Homeownership Crisis: How the American Dream Slipped Away in Just 4 Years

Today, aspiring homeowners face a daunting financial reality: earning over $106,000 is now a prerequisite for affording a home comfortably—an 80% increase from January 2020. Median income has risen only 23% in the same time frame putting the dream of homeownership out of reach for many Americans as per the latest report from Zillow.

Rampant Inflation Caused Asset Prices to Increase

Inflation exerts a significant impact on the value of hard assets, particularly real estate. As the general price level of goods and services rises, the purchasing power of currency diminishes. Investors often turn to hard assets like real estate as a hedge against inflation, seeking to preserve and potentially increase their wealth.

Real estate values tend to rise during inflationary periods, driven by increased construction costs, higher demand for housing, and the perceived stability of tangible assets. Additionally, landlords may raise rents to compensate for the eroding value of money, contributing to the overall appreciation of real estate in times of inflation. Home values have surged by 42.4%, with the average home now valued at approximately $343,000.

Fed Raised Rates to Tackle Inflation

The landscape of housing affordability has dramatically transformed in the past four years, with the monthly mortgage payment for a typical U.S. home almost doubling to $2,188, marking a 96.4% increase. Mortgage rates started at a manageable 3.5% in January 2020 and have since climbed to over 8% and currently at 6.6%, further complicating the dream of homeownership. A significant portion of the monthly mortgage payment is now interest cost.

Wage Growth Not Keeping Pace With Rising Prices

The wage growth has failed to keep pace with these rising costs. In 2020, a household earning $59,000 could afford a home without spending more than 30% of its income on mortgage payments. Today, a household would need to earn around $106,500 to afford the same. The typical U.S. household income is around $81,000.

Sharing Rooms to Afford Housing

To bridge this gap, many buyers are now pooling resources with family or friends, exploring co-buying arrangements, or adding roommates to defray the monthly mortgage costs. The median-income household now requires almost 8.5 years of savings for a 10% down payment on a typical home, driving many towards financial assistance from loved ones.

Renting parts of their home to strangers has become a critical consideration for most millennial and Gen Z buyers giving rise to the term “house hacking

Related Article: Learn How To Live for Free in Your House With House Hacking

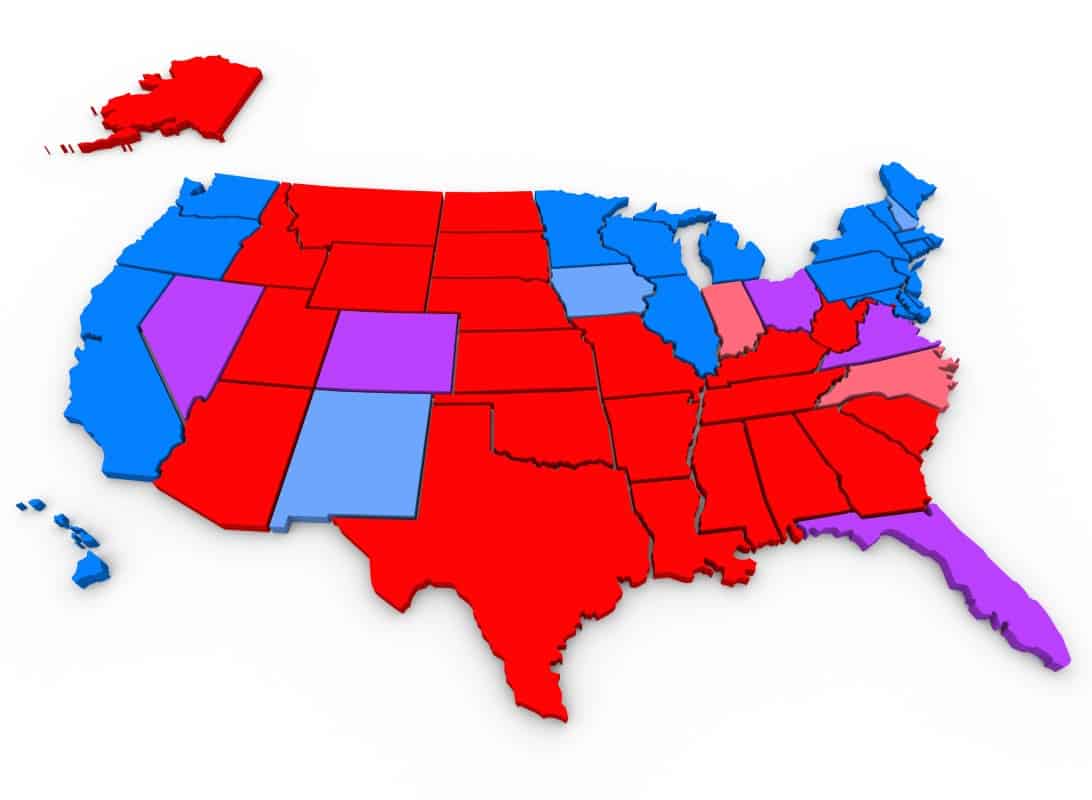

Moving to Affordable Regions

The soaring costs of housing in various parts of the United States have prompted a notable trend of Americans seeking more affordable regions. Faced with skyrocketing home prices and increasing mortgage rates, many individuals and families are choosing to relocate to areas where housing is comparatively more affordable. This migration is driven by the pursuit of financial prudence and homeownership accessibility. Particularly, millennial and Gen Z homebuyers are adopting a pragmatic approach, opting for locales with lower living expenses and more budget-friendly real estate options. As the demand for housing in affordable regions grows, it reshapes demographic patterns and highlights the significant impact of housing affordability on migration trends.

Only 3 Affordable Major Metro Areas

In terms of affordability, Pittsburgh, St. Louis and Detroit are the only major metro areas within reach for those earning less.

The list of affordable cities (with the Income needed to afford homes) is

– Pittsburgh ($58,232)

– Memphis ($69,976)

– Cleveland ($70,810)

– New Orleans ($74,048)

– Birmingham ($74,338)

Over $200,000 Income Needed Here

In seven prominent metropolitan areas, a household must boast an income surpassing $200,000 to afford a typical home with ease. A significant number of individuals in their 20s are choosing to defer the aspiration of owning a home entirely due to the increasingly challenging landscape of housing affordability. The primary demographic of first-time homebuyers for this real estate professional consists mainly of individuals in their 30s and 40s, characterized by a career-centric focus during their renting phase while diligently saving for a down payment.

California Tops the Charts

The San Jose metropolitan area, home to the major tech players such as Google, Facebook, Nvidia and Apple, stands out as the least affordable market. To comfortably purchase a home with a median price in this region, households would require an income of $454,296.

On the “unaffordable” list are three other California cities:

– San Francisco ($339,864)

– Los Angeles ($279,250)

– San Diego ($273,613).

Related Article: Exodus From California to Florida and Texas Continues

Other Coastal Cities Not Far Behind

The remaining three cities on the list include

– Seattle ($213,984)

– New York City metro area ($213,615)

– Boston ($205,253)

While the coastal cities have always been expensive, the rest of the country is also now becoming unaffordable.

Home Affordability Worsening

In the last four years, inflation has fueled a rapid surge in home prices, outpacing the growth of median incomes and rendering homeownership increasingly unattainable for a considerable portion of Americans. What was once a challenge limited to coastal cities has now permeated throughout the country, with a majority of regions grappling with soaring housing costs. In the current landscape, only three major metro areas nationwide remain affordable, highlighting the widespread impact of inflation on the affordability crisis in the housing market.

Like Financial Freedom Countdown content? Be sure to follow us!

Japan and UK Just Fell Into a Recession. Is the US Next?

Two of the largest global economies have officially entered a recession as per the data released last week. Japan experienced an unexpected decline in GDP, attributed to its weakened currency and aging population. Simultaneously, the UK witnessed a contraction in growth for the second consecutive quarter, occurring just months before a crucial election. Economic data released in the U.S. showed rising unemployment. Although the Federal Reserve could cut rates, inflation came in higher than expected effectively causing concern among economist.

Japan and UK Just Fell Into a Recession. Is the US Next?

Trump Tax Cuts Expiring Soon: Action Steps You Need to Take Now

Several key elements of the Tax Cuts and Jobs Act (TCJA) are scheduled to lapse by 2025. This pivotal tax reform, implemented during President Trump’s tenure, brought substantial changes to the U.S. tax structure. With the expiration drawing near, it’s crucial for individuals to take proactive steps in their tax planning.

Trump Tax Cuts Expiring Soon: Action Steps You Need to Take Now

Why 1 in 5 Retirees Are Returning to Work? The Surprising Reasons Behind the Unretirement Wave

In recent years, the concept of retirement has begun to evolve beyond traditional expectations of leisure and relaxation. A surprising trend has emerged, reshaping our understanding of work and retirement’s roles in life’s later stages. As this phenomenon unfolds, we’re left to wonder: What’s drawing so many retirees back into the workforce?

Why 1 in 5 Retirees Are Returning to Work? The Surprising Reasons Behind the Unretirement Wave

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.