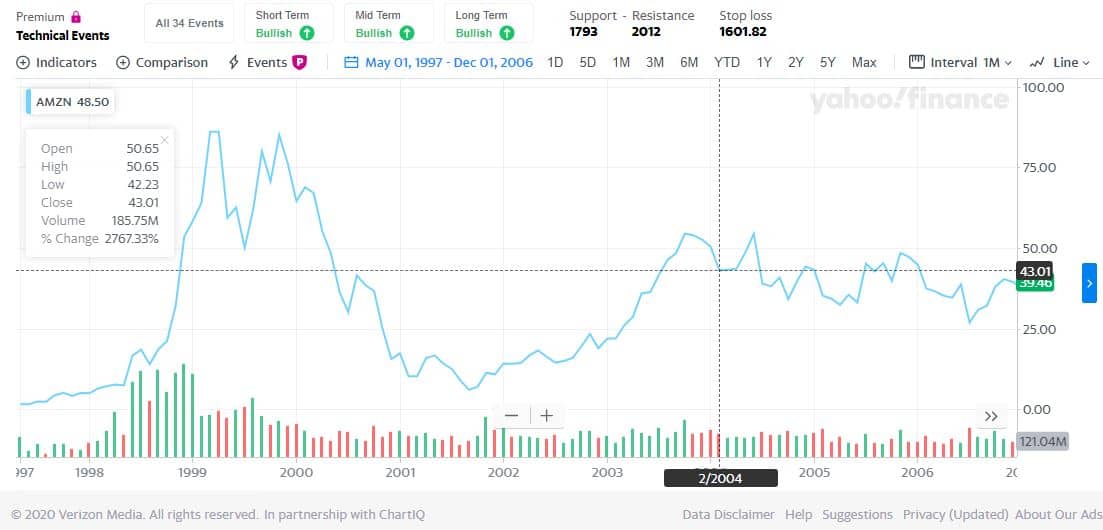

Amazon started as a retailer of only books. It then expanded to the “Everything Store.” Now home-grown technology of AWS makes up a significant part of its revenue. The recent acquisition of Pill Pack indicates a push into healthcare. The Amazon price chart is over a similar period, excluding the last decade.

As you can see, Amazon peaked during the dot com boom. It crashed and slowly made its way back up and surpassed the peak. This kind of price volatility leads us to second guess when investing in moonshot companies. After all, few would have had the discipline to continue holding to such stocks, let alone keep buying them.

Analysts using traditional metrics to value Moonshot Companies fail to realize the tectonic shift in trend. And the work done years in advance at these companies before the markets see it.

“When somebody congratulates Amazon on a good quarter … I say thank you. But what I’m thinking to myself is … those quarterly results were actually pretty much fully baked about 3 years ago”

Jeff Bezos

What Is Dollar Cost Averaging?

Dollar-cost averaging (DCA) is an investment strategy in which an investor divides up the total amount to be invested across periodic purchases to reduce the impact of volatility on the overall purchase.

The purchases occur regardless of the asset’s price and at regular intervals. In effect, this strategy removes attempting to time the market.

Dollar-Cost Averaging is not a new concept. Your paycheck at work is invested similarly into your 401(k).

Using Dollar Cost Averaging For Moonshot Investing

Dollar-Cost Averaging is a way for an investor to neutralize price volatility. The main benefit of Dollar Cost Averaging is that you buy fewer shares when prices are high and buy more shares when prices are low. The goal is to buy more shares at a lower average cost per share over time.

How Has My Moonshot Investing Portfolio Performed?

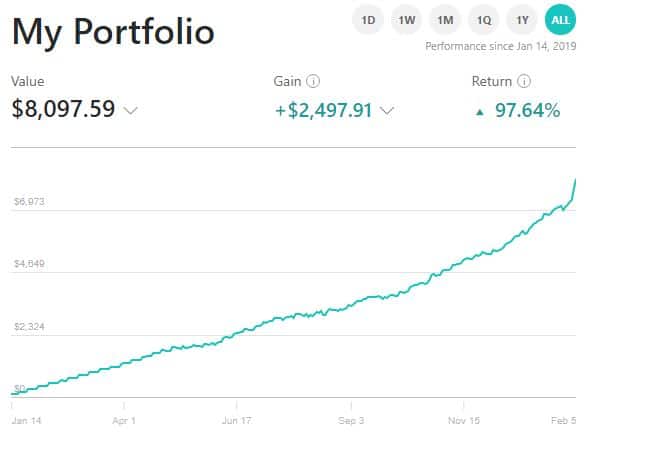

The selected stocks I picked; resulted in over a 95% return. The market has been tearing lately, but this is much higher than most indices.

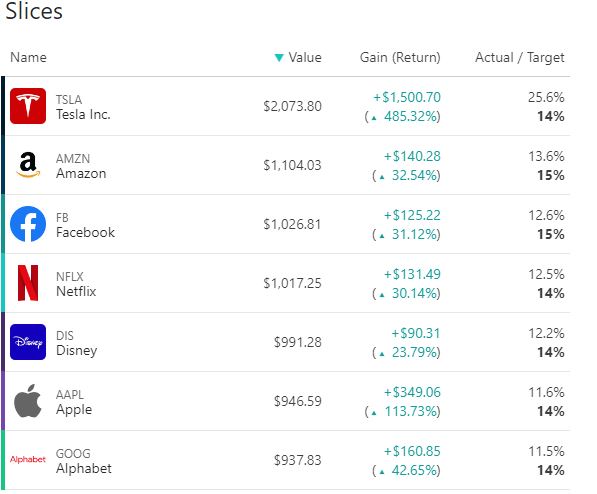

Here are the stocks in my portfolio. Again this is not a buy, sell or hold recommendation. It is only an example of how I invest in companies while minimizing any behavioral biases. Past performance is no guarantee of future performance. Consult a licensed investment professional.

How To Setup Moonshot Investing Portfolio

I set up my Moonshot investing portfolio using M1 Finance. I am using M1 Finance compared to Vanguard or Fidelity, or Schwab because M1Finance lets you buy fractional shares. Imagine trying to wait to buy Amazon at other brokerages while you can buy a fraction of it with just $100 at M1Finance.

M1Finance also lets you set up an auto-invest schedule and auto-rebalances your portfolio. When some of your selected stocks are high, and others are low, the rebalancing feature automatically buys the low ones. “Buy low and sell high” is the only way to make money when investing in stocks.

And M1Finance does not charge any fees, which means more money to invest. You can read my detailed M1Finance review here.

- Use my affiliate M1 Finance signup link if you do not already have an account.

- Determine how much you want to invest weekly. Let us assume you decide $100.

- Pick your favorite moonshot companies. It can be any number.

- Decide how much % you want to invest in each company. Let us assume you pick five companies and decide on an equal % to make it simple.

- Week 1 – Your $100 is divided equally among all five companies and used to buy stocks

- Week 2 – Assuming company 1 goes up a lot, your $100 from week two is used only to buy the other four companies. It ensures that your moonshot portfolio is balanced automatically.

In my case, Tesla has had a monstrous run over the last month. So the actual % of my portfolio (25%) is a lot higher than my Target (14)%. All future weekly contributions will go to my other stocks till they reach the desired target value.

M1Finance ensures that I don’t buy Tesla at the peak and instead buy others that are at a comparatively lower price point.

Moonshot Portfolio Update 2022

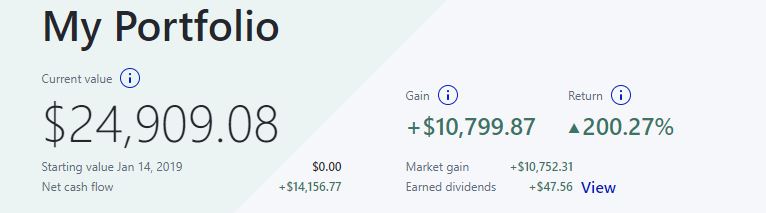

Since it has been almost two years, let us look at the portfolio performance. The money-weighted return of my portfolio is now 200%.

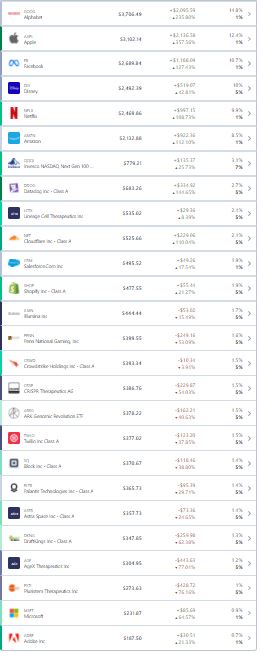

My portfolio is still technology-focused as I understand the technology and am a firm believer in software eating the world. We all have to be prepared for a scenario where robots take our jobs.

The most significant change was selling Tesla, which had a substantial monstrous run. Since Tesla is now a part of the indexes, I still have enough exposure to Tesla.

Besides technology, I added a lot of biotechnology to my portfolio. Most of these companies are early stage and might not all survive. The drawdowns have been massive, as you can see from my current portfolio. However, as humans live longer, the companies at the forefront of genetic engineering will thrive.

I also added exposure to gaming and space stocks.

All my recent additions are down, but I plan to hold them for an extended period. And in the spirit of transparency, I wanted to share with my readers.

Regardless, please do not consider my current portfolio a buy, sell or hold recommendation. It is only an example of how I approach investing in companies while minimizing any behavioral biases. Past performance is no guarantee of future performance. Consult a licensed investment professional.

Summary Of Moonshot Investing

Moonshot investing involves a combination of luck and skill. It satisfies our urges to pick individual stocks based on trends. The method of investing I use with auto investment and auto-rebalancing has helped me reduce the price volatility. I consider this investment speculative and allocate only a tiny part of my portfolio.

Readers, do you pick stocks in your personal portfolio? If yes, what strategies do you use? Have you benefited from following trends as I do with Moonshot Investing?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

4 Comments