The Ultimate Guide To Value Investing: Everything You Need To Know About This Investment Strategy

Do you want to learn how to invest like Warren Buffett? If so, you have come to the right place! We will discuss everything you need to know about value investing. We will cover what it is, how to do it, and why it works. We will also tackle the pros and cons so you can decide if value investing is worth considering!

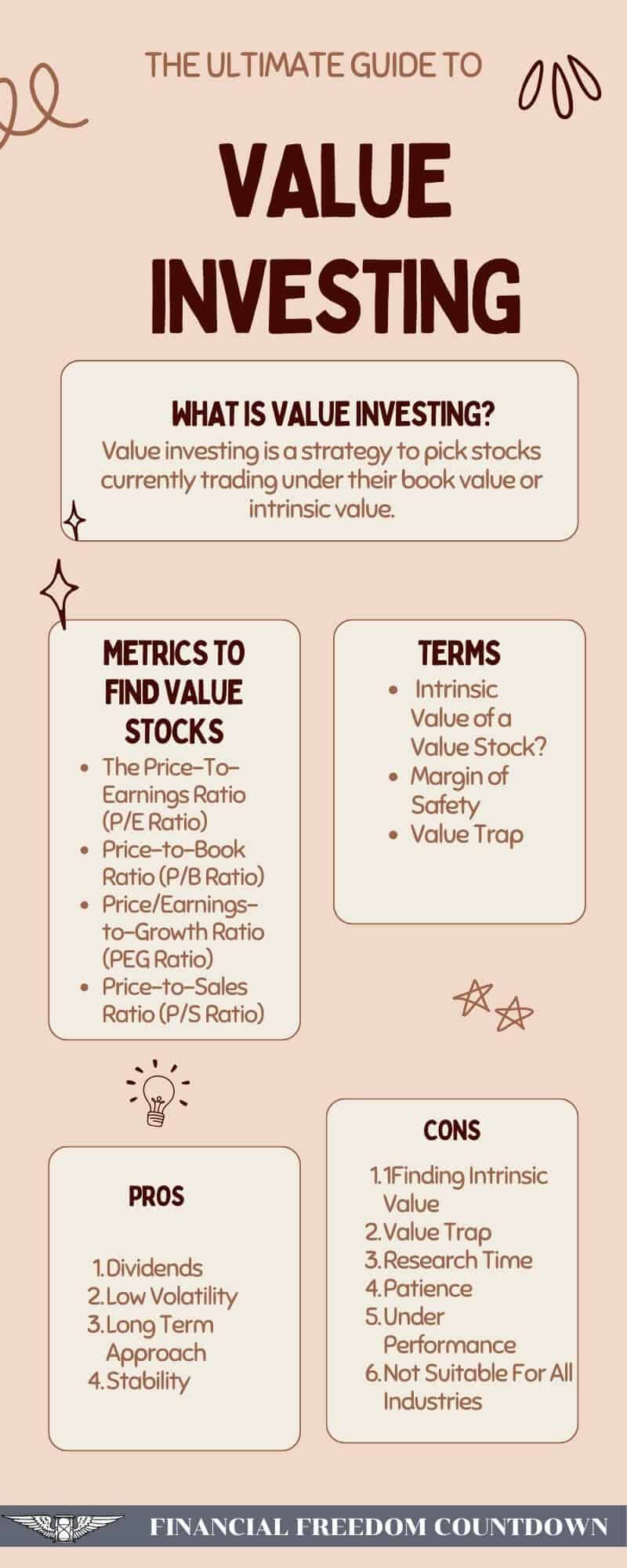

What Is Value Investing?

Value investing is a strategy to pick stocks currently trading under their book value or intrinsic value.

Value investors believe that the stock market overreacts to good and bad news. Some famous value investors have become billionaires by investing in stocks at a discount. Warren Buffett is probably the best-known value investor.

What Are Value Stocks?

Value stocks often trade at a lower price than they should be, which results in these stocks becoming a stock that one can buy at a discount. Value investors use fundamental analysis to find value stocks.

Fundamental analysis is finding the true value of a stock by using fundamentals like the price-to-earnings ratio (P/E ratio), dividend yield, price-to-book (P/B ratio), and other data that shows what the company is worth. Value investing has also been referred to as bottom-line value investing. The bottom line of financial statements is usually a company’s net worth, defined as assets minus liabilities.

If a company’s stock is trading below its book value, it can be considered a value stock. A stock becomes a value stock for several reasons. If a company has a bad earnings report or some negative news about the company comes out, it can send a good stock’s price down.

Value-type stocks are almost always more mature and established companies with a consistent dividend that has seen their price drop because of the negative news. If the price drops below the actual value of the company, it can then become a value stock worthy of buying.

Value investors will have to look at the news and determine if the information warranted the significant drop in the stock price or if the market oversold the stock. For a value stock to turn around and rise in price to at least its intrinsic value, public perception of the company must change. Traders will once again have to become interested in buying the stock.

In contrast, growth stocks are stocks that growth investors believe will continue to grow and deliver higher than average returns. Growth investors are looking for and investing in younger and high-flying companies that could snowball. Growth companies usually don’t pay dividends and will reinvest all their profits into research and development and growing the company. A growth company has the following characteristics:

- Stock price: Currently overvalued

- Dividends: The dividend yield is low, or the company does not pay a dividend

- Price-to-earnings (P/E ratio): Above average

- Risk: High volatility

A value stock has the following characteristics:

- Price: Currently undervalued

- Dividends: Usually good to high dividend yields

- Price-to-earnings (P/E ratio): Usually low P/E ratio

- Risk: The price might not appreciate as much as expected

How Do Value Investors Find Value Stocks?

The father of value investing was Benjamin Graham, who also happened to be Warren Buffett’s professor and mentor. Benjamin Graham was a value investor and author of the book “The Intelligent Investor.” When he wrote The Intelligent Investor book over 70 years ago, it was the ultimate guide to value investing and is still considered one of the best books on investing.

Graham believed that the only time a stock was undervalued was when one could buy it for below its liquidation value or the value determined by its net assets per share. This way of finding value stocks is still used, although finding them is not as easy.

Warren Buffett changed this theory slightly after meeting Charlie Munger. He believed in finding undervalued stocks that are also wonderful companies run by good people and still priced well below their actual value. The goal of all investors is to find stocks with an intrinsic value higher than the current market price, which results in a stock with a discounted price.

What Is the Intrinsic Value of a Value Stock?

There are different ways to view what a stock is worth. To many investors, the current stock price is what the stock is worth since that is what traders are paying for. But a current price is constantly at the mercy of the overall stock market. How often have we seen the S&P 500 down by 2% or more, and almost all stocks are down in price?

Does this mean all stocks have just dropped in intrinsic value? No, it doesn’t. The stock is down because of the overall market and the market’s whims each day.

A much better way to determine the actual worth of a company’s stock is to find its intrinsic value. The intrinsic value of a stock is the true value of the stock or what it is worth. Finding a stock’s intrinsic value takes out all of the market whims. By finding the intrinsic value of a stock, value investors can find stocks worth more than their current stock price.

Finding the intrinsic value of a stock is not simple. Thankfully, there are online calculators that a value investor can use. Once you’ve discovered the intrinsic value of a stock, you can then use online stock screening tools to search for bargain stocks. Buying stocks of good companies at a discount is the goal of all value investors.

Benjamin Graham developed the formula to find the intrinsic value of a stock. Over the years, value investors have made slight changes to the formula. The Graham formula is as follows:

Intrinsic value = earnings per share times (EPS) (8.5 x 2G) times 4.4 divided by Y. The following represents the symbols in the math equation:

- The EPS is the company’s last 12-months earnings per share

- 8.5 is the constant that represents the appropriate P/E ratio of a no-growth company

- G = the long-term five-years growth estimate of the company

- 4.4 was the prevailing (1962) rate on high-grade corporate bonds listed on the New York Stock Exchange.

- Y = The current yield of an AAA-rated U.S. corporate bond

The AAA-rated bond is used since it is one of the best fixed-income investments to gauge market sentiment.

Even Warren Buffett and his partner, Charlie Munger, have stated that it is not easy to pin down the actual intrinsic value of a company. Investors will look at numerous metrics to find good value stocks and use fundamental analysis.

Margin of Safety in Value Investing

The margin of safety is one of the main investing principles of value investing. Investors will only buy stocks if their price is trading below their approximate intrinsic value. Approximate because it is hard to know the actual intrinsic value of a stock.

By adhering to the margin of safety principle, an investor’s downside risk is better protected. The margin of safety is a cushion that allows for some losses without having significant losses.

Buying stocks at a discount to their intrinsic value decreases significant losses in their portfolio if the whole market drops substantially. It also reduces the chance that an investor will overpay for the stock.

The idea behind this principle is the difference between the current share price and the approximate intrinsic value. To find the margin of safety, investors use the following formula:

Margin of safety = 1 – (current share price / intrinsic value).

For example, an investor is looking at a company’s shares that are trading at $10, and the investor has calculated the intrinsic value at $8.

The margin of safety is 25% (10 / 8 = 1.25 – 1 = 0.25)

The formula tells us that the price of this stock can drop by 25% before it reaches the estimated intrinsic value of $8. That is how investors reduce investment risk.

What Metrics Does a Value Investor Use To Find Value Stocks

To find the best value stocks, a value investor needs to answer three questions:

- Is the stock undervalued?

- Is the stock overvalued?

- Or is it trading at fair market value?

To find the answers to these questions, investors use valuation metrics that compare the stock price to the company’s performance.

The purpose of using these metrics is to measure the value of a company in comparison with other stocks and to find out if there is a reason to expect growth in the value of the stock from its discounted price.

When comparing stocks, it is important to only compare to other stocks in the same sector. Each sector can have completely different average ratios.

The Price-To-Earnings Ratio (P/E Ratio)

The P/E ratio is the most important metric that a value investor will use. The P/E ratio compares the price of a stock to the company’s earnings per share (EPS) over 12 months. Investors can use the P/E ratio to compare other similar stocks in the same sector.

The P/E ratio is found by dividing the share price by the company’s earnings per share. You can find a stock’s P/E ratio on many websites. The P/E ratio can be further calculated to define 12-month periods.

- Forward-looking price-to-earnings ratio: This ratio compares future earning expectations for the next 12 months to the current company’s stock price.

- Trailing P/E: This ratio compares earnings generated over the past 12 months to the stock’s current price.

- Mixed P/E: Other investors regard this ratio as the most accurate. The mixed P/E compares the past six months of earnings plus expected earnings over the next six months to the stock’s current price.

Many investors are screening for companies with a low P/E ratio. And then compare the current P/E ratio of the stock to the average P/E ratio within its industry sector.

For example, you find a stock you think qualifies as a good value stock to invest in with a P/E ratio of 10. This stock is in the technology sector. You would then look online and find the average P/E of the technology sector is 26.92.

This stock would be highly undervalued and inexpensive relative to the average of the entire technology sector and a possible value stock to buy. If the stock you were looking at had a P/E over 26.92, the stock would be overvalued and expensive.

Price-to-Book Ratio (P/B Ratio)

The price-to-book ratio compares a stock’s price to the company’s current price. The book value (BV) is the total value of the company’s assets minus all liabilities on a per-share basis.

You can find this information on the Internet, but if you want to calculate the P/B ratio, it is: P/B ratio = Share Price/book value per share.

Investors need to know the value of a company per share. To find this, divide the company’s total net assets by the number of outstanding shares. You can find this information on the company’s balance sheet.

For example, a company has $100 million in net assets, and 10 million shares are outstanding. The company’s Book Value per share is $10.

The stock price for this stock is $50. To calculate the price-book ratio, divide the price of $50 by its Book Value per share of $10.

The P/B ratio is 50/10 = 5

Value investors can now compare the stock to other stocks in their industry sector. Since this stock is in the technology sector, look online to find the P/B ratio of the technology sector and see it is 5.71. That makes this stock slightly undervalued.

Price/Earnings-to-Growth Ratio (PEG Ratio)

Many value investors believe the PEG ratio is one of the best metrics for finding good stocks and a more accurate representation of value than the P/E ratio. It provides the same information as the P/E ratio plus the expected earnings growth rate.

A lower PEG ratio shows you’re paying less for each share of the anticipated earnings growth. Investors are paying for anticipated earnings in the future. Of course, things change, and the expected earnings can change in the future.

The formula for the PEG ratio is PEG ratio = P/E ratio/earnings growth.

You can find a company’s current PEG ratio and more on the Internet or the company’s website. Typing a company’s stock symbol and PEG ratio will bring up all this information.

For example, let’s look at two separate companies, Microsoft (MSFT) and Advanced Micro Devices (AMD). The current P/E ratio for Microsoft is 30.02, and the current P/E ratio for Advanced Micro Devices is 36.27. That makes Microsoft look like the best value.

Looking at the PEG ratio of each stock will change things. The PEG ratio of Microsoft is 2.33, while the PEG ratio of Advanced Micro Devices is 0.85. That clearly shows that Advanced Micro Devices is the better bargain.

Price-to-Sales Ratio (P/S Ratio)

The P/S ratio is a simple ratio that compares the price of a stock to the sales the company has generated per share over a year. Like all ratios, you can do the calculations yourself or find the P/S ratio for most stocks on the Internet.

You can compare stocks to each other as long as they are in the same industry sector or compare the companies in their respective industry sector. There used to be a general rule that if a company’s PS ratio is below 1, it is undervalued, and a PS ratio above 1 is overvalued.

But with today’s higher stock prices and higher P/E ratios, you can compare them to each other or the industry sector average.

For example, comparing the above example, MSFT and AMD are both in the technology sector. Currently, the PS ratio of the technology sector is 4.42. The current PS ratio for MSFT is 10.51, and the current PS ratio for AMD is 5.889, making AMD a better value stock.

Simpler Approach To Value Investing

Considering the popularity of value Investing, many of the best online stock brokers have made it easy to invest in value stocks using index funds.

Value stocks can be part of your income-generating assets since they are investments that produce monthly income.

Some of the most popular ETFs are

VTV – Vanguard Value ETF

FVAL – Fidelity Value Factor ETF

SCHV – Schwab U.S. Large Cap Value ETF

You can buy all the ETFs using M1 Finance. M1 Finance has zero fees, low minimums and automated investment options. You can read my M1 Finance review, including the comparison with other platforms.

What Is a Value Trap?

A value trap is something value investors should avoid. A value trap is a stock that looks cheap, but in reality, it isn’t. Two situations are associated with value traps:

- Stocks involved in intellectual property are susceptible to becoming a value trap. For example, if a pharmaceutical company has a high-selling and profitable treatment that is about to lose the patent protection for its product. What looked to be an excellent company could lose those profits quickly.

- Cyclical stocks like manufacturing and construction can see earnings rise quickly during economic booms and drop when the economy cools or falls into a recession. When investors sell the stock because of the coming slower economy, its valuation will look inexpensive compared to its recent earnings—one of the many reasons investors need to be cautious when investing during a recession.

One way to avoid value traps is to remember that the company’s future is more important than its past earnings. The best advice for value investors is to focus on the company’s future prospects for earnings and sales growth.

As a value investor, you must understand the fundamentals of the company you are researching. Value investors make their profits by investing in undervalued companies and holding them until the market traders have once again found them worthy of buying. Because of research, value investors will already know the stock was a great buy before the trading public sees it.

Advantages of Value Investing

There are several advantages of value investing strategies you don’t see in other forms of investing.

Dividends

These stocks usually pay dividends, and dividends are the best way to use the power of compounding. While the value investor waits for their value investing to pay off, they are paid quarterly dividends.

Investors can take these dividends and reinvest them back into the value stock. The more shares investors own, the higher their dividend payment will be each quarter. While every stock on the Dividend Aristocrats list might not be a value stock, many stocks meet the criteria.

Low Volatility

These stocks are less volatile than growth stocks, which means they shouldn’t fall as much in a bear market or even market crashes. It also means they might not gain as much in a bull market. Less volatility also means less risk of losing money.

Long Term Approach

The buy-and-hold investment strategy of value investing takes away the risk of trying to time the market. If an investor continually tries to time the market, they can miss out on more significant profits and might end up churning their account. Value investors are patient and take a longer-term approach.

Stability

Value stocks provide stable growth and are a great long-term strategy.

Disadvantages of Value Investing

There are a few disadvantages to value investing.

Finding Intrinsic Value

The main disadvantage is finding the true intrinsic value of a stock is not easy. Even so, investors can find undervalued stocks and buy them at a discount.

Value Trap

There is a risk of loss. Investors are buying an undervalued stock that they believe has been mispriced by the stock market, but the stock market might have been right all along, and it could be a value trap. Rapid drops in stock price cause people to often panic and wonder, “should I sell my stocks now “?

Research Time

It takes time to be a value investor. Investors can use online screeners to find undervalued stocks, reducing the time needed to research the entire stock market to find an undervalued stock.

Patience

It takes patience to be a value investor. Value investing is not a get-rich-quick stock market approach. Value investors should watch out for getting too emotional with stocks and selling before the value stock has a chance to grow in price.

Under Performance

Growth investing has outperformed value investing because growth stocks can have spectacular returns. The past decade has seen growth stocks like Amazon and Google grow dramatically. One of the many reasons I am bullish on moonshot companies.

Not Suitable For All Industries

Value investing was conceived in an industrial age when we did not have the power of brands. Value investing ignores the value of a brand in the stock price.

Final Thoughts on Value Investing

Value investing is an excellent investing strategy that takes patience. One can undoubtedly increase their average net worth with value investing, but it is not so easy to create generational wealth.

The hardest part of value investing is calculating a company’s intrinsic value. One can use several formulas to determine the present value of a company’s free cash flow and future earnings.

But even investing gurus like Warren Buffett admit that finding intrinsic value is hard for individual investors. One of Warren Buffet’s quotes regarding his investment after he dies is, “I just think that the best thing to do is buy 90% in S&P 500 index fund.” Investing in the S&P 500 is one of the simplest ways to start investing in stocks.

Much of the research to find quality companies is looking through a company’s financial statements and determining a company’s future earnings and cash flows. The goal is to determine if the stock market has accurately priced a company’s share price.

If the current share price is less than the company’s true value, it can become a quality value stock. When investors buy, quality stocks priced below their true value become a discount and should be considered a buy.

Once all due diligence has been done, it can be determined if the stock is a quality company and if the market has wrongly priced it too low. Determining the real price of a company is also about the company’s prospects for the future. Will it continue to drop in price, or will it go up?

Value investing takes time and patience and is a buy-and-hold strategy, and investors need to stick to their investing principles. Instead of trying to find your own value stocks, you can invest in value funds. A diversified portfolio could include several mutual funds like value, growth, and index funds.

When it comes to financial planning, a diversified portfolio is the best way to ensure asset allocation. An index fund follows the broader market and will contain many value stocks. Funds make it easier than buying individual stocks. Fund managers are paid to find the best stocks within their category. The job of a fund manager is to discover stocks at bargain prices.

In contrast, growth investing is buying growth stocks that are growing and expected to continue to grow. Growth stocks are usually overpriced, but investors are willing to pay the extra price in exchange for future gains. Whereas value investing strategies are looking for stocks being sold at a discount or below what their value is.

If you’re looking for an investment strategy that has proven to help other investors make money, a value investing strategy could be one of the investment strategies. Weigh the pros and cons and stick to the timeless principles of asset allocation and diversification.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.