What Is Hard Money Lending and 5 Alternatives to Hard Money Loans

Are you looking for a fast and easy way to get funding for your next real estate project?

It’s hard to get a loan when you don’t have perfect credit. Also, traditional lenders are not always willing to lend money if the property you are buying does not meet their defined lending criteria.

It can be incredibly frustrating because you may need money in a hurry to grow your business.

Hard money lenders can help. Let us dive in and understand what is hard money lending. What are the pros and cons, and how to find hard money lenders? Finally, let us explore alternatives to traditional hard money.

What Is Hard Money Lending?

Hard money lending is a short-term real estate loan obtained from private investors or individuals at rates higher than a traditional lender based on the value of the property instead of the borrower’s creditworthiness.

There are many circumstances where a person may need to borrow money or raise capital for real estate investing. If a traditional mortgage does not work, there are many financial options available to you to draw down credit and get access to the cash you need.

One of the more popular options is a hard money loan. Loans are quick, secured by that property, and comparatively easy to get if you have property.

What Is a Hard Money Loan?

A hard money loan is a type of loan secured by real property. The loan is based on the property, meaning that the borrower’s creditworthiness is not what is taken into account when making a hard money loan offer. As such, the value of the real property determines the amount of money you can borrow.

Lending money based on an asset is prevalent among hard money borrowers. Owners of investment properties have repeatedly used these strategies as part of an effort to gain access to additional capital and invest in real estate. Hard money loans are a form of secured loan, so you have to have financial access to the asset.

Don’t use hard money loans for long-term financing. Use them primarily for short-term funding, typically for no more than a year before you should fully pay it back. A hard money loan is used on an investment property or to purchase an investment property. It makes hard money loans the preferred method of loans for many real estate investors or private investors.

There are many common uses of a hard money loan. You can use it

1) for the down payment on a real estate purchase

2) as an alternative to traditional financing

3) as a bridge loan for other financial purchases

4) to cover closing costs of a loan

5) to reduce the need for home equity loans

6) to outbid other investors by purchasing a property in cash and negotiating a lower purchase price

7) for various purposes directly related to home renovations

8) or to get around needing to borrow money from another private lender.

When used correctly, they enable real estate investors to act as their lending services. It makes hard money loans a perfect bridge – to traditional mortgages or traditional loans. Hard money loans are a critical part of the personal finance model of many real estate investors.

How Does a Hard Money Loan Work?

Hard money loans are also known as “secured loans” since they are tied to a specific asset, namely a piece of real estate. As such, you can’t get a hard money loan without owning a piece of real estate. Fortunately, hard money loans are relatively common for real estate investment. As a real estate investor, it provides funding options instead of a personal loan.

You’ll have to identify a hard money lender. Generally speaking, a hard money lender can’t be found with anyone who offers a traditional loan. However, loan officers at banks and credit unions may know private lenders involved in real estate investing.

You will want to shop around and find the best interest rates possible. The average interest rate on a hard money loan is higher than on traditional loans. So you will want to keep this in mind when finding the best price and option possible.

You will have to go through the standard paperwork. A lender will check to confirm the property’s value using an appraisal. And ensure that you are the property owner in question via a title search. You will have to provide any documents necessary to prove as much. However, once that is done, you should be good to borrow the money. The property will essentially be used as collateral in this case. If you fail to make payments, you risk having a lien placed against your property, or you may risk losing it altogether.

Obtaining a hard money loan can be considered the other side of a real estate note transaction. As a borrower, you take a hard money loan against your property. The mortgage note secures the loan, and you have to pay the lender as per the terms of the note.

Mortgage notes have different terms. The hard money note will have a shorter period, typically less than a year. Also, depending on the deal, the borrower can work out an arrangement to not make periodic interest payments and only pay back the interest with the principal at the end of the term.

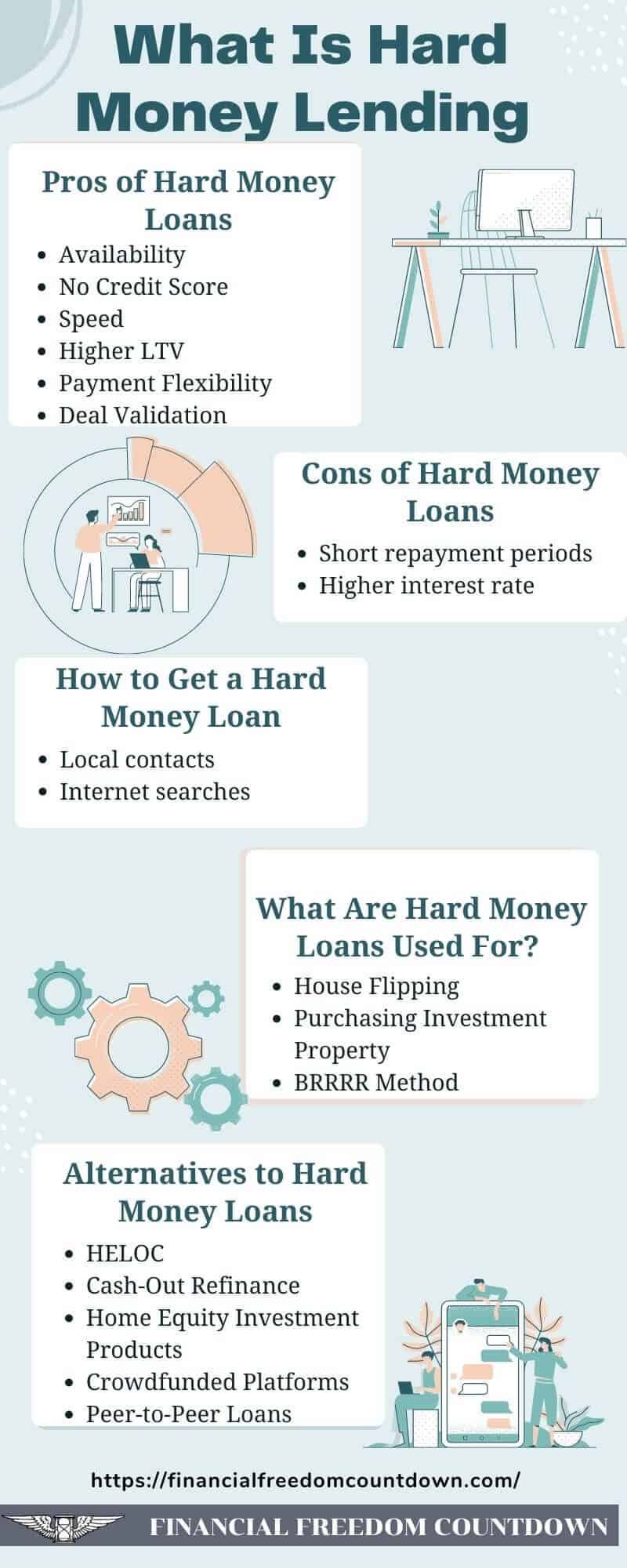

Pros of Hard Money Loans

Hard money loans are beneficial and flexible methods of acquiring the funding you need. They work well and are a good way of avoiding the stringent approval process of other loan types. Some of the benefits of hard money loans are

Availability

Most lending institutions that offer conventional loans or a traditional mortgage will not provide a hard money loan. However, with the low yield of fixed income investments, many individuals are ready to offer one. They are relatively easy to get and a relatively common form of financing for many real estate investors.

No Credit Score

The borrower’s creditworthiness is not considered part of a hard money loan. It means that you can get a hard money loan based solely on the value of your property, not your credit history. It also helps to explain why they are so popular among real estate investors, even those who have typically struggled to gain access to funding in the past.

Speed

Compared to conventional loans or conventional financing, hard money loans come fast. Conventional loans can take two months, even if things go perfectly. Hard money loans may be deposited in a borrower’s bank account within a few days. Most lenders will be able to get it to a borrower in as little as a week. It provides a considerable advantage over a conventional loan or conventional financing.

Higher LTV

The available loan amount is usually as high as the property value. It ensures that you can use the total value of an investment property and do not need a higher down payment to secure the property. It makes these loans very popular with house flippers and wealthy investors alike.

Payment Flexibility

Many hard money loans have highly flexible payment options. For example, you may be able to make interest-only payments for some period. Or even structure the hard money loan so that you back the principal and interest at the end. Of course, this does mean that you’ll be paying more off eventually.

Deal Validation

Hard money lenders are well versed in evaluating rental property deals because they fund many other investors and can recognize a profitable deal from a “money-pit.” If several hard money lenders decline to fund your deal, it is time to be cautious since experienced investors anticipate potential risks.

Cons of Hard Money Loans

There are several real estate investment risks so one should have an appropriate risk mitigation plan in place. Despite all the advantages here are some of the significant potential difficulties with hard money loans.

Short repayment periods

You will agree to it ahead of time, but most hard money loans don’t have long pay periods. You will be expected to pay back the money you borrow as quickly as six months or several years. It explains why hard money loans are often used for brief periods until more stable and affordable financing comes in.

Higher interest rate

Hard money loans come with much higher interest rates. The base interest rates range much higher than other forms of funding typically found in corporate finance loans such as Federal Housing Administration (FHA) loans, VA loans. You also have points charged, increasing the total hard money loan rates to higher than that provided by traditional lenders. Furthermore, you will still have the usual suite of fees that you have to pay, including origination fees. It results from a hard money loan being based on a tangible asset.

What Are Hard Money Loans Used For?

Here are a few of the most typical reasons people take out hard money loans.

House Flipping

Hard money loans, also known as bridge loans, are best suited for flipping houses. Investors buy low-cost houses that need upgrading, make value added real estate repairs and renovations, and then sell the properties for a profit.

Professional flippers frequently prefer quicker forms of capital because these projects usually take place in a short period. In addition, because house flippers try to sell the property as quickly as possible – often within a year or less – they don’t require a long-term loan.

Also, the houses which are prime candidates for flipping houses do not typically qualify for bank loans since they are not in a habitable condition. Banks often do not lend on properties with structural issues.

Purchasing Investment Property

Individuals who want to invest in a rental property but don’t qualify for traditional financing might seek a hard money loan.

This approach may benefit those who cannot obtain a regular loan due to their lack of excellent credit scores. Or for people who require more money than a typical lender will provide. Or if they do not have the down payment. Using hard money loans to buy an investment property raises the acquisition costs, so one needs to factor these details when evaluating a rental property.

Although hard money loans are an option, traditional financing offers better rates. Therefore, improving your credit history should be a priority.

One should constantly monitor the credit reports. Even if you have excellent credit habits, identity theft and errors in credit reports can cause your score to tank, and you might not even know about it. Credit Karma partners with Equifax and TransUnion and offers free credit reports and free credit scores updated weekly. It also provides alerts when it detects unusual activity on your credit files.

You can also sign up with Transunion with a paid subscription for additional monitoring and peace of mind.

BRRRR Method

The BRRRR method is a real estate investment technique. You purchase a distressed property, fix it, rent it, and cash out and refinance it to fund your next BRRRR rental property.

For BRRRR to yield the highest profit, one should buy a house that needs repairs. Because the property condition is terrible, it will be cheaper to purchase and will be a great deal. Financing will be complex, and you might need to rely on non-conventional funding.

Hard money loans are the best way to obtain financing.

How to Get a Hard Money Loan

Local Contacts

Real estate company owners, real estate investors’ clubs, local REI meetups, and a local real estate agent are all excellent references. You need to contact several hard money lenders and establish a rapport before closing on a property. Unlike a traditional loan, one can customize the terms of hard money loans.

Internet Searches

To locate hard money lenders, go to websites of institutions that specialize in these kinds of deals. Quick internet searches for hard money lenders may provide several lenders in your region.

Since hard money loans are less regulated, you’ll have more options. You may be able to get lower rates or negotiate different terms with other lenders if you shop around.

Online Lending Platforms

If you do not have local contacts, online lending platforms can be a better choice compared to reaching out via random internet searches.

Platforms such as Groundfloor Lending permit real estate investors to borrow funds for their fix-and-flip projects. Create a borrower account today to learn more about becoming a borrower.

Alternatives to Hard Money Loans

As you can see, a hard money loan unquestionably has its use. Still, there are circumstances where alternatives to hard money loans may be preferable. It may be for many reasons, including interest rates, available credit, current economic events, or more. Fortunately, there are many options. Real estate investors should make sure that they thoroughly survey the real estate industry and other available private loans, as hard money loans typically can be expensive, even in the short term.

Banks and financial institutions ensure that the lending services are wide-ranging and can encompass a range of uses and economic situations. It behooves an investor to check out more traditional forms of loans before deciding to take out a hard money loan and relying on other people’s money to finance their real estate purchases.

HELOC

A HELOC – or home equity line of credit – is a prevalent financing method used when someone has a real estate asset they want to borrow against. It essentially turns your house or other real estate assets into a line of credit.

With a HELOC, your home is turned into collateral. You borrow against the money, putting up the equity in your home as collateral. You pay the money back over time. The main benefit of a HELOC, as opposed to other loans, is you’re not pulling equity out of your house. Instead, you are borrowing against that equity, which turns your home into an asset that you can borrow against.

The challenge is that this does place a lien against your home. Fortunately, once you pay off the HELOC, the lien goes away.

Cash-Out Refinance

Cash-out refinance requires that an individual have an asset that they have built equity into. The property is then refinanced, with the borrowers taking some of the money out of the property and investing it elsewhere.

You’ll have to pay the money back, as you will essentially be taking out a larger mortgage than you initially put down. Like any other loan, you will have to pay interest on this loan. However, the benefit of a cash-out refinance is that you borrow against the equity you already put into the house, giving you access to money you have already paid.

Home Equity Investment Products

Another option for hard money loans is using home equity investment products. A home equity investment product’s advantage over HELOC or cash-out refinancing is that you do not need to repay the loan immediately.

You get access to the equity you’ve built up in your home without interest or monthly payments. The home equity investment products usually can get you the cash you need in as little as three weeks.

Home equity investment products are flexible since you can put the money toward whatever is most important to you, whether that’s paying off debt on personal loans, renovating your home, paying for a child’s education, or putting a down payment on a second home.

Check out Hometap or Unison, which provides money today, and participate in the proceeds at settlement. When you sell the house, you repay them with the loan and the amount of growth in equity.

Crowdfunded Platforms

Another alternative to obtaining loans is on a real estate crowdfunding platform. We have talked about how you can be an investor lending to others on such platforms. And how to use a checklist to evaluate real estate crowdfunding deals. In this case, you are the borrower and should use the list to make your property attractive to investors.

Peer-to-Peer Loans

Peer-to-peer loans have emerged as a relatively new way of lending money to individuals. They are not legal in every state, but they can be a good form of last-second financing when they are needed. Many websites, such as Prosper or Funding Circle, will send these loans to investors. They are essentially crowdsourced loans. Individual investors own small shares of these loans and then get repaid as the borrower repays the money. Interest rates are determined by the total credit risk of the private individuals taking out these loans.

These loans are often costly, with interest rates being very high. However, they can be helpful as a last resort funding source for an investment purchase. They are typically only used by people who have no other options or are just starting as real estate developers.

Final Thoughts on Hard Money Lending

Real estate is one of the most accessible income-producing assets available to individuals looking to improve their average net worth.

While there are several ways to invest in real estate with little to no money down, sometimes one needs access to financing.

Hard money loans can be an excellent alternative to going to a local bank or credit union, filling out a loan application, or proceeding with a more complicated financing effort. Hard money loans are independent of credit scores or debt to income scores. They are not viewed as higher risk, as the property secures the loan.

You may wind up paying higher interest payments. Still, these loans’ straightforward approval process and increased accessibility indicate circumstances where a hard money loan may be perfect, especially if you have trouble accessing more traditional funding.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.