Personal Capital Review 2026 – Pros and Cons

One of my favorite books as a kid was Alice in Wonderland

“Alice: Would you tell me, please, which way I ought to go from here?

The Cheshire Cat: That depends a good deal on where you want to get to.

Alice: I don’t much care where.

The Cheshire Cat: Then it doesn’t much matter which way you go.

Alice: …So long as I get somewhere.

The Cheshire Cat: Oh, you’re sure to do that, if only you walk long enough.”

What gets measured gets managed – Peter Drucker in The Practice of Management. I am sure, everyone has found value in some form of measurement to track goals which are important to them.

In order to accelerate our Financial Freedom; we should at any point in time know which direction we want to go.

- Knowing our current financial situation and

- also tracking how far we are away from our goals will not only keep us motivated; but it will also inform our investment choices and the risks we are willing to take with respect to our Human Capital or investments.

As you know by now; I am a huge fan of automation. Even investing in stocks is an automated process for me. I use M1Finance to automate all my purchases since the platform has zero fees, very low minimums, automatic rebalancing to pre-defined asset allocations and fractional shares. You can read my M1Finance review and why I prefer it over Vanguard, Schwab and Fidelity.

The time and energy spent doing anything manually; is just not worth it. It can be better spent either earning more money or enjoying life.

I have over 45 different financial accounts – bank accounts (for bonuses); investment accounts and credit cards (for rewards). Keeping track of all these; was a nightmare before Personal Capital. I used to login once a month to the 45+ accounts and manually update my excel. As I started using the free version of Personal Capital, I also found additional features which were quite useful.

What is Personal Capital?

Personal Capital is a Registered Investment Advisor with over $12B in assets under management. They are ranked #3 on RIA Channel’s list of the Top 100 Wealth Managers in 2019, as featured in Forbes.

Personal Capital provides a free tool which enables you to track your net worth; cash flow, budget, emergency fund.

It also provides information with respect to your investments such as asset allocation, performance against benchmarks, any hidden fees which are eating away your retirement savings.

You can also use it for retirement planning, savings planning and checkup on your investments.

Get started by signing up and linking all your banking, investment and retirement accounts. Your entire financial life at-a-glance is now visible in a simple, easy to use actionable dashboard.

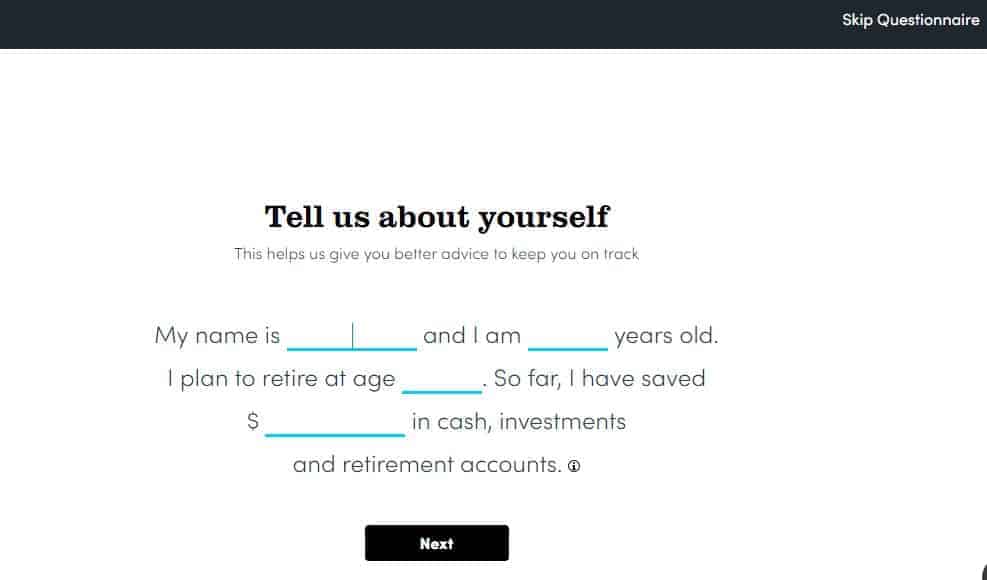

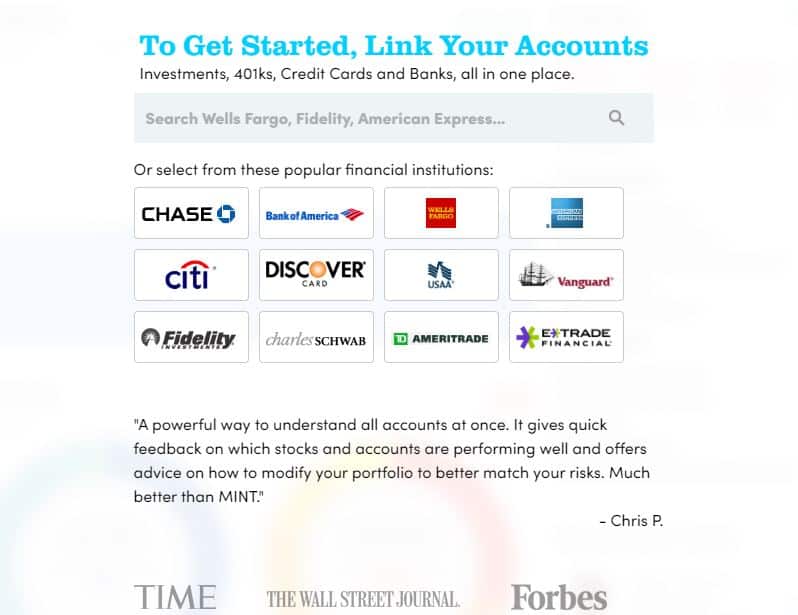

Personal Capital Sign up process

When you sign up; the software will prompt a questionnaire. I just skipped it and went to directly link my accounts.

The linking screen provides icons for most of the common bank and investment accounts. You can search for the ones you do not notice and add them all. Some financial institutions can be linked by just providing the username and password. Others may send you an additional verification code which you need to enter.

After all accounts are linked you can either run the Investment check or Go to Dashboard. Let us go to the Dashboard and take a look

Personal Capital Dashboard

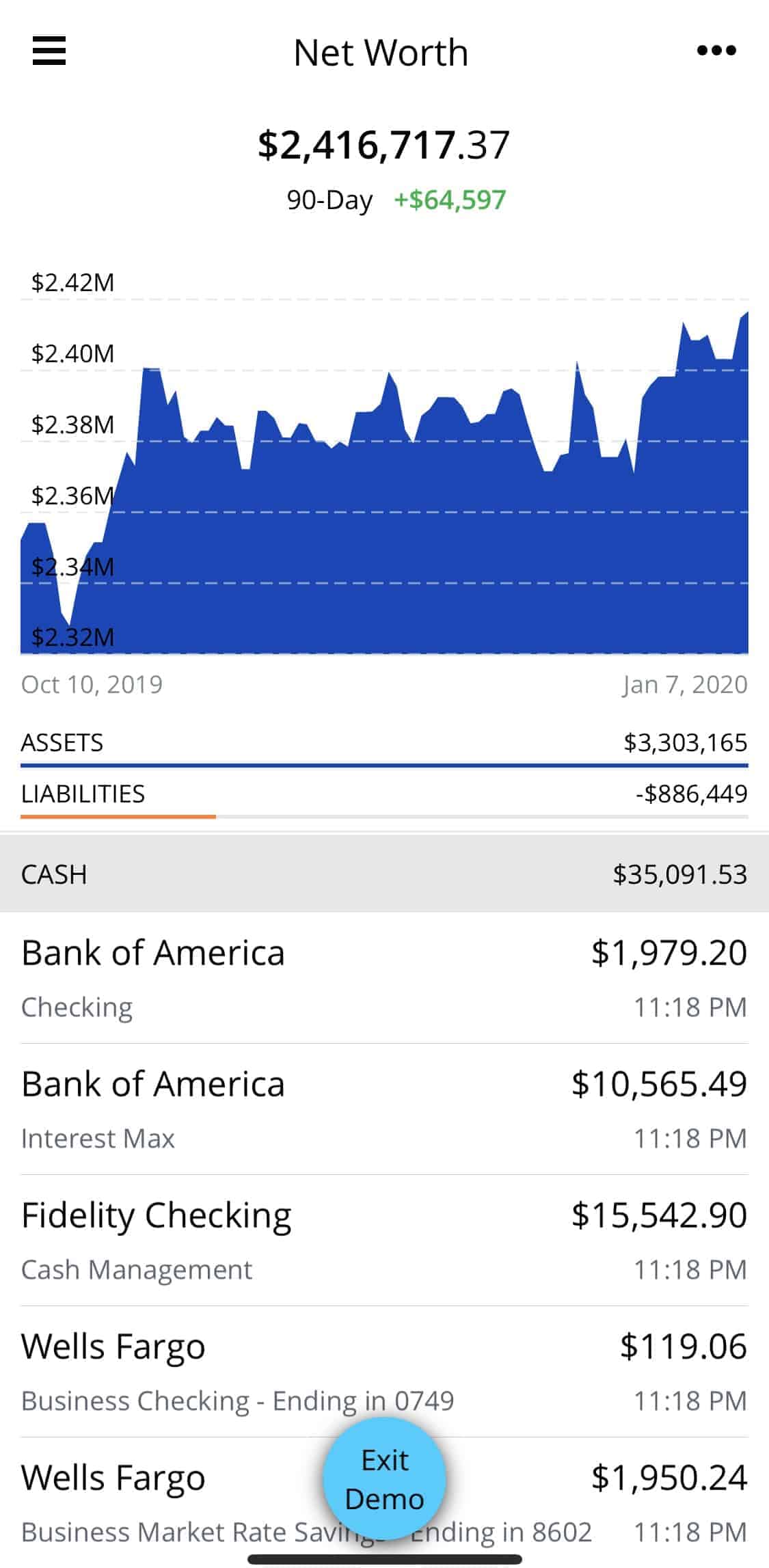

Net Worth Tracker

In order to figure out your net worth, we must track what we own (assets), minus what we owe (liabilities). Personal Capital capital aggregates all the information; in a visual form indicating how your net worth has changed over a period of time. It is pretty inspiring to see the line going higher and higher over a period of time.

It also list the Assets and Liabilities below by each account in case you want to drill down further. So if we click on the Bank of America line item; it lists every transaction in that account.

Cash Flow Tracker

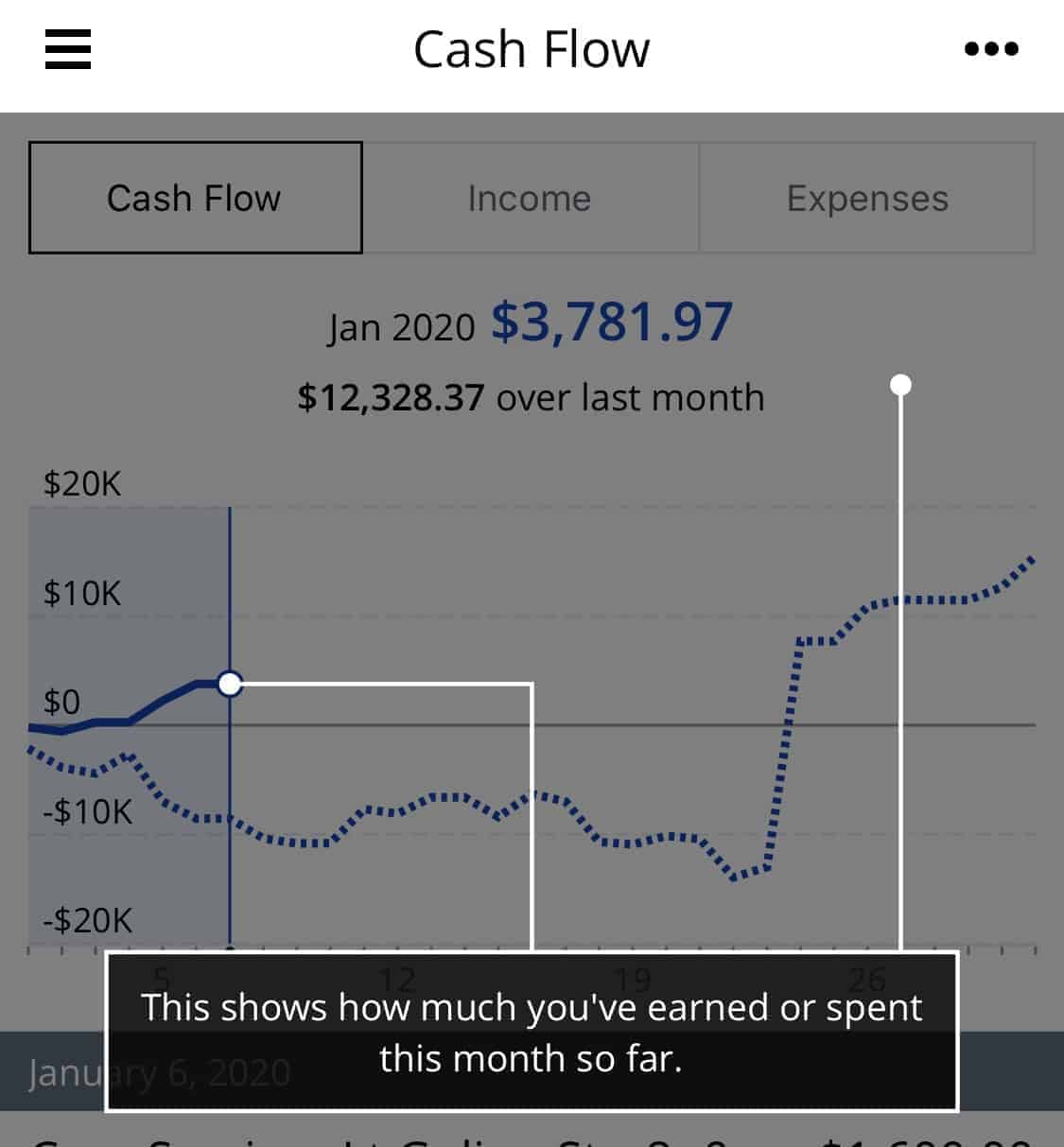

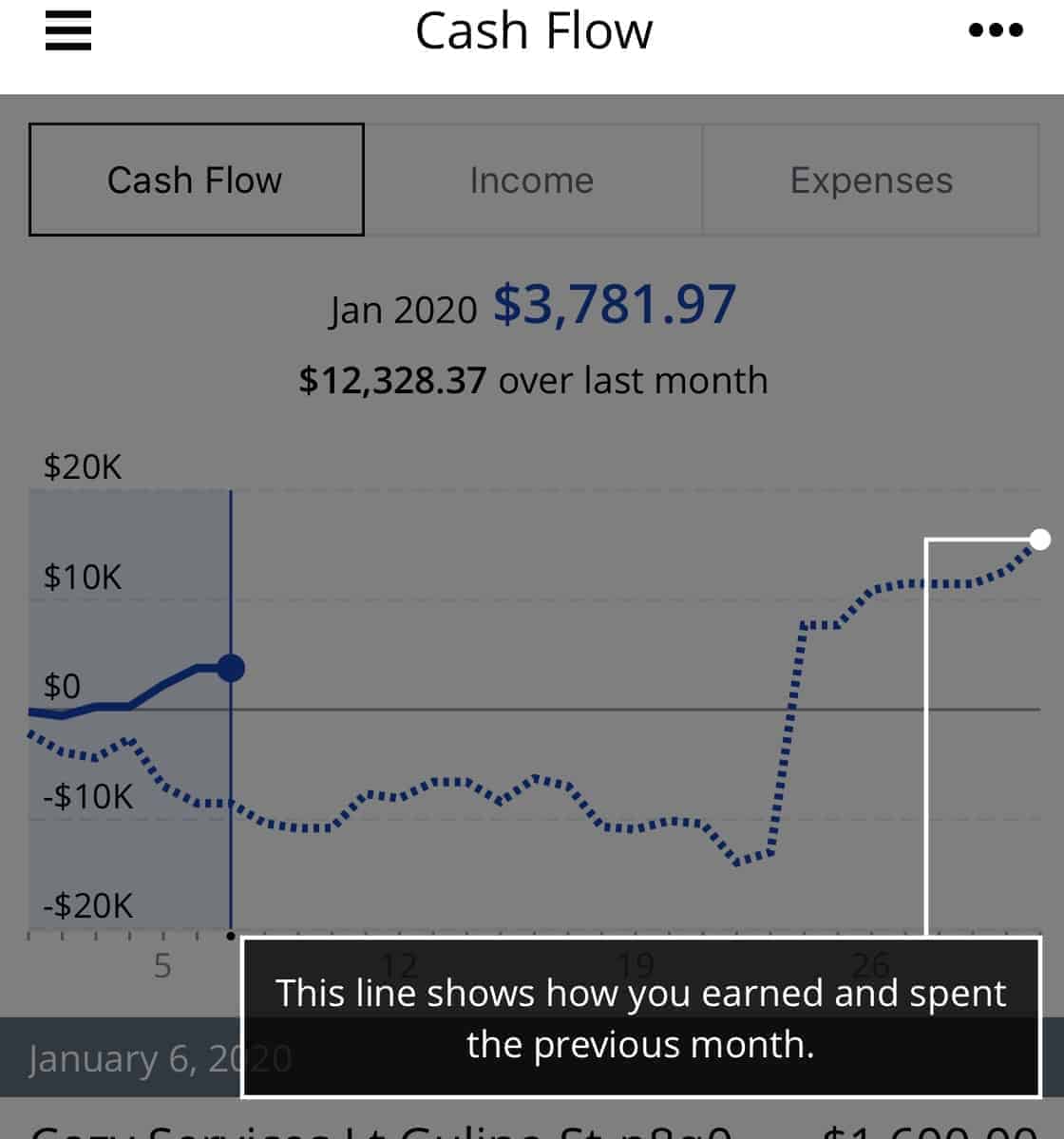

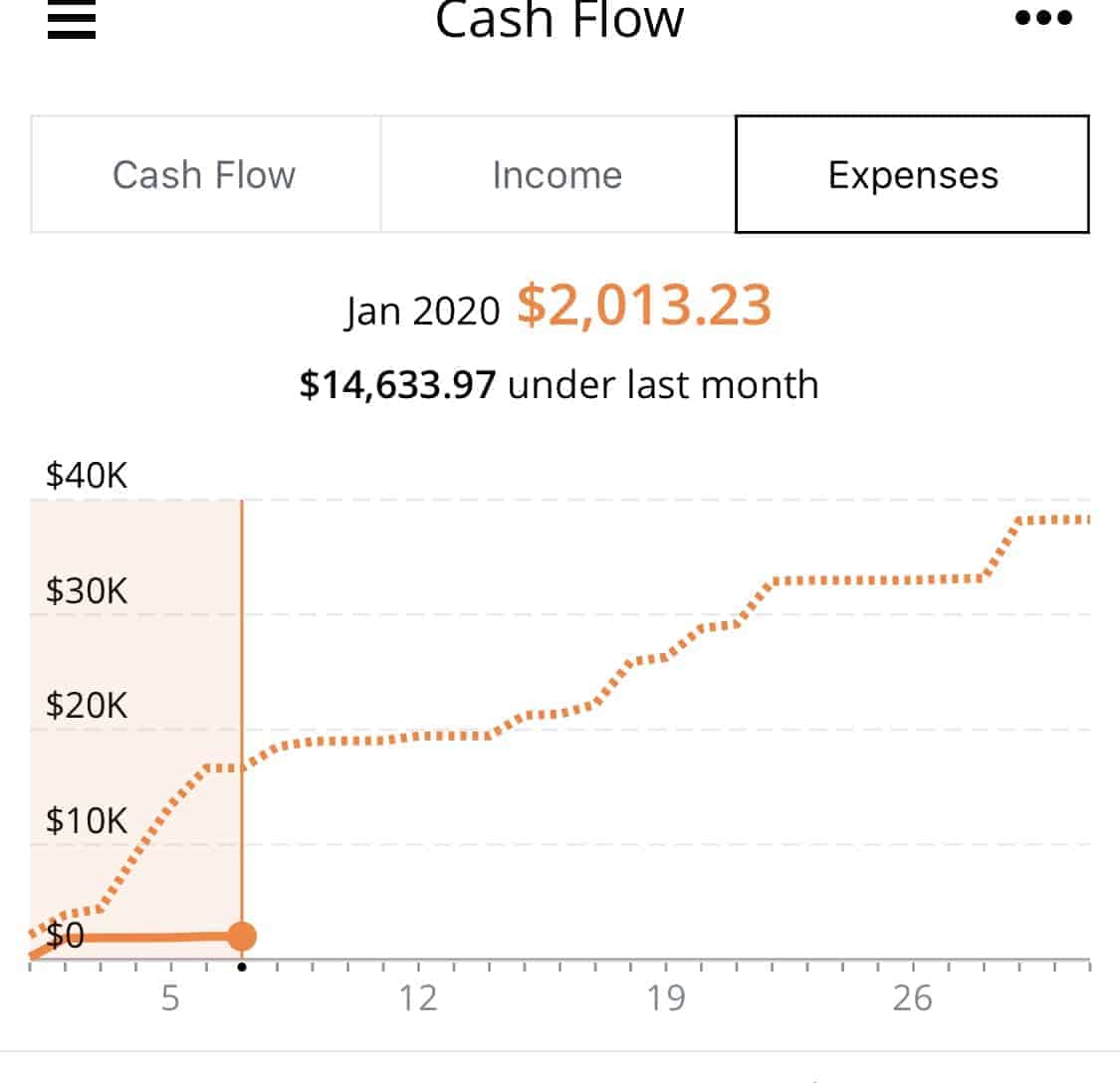

The solid line shows where you are this month against the same time (dotted line) for the previous month. The Cash Flow tracker is one of the best features to visualize if you are on the right track or adjustments need to be made.

![]()

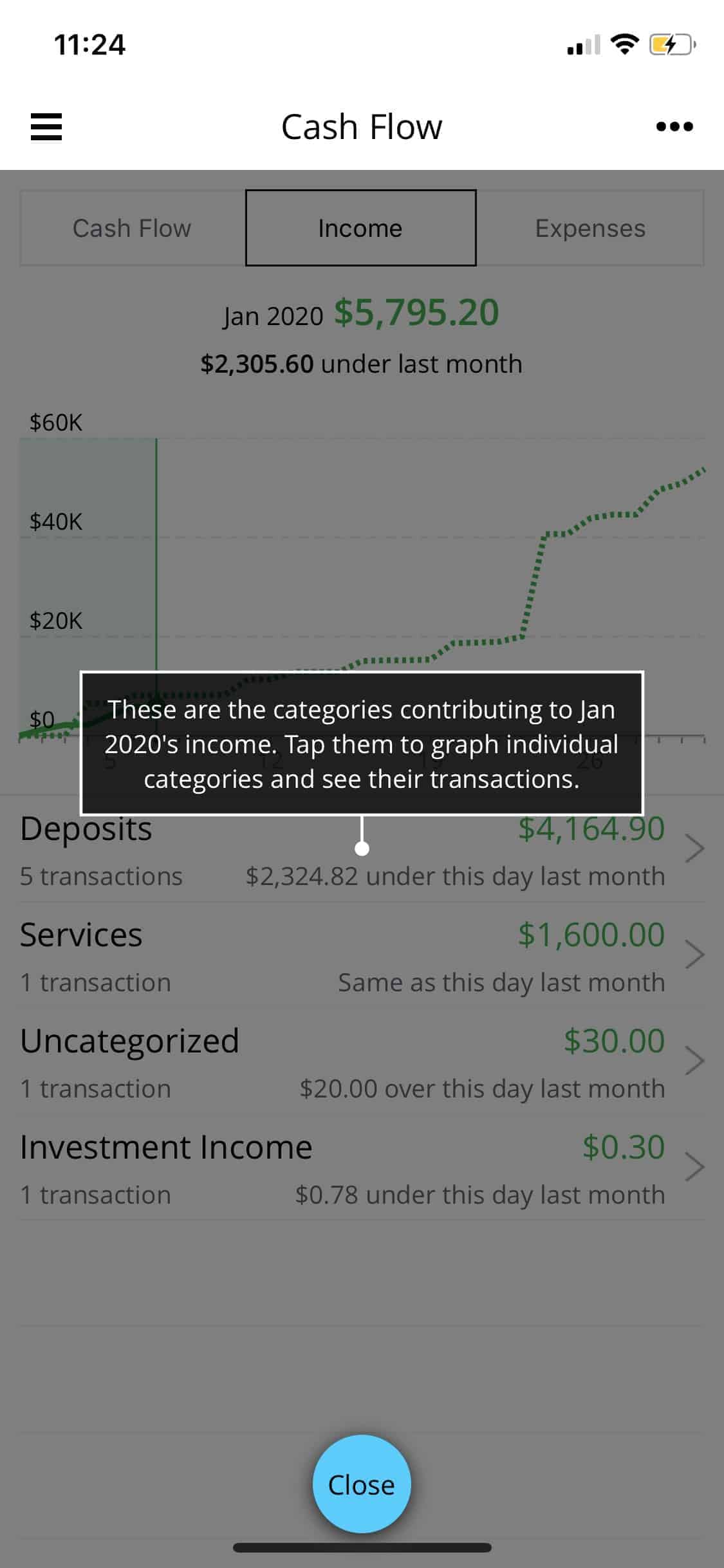

Within Cash Flow you can also look at Income and Expenses.

The income and expenses also have a graph with details below of each transaction which contributes to the overall numbers.

Personal Capital Cash Flow Expenses shows your current month’s expenses (solid line) against previous month’s expenses (dotted line).

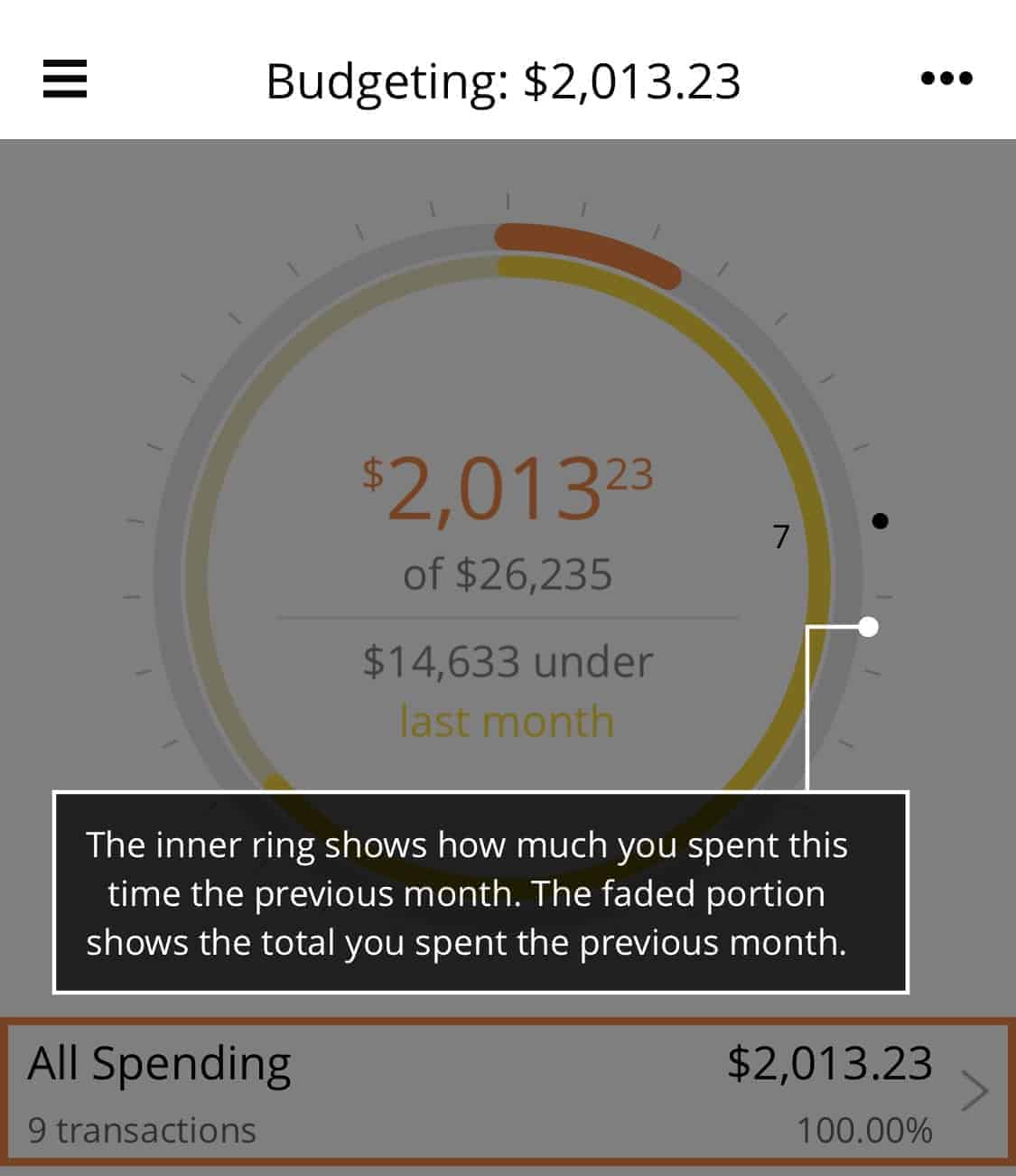

Budgeting

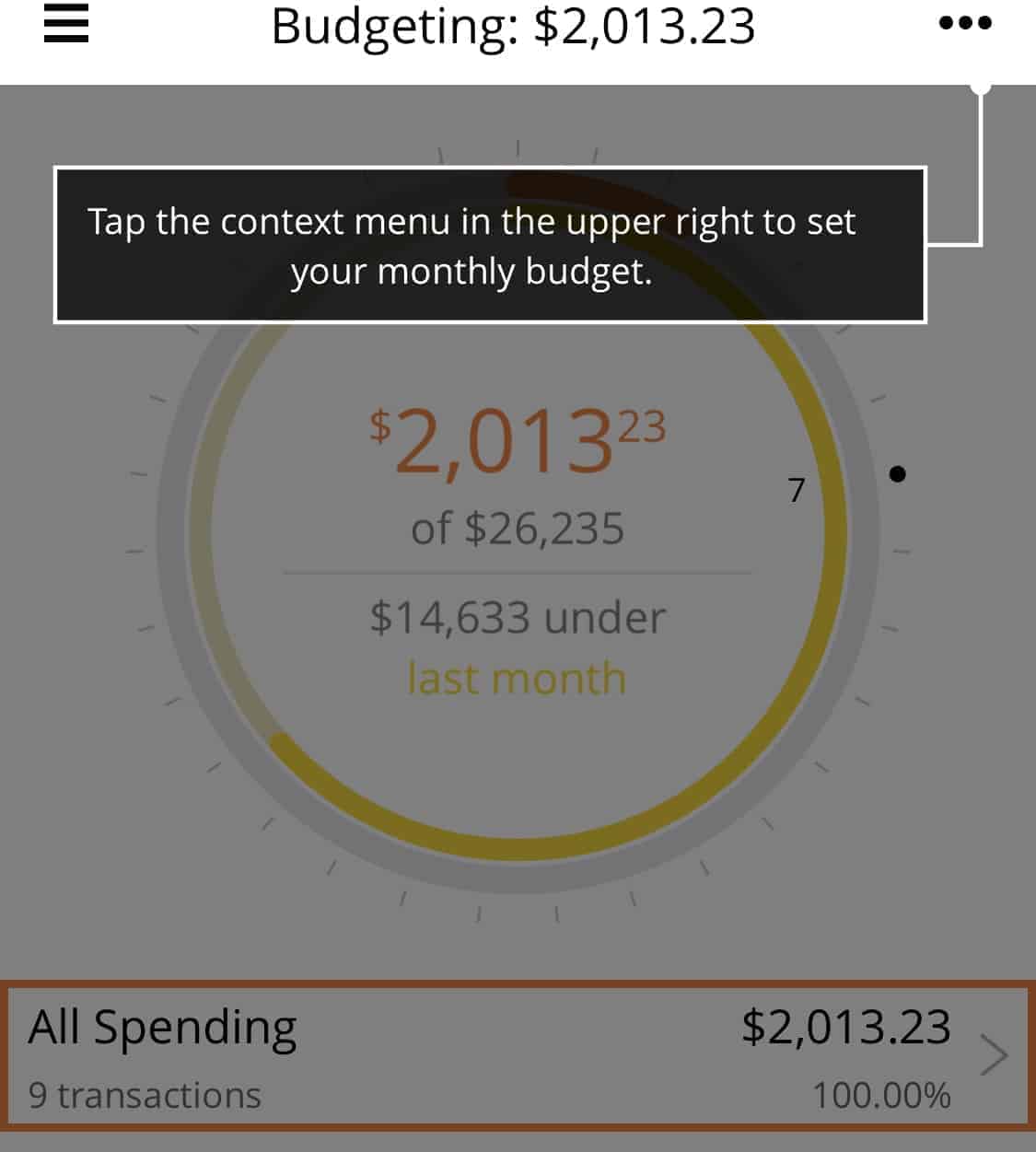

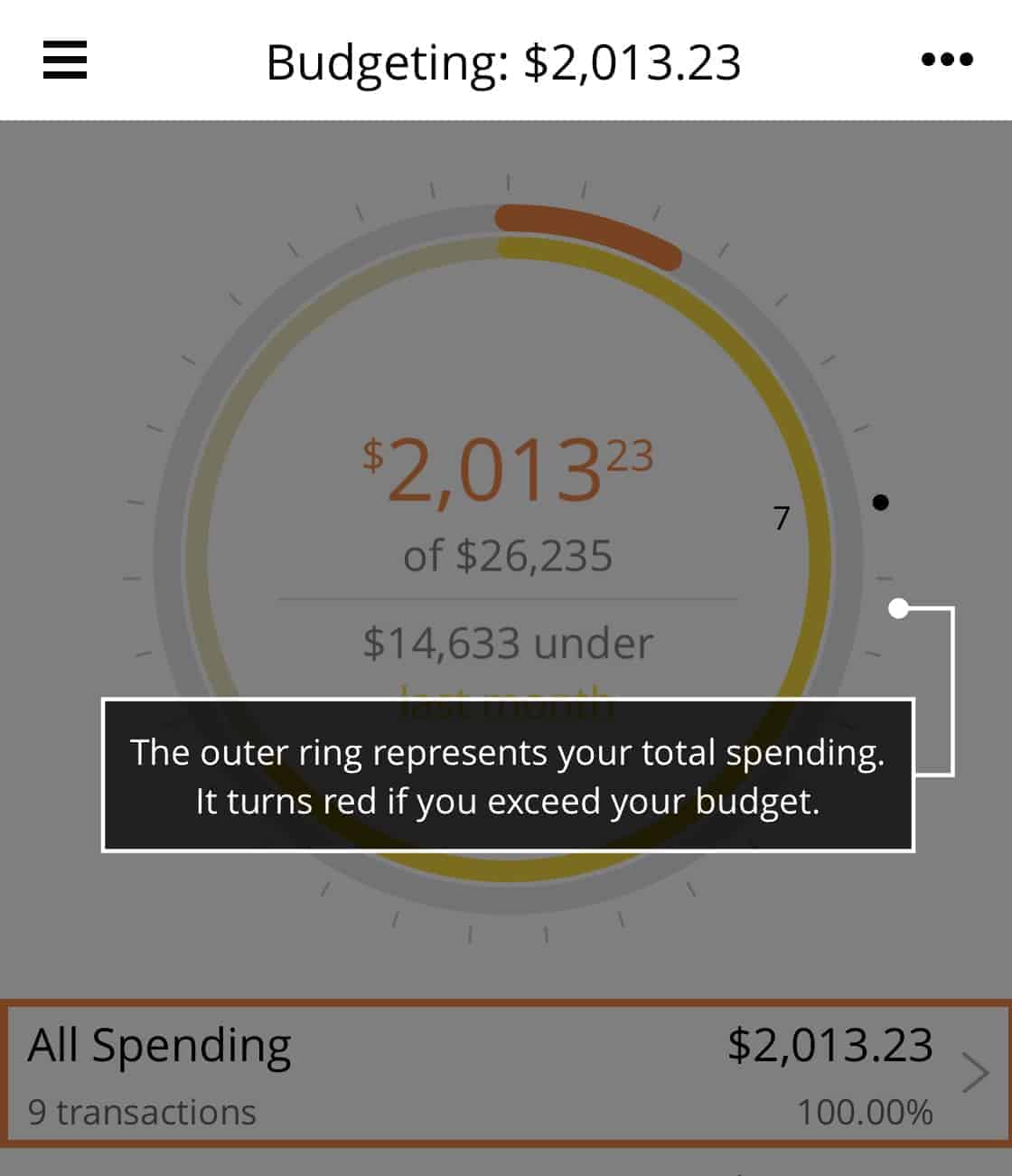

Personal Capital added the budgeting feature at a later point.

When you first create an account, Personal Capital uses your last month expenses to define your budget. You can also set your monthly budget if you don’t believe the prior month is an accurate representation going forward.

The outer ring shows your total budget and the inner ring indicates how much you spent at this time in the previous month.

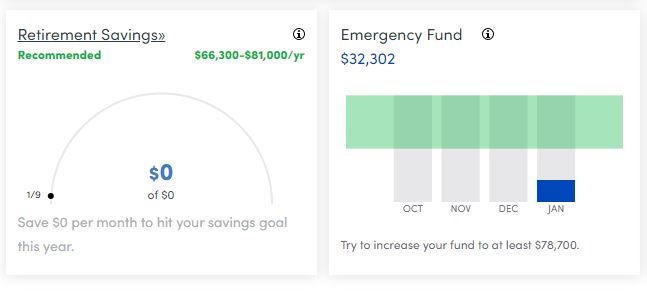

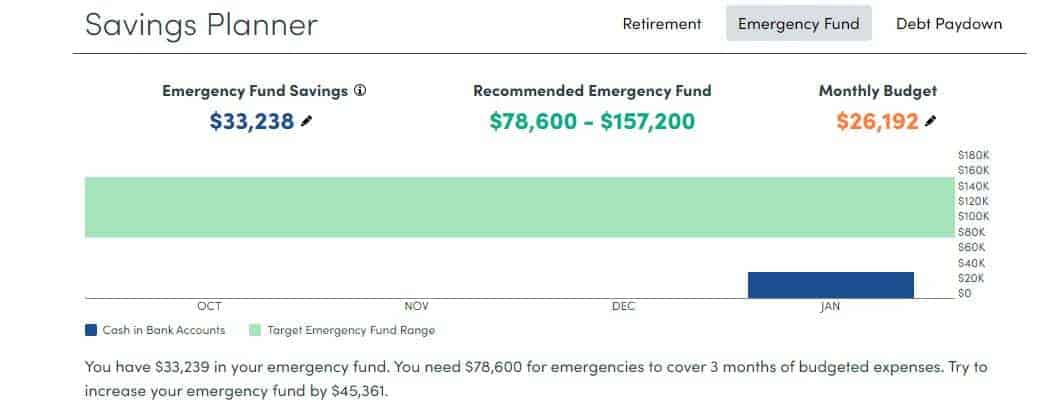

Emergency Fund

This is a sum of all your linked bank accounts. I use a strategy to earn over 8% interest on my emergency funds with various bank accounts. So this feature is useful to know my total emergency cash, across all accounts at a quick glance.

Retirement Savings

This is a visual gauge for this year’s net inflow into your investment accounts. This is not how much you have saved in the previous years. But rather to see how much you are putting money aside this year. It is currently zero for me since I have not yet done any contributions. It also provides a range which I should target in terms of Retirement Contributions this year.

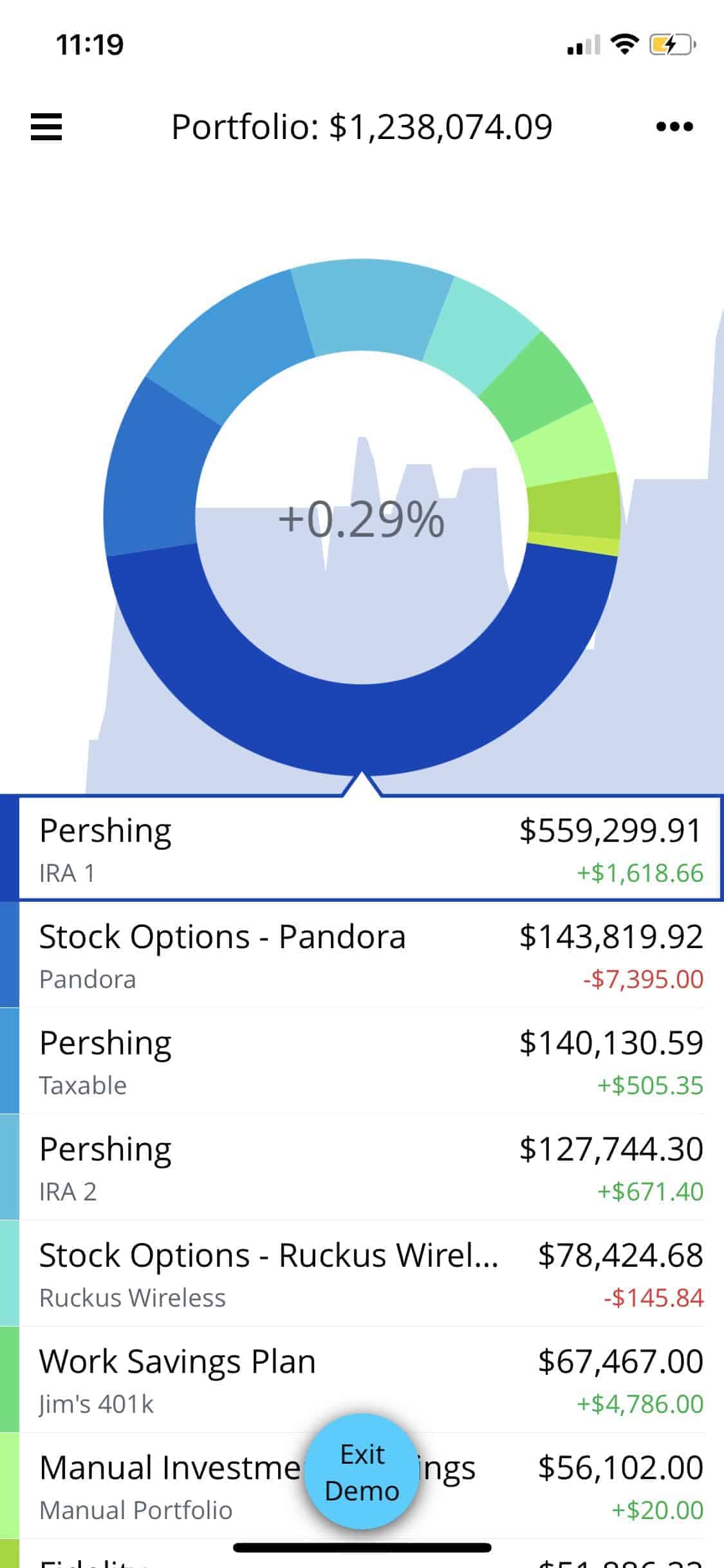

Personal Capital Portfolio

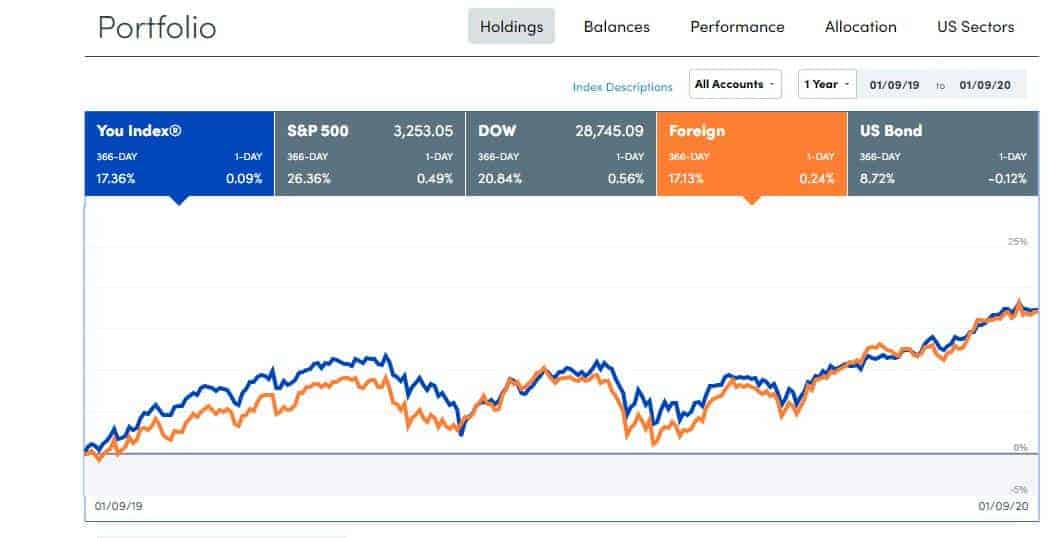

Holdings

This indicates all your holdings and you can benchmark against the index you track.

Allocation

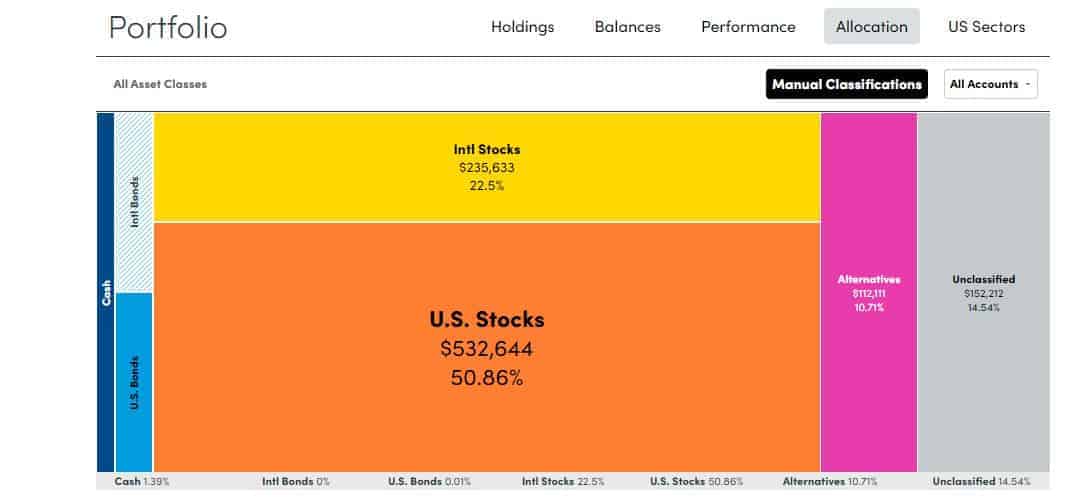

This indicates how diversified you are across different asset classes.

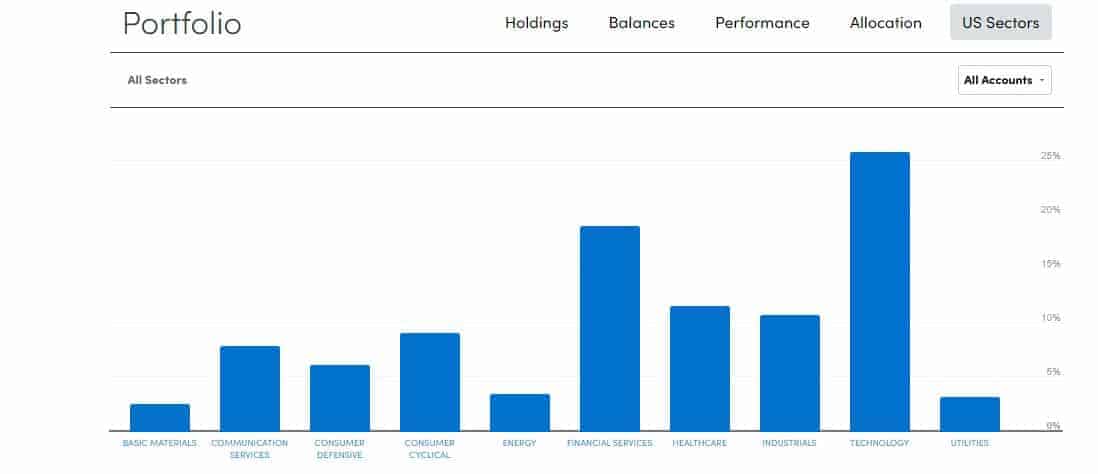

Sectors

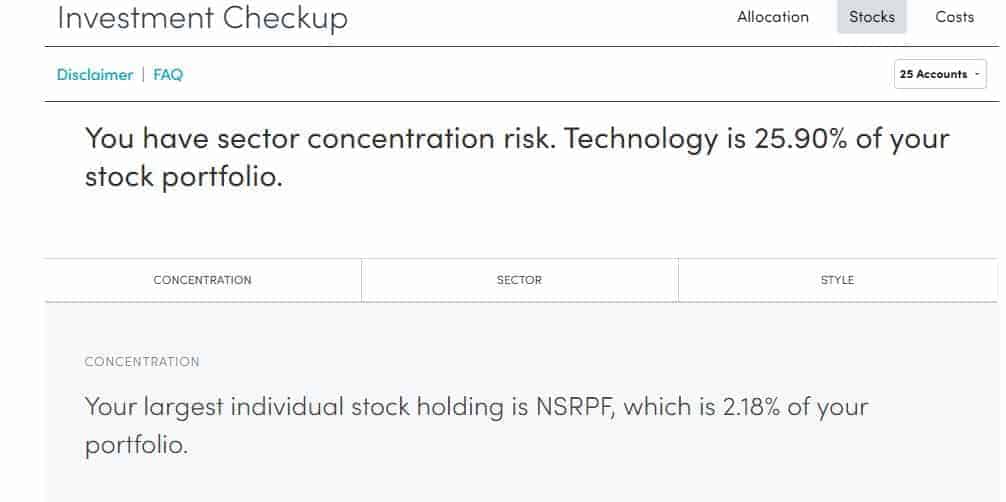

You can also drill your portfolio across sectors to check if you are overweight or underweight based on your risk tolerance. Imagine how useful this is to have this information; not only across various funds but summarized across accounts. Looking at this graph, I realize that I am overweight technology and might need to dive deeper into it.

Personal Capital Planning

Now we come to the most exciting part related to our Financial Freedom Countdown.

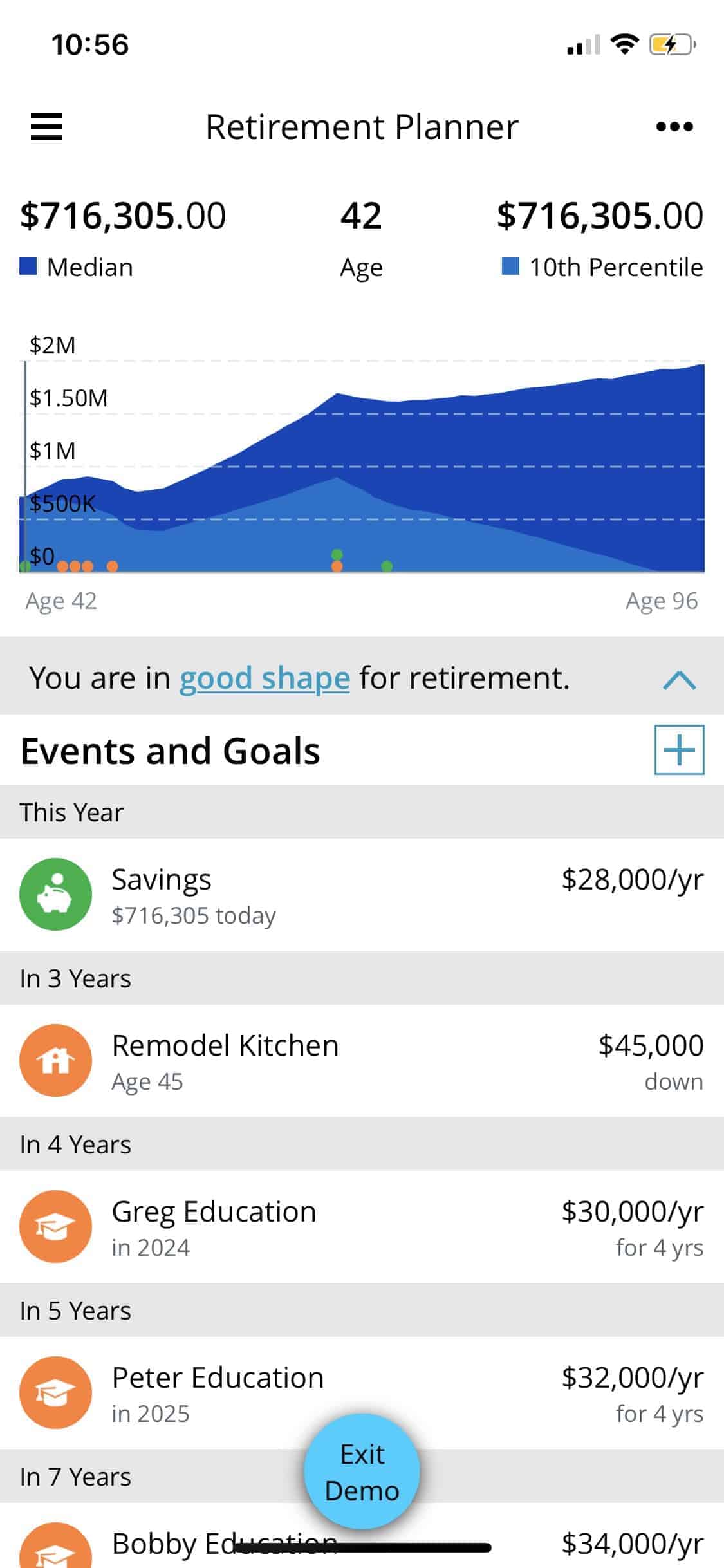

Retirement Planning

The Personal Capital Retirement Planner indicates if you are on track for retirement based on all your assets and liabilities. You can also setup goals for the future such as amount needed for a child’s education or a kitchen remodel; and the planner takes all of that into account.

The Personal Capital Retirement Planner also takes into account the fact that some of your money is in Taxable accounts and some is in Tax deferred accounts such as IRAs and 401(k). Your Federal and State taxes are also considered when running around 5,000 Monte Carlo simulations. It shows the median draw down of your portfolio and also the 10th percentile so you know how you would perform in an average market v/s a really bad market.

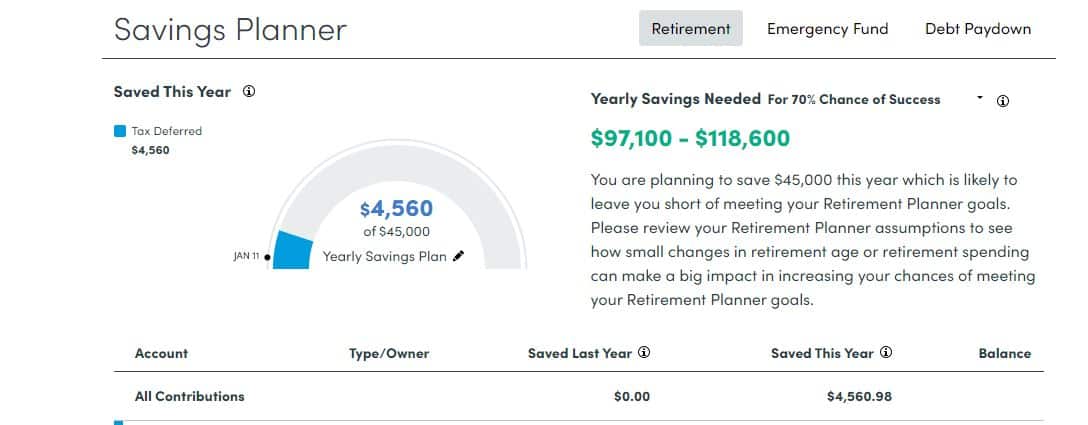

Savings Planner

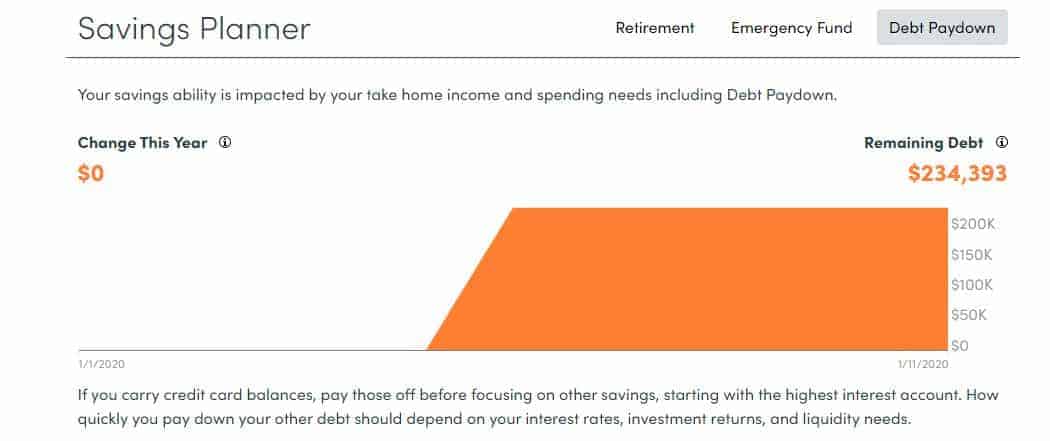

The Savings Planner shows how you are tracking against your savings goals against 3 buckets

- Retirement

- Emergency Fund

- Debt Payoff

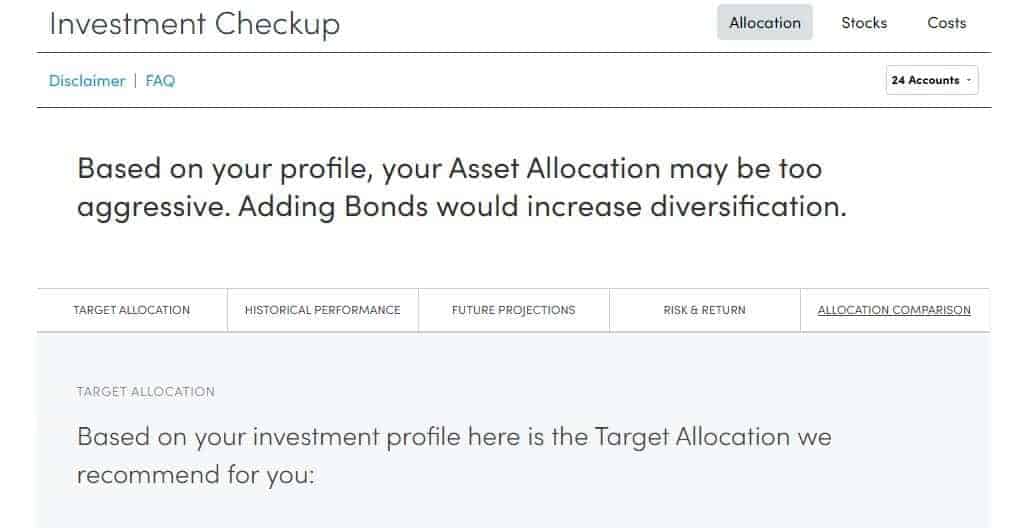

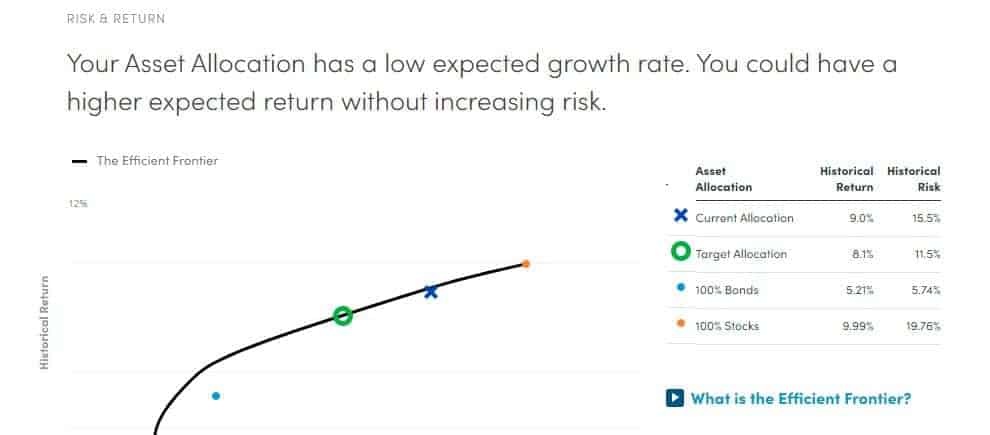

Investment Checkup

Allocation

It looks at your current allocation and also recommends a Target Allocation.

Stocks

This identifies not only your sector risk but also if you are overweight any particular stock so you can take action accordingly.

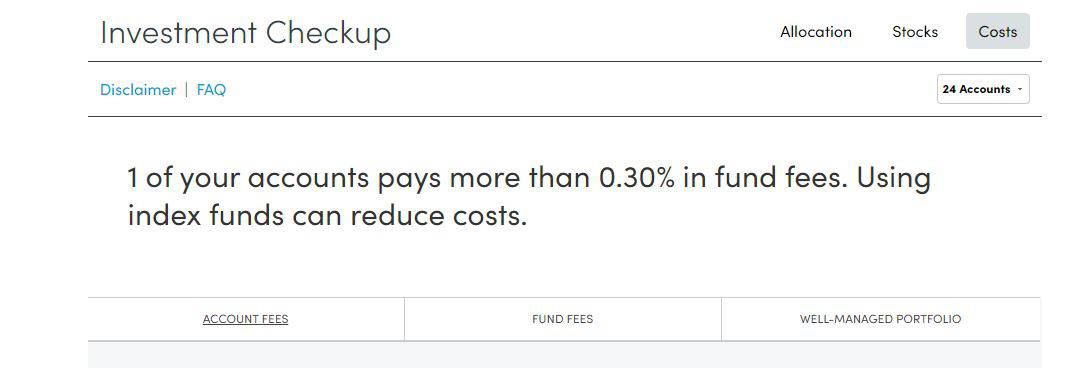

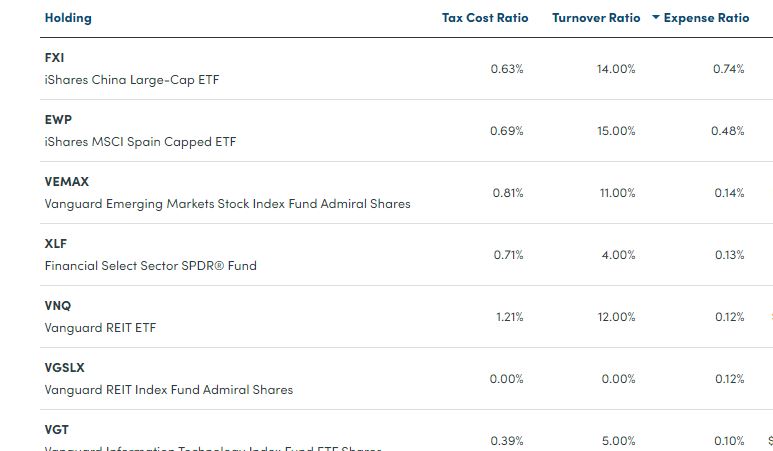

Costs

Here you can identify the costs in terms of Account fees and also Fund fees. Remember to examine these costs and make a conscious decision if you believe the accounts and funds justify the cost being charged. After all once your account reaches a sizable amount; the costs eat up a significant chunk of your money. Here are the details of the fees I am being charged. I plan to make changes based on this information.

Benefits of using Personal Capital

- Free: While Personal Capital has an advisory service which charges fees with the benefits of a personal advisor; all the features I have described above are totally free and can be used by just signing up

- One single place to look at your entire financial life and take action saving you time and energy with respect to tracking.

- Net Worth Tracker: No need of manual maintaining an excel sheet to track all your various account balances. Personal Capital Net Worth Tracker aggregates all your data.

- Cash Flow Tracker: You can literally track on a daily basis how you are doing for the current month against the last month. Personal Capital Cash Flow Tracker helps you manage income and expenses.

- Budget Tracker: You can set your budget and monitor it. Personal Capital Budget Tracker helps you get your spending back on track.

- Emergency Fund tracker: Aggregates all your cash balances so at a moment’s notice you can know if you have enough funds to meet any emergency. Personal Capital Emergency Fund tracker also alerts you when your emergency fund is low.

- Portfolio Tracker: Personal Capital Portfolio Tracker shows your entire portfolio across asset classes and sectors which helps you balance risk accordingly and avoid being too concentrated. You can of course make concentrated bets as I do with certain sectors but this needs to be a conscious choice. Else you would be caught unaware in a downturn.

- Retirement Planner: The Personal Capital Retirement Planner indicates if you are on track for retirement based on all your assets and liabilities. It also allows you to make changes for your future goals like home improvement or saving for college. The Monte Carlo simulations should make you more confident before taking the plunge into retirement.

- Savings Planner: The Personal Capital Savings Planner visually indicates how you are tracking against your savings goals for Retirement, Emergency Fund and Debt Payoff.

- Investment Checkup: Personal Capital Investment Checkup highlights if your stock bond allocation is appropriate for your risk profile and suggests a target allocation. It also highlights all the account and fund fees you are currently paying thereby saving you money.

Why is Personal Capital Free?

Personal Capital operates on a “fremium” model. While the above features are all free; it also has a wealth management service with over $12 billion in assets under management. They would ideally like some of their users to start using their paid services. After you sign up; you would receive either an email or a phone call from a personal advisor asking if you need their services.

The wealth management service is only available for balances above $100K. For balances between $100K and $200K you get a team of advisors and for balances greater than $200K you get assigned two dedicated financial advisors. Personal Capital charges a 0.89% account management fee for the first $1 million and reduces to as low as 0.40% for larger account balances.

When I received the introductory phone call, I politely replied that I do not need wealth management service at this point. You are under no obligation to use the wealth management service and can continue to use the free service.

[bctt tweet=”Personal Capital provides a free tool enabling you to track your net worth, cash flow, budget, emergency fund, asset allocation, performance against benchmarks, any hidden fees and retirement planning.” username=”FFCsocial”]

FAQs

How many people use Personal Capital?

Personal Capital is used by nearly two million people, who primarily use the free version to track their financial goals.

Does Personal Capital sell your information?

As per their Privacy policy, they do not rent, sell or trade your Personal Information.

Is Personal Capital trustworthy or Can I trust Personal Capital?

Personal Capital is a fiduciary registered with SEC. You can check details at https://www.adviserinfo.sec.gov/Firm/155172

Can Personal Capital be hacked or How safe is Personal Capital?

As with most similar services, Personal Capital claims bank-level, military-grade security like AES 256-bit encryption. The background account data retrieval is run by Yodlee, which partners with other major financial institutions like Bank of America, Vanguard and Morgan Stanley.

Before you can access your account on any new device, you’ll receive an automated phone call, email, or SMS asking to confirm your identity. Their smartphone apps are compatible with Touch ID/Face ID on Apple and mobile PINs on Android devices.

The above details helped answer my question “is Personal Capital safe?”

How does Personal Capital make money?

Personal Capital operates on a “fremium” model. While the above features are all free; it also has a wealth management service with over $12 AUM. You are under no obligation to use the wealth management service and can continue to use the free service.

How to avoid Personal Capital Phone Calls?

Personal Capital would call you since they would ideally like some of their users to start using their paid services. After you sign up; you would receive either an email or a phone call from a personal advisor asking if you need their services. If you tell them that you do not want to be contacted, they will honor that request.

Can I use Personal Capital without linking accounts

No. The advantage of Personal Capital is as a result of linking the accounts. Without having all the data; you will not get any benefit.

How is Personal Capital different from Quicken?

Quicken is a paid service compared to the free version of Personal Capital. Also Quicken does not have the Portfolio analysis, fee analyzer, retirement planner, etc tools

How is Personal Capital different from Mint?

Mint aggregates accounts but does not offer the other features of Personal Capital such as Cash Flow, Retirement Planning, Fee analyzer, Portfolio analysis, etc

How is Personal Capital different from YNAB?

YNAB is only a budget application. Personal Capital provides investment management; retirement planning, asset allocation, etc in addition to budgeting. Also YNAB is a paid service while you can use Personal Capital for free.

Can Personal Capital be used for Budgeting

Yes. Personal Capital can be used for Budgeting in addition to keeping track of all your investments and retirement planning.

How is Personal Capital different from M1 Finance?

M1 Finance is a free platform for automated investments while Personal Capital is used more like a Dashboard to keep track of all your accounts including M1 Finance.

How is Personal Capital different from Betterment?

Betterment is a fee based robo-advisor while Personal Capital is used more like a Dashboard to keep track of all your accounts including Betterment.

How is Personal Capital different from Wealthfront?

Wealthfront is a fee based robo-advisor while Personal Capital is used more like a Dashboard to keep track of all your accounts including Wealthfront.

How is Personal Capital different from Robinhood?

Robinhood is used to actually trade stocks while Personal Capital is used more like a Dashboard to keep track of all your accounts including Robinhood.

Is Personal Capital a Robo-advisor

The Free version of Personal Capital is not a Robo-advisor and only provides actionable insights via the Dashboards. The Wealth advisory version of Personal Capital has actual human advisors assigned to your account and charges fees based on assets under management (AUM)

How is Personal Capital different from Vanguard?

Vanguard is a free platform for investments while Personal Capital is used more like a Dashboard to keep track of all your accounts including Vanguard.

How is Personal Capital different from Acorns?

Acorns is used for micro-investing few dollars. Personal Capital is used more like a Dashboard to keep track of all your accounts.

Will Personal Capital import Quicken data?

Personal Capital does not import Quicken data at this point. However I did not need it. After I linked all my accounts to Personal Capital; my previous transactions were all in the Personal Capital Dashboard.

Does Personal Capital automatically track Bitcoin or other Cryptocurrencies?

Personal Capital doesn’t track bitcoin or any other cryptocurrency since these are either stored on exchanges or in hardware wallets.

Personal Capital used to offer connectivity to Coinbase; but doesn’t do so any longer.

You can use Coinbase, BlockFI, Binance.US to buy cryptocurrencies or even use AltoIRA to buy crypto in your IRA and then track the value in the respective app.

Or you can also manually add the crypto value in Personal Capital.

Can you export data from Personal Capital?

Yes. Log in to Personal Capital, then click Transactions from the navigation at the top. Then click the CSV export button. Your data is exported to Excel.

Personal Capital export to excel is a great feature.

What is the cost of Personal Capital?

Personal Capital operates on a “fremium” model. While the above features are all free; it also has a wealth management service. You are under no obligation to use the wealth management service and can continue to use the free service.

What are Personal Capital fees?

The free version using all tools described above is free. If you opt for using advisors; then based on your account size there are fees of 0.89% upto a million and lower for above that amount.

How to close Personal Capital account?

1. Log into Personal Capital

2. Click on the down arrow next to your name on the top right corner of your dashboard and then Settings.

3. Scroll to the bottom of your page and click on ‘Delete User Account‘ to remove your information.

How often does Personal Capital Update?

Every 4 hours

Is Personal Capital worth the fee?

I am only using the free version for now so cannot comment on the paid advisor version which charges fees. I will update this review if I decide to use the paid version.

Is Personal Capital a Fiduciary?

Yes. Personal Capital is a fiduciary and must act on behalf of your own personal interests.

What is Personal Capital Cash Account or Personal Capital Savings Account?

Personal Capital Savings Account was renamed to Personal Capital Cash Account.

There are no limits on the number of deposits or withdrawals you can make. Standard FDIC insurance coverage limits up to $250,000 (including principal & interest) apply.

It is hard for me to do a Personal Capital Cash Review since I have not used this feature. I keep most of my cash including emergency funds in accounts yielding higher interest rate of 5%

What is Personal Capital Smart Withdrawal?

Personal Capital has a new feature called Smart Withdrawal as an addition to our popular Retirement Planner tool. Smart Withdrawal is available exclusively to the paid advisory clients. It uses advanced tax forecasting to predict your optimal account withdrawal order in retirement.

What are Personal Capital Wealth Management fees?

Personal Capital charges an asset management fee of 0.89% for portfolios between $100,000 and $1 million. I have not used this paid version and am only using the free version which I reviewed above.

Summary

Readers, how are you tracking towards Financial Freedom?

Have you tried Personal Capital? How does it compare against other free tools you have used or are currently using?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

Hello, have you noticed any changes with this service since Empower Retirement acquired Personal Capital?

I have not noticed any changes in the service since the acquisition. Of course, I am only using the free option which I recommend in the article and am not currently using paid advisors.

I’ve let Personal Capital manage one seven figure account of mine for the last four years so I suppose I’m the one making it free for the rest of you. I like having at least a part of my portfolio not in index funds and not capital weighted and they do that. Most of my accounts are in index funds so I feel like Personal Capital provides some diversity.

Great to hear that you have had a positive experience. I do plan to try the managed account after a year or so of testing their other features. The “smart withdrawal” seems intriguing for drawing down the portfolio.