Should I Sell My Stocks Now? 5 Good And 4 Wrong Reasons On When To Sell Stocks

As you turn on any news channel, you are hit with several doomsday predictions. Elections, trade war, interest rates, yield curve, deficit, slowing GDP, recession fears, impeachment, Brexit, climate crisis, inflation, stagflation, depression, lockdowns, new tax laws, presidential candidates’ policies, etc. And that is in just the last five years. You must have often wondered at every stage of the news cycle, “should I sell my stocks now”?

Honestly, it is always best to ignore any noise. Build an investment plan based on the best assets to buy and continue dollar-cost averaging rain or sunshine instead of worrying when to sell stocks.

When To Sell Stocks

There are five good reasons for when to sell stocks.

When You Need The Money

You should always invest with an end goal in mind. It could be something as long-term as retirement. Or it could be short-term as your kid’s college education.

Naturally, when the time comes for the event you have planned and invested for, it makes sense to sell your stocks.

Your Investment Thesis Has Played Out

Assume you have Tesla in your moonshot portfolio as I did. I sold as soon as the S&P committee announced the index inclusion. Of course, the stock continued to rise after that event, but I reached my main idea for owning the stock. And after all, no one lost money by booking profit.

Or you might have bought a SPAC such as CCIV. You might decide to sell depending on the target company.

Your Investment Thesis Is Incorrect

When picking individual stocks, you could often run into issues where your original thesis proves to be wildly incorrect. Fraud is the most common example.

Wirecard was a German-based payments processor. Around April, allegations of fraud started circulating. Accounting irregularities are a huge red flag for me. After all, we all know what happened to Enron. It is always better to exit the stock rather than hold and watch it go to zero in such cases.

Better Investment Opportunities

Often you might find other asset classes become relatively cheap to their intrinsic value.

Although we have talked about investing in real estate with little or no money, some of the strategies do require funds.

When to sell stocks was an easy decision for me to buy my primary home when prices temporarily dropped in the San Francisco Area. After all, San Francisco Bay Area is the best place for technology jobs. My average net worth significantly increased due to that one-time decision.

Tax Planning Strategies

Taxes eat up a large chunk of your hard-earned money. Effective tax planning strategies are the key to reducing your overall taxable income.

To reduce my taxable income, I often sell stocks using the tax-loss harvesting technique. On the other hand, if I am in a lower tax bracket and hold long-term capital gains stocks, I sell enough of them to generate long-term capital gain sheltered by the 0% rate. This method is known as tax gain harvesting.

Of course, never let the tax tail wag the dog. So if the stock still has upside, do not sell it just for tax benefits. Or if the stock has fraud issues, do not hold onto it; to avoid paying taxes.

When Not To Sell Stocks

We are often bombarded with noise which makes us second guess ourselves. We deviate from our investment plan and succumb to the siren song, wondering when to sell stocks. Let us explore four wrong reasons for trading stocks.

Based On Forecasts

No one has any idea how the stock market performs daily or even on a long-term basis. And that includes experts who have called past bubbles.

Legendary investor Jeremy Grantham renewed his warning to investors that the stock market is in a “fully-fledged epic bubble” in a letter titled “Waiting for the Last Dance.”

Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives.

Jeremy Grantham, GMO co founder, and chief investment strategist

Woah. That sounds scary!

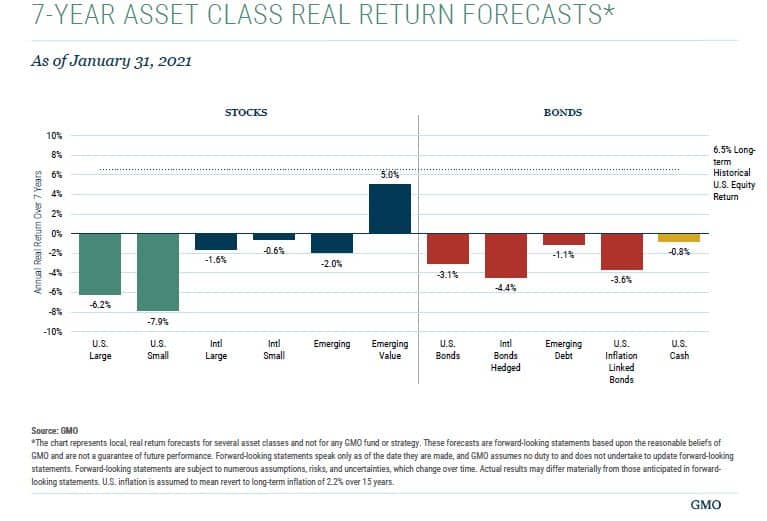

I looked up the recent forecast which predicted negative returns for the U.S. markets for the next seven years.

Guess I should sell all my U.S. stocks immediately and not lose 7% annually for the next seven years.

Not so fast!

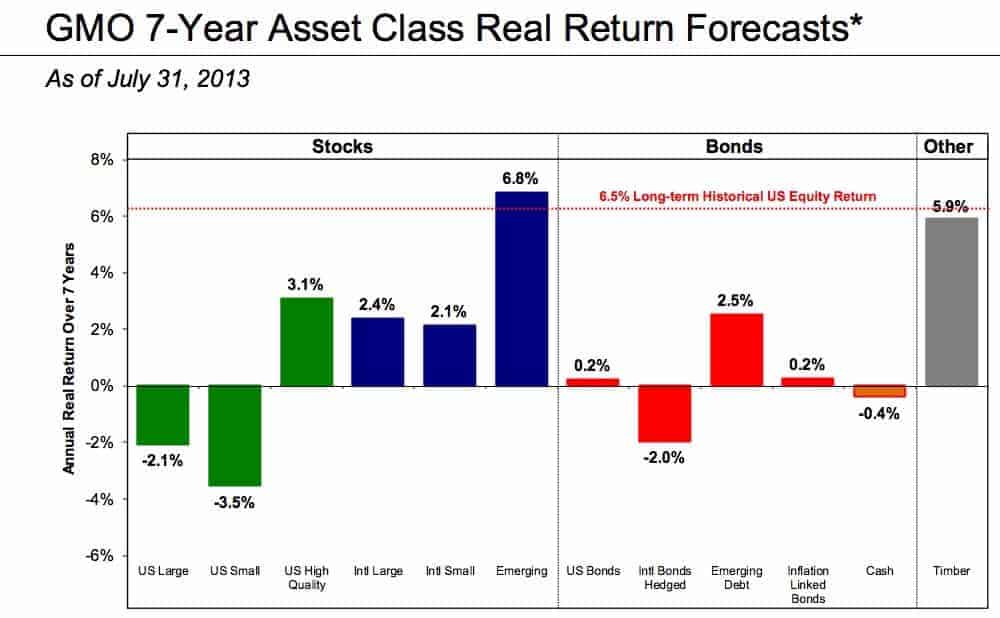

Let us go back sever years in the past and see how his 7-year forecast performed.

The U.S. stock market has returned around 10% annually in the same period.

And this is not isolated to his 2013 call. I looked at 2014, 2015, 2016, and even his 2019 calls. All of them are super bearish on U.S. equities, and he has been wrong.

Ironically he continues with the same bearish call every year, and eventually, he will be proven right. After all, a broken clock is right twice a day. But the key takeaway is that forecasts are a terrible reason to decide on when to sell stocks.

Incidentally, he is not the only one. Several fund managers and economists have been widely incorrect in making predictions.

Ironically, Jeremy Grantham is also not in favor of SPACs. However, to solve the huge problems he believes the world is facing, he personally invests in several companies funded by VCs. Many of then have raised funds via a SPAC. In fact, he privately invested in QuantumScape (QS) which came public via a SPAC (Ticker: KCAC). QuantumScape is one of his largest holdings.

Blindly Following Guru Investors

Many in the investment community love Warren Buffet. After all, he appears to a friendly wise grandpa with lots of wisdom. However, his track record for the last 22 years has been dismal. Berkshire Hathaway has underperformed the S&P 500 by 54% over the previous 18 years. In fact hedge funds like the Medallion fund have beaten Warren Buffet’s performance for decades.

Furthermore, he often preaches one thing and does the opposite in his investment. Buffett says if you don’t feel comfortable owning a stock for ten years, you shouldn’t hold it for 10 minutes.

Our favorite holding period is forever.

Warren Buffet

Yet, he panicked and sold the airlines for a loss.

Based On Outdated Metrics

Value investors love to tout the Price/Book ratio as a method of finding value stocks. The word value is enticing. After all, we consider ourselves value investors, not overpaying stocks. However, there is a reason for value stocks to be cheap.

Similarly, there are other metrics like CAPE, Tobin’s Q, Buffet indicator, which has not worked for such a long time. It is good to examine if the world has changed such that these metrics are outdated and no longer reliable.

Another reason for Buffet’s underperformance has been the rise of the knowledge economy. Will robots take my job is no longer a hypothetical question. We all have to assume it will be a reality sooner rather than later.

One of the biggest challenges with the rise of the knowledge economy is the accounting rules and how intangibles are not represented on the balance sheet. Let us consider Google. How does one value the brand value and the technology? There are countless such examples where intangibles make a company look more expensive compared to traditional metrics.

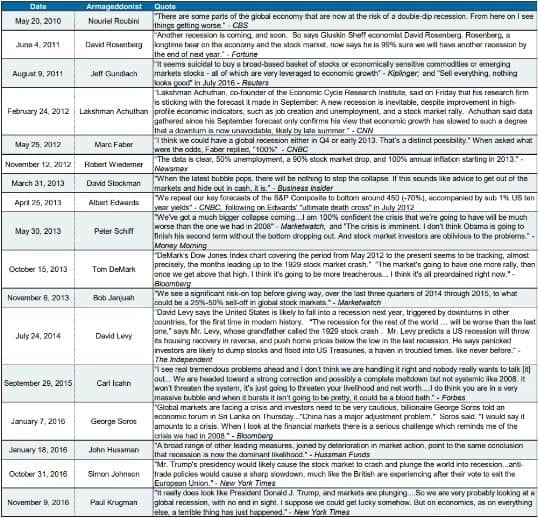

Based On Doomsday News

Take a look at the following list of doomsday predictions made by several famous investors based on the current news cycle.

How did you react when you heard every single one of these “world is ending” predictions. Did you

- Say I should sell my stocks now?

- Or did you stop adding more money and let idle cash accumulate?

- Or did you do nothing and stick to your investment plan?

How Would Investors Have Fared Without A Plan On When To Sell Stocks?

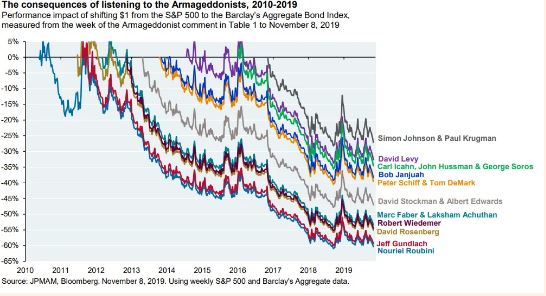

JPMorgan’s Michael Cembalest, chairman of market and investment strategy at the firm’s asset management arm, has taken it upon himself to work just how investors would have fared if they’d listened to the self-proclaimed Cassandras of this cycle whenever they made a bearish market call.

He did so by calculating the returns investors would have missed out on if they rotated out of equities and into the Barclay’s Aggregate Bond index after each specific call.

How Should You Invest?

Humans are wired to pay more attention to bad news. As a species, our ancestors needed to survive every day from predators much more gigantic than them. Not paying attention to bad news; could be the difference between being stomped down by a mammoth or eaten by a lion.

Even after humans became the dominant species, we still had to keep abreast of bad news to find out if a rival horde of barbarians would be headed in our direction. Our innate human tendency often triggers the decision on when to sell stocks.

Investing in stocks is hard. Timing when to buy and sell is more challenging. Turning off the daily gloom and doom news and sticking to your investment plan is more problematic due to many behavioral and psychological challenges. The psychological challenges are one of the major challenges I covered when deciding to invest in stocks or real estate.

- Use the various free retirement calculators to determine how large should be your nest egg to retire comfortably.

- Based on the calculators, determine how much you need to invest every month to grow your liquid net worth.

- If the volatility of stocks scares you, diversify with other income-producing assets. It could be anything from bitcoin, real estate syndication, stocks, bonds, farmland, art, etc.

- Invest periodically, ignoring any good news or bad news.

- If one particular asset increases a lot, regularly re-balance back to your target asset allocation.

For all these steps, it is essential to recognize that often we are our own worst enemies. Just automate the entire investment process to remove human nature from any emotional decisions.

I talked about this at length in my M1 Finance eview, which automates all the steps, including re-balancing after picking one of the pre-defined asset allocation “pies” or defining your pie. Sign up for M1Finance here

The growth in the market following this simple approach and ignoring doomsday calls would have rewarded you handsomely.

It is hard to bet against the stock market. As per stock market statistics, stocks have risen 1,100-fold over the past 70 years.

Final Thoughts On When To Sell Stocks

There is nothing inherently wrong with bad news, but we should be conscious of the world we live in and the media cycle pushing the more sensational story to grab our attention. We should believe in the undeniable quest of all humans to push the boundaries of our civilization. Of course, there are pockets of instability even in this day and age. But on the whole, the world, over time, will improve.

The human spirit will grow and make this a better and more efficient place to live than before. If that assumption turns out to be incorrect, we have a lot more to worry about than the value of our stock portfolio.

So just put your investment on autopilot. Use the free time to enjoy life. There is no need to spend time and energy focusing on when to sell stocks.

Readers, how do you eliminate all the noise when needing to make investment decisions? Are you relying on the basis enshrined in the beginner’s books on investing? Do you struggle with the decision to sell your stocks based on news or forecasters on T.V.?

You can also view Should I sell my stocks now post in a web story format

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

Thanks for sharing this wonderful idea its really help me a lot keep posting such amazing ideas