Roth 401(k) Vs. Traditional 401(k) And What Is The Best Option

I was not contributing to my 401(k) when I started working. The complexity of selecting investment options coupled with the uncertainty of continuing to live in the U.S. resulted in analysis paralysis.

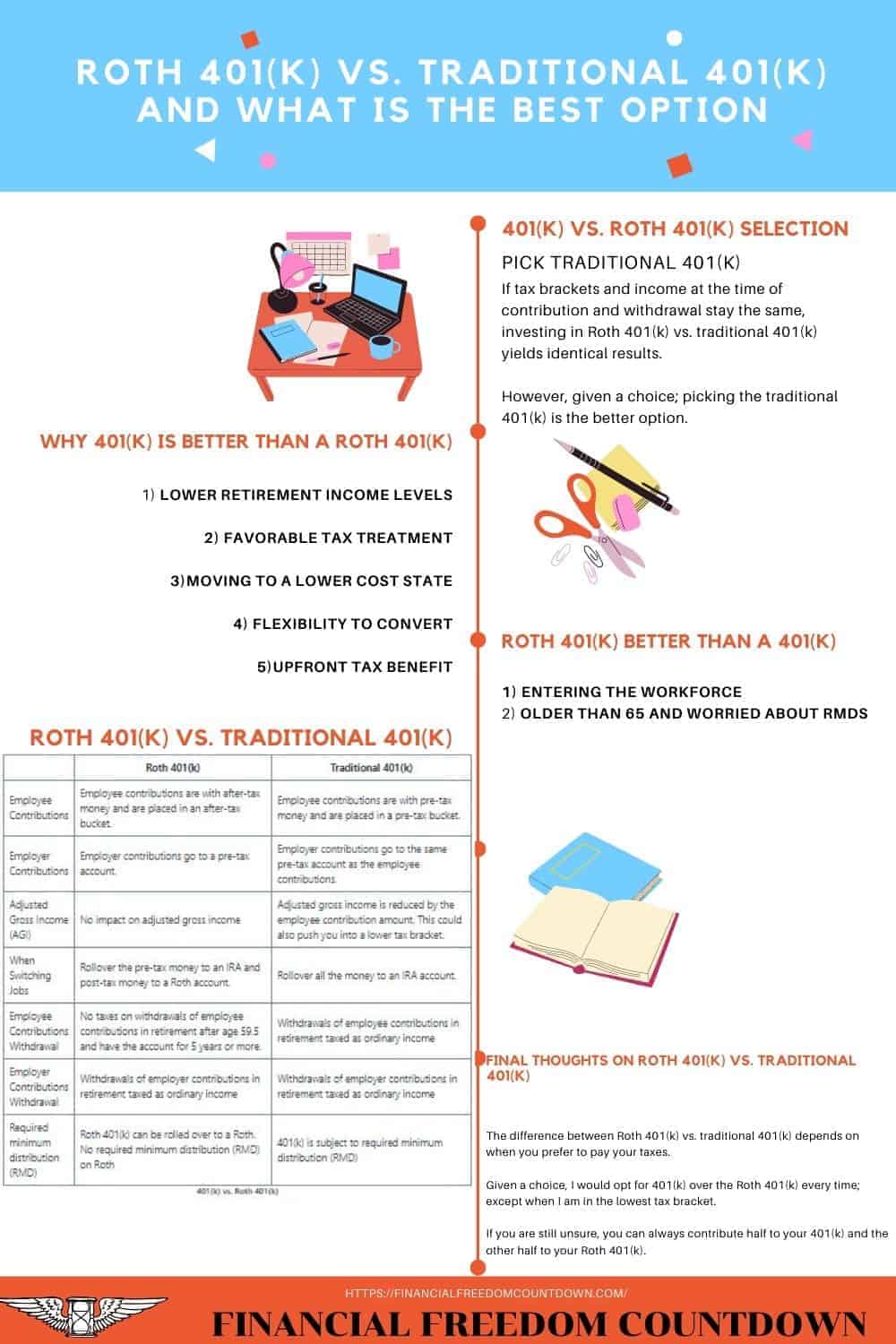

With the advent of Roth 401(k) in the workplace, many individuals are wondering if they should contribute to Roth 401(k) or a traditional 401(k). While focusing on tax strategies is a great idea, deciding on contribution to Roth 401(k) vs. a traditional 401(k) involves predicting your income levels and tax brackets in retirement.

In an ideal world, if tax brackets and income at the time of contribution and withdrawal stay the same, investing in Roth 401(k) vs. traditional 401(k) yields identical results. However, given a choice, picking the conventional 401(k) is the better option.

Just like we saw when comparing investing in 401(k) vs. real estate, there are nuances to the topic of 401(k) vs. Roth 401(k). Let us explore the topic in-depth with examples and pros and cons.

What Is A Traditional 401(k)

Traditional 401(k) accounts are funded with money on a pre-tax basis, meaning it comes out of your paycheck before you pay any taxes on it. Your adjusted gross income (A.G.I.) is lowered by the amount you contributed, which could put you in a lower tax bracket.

For example, assume your annual income is $182,000. The current tax rate for that income range is 32%.

If you contribute $19,500 to your 401(k), you do not pay any taxes on your contribution. And as a result of your 401(k) contribution, your taxable income is now reduced to $162,500 on your tax returns. The current tax rate for that taxable income is 24%. Your marginal tax rate is effectively reduced as a result of your 401(k) contribution.

As a result of receiving the tax break up front, you pay taxes on your 401(k) contribution and growth when you withdraw.

Any employer matching contributions are placed in the same pre-tax bucket as your employee contributions.

What Is A Roth 401(k)

In a Roth 401(k), you contribute money after paying your taxes. Contributions to the Roth 401(k) also do not reduce your adjusted gross income. However, the money in your Roth 401(k) grows tax-free, and you do not pay taxes on your contributions or the growth when withdrawn after age 59.5 and having the account open for a minimum of 5 years.

With a Roth 401(k), any matching contributions by your employer are considered pre-tax money. And you pay taxes on the employer contribution and growth.

Roth 401(k) Vs. Traditional 401(k)

| Roth 401(k) | Traditional 401(k) | |

|---|---|---|

| Employee Contributions | Employee contributions are with after-tax money and are placed in an after-tax bucket. | Employee contributions are with pre-tax money and are placed in a pre-tax bucket. |

| Employer Contributions | Employer contributions go to a pre-tax account. | Employer contributions go to the same pre-tax account as employee contributions. |

| Adjusted Gross Income (AGI) | No impact on adjusted gross income | Adjusted gross income is reduced by the employee contribution amount. This could also push you into a lower tax bracket. |

| When Switching Jobs | Rollover the pre-tax money to an IRA and post-tax money to a Roth account. | Rollover all the money to an IRA account. |

| Employee Contributions Withdrawal | No taxes on withdrawals of employee contributions in retirement after age 59.5 and have the account for 5 years or more. | Withdrawals of employee contributions in retirement taxed as ordinary income. |

| Employer Contributions Withdrawal | Withdrawals of employer contributions in retirement taxed as ordinary income. | Withdrawals of employer contributions in retirement taxed as ordinary income. |

| Required minimum distribution (RMD) | Roth 401(k) can be rolled over to a Roth. No required minimum distribution (RMD) on Roth. | 401(k) is subject to required minimum distribution (RMD). |

Example Of Roth 401(k) Vs. 401(k)

If tax brackets and income at the time of contribution and withdrawal stay the same, investing in Roth 401(k) vs. traditional 401(k) yields identical results.

Let us consider Jack and Jill, who have the same income, similar tax filing status. One selects Roth 401(k), and the other opts for a traditional 401(k). Let us find out how their choices impact their retirement.

| Jack using Roth 401(k) | Jill using 401(k) | |

|---|---|---|

| Pre-tax Income * | $10,0000 | $10,0000 |

| Taxes when contributing with 30% tax rate | 30% of $10,000=$3,000 | $0 |

| Contribution amount | $7,000 | $10,0000 |

| Growth (assume 3 times) | $21,000 | $30,0000 |

| Taxes in retirement with 30% tax rate | $0 | 30% of $30,000=$9,000 |

| Retirement money | =$21,000-$0 = $21,000 | =$30,000-$9000 = $21,000 |

*I have taken absolute tax rates and not marginal tax rates.

As you can see, with the same tax rates at the time of contribution and withdrawal, both have the same amount of money in retirement.

Jack paid his taxes at the time of contribution, while Jill paid at the time of withdrawal. Hence, in an idealized scenario selecting Roth 401(k) vs. traditional 401(k) provides the same results.

However, life is not ideal. There are several nuances when exploring how we plan to fund our retirement.

Why 401(k) Is Better Than A Roth 401(k)

In an ideal world the difference between the 401(k) v/s a Roth 401(k) is just the timing of when you receive the tax break. With a 401(k), you receive it immediately while with a Roth 401(k) you receive the tax benefits later.

The big if in the above scenario is the tax rates remain the same and your income now is the same as your income at the time of withdrawal.

However anyone pursuing Financial Freedom Countdown knows that our goal is to earn more now by improving our Human Capital and then gradually decrease our income so we can enjoy life. As a result of our decreased income our tax rate would be lower and hence it makes more sense to obtain the maximum tax benefit now compared to later.

Given a choice, I prefer to opt for traditional 401(k) compared to the Roth 401(k) because

Lower Retirement Income Levels

Your income should be lower in retirement compared to when you are working. When you are working, you need money to fund your lifestyle and to save for retirement. Assuming a 30% Savings Rate, your income is 30% higher than your actual lifestyle spending needs.

You are only using the income to fund your retirement lifestyle and don’t need extra money to save for retirement. Hence your income needs are lower in retirement. Make sure you run your retirement numbers using various free retirement calculators.

Favorable Tax Treatment

As a result of contributing to your 401(k), you reduce your taxable income and pay fewer taxes. Ideally, you should invest the money saved by reducing your tax bill. Pick a platform like M1 Finance with zero fees, very low minimums, automated investment with automatic rebalancing. You can read my complete M1 Finance review, including the comparison with other platforms.

This money invested has favorable tax treatment. For example, the long-term capital gains tax rate is lower than earned income.

Moving To A Lower Cost State

Every state in the U.S. has different tax rates. To jumpstart your career, you would need to work in job-specific hubs initially. For example, N.Y.C. for finance, Hollywood for acting, or San Francisco as the best place for technology jobs,

In such cases, you are better off taking the tax deduction now when working in expensive locations like California or New York. After taking the tax break, you could move to Florida or Texas later in your career. Or you might decide to move out of state in retirement when you need to withdraw from your 401(k).

Flexibility To Convert

With a traditional 401(k), you can decide to convert to Roth based on your situation. For example, if you are unemployed for a few months, your income is lower, and you can use the lower tax bracket to convert to Roth. Or you decide to be a stay-at-home parent for a few years taking care of your children.

In this case, you had already received the tax benefit upfront when you contributed to the 401(k). By converting when your income is lower, you can again avoid paying taxes. Now you have the money in Roth and also paid fewer taxes.

Instead, if you opted for Roth 401(k) vs. 401(k), you wouldn’t receive the tax benefit at the time of contribution.

Personal Capital has the free Retirement Planner, which you can use to model scenarios. Sign up for free and decide when it makes sense for you to rollover your 401(k) to Roth. The 401(k) provides you flexibility in adjusting your taxable income.

Upfront Tax Benefit

With a traditional 401(k), you receive the tax benefit upfront. Remember both 401(k) and Roth 401(k) yield the same results only if the rule stays the same. You never know when the government might change taxation rules for Roth 401(k). A bird in the hand is better than two in the bush.

The most common argument I’ve heard in favor of the Roth 401(k) is that tax rates are lowest now. Considering the increasing deficit and our inevitable path towards Modern Monetary Theory (MMT), many folks worry that the tax rate would be higher in retirement.

I’m afraid I have to disagree with that viewpoint. Even if tax rates increase, your tax bracket will be lower in retirement.

If you are worried about the government changing the tax rates, a bigger worry could be that the tax break you deferred by opting for Roth 401(k) could be restricted, and you might not get to use it. For example, the government could easily cap Roth accounts over a certain amount and strip away the tax exemption.

Now you did not obtain the benefits at the time of contribution. And at the time of withdrawal, you could be subject to the changed tax rules. In case you are wondering if this might happen, remember with the passage of the SECURE Act the government changed the rules by eliminating the Stretch I.R.A.

Another argument people make in favor of Roth 401(k) is that the government will not tax the same money twice. But we already know that the government has changed rules in the past. Prior to the Tax Cuts and Jobs Act (TCJA), you did not pay federal taxes on the money paid in state and local taxes. However, with the TCJA $10,000 limit many people living in NY, NJ, IL, CA ended up paying federal taxes on the money paid as state and property taxes.

All the more reason to get the tax benefit now!

Is Roth 401(k) Better Than A 401(k)

There are only two situations where Roth 401(k) is better than traditional 401(k)

Entering The Workforce

As a young professional, when you start working, your income is the lowest. Our income gradually increases as we gain more experience and switch jobs or add value to our employer.

If you are in the lowest tax bracket, go for Roth 401(k); else, always pick the traditional 401(k).

Older Than 65 And Worried About RMDs

Ideally, most readers will no longer be working past 65. However, if you enjoy working and continue to work, you might notice your 401(k) balance is already substantially high. It might make sense to opt for Roth 401(k) to avoid the IRS mandate of Required Minimum Distribution (RMD).

As per the R.M.D. Rules, the withdrawal is mandatory even if you don’t require the income. You could be pushed into a higher tax bracket as a result of the withdrawal.

If you have this problem, it indicates you have saved too much for retirement and would be better served by quitting work instead of juggling taxes. After all, you do not want to experience the 5 regrets of the dying.

Final Thoughts On Roth 401(k) Vs. Traditional 401(k)

The difference between Roth 401(k) vs. traditional 401(k) depends on when you prefer to pay your taxes.

Given a choice, I would opt for 401(k) over the Roth 401(k) every time, except when I am in the lowest tax bracket.

If you are still unsure, you can always contribute half to your 401(k) and the other half to your Roth 401(k).

No matter what you decide, let perfect not be the enemy of good enough. Don’t delay starting your contribution like me. Focus on saving and investing in passive income-generating assets.

Perfect is the enemy of good enough

Voltaire

Readers, does your workplace have the Roth 401(k) option? Did you decide to invest in Roth 401(k) or traditional 401(k)? What factors influenced your decision?

Roth 401(k) Vs. Traditional 401(k) article is also available as a web story

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

Love the blog John! Traditional vs. Roth has been a classic argument, but it ultimately depends on the person’s situation. I’m personally a fan of the Roth since I will not have to worry about taxes in the future. The amount you accumulate is the true amount you will be able to withdraw in the future! Keep up the great work!

Yes, all personal finance decisions are dependent on a person’s situation.

Thank you for a thorough analysis of the Roth v traditional 401k/IRA options. Very often, the recommendations that I have come across are to convert non-Roth accounts to Roth accounts. The primary justification is that Roth accounts can be withdrawn tax free. There is hardly any discussion of why traditional retirement accounts could be more beneficial.

But as your analysis points out, the critical factor is the tax bracket currently v tax bracket in retirement. A million dollar conversion puts one into the highest tax bracket. The same amount when subjected to RMD could have much lower taxes.

Also, I would much rather take my deductions now rather than expose myself to the whims of the politicians in the future.

Totally agree.