Real Estate Syndication: What Is It And How Can You Profit?

Stocks and real estate make up 70% of my current net worth. Real estate provides one of the best returns on a risk-adjusted basis among different income-producing assets. Real estate syndication offers all the benefits of real estate without needing to be involved in the day to day operations. Today, let us deep dive, into real estate syndication.

What Is A Real Estate Syndication?

A real estate syndication is a legal structure for individual investors to pool money together for investing in large real estate deals. The legal structure is either set up as a Limited Liability Company (LLC) or a Limited Partnership (LP).

Syndicated real estate is crowdfunding for real estate and was made possible by the Jumpstart Our Business Startups Act (JOBS) passed by Congress. Before the passage of the JOBS Act, investing in real estate was confined to only the wealthy connected individuals as a result of the Securities Act of 1933. In short, the JOBS act made the process of raising capital simpler, cheaper, and faster and eventually made investing in crowdfunded deals possible.

Now everyone has an opportunity to invest just like the wealthy and connected folks.

Real Estate Syndication Vs. Real Estate Investment Trust (REIT)

The main difference between a Real Estate Investment Trust (REIT) and syndicated real estate is that a REIT consists of several income-producing properties bundled together like a mutual fund. Syndication usually deals with only a single investment property.

Some of the significant differences between an equity REIT and a real estate syndicate are

| REITS | Real Estate Syndication |

|---|---|

| Several properties | Single property |

| Required to distribute 90% or more of its income annually to shareholders | No such requirement |

| Tax Inefficient due to dividend distribution | Can be structured for tax efficiency |

| Cannot defer capital gains using Sec. 1031 rules | Can use Sec. 1031 exchange rules |

| Cannot pass depreciation and tax losses to investors | Can pass depreciation and tax losses to investors |

| Cannot utilize opportunity zone credits | Can use opportunity zone credits |

| Publicly traded | Not traded publicly |

| Can sell anytime to exit | Cannot exit until the property is sold |

While private REITs are available, publicly-traded REITs are more popular. REITs provide liquidity, diversification, and a real estate passive income stream. But you lose some of the tax benefits of real estate investing.

However, REITs are a good start if you do not have any real estate exposure. You can purchase them on any brokerage platform. I use M1 Finance to automate, and dollar cost average my REIT purchases. You can read my complete M1 Finance review here.

Real Estate Syndication Structure

The real estate syndication structure defines who is involved. Ensure an experienced real estate lawyer creates the contract and is fair to all parties. Besides the deal, voting rights, syndication fees, payment terms, and risk, the private placement memorandum (PPM) should cover various scenarios, including capital calls. Capital calls occur when the real estate project needs more funds than what the sponsor initially anticipated at the project’s start.

Typically any real estate syndication structure involves a sponsor, investors, and joint venture partner.

Who Is The Sponsor In Syndicated Real Estate?

The syndicator is also known as a “sponsor.” They are responsible for finding, acquiring, and managing real estate. They have prior real estate experience with underwriting and do due diligence on real estate.

The sponsor does a lot of the legwork involved in finding the deal and putting it together. The sponsor acts as the General Partner (GP) for the contract. Sometimes the sponsor will invest their funds with the investors, and other times their contribution to the project is only in terms of their skill, time, and effort. It is always preferable for the sponsor to have some “skin in the game.”

Who Are The Limited Partners?

Investors act as Limited Partners (LP) in the syndication and play a passive investor’s role. They invest with the syndicator and own a percentage of the real estate based on each investor’s amount.

Since they are passive investors and not involved in the acquisition or day to day operation or disposal of the investment property, they pay the sponsor fees.

Who Is The Joint Venture (“JV”)/Equity Partner?

The Joint Venture (“JV”)/Equity partner is a third party present in some transactions. They assist the syndicator with reporting, communications, and even tax documentation.

Sometimes the role of the JV partner could be undertaken by the sponsor.

What Are The Phases of Real Estate Syndication?

Typical real estate syndication has three phases.

Origination

The origination phase involves planning, making offers, acquiring the investment property, satisfying registration and disclosure rules, and marketing to raise funds from real estate investors.

Operation

As part of the operation phase, the sponsor usually manages both the syndicate and the real property. They communicate regularly with real estate investors and regulators. Arranges refinances as needed. Optimizes the operation of the property to lower the cap rate. Distributes income from the property as defined in the PPM.

Liquidation

As the name implies, the liquidation phase is to finalize the investment property sale. Distribute final sale proceeds to the investors and satisfy the regulatory requirements of winding down the legal entity.

Types Of Real Estate Syndication

The two most common types of real estate syndications are

- Specific Offering: In a specific offering, the sponsor identifies a particular asset to be acquired and raises the capital necessary to carry out the investment’s acquisition and operation.

- Blind Pool: The blind pool type of real estate syndication operates like a blank check company. Based on the sponsor’s past reputation, the investors provide funds to acquire assets the sponsor deems to be profitable.

Both specific offering and blind pool have their pros and cons.

With a blind pool, the syndicator can swoop in to pick up distressed assets for pennies on the dollar since they have the funding already available. The blind pool model is advantageous for real estate properties with a shorter time to close.

The risk of a blind pool is that you trust the syndicator will pick up a great asset. You have no opportunity to perform any due diligence on the property or if the deal deserves your funds.

How Do Investors Make Money In Real Estate Syndication?

Real estate syndication returns for Investors is in the form of distributions.

- Operations – During the property’s lifetime, any income generated is distributed to the investors. Consider this money to be the regular cash flow from a rental property, such as rental income. One can use value add real estate strategies to create additional income streams.

- Refinance – Often, the property after the acquisition is refinanced to lower the interest burden. Syndications may opt for agency debt or bank funding. In either case, any benefit due to the reduced interest cost is passed on to the investors.

- Sale of the property – When the property is finally sold, the profits are distributed to the investors. During the project’s operations phase, the syndicators will update the units, which let them charge higher rents. The increased income changes the cap rate when they finally sell the property.

How Do Real Estate Syndicators Make Money?

Real estate syndicator returns are comprised of distributions and syndication fees.

Distributions

The returns from distributions are similar to how investors make money.

- Operations

- Refinance

- Sale of the property.

Although the sponsor has not contributed a lot of money, they are compensated through equity participation on the deal. To provide an incentive to the sponsor for meeting the project goals, they receive additional profits after the preferred rate is met. For example, a real estate project could have an 8% preferred rate and a 70/30 split between LP and GP. The division could even go to 50/50 if the project returns over 20% average annualized return.

While a 50/50 split might seem large for the investor, remember only the amount over the 20% average annualized return would be split.

This tiered structure of distribution is also known as waterfall equity distribution. It protects the capital of limited partners who provide the majority of the funds and incentivizes the general partner to produce as high a return as possible.

Syndication Fee

In addition to syndicators’ distributions, the additional income stream for syndicators is the syndication fee. The fee is for all the “sweat equity” by the syndicators in acquiring the property, managing it, refinancing, and final sale.

The most common fees and the typical amounts charged are

| Fee | Amount |

|---|---|

| Acquisition fee | 1% to 3% of the purchase price |

| Asset management fee | 1% to 2% of gross collected revenue |

| Administrative fee | 0.1% to 0.2% per year of equity invested |

| Loan Guarantor fee | 1% to 2% of the loan amount or a flat fee |

| Refinance fee | 1% to 2% of the refinance loan amount |

| Disposition fee | 1% to 3% of the sale price |

Each deal is unique. Not every arrangement will have all the above fees included.

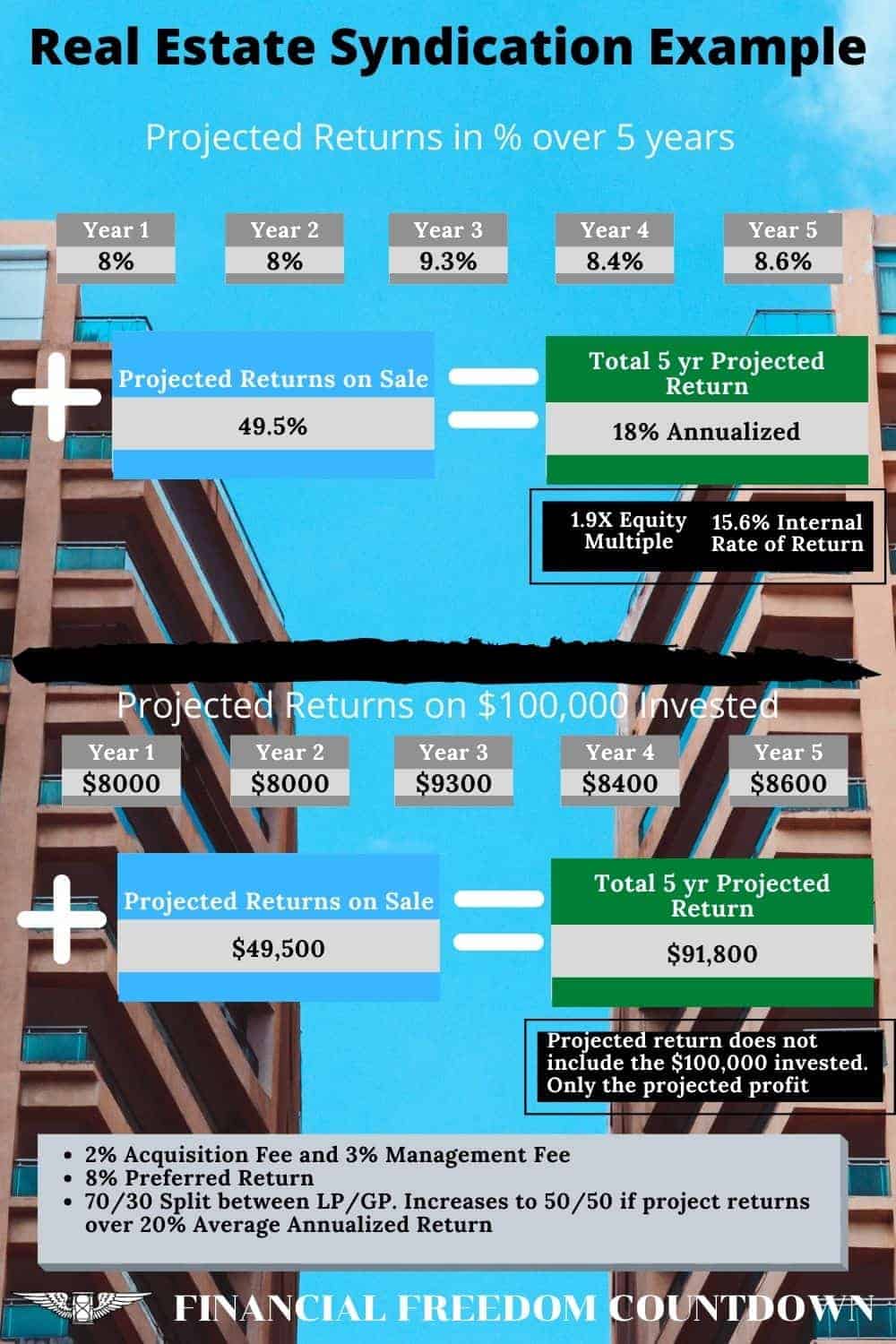

Real Estate Syndication Example

A syndicator and a group of investors acquire an apartment complex for $1,000,000. To simplify the calculation, assume it is a cash deal with no mortgage.

Real estate syndication deals are structured with a waterfall payment. I have taken a complex waterfall structure with three levels. Your individual deal might be more straightforward than the one portrayed below.

The terms of the deal are 8% preferred returns with a 70/30 split (limited partners/general partner) and a 50/50 split if annual profits exceed 20%.

- The first level is the preferred return (8%) which needs to be paid.

- After the preferred return is paid, the remaining annual cash flow is split with 70/30 ratio up to the max limit of 20%.

- If annual profit exceeds 20%, then any amount exceeding 20% is paid in the 50/50 ratio.

Example 1 (Single waterfall)

The investors funded the entire amount. After all of the expenses have been, the property generated $100,000 a year in profit.

- The investors would be entitled to a preferred interest payment first. Since the preferred interest rate is 8%, the investors would get $80,000 in interest first out of that $100,000 profit (8% of the $1,000,000 investment).

- The remaining $20,000 would be split between the investors and sponsors at a 70/30 ratio. So investors would get an additional $14,000.

Example 2 (Multiple waterfalls)

Assume the deal was so wildly successful that the property generated $220,000 a year in profit.

Since the annual cash flow is above 20% (greater than $200,000), the 50/50 split would come into the picture.

- In that case, the investors would get the $80,000 in interest first.

- The 20% ceiling of the 3rd level caps the second level waterfall at $200,000 (20% of $1,000,000). The remaining $120,000 ($200,000 – $80,000) would be split between the investors and sponsors at a 70/30 ratio. So investors get an additional $84,000 (70% of $120,000) at this second level.

- Since the syndicator has generated returns over 20%, the final $20,000 is split 50/50 between investors and syndicators. So investors get an additional $10,000 at the third level (50% of $20,000).

Most deals are not as successful as the example above. But the waterfall split exists to incentivize the sponsors’ outperformance.

Here is an example of another deal where the sponsor provides steady cash flow while updating the units as they become available. As a result of the updated units fetching higher rent, the Net Operating Income (NOI) increases. Sale of the real estate property resulted in substantial gains in year 5.

Best Real Estate Syndication Companies

The best real estate syndication companies depend on your goals!

Crowdfunding platforms for accredited investors

EquityMultiple is a real estate investing platform that gives accredited investors direct access to individual commercial property, allowing you to review, compare, and personally choose the deals that meet your investment criteria. EquityMultiple has a low minimum of only $5,000 investment. They are one of the few sites that claim to co-invest in every investment, ensuring “skin in the game” and the most significant incentive to do maximum due diligence. EquityMultiple has many different asset types: office buildings, industrial, senior housing, retail, residential, self-storage, student housing, data centers, etc.

CrowdStreet is a commercial real estate investing platform for accredited investors. It has a higher minimum of $25,000 per deal. CrowdStreet offers both single property investments and multi-property funds, as well as both equity and debt deals. Most commercial real estate investments have no investor fees (unless investing in a fund with underlying fees). CrowdStreet has the highest number of different asset types available for investing. Commercial real estate projects, including office buildings, industrial, hospitality, senior housing, retail, multifamily apartments, storage, schools, medical centers, student housing, data center, parking garages, etc., are available to invest directly.

Crowdfunding platforms for non accredited investors

A few options are available using the REIT structure if you wonder about equity crowdfunding for non-accredited investors. Note that these REITs are not the same as publicly-traded REITs. Unlike many publicly-traded REITs, the crowdfunded investments are typically privately held.

Streitwise is similar to Fundrise in offering a fund structure and is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. I do like the high conviction to invest their own money along with other investors. You can invest in Streitwise as an Individual, LLC/Corporation, Trusts or IRA/401(k). The other advantage is that Stretwise is also open to foreign/non-USA investor. Minimum investment is $5,000.

The trade-off with low investments of Streitwise is that you cannot select one particular property; but rather an eREIT invested in several commercial real estate investments. If you are a fan of diversification, the investment spread over multiple properties reduces the risk.

| Investment Platform | Open to | Type of Investment | Minimum |

|---|---|---|---|

| EquityMultiple | Accredited Investors | Commercial | $5,000 |

| CrowdStreet | Accredited Investors | Commercial | $25,000 |

| Streitwise | Accredited and non-Accredited Investors. And also foreign/non-USA investors | Commercial | $5,000 |

If you do not qualify as an accredited investor based on financials, you can still meet the accredited investor qualifications based on knowledge.

How Is Real Estate Syndication Income Taxed?

When we compared real estate syndication to REITs, we highlighted several tax advantages. Let us cover those in detail.

Depreciation

Depreciation is one of the most valuable tax advantages of real estate syndication. As per the IRS, any improvements made to the property can be depreciated over the property’s expected life. Typically the duration is 27.5 years for residential and 39 years for commercial property.

For example, if your rental property (the structure itself) is valued at $5,000,000, you would divide that by 27.5 years (~$181,818). You can now deduct $181,818 as a depreciation expense annually for 27.5 years.

The depreciation deduction allows you to report a smaller profit to the IRS, thereby reducing the amount you ultimately owe in taxes. In this way, you can significantly offset the gains.

Cost Segregation

If the syndicator maintains accurate records of improvements or performs a “cost segregation” study, they can depreciate certain items using an accelerated depreciation schedule.

With a cost segregation study, you can identify improvements that can be depreciated over a shorter period. For example, as part of renovating the kitchen to increase rent, you replace the fridge, microwave, etc. You can depreciate the refrigerator and microwave over five years compared to 27.5 years. Accelerated depreciation takes into account the time value of money. A dollar written off today is more valuable than 27 years later.

Bonus Depreciation And Section 179

IRS finalized the bonus depreciation rules as per The Tax Cuts and the JOBS Act. Businesses can accelerate the depreciation timeline and take it earlier in the lifespan of the property. Some rental properties can also use section 179. Details on Section 179 are available in IRS Publication 946.

Opportunity Zone

Specific properties on real estate syndication platforms are located in opportunity zones. If you have substantial capital gains, look at real estate syndications in the Opportunity Zones.

Section 1031 exchange

Section 1031 exchange is one of the best tax advantages of real estate investing, where the investor can rollover the gains from the previous real estate project into the next project. I have noticed some real estate syndication deals offer section 1031 exchange benefits to a limited subset of investors. Using a Tenant In Common (TIC) entity and the usual investor LLC structure makes this possible.

Note that the syndicator needs to structure the deal differently to stay within the IRS guidelines. Hence it might not be as common as the other tax benefits.

Capital Gains

As a result of improvements made to the property and the resultant changes in cap rate, the syndicator should be able to sell the property for more than the purchase price. Rates for long term capital gains are lower than short-term capital gains.

Holding the property for the long term can prove advantageous when computing capital gains.

Mortgage Interest

The interest paid to service mortgage debt on rental investment is 100% deductible. The real estate syndication provides this write-off benefit to the investors.

Refinancing

Refinancing would lower interest costs. Although it is not directly a tax advantage, the investors benefit from the lower expenses.

The syndicator can perform a cash-out refinance, which is a tax-free event.

An experienced syndicator, will have tax professionals to maximize tax benefits for investors. Please note that I am not a tax professional, and you should consult a CPA for your situation.

How Do You Become A Real Estate Syndicator?

To successfully run real estate syndication, you need to be well-versed and have significant real estate experience in that particular niche.

We talked about getting started investing in real estate with little or no money. However, jumping from a no money deal immediately into syndication is fraught with risk. A better approach is to follow a step by step approach. For example, if you want to be a syndicator for large multifamily deals, start with a duplex, then graduate to a fourplex and then a sixteen unit apartment.

Next, go and invest in some syndication deals as an investor. You will get experienced in evaluating real estate syndication deals and better understand the entire life cycle of the transaction, including all the legal paperwork involved.

After investing in a few syndication deals, here are the real estate syndication steps to get started

Get Educated

Learn about the various asset classes, from commercial real estate to shopping malls to apartment buildings. Take courses from reputed investors who have done successful deals.

Determine Your Niche

For example, decide if you want to specialize in commercial real estate or apartment buildings. If you picked apartment buildings niche down further to determine if your strategy should be focused on rehab and increasing the rent, or building apartments on vacant land.

Network With Brokers

A running joke in real estate syndications is that Loopnet is where bad deals end up. You can sometimes find good deals on Loopnet, but a better strategy is to build a relationship with brokers. Off-market sales where the owners have not even considered listing their properties are where you could get the most bang for your buck. Provide your criteria to the brokers operating in your area. Meet with them periodically, even if they have no deals. You want to be the first one they think of when something comes across their desk.

Build Your Team

Real estate syndication is not a one-person show. Consider your company’s various roles, from acquisitions manager to operations manager to legal. Team up with individuals who have the necessary skills. If you are forming a company and in it for the long haul, carefully vet everyone.

Create A Legal Entity

Form a company. Define the various roles and responsibilities. Develop your marketing material for brokers, sellers, and investors to understand what you are buying, why you are buying, and how you plan to make money. Have an experienced real estate attorney who is well versed in securities law on your team.

Build Your Investor Database

Start creating a list of your potential investors. If this is your first large syndication deal, it would be hard to attract new money. Start by leveraging your prior real estate investors on the smaller ventures and educate them on the benefits of joining your syndicate as investors. Setup your website and highlight your team’s skills and past successes.

Analyze Deals And Make Offers

Run the numbers and analyze deals. Since you have already predetermined your niche, you can build models based on cap rate, occupancy, interest rates, operating and capital expenses, etc. These can be utilized to make several offers in a day.

Real estate is a numbers game. You need to analyze several deals and make offers before landing one property.

Get The Property Under Contract

Conduct the necessary due diligence by examining the books, including rent rolls and bank deposits. Physically inspect the property and conduct title searches. Line up your lending. Get the property under contract with appropriate contingencies.

Complete The Legal Paperwork

Draft the private placement memorandum. File the required notices and registrations with the Securities and Exchange Commission (SEC) and other regulatory bodies.

Conduct Investor Presentations

Share the details of your property with the investors. Conduct webinars to answer their questions. Inform them what returns are expected, timeframe, risks, and how the deal is beneficial.

Finalize The Deal

Close the deal after completing your final due diligence. Have the investors wire the funds. Execute your plan. Regularly communicate with your investors on a set schedule. Type A personalities like me prefer to receive a quarterly email from the real estate sponsor that everything is fine. I appreciate that email, even if there is nothing significant to report. Others may prefer communication only when things blow up. Treat your investors well, and they will continue to fund your future deals.

Where Can I Find Real Estate Syndication Deals?

You can find real estate syndication deals through your local real estate meetups or real estate crowdfunding platforms. Syndicators or their agents frequently attend meetups to build their investor database. I prefer investing in real estate crowdfunded platforms compared to offline syndicators.

The main advantages of using crowdfunded platforms are

Additional Due Diligence

Crowdfunded platforms provide an additional set of eyes on the deal. Since they want to maintain their platform’s reputation, they perform essential due diligence of vetting deals before being presented to the website.

The platform’s due diligence should not replace your evaluation of the deal. But, significantly, only a filtered subset of sales is available for you.

Past Performance

Past performance is no guarantee of future performance. But using the crowdfunded platform, you can see the track record of the syndicator and how the current deals are performing. Your chances of deal success significantly improve if you notice how the syndicator has worked over the past.

Lower Investment

Without a crowdfunded platform, direct investment in syndication deals has a high minimum of at least $100,000. The advantage of real estate crowdfunded platforms is investing as low as $10,000.

Diversification

Due to the lower minimum investment in a crowdfunded platform, you can reduce your risk by spreading your real estate funds over several different projects.

The other diversification benefit is from a real estate market cycle and geographic perspective.

How To Evaluate Real Estate Syndication Deals?

The most important considerations when assessing syndication are the sponsor and the deal. Some of the typical aspects to focus on are

Evaluate The Sponsor

- Have they done similar projects in the past in terms of size, location, type of property

- What is the track record of the real estate sponsor

- Do the communication style and frequency match expectations

- What did they learn from failed past investments

- Who else is on the team, and what do they bring to the table

- Contingency plan if the General Partner is hit by a bus

- How did the sponsor lead the syndication deals through various real estate market downturns

Evaluate The Deal

- Do the numbers make sense in terms of projected cash flow, cap rate, net operating income (NOI), IRR

- How much leverage will be used to finance the real estate purchase

- What happens if the loan matures during a recession and refinancing is impossible

- Did the sponsor consider all possible risks for the project

- What happens when the real estate market cycle turns

- What are the contingencies in the project

- Is market data available to evaluate the project

- How are capital calls handled

- Is the structure of the offering including waterfalls, fair

- What is the exit strategy

- Is the property in one of the best states for real estate investors?

Refer to my checklist for evaluating crowdfunded deals and add your own criteria.

Who Can Invest In Real Estate Syndication?

Due to regulatory requirements, some investments are restricted to accredited investors, while others are open to anyone.

Non-accredited investors can invest in real estate syndication deals, but few opportunities are available. Syndicators accepting non-accredited investors’ money have more stringent and expensive SEC regulations to meet.

The weird aspect of the accredited investor requirement is that it is not uniformly enforced. Some crowdfunded sites just ask you to self certify and declare you are an accredited investor, while others demand proof in terms of tax returns or income statements.

As per the SEC, an accredited investor is a person who has

- an annual income exceeding $200,000 ($300,000 for joint income) for the last two years.

- Or net worth exceeding $1 million (excluding your primary residence).

- Or specific professional certifications, designations, or credentials such as Series 7, Series 65, or Series 82 license.

What Are The Benefits Of Real Estate Syndication?

Professional Management

I dabble in real estate investments in my spare time. I know enough to be dangerous and ask the tough questions. But if I was investing a significant chunk of my net worth, wouldn’t it make more sense to have a professional who has been in the industry and done it successfully manage it?

Real estate syndication provides that professional management for a low fee. You don’t need any expertise at your end. In the grand scheme of things, the syndication fee should be worth it as long as the deal makes sense.

Passive Investment

As a result of professional management, real estate syndication is truly passive. You can focus on improving your human capital to make more money. And the syndicator can generate returns for you. The syndicator gets a larger percentage if they exceed the average annualized returns. Structuring the payout aligns the incentives between the investors and syndicators.

Leveraged Returns

Real estate generates high returns only because of the effective use of leverage. While investing in REITs is a great start, you cannot obtain leverage benefits. And leverage on stocks is risky due to margin calls. Real estate syndication provides leveraged returns on your investment while continuing to be a passive asset for growth.

Economies of Scale

Anyone who has a rental property investment knows that the amount of work it takes to manage a single-family is almost the same as operating a duplex. The work doesn’t double. As you scale up to more units, you have enough economies of scale to hire a full-time handyman. As you get more extensive, you can have a full-time property manager.

Real estate syndication is targeted towards larger properties where the benefits of size come into play. Everything from ordering material in bulk to refurbish units to managing the property has a lower unit cost.

Limited Downside

The risk to the investor is limited only to the capital provided. If the deal goes wrong, you can lose the money invested or receive less than promised. As a limited partner, you cannot lose more than your investment amount.

On the other hand, if you own real estate directly and a tenant gets injured on your property, they could sue you for millions. So your risk with direct real estate investment could be even more than what you invested. Of course, you could create an LLC, but then you would run into funding issues since not all banks lend to LLCs.

No Impact To Personal Credit

The syndication would obtain a bank loan, and it does not impact your credit score or show up on your credit report. On the other hand, if you buy real estate, the loan is typically in your name, limiting the amount of additional credit available to you.

Tax Benefits Of Real Estate

We already discussed in detail the tax benefits of real estate available for syndicated real estate, namely

- Depreciation

- Cost Segregation

- Bonus Depreciation And Section 179

- Opportunity Zone

- Section 1031 exchange

- Capital Gains

- Mortgage Interest Deduction

- Refinancing

Crowdfunded Platform Benefits

We talked about the four main advantages of using crowdfunded platforms for syndicated real estate deals

- Additional Due Diligence

- Past Performance

- Lower Investment

- Diversification

Are Real Estate Syndications Risky?

There are several real estate investment risks so one should have an appropriate risk mitigation plan in place.

Risks To The Sponsor

Depending on how the deal is structured, sponsors often need to provide personal recourse guarantees on the acquisition loan. If the transaction goes south, the lenders can take over the sponsor’s personal assets.

The second risk for the sponsor is reputation risk. Since real estate syndication involves raising funds from real estate investors, it will be impossible to raise funds after a few failed deals.

Risks To The Investor

The investor’s risk is purely financial and limited to the capital provided. If the deal goes wrong, you can lose the money invested or receive less than the promised amount. As a limited partner, you cannot lose more than your invested amount.

The advantage of using a crowdfunded real estate platform to invest in syndication deals is that you can reduce your risk by investing in several different projects.

Without a crowdfunded platform, direct investment in syndication deals has a high minimum of at least $100,000.

How To invest in Real Estate Syndication

Real estate provides one of the best returns on a risk-adjusted basis among different income-producing assets.

Real estate syndication provides all the benefits of real estate without needing to be involved in the day to day operations. There are several tax benefits of real estate which are available in syndication and not in REITs

Furthermore, the advantage of using a crowdfunded real estate platform to invest in syndication deals is that you can reduce your risk by investing smaller amounts in several different projects spread across market cycles and geographies. Without a crowdfunded platform, direct investment in syndication deals has a high minimum of at least $100,000. The websites also perform necessary due diligence of vetting deals before they are presented to the platform. And you can view the performance of past contracts.

EquityMultiple and CrowdStreet are best real estate syndication companies providing opportunities to compare and invest in residential and commercial real estate deals, respectively for accredited investors.

Streitwise is one of top real estate crowdfunding platforms for non-accredited investors. The other advantage of Fundrise is the low minimums – only $2,500.

Readers, have you considered investing in real estate syndication deals. Do you have any positive or negative experiences to share?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

8% of $100,000 is not $80,000. The 70/30 split would be on $92,000 dollars, not $20,000. Please check your above math so as not to confuse anyone.

Thanks for your comment Ryan. I can see how the example was confusing and added more details to clarify. The 8% preferred return is calculated based on the invested amount. Also for the split there are caps based on each level. Hopefully the numbered levels of each waterfall help.