Can The BRRRR Method Help You Kickstart Your Real Estate Journey?

Are you looking to invest in real estate but getting frustrated with the sky-high property prices and constantly getting outbid?

As long as you are willing to put in some sweat equity, the BRRRR method is one of the best methods to start investing in real estate with little or no money down and slowly build your real estate portfolio.

The BRRRR investing method is a compelling way to build passive income through real estate. It is also one of the most popular strategies among real estate investors because it allows them to buy, fix up and rent a property without a substantial financial commitment. You can use this method repeatedly, acquiring several BRRRR properties until you have enough rental cash flow to quit your day job!

If you are a real estate investor thinking about utilizing this approach, keep reading to discover more about how the BRRRR method works, its advantages and drawbacks, and whether it’s appropriate for your financial and real estate investing objectives.

After all, real estate is one of the best assets to own.

What Is The BRRRR Method?

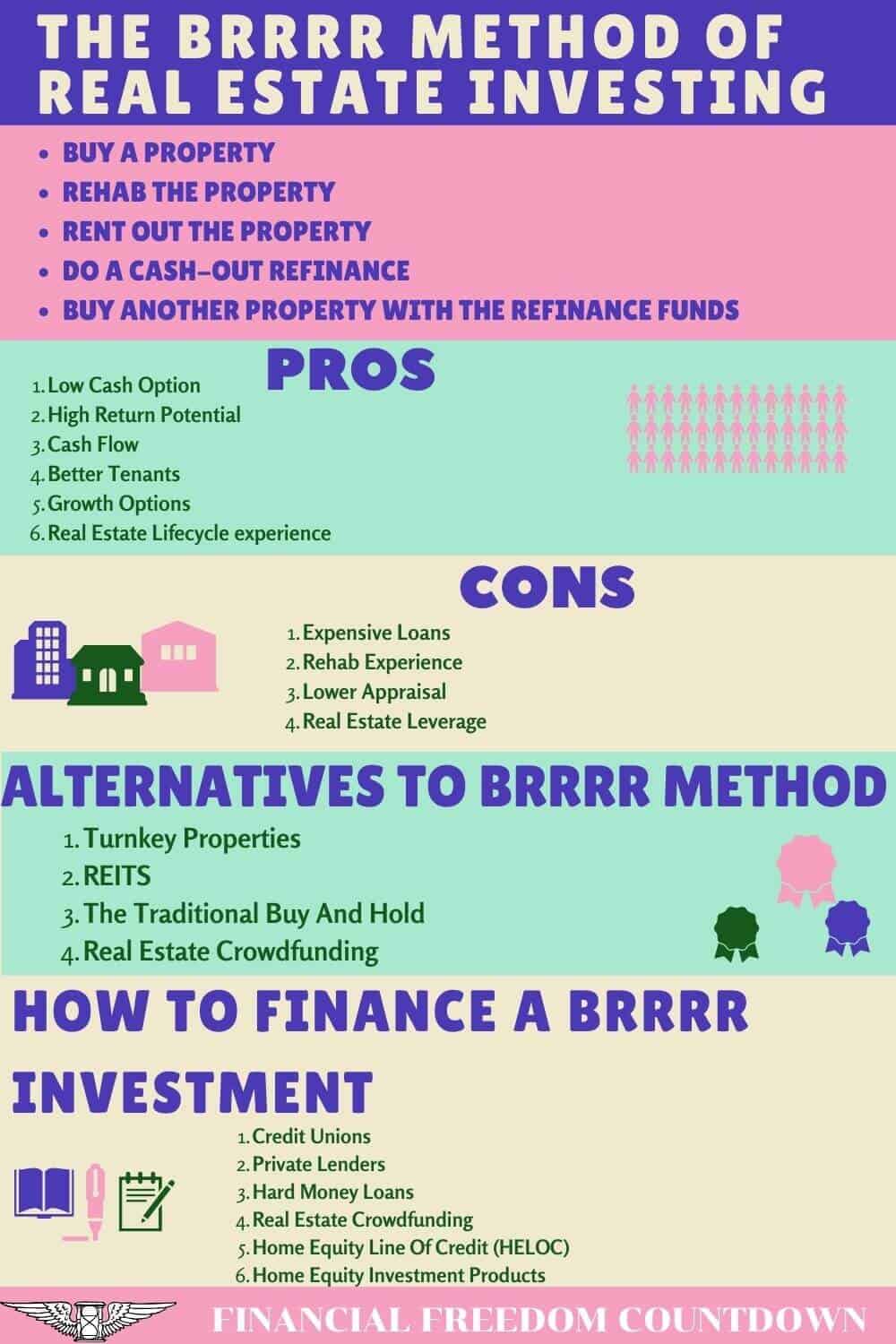

The BRRRR (Buy, Rehabilitate, Rent, Refinance, Repeat) method is a real estate investment technique in which you purchase a distressed property, fix it up, rent it, cash-out refinance it to fund your next BRRRR rental investment property.

Buy a property: A house that needs repairs is the sort of property you should buy. Because of the home’s condition, it might be cheaper to purchase and will be a great deal. Financing will be complex, and you might need to rely on non-conventional funding.

Rehab the property: Since the home is in terrible condition, it will need a lot of repairs. In this stage, you’ll remodel the property to make structural, safety, and aesthetic improvements as well as prepare it for renters.

Rent out the property: Determine the monthly rental rate and locate renters for the property to obtain a positive cash flow.

Do a cash-out refinance: Since you have rehabbed the property, it will appraise higher. Do a cash-out refinance, repay the expensive hard money loan, and use the remaining money to fund your next BRRRR purchase.

Buy another property using the funds from the refinance: Since you already have money from your cash-out refinancing in the previous step, you don’t need hard money anymore. You can directly use that to purchase another distressed property and repeat all the steps to buy your second rental property.

How Does The BRRRR Method Work?

The primary difference between the BRRRR technique and a typical rental property investment approach is investing in distressed properties and refinancing the acquired real estate to buy another.

Buy

The first step in the BRRR strategy begins with you purchasing the property. It may sound simple, but it’s usually one of the most challenging steps, especially for first-time investors.

The reality is you want this property to rent quickly. It means your BRRR property has to be in a nice neighborhood. It has to be in the middle of everything a renter will want, like good shopping options or good schools. Look for a place with a high walkability score as more people get into low-impact exercising.

You want the renter to live in the property as long as possible. In essence, you have to pick a property that you’ve researched well and one that you’d want to stay in. Also, the property has to be within your price range. You have to keep in mind many things as you consider the BRRR investment strategy.

Finding a home that satisfies the above criteria and is undervalued, or you can improve with renovations might be difficult, but it’s critical if you’re using the BRRRR real estate method. Buying a distressed property needing work is the cornerstone of the BRRRR strategy. Distressed properties will be cheaper since

1) they won’t be listed on MLS

2) will require lots of work which means first time home buyers will avoid it

3) as the repairs are supposed to be extensive, most of the distressed properties won’t qualify for a bank loan, further reducing the competition from other buyers.

Due to the above three factors, you can buy distressed property cheaply. Make sure you know how to evaluate a rental property when purchasing.

How To Finance A BRRRR Investment

Since the BRRRR strategy relies on you purchasing a run-down house in need of renovations, it is usually challenging to obtain a regular mortgage on the home from a conventional bank.

Since bank loans are not an option, you have to seek other opportunities to fund your first BRRR property.

Credit Unions

You might be lucky and find a credit union that keeps all the mortgages on their balance sheet without reselling. Local lending institutions are more flexible regarding real estate financing, with mortgage limits and debt-to-income ratio concerns. They frequently enable the loan to cover rehabilitation costs as well. You might require an established relationship with the credit union to obtain such a loan.

Private Lenders

You can get private money from people you know, such as friends, family, business partners, or other investors. The rates may differ based on the property and your relationship with the lender in this instance. Private lenders frequently finance any required repairs on a property.

Hard Money Loans

Hard money lenders specialize in lending to house flippers and rental investors. The cost and interest rates of hard money loans are generally higher than those available from banks. They will, however, almost certainly pay for repairs and enhancements. Hard money is expensive because they usually charge points on the loans.

Real Estate Crowdfunding

The best place to obtain loans is on a real estate crowdfunding platform. We have talked in the past about how you can be an investor lending to others on such platforms. And how to use a checklist to evaluate real estate crowdfunding deals. In the BRRRR investment strategy, you are the borrower and should use the list to make your property attractive to investors.

Home Equity Line Of Credit (HELOC)

If you already own your primary house and have equity in it, HELOC could be another option. I’m not too fond of home equity loans because you need to start paying back the loan soon. If something goes wrong with your BRRR investing method, you could lose your primary home.

Home Equity Investment Products

Another option to finance BRRRR deals is using home equity investment products, like Hometap or Unison, which give you access to the equity you’ve built up in your home without interest or monthly payments. The home equity investment products usually can get you the cash you need in as little as three weeks. They provide money today and participate in the proceeds at the time of settlement.

Evaluate all six financing options and pick the best one for your needs.

Sometimes you might get lucky and find a great property undervalued on the MLS. Or you might meet someone who does wholesale real estate investing and gives you a great deal.

When purchasing a distressed property, it’s critical to figure out the After Repair Value (ARV). The after-repair value is the anticipated market price of the home once you have renovated or repaired it. To calculate ARV, you compare the home’s planned final value to comparable homes recently sold in the region.

As per the 70% rule, don’t buy a house for more than 70 percent of the property’s ARV. If a home’s ARV is $500,000, you should not pay more than $350,000 for it. The 70% ARV rule is commonly used by flippers when flipping houses and is applicable since BRRRR investing is a form of flipping.

Be conservative in your purchase price because you still have to fund the rehab and repair for the BRRRR property, so budget accordingly. If you pay too much for a BRRRR property, there’s little you can do to recover from any unexpected issues or problems.

Rehab

The first of the R’s stands for the rehabilitation phase of the BRRRR real estate property.

As mentioned earlier, people need to research the property they’re thinking of buying. The research should include rehab costs as these costs can wallop you.

You have to be thoughtful about the rehabilitation process. It can’t be extensive or too peculiar. Ensure you get what you want from your investment while retaining your profit margin.

Code Standards

First, concentrate on making it livable. Since you purchased a distressed property that isn’t up to code, you can’t rent it out as is. Bring your property in compliance with the code standards. A property inspector can help guide you with this part of the process. You should also get other inspections, like a mold inspection.

Basic Utilities

Pay attention to roofing and plumbing issues. You also want to pay attention to the electrical system.

Once you’ve taken care of the basics, you can move on to cosmetic updates.

Cosmetic Updates

Your property should have a few additions that’ll help you get more out of your property with a high ROI. The key is figuring out which updates will justify a higher rent than similar properties. One update to make is the kitchen. For some reason, renters love a modern kitchen. Most renters don’t like kitchens with a dated look.

The same goes for the restroom. Renters love modern updated bathrooms. If you buy a three-bedroom house with one bathroom, adding a second bathroom is more desirable.

Adding Living Space

Look into ways to also augment the living space. Adding a bedroom or two might be a good idea. Getting a family to stay there is ideal because families don’t usually move around much, unlike single folks. Having more bedrooms invites families or people thinking of staying there to raise their kids.

Landscaping

Landscaping is another wise investment to make, but be sure to keep it tasteful and relatively universal. A gate, shrubs, or hedges can add privacy that most people desire when living near others. It increases the value of a property.

Don’t try to get too creative with your ideas. You can save that for your personal property. You want something that most people will like. You won’t wow or astonish anyone with relatively safe landscaping, but at least you won’t turn most people off.

There’s no doubt this step isn’t going to feel great. You’re going to spend money and won’t have money coming in just yet, but if you get this right, the following steps are going to be easier.

It might take some time to finish the rehab property, so be sure you have enough money to get it all done. Estimate every repair and update you’re considering, and always have extra for things you couldn’t predict. A book which is I highly recommend is the Book On Estimating Rehab Costs by J Scott. He was a flipper, and his book has detailed calculations to estimate a rehab project.

Set a realistic budget and timetable for your project before you begin.

The next step is to rehab the property. Try to finish the rehabilitation quickly. It reduces expenses and allows you to get money flow sooner.

Remember that you are marketing this property as a rental investment, so do not go overboard with the rehabilitation. The home should be similar to the other properties in the neighborhood, so your rent is comparable to other rentals. If other properties do not have a granite countertop and stainless steel appliances, do not install them in your rehab property. You will not recover the cost, and you will have difficulty finding a renter willing to pay extra for all the upgrades.

Make the property secure, attractive, and pleasant. Consider renovations only if the value they provide justifies a higher monthly rent.

Rent

The following R is renting. It is a big reason people consider the BRRRR real estate method.

This part wouldn’t be so hard if you completed the rehab updates that allow you to rent your property at a market rate.

Determine Rent

Make sure the rent you set is appropriate for the neighborhood and similar properties. You can use Rentometer and also Stessa. You can read my Stessa review to understand how I use the various free software features to manage my property like a business.

When buying the property, you should already have researched the rental market to determine how much you can rent the house for and your cash flow based on the rental expenses. Make sure to also budget for capital expenses. Do not be like this landlord in San Francisco who can barely make ends meet to generate positive cash flow based on his rental property investment.

The rent you obtain net of expenses also defines your cap rate for the property. The cap rate is the percentage of return based on the property’s value and is a valuable metric to monitor as a real estate investor. Cap rates vary widely based on the market and the property type.

Find Tenants

The most effective part about renting is advertising your property well at the right places. Most renters love to search online, so that should be the focus.

You must photograph your property well since people may tour your property based solely on the pictures. Consider not only hiring a good photographer but an interior designer or home stager. This person will create visuals that’ll help get your place rented quickly.

It would help if you also considered a videographer because some renters expect to see virtual tours. It may seem like you’re doing too much, but it’s a great idea.

It helps weed out folks who wouldn’t rent your place anyway. It reduces wasted time on folks who might not be suitable for your home. It can be more cost-effective for you, and that’s always a good thing, especially for real estate investors.

Be sure to have your property management company advertise within the local neighborhood, too. It may not be as popular as it once was, but it might help you find reliable tenants.

Screen Tenants

You need to focus on the type of tenants you want and have a rental application process with well-defined criteria for tenant selection. Some of the most common attributes landlords look for are

1) Income must be at least equal to three times monthly rent

2) Clean credit report with no defaults or bankruptcy

3) Absence of prior evictions or criminal record

5) Proof of employment and references

6) Ability to pay the security deposit

By conducting a background check and checking the potential tenant’s credit report, you’ll be able to learn more about them. Of course, you’ll want to make sure they agree to it and that you’re complying with all housing regulations.

Check your local laws because some cities prohibit denying housing based on past criminal records or source of income etc. Local laws are a significant reason why only certain states are favored as best states for real estate investors.

Accepting renters without a rental application process could leave you exposed to lawsuits. Not correctly vetting each potential renter could cost you dearly. The wrong renter could mean extensive property damage. You could deal with tenants that don’t pay or tenants who leave quickly, forcing you to start all over again. It might mean you may not be able to pay your mortgage if this happens often.

Property Management

You could either be your property manager or hire a professional property management company to screen potential tenants. While there’s no guarantee you won’t face issues, at least you’ll reduce the possibility of being sued for discrimination or not complying with the various local laws.

Hopefully, the folks who rent out your property are reasonable people and stick with you long enough to help you move on to the next big step.

Before you refinance, it’s critical to find renters because lenders generally won’t refinance a house until there are tenants.

Refinance

The Refinance process is the next big step in the BRRRR method. Here’s where you can begin to feel the benefits of all your hard work.

Sure, seeing money coming in from your first rental property is excellent, but that’s not the ultimate goal of the BRRRR investing method.

What you want from your first property is the opportunity to get cash out and use it to fund your real estate empire.

You’ve rehabbed it and made it suitable for renters. You proved that your BRRRR property brings in cash and enough to make a profit.

All that plus more should put you in a good position to refinance your rental property so that you can move on to this step in the BRRRR strategy.

It’s time to start the process of refinancing once you have rented the property to tenants and you have documented several months of rental history. Refinancing may be the most challenging part of the BRRRR investing method because specific lenders will have special requirements for refinancing procedures.

You want to look for a cash-out refinance because it freezes your chances of moving to your next step. You can use the cash to pay off your outstanding debt (typically the hard money or crowdfunding loan) and use the remaining money to fund your next purchase.

Before you consider taking the refinance step, find out how long banks and lenders want you to own the property before they think of this refinancing deal. The time required is usually called a seasoning period. The minimum seasoning period is six months, and it could go higher depending on your lender.

While this might sound scary because refinancing is a big part of the BRRRR method, don’t worry. While one bank may deny you, that doesn’t mean they all will. Explore various refinancing options, including a mortgage broker.

Most banks will only give you 75% or less of the assessed value in a cash-out refinance. Even if the house is worth more as per the appraisal, they will only lend up to a certain amount of the fair market value (FMV). The FMV varies depending on the bank’s risk assessment criteria, the asset (house), your real estate experience, debt to income (DTI) ratio, and credit score.

Use a free tool like Credit Karma to track your credit report and score before you apply for any financing.

Continue working with other banks, maybe even community banks, until you find one that’s willing to work with you. Local community banks are usually more flexible and helpful to small businesses.

In addition to banks, you could look to independent lenders or people with cash within your group of friends or acquaintances.

You’ll be surprised how many folks are interested in investment opportunities like this one, but they just haven’t been asked.

There are also online platforms connecting people to angel investors who may be willing to work with you.

Independent investors may not even need you to have the property for as long as some banks may require, so it’s a good route to choose. Once you’ve secured the cash-out refinancing deal, you can start thinking of moving on to the next and last big step of the BRRRR strategy.

Your mortgage rate will be slightly higher with the BRRRR real estate investment strategy than with the traditional method because you are cashing money against the house.

Repeat

You are at the end of the strategy, where you get to do it all over again. Finally, you utilize the previous rental property’s cash-out refinance to help finance the purchase and renovation of your second property.

While this step is the last one, there are a few things to consider. For one, you can’t get here without the cash-out refinancing deal.

This step doesn’t just mean repeating everything you did. It’s kind of strange to say that since the last R of the BRRRR method does mean “repeat,” but it’s true.

You have to add everything you’ve learned from your first investment and so on.

If you didn’t calculate your repairs and updates correctly, then be sure to refine your ability to predict how much you’ll need to rehab your next property. If you didn’t choose the best location, maybe you can do better this time.

Whatever mistakes you made with your first property, you have the opportunity to fix them and redeem yourself. You’ll learn more as you go along, which is vital for anyone who wants to be a real estate investor.

Hopefully, the success of your first property allows you to obtain more cash than what you had for your first property.

Having more cash in hand means you can afford better properties and better upgrades for your second property.

More and better opportunities could be yours in this second round, and things are supposed to get better for you as you continue to repeat the BRRRR method.

It doesn’t mean you won’t encounter issues because you most certainly will, but you’ll have the knowledge to deal with these obstacles better because of your experience.

The first property will let you know if this is right for you. Sure, the headaches won’t feel great, but if you finish the BRRRR strategy feeling proud of what you accomplished, then this might be for you. If you feel excited about repeating the process, this might be for you.

When you begin your next cycle, be sure that you consider working with people who know more than you.

It may be possible that you’ll have enough cash to work with a rental advisor or other professionals who can cut some of the work you have to do to get this cycle going, like researching properties.

You know how long it took to get this done the first time on your own. Try to lighten the load if you can.

There’s no exact science to this method; each person works differently. Focus on finding a way to make this method work for you, and the rest will come.

BRRRR Example With Numbers

Here’s a BRRRR example of how the numbers might appear using this approach with a very bare-bones model. For simplicity, I didn’t include listing fees, closing costs, insurance, etc.

- BUY a distressed property for $100,000

- Your Down Payment is $25,000. Every lender expects you to have “skin in the game” demonstrated by your down payment cash. Also, no lender provides 100% Loan to Value (LTV)

- Take out an interest-only loan for $75,000 at 10%. One year interest cost is $7,5000

- REHAB budget $20,000 with a timeframe of 3 months.

The total out of pocket cost for you is $52,500 (down payment + rehab budget + interest cost)

- RENT out the property for $1500/month.

- Assume your bank requires only a six-month seasoning period; you collected $9,000 in rent. Use the rent of $9,000 to pay your hard money interest of $7,500 for the year and the $1,500 for property taxes.

- REFINANCE the property for an appraised fair market value of $170,000 a year later.

- Generally, Fannie and Freddie LTV requirements are 75% for 1 unit and 70% for a duplex to fourplex. Assume the bank approves a loan for 75% of the appraised value for one unit ($170,000 x .75 = $127,500).

- Take the $127,500, pay off your outstanding debt (the original loan) for $75,000. Now you have $52,500 in cash, which is the exact out-of-pocket costs when you started your first BRRRR property.

- REPEAT by finding your second BRRR deal with the $52,500.

- You also have your first BRRRR property spitting out cash. Use the monthly rent for the mortgage payment, interest, taxes, insurance and save the rest for emergencies and capex reserves.

Pros Of The BRRRR Method

Low Cash Option

The BRRR strategy is a tried and tested method to invest in rental properties with low money down. In essence, you can learn from the experience of other real estate investors. You can start something and feel confident that it has worked for others.

Traditionally, if you wanted to own ten rental homes, you would need a down payment for each with a long-term mortgage on each. Using the BRRRR investment strategy, you get to ten rental properties using far less money than a traditional rental investment path.

Of course, you need to employ creative financing strategies, but the cash constraint eliminates decision fatigue and helps you narrow your search to only the best deals.

High Return Potential

One of the most significant advantages is a large return on investment (ROI). When done correctly, BRRRR investors may buy an underperforming property below market value and appraise it for a much higher amount.

Cash Flow

The BRRRR strategy ensures that investors get consistent cash flow from their investments. After the Rent step of the BRRRR process, you’ll earn passive income through the rent you receive.

Even if the market crashes and your appraisal comes lower than expected, you can wait out the storm by just collecting rent till the market improves. Contrast that with a flipper who can get stuck with an expensive remodel in a downturn.

Better Tenants

If you have completely restored the BRRRR property to satisfy consumer expectations in a specific market, it will almost certainly attract excellent tenants. In exchange for particular features and amenities, tenants who pay top dollar for their rental property are more likely to care for it properly. Better cash flow is frequently associated with better tenants.

Growth Options

Most strategies on how to start investing in real estate do not lay out a roadmap on the next steps. The repeatable nature of the BRRRR deals shows how it has worked for many people, so there are a lot of great BRRR method examples for you to follow.

Real Estate Lifecycle experience

The BRRR real estate method touches on various aspects of the real estate business. You learn different industry parts, starting with property acquisition using rules, dealing with creative financing, managing rehab, flipping aspects, property management, and finally dealing with banks to refinance.

After your first BRRR property deal, you can decide what aspects you enjoy of the real estate and which ones you want to outsource.

Cons Of The BRRRR Method

There are several real estate investment risks so one should have an appropriate risk mitigation plan in place. BRRRR investing has several moving parts that add to the risk.

Expensive Loans

Since conventional loans are not available for distressed properties, the BRRR investor is stretched thin with expensive hard money loans or risky cash out on their primary.

The longer duration your hard money loan is for, the less profit you make. The key to this BRRRR investment strategy’s success is to enter and exit the deal as quickly as possible.

The refinance loan is also expensive since you are doing a cash-out refinance, typically at higher rates than conventional mortgages.

Rehab Experience

Anyone who has dealt with home remodels knows that they cost twice as much budgeted and take twice as long to complete. Managing costs and the schedule of the rehab process are critical for the BRRRR investment strategy. During the rehabilitation phase, investors can be over-leveraged due to the cost and time overruns since they financed the property with short-term or hard money loans at high-interest rates. Managing contractors and the renovation work is an acquired skill, and theoretical knowledge alone can’t equip you.

Renovation projects entail meeting deadlines, managing city permits and inspectors, contractors, and addressing unforeseen problems. Make sure you have the proper resources and contingency funds in place before starting the project.

Individuals might not have the necessary experience in managing a rehab project, especially since distressed property rehab will be more complicated than a regular rental remodel. You might have to deal with complex tasks like foundation issues or septic tanks on the property during your BRRRR renovation projects.

Lower Appraisal

The most critical disadvantage of BRRRR real estate investments is that the property’s value is based on a future assessment.

What if, during the refinance process, you qualify for less money than expected. The market could crash, and the appraisal might come lower, resulting in you being unable to do the cash-out for your next project. Make sure you have an exit strategy in place.

Real Estate Leverage

All your BRRRR properties will operate with high real estate leverage with the cash-out refinance. Stripping out all the equity from your BRRRR properties results in higher real estate leverage and little margin for error. Not everyone would be comfortable with aggressive leverage, and the amount depends on your risk profile and tolerance.

Types of BRRRR Properties

Single Family Homes, apartment units, condos, and townhouses are great candidates for BRRRR real estate.

If you are ambitious and have prior experience, you could also do a duplex, triplex, or fourplex.

Carefully analyze which market you want to buy your properties in. Houses and multi-family homes (below five units) are usually the easiest to finance compared to commercial projects.

More advanced investors can try their hand at more significant deals like fixer-upper retail space, office buildings, etc. However, such projects require more experience and expertise than dealing with residential real estate.

You can undoubtedly use tax strategies like 1031 exchanges to move up the real estate ladder, tackling these larger projects after you have enough funds and expertise.

Alternatives To The BRRRR Method

We covered the BRRRR method in detail, including the pros and cons.

Since the IRS classifies rental income as passive, many individuals expect real estate investing to be passive.

BRRR is a real estate strategy where you need to be involved every step of the way and invest a ton of “sweat equity.” The BRRRR method is similar to house flipping, except you are holding it long term

Many individuals feel overwhelmed with the BRRRR method real estate of active investment.

If you prefer security with lower risk levels and less active involvement, then other real estate investment strategies might be better for you.

Turnkey Properties

A turnkey property is a completely renovated house or apartment that an investor can purchase and rent out right away. Turnkey investments are frequently renovated by the same firm that provides property management services to purchasers, reducing the amount of time and effort involved in the rental.

Most Turnkey providers also select a renter and have your unit ready to cash flow by the time you are done with the deal.

Although this approach sounds like a passive investment dream, there are often several issues with the cash flow assumptions made by the turnkey company to the rehab work done to the quality of the tenant placed.

If you decide to follow the turnkey approach, make sure you validate all the assumptions in the Pro-forma, including the condition of the property you buy.

REITS

Real estate investment trusts (REITs) own, operate, or finance income-producing real estate across many property sectors. The real estate investment trust is a way to invest in real estate passively.

REITs allow anyone to invest in real estate assets by purchasing individual company stock or through a mutual fund or exchange-traded fund (ETF). The stockholder of a REIT earns a share of the income produced without actually having to go out and buy, manage or sell the property.

You can go with a diversified index ETF from Vanguard (VNQ), Schwab (SCHH), Fidelity (FREL). One can buy publicly-traded REITs using no-fee platforms like M1Finance for as low as $10. Check out my M1 Finance review for more details on dollar-cost averaging your REIT purchases.

Publicly traded REITs have the advantage of simplicity and liquidity. All the other options require some due diligence in evaluating the deal, but there is a possibility of higher returns and additional tax benefits. As with everything in life, there are trade-offs in each investment option.

The Traditional Buy And Hold

The traditional method is to purchase a property in excellent condition with a conventional bank loan and then rent it out. The rental income essentially covers your mortgage, capital reserves, and expenses, while the additional cash is your passive income.

The traditional method is quite popular because it is a tried and proven method of acquiring properties at a slower pace with less stress than the BRRRR strategy. The con of the traditional method is that it requires more funds than the BRRRR method.

Make sure you are familiar with how to evaluate a rental property, including all the standard metrics used by real estate investors.

Real Estate Crowdfunding

A more innovative technique is a crowdfunded real estate investment. Real Estate Crowdfunding, also known as crowdfunded investing or property crowdfunding, allows several investors to pool their money together and buy a real estate investment property with the contributed pool.

People can make investments for less money, and it is passive while still receiving the benefits of real estate investments, including tax advantages. Crowdfunding for real estate investors is a way to diversify their investments and own multiple properties with less risk than if they were doing it alone. The process gives individual investors access to the real estate market without owning, financing, or managing properties.

We have covered the pros and cons of the crowdfunded approach extensively.

Depending on your investment style, you could start with Fundrise, one of the lowest minimums (only $10 for the Fundrise Starter Portfolio), or DiversyFund with a $500 minimum.

The trade-off with low investments of Fundrise and DiversyFund is that you cannot select one particular property; but rather an eREIT invested in several commercial real estate investments.

You have more comprehensive selection options if you meet the accredited investor qualifications. PeerStreet offers residential and commercial real estate investments for $1,000 minimum investment or EquityMultiple for commercial property investment with a $5,000 minimum investment.

Final Thoughts On The BRRRR Real Estate Strategy

The BRRRR method, once implemented correctly, can set your real estate portfolio to be the foundation of your generational wealth building.

The BRRRR approach can raise your net worth, create passive income through rent, and ultimately lead to financial freedom by allowing you to own rental real estate in a step-by-step manner.

The BRRRR approach is more time-consuming and risky, but it may pay off handsomely. If you’re an investor who is comfortable with a certain level of risk, has cash available for an initial down payment, and is ready to get your hands dirty learning many aspects of the industry, the BRRRR real estate technique is for you.

Readers, have you considered the BRRRR strategy to kickstart your real estate investing journey. What aspects of the BRRRR method do you find the most challenging?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.