Stocks Vs. Real Estate: What Is The Better Investment?

Have you ever wondered if it’s better to invest in stocks vs. real estate? We already covered the topic of investing in 401(k) vs. real estate. But 401(k) has an unfair tax advantage, and often you still have this question after maximizing your retirement accounts. Let us figure out today; if real estate investing or stocks will make you richer?

While most Americans have a large percentage of their net worth tied to their primary residence, we would specifically be looking at investment real estate. We will be comparing the pros and cons of stocks or real estate investment properties. We will also analyze historical data and show you how to calculate stocks vs. real estate returns based on your local real estate market data. By the end of this article, we hope you have a clear understanding of whether investing in real estate vs. stocks would be more beneficial to your financial situation. Let’s dive in!

Pros Of Investing In Stocks

Low Investment Costs

Compared to commercial real estate investing, anyone can buy shares in mutual funds or Exchange Traded Funds (ETFs) for a relatively low amount. Fee-free platforms like M1Finance make it easy to start investing in stocks and ETFs for just $10/week. You can read my M1Finance review and how I invest in stocks.

Easier To Diversify

Diversification is a good investment strategy for any portfolio. Diversification means investing in a variety of assets to reduce risk and increase profit. Due to the low investment costs, stock investors can spread their money across thousands of companies across various countries, industries, and market cap for the same price as the down payment on one rental real estate.

When stock investors spread their money across different stocks, this reduces a single company’s impact on their overall profit. In comparison, a real estate investor has to invest all their capital into just one property due to the high downpayment needed. It is harder to diversify a real estate investment portfolio.

Dollar-Cost Averaging

One of the most effective investment strategies is dollar-cost averaging (DCA). DCA means that you purchase an asset or investment with a fixed dollar amount on a regular schedule over time regardless of what the market is doing. Platforms like M1Finance allow stock investors to automate their share purchases weekly. Since they invest their money over some time, stocks investors are never stuck buying at the peak.

With rental real estate, though, you cannot get the benefit of dollar-cost averaging. The purchase is made at one point in time. If your timing is terrible, you could be stuck buying at the peak of the market.

Liquidity

Stocks are highly liquid. It means that stock investors can sell their stocks quickly, whenever they want. Your investment can be locked up for years in commercial real estate. Unlike investment real estate, it’s also easier to know the value of your stock’s net worth at any given time.

Dividends

Some stocks pay dividends. These are extra returns produced by the company in addition to the average appreciation of your stock price. Dividends permit stock investors to have a nice passive income stream. If you continue holding on to these stocks and reinvest the dividends, you will see your net worth increase exponentially after a few decades of compound growth.

No Transaction Fees

Due to the competition and the addition of new players in the stock investment market, stock transaction fees have dropped to almost zero. The absence of any transaction fee helps stock investors to keep most of their profit to themselves.

Compare this with real estate: You will pay anywhere from 4-6% in transaction fees when buying and selling a home, depending on your local real estate market. There are also closing costs associated with purchasing an investment real estate, such as commissions, title searches, and legal fees.

Stepped-Up Basis

One of the chief components to build generational wealth is to keep your money in the family (and out of Uncle Sam’s hands). If you invest in stocks, when you die, your heirs can claim a stepped-up basis on what you paid for the stock. If the company’s growth is significant, they inherit its value at the time of death rather than what you paid for it. So your heirs get a huge tax break and a larger inheritance to boot!

No Knowledge Needed To Invest In Index Funds

In the past, when people thought of investing in stocks, most people tended to believe that you needed a lot of experience and knowledge to invest in the stock market. However, today this is not the case.

Nowadays, they can choose from investment options such as index funds (index funds are mutual funds that track the performance of an underlying index like the S&P 500) and get started without needing to analyze individual companies.

Cons Of Investing In Stocks

Less Control Over Your Investments

The first significant risk is that you do not have complete control over where you are putting your money.

Apple could stop being innovative and become the next Blackberry. Congress could consider Facebook a monopoly and break it up. Elon might jump on SpaceX rocket imploding in flames, causing my Tesla stock to crash. Of course, diversification with an index fund approach will mitigate some of the risks, but company-specific factors are still outside my control.

With commercial real estate investing, investors know what they are investing in and where their money is going. However, with the stock market, the investor does not know what companies they are potentially handing their money over to or what those companies plan for that money.

Stocks Can Trigger Emotional Decisions

Property prices change over time, but the data is not always available in real-time or in your face all day.

Stock prices constantly change, which takes an emotional toll if you are constantly distracted. Another major con of investing in the stock market is that it can trigger emotional decision-making. Watching the daily gyrations of the stock market across every news channel can be nerve-racking. The talking heads on TV can make you second guess your every move, making investors frustrated and selling their stocks at a low.

Stocks are risky based on your investment temperament. If you are easily influenced by the constant news cycle and wonder, “should I sell stocks now “it can be hard to hold on to the shares.

The emotional risk of stocks might not be a huge factor if you have the stomach to withstand a crash and not react impulsively.

Market Risk

The stock market is vulnerable to short-term risks, such as the health of the companies you invest in. If a company goes bankrupt, it can have a spillover effect on the stock prices of other companies within the same industry.

Specific sectors could be hit hard depending on the market conditions. Airline and retail stocks were hit when the economy was shut down. Tech stocks fell during the dot com crash. You can never predict the market risks.

Interest Rate Risk

Other risks are unique to the stock market, such as interest rate risk.

Technology stocks have done well in a falling interest rate environment since they have enough runway to build their market share even though they are currently unprofitable. Investors in a low-interest-rate environment are willing to fund the growth of these companies.

Growth stocks do poorly in a rising interest rate environment since investors are unwilling to fund companies reliant on future cash flow projections.

Higher Risk With Leverage

The stock market is also highly susceptible to the use of leverage. Leverage can be a great way to juice up your returns. However, the danger lies in that if the investment does not go as planned, it can result in heavy losses and even bankruptcy.

I highly recommend avoiding any form of leverage trading in the stock market. You will receive a margin call when stocks fall, and the brokerage will liquidate all your shares at fire-sale prices unless you add additional capital to the account.

No Special Tax Deductions

Long-term capital gains and qualified dividends are taxed at lower rates compared to W2 income. However, when you sell your stocks, the capital gains are still taxed. Contrast that with tax advantage for commercial real estate investing, where you can defer the capital gain as per the IRS with section 1031 exchanges .

Higher Risk With Leverage

The stock market is also highly susceptible to the use of leverage. Leverage can be a great way to juice up your returns. However, the danger lies in that if the investment does not go as planned, it can result in heavy losses and even bankruptcy.

I highly recommend avoiding any form of leverage trading in the stock market. You will receive a margin call when stocks fall, and the brokerage will liquidate all your shares at fire-sale prices unless you add additional capital to the account.

Pros of Investment Real Estate

You Are Responsible

With stocks, you are handing your money over to another company. When it comes to investing in real estate, though, you are in control of what happens with your investment since you own the property.

When commercial real estate owners buy a rental property as an investment, they are directly responsible for the investment returns of their real estate portfolio. Rental property investment returns depend on your high income skills to find a great deal, analyze and negotiate a deal. Or fix up the property, increasing the value. Or your photography and copywriting skills to attract a great tenant. Or your management skills in keeping a great tenant. Or all of the above.

One of the biggest pros of real estate for a Type-A personality is that you are responsible for your real estate portfolio’s success and failure.

Contrast this with stocks where you have no control over the returns. I could do all the research and pick Tesla as part of my Moonshot Investing portfolio. But Elon could send a tweet causing the price to drop. Nothing is in my control with stocks.

Potential To Force Price Appreciation

Another major pro of investing in real estate vs. stocks is the ability to increase the property’s value since you own the property. The forced appreciation is in addition to the regular price increase, which depends on your local real estate market.

I am not referring to the tons of sweat equity you need for a fix and flip property or when wholesaling real estate by forcing price appreciation.

You can pull simple one-time levers to generate additional cash flow even with buying and holding long-term rental property using value add real estate strategies.

For example, you rent a single-family house to a tenant. But the tenant is a hoarder and also pays for a self-storage unit offsite. You could install a shed in the backyard and charge extra for the shed. The tenant pays a lower amount compared to the storage unit and can access her stuff more easily. You get the increased cash flow every month. It is a win-win situation.

Or you might own a fourplex and decide to install a vending machine on site. The tenants don’t need to drive to the store for a quick snack, and you get additional income from your real estate portfolio.

Or you might notice that the rental units do not have their individual utility meters. Rental property owners can implement Ratio Utility Billing System (RUBS) to eliminate the utility expense from their balance sheet and promote conservation.

When you own stocks, you have zero ability to influence the stock price.

Ability To Use Leverage

Many investors like to use other people’s money (OPM) when they buy a property, which allows them to get into the property market on a budget. Using leverage, investors can pay less of their capital and borrow the rest from a bank or other lending institution. The use of leverage also increases your net worth substantially.

Unlike investing in stocks, where it could be dangerous to invest with borrowed money, you can use significant amounts of financing when investing in real estate without adding a ton of risk.

The USA is one of the few countries with low fixed interest rate mortgage loans backed by government institutions like Fannie Mae and Freddie Mac.

Just be sure not to over-leverage yourself.

Personal Assets Protected

There are 12 non-recourse states in the US. Even in the worst-case scenario where you use excessive leverage and end up with negative equity on a bank loan, you can hand over the key to the bank and walk away.

Recourse and non-recourse loans allow lenders to seize the property after a borrower fails to repay a loan. With a non-recourse loan, lenders can foreclose on the property but may not go after your other assets.

If the value drops significantly and you are confident that the property value never recovers, consider your options accordingly if you are in a non-recourse state. Protect your net worth at all costs.

Most mortgage loans are recourse loans, except in 12 states that forbid recourse home loans, namely Alaska, Arizona, California, Connecticut, Idaho, Minnesota, North Carolina, North Dakota, Oregon, Texas, Utah, and Washington.

Of course, when you are involved as a lender and evaluating crowdfunded real estate investments, avoid the non-recourse states.

Familiarity With The Investment

If one has already purchased their home, it is a quick learning curve with rental investment properties. Of course, investing in a rental property is not as easy as pushing a button and buying a stock or index ETF. However, it is still more accessible than other investments on our list of passive income-producing assets.

Consistent Cash Flow

Some types of real estate investments, like vacant land not being developed, may never produce any cash flow for investors until they sell it off. However, rental properties provide a steady cash flow generating a real estate passive income stream.

Stocks do pay dividends creating passive income; however, the dividend yield is unpredictable. If the company is going through hard times, it will often cut the dividends.

Loan Pay Down

Typically you would buy the rental investment property with a loan. The tenants with their monthly rent payments are paying down the loan for you. If you hold the property as a long-term investment, your loan will be gone in 30 years or sooner. And you now have the property free and clear. The loan pay down again increases your cash flow.

Tax Advantages

Rental property investment offers many unique tax advantages. Internal Revenue Service (IRS) provides a mechanism for recovering your cost in an income-producing property and shelter capital gains.

Rental property owners can deduct or depreciate many repair and maintenance costs on their taxes when they own the rental property. It would be best if you took this depreciation over the expected life of the property. You can also use accelerated depreciation if you follow cost segregation.

You do have to pay back the depreciation when you sell. IRS has rules for Depreciation Recapture to be taxed as ordinary income.

After you sell your rental property, commercial real estate owners can rollover the profits into your next investment property. Capital gains tax can be deferred using section 1031 exchanges as you scale into bigger and better properties. The government wants you not to pay taxes as long as you invest that capital gain into more rental properties.

When you borrow money from the bank or create a real estate syndication structure, your interest expense is tax-deductible and will help reduce your taxable income.

Your insurance premiums and property taxes are also fully deductible as business expenses.

Any travel associated with the rental property is also a tax-deductible expense. Wouldn’t it be nice to visit Hawaii inspecting properties to buy on Friday and Monday with your CPA advising you that you can deduct the entire trip, including your weekend stay?

The Tax and Jobs Cut Act also provided for QBI deductions for rental properties.

For more tax benefits, check out books on Tax Strategy for Real Estate Investors and Advanced Tax Strategy for Real Estate Investors.

I am not a Certified Financial Advisor, Financial Planner, or tax expert, so please read the books and consult a licensed professional to plan your tax and investment strategy.

Generational Wealth Transfer

Real estate is one of the best ways to transfer generational wealth to your heirs. Just like stocks, your rental property gets a stepped-up basis when transferred to your children and grandchildren.

Although Congress might reverse the stepped-up benefit for stocks, I am more confident of them retaining it for real estate. It is easier to incite outrage over stock investments compared to real estate.

Don’t believe me? Look at the recent White House American Families Plan proposing an exemption for farms and family-owned businesses. Because the average American thinks stocks are for wealthy Wall Street and farms are for the middle class, I am bullish on farmland investing.

Also, if you read the plan, family-owned businesses are exempt—a great incentive to start an online business.

In California, Prop 13 protected your property taxes from exorbitant increases on an annual basis. However, the passage of Prop 19 wiped out the former Prop 58 and Prop 193 family transfer benefits for all rental properties.

If the home was the primary residence of parents and the child makes it their primary within a year of death and the fair market value at the time of death is under $1M, then you will retain the Prop 13 value. Anything above $1M has the formula to calculate the blended tax rate.

Although California no longer benefits from retaining tax basis on rental properties, check if your state or county still provides an exemption for assets transferred on death or via an estate plan.

Intrinsic Value

When you buy real estate, you own physical land or property with intrinsic value. It’s not just paper or digital like stocks and bonds, so even in the worst of financial crashes, it can still be worth something.

Real estate is something you can see, touch, and physically use. It is a tangible asset. Everyone needs a roof over their head.

Lower Volatility

Because of the transaction costs involved in buying and selling real estate, investors are not trigger happy to buy and sell real estate. Also, if the landlord can obtain a passive cash flow through rents, they are unlikely to sell immediately in a downturn. As a result, real estate investors experience less volatility compared to stock investors. Other than the Great Financial crisis, I don’t remember anyone constantly talking about the real estate prices during an economic downturn.

Cons of Investing in Real Estate

There are several real estate investment risks so one should have an appropriate risk mitigation plan in place.

High Transaction Costs

Buying and selling real estate has a lot of transaction costs compared to stocks which can be bought and sold for free on a platform like M1Finance.

On average, when you buy or sell, the commission itself is around 6%. And you have to add closing costs, title insurance, and a host of other charges.

Higher Operating Costs

You may need to pay property management fees to rent out your property if you do not have the time or skills to manage the property yourself. Besides the regular expenses like broken toilets, you also have to deal with significant capital expenses such as roof replacement or plumbing upgrades.

And don’t forget property taxes. Even if you hold vacant land that doesn’t provide income, the government will still charge you property tax annually.

Needs More Knowledge

When investing in stocks, you can just buy a low-cost, diversified index ETF. However, buying, operating, and selling real estate requires a lot more knowledge. It’s not an easy task to become a real estate investor. You have to deal with legal issues, accounting, taxes, upkeep expenses, and so on.

Work Involved To Buy, Operate And Sell

Investing in real estate needs more research and time than buying a stock online in 10 seconds.

Operating a rental investment portfolio also requires more work than owning a stock. Maintaining your investment, especially renting out the space to earn income, is hard work!

High Initial Investment

Although you can obtain loans and qualify for a property valued higher than your down payment, you still need to invest in the down payment. Due to high property prices, your down payment would run into several thousand dollars.

Lower Diversification

Compared to buying a basket of stocks or an index ETF, it is hard to diversify when purchasing rental property due to the higher costs. For example, if you have $25,000, you might be able to use it as a down payment on one property. Contrast that with stocks when you can buy stocks in several companies or the entire US stock market via an ETF.

A single rental property doesn’t provide enough diversification.

Illiquid

Real estate is very illiquid compared to stocks. It would take many months for you to sell a house. Even if you get a cash buyer, the title search and closing will take at least two weeks. Real estate investing is for the long term.

Time Investment

Lastly, it takes time to manage rental properties. You need to screen tenants, coordinate with contractors for repairs/upgrades, deal with eviction disputes and disputes between tenants. It does not include the endless phone calls from tenants with problems.

Even if you outsource the property management to a company, you still need to manage the property manager. And approve their expenses. Or at least scrutinize it to ensure no one is taking advantage of you. Asset management software like Stessa has made life easier, but it still involves work.

Bad Tenants

You can’t immediately sell your rental property if you encounter a bad tenant. While most tenants are great, you could be unlucky to experience a bad one.

If your tenants are using your property for illegal activities, the health officials will condemn the property, and the cost of professional remediation would be the landlord’s responsibility.

Depending on your state laws, it might take years to evict problematic or non-paying tenants.

Even if you manage to evict, tenants can wreck your property when leaving. The deposit you collect might not be sufficient to repair the property. Unfortunately, states limit the amount of deposit you obtain, so you cannot protect yourself.

Make sure you verify if a city or state has tenant-friendly laws before buying a rental property.

While waiting for all the evictions, you still need to continue making your mortgage payments to the bank and property tax payments to the county. Make sure you can afford several months of non-paying tenants. Use free tools like Personal Capital to figure out your current cash flow and how it can survive these situations. Refer to my Personal Capital review for details on how I use it.

Downside Protection

While you can buy insurance to protect your real estate investment from disaster, there are not many insurance products to protect you from bad tenants or the price of your property dropping.

With stocks, you can always hedge your portfolio relatively cheaply.

Market Risks

Your market and the surrounding area will determine your property value. If there is an economic downturn in your region, you can lose substantial capital even if your tenants still make their monthly payments on time. It is crucial to have a diversified rental portfolio across different geographies.

Unlike flood or earthquake risks you can insure, there are very few methods to eliminate vacancy risks in a rental portfolio.

Inability to Dollar Cost Average

Investing over some time in an asset class ensures you are not buying at the peak. Dollar-cost averaging helps achieve this objective.

Unfortunately, real estate transactions are a one-time occurrence, and you cannot buy a rental property over a period of time as you can with stocks.

Real Estate Returns Vs. Stock Market

While data on total returns of the stock market is widely available, it is harder to compute the real estate returns due to the following factors.

- The real estate market is highly localized. Real estate prices vary across cities and even from one block to the next among the same cities.

- Real estate markets are not efficient. Due to the illiquid nature of real estate, you could find good deals just because of luck. Sometimes the owner might not be ready to sell, and other times, the owner is prepared for a fire sale.

- Real estate involves many different strategies for rehab, which influence the rate of real estate returns.

- The use of leverage is a significant component of real estate returns. Real estate has a variety of financing strategies, from seller financing to hard money loans to real estate crowdfunding platforms to institutional debt, making it harder to compute returns.

- Returns of any asset class should always be calculated post-tax. The ability to structure real estate deals in various tax-efficient ways makes it harder to determine the after-tax returns.

The above factors make it hard to compare an accurate apples-to-apples total return between stocks or real estate.

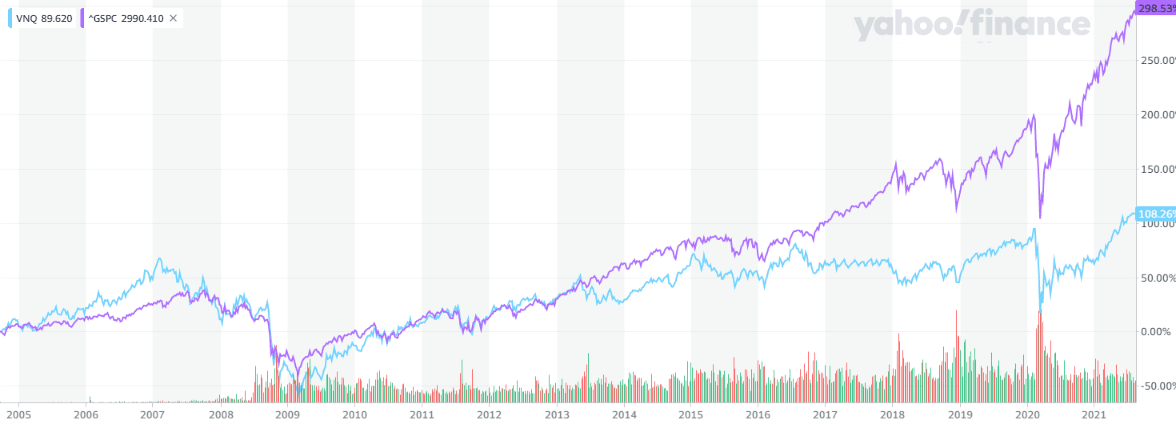

Stocks Vs. Real Estate Investment Trust Returns

If we need to compare stocks vs. real estate returns, the best proxy is Real Estate Investment Trusts (REITs), although it is an imperfect measure. Publicly available real estate investment trusts trade like stocks and are companies owning real estate assets. Hence they are also commonly known as real estate stocks.

If we compare VNQ, one of the most extensive publicly traded real estate stocks, with the SPY fund, it seems as though the publicly traded REIT has underperformed the stock market.

The BlackRock Return Map shows annual returns for selected asset classes ranked from best to worst within each calendar year over the last 10-years.

Based on the annualized 10-year data, investing in real estate vs. stocks was not a great idea; if you used REITs as a proxy for real estate returns.

However, if we go back to a 20 or 30 year period, we do see REITs outperforming S&P500. Of course, the composition of the S&P 500 20 years ago was vastly different in terms of sectors compared to the technology-heavy makeup of the current S&P 500.

Declining interest rates are positive for real estate stocks. And in the last decade, we had falling interest rates. However, when comparing stocks vs. real estate returns, we see that our stock measure is the S&P 500, which is comprised of growth stocks.

So although REITs did benefit from the falling interest rate, growth stocks were a more significant beneficiary.

Note that the annualized 10% returns of real estate stocks for a decade are not bad, considering that we are relying on the 4% safe withdrawal rate for our financial freedom. The returns are just not as good when compared to stocks. As with everything in the financial markets, performance is relative.

Another point to note is that REITs are more tilted towards commercial real estate investing in office buildings and malls, which have not outperformed residential real estate.

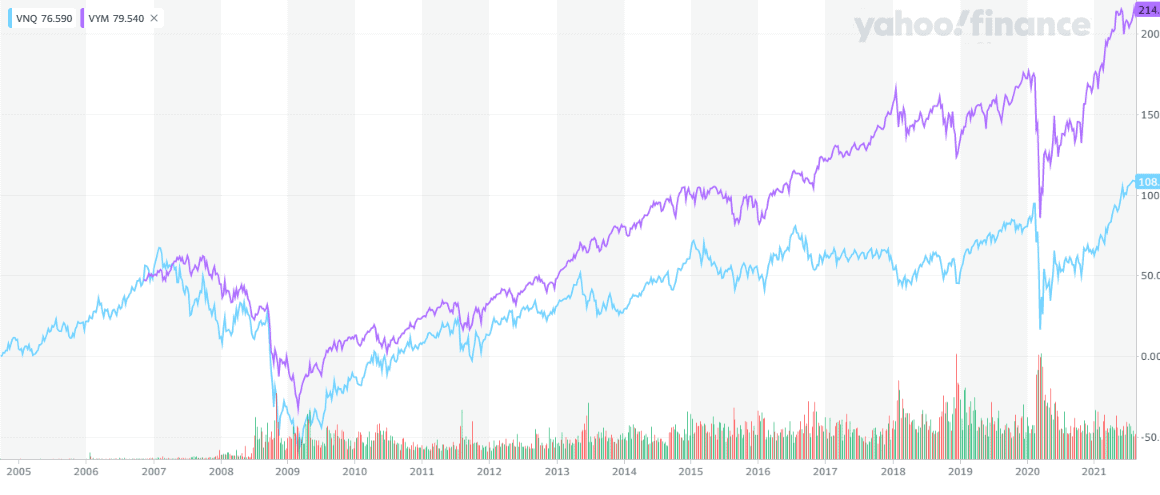

Dividend Stocks Vs. Real Estate Returns

Although buying real estate in some pockets like NYC or San Francisco, the real estate functions as a growth stock; publicly traded REITS are more similar to dividend stocks with an income component and hardly any appreciation. Some investors compare the real estate cap rate to the dividend yield.

Let us compare publicly traded real estate stocks to dividend stocks.

Although the outperformance reduced with swapping out S&P 500 with a dividend index, we still see the total return of publicly traded REITs lagged.

However, I do not consider publicly-traded REITs or real estate stocks an excellent proxy for real estate investment. Real Estate Investment Trusts have a high dividend yield and distribute over 90% of their income as dividends. Real Estate Investment Trusts are worse than a regular stock market index fund from a tax advantage perspective.

Calculator For Stocks Vs. Real Estate Returns

To truly compare the stocks vs. real estate returns, we will have to create a custom calculator with certain assumptions.

Consider a couple married filing jointly in California, each earning $100,000. To compare rental property vs. stock market, we will run two scenarios.

Assume each couple has 25,000K in year 1 to invest

Stock investment Couple – Invest in the stock market and let it grow for 38 years

Assume an 8% return on the 401(k) for the stock investment couple. Due to the magic of compounding, after 38 years, they would have $465,632 in stocks.

Using the 4 percent safe withdrawal rate, the stock couple can live off $18,625 annually.

Rental Investment Couple – Invest in a rental property for 38 years

The rental investment couple uses the $25,000 as a down payment for a $100,000 rental property. The $1,710 is utilized as closing costs.

| Buy Price | $100,000 |

| Down payment | 25,000 |

| Loan amount | 75,000 |

| Monthly mortgage @3.5% for 30 years (principal and interest) | $337 |

| Operating expenses (taxes, insurance, maintainence) | $400 |

| Monthly rent | $1,000 |

| Monthly cash flow (after paying mortgage and expenses) | $263 |

| Annual cash flow | $3156 |

After 30 years, the rental investment couple has a property worth $181,100 (assuming property appreciation at 2% annually). They have no mortgage after 30 years, but they still have operating expenses on a 30-year-old property. The monthly cash flow after the tenants pay down the mortgage is $600.

The rental couple also receives an annual cash flow of $3156 every year from year 1. Assuming the couple saves the monthly cash flow and uses the saved money to buy a second rental property with the exact financials after eight years.

After 38 years, the rental investment couple has a second property worth $181,100 (assuming property appreciation at 2% annually). They have no mortgage after 30 years, but they still have operating expenses on a 30-year-old property. The monthly cash flow after the tenants pay down the mortgage is $600.

Assuming the couple repeats the strategy every eight years, they will have 2-3 additional properties. Also, since our rental investment couple is savvy, they would graduate from single-family homes to fourplex to multifamily over the four decades compounding their returns.

Even if they stick with only two properties, they will receive $14,400 annually in rental income. And the $3,156 annual cash flow every year from year 9

Assumptions In The Stocks Vs. Rental Property Example

- We estimated operating expenses of 40% for the rental couple. Your costs could be lower, but this is the standard value used in most real estate calculators.

- Monthly rent at 1% of the purchase price.

- We did not deduct taxes for the monthly rental income or the stock portfolio.

- We used any rent increases for the property to pay capital expenses and, hence, not included in the cash flow.

In this example, the rental property investment couple did better than the stock investment couple.

- The rental property couple invested their sweat equity in finding the property, analyzing and managing it.

- The couple did take on more risk as you can’t quickly diversify rental properties.

Due to both reasons, it is expected that they would earn higher returns than the stock market couple.

Rental property income is not passive, even if the IRS treats it as such.

Financial Freedom Countdown

Academic Paper Comparing Stocks Vs. Real Estate Returns

Our calculation results are also corroborated by the paper “The Rate of Return on Everything, 1870–2015,” published by the San Francisco Federal Reserve.

The working paper attempts to answer which particular assets have the highest long-run returns in 16 advanced economies from 1870 to 2015.

The data shows that residential real estate, not equity, has been the best long-run investment throughout modern history (1870 to 2015).

If we analyze the data post-1950, equity had slightly higher returns compared to real estate.

The most important part of the study was that although returns on housing and equities are similar, the volatility of housing returns is substantially lower.

As per the authors,” Returns on the two asset classes are in the same ballpark – around 7% –, but the standard deviation of housing returns is substantially smaller than that of equities (10% for housing versus 22% for equities). Predictably, with thinner tails, the compounded return (using the geometric average) is vastly better for housing than for equities—6.6% for housing versus 4.6% for equities.”

The main reason risk-adjusted housing returns are higher is the lower volatility of house prices. Equity prices have experienced large swings, which is one of our main cons of stock investing.

The paper is well done to include more than 150 years of data encapsulating World Wars, GDP growth, the Great Depression, several recessions, including the recent financial crisis. The historical benchmark yields are calculated net of estimated running costs and depreciation to enable a like-for-like comparison. The data on housing returns cover capital gains, and the net rents paid renters and owners (i.e., imputed).

Typically in finance, lower volatility is often associated with lower returns. But the findings of higher real estate returns with lower volatility compared to stocks were such an eye-opener that the authors attempted to further dig into the data. Another paper published in 2019 titled “The Total Risk Premium Puzzle” was published.

Based on the two papers, I am convinced some real estate exposure is warranted in a balanced portfolio. Avoiding real estate might not be optimal.

Stocks Or Real Estate: Which Is Right For You?

If you want to build wealth, both stocks and real estate are great choices.

If being more hands-off with your investments is your style, then just buying a stock market index ETF would be the better option. Be mindful of emotional investing.

If you are looking for a steady income stream with low volatility, investing in rental property would be better. However, it is not easy to obtain your first property, let alone own many properties over time. If you have the time, money, and patience, you should consider real estate.

But real estate is not passive, and publicly traded REITs don’t offer all the benefits of real estate. If you desire some of the benefits of real estate but lack the knowledge, time, or skills to invest directly, you could consider real estate crowdfunding.

Real estate crowdfunding does eliminate some of the cons of buying rental properties directly. The only hitch is that your returns with crowdfunded real estate might be lower than direct ownership of the rental real estate. However, crowdfunded real estate does save you time and expertise.

The table below illustrates the various tradeoffs between real estate crowdfunding platforms vs. Real Estate Investment Trusts vs. rental properties.

| Crowdfunded Real Estate | REITs | Traditional Rentals | |

|---|---|---|---|

| Experience needed | Medium. We need to at least evaluate the deal. | Low since totally hands-off and index driven | High to select a good deal, close and operate the property |

| Types of deals | Debt or Equity | Equity | Equity |

| Direct Control | After picking the crowd funded investment you lose management control | You can pick a REIT but you do not have the ability to select a particular property or influence the management or sale of the properties within the REIT | You have complete control over selecting the property, the financing options, the tenants, the management, the expenses associated with the property and the final sale. |

| Active or Passive | Mostly passive after selecting the crowdfunded investments. You might need to analyze future capital calls | Totally passive | The IRS considers rental property as passive investment for taxation purposes. But rental properties are active in terms of effort and time due to the level of involvement required in all stages of the investment. |

| Cash flow | Payments depend on the type of deal structure. Can have periodic monthly payments or no initial cash flow with a lumpsum at the end. | At least quarterly while some pay monthly | Monthly |

| Minimum investment | $1,000 debt deals $10,000 equity deals | $10 can buy fractions via a platform such as M1Finance | Down payment and closing costs required |

| Ongoing costs | Management fee of sponsor | None except negligible ETF expense ratios | Rental repair expenses |

| Availability | Usually restricted to accredited investors. Limited real estate crowdfunding for non-accredited investors is available. | Available to everyone due to low costs | Highly restricted due to higher minimum investments and ongoing costs |

| Deal flow | High due to the availability of several sponsors and no geographic limitations to invest in private market deals | N/A since index ETF is responsible | Low since it is harder for an individual to source several deals. Also limited by geography. |

| Diversification | Medium since you can invest in several crowdfunded real estate deals | High since each publicly traded REIT owns several properties. | Low since the high minimum investments reduce opportunities for other investments. |

| Deal selection | Ability to select particular deals | REITs don’t let you invest in individual properties | Ability to select specific deals. |

| Liquidity | Low since you are locked for the deal duration. It might be possible to surrender the stake to the sponsor | Very liquid as you can sell the ETF anytime on any exchange | Very low unless you are willing to sell at fire-sale prices |

| Ability to use as collateral | Unless a secondary market exists, the ability to use your crowdfunded investments as collateral for loans is negligible | REITs can be used as collateral similar to stocks | Rental property can be used as collateral depending on the equity in the property |

| Leverage | Although the crowdfunded investment might use leverage, the investor doesn’t reap all the benefits | REIT investors do not receive any benefits of the leverage used | Rental property owners can use high leverage when purchasing investment properties |

| Tax benefits | Medium since you can avail most of the rental property investment tax benefits in equity deals. | Low since REITs have high dividends which are taxed at income tax rates | Highest. You can take advantage of all the tax benefits such as writing off property taxes, repairs, mortgage interest, expenses, taking depreciation, utilizing QBI and 1031 exchanges |

| Self Directed IRA (SD IRA) | Opportunity to use SD IRA | Opportunity to use SD IRA | Not advisable to use SD IRA for rental properties due to the risk of prohibited transactions. |

| Profit potential | High since you receive the tax benefits and sponsor manages the deal | Lower profit potential since REITs have limited tax benefits | Highest since you can select and manage all aspects of the deal and avail of the maximum tax advantages of real estate investing. |

| Liability | Unless you are the primary syndicator, your liability in a crowdfunded real estate investment is minimal. | Investors in a REIT generally are not liable for any of the issues the REITs may encounter | Highest exposure since you are ultimately in control of the property and all the decisions. Risk can be mitigated through appropriate insurance, LLCs and following the local regulations. |

To get started with real estate crowdfunding, Fundrise, DiversyFund, or Streitwise with a minimum investment of $10, $500, and $5,000 respectively are available to non-accredited investors.

Or, if you are an accredited investor, crowdfunding real estate platforms like PeerStreet are a great option with a minimum investment of $1,000.

Final Thoughts On Investing In Real Estate Vs. Stocks

While the decision to invest in stocks vs. real estate is personal, you should consider many factors such as your financial situation, risk tolerance, goals, temperament, and investment style. The pros and cons outlined above should help you better understand the two types of investments.

A few essential points to consider are liquidity, diversification, passive income stream, growth potential, dividend yield, market risks, economic risks, time invested, and investment size. There are no one-size-fits-all answers when it comes down to investing in either type of asset class. Your investment choice does depend on what your end goal is for that money as well as how much time and effort you’re willing to put into managing your investment portfolio.

Rather than pick stocks or real estate, I invest in both. I prefer to have my net worth diversified in my investment portfolio.

No matter what you choose, you can’t go wrong. Both stocks and real estate have been massive wealth generators over the last few decades. If you are still undecided, just divide your investment equally in both.

Leaving your money in cash instead of investing will be the worst choice.

Open up an account with M1Finance and start investing in stocks without any fees. You can read my M1Finance review and how I invest in stocks.

Check out my beginner’s guide to real estate crowdfunding for investment in real estate. Or the 20 ways to invest in real estate with little or no money.

Readers, between stocks or real estate, what is your preferred investment vehicle to achieve financial freedom?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

There are so many blog i read right know but any one of them satisfy me but this one is so informative blog.