A Comprehensive Guide to Real Estate Waterfall Equity Structures

Investing in real estate can be a great way to create long-term generational wealth, but it’s essential to understand the different types of investments and how they work.

When most people think of investing in real estate, they think of buying and renting a property. While this is a great option, there are many other ways to invest in real estate.

On one end, you have individuals investing in real estate with little to no money. Conversely, high net worth individuals meeting the accredited investor qualifications plow minimums of $100,000 in real estate syndication deals.

When you’re looking to invest in a real estate syndication, it’s essential to understand the different components of the investment. One key element of syndication is the real estate waterfall equity structure.

Today, we will define a waterfall equity structure and discuss how one can structure the deal. We’ll also provide specific examples to understand better how this type of structure works.

What Is a Real Estate Waterfall Equity Structure?

A real estate waterfall is a structure in sizeable real estate syndication deals to model how cash flow is fairly distributed to all parties involved.

The model is based on pre-set hurdles or when certain return hurdles are accomplished. Models are usually used when numerous real estate investors are involved in a real estate project, and they can be pretty complex.

Whether a private equity waterfall or a real estate waterfall, they are distribution waterfalls that determine how to allocate investment returns and capital gains among those in a group of real estate investors or a pooled investment.

They define the order of how distributions are allocated to the limited partners and general partners. Sometimes the general partner is referred to as the sponsor, operating partner, or manager.

It is common for the general partners to receive a considerably more significant share of the total profits relative to their initial equity investment when all is said and done. It is to give the general partner the correct incentives to maximize the investors’ profits.

There are two main types of waterfall structures. The American version favors the general partner, while the European version favors passive investors more favorably. The mechanics of the arrangement will be written out in detail in the distribution section of the private placement memorandum (PPM).

What Are Waterfalls?

Real estate syndications mainly use waterfalls to structure the compensation that real estate investors and sponsors receive. It also helps the investors achieve maximum profits.

Once a waterfall model is developed, it is rarely changed. Waterfalls can be simple or complex, and there are numerous ways to design a real estate waterfall model.

In its basic form, a real estate waterfall models how cash available for profits and distribution on a real estate project moves or cascades through its calculations to make payments to the investors and developer. It is accomplished in a pre-programmed hierarchical way.

The waterfall model defines how profit splits and revenue are distributed. The commonly used modeling tools include the preferred return and the internal rate of return (IRR). One can use these tools together to create various breakpoints as certain hurdles are accomplished as measured by the IRR. As things change, the proportional share of profits is adjusted.

Another term is distribution waterfall, which refers to how capital gains are paid between all of the participants in a real estate investment. Participants typically include a general partner and a limited partner.

To visualize a real estate waterfall distribution example, picture five sets of stair steps. The top of the landing of the stairs is labeled the distribution, where all the cash flows begin.

The five steps are then labeled with the distribution amount for the general partner (GP) and the limited partners (LP). The distribution amounts will change for each circumstance when a specific hurdle is reached. These cash flow splits are only a sample of how a waterfall model might be designed.

- Return of Capital: Pari Passu and is distributed as 90% LP and 10% GP

- Preferred Return: 8% with 85% to the LP and 15% to the GP

- Catch-Up Tranche: 10% with 80% to the LP and 20% to the GP

- Carried Interest: 13% with 70% to the LP and 30% to the GP

- Final Distribution: Over 13% with 60% to the LP and 40% to the GP

Pari passu is a Latin phrase that means equal footing. In commercial real estate, investors’ assets and creditors are on equal footing, without preference for one or the other. The phrase is commonly used to describe how investors receive payments, especially when developing waterfall structures.

A GP manages the capital invested by the limited partners. The GP contributes a small portion of the total investment. Distribution waterfall models are in place to ensure that profits are given to the manager only after the limited partners receive the agreed-upon return on their investment.

Cash Flows and Real Estate Waterfalls

The real estate waterfall describes how the other investors are paid their investment distributions through their share of the available cash flow. The payment structure of a real estate waterfall can take numerous forms and range from simple to very complex.

Models like these show who gets paid what and at what point. Those in line to earn a preferred return are repaid before all the other investors.

Before the deal sponsor can start earning its share of the cash flow distributions, specific benchmarks have to be met. Structuring the models in this fashion keeps the sponsor motivated and ensures that all interests are united throughout the project.

The four steps or investment tiers under the distribution of a basic waterfall model are:

- Return of Capital: The original capital investments of the investors, without some fees and expenses, are returned to the investors.

- Preferred Return: 100% of the distribution goes to the limited partners until the preferred internal rate of return is based on all issuances and every contribution is reached.

- Catch-up: The catch-up tier is most favorable to the GP since they are given all or a significant portion of the gain until they receive a certain percentage of the profits.

- Carried: Carried interest is made up of the allocation of additional cash flows between the limited partners and general partners.

In some models, if the cash flow in a given year is less than the first hurdle rate, the unpaid preferred is shifted to the accrued preferred. Once moved to the accrued preferred, it is paid down before the investment balance by either a capital event or cash flow.

If cash flow has met expectations in a given year and after the preferred return hurdle has been met, any excess cash flow that results in a profit is split between the parties, as stipulated in the deal structure. Sometimes the extra cash flow is referred to as the residual split. In some deals, excess capital is split 50/50. It can depend if there are different classes of investors and how different investors are paid.

Real Estate Waterfall Components

The structure and components of waterfall models depend on the type of deal, including the number of investors involved and the investment timeline. Equity waterfalls are complex concepts to understand fully because of the various ways they can be constructed.

Return Hurdle

In real estate waterfall models, the term return hurdle defines the rate of return that has to be achieved before any remaining cash flow distributions can flow onto the next tier of investors.

It is not unusual for real estate waterfall models to have multiple return hurdles. Typically, return hurdles are based on hitting a predefined internal rate of return (IRR) or equity multiple.

Return hurdles are vital because they trigger the unequal distribution of profits. They are designed to incentivize the deal sponsor to manage the entire project as profitably and efficiently as possible.

The higher the rate of return, the more significant share of the profits the sponsor could make relative to their initial investment. An example of how those tiers we looked at earlier can work is shown in the following example.

A deal is expected to achieve an internal rate of return of 8%. In the tier below that hurdle, the cash flow is split by 80% for the investors and 20% for the sponsor. The next hurdle splits the returns to 70% for the investors and 30% for the sponsor.

Preferred Return

The preferred return in a real estate waterfall model refers to the first claim on any profits earned by investors until a specific target return is completed. It can be similar to a bank paying interest with some distinctions. One distinction is that one can pay it either accrued or current. A bank only pays current.

The second distinction is it is not guaranteed like a bank. Investors are the first to get paid in the form of the preferred. After the preferred hurdle is reached, any excess profits are split between the parties involved, the preferred investors, or as stipulated in the deal. What constitutes a preferred investor will vary from deal to deal.

Lookback Provision

A waterfall model will typically have a lookback provision when the waterfall model pays out cash flow distributions before the asset’s disposition. It states that if the investors do not get their anticipated and pre-agreed rate of return, the sponsor is required to use a portion of the distributed profits they have received to fill the gap.

The sponsor is compelled to provide the investors with the total amount of the predetermined return. Often, that is accomplished through the sponsor’s proceeds of the asset’s sale. Another reason for the lookback provision of a real estate waterfall is to motivate the sponsor to perform.

Catch-Up Provision

A catch-up provision requires that investors get 100% of the profit distributions until an agreed-upon predetermined rate of return has been met. Once an investor reaches the required return level, 100% of the profits will go to the sponsor until their returns equal the investor’s returns.

The catch-up provision is a variation of the lookback provision and is utilized for the same reasons. The difference between the lookback and catch-up provisions is that the investor gets paid at the end of the deal with the lookback provision.

The catch-up provision provides the investor with 100% of the profits until the return is met. And only at that time does the sponsor receive a distribution.

Sponsors prefer the lookback provision over the catch-up provision because they get to use that money in the short term, even if they eventually have to pay it out to investors.

But in the short term, they have the use of the money and can at the least earn interest on the money. Investors prefer the catch-up provision because they get their money first and do not have to track down the sponsor to get their money if a deal does not go as planned.

Invested Capital

In some models, the distribution waterfall usually does not consider whether or not the GP (sponsor) invested any capital.

If a general partner chooses to invest capital, it is usually invested with the same terms as the capital of the LP. Because of this, the split between the general partner’s invested capital and the LP’s invested capital is of little significance.

Real Estate Waterfall Equity Distribution Examples

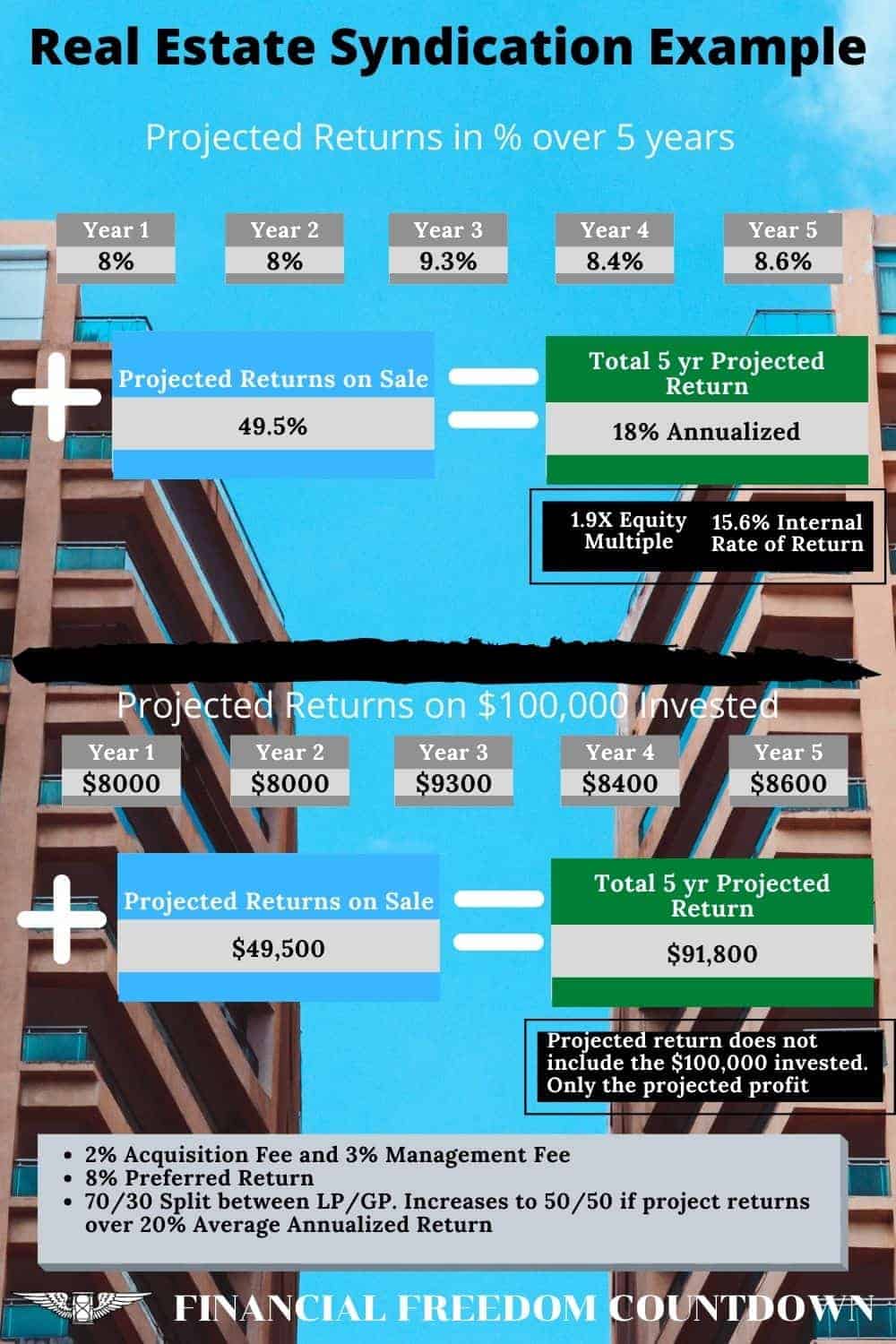

A syndicator and a group of investors acquire an apartment complex for $1,000,000. To simplify the calculation, assume it is a cash deal with no mortgage.

Real estate syndication deals are structured with a waterfall payment. I have taken a complex waterfall structure with three levels. Your individual deal might be more straightforward than the one portrayed below.

The terms of the deal are 8% preferred returns with a 70/30 split (limited partners/general partner) and a 50/50 split if annual profits exceed 20%.

- The first level is the preferred return (8%) which needs to be paid.

- After the preferred return is paid, the remaining annual cash flow is split with 70/30 ratio up to the max limit of 20%.

- If annual profit exceeds 20%, then any amount exceeding 20% is paid in the 50/50 ratio.

Example 1 (Single waterfall)

The investors funded the entire amount. After all of the expenses have been, the property generated $100,000 a year in profit.

- The investors would be entitled to a preferred interest payment first. Since the preferred interest rate is 8%, the investors would get $80,000 in interest first out of that $100,000 profit (8% of the $1,000,000 investment).

- The remaining $20,000 would be split between the investors and sponsors at a 70/30 ratio. So investors would get an additional $14,000.

Example 2 (Multiple waterfalls)

Assume the deal was so wildly successful that the property generated $220,000 a year in profit.

Since the annual cash flow is above 20% (greater than $200,000), the 50/50 split would come into the picture.

- In that case, the investors would get the $80,000 in interest first.

- The 20% ceiling of the 3rd level caps the second level waterfall at $200,000 (20% of $1,000,000). The remaining $120,000 ($200,000 – $80,000) would be split between the investors and sponsors at a 70/30 ratio. So investors get an additional $84,000 (70% of $120,000) at this second level.

- Since the syndicator has generated returns over 20%, the final $20,000 is split 50/50 between investors and syndicators. So investors get an additional $10,000 at the third level (50% of $20,000).

Most deals are not as successful as the example above. But the waterfall split exists to incentivize the sponsors’ outperformance.

Here is an example of another deal where the sponsor provides steady cash flow while updating the units as they become available. As a result of the updated units fetching higher rent, the Net Operating Income (NOI) increases. Sale of the real estate property resulted in substantial gains in year 5.

Alternatives to Complex Waterfall Structures

Waterfall distribution is a typical feature in significant equity real estate deals involving 7-figure minimum investments by accredited investors.

Real estate crowdfunding permits investors to invest in similar deals with smaller investment amounts avoiding the complexity of waterfall distribution.

Fundrise has one of the lowest minimums (only $10 for the Fundrise Starter Portfolio and is available for accredited and non-accredited investors.

Streitwise is similar to Fundrise in offering a fund structure and is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals.

EquityMultiple gives accredited investors direct access to individual commercial property with a minimum of only a $5,000 investment.

PeerStreet has equity or debt investments on its platform. For debt deals, you provide hard money loans for others to buy the property. The advantage of PeerStreet is that you can filter debt deals by Loan To Value (LTV) and also stressed LTV. PeerStreet has a low $1,000 minimum and has an optional automated investing feature that automatically places you into investments that match your criteria.

CrowdStreet is a commercial real estate investing platform for accredited investors. It has a higher minimum of $25,000 per deal. CrowdStreet offers both single property investments and multi-property funds, as well as both equity and debt deals.

Make sure you use a real estate crowdfunding checklist to assess the deals before investing.

Frequently Asked Questions About Real Estate Equity Waterfall

The topic of the real estate equity waterfall model is complicated. You can find numerous private equity waterfall models online to analyze until you become more familiar with them. Some of the most frequently asked questions about the private equity waterfalls include:

What Does Waterfall Mean With Private Equity?

A private equity waterfall refers to a model or a structure of how cash flows will be distributed among the GP and LP. They can be applied to any investment with multiple investors and are used extensively in real estate investments.

How Does a Private Equity Waterfall Work?

A private equity waterfall is a set of predetermined rules that allocate which shareholders get what and when concerning capital events and cash distributions in a real estate partnership or a real estate pool of investors.

You can design a real estate equity waterfall or buy a model already designed. They can be as simple as you like or as complicated as you want.

What Is the Difference Between IRR and Hurdle Rate?

The IRR calculation is the internal rate of return and a metric used to convert the sum of all future uneven cash flows. The hurdle rate is a predetermined calculation of how profits are split when a target return metric has been reached.

Some two-tiered waterfall models also include a limited partner IRR check that takes the total cash flows to the limited partner in a tier that does an IRR calculation to ensure that the LPs are getting the cash that is owed them.

A model can also include an LP IRR check that takes the total cash flows to the LP in this tier to calculate an internal rate of return.

How Is Preferred Return Calculated?

The preferred return is the return expectation that the sponsor or general partner writes out in the operating agreement of a real estate project.

There are no complicated calculations to figure out what the preferred return number should be for the investors. Usually, it is between a 6% and 8% preferred return, but it can be higher.

What Is the Difference Between an IRR Waterfall and a Simple Interest Waterfall?

A simple interest waterfall is better for the general partner or sponsor because the unpaid preferred does not compound, and there is no compound interest involved. If a real estate project goes badly, this could have an impact.

In a well-executed project, there is rarely much difference between the IRR waterfall and the Simple Interest Waterfall regarding returns. For the LPs, it is always better to have an IRR waterfall to incentivize the GP to perform.

Is the Hurdle Rate the Same As the Return on Investment?

The return hurdle is the rate of return that must be achieved before moving on to the next barrier. This is crucial to properly define since it determines which profit divisions are triggered by the return hurdles (or tiers).

The term “rate of return” can be defined differently, so the return hurdle in a waterfall distribution structure can also vary. The Internal Rate of Return (IRR), XIRR, and Equity Multiple are usually used as return hurdles.

What Is an 8% Hurdle Rate?

The hurdle rate is an important metric when it comes to future projects. A company will determine if it should take on a capital project and the level of financial risk.

If the expected rate of return is above the hurdle rate, the financial project is considered a good investment. If the rate of return or return on investment is projected to be below the hurdle rate, the investors might choose not to take the project.

A hurdle rate is sometimes referred to as the break-even yield. An 8% hurdle rate means the project is projected to return 8% above costs. The riskier a project is, the higher one will compare the hurdle rate with less risky projects.

What Is the Promote?

The promote will define the unequal share of cash flow the sponsor or GP will receive when return hurdles are achieved. The promote can be calculated in more than one way, so it is crucial to determine who is responsible for paying the promote and the amount of the promote.

Most of the time, the promote is clearly defined as a percentage. It could be described as 10% after the investor earns an 8% preferred return. Other times it is not as clearly defined. It is not unusual to see it as 90/10 to 8%, then 80/20 to 12%, etc.

A question that often comes up is what happens if the 8% is not reached in a given year? Does it carry over or accrue to the following year? If it does carry over, is the preferred return compounded? This will be defined in the legal documents as whether it compounds or is non-compounding.

If it is an operating cash flow promote, the GP might receive a percentage of the operational cash flow, but only after the preferred retune has been paid.

What Is Equity Multiple?

The equity multiple hurdle is how much real estate investors could make on their initial investment. In commercial real estate, the equity multiple is the total cash distributions received from a real estate investment divided by the total equity invested.

What Are the Different Waterfalls?

In addition to the common equity waterfalls, there are the non-preferred return waterfall, the wacky waterfall, and the side letters waterfall. These types of waterfalls are not common but have been used before.

The non-preferred waterfall has no preferred return and can use a straight split from the first dollar, like a 70/30 split.

The wacky waterfall is where the sponsor calculates a breakpoint that is based on a more significant or something calculation. The sponsor can make the split dependent on whether or not a 15% IRR or a 1.5 equity multiple is greater.

The side letters waterfall structure is a waterfall where there are side letters between a sponsor and the investors within different classes.

Summary Of Real Estate Waterfall Equity Structures

Equity waterfalls are used mainly in real estate syndications, but one can also use them with different investments. There are numerous types of real estate equity waterfall models. Waterfall structures can be made simple and or complex. You can use the two-tiered waterfall and preferred return waterfalls. Once a waterfall has been designed, it is rarely changed.

There are the American waterfall structure and the European waterfall structure—the American favors the GP, and the European favors the LP.

A distribution waterfall is a way to allocate capital distributions among a group or pooled investment pool. A waterfall model is most commonly used with a private equity fund and real estate deals. They define a pecking order in which cash flow and capital gains are distributed among the GP and LP.

If you can visualize steps or tiers with water flowing down them, the water is the cash flow. Each model has hurdles or the hurdle rate, a point at which the cash flow split between the GP and LP changes.

Every change will change the percentages of how much of the additional cash flow goes to each party in the real estate investment. The most common way a real estate investment waterfall is arranged is with four investment tiers below the distribution level:

- Return of Capital

- Preferred return

- Catch-up tranche

- Carried interest

- Final distribution

The sponsor of the investment opportunity will start earning money on any capital invested after specific benchmarks are met. The reason the waterfall structure is designed this way is to give incentive to the sponsor throughout the real estate project.

Real estate equity waterfalls use tools in their models like preferred return and the internal rate of return (IRR). Models will also let you use hard or soft hurdles and other optional tools.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.