How Will Modern Monetary Theory (MMT), Reserve Currency Status and Central Bank Digital Currency Impact You

While the entire world is transfixed on the U.S. elections, several exciting events that have much broader implications than the U.S. elections are occurring.

The IMF has called for a new Bretton Woods, and the Fed Chairman Powell spoke on Central Bank Digital Currency. We have already embarked on the Modern Monetary Theory journey, and actions after the election could only hasten the adoption.

Modern Monetary Theory (MMT) relies on the U.S. Dollar continuing as the world reserve currency. The reserve currency status could be challenged by the rise of the Central Bank Digital Currency. The impact on the global economy and the path forward for the USA would be interesting.

All of these factors would change how we accumulate assets in the future.

There are only a few occasions where the Federal Reserve Chairman speaks as part of a panel. Naturally, this tweet caught my attention.

What Is Reserve Currency Status

A reserve currency is a foreign currency held in significant quantities by most world governments via their respective central banks.

It is used as a settlement currency when goods and services between various nations are exchanged. Besides trade, the reserve currency forms a significant part of the countries’ foreign exchange reserves to service debt obligations.

When a crisis hits a country, capital is withdrawn by foreign investors. As a result, the local currency (Eg: rupees for India) drops in value. Countries hold reserve currency to pay debts and avoid the balance of payment crisis. The reserve currency can be used in such cases as it is a safe-haven currency.

How Did The U.S. Dollar Become The Reserve Currency

The United States has been a lucky beneficiary of the two World Wars. It was geographically far away from the actual destruction happening to various countries in both the World Wars. The USA also entered both the Wars later in time, namely 1917 for World War 1 (1914-1920) and 1941 for World War 2 (1937-1945).

During World War 1, countries abandoned their gold standard currencies to finance the war. The United States became the de-facto lender, supplying dollar-denominated U.S. bonds. The pound, which was the world’s reserve currency at that point, was replaced by the U.S. Dollar.

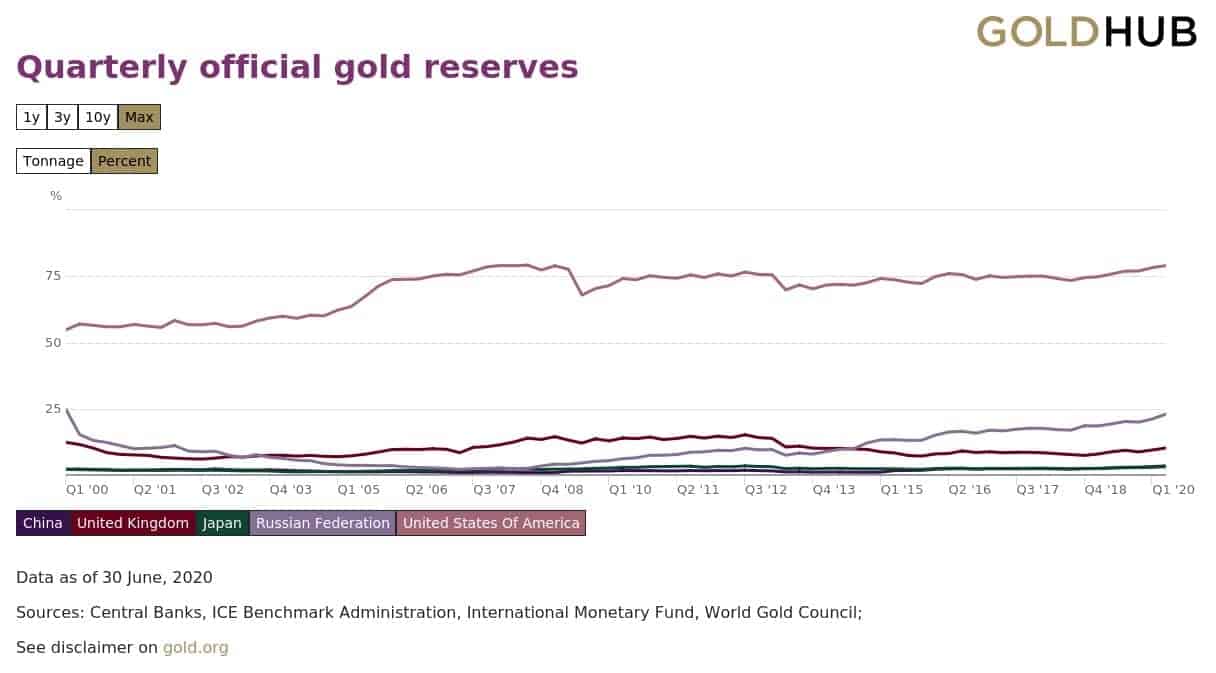

During World War 2, the USA became the primary supplier of weapons and other goods to the Allies. The United States collected gold in exchange for payment and became the largest owner of gold. And the USA continues to be the largest holder of gold to this day.

At the end of World War 2, the delegates from the 44 Allied countries met in Bretton Woods. Since they no longer had significant gold reserves, it was decided that their currencies would be linked to U.S. dollar via fixed exchange rates. And the dollar was fixed to gold. This was known as the Bretton Woods System.

As a result of the Bretton Woods Agreement, the U.S. dollar was officially ordained the world’s reserve currency. Instead of gold reserves, other countries accumulated reserves of U.S. dollars. Needing a place to store their dollars, countries began buying U.S. Treasuries, which they considered a safe store of money.

The International Monetary Fund (IMF) was established to monitor exchange rates and lend reserve currencies to nations with balance-of-payments deficits. The Bretton Woods system was in place till 1971 when President Nixon ended the dollar’s convertibility to gold.

The discovery of oil in the Middle East resulted in another strategic advantage for the United States. Saudi Arabia agreed to price its oil sales exclusively in U.S. dollars. By 1975, all of the oil-producing nations of OPEC had agreed to price their oil in dollars and invest surplus oil proceeds in U.S. government debt securities. Most commodities, including oil, continue to be priced in dollars.

Petrodollar recycling creates demand for U.S. assets when dollars received for oil sales are used to buy investments in the United States, financing its current account deficit.

Is The Dollar Losing It’s Reserve Currency Status

In the last few years, there has been more talk about the U.S. dollar losing its status as the reserve currency. In 1960, the U.S. represented about 40% of the world economy, but that has shrunk to less than a quarter.

The U.S. sanctions on various countries have made them realize that they need to move away from the U.S. dollar. Venezuela said in 2018 that it would begin selling its oil in the yuan, euro, and other currencies.

In 2019, Saudi Arabia threatened to end dollar oil trades if the U.S. moved forward with the NOPEC bill. This bill would expose OPEC members to antitrust action. In short, the changing landscape of the global energy market could result in an end to the petrodollar.

The U.S. dollar losing its reserve currency would necessitate another currency to take its place. At this time, no other country’s currency provides stability, convertibility, and wide spread availability as the U.S. dollar. This could change in the future, and the dollar might lose the reserve currency status to digital currency or a basket of currencies.

Real concerns around the longevity of the U.S. dollar as a reserve currency have started to emerge.

Goldman Sachs Group Inc

The Bank of England governor Mark Carney laid out a radical proposal in 2019 for an overhaul of the global financial system that would eventually replace the dollar as a reserve currency with a Central Bank Digital Currency.

The Federal Reserve is well aware that reserve currencies don’t last forever. The Atlanta Fed published a paper in 2014 titled the Death of a Reserve Currency.

What Is Modern Monetary Theory (MMT)

Having the U.S. Dollar as the world’s reserve currency has significant benefits to both the U.S. government and the U.S. consumer. Foreign governments and central banks are more likely to buy U.S. government debt. This allows the U.S. government to “create” more money, spend more money, and run up deficits with a low-interest rate.

Modern Monetary Theory takes this a step further. It states that as long as a country holds reserve currency status, it can keep printing currency to finance its needs without any negative consequences. MMT is a significant departure from conventional economic theory. Although American economist Warren Mosler developed MMT in the 1970s, it has recently been in the news due to some vocal voices.

Stephanie Kelton, who currently works as a public policy and economics professor at Stony Brook University, is the most ardent proponent of Modern Monetary Theory. And yes, Stony Brooks university is the same university where Jim Simons worked as the Chair of the Department of Mathematics before launching the money printing Medallion Fund.

Out of all the Modern Monetary Theory proponents, I am focusing on Stephanie Kelton’s views because she served as chief economist for the Democrats on the U.S. Senate Budget Committee and was a senior economic advisor to Bernie Sanders′ 2016 presidential campaign. In a Bernie Sanders or Alexandria Ocasio‐Cortez administration, you can expect her to be holding a significant position, either as a Fed Chair or a Treasury Secretary.

Here is a video of Modern Monetary Theory explained by her.

The critical points of MMT are

- The U.S. dollar is a public monopoly.

- The U.S. government is not like a household. The U.S. government cannot face a solvency problem. It never has to worry about finding the money to spend.

- Deficits are not a sign of fiscal irresponsibility. We do not need to eliminate deficits.

- Unemployment in the economy is a sign that the deficit is too small.

- Should run more significant budget deficits to boost growth.

- Deficits do matter, but only when inflation arises.

- The government’s deficit is, by definition, the private sector’s surplus.

- The goal should be a balanced economy at full employment guarding against inflation risks.

- Accelerate productivity growth by making investments in education, infrastructure, R&D, etc., to improve real GDP in the future.

- Increased inflation could be a problem. Hence, the focus of any spending bill should not be the deficit; but ways in which it would increase inflation.

- Inflation often occurs as a result of cost-push v/s demand-pull. The increase in oil prices as a result of the Iran crisis is an example of cost-push inflation. Reducing cost-push inflation needs to be done in a targeted manner rather than globally raising rates or taxes.

The only potential risk with the national debt increasing over time is inflation. And to the extent you do not believe the United States has a long term inflation problem, you shouldn’t believe that the U.S. is facing a long term debt problem.

Stephanie Kelton, professor of public policy and economics at Stony Brook University.

If you want to learn more about the subject, I highly recommend Stephanie Kelton’s book The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy.

Problems With MMT

2 of the significant criticisms of Modern Monetary Theory are

- It overestimates the potency of fiscal policy while underestimating the effectiveness of the monetary policy.

- MMT is based on a tradeoff between inflation and unemployment, which could be a flawed concept.

The Cato institute goes into these topics in depth.

Risks Of Modern Monetary Theory

If you are wondering whether MMT causes inflation; the answer is – it depends.

Traditional thinking says such high deficit spending would be fiscally irresponsible as the debt would balloon, and inflation would skyrocket.

Proponents of Modern Monetary Theory acknowledge that there is a potential limit to printing money to finance government deficits. At some point, increased government spending facilitated by MMT could lead to increased inflation. But, countries like the United States can sustain much more significant deficits without cause for concern.

If inflation increases; figure out if the inflation has occurred due to cost-push v/s demand-pull.

If it is cost-push inflation (e.g., increase in healthcare costs), target only that sector.

If demand-pull inflation is visible in all sectors of the economy, stop printing money to finance deficits. Increase taxes to soak up the excesses.

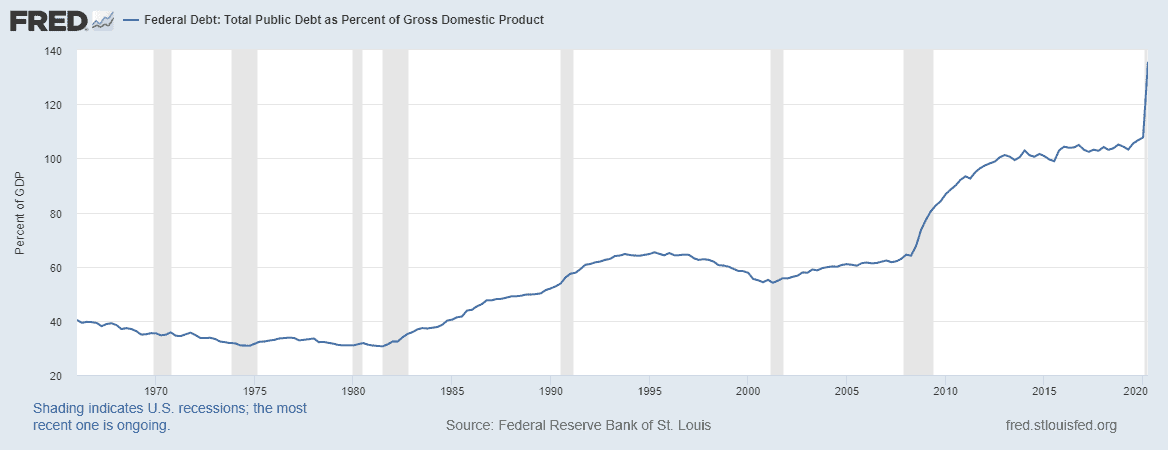

After World War 2, government debt to GDP in the United States reached an all-time high of 119% in 1946. The record low of 32% was in 1981. The U.S. government debt to GDP has been high, with an average of 63% considering the period from 1940 until 2019.

The U.S. Total Public Debt as Percent of Gross Domestic Product has been high for several years. And we have had low inflation for several decades. But, no one can predict when inflation will arise.

What Is Central Bank Digital Currency (CBDC)

Central banks could always print money digitally. Here is Chairman Powell in his 60 MINUTES interview.

The idea of Central Bank Digital Currency gained traction with the rise of Bitcoin. Central banks would create their own “coin” backed by their currency. Instead of dealing with cash, everything would now be electronic.

Each central bank has already begun working on some form of its currency.

China extended its lead in the global race to develop a central bank digital currency (CBDC) to conclude the digital yuan pilot project.

Sweden’s Riksbank has been testing an e-krona, taking the country a step closer to creating the world’s first central bank digital currency (CBDC).

Uruguay did a successful pilot of E-peso.

Russia considers the issue of the digital ruble.

France to begin a pilot of a central bank digital currency (CBDC)

The Bank for International Settlements (BIS) envisions Central Bank Digital Currency as a new form of digital central bank money with various design choices including access (widely vs. restricted); the degree of anonymity (ranging from complete to none); operational availability (ranging from current opening hours to 24 hours a day and seven days a week); and interest-bearing characteristics (yes or no). The Bank for International Settlements and seven central banks published a report laying out some critical requirements for central bank digital currencies, or CBDCs. They recommended that CBDCs complement — but not replace — cash and other forms of legal tender and don’t harm monetary and financial stability.

The Bank for International Settlements and seven central banks published a report laying out some critical requirements for central bank digital currencies. They recommended that CBDCs complement but not replace cash and other forms of legal tender and that they don’t harm monetary and financial stability. They said digital currencies should also be secure, as cheap as possible.

Speaking at a Monday panel on cross-border payments hosted by the International Monetary Fund, Chairman Powell indicated that the United States would not be issuing a digital dollar until the Federal Reserve resolves all questions around a potential central bank digital currency.

If a basket of CBDCs replaces the U.S. dollar as the next reserve currency, the United States stands the most to lose. I was not surprised at hearing Powell’s statement.

We have not made a decision to issue a CBDC, and we think there is a great deal of work yet to be done. In fact, I actually do think that CBDC is one of those issues where it is more important for the United States to get it right than it is to be first.

Jerome Powell, Fed Chairman

How Does Central Bank Digital Currency Work?

From a user perspective, it is very similar to our existing payment systems. You would download a digital wallet which would be used for everyday banking activities, such as payments, deposits, and withdrawals. You can pay for goods and services by scanning a Q.R. code.

However, instead of your banks storing the transactions; it would be held by the central bank. In an Orwellian world, the government would know exactly how many donuts you purchase in a day. Implications could range from increased health screenings to additional hours spent on fitness activities.

Digital Currency is everything you don’t understand about money combined with everything you don’t understand about computers

John Oliver, comedian

Benefits Of Central Bank Digital Currency

Chairman Powell has often mentioned the limits of monetary stimulus and asked Congress to enhance fiscal stimulus. With a Central Bank Digital Currency, he could directly provide stimulus to the people without waiting on Congress or the banks.

Introduction of Central Bank Digital Currency will result in the elimination of cash. Now every transaction can be tracked by the government. So no illegal activities can be funded.

The tax collection would be simplified. Taxes can now be imposed on every stage of providing goods and services. A Value Added Tax (VAT) system can be easily implemented.

Redistribution of wealth would be easier since the government can implement negative interest rates and directly debit your account.

Policy Impact Of Central Bank Digital Currency

The list of assets that won’t be impacted by the Central Bank Digital Currency would be Bitcoin, Gold and segments of real estate such as farmland.

I always considered Bitcoin as an asset; no government entity can freeze. The rise of the Central Bank Digital Currency fits perfectly with that narrative.

Since my last post where I talked about my personal reasons for buying Bitcoin; a number of significant events have occurred. Companies which used to store their cash deposits in bonds are slowly considering Bitcoin.

MicroStrategy, the largest independent publicly-traded business intelligence company adopted Bitcoin as primary treasury reserve asset.

Stone Ridge Holdings purchased $114 million of Bitcoin as part of its treasury reserve strategy.

Jack Dorsey’s mobile payment firm, Square purchased $50 million in Bitcoin.

We believe that bitcoin has the potential to be a more ubiquitous currency in the future.

Amrita Ahuja, Square’s Chief Financial Officer

Three publicly owned companies adding Bitcoin as part of their treasury reserve strategy does bode well for the future of Bitcoin.

At this point, Bitcoin is still considered a store of value. It is not ready to be used for micro payments due to speed of transactions. However, various technological updates could change that very easily. In the early days of internet, we all were stuck with a dial-up modem waiting 10 minutes to load a website. Now we watch streaming movies.

Of course, being too early is also a curse. A few failed Initial Coin Offerings (ICOs) count as one of my worst investment.

Gold is the other asset that has been used as a reserve currency for over 5,000 years. It might not be a bad idea to revisit how to invest in gold. I personally own gold mining firms since it provides me cash flow and leverage to the price of gold. Even Warren Buffet has finally decided to add gold miners to his portfolio.

Gold is the currency of last resort, particularly in an environment like the current one where governments are debasing their fiat currencies and pushing real interest rates to all-time lows.

Goldman Sachs

Real Estate is generally a great hedge against inflation. However, due to the government regulations, residential real estate may no longer be a great investment. Farmland investing provides a great hedge against inflation. Unlike non-paying tenants the farm produces cash flow in the form of agricultural produce which is always needed. And unlike commercial real estate, farmland will not be impacted by shutdowns or “work from home” policies.

Final Thoughts On MMT, Reserve Currency Status and Central Bank Digital Currency

Although some of the impacts from the topics discussed might take a few years to play out, I believe we have already started the journey.

One of the best applications of MMT is Universal Basic Income (UBI). The CARES act already laid the groundwork for UBI with the stimulus checks being distributed based on income. Note that the stimulus checks are different from the additional unemployment benefits. While I have argued for the continuation of unemployment benefits; the stimulus checks are a different beast. We are starting MMT in some shape or form in the United States.

The reserve currency status of the U.S. dollar seems to be in jeopardy. Historically, we know those reserve currencies don’t last forever. The U.S. dollar reigns as the dominant reserve currency today. The British pound occupied a similar status in the nineteenth and early twentieth centuries. Preceding the British pound in this leading role was the Dutch guilder. It is only a matter of time before a Central Bank Digital Currency or another currency takes its place.

Readers, what are your thoughts on MMT? Does the U.S. dollar deserve to be the world reserve currency considering the U.S. share of global GDP is less than 25%? Would the introduction of Central Bank Digital Currency lead you to invest more in hard assets or other currencies like Bitcoin or gold?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

Excellent article and explanation.

Small typo: Bretton Woods system in place until 1971, not 1917.

Updated. Thank you 🙂

Top tier article! I love these detailed deep dives, extremely educational.