Ray Dalio All Weather Portfolio

Investing can seem daunting, especially when considering its psychological aspect. Even if you know how to invest, the daily headlines will make you second-guess your decisions. The Ray Dalio All Weather Portfolio, developed by acclaimed investor and founder of Bridgewater Associates, Ray Dalio, was designed to help protect your capital from significant losses due to varied market conditions – whatever the state of the economy!

Aiming for a balanced approach between caution and opportunity-seeking amongst four separate asset classes allow nearly anyone with access to a brokerage account to seek financial security in uncertain times.

What Is the Ray Dalio All Weather Portfolio

The All-Weather Portfolio is called the All Weather Portfolio because it was designed to fit any economic mood or investment style. Its components are meant to ensure slow and steady growth while protecting you from extreme volatility.

It is not overly exposed in any individual sector. Instead, it is meant to create an asset allocation that fits many different investment needs, economic cycles, and growth periods.

The All-Weather Portfolio first came from Bridgewater Associates. Bridgewater Associates is an asset management firm known for managing money for billionaires. In that capacity, the firm has developed various strategies to help investors keep and grow their generational wealth. They can help investors create an investment portfolio that suits their specific needs while ensuring investors incorporate goal-oriented approaches to investing in various asset classes.

As you can tell from the name, the creator of the All Weather Portfolio is Ray Dalio. In 1971, Dalio was just out of college and working as a New York Stock Exchange clerk. President Nixon had just temporarily suspended the convertibility of the dollar into gold. Dalio expected the stock market to crash. Instead, it rose, which taught Dalio a critical lesson: Investing had to go beyond one’s own experiences.

Although deviating from the Bretton Woods agreement was expected to devalue the dollar, the stock markets had shrugged it off since the U.S. dollar remained the reserve currency.

Dalio would go on to found Bridgewater Associates and achieve significant financial success. Part of that success is owed to the All Weather Portfolio, which Dalio created after studying the various components of the financial marketplace and how those components interact. He called it the All Weather Portfolio in reference to the primary goal of this particular portfolio: It is supposed to perform well across all economic conditions and in different economic environments.

Risk Parity, a specific portfolio management strategy, is critical to the composition and regular asset class rebalancing of the All Weather Portfolio. The basic idea behind Risk Parity is that you use risk to determine asset allocation. Asset allocation refers to how much of an overall portfolio you want to invest in various asset classes, including stocks, bonds, and more.

Risk parity enables savvy investors to invest at a level that balances out risk for economic conditions, ensuring that an overall investment strategy will never exceed a comfortable level of risk. The All Weather Portfolio was launched in 1996 and took advantage of the ideas behind Risk Parity. It was based on Dalio’s belief that you could understand how an asset class will perform by understanding that assets are related to the economy as a whole. Hence, regular portfolio rebalancing could enable individuals to achieve risk parity.

Composition of the Ray Dalio All Weather Portfolio

Like all investment portfolios, the Ray Dalio All Weather Portfolio has an asset allocation that is meant to balance the proposed goals of the portfolio itself. The portfolio is meant to have asset allocations to ensure investors have an appropriate balance that enables them to weather all seasons of economic cycles of growth and downturn.

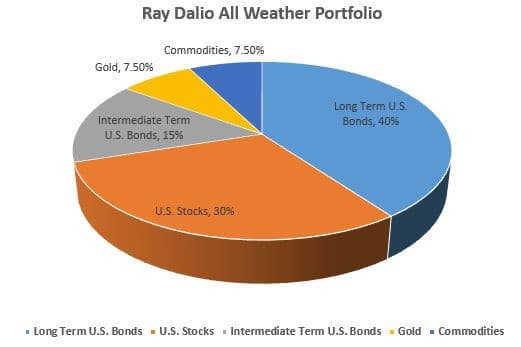

The Ray Dalio All Weather Portfolio asset allocation consists of the following rough breakdown of asset classes:

- 30% stocks

- 40% long-term bonds

- 15% intermediate-term bonds

- 15% commodities

The portfolio is rebalanced quarterly to ensure that it appropriately fits investors’ goals of performing well in any circumstance. This means that each specific asset class will periodically be examined in the quarterly rebalancing to ensure that it appropriately meets expectations. Like all portfolios, the Ray Dalio All Weather Portfolio will not always perform better than a comparable hedge fund or mutual fund. However, the Ray Dalio All Weather Portfolio typically outperforms other similarly situated portfolios.

Why Does the All Weather Portfolio Work

Markets fluctuate due to varying conditions from what is expected and priced into them. This deviation or “surprise” causes a price movement. For example, if everyone expects the earnings to be bad and the actual reported earnings are bad, the stock would not drop.

On the other hand, if everyone expects decent earnings and the earnings are a surprise to the upside or downside, the stock would move accordingly.

The surprise reaction compared to the expectations baked into the stock prices resulted in ‘The Nixon Rally,’ which greatly influenced Dalio and the creation of the All-Weather Portfolio.

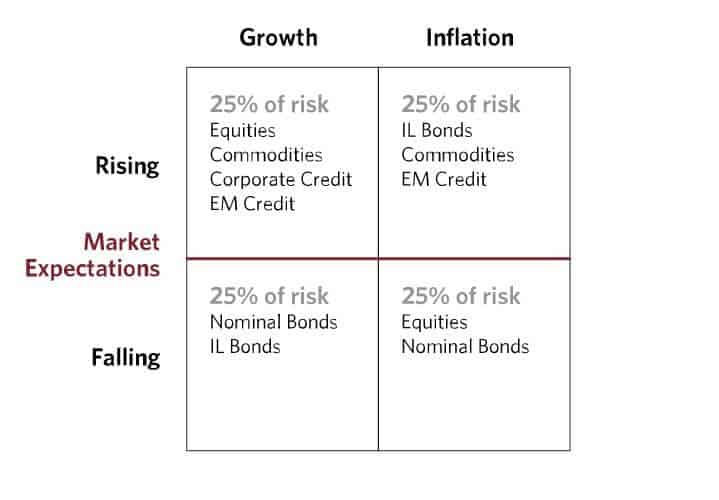

As a result, the All-weather portfolio is expected to tackle the four economic conditions

- Rising prices (inflation)

- Falling prices (deflation)

- Rising growth (bull markets)

- Falling growth (bear markets)

The Nominal bonds mentioned in the image above are bonds without inflation protection, such as Treasuries or T-Bills.

The IL Bonds refer to inflation-linked bonds such as I-Bonds and TIPS.

Inflation-linked bonds like I-Bonds or TIPS are ideal investments during times of rising inflation, while stocks and nominal bonds fail to provide the same results.

When Ray Dalio created the portfolio, however, there wasn’t a single issuer in the United States offering these debt securities. Instead, they were only available in countries such as the U.K., Australia, Canada, and other emerging markets.

Hence, the original Ray Dalio All-Weather Portfolio included Emerging Market credit with the bond portfolio hedged back to dollars, eliminating the currency risk.

How To Build an All-Weather Portfolio

Let’s take a look at the breakdown of each of these asset classes and how to build an All-Weather portfolio modeling the

Stocks

To invest in stocks, you can pick any broad-based index fund. The Vanguard Total Stock Market (VTI) is an ETF that seeks to track the U.S. total market. As a diversified ETF, it has stocks distributed across various sectors, including small, medium, and large-cap companies. As a passively managed ETF, it has a low expense ratio low.

Since the S&P 500 is a sufficiently diversified representation of the U.S. stock market, one can also substitute the VTI ticker with SPY.

Bonds

Investing in bonds, however, is slightly more complicated due to the duration risk. One needs to pay attention to the shape of the yield curve, and how long one wants to hedge against inflation risks. The All Weather Portfolio breaks the bond investment into long-term treasury bonds and intermediate-term bonds

Its 40% long-term bond is invested in the iShares 20-Year Treasury Bond (TLT). Bonds tend to be safer investments, although longer-duration bonds are believed to be somewhat riskier investments.

However, bond investments do well – particularly compared to stocks – during a bear market. This allows bonds to balance stocks, which typically grow better during a bull market.

An investment in bonds can also reduce portfolio risk. Treasury Bonds are among the most stable investments in the entire world and are among the more conservative investments an investor can make.

15% of the fund is invested in iShares 3-7 Year Treasury Bonds (IEI). This medium-duration bond fund is a low-risk bond. These stable intermediate-term treasury bonds act as an ideal hedge against inflation, enabling investors to do well even in high inflation.

If you want to go further along the yield curve, you can substitute IEI with IEF, the iShares 7-10 Year Treasury Bond ETF.

Commodities

In the 1970s, investing in commodities was a much wiser decision than purchasing stocks and bonds. A rising inflation environment hurts stocks and bonds as real assets retain value.

7.5% of the fund is invested in gold to provide for growth, risk reduction, and an inflation hedge. The ETF GLD is the simplest way to gain exposure to paper gold. Of course, one can also invest in physical gold using

APMEX is one of the largest dealers of precious metals in the U.S. It offers a safe, trusted way to invest in gold and other metals. Besides one-time purchases, APMEX also offers additional features such as auto-investing or a precious metals IRA.

The remaining 7.5% of the fund is invested in GSG, a broad, diversified commodity index that tracks a variety of commodities across the world.

DBC is another alternative commodities index from Invesco that can be used instead of GSG

Although annual rebalancing is possible, it is recommended to rebalance quarterly to keep the asset weights of the various ETFs in the suggested ranges. All profits from the fund are reinvested, enabling growth to occur in the fund.

It is possible to recreate the Ray Dalio All weather portfolio using M1Finance.

You can read my M1Finance Review and why I prefer this platform to Vanguard, Fidelity, Schwab, or Betterment.

Historical Performance of the Ray Dalio All Weather Portfolio

Anyone interested in potentially investing in this portfolio should consider the All Weather investment strategy and the All Weather fund performance. Has the All Weather Portfolio outperformed the market? How often?

According to historical data, the entire portfolio has performed well, even during market downturns. It has shown constant and consistent growth in various financial markets. As of this writing, the metrics are as follows, with the performance noted below and the U.S. inflation-adjusted return noted in parenthesis:

- One month return: -3.85% (3.85%)

- Six-month return: -2.92% (3.90%)

- One-year return: -13.93% (18.38%)

- Five-year return: 3.90% (.16%)

- Ten-year return: 4.37% (1.76%)

- Thirty-year return: 7.19% (4.59%)

What is most striking about the portfolio returns is that it has performed well in bear and bull markets. Indeed, the fund’s performance occurs irrespective of the global economic picture.

That’s not to say that the fund always performs well or returns a profit: As you can see, the past year has been rough for this fund and the market in general. However, the All Weather Portfolio performance has outclassed the performance of the world economy in general, and portfolio returns remain strong.

It is impossible to predict future conditions. Market conditions may change any day, and this may impact the future performance of the Ray Dalio All Weather Portfolio. The average investor frequently confuses past performance as a guarantee of future performance, but nothing could be further from the truth. This fund’s relatively strong success does not mean it will always be successful in the future.

Benefits of the Ray Dalio All Weather Portfolio

There are many reasons that the average investor may want to consider an investment in the Ray Dalio All Weather Portfolio. Indeed, one of the main benefits of the portfolio is that it provides a solid investment strategy, even for relatively inexperienced investors.

Decent Track Record With Low Volatility

The ability to stick to a portfolio allocation in times of economic stress is one of the major attractions of the All Weather Portfolio. Given the diversification across different asset classes, the portfolio has had a lower drawdown than an all-stock or 60/40 portfolio in times of economic shocks.

Simple and Easy To Understand

The portfolio value and composition are easily understood. Rebalancing happens regularly, ensuring that the portfolio remains protected against future volatility and sticks to its primary goal of being an investment fund that can profit in different economic conditions, irrespective of the performance and turbulence of global economies. Most investors can easily understand the strategy behind the assets and allocation.

Eliminates Decision Fatigue

Many investors want to focus on other aspects of their life, whether starting a side hustle or improving their human capital for a 7 figure salary. The asset allocation of the All Weather Portfolio ensures that you can turn off the distractions in financial media and concentrate on other ways to increase your types of income.

You no longer have to make decisions about your portfolio by trying to guess second if we are in a recession or not.

Low Expense Ratios

With an expense ratio of just .19%, it is clear that the All Weather Portfolio can invest most of its profits into the fund instead of paying managers. Indeed, compared to most similar hedge funds, this expense ratio is extremely low. This means that the fund is lean yet still able to perform well.

Risks and Challenges With the Ray Dalio All Weather Portfolio

No matter how positive its previous returns have been and how the portfolio positions itself as an ideal investment platform for all seasons, every investment comes with risks and challenges. This investment portfolio is no exception.

No New Asset Classes

First, its asset class is unchanging. It ignores newer asset classes, such as cryptocurrency investments or investing in real estate.

While this may allow for a predictable average return, there’s no guarantee that future conditions wouldn’t necessitate a better-balanced portfolio that may further mitigate risk or enable you to make a higher profit.

Indeed, while the Ray Dalio All Weather Portfolio is known for its stability and ability to outperform the market, that’s not to say that it couldn’t do better or that other investment portfolios hadn’t done better. The portfolio sacrifices the potential for gains for a higher ability to weather volatility and generate stable and predictable returns for investors.

Unsuitable for Retirees

For retirees looking to generate cash to maintain their lifestyle, the Ray Dalio All Weather Portfolio may not be appropriate. Currently, the Ray Dalio portfolio has a dividend yield of about 2.1%. While this is not a bad yield by any means, other portfolios, such as dividend aristocrats, offer a higher yield or adjust allocation to generate a better dividend.

The All Weather Portfolio may not be able to generate much cash for reinvestment, and if this is your long-term goal, you may find yourself challenged by the portfolio’s offerings.

If you are seeking retirement income, a better option would be to look at investments for monthly income.

Exposure to Commodities

Third, the commodities section of this portfolio is not entirely as risk-free as possible. Different commodities are exposed to potential risks, including war, weather, climate, etc. Some have argued that the commodities section of this portfolio may have more risk exposure than many naturally risk-advertise investors necessarily want to tolerate.

Also, most commodities index ETFs do not track the actual commodity prices. They are based on futures contracts with a backwardation (futures price is lower than spot price) or contango (futures price is higher than spot price) impact.

Also, different sectors – such as utilities – may be more appropriate for investors looking to stash their cash somewhere safe, relatively low risk, and able to survive both an economic downturn and an inflationary period. After all, there are several recession-proof sectors of the market.

Lower Performance

Although the Ray Dalio All Weather Portfolio makes sense and provides a psychological boost, there might be better portfolios to grow your wealth. Of course, it has yet to keep up with other hedge funds like Medallion Fund, but even a simple S&P 500 investment has outperformed the All Weather Portfolio.

When stock returns are high due to booming economic conditions, the All Weather Portfolio will not compete with other mutual funds since it only holds a 30% allocation in equities.

The low stock allocation reduces the portfolio volatility in times of distress, but returns are sacrificed over the long term. On the bright side, the stock allocation is a bit higher than the Harry Browne Permanent Portfolio.

Who Is the All Weather Portfolio For

Generally speaking, there are two types of people for whom this portfolio may be right:

- Risk-averse individuals looking for a portfolio with a proven track record of success.

- Fans of passive income want a “set it and forget it” portfolio without needing portfolio managers or paying specific management fees.

The excellent track record of performance, low management fees, and solid philosophy over time make this an excellent investment for individuals in either category.

Is this particular asset allocation right for you? That ultimately consists of various individual and systemic factors, including the asset classes you prefer, the overall economic environment, and the general performance of the financial markets.

However, as the historical performance has made clear, there are real benefits to the All Weather Portfolio for institutional investors. It is called the All Weather Portfolio because it tends to perform well in a slew of conditions and can help all different investors meet their financial goals.

If you’re looking to build a portfolio that best fits your risk profile, it’s essential to identify what type of investor you are and what type of allocation is most appropriate for your needs. Investing can be daunting—with so many options available—but the Ray Dalio All Weather Portfolio gives you the tools necessary to construct a portfolio that suits your goals and risk preferences.

With over 30 years of successful investing experience, Ray Dalio has outlined four distinct types of investors based on their attitudes toward returns and risk. Picking the proper asset allocation for each type relies heavily on determining which of these categories best describes you. Consider various factors like life stage, goal horizon, return objectives, liquidity needs, tolerance for volatility, the required rate of return, etc., when deciding which route to take.

As always, you should research, make sure the All Weather Portfolio suits you, and invest accordingly.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.