Is Farmland A Good Investment? 4 Factors To Consider

Farmland is one asset class that has been a favorite of billionaires for centuries and is a great way to diversify your portfolio. But is farmland a good investment?

Today, let us explore what drives farmland returns and how it has performed with expectations for the future.

What Is Farmland Investing?

Farmland investing has a long history of producing stable returns.

The returns are due to increasing farmland values and the profit from the cash crops.

Farmland Value Increases

No one is making more land. As the population keeps increasing, we need to build more houses, acquire more land for transportation, shopping, etc., reducing the amount of farmland available. Also, with the increased global population, demand for food rises, making the existing shrinking supply of farmland more valuable.

Farms Produce Cash Crops

Crops grown on farmland are sold for profit. The income produced by farmland investments can be considered similar to rental income. Gross farm income reflects the total value of agricultural output plus Government farm program payments.

Why Invest In Farmland?

Although many might have believed the government officials and the Fed talking about “transitory inflation,” we have seen inflation zoom higher with no signs of abatement.

The government measures inflation differently than you and me, who face it daily at the gas pump or the grocery store. Regardless, even the government is now forced to admit that inflation is present with no signs of immediate reduction. The Treasury raised the interest rates on I-Bonds to 7.12%. The same I-Bonds a year ago were yielding 1.68%. We have over 4x increase in less than a year.

Farmland offers a unique ability to provide inflation protection without the volatility of stocks. While stocks are considered a monolithic asset class, performance differences are based on different environments.

Growth stocks tend to do well in low-interest-rate environments since institutional investors are willing to pay a premium for future performance even if the companies are making a loss currently.

In a higher interest rate environment, institutional investors have lots of options to get safer returns on their cash and might avoid growth stocks. If the Fed decides to raise interest rates, it could impact the stock market.

Performance Of Farmland Investing

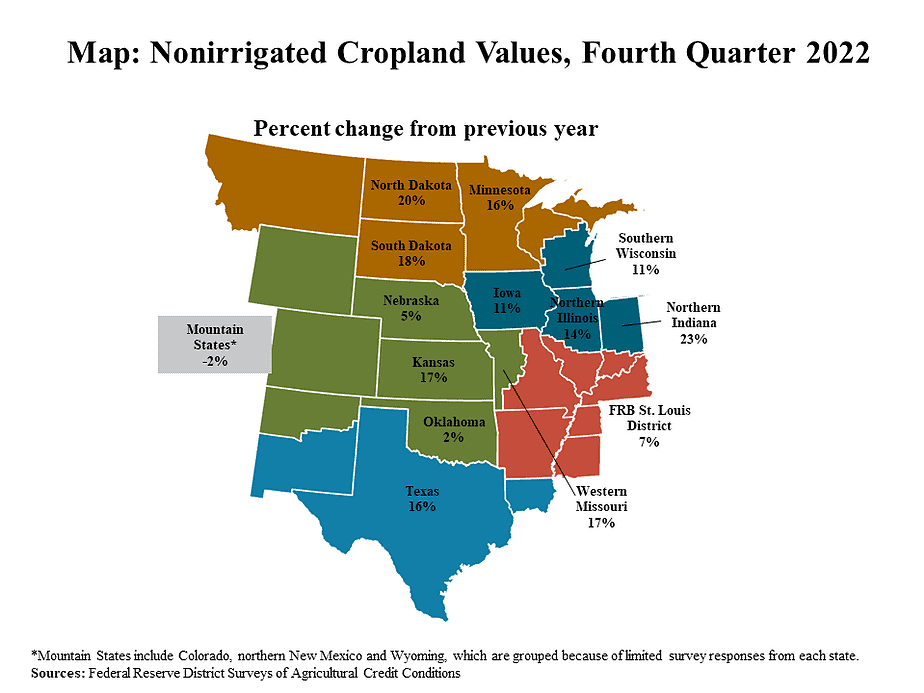

The Federal Reserve Bank of Kansas City recently published their report titled “Growth in Farmland Values Slows Amid Higher Interest Rates”. The report highlights that farm real estate values increased considerably in 2022 but showed signs of softening during the final months of 2022 as interest rates rose sharply.

Elevated commodity prices continued to support profit opportunities for many producers across the farm sector, but concerns about operating expenses, higher interest rates and intense drought persisted.

The NCREIF Farmland Index, a quarterly measure of investment performance of farmland properties acquired in the private market for investment purposes, shows a similar upward trend.

Is Farmland A Good Investment Still?

Factors that make me bullish on farmland

Increasing Food Demand

It is hard to predict the future, but I struggle to see a scenario when the demand for food decreases.

The global population has been increasing, and demand for food has been steadily growing. A meta-analysis of projected global food demand by Nature indicates the total global food demand is expected to increase by 35% to 56% between 2010 and 2050. It will have a significant impact on agricultural markets. Farmers worldwide will need to boost crop production in some way, either by expanding the amount of farmland devoted to agriculture or by increasing productivity on existing agricultural properties.

Pricing Power Of Crops

Farmers have pricing power for their crops. Food is not a discretionary item on any budget. Everyone needs food to survive, and we all will be willing to pay any price to eat. We might cut other expenses but not food.

Farmland increases in value when agricultural products increase in value since the underlying land becomes more valuable. It makes farmland well-suited to retain value over time, even during recessions. After all, people will always need to eat. Farmland investing is one of the most stable real estate options around and has consistently gained value since the 1990s.

The combination of the increased value of crops grown and scarcity of farmland provides a potent combination for farmland investing.

Lower Labor Costs

With automation in full force, we often wonder whether robots will take our job. But automation is bullish for farms. Labor is a huge component of their current expenses. If farmers can reduce costs with automation, the profit margins will increase. Implementation of mechanized farming increased the productivity of farmers compared to those who manually tilled their fields.

And unlike other industries where one needs to worry about cheaper imports driving down costs, one can’t easily outsource the growth of crops.

Government Support

Farms and farmers enjoy tremendous government support. And this is true not just in the USA but every other country around the world. Farmers protesting makes the news, and the governments do take notice.

Farms accept subsidies for growing crops since food security is a political issue. Farmers receive favorable loan terms, and bailouts are always on the table if conditions are unfavorable to farmlands. Since the early 1980s, Congress has been susceptible to demands from agricultural interest groups for all possible risks to be removed of farms through tax dollars to guarantee crop prices and cash revenues.

The Warren Buffet quote in a 2014 letter to investors describing farmland as an investment that has “no downside and potentially substantial upside” is fitting.

Farmland also has great lobbyists advocating for their cause. Although Congress might reverse the stepped-up benefit for stocks, I am more confident of them retaining it for farmland.

Don’t believe me? Look at the recent White House American Families Plan proposing an exemption for farms and family-owned businesses. Politicians believe stocks are for wealthy Wall Street and farms are for the middle class.

Here is the exact language from the plan “The reform will be designed with protections so that family-owned businesses and farms will not have to pay taxes when given to heirs who continue to run the business.”

The special exemption for farmland shows how much political support this asset class enjoys and is the perfect candidate for the Buy-Borrow-Die strategy.

How To Buy Farmland For Investment?

There are three ways to buy farmland for investment.

- Directly buy farmland

- Farmland crowdfunded real estate.

- Farmland REITs

Directly Buy Farmland

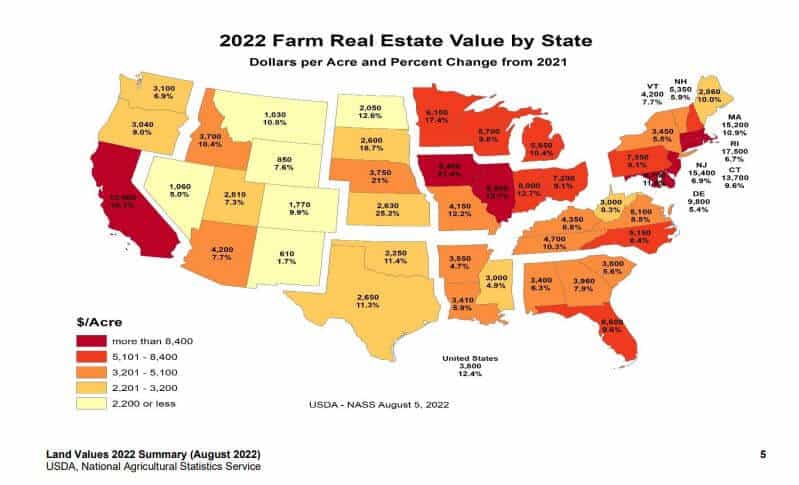

The U.S. Department of Agriculture publishes a land value report annually. The information breaks down the value of farmland depending on whether it is used for crops or pasture. And by each state.

As per the report, the value of cropland in the United States rose by 7.8 percent to $4,420 per acre.

The challenge is the size of the farms to make the operation economically viable would need to be at least 500 acres which means at least a $2 million investment just for raw land. Adding equipment would cost an additional $750,000. And then, we need to factor in the cost of labor.

It would help if you were a billionaire to buy farmland for investment like Bill Gates, the largest private farmland owner in the United States, with over 300,000 acres to his name.

Besides the cost, the challenge is also finding the availability of farmland suitable for growing crops.

Farming is generally a family business. You would sometimes find farms available for sale where the owners are older and the children are not interested in the family farm business. Buying agricultural land from farmers who want to retire and leasing it to new farmers is easier to get started with farmland investing.

Similar to the above approach, again, the mortgage cost is very high. Also, banks want to see your track record related to your experience in farmland before lending. If the farmer owns the land with no mortgage, you could ask them if they are interested in seller financing. In this case, the farmer selling you the farm acts as the bank, and you make periodic payments to them. They may still be wary of your lack of experience, but it is easier to convince the seller vs. the bank. Also, note that the interest rate may be higher in these cases than directly obtaining a loan from the bank.

It’s critical to know about local land regulations and jargon. If the buyer isn’t well-versed in local land rules and terminology, such as land measurement units utilized throughout the transaction, purchasing agricultural property might be extremely challenging.

Another approach would be to buy non-agricultural land and convert it to be used as farmland after obtaining the necessary approvals.

Then just like a rental property, you can lease it to farmers for growing crops on your land. The farmer will pay you rent and also provide a certain percentage of the profits to you.

This approach provides the maximum return on your farmland investment. The challenge is with trying to find land suitable for agriculture that is available for sale. The soil quality, weather, and water sources are important factors to consider when purchasing land. After you buy the property, you need to ensure that necessary irrigation and drainage systems are installed. And you are finally leasing it to the farmer who is experienced enough to turn your farmland investment into a profitable venture.

Because of the complexities involved in this approach, I would not recommend it unless you are highly experienced. The cost of the mortgage to purchase land and convert it for agricultural usage is very high. Also, banks want to see your track record in farming before approving the loan.

It’s an asset with increasing value

American Farmland Trust CEO, John Piotti

Farmland Crowdfunded Real Estate

With the passage of the JOBS Act in 2012, high net worth individuals who meet the accredited investor qualifications can pool their money together and buy the property with the contributed funds, including alternative investments like farmland.

Farm Together provide accredited investors with an option to invest in institutional quality farmland at the click of a button. You get the benefit of an experienced team evaluating various options before it is available on the farmland investing platforms.

- The crowdfunded farmland investing platform selects parcels based on their selection criteria and places each farm in its legal entity, such as an LLC.

- The farm is presented on the platform for individuals to evaluate based on land values, income potential, and other income-producing assets.

- You purchase shares in the entity which owns the farm.

- The platform takes care of farm management aspects such as insurance, accounting, leasing the farm, and working with the farmer.

- The platform distributes excess income from the farm periodically.

- Distribution of final sales proceeds when the farm is finally sold after 5+ years.

Farm Together has a minimum investment of $15,000. Since farmland is not sold often, the farmland crowdfunded platforms have a limited number of farm deals at any point in time. It is better to sign up for both websites so you get notified when they have an upcoming investment opportunity.

Bear in mind that farmland investment is long-term compared to the stock market, where you can trade at the click of a button. It’s just the nature of private real estate investments, and you need to be aware of and comfortable with it before diving in.

Farmland REITs

Farmland investing for non-accredited investors can be accomplished via a “real estate investment trust” or REIT. It is a company created to acquire and hold farmland. Although farmland REITs are not a perfect method, they are an option for non-accredited investors to invest in farmland. By investing in a farmland REIT, investors get exposure to farmland investments and avoid the responsibilities of owning a farm.

REITs are traded on stock exchanges just like stocks and are highly liquid. You can use a platform like M1 Finance to dollar cost average with no fees when buying REITs. There are several listed farmland REITs. Gladstone Land Corporation (LAND) and Farmland Partners Inc. (FPI) are the two most popular publicly traded farmland REITs.

One major disadvantage of REITs compared to directly investing in farmland via Farm Together is that with the REITs, you do not know in which exact properties you are investing. You have no control over selecting a particular farm or cash crop.

The other disadvantage of REITs is tax treatment. REITs are supposed to pay back their earnings in the form of dividends. Since dividends are taxed as ordinary income, you might pay higher taxes compared to other stocks.

When farmland investors sell their REITs, it is treated as capital gains. If investors hold the REIT for over a year, it will be taxed at favorable long-term capital gains rates. If the REIT were held for less than a year, it would be taxed as short-term capital gains, the same rate as ordinary income.

Final Thoughts On Is Farmland A Good Investment

I am bullish on farmland investing based on the combination of increasing food demand, pricing power, lower labor costs, and government support.

And all these factors are even before we add that inflation is expected to stay elevated for the near future, providing a boost to the price of farmland crops and the underlying land.

Another factor in favor of farmland is that passive income returns avoid stock market volatility. While you will not get the returns of Tesla or Amazon, you can at least prevent the anxiety and questioning should I sell my stocks now every time the stock market crashes? Farmland has even lower volatility than commercial real estate.

Readers, what do you think of farmland investing? Do you know anyone with family farms, or have you been involved with farmland in some shape or form? Are you planning to add it as part of your asset allocation? Would it provide diversification to your existing portfolio?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

Thanks for the thorough post. If you are bullish on farmland, how much have you invested in it and with which platform?

Thanks

Hi Joe, since farmland deals are few I would invest across both platforms. With respect to the amount I would say invest what you are comfortable with and how it fits in your overall asset allocation plan. I might have need for steady returns and you might need to have explosive growth. So the amount we invest and the assets we pick as a percentage of our net worth might be totally different. The first link in the post talks about the different assets and also the ranking factors (volatility, risk, accessibility, etc.) which should one should consider before creating an asset allocation plan. Hope that helps.