What is Forex Trading And Is It Right For Me?

There are very few investors who have consistently made massive fortunes over a while. Jim Simmons, a quiet recluse, has been successful with smaller frequent trades in his Medallion fund. On the opposite end of the spectrum is the brash George Soros, who publicly “Broke the Bank of England” and made billions in a single forex trade on Black Wednesday.

Soros had been building a substantial short position in pounds sterling for months leading up to September 1992. He knew the rate at which the United Kingdom was brought into the European Exchange Rate Mechanism (ERM) was too high, their inflation was triple the German rate, and British interest rates were hurting their asset prices.

The British government failed to keep the pound above the lower currency exchange limit mandated by the Exchange Rate Mechanism (ERM). It was forced to withdraw the pound sterling from the ERM, devaluing the pound. The estimated cost to the U.K. Treasury was £3.4 billion. Soros’ fund profited from the U.K. government’s reluctance to raise its interest rates to levels comparable to those of other ERM countries or float its currency.

Everyone is familiar with investing in stocks, gold, or real estate. But forex trading has always been shrouded in mystery.

What Is Forex Trading?

Forex trading refers to the foreign exchange markets where investors and traders worldwide buy and sell one currency for another.

You might have even participated in forex trading without even realizing it. Anytime I visit a foreign country, I exchange my U.S. dollars for the local currency based on the prevailing exchange rate. In its simplest form, that is forex trading.

Currencies rise and fall against each other depending on various economic and geopolitical news. If you can buy low and sell high, you can make a profit in forex trading. Demand for particular currencies can be influenced by interest rates, central bank policy, GDP, and country’s political environment.

Because of forex’s global nature, the markets trade for 24 hours a day, five days a week. Forex markets are the most liquid markets in the world.

Forex Trading Terminology

Forex markets have different terminologies and nuances for trading. Below is the list of most common terms.

Currency Pairs

Traders frequently trade currencies by selling one currency and buying another. Forex trading always involves the exchange of currencies in pairs. You could have a EUR/USD pair for U.S. dollars and Euros. You can have similar pairs against the Japanese Yen or the Australian Dollar.

The Major Currency Pairs are the four most heavily traded currency pairs in the forex market. Because of the massive liquidity, you can always trade them with the lowest spread. The four major pairs are EUR/USD, USD/JPY, GBP/USD, USD/CHF. Note that the U.S. dollar is involved in every major pair because it is the world reserve currency.

The Minor Currency Pairs don’t include the U.S. dollar and are also known as cross-currency pairs. For example, EUR/AUD and CHF/JPY.

The first currency in the pair is the base currency, and the second currency is the quote currency.

If you are bullish on the European Union, you want to buy EUR and sell JPY. In this case, you would buy the EUR/JPY pair.

If you are bearish on the Japanese yen, you want to buy USD and sell JPY. In this case, you would sell the JPY/USD pair.

The Forex Quote determines the price at which you do the buying and selling.

Forex Quotes

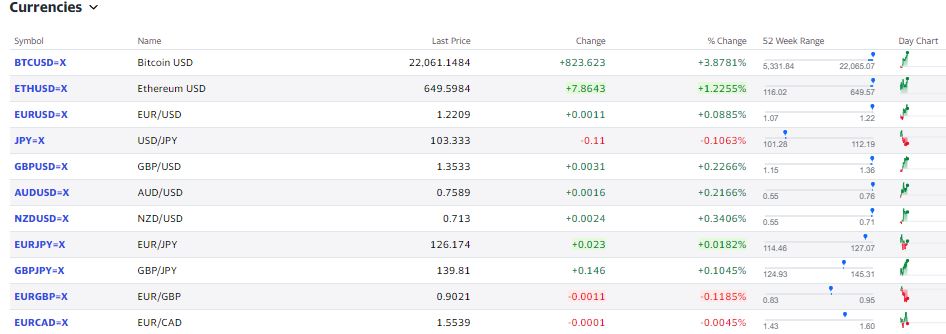

The EUR/USD is the currency pair, and the price is 1.2209. The price indicates that for every Euro you sell, you could buy 1.2209 USD.

The 52 week range indicates that in the last year, the price has fluctuated from 1.07 to 1.22. You make a profit when you sell a currency for more than what you paid for.

PIP

You might have noticed the forex quote has four places to the right of the decimal. The smallest price change that a given exchange rate can make is the pip. Most currency pairs, except Japanese yen pairs, are quoted to four decimal places. After the decimal point (at one 100th of a cent), this fourth spot is what traders watch to count “pips.”

For example, if the EUR/USD moves from 1.2202 to 1.2205, we say the EUR/USD has increased by three pips.

Forex Lot

Forex is traded in lot sizes.

Standard Lot = 100,000 units

Mini Lot = 10,000 units

Micro Lot = 1,000 units

A larger lot size involves more risk due to the amount of money involved. If you are starting, always trade in micro lots.

Leverage

Forex traders often use leverage to juice up the returns. Since currencies trade in a small range, they want to amplify their gains. The challenge of leverage is that it cuts both ways. If you are right, then using a 50:1 leverage will increase your profits by 50 times. However, if you are wrong, then you lose 50 times more.

For this reason, it is advisable to avoid using leverage when trading forex.

Can You Get Rich By Trading Forex?

Forex investors make money by deciding what currencies will rise and fall. Some traders swear by technical analysis and others will rely on fundamental analysis. Traders believe they know what direction the currency would move based on the latest news. The challenge with making money trading is that the same information is also available to everyone else, including professional investors.

An individual investor who is not involved with trading the forex market for a living would find it very hard to make money. You could get lucky once or twice. But eventually, your steak runs out.

The individual investor has no advantage over professionals who do this for a living. My four worst investments article highlights how easy it is to lose money when trading against professional investors.

As they say in poker, if you’ve been in the game 30 minutes and you don’t know who the patsy is, you’re the patsy.

Warren Buffett, February 29, 1988

Professional traders have powerful trading tools to take advantage of their online forex trading strategy. The trading platforms provide signals for automated trading and scalping. Forex scalping methods place trades for 1 to 10 minutes and close positions after gaining five pips. An algorithmic trading system combined with leverage enables the professional traders to day trade forex pairs better than individual investors.

If you want to grow rich and retire early, the best plan is to accumulate income-producing assets. Most stocks pay a dividend, or they increase in value like moonshot stocks. The rental property provides income in the form of rent and appreciating property prices.

Forex trading only makes money if you are right in timing and direction of currency prices change. You cannot have a “buy it and watch it grow” approach with forex. If you are wondering “when can I retire” it is quite likely that forex trading won’t help you.

Who Does Forex Trading

Professional investors trade forex to make money. Trading is done in the spot market, where exchange rates are determined in real-time depending on the current economic and geopolitical factors.

Global companies actively trade forex as well in the futures market. They create a contract to buy or sell a predetermined amount of a currency at a specific exchange rate at a date in the future. The primary purpose is not speculation but as a hedge.

For example, Infosys (NYSE: INFY) is a Consulting company headquartered in India, but they have clients worldwide. They report results on the Indian Stock Exchange. Since the Indian rupee trades in a wide range against the U.S. dollar, Infosys would use the forex markets to hedge against currency risk.

Similarly, ARAMCO (SAUDI-ARAMCO) is one of the leading players in the petroleum and natural gas industry. It needs to hedge its commodity exports against price changes in U.S. dollars.

Final Thoughts On Forex Trading

Forex is part of our everyday life as a result of living in an interconnected global economy. Currencies usually trade in a tight band. If a currency suddenly depreciates, it could be an indicator of upcoming inflation or potential geo-instability.

It is tough to get rich with forex trading for individuals. You might lose all your investment. To be profitable, one needs a deep understanding of the macroeconomic fundamentals driving currency values coupled with technical analysis experience. And it would help if you traded on it before anyone else does.

Proceed with caution if you decide to incorporate forex trading as part of your investment strategy.

Readers, have you considered forex trading? If you did trade, what was your experience?

I originally wrote this original article for Your Money Geek. It has been republished with permission.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

What a great discussion about FOREX and who this type of trading may actually be for.

I have a friend who is a CFA and swears by technical analysis for FOREX. He’s also made some money in the markets with this trading strategy. However, I completely agree that FOREX is certainly not for everyone – especially not the skilled and professional investor. In those cases, I agree with what you said – it very well makes sense to go another route such as index investing, purchasing real estate or other income producing assets.

Great read!

Fiona

Yes, many people rely on technical analysis. Hoping your friend’s winning streak continues. I know many people who had one down day wipe out not only the profit, but also their initial investment 🙁