Is Gold A Good Investment: How To Invest In Gold

In the past, we have covered all the various assets to buy and ranked them based on risk, volatility, return, liquidity, passive nature, and availability. Ideally, your net worth should be comprised of various assets.

Today let us, deep-dive into gold as an investment. What are the environments in which gold outperforms, and has it done so recently?

Gold has a recorded history of over 5000 years as an asset. The shiny precious metal has attracted generations, given its unique properties. Gold doesn’t corrode. It can be easily melted to form various shapes. Moreover, gold has a unique and beautiful color, unlike other metals. It is sufficiently rare to hold value.

Many of you will have questioned if gold is a good investment based on the rapid increase in the gold price. Or due to the policy announcements by global central banks. Or looked at the Federal Reserve balance sheet. No matter the reason, gold has caught our attention, and we will discuss how to invest in gold.

Is Gold A Good Investment

There are many reasons why investing in gold is a good idea.

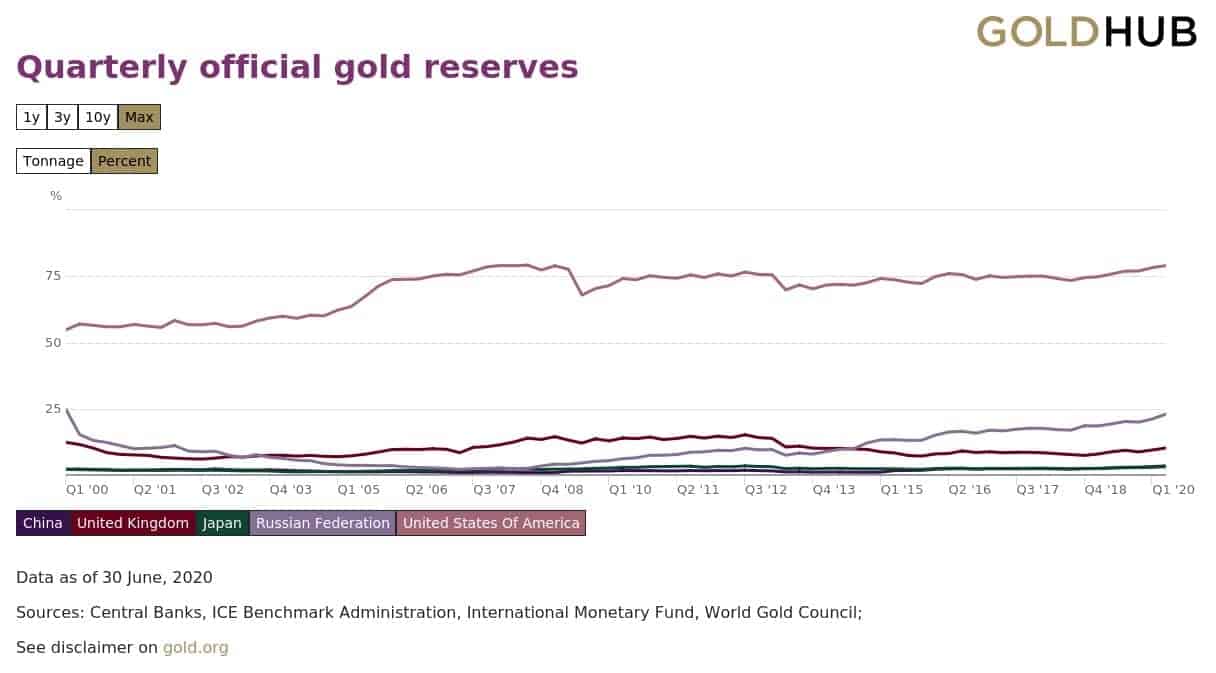

Long Track Record

Gold has been used as an asset for more than 2,000 years. It has the most extended history out of all the assets we discussed. And it is still used to this day, not only by individuals but also by various governments. Gold remains an essential asset in the reserve holdings of several countries such as the USA, China, India, Russia, Japan. The International Monetary Fund also holds gold. The New York Fed acts as the guardian and custodian of the gold on behalf of account holders, including the U.S. government, foreign governments, other central banks, and official international organizations.

While many are skeptical of new assets like Bitcoin, gold has proved to be an asset class for elites and masses over thousands of years.

Currency

Gold has a long history of being used to procure goods and services. It forms the perfect medium of exchange as a currency.

Liquidity

Since gold is universally accepted and has a long track record, it is considered one of the most liquid assets. Gold can be converted to cash easily anywhere in the world.

Portable

Physical gold is one of the few assets you can pick up and leave at a moment’s notice. History is rife with individuals going with only gold, abandoning all other assets when their life was threatened. It could be Jews during WW2 or refugees from Vietnam leaving by boats.

Deflation Hedge

Deflation is when the price of goods and services falls over some time. Gold loses value slower than other assets in times of deflation. Cash does well in a deflationary environment. You can hoard some money and use it to buy cheaper goods in the future. Although gold is not the perfect hedge for deflation, it performs well relative to other assets. While prices of other goods fall in value, people rush to buy gold, causing gold to increase.

Inflation Hedge

Very few assets act as a good hedge against inflation. Cash loses its purchasing power. Bonds will fall in value as inflation increases. Gold preserves purchasing power in times of inflation. As inflation rises, you will find gold price increases. Investors realize money is losing value due to inflation and move into hard, tangible assets.

Besides gold, a Rental property with a fixed-rate mortgage is also a good hedge against inflation. Unfortunately, rental properties are subject to confiscation by the government. And are not as liquid as gold.

Currency Hedge

Gold is typically priced in dollars. If the value of dollars falls, the price of gold increases.

Geopolitical Risks

Gold is considered a safe haven and is universally accepted as a medium of exchange. Gold is a “crisis commodity” as people rush to buy it in times of turmoil. There are few instances when gold and the USD will rise simultaneously. Economic distress or geopolitical risks are when both gold and USD increase simultaneously.

Store Of Value

Since gold has generally retained its value over long periods, including inflation, deflation, wars, famine, etc., it is a good store of value. You can also pass it down through generations.

Diversification

The bedrock of any asset allocation is to diversify among all the assets you own. So when one part of your portfolio zigs, the other should zag. Diversification helps you sleep at night. Gold is not related to the stock markets, bond markets, real estate, etc., and provides the required diversification for your portfolio.

Reasons Why Gold Is A Bad Investment

Gold Prices Rise And Fall

One of the appeals of an asset as a store of value is that it would hold the value steady in times of need. But, gold prices rise and fall depending on supply and demand. They also change based on economic and geopolitical risks. The price fluctuations are a feature and not a bug for this asset class. One needs to be prepared for it when holding gold.

No Return On Investment

Stocks, Bonds, and Cash generally provide you some return for holding them in the form of dividends or interest payments. Gold does not earn any return for keeping it. If you own gold in physical form, it can cost money for storage.

When To Buy Gold

Before you decide to buy gold, look at your overall asset allocation and determine where it would fit. When to buy gold is a personal decision. Since the price of gold fluctuates, it might not be a bad idea to invest gradually till you reach your desired target allocation.

How To Invest In Gold For Beginners

There are several options for buying gold. A professional trader would rely on the futures and commodities market. Or buying exchange-traded notes (ETN)

You can either buy physical gold or paper assets representing gold as a beginner. The best way to invest in gold depends on your comfort level and need.

Buying Physical Gold

There are two significant challenges with buying physical gold.

- If the gold you buy is of lower purity than what the dealer promised, you will lose money. Always buy from a trustworthy gold dealer.

- Storing the physical gold in a safe place, so it is not lost or stolen.

- Gold is considered a collectible as per the IRS. You will be taxed at the collectibles capital gains rate if you sell your physical gold. For short-term assets, that is your marginal tax rate. Your marginal tax rate for long-term investments is capped at 28%.

The positive aspect of buying physical gold is that you keep control of the asset at all times.

APMEX is one of the largest dealers of precious metals in the U.S. It offers a safe, trusted way to invest in gold and other metals. Besides one time purchases, APMEX also offers additional features such as auto-investing or a precious metals IRA.

Buying Gold Bars Or Gold Coins

Gold coins are a good investment for beginners. Popular coins include:

- The American Eagle coin.

- The Canadian Maple Leaf coin.

- The South African Krugerrand coins.

As you accumulate more assets, you could branch out into gold bars. When buying bullion, get a certificate of authenticity. Validate the “melt value” so you know the actual gold content in the collectible gold coins or bars you are buying.

Buy Gold Jewelry

Jewelry has been used in several cultures to indicate wealth. Gold jewelry is used to pass on and preserve generational wealth.

To make it simple for investors to buy and store physical gold one can use apps like Vaulted. Starting with an investment of as little as $10 and the ability to add any increment at any time, Vaulted provides a level of flexibility that appeals to young investors who may be at different stages in their investment story.

Benefits of Vaulted

- Acquire 99.99% fine gold kilo bars at the Royal Canadian Mint

- All ounces are allocated to the client, not pooled or leased

- The most transparent and competitive gold pricing

- Start investing with as little as $10

- Real-time visibility on your investment

- Selling gold is as easy as moving funds from one account to another

- Available to investors in the U.S. and around the world

- Speak with experienced advisors to answer any questions and help determine investment strategies and management

Sign up for an account with Vaulted to buy and securely store physical gold.

Buying Gold Using Paper Assets

Advantages of buying gold with paper assets

- You can dollar cost average to reduce price volatility when purchasing gold. I recommend using M1 Finance to buy with zero fees, very low minimums, and automated investment.

- You do not need to worry about keeping your gold assets secure

- There are no storage costs to gold paper assets

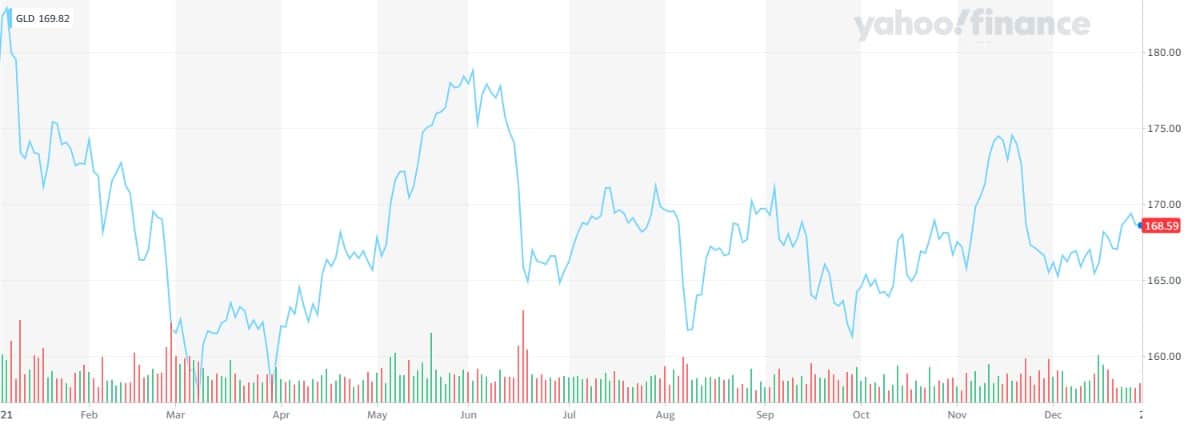

Buying Gold ETF

Due to the boom in the ETF markets, you have several options to buy gold as a paper assert. One of the most popular instruments is the GLD Exchange Traded Fund (ETF). The GLD ETF represents fractional, undivided beneficial ownership interests in the Trust, the sole assets of which are gold bullion and cash from time to time. Make sure you read the prospectus before investing.

The taxation for Gold ETFs is different compared to other stock ETFs. When you sell your Gold ETF, you will receive a schedule K-1 for tax purposes.

Also, the IRS does not permit collectibles to be directly owned in IRA. So you cannot own physical gold in an IRA. But you can hold a gold ETF in an IRA.

Buy Gold Stocks

Gold mining stocks are not a direct investment in gold; but rather in companies that mine gold. Mining stocks of gold producers allow you to buy gold with leverage. But there is risk involved.

Most junior gold miners start as explorers before turning into gold producers. Several have lousy management. It is a very capital-intensive industry. After all, mining stocks count as one of my four worst investments.

The gold mining company might have mines that yield less gold than projected. Operational challenges during exploration or extraction could ruin the company. The price of gold can change from when the company starts exploration to production. It can make a mine unprofitable.

Several of the mining companies are located in jurisdictions outside the developed world. The local government can seize the mine.

It is hard to perform due diligence on these mining companies unless you have deep subject matter expertise and local knowledge.

VanEck has created index ETFs GDX or GDXJ if you want to invest in a basket of gold mining companies. The GDXJ includes smaller exploratory or early development phase companies. Make sure you read the prospectus before investing. Both of these are also available on M1 Finance. You can read my M1Finance Review on why I use it compared to other providers.

Actual Gold Performance Against Inflation

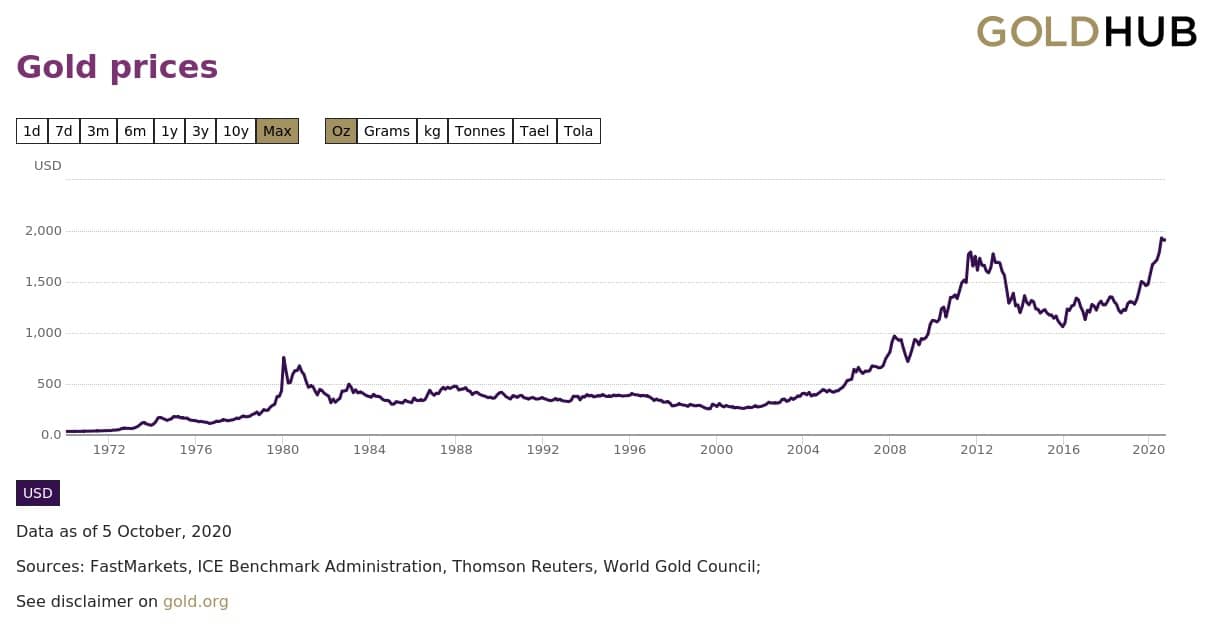

The last time we had inflation was in the 1970s when Paul Volcker, the Fed Chairman, had the unpopular task of raising rates to break inflation.

Gold was a fantastic hedge against inflation in the 1970s and rose approximately 30% annually compared to 7% inflation.

The consumer price index as measured by the BLS in Jan was at 1.4% and in Dec increased to a whopping 6.8%

| CPI | Gold (measured by GLD price) | |

| Jan | 1.4% | $181 |

| Dec | 6.8% | $168 |

But gold stayed flat and even dipped lower.

Why Did Gold Not Perform As Expected?

Markets are hard. Even if, as investors, we know all the information in advance, including how certain assets perform under certain economic conditions, the behavior of individuals constantly changes.

History Doesn’t Repeat Itself, but It Often Rhymes

Mark Twain

Markets are made up of several individuals trading at any given point in time with different time horizons, motives, risk appetites, and theories, making it complicated.

Gold bugs will complain that the Federal Reserve now plays an outsized role in the market, and we are now living in a Modern Monetary Theory (MMT) world. While that might be true, your portfolio does care. We invest in making money.

There is no difference between money made in speculative investments compared to money made by spending hours studying the macro environment or analyzing company balance sheets.

One theory is that cryptocurrencies have replaced gold as the inflation hedge. And that theory could be valid for several factors.

- Historically, we talked about how families would flee persecution carrying their wealth in gold. Bitcoin is easier to store, transfer and spend compared to gold bars.

- Millennials and the future generations have only known Bitcoin as gold all their adult lives. Do you expect they would buy more gold or bitcoin in the future?

- Financial planners are now more comfortable with cryptocurrency. In fact, you can now even invest in cryptocurrency in your IRA.

What Percentage Of Your Portfolio Should Be In Gold

The amount of gold as part of your portfolio entirely depends on your risk tolerance, your other assets, where you live, etc.

Although gold has many unique characteristics, it has a few significant drawbacks. I consider gold mainly as an insurance asset. I would not exceed 15%.

Ideally, I would prefer most of my net worth in growth or income-producing assets.

Closing Thoughts On Gold As An Investment

Gold is a good investment because it offers diversification, currency, and liquidity benefits, is a store of value, has a long track record against geopolitical risks, inflation, and deflation.

Buying gold bars, coins, jewelry, gold ETFs and mining stocks are some of the ways to invest in gold for beginners.

However, recent history has shown that gold no longer rises as expected when inflation increases. The critical takeaway is always maintaining proper asset allocation and diversifying among various asset classes.

Maybe investing in cryptocurrencies is the new gold? Only time will tell.

Readers, do you own gold as part of your asset allocation? Has the allure of gold as an asset changed over generations?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

Thanks for sharing this valuable information. It’s really useful for me.

Gold has been proven to have a reliable store of value during the pandemic. There is a gradual shift to gold investments from traditionally more volatile investments, like stocks. I, myself am looking to either investing to direct gold or gold funds in the future. Great read, by the way!

I went down the gold bug rabbit hole when I was in my twenties. In hindsight, I realized that the government has too much control over the currency. Since then I hedge my investments across a variety of asset classes.

Totally agree Michael. It is better to retain diversification across asset classes. All about risk management.

I can’t tell you if gold is a good investment. I bought 2 oz of gold when it was $1300 I decided not to buy further, because of it’s illiquidity. In fact it is that illiquidity that forces you to keep for a long time. If it had been a stock I would have sold it already.

Agree. I guess the advantage of physical gold would be when you need to leave the country suddenly. I am often fascinated by stories told by my Vietnamese friends who left the country with only gold. In modern times I would prefer Bitcoin which is easier to carry and quite liquid.