What Is A SPAC And How To Evaluate If It Is Worth Investing

IPO listings have been on a tear over the last year. Snowflake soared as high as 166% on opening day, while Airbnb opened at 115%. With all the focus on the IPOs gains, Special Purpose Acquisition Company (SPACs) have largely flown under the average investor’s radar.

SPACs have recently come into vogue with the promise of solving IPO allocation issues for the small retail investor. Do SPACs offer a unique opportunity for investors who have been unable to get IPO allocation? Is there a better method to make sure retail investors who are not high net worth clients get early dibs on emerging sectors?

In the past, we had explored bitcoin, moonshot investing, avoiding residential rental properties, MMT, and a host of other ideas before they became mainstream. With money gradually flowing into SPACs, let us stay ahead of the game and learn about SPACs, the lifecycle, and how to evaluate them. What are the advantages of SPACs over IPOs and any risk factors to avoid?

What Is A Special Purpose Acquisition Company (SPAC)

A SPAC is a non-operating “shell” company created to raise capital to acquire an existing company. A SPAC is also known as a “blank check company” designed to take companies public without going through the traditional IPO process.

SPACs are generally formed by a team of sponsors with expertise in a particular business sector to pursue deals in that area. A SPAC is only a shell company when it becomes public. The SPAC does not have an underlying active business and does not have assets other than cash raised from the IPO.

When you invest in a SPAC as soon as it is listed, you are making a bet that the management team will find an invisible unicorn. And successfully negotiate the merger. The combined company following the transaction is publicly-traded and carries on the target operating company’s business.

SPACs have a timeline (generally two years) to complete a deal, or they need to be liquidated.

Difference Between A SPAC vs. An IPO

A common criticism with Uber and other companies coming to market via the traditional IPO process is that they often wait too long to be publicly listed. As a result, the retail investors don’t get the hyper-growth aspect of a young company. Instead, they have to buy shares of a matured company and have muted returns.

Many startups prefer to stay private since the traditional IPO process involves many burdensome regulations to raise funds. Selection of lead bankers takes time. The founders need to be available for roadshows and investor presentations. SEC has a lot more requirements in terms of disclosures and fees. All of this takes away the focus of the founders from their day jobs running the fledgling startups.

When a SPAC company is listed, it is available at Net Asset Value (NAV) or slightly above NAV depending on the SPAC sponsor’s reputation and the sector they are targeting.

The lack of hype enabling retail investors to allocate close to the NAV is the most significant advantage of a SPAC vs. an IPO. Of course, the disadvantage with a SPAC is that you do not know which company merges with your SPAC.

For example, Virgin Galactic (SPCE) came public through a SPAC and not an IPO. The SPAC was IPOA, which reverse merged with Virgin Galactic. So everyone who bought IPOA at listing could get Virgin Galactic stock. Contrast that with SNOW IPO listing, where retail does not get stock at listing price. And on Day 1 of listing, there is a mad scramble driving the stock to crazy valuations.

SPACs make the most sense for companies in emerging high growth sectors. Because the SPAC is a merger, the deal can be marketed using forward-looking projections, which can help fast-growing companies that aren’t yet profitable. For IPOs, regulatory rules require that companies can share only historical financial statements.

SPACs also offer a much speedier way for companies to enter public markets. A merger between a SPAC and a target company can take between four to six months. In contrast, the conventional IPO model can take 12 to 18 months.

| SPAC | IPO | |

|---|---|---|

| Price | Determined in advance based on merger discussions | Determined day prior to listing based on market conditions and banker recommendations |

| Financials | Can use forward-looking projections | Only historical financial statements permitted |

| Fees | Can save millions in underwriting fees | Investment bankers charge exorbitant fees |

| Timeframe | 4 to 6 months | 12 to 18 months |

| Expertise | Knowledgeable sponsors add value to the operations of the company | No value add to the operational aspects by the investment bankers |

| Investment Decision | Based on the sponsor’s reputation and targeted industry | Based on the reputation of the company |

| Upside | Upside potential due to warrants | Warrants not issued when buying IPO at the listing |

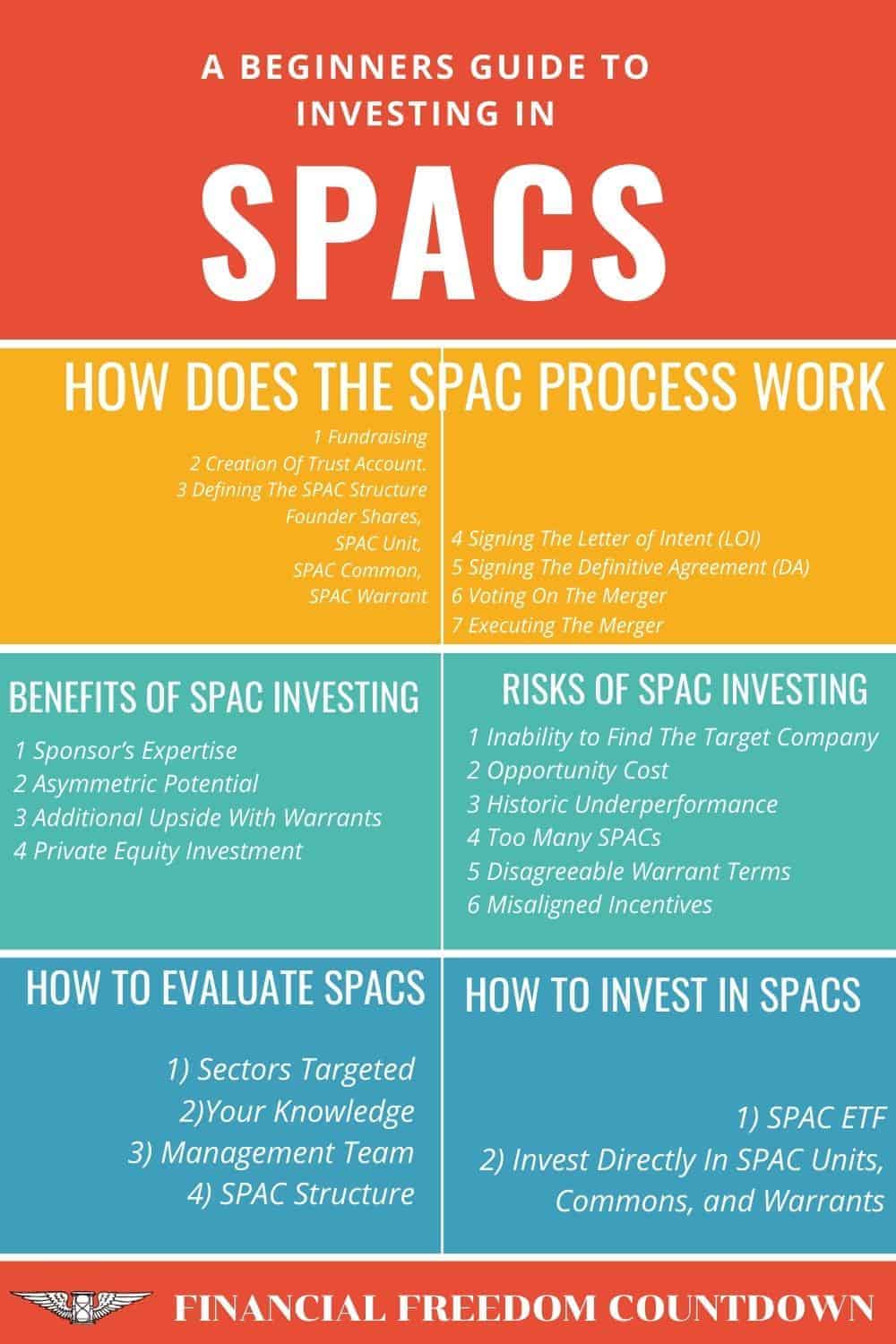

How Does The SPAC Process Work

Fundraising

The SPAC process involves the sponsors raising capital from investors for buying an operating company. Sometimes the sponsor will announce which industries and types of companies they are looking to acquire.

You should study the SPAC’s IPO prospectus as well as its form 10-K and 8-K filed with the SEC according to its ongoing reporting obligations in the SEC’s EDGAR database.

Also, given that the SPAC does not have an operating history to evaluate, it is essential to review SPAC management’s business background and expertise.

Creation Of Trust Account

Typically, SPAC IPO proceeds, after fees and expenses, are held in an interest-bearing trust account. These funds can only be used to complete an acquisition. Or if the SPAC is liquidated, the money in the trust account is returned to investors.

Although SPACs are supposed to invest the proceeds in relatively safe, interest-bearing instruments (usually Treasuries), it is better to validate by review the offering documents.

Defining The SPAC Structure

The sponsor is given founder shares for a token amount as payment for setting up the blank-check company, raising funds, and searching for the target company. These founder shares usually convert to 20% of the proforma equity once the business combination is complete.

Sponsor shares also known as sponsor promote which allows a SPAC’s founder to buy a huge chunk of equity for a shockingly tiny price, usually 20 percent for $25,000 is one of my main pet peeves with SPACs.

The best-run SPACs have a lower percentage of founder shares allocated or have the founders contributing more money for their shares.

What Is A SPAC Unit

When the SPAC IPO is listed, units are available with a NAV of $10. Each unit is usually made up of one share of common stock (share) and a fraction of a warrant.

You can use the warrant to purchase common stock (generally exercisable at $11.50) in the future.

The number of warrants you get based on the number of common stock you own is variable and dependent on the SPAC structure. Some SPACs are structured such that you get one warrant for every common stock. Others may provide one warrant for every 12 common stocks.

SPAC Units are generally listed on the exchanges with the Share ticker plus “U” at the end – e.g., IPOEU

While most SPACs offer Units at $10, some SPACs offer Units at $20 NAV. Do not always look at the price and assume if a SPAC is overpriced or not. Pershing Square Tontine Holdings Ltd (PSTH) is a SPAC by Bill Ackman, which has a $20 NAV instead of $10.

In the last few SPAC offerings, I have noticed some units are not offering any warrants. For example, DGNS did not provide warrants.

Around 50 to 60 days after the SPAC’s IPO, the common stock (Shares) and Warrants included in SPAC Units become separable. The Warrants and Shares are now listed separately with the unseparated Units.

Based on our previous example, you would now have IPOEU (units), IPOE (ordinary shares), and IPOEW (warrants) trading on the exchanges.

Note: Not all brokerages split units for free. Some brokerages charge a fee, while others do it free of charge depending on your account’s size.

What Is A SPAC Warrant

A warrant is similar to an option. It gives you the right (but not the obligation) to purchase additional shares in the future at a specific price.

If you purchased the unit, you automatically get the warrant as specified in the SPAC documents. Or you can also directly buy the warrant after it is listed on the exchanges. Warrants have the letter W at the end of their ticker symbol. (Eg: IPOEW, GSAHW, AJAXW, etc.)

The terms of warrants may vary significantly across different SPACs. The warrants’ terms include how many shares the investor has the right to purchase, the price, and the period during which you may buy shares. It also has details on when the warrants will expire.

How To Exercise Warrants

To exercise your warrants, you need to call your broker. You can only do this after the company opts to redeem its warrants, so keep an eye out for any announcements.

Some brokerages carry warrants, while others do not.

Signing The Letter of Intent (LOI)

One can consider this as the “dating” phase for the SPAC and the planned target company. The SPAC finds a company that matches their criteria and strikes a deal.

Depending on whether the market participants like the target company, the SPAC price can swing wildly at this phase.

Signing The Definitive Agreement (DA)

After the LOI, this is the next logical step. Consider this to be the “engagement” phase. The SPAC and the company it courted have hashed out the terms of the deal. They publish all the financial numbers. The DA also has penalty clauses, so one party can’t back out.

Signing the DA provides the market additional confidence that the deal will happen. If the target company is excellent, you might see another price jump at this point.

Voting On The Merger

SPACs announce when shareholders need to vote on the future merger and other essential characteristics such as board appointments.

This stage is the “does anyone object to this marriage.” Sometimes if the vote fails, the SPAC either gets more time to find another company. Or the SPAC has to return the money to the investor at NAV.

Executing The Merger

The actual marriage where the SPAC and the reverse merged company are combined. The moment everyone has been waiting for. The new combined company starts trading under the new ticker.

Any SPAC common shares or warrants in your brokerage account are automatically converted to the new name and ticker symbol.

So IPOE will be traded as SOFI. Or IPOA will start trading under the SPCE ticker.

Benefits Of Investing In SPACs

Sponsor’s Expertise

The best benefit of SPAC investing is the handpicked selection of the target company by the sponsor. You are making a bet on the sponsor’s expertise, whether it is Peter Thiel or Bill Ackman.

Asymmetric Potential

If you buy a SPAC close to NAV, your downside is capped by the NAV before the merger vote. On the other hand, your upside potential is high if the target company is excellent.

Let us take the example of SOFI. IPOE traded slightly above $10 per share before the actual announcement. If you bought IPOE and did not like the target, you could vote against it and get your $10 back if the merger failed.

And if you liked SOFI as a target and held on, the stock doubled after announcement.

Additional Upside With Warrants

Purchasing Units close to NAV gives you free warrants. Exercising warrants for SPACs which have done well can provide additional upside profits. For example, Quantumscape Corp (Ticker: QS) traded near $134 per share. Exercising warrants would grant you additional common stock for $11.50 per share. In this case, exercising the warrants and selling the shares would have generated nearly ten times profits.

Private Equity Investment

Legendary investor Jeremy Grantham (from GMO) had invested in Quantumscape Corp several years ago. Private equity investments in the past have been available to only multi-millionaires.

With the advent of SPACs, you have the possibility of investing alongside legends, albeit at a different price.

Risks Of Investing In SPACs

Inability to Find The Right Target Company

Most SPAC units trade at a premium to NAV once the SPAC is listed on the exchanges. SPACs with good management teams are bid up on day one for over $11 a unit. If the SPAC can’t find a suitable target and decides to liquidate the trust, it will pay the unitholders at the SPAC’s IPO price, which is likely $10 per share. Investors may lose the difference between what they paid (for example, $11) and the $10 received.

Opportunity Cost

SPACs have around two years to find a company. You are locking your money by waiting for a deal while you could have invested the money elsewhere.

Although most SPACs identify target companies before two years, it is still a risk.

Historic Underperformance

In 2017, Johannes Kolb and Tereza Tykvova published a paper analyzing the performance of SPACs. They concluded that SPAC firms are associated with severe underperformance compared to the market, the industry, and (comparable) IPO firms.

One could argue that in the past, SPACs were associated with penny-stock schemes, and times have changed. But it is always better to safe than to be sorry.

Too Many SPACs

Due to the increasing number of SPACs, the target companies are now bargaining harder for more attractive deal terms. A more attractive deal for the target company will result in your SPAC having a limited upside.

Several of the SPACs I am invested in; are taking a lot longer to close the negotiations.

Also, too many SPACs and not enough good target companies could result in sponsors making bad deals to get it closed.

Disagreeable Warrant Terms

A few SPACs have a clause that states if the target company shares trade above a specific price or a certain amount of time, they can redeem the warrants for nominal consideration (e.g., $0.01 per warrant). This action would force the warrants to lose value.

Make sure you read the S1 and other SEC documents before buying warrants.

Misaligned Incentives

Sponsor incentives are one reason you need to be suspicious of SPACs. We already talked about founder shares awarded at approximately 20% of the listed company. The sponsors will lose millions of dollars if a merger does not close. The sponsor’s incentives are to close the deal, even on unfavorable terms. Your incentive is to get a good target company.

SPACs have several pros and cons based on the current market dynamics and the rush of celebrities and retail investors. Selectively evaluate each SPAC considering your risk profile.

John, Financial Freedom Countdown

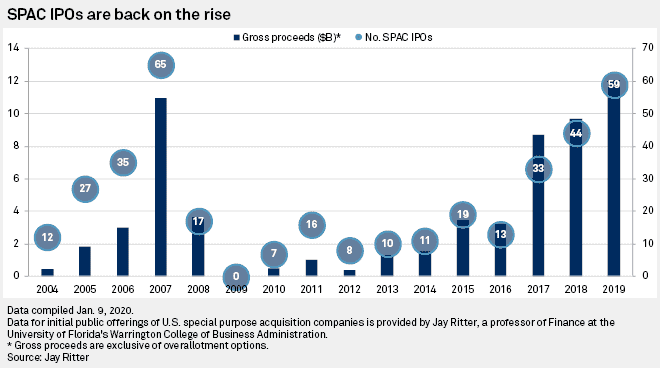

What Is The SPAC Boom

Contrary to popular belief, SPACs are not a recent phenomenon. SPACs existed in some shape or form in the last 20 years. However, most of the SPACs in the bygone era were low-quality companies and were relatively unknown.

Nikola, Virgin Galactic, Draft Kings all have had meteoric rises in the last year. All of them started as SPACs.

The challenges of getting IPOs like Snowflake at listing price combined with SPAC listings increasing in price have captured the imagination of select retail investors, celebrities, and venture funds.

Wall Street underwriters such as Goldman Sachs, Credit Suisse, and Deutsche Bank anticipating business loss from future IPOs, have jumped in to create SPACs.

Celebrities from Shaquille O’Neal to Paul Ryan to Colin Kapernick are launching SPACs. Chamath Palihapitiya who popularized SPACs by taking Virgin Galactic public through IPOA believes that we are still in the early stages. He has since gone live with IPOB, IPOC and IPOE.

The market is gradually getting crowded, and you now need to be more diligent when buying SPACs.

How To Evaluate SPACs

I use several factors to evaluate which SPACs are worthy of investment before the LOI is announced. Please note that this is my framework, and there could be better ways to assess SPACs. I am not a licensed investment professional, and you should consult with one before making investment decisions.

Sectors Targeted

I typically look for macros trends around sectors that could potentially aid my SPAC investment. Lately, electric vehicles, clean energy, space exploration seem to be the rage. There is also a lot of government support around these themes.

People are getting older and want to live longer and enjoy a better quality of life. I foresee a lot of demand in the healthcare and longevity sector.

So my first filter is to look at SPACs, specifically targeting themes that have potential future demand.

Leverage Your Knowledge

I used to work in Silicon Valley and have a decent idea of emerging trends in software. Based on my hobbies, such as finance, I am very interested in anything related to FinTech. I geek out a lot on space travel, longevity, and other esoteric topics.

Your knowledge should be a filter criterion since it would aid you in researching the SPACs. For example, if you love sports, study SPACs based on sports teams, sports betting, or online sports. My knowledge of sports is pretty limited. Hence I would avoid any sports-related SPACs but it could be a great fit for you.

Management Team

Does the management team have experience in the sector they want to explore for SPACs? For example, in the FinTech area, does the sponsor and the team have a past background in FinTech?

Similarly, if Shaquille O’Neal is launching a SPAC, does he focus on an area where he has significant knowledge?

The management team is the most critical factor when evaluating a SPAC because you hand the sponsor a blank check to buy a company after they do the appropriate due diligence. If the sponsor does not know anything about the sector, they might overpay or not anticipate all risks when buying the target company.

SPAC Structure

We talked earlier about Units and Warrants. Check if the SPAC structure is friendly to shareholder participants? Do individual investors get sufficient warrants for purchasing the units to compensate for the risks? What are the management fees, and are they overpaid? How can the warrants be exercised?

Even if you purchase only the commons, these are important questions to research. Bottom-line, I would not reward a sponsor who has an unfriendly SPAC structure.

How To Invest In SPACs

You can invest in SPACs directly or via Exchange Traded Fund (ETF).

Invest In A SPAC ETF

Since the retail investors have not yet jumped in with both feet, there are only a few SPAC ETFs. The 3 ETFs I researched target different lifecycles of the SPAC journey.

Defiance NextGen SPAC Derived ETF (SPAK)

This ETF focuses on the mature end of the lifecycle. Approximately 80% is invested in companies after undergoing the ticker change (Eg: DKNG, SPCE, etc.) and only 20% on the blank check companies. SPAK tracks the Indxx SPAC & NextGen IPO Index.

Tuttle SPAC and New Issue ETF (SPCX)

This actively managed ETF focuses on the initial part of the lifecycle. Most of the investments are on the blank-check companies.

Morgan Creek-Exos SPAC Originated ETF (SPXZ)

Actively managed SPXZ ETF holds a mix of blank-check companies and companies listed on the exchanges through the SPAC process. Of the 3 SPAC ETFs, SPXZ is relatively new.

Below is the list of currently available SPAC ETFs along with their inception date and expense ratio. Note that the expense ratio could change so always check your ETF prospectus.

| Fund/Ticker | Inception Date | Expense Ratio |

|---|---|---|

| Defiance NextGen SPAC Derived ETF (SPAK) | 09/30/2020 | 0.45% |

| Tuttle SPAC and New Issue ETF (SPCX) | 12/15/2020 | 0.95% |

| Morgan Creek-Exos SPAC Originated ETF (SPXZ) | 01/25/2021 | 1.00% |

Invest Directly In SPAC Units, Commons, and Warrants

Rather than buy ETFs, you can control the process more efficiently by picking individual SPACs to invest in. Given that we now have celebrities jumping in the game to make a quick buck, it is all the more important to be selective.

Since the RobinHood fiasco, I have been using SOFI. The best part of using SOFI to buy SPACs is that SOFI used to be a SPAC. IPOE was the original SPAC, which then reverse merged with SOFI.

Is SPAC A Good Investment

SPACs provide individual investors a unique opportunity to obtain shares in desirable sectors. Unfortunately, due to the nature of SPACs, the average investor is unable to decide in advance what would be the acquired target company.

Investors do have an option to reject the merger but would lose the opportunity cost of having the money tied up in the SPAC. And the difference between the price they purchased the SPAC and the SPAC NAV.

If you are wondering, “can you lose money on a SPAC?” the answer is yes. Sometimes SPAC commons trade below NAV. After the merger, the target company is listed on exchanges, and the stock market participants would evaluate the company just like any other publicly listed firm. So you might have bought a SPAC for NAV, but the stock market could push the price even lower if the company does not deliver.

Remember, the stock market has no memory and does not care what price you purchased the stock. If it is good, it will be rewarded in the long run or punished.

Investment in SPAC needs an understanding of the sponsors and the potential of the target industry. From a risk management perspective, it is better not to have a large allocation to SPACs.

My risk tolerance is higher than most investors. I consider SPACs in the same bucket as my other speculative investments, such as bitcoin, moonshot investing, and private equity. As with any speculative investments, SPACs are not risk-free. The risk is amplified after many celebrity sponsors, and retail investors start moving into this space.

Some context for new readers. My portfolio is diversified based on investing in a wide variety of income-producing assets. I balance my speculative investments like SPACs by investing in boring asset-backed investments such as Real Estate Syndication. The boring secured investments permit me to take precarious risks and still sleep at night.

Readers, have you invested in SPACs, or would you consider investing in them? What criteria do you use to evaluate SPACs?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

Wow, tons of great info here. SPACs are frothy indeed. I’ve just went pretty big into one in the private aviation industry (their target company was announced) … the biggest gamble I’ve taken thus far.

Tech SPACs seem to have bit more upset but I’m hoping to have found something a bit more under the radar.

Thanks for this write up!

Thank you for your kind words. Yes, SPACs are frothy and one needs to evaluate the themes and sponsors. I have an eVTOL as well 🙂