QBI Deduction For Rental Property (A Helpful Example Activity Log)

What is Qualified Business Income (QBI) or Section 199A Deduction

Before we dwell into QBI Deduction for Rental property, let us understand what is QBI deduction.

The Qualified Business Income (QBI) deduction, (also called pass-through deduction, or section 199A deduction) was created by the 2017 Tax Cuts and Jobs Act (TCJA).

With the QBI deduction, most self-employed taxpayers and small business owners can exclude up to 20% of their qualified business income from federal income tax.

Rental Real Estate as Passive Income

Although Real Estate has some favorable provisions compared to W2 income; there are some aspects that bother me.

IRS classifies Rental Real Estate as passive. This has several unfortunate implications. Any losses a landlord suffers in Real Estate cannot be offset against income you earn from job, stocks, etc.

Anyone who has ever been a landlord, can attest to the fact that real estate business is never passive. No matter what the IRS says!

In fact, I am often tempted to ask my tenants to call the the IRS commissioner at 2 am when there is a leaky toilet issue. Anyone have his/her number?

Without passive income, your rental losses are suspended losses and can’t be deducted until you have sufficient passive income in a future year. You may not be able to deduct such losses for years.

In short, your rental losses will be useless without offsetting passive income.

On way around this is the real estate professional designation. But we will tackle that in another post.

How To Apply QBI for Rental Property

Solely for the purposes of § 199A, a safe harbor is available to individuals and owners of passthrough entities with respect to a rental real estate enterprise.

Under the safe harbor, a rental real estate enterprise will be treated as a trade or business for purposes of the QBI deduction, if certain criteria are met.

- Separate books and records are maintained to reflect income and expenses for each rental real estate enterprise.

- For rental real estate enterprises that have been in existence less than four years, 250 or more hours of rental services are performed per year. For other rental real estate enterprises, 250 or more hours of rental services are performed in at least three of the past five years.

- The taxpayer maintains contemporaneous records, including time reports, logs, or similar documents, regarding the following: hours of all services performed; description of all services performed; dates on which such services were performed; and who performed the services.

- The taxpayer attaches a statement to the return filed for the tax year(s) the safe harbor is relied upon.

Real estate rented under a triple net lease (NNN) in which the tenant pays for taxes, fees, insurance, and maintenance is not eligible for the safe harbor. Given that the landlord does not spend any time on such properties; this makes sense. Triple net leases are quite hands-off.

Also properties used as a residence by the taxpayer do not qualify for the safe harbor.

One of the books around this topic I found useful was Maximizing Section 199A Deductions: How Pass-through Entity Owners and Real Estate Investors Can Annually Save Thousands in Income Taxes

Why Section 199A Safe Harbor Provision Is Important For Real Estate

The Safe Harbor provision allows rental real estate to be treated as a trade or business for purposes of the qualified business income deduction under section 199A.

While there was a lot of confusion initially with respect to QBI deduction for rental property; the clarifications published by IRS have helped.

However since this is still a new area make sure that your CPA has included the appropriate level of deductions in your tax returns. CPAs do make mistakes on your tax returns.

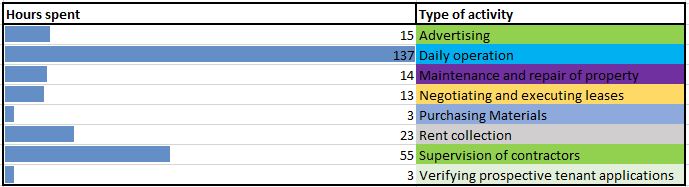

One of the requirements is the onerous documentation of hours spent. Based on the IRS guidance, I have meticulously tracked all the time spent and looks like I spent over 250 hours on my rental property in a year.

Qualifying Activities To Claim QBI For Rental Property

Remember to claim QBI for Rental property, one of the Safe Harbor rules is 250 hours or more of rental service in the year.

Some examples of these activities are

- Advertising to rent or lease

- Negotiating and executing leases

- Verifying information contained in prospective tenant applications

- Rent collection

- Daily operation, maintenance and repair of the property

- Managing the property

- Purchasing materials and supplies

- Supervising employees and independent contractors

The Rental services do not necessarily need to be performed by you as the owner. They can be performed by owners or employees, agents, and independent contractors.

Rental Activities Excluded From Claiming QBI For Rental Property

The Safe Harbor rules explicitly deal with managing the property. So a number of activities which rental owners typically perform with respect to acquisition are excluded.

Activities specifically excluded are

- Arranging financing or any investment management activities

- Acquiring the property

- Studying or reviewing financial statements or operational reports

- Planning, managing or constructing long-term capital improvements. Note repairs are covered but capital improvements are excluded.

- Hours spent on traveling to and from properties

Activity Log Of Hours Spent To Claim QBI Deduction For Rental Property

Based on my understanding of the activities, I maintained a detailed log of all activities and classified them accordingly.

Advertising

In order to ensure I am attracting the best candidates; I spend a lot of time advertising.

This includes the following activities

- Taking great pictures of the unit

- Determining local demand and inventory to inform pricing of my unit

- Rental ad creation highlighting the features of my neighborhood and names of potential employers

- Ensuring ad does not violate any federal and local laws

- Publishing the ad to 3 networks for maximum reach

Verifying Prospective Tenants

After advertisement you will get a deluge of candidates. Make sure you apply the same criteria to verify all prospective tenants.

- Perform a credit check and income verification.

- Read the eviction report for past evictions

- Contact prior landlords, references and current employer.

Daily Operations

This includes

- Creating the rental forms

- Responding to prospective tenants applying

- Reading up on local rental guidelines

- Conducting open houses

- Setting up the background checks

- Cleaning the apartment between tenant turnovers

- Validating tenant insurance

- Contacting prior tenant for old mail

- Evaluating quotes from vendors such as plumbers, electricians, etc for repairs

Maintenance And Repair

Things always break down in a rental property. This category includes all the maintenance and repair activities as part of regular operations. I had to replace a heater last year and also a window.

Negotiation And Executing Leases

- Move-in and move-out walk through as part of the lease

- Calculating any damages

- Return of security deposit

Rent Collection

Most of the rent collection is done in an automated fashion. However I still spend time

- Setting up the rental software with the lease dates, late fees, etc

- Extending or terminating dates based on notices provided by tenants.

A Helpful Example Activity Log

Here is my sample activity log of hours spent based on the safe harbor guidelines to qualify for Sec 199A .

| Date | Hours spent | Activity |

| 2/14/2019 | 6 | Contacting multiple hvac vendors |

| 2/15/2019 | 3 | Diagnosis and Thermostat replaced |

| 3/6/2019 | 3 | Contacting window installers for a broken window |

| 3/10/2019 | 5 | 2 vendors visited for measuring windows to provide quotes |

| 3/16/2019 | 8 | Window installation |

| 4/2/2019 | 2 | Rental software stopped at year end so had to recreate the link |

| 4/12/2019 | 2 | Noticed Rental software skipped April so requested April manually |

| 4/17/2019 | 1 | April skipped rent reminder |

| 4/18/2019 | 1 | April paper check and deposit |

| 4/30/2019 | 1 | Tenant informed payroll issue and to wait till next month |

| 5/13/2019 | 1 | Responding to Lease termination notice |

| 5/13/2019 | 3 | Pics for the rental ad |

| 5/13/2019 | 2 | Creating rental application form |

| 5/13/2019 | 3 | Determining local demand and inventory |

| 5/13/2019 | 2 | Determining pricing for the unit – Rentjungle, rentometer |

| 5/13/2019 | 4 | Writing the rental ad based on rental criteria and Fair housing |

| 5/13/2019 | 2 | Optimizing the rental ad with key locations SEO |

| 5/13/2019 | 1 | Publishing the ad to 3 networks |

| 5/13/2019 | 12 | Responding to posted ad queries by prospective tenants till 5/31 |

| 5/14/2019 | 38 | Reading up latest local rental guidelines – 2 Landlord books |

| 5/17/2019 | 1 | Conducting open houses – A |

| 5/17/2019 | 1 | Conducting open houses – K |

| 5/17/2019 | 1 | Priniting lease documents and addendum |

| 5/18/2019 | 1 | Setting up background check system |

| 5/20/2019 | 5 | Move-out walkthrough including remediation |

| 5/20/2019 | 1 | Calculation of move out amount |

| 5/20/2019 | 42 | Cleaning the unit for next tenant |

| 5/20/2019 | 10 | Creating rental lease complaint with local guidelines including addendums |

| 5/20/2019 | 1 | Conducting open house – J |

| 5/20/2019 | 2 | Reading background check and credit report to make a decision |

| 5/20/2019 | 1 | Verifying information contained in prospective tenant applications |

| 5/23/2019 | 3 | Lease signing including explaining each lease item |

| 5/23/2019 | 1 | Setting up Online Rental collection |

| 5/23/2019 | 2 | Move-in walkthrough checklist |

| 5/28/2019 | 2 | Check returned issue including contacting tenant for alternate options |

| 5/28/2019 | 5 | Validating information again in Application and credit report owing to the returned check fee |

| 5/29/2019 | 2 | Contacting my bank to waive returned check fees and validating it was done |

| 6/6/2019 | 4 | Return of security deposit including buying stamps/envelope for mailing |

| 6/7/2019 | 2 | Responding to previous tenant with respect to deposit question |

| 6/30/2019 | 1 | Contacted previous tenant with respect to old mail |

| 7/12/2019 | 1 | Validate Tenant reported insurance |

| 8/13/2019 | 8 | Research on tankless v/s tank water heater |

| 8/14/2019 | 4 | Contacting plumbers for water heater |

| 8/14/2019 | 2 | Evaluate various plumber quotes based on water heater types, warranty, yelp ratings, responsiveness, attention to detail |

| 8/15/2019 | 8 | Water heater installation |

| 9/5/2019 | 1 | Responding to reference check for previous tenant |

| 12/31/2019 | 36 | Supervision of Gardener |

| 12/31/2019 | 6 | Collection of rent and validation |

| 12/31/2019 | 3 | Purchase of material for the backyard |

| 12/31/2019 | 6 | Mail and package delivery |

Although I have provided my QBI for rental property example, please note that all content on this website is for entertainment purposes only. It does not constitute professional financial, tax or legal advice. You should consult a licensed financial, tax or legal professional for your own situation.

Summary

QBI deduction for Rental Property reduce taxes as long as you maintain separate books and track hours as per the IRS guidelines.

Readers, did you used the QBI deduction when filing your tax returns?

If you have a rental real estate, have you tracked the amount of time spent in actually managing your Rental Real estate? Feel free to borrow my template and log your hours after checking with your CPA.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

Thank you for the information. when aggregating similar rental properties into one enterprise, is it still 250 hours per property or by enterprise

Please check with your CPA depending on how your properties are structured for taxes