Investing in Undervalued Real Estate Markets: What You Need to Know

In real estate investing, everyone wants to buy low and sell high. There are several ways to achieve this goal, such as buying distressed properties and returning them to market value or buying fairly valued properties and performing value-added improvements to increase the real estate price.

A third method that requires a great deal of patience and luck is investing in undervalued real estate markets.

Of course, finding undervalued housing markets can be challenging. Doing so requires comprehensive knowledge of what makes a market undervalued. Let’s look at how to find undervalued housing markets and what cities are currently on the list.

What Is an Undervalued Housing Market?

There isn’t necessarily a formal, scientific definition. However, the housing market is generally undervalued based on the home price-to-income ratio.

If home prices are low but income is high, you will have a lower percentage. The lower the ratio, the more affordable the housing.

The U.S. Department of Housing and Urban Development recommends that households limit their total housing expenses to no more than 30% of their gross monthly income. The 30-percent rule for measuring affordability can be traced back to the Brooke amendment passed in 1969 and the subsequent cap raised by Congress in 1981.

An undervalued housing market can be defined as areas where the median housing payment to family income ratio is lower than 30%.

The 30% number fits in well with the 50/30/20 budget template, which stipulates that one should spend at most 50% of the income on needs, including housing.

When buying a house, lenders usually require that a borrower’s housing payment, which comprises principal, interest, taxes, and insurance, be at most 28% of their pre-tax monthly gross income. The 28% limit is the front-end ratio and ties in with the 30% rule for most undervalued housing markets based on median family income.

However, with the rising mortgage rates due to inflation, the list of undervalued housing markets is decreasing rapidly.

What Metrics Can You Use To Find Undervalued Markets?

Like anything else in today’s real estate market, finding the most undervalued housing markets isn’t a matter of luck: It comes down to skill. To that end, you can use a series of metrics to examine home prices and see if they fall into the “undervalued” bracket. These include:

Median Home Value

The median home value is one of the critical metrics for finding the most undervalued housing markets. It would be best if you always compared the home value of a community to the national average.

Average Weekly Wages

It is essential to compare the price of the average weekly wages to the median home value. You may have found an undervalued housing market if salaries are high compared to the median home price and national average. Other metrics – such as the median family income – will also work.

Comps

Undervalued markets can often be found by taking the home prices of one neighborhood and comparing them to the home prices of a similarly situated community. This comparison of home prices – comps – will make it easier to determine if a median home price in an area is above or below what a market can support.

Historical Trends

As noted above, a neighborhood’s trends matter more than anything else when finding undervalued housing markets. The reason is simple: House prices are never static. They will rise and fall with the local economy, neighborhood, demands in housing trends, and more.

If a price is trending up and appears likely to do so in the future, you should check out metro areas with increasing prices, as this is likely to indicate rising housing prices.

Family Income Ratio

As noted above, the family income ratio – or how much a family pays for housing – is critically important. The lower the ratio, the more a family may spend on housing.

This will typically push prices higher, creating more value for existing homeowners. If you can invest in an area with a low ratio, you may set yourself up for future success and generational wealth creation.

Factors That Increase Prices in Undervalued Real Estate Markets

Once you identify an undervalued real estate market, you need to consider a few possible factors that could cause the median home price to increase.

Population Growth

If population growth occurs in an area, there is more demand for house prices. One of the many reasons it is vital to track states losing population and where the people are moving is based on net domestic migration trends.

Home values in Florida and Texas have benefited from this trend over the last few years.

Job Growth

Creating jobs in an area will result in cumulative wage growth and attract others to the region, further pushing home prices. Opening a manufacturing facility, hospital centers, and defense bases are all news events one needs to track carefully.

These factors will increase the median property value, meaning home prices will likely increase.

Wage Gains

Wage gains are typically indicative of the economic power of an area. If individuals make more money compared to the rest of the nation, then that area will likely increase housing values over time.

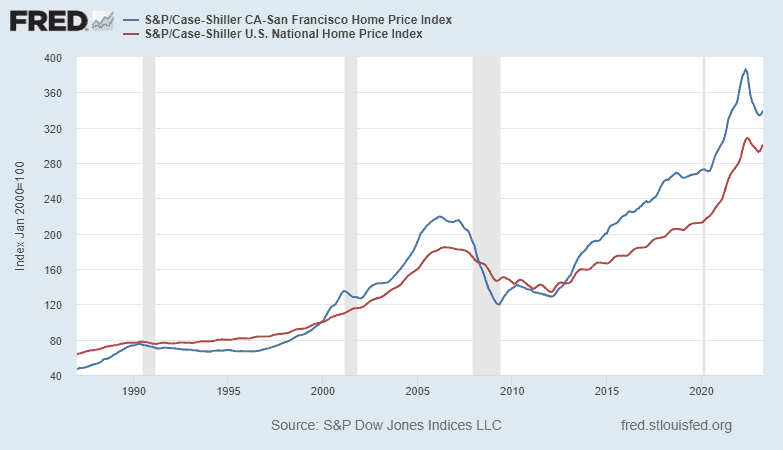

For example, with the rapid rise in the average wages of Silicon Valley workers, home prices in the San Francisco Bay Area far exceeded national price increases.

Infrastructure Development

Regarding real estate, infrastructure development is one of the critical factors that can have a significant impact on property prices. For example, after the announcement of high-speed rail in California, several cities designated as planned stops on the route saw a dramatic price increase.

A similar phenomenon was observed in certain parts of Austin, Texas after the city announced an extensive expansion of its light rail system.

Numerous businesses and residents began to move to specific areas. The influx of people drove up demand for housing in Austin, resulting in increased home prices.

Besides the large infrastructure projects, even minor ones, such as increased broadband services, can impact home prices. If cities offering free land programs can provide high-speed internet connectivity, it might attract more individuals who want to experience a rural lifestyle.

Some of these criteria as similar to the ones we use to identify the best states for real estate investors.

What Are the Undervalued Housing Markets?

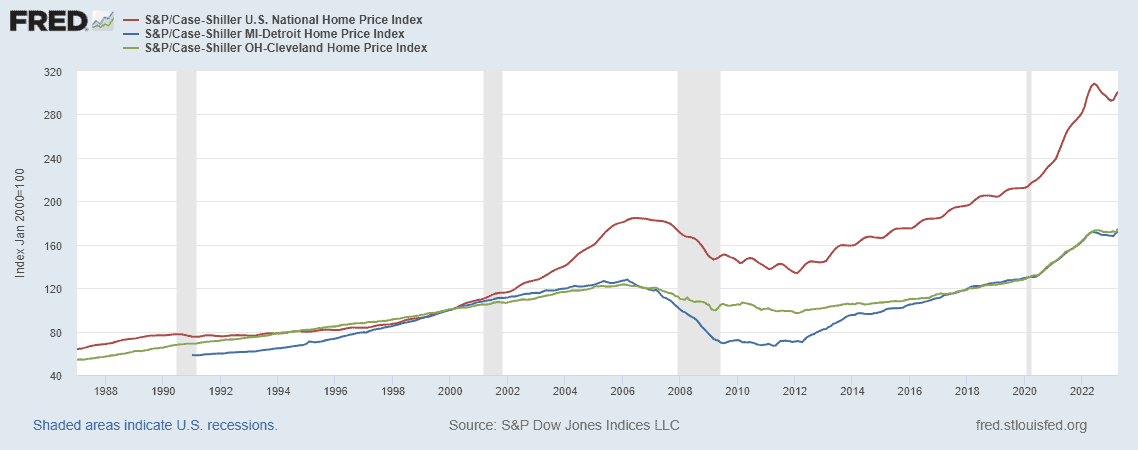

Data from the National Association of Builders and the National Association of Realtors shows some of the most undervalued housing market areas in the Mid-West and East Coast.

The following five cities have a payment-to-income ratio below 30%, the maximum rate suggested by HUD, and hence classified as undervalued.

- Detroit: 17%

- Cleveland: 19%

- St. Louis: 22%

- Philadelphia: 22%

- Cincinnati: 24%

Should You Invest in Undervalued Housing Markets

No matter if you are in an HCOL or LCOL area, the housing market nationwide has seen a massive rise in costs and a distinct lack of affordable housing.

These changes have largely been driven by the rise of remote work and a low housing supply and home inventory level in traditionally undervalued markets.

The assumption of investing in most undervalued housing markets is that these low prices and lower ratios will only stay that way for a while, mostly because demand will typically drive the median property value up.

As a home value increases, so do sale prices, ultimately making the median home price in an area less affordable.

However, in the past few years, many of these areas – notably Detroit – have struggled regarding population and business growth.

The graph shows that home prices have not recovered and have lagged National averages since the 2000s.

Although the unemployment rate in Detroit is low, there is a low demand for housing due to a significant decrease in population over the past few decades caused by job losses in the region.

You could be waiting for an extended period if you used the reversion to mean theory for the undervalued real estate markets.

Unfortunately, there is no question that some housing markets are vastly overpriced and extremely expensive to live in. High rent and a high home-to-income ratio make places like San Francisco, New York, Los Angeles, Jersey City, etc., far too expensive for all but those who have high average weekly wages to afford.

But remember that the most affordable home prices do not necessarily mean an area is undervalued. Home value is relative and mainly based on future growth potential, driving up housing demand.

Yes, an area may be overpriced compared to the rest of the nation. However, if the city shows tremendous growth potential in terms of its median property value, it may increase.

Investing in this area may open up many opportunities for future growth, particularly given that these areas are the subject of significant local, state, and federal reinvestment and redevelopment efforts.

As you can see, finding a median home price lower than the national average – but still a worthy investment – is challenging. It takes understanding key metrics, knowing what you are looking for, and experience in spotting neighborhood trends to make this proposition successful.

With enough foresight and access to the right kind of data, you can make these types of investment work, but you need to understand that doing so will be challenging, and it could be fraught with risks if your investment thesis does not play out.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.