How To Invest in Treasury Bills: Step-by-Step Guide

If the recent bank runs have you nervous, investing in Treasuries can be a great way to diversify and protect your portfolio. With Treasuries, you are investing directly in the U.S. government, an entity generally considered safe and highly reliable when it comes to paying out returns on investments – creating a low-risk investment option that also has the potential for gains in times of economic growth.

What Is a Treasury Bill

Treasury bills, also known as T-bills, are U.S. debt instruments issued and backed by the U.S. federal government that possess shorter maturity periods of four weeks to one year. These investments offer the lowest risk due to their guarantee from the United States government, making it one of the safest investments for those seeking stable returns over a short period.

T-bills are available in denominations of $100 up to $10 million and can be purchased with various maturities. The most popular terms range from four, eight, 13, 17, and 26 to 52 weeks.

Not only do treasury investments offer low risk and potentially higher returns than many other assets, but they’re also very straightforward to purchase – you can buy U.S. Treasury securities directly from the U.S. Department of Treasury or through a brokerage account if you require more guidance.

Treasury notes and bonds make regular interest payments, but Treasury bills are a different story. Instead of earning you money through interest periods, T-bills are sold to investors at a discounted rate; for example, if the Treasury bill is purchased for $990 with 1% interest, then when it matures, the investor will receive $1,000 – the initial purchase price plus an additional 9.90 in interests ($990 +$9.90).

How Do You Buy Treasury Bills Directly From the U.S. Government

You can buy Treasury bills directly from the U.S. government at TreasuryDirect.gov. Here is a step-by-step guide to buying and holding T-Bills in an account at the U.S. Treasury.

Step 1

Set up a Treasury Direct account. If you have already purchased I-Bonds, you should have an account already. If not, click “Apply Now,” complete the identification details and select a password and security image.

Step 2

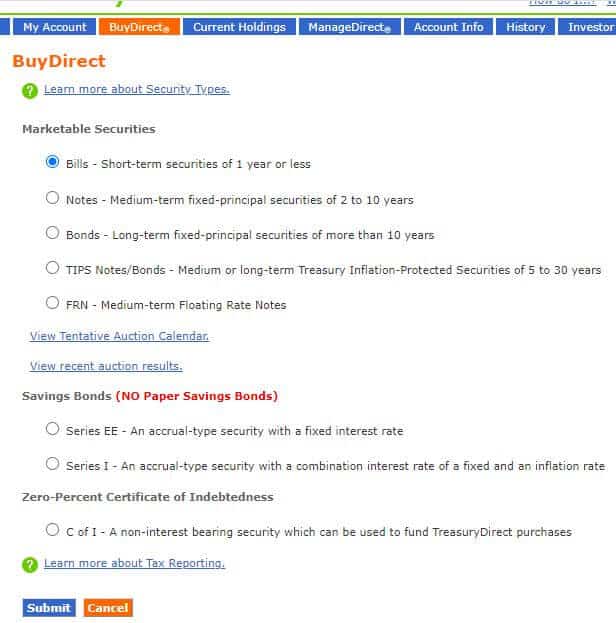

After logging in, click “Buy Direct” at the top. Select “Bills” under “Marketable Securities,” We will buy T-Bills for less than a year.

Step 3

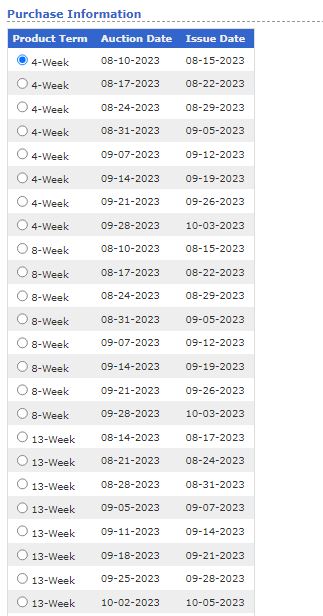

The next screen shows the various T-Bills along with their maturity. Based on your investment needs, you can select the appropriate duration or build a ladder of T-Bills with varying maturities. The first date is the auction date, and the second is when the T-Bill will be issued. For example, in the image below, 3/30/2023 is the auction date, and 4/4/2023 is the issue date for the T-Bill, which matures in 4 weeks. You can check the rates for the most recent auctions.

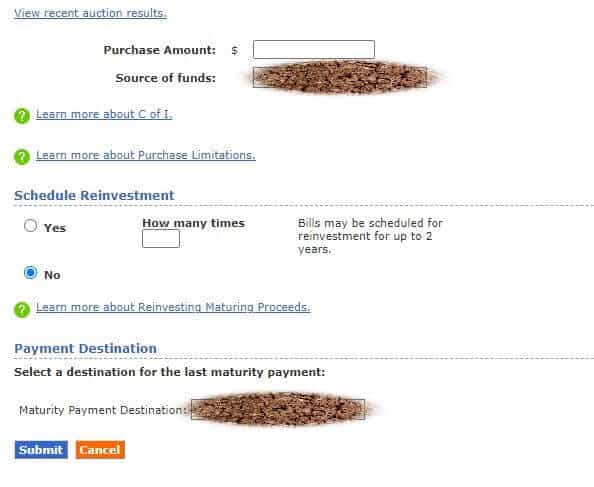

Step 4

Fill out the purchase amount. You can select the reinvestment option if you want. Select your bank account as the source and destination of funds.

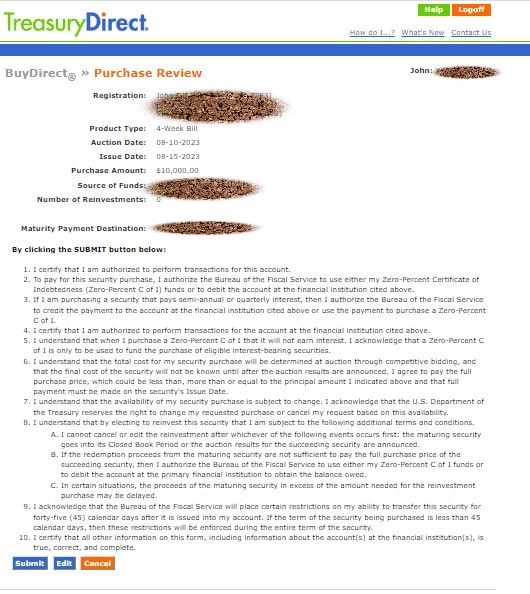

Step 5

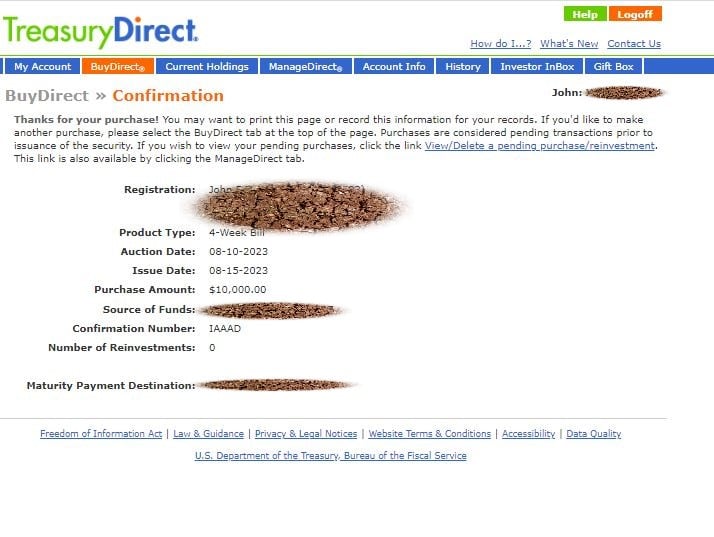

Next screen shows you the purchase details for you to review

Click “Submit” and you are presented with the conformation screen

The Benefits of Buying and Holding T-Bills in Your Account at the U.S. Treasury

Figuring out how to invest can be daunting, but with U.S. Treasuries, it doesn’t have to be.

Investing in treasuries is an intelligent choice for anyone looking to stay wealthy. Keeping your treasuries in your account at the U.S. Treasury also offers additional benefits.

1) It simplifies your portfolio management by centralizing all of your investments in one place.

2) The U.S. Treasury offers a suite of online tools and resources to help you track the performance of your holdings and make informed decisions about your investments.

3) Best of all, treasuries come with a very low risk of default, making them an attractive option for risk-averse investors looking for a safe haven for their money.

So if you’re looking for a solid addition to your investment portfolio, consider buying and holding T-Bills in your account with the U.S. Treasury.

How Do You Buy Treasury Bills Through a Broker

For customers with big firms such as Fidelity, Vanguard, and Charles Schwab, investing in T-Bills through your broker is possible.

Investors aiming to add T-bills to their Individual Retirement Accounts (IRAs) must go through a broker because Treasury Direct does not support direct funding of IRAs. Although from a tax efficiency standpoint, it is best to preserve the space in your IRA for high-growth investments such as moonshot stocks rather than T-Bills.

Treasury Bills vs. Treasury Notes vs. Treasury Bonds vs. TIPS

The government-issued Treasuries are an excellent option for those looking for a low-risk investment with guaranteed returns. There are several types of Treasuries you can invest in, each with its unique characteristics.

- T-bills are short-term government investments with maturities of one year or less

- T-notes are medium-term investments with maturities of two, three, five, seven, or ten years.

- Treasury bonds are long-term government investments with maturities of 20 or 30 years.

TIPS are inflation-protected Treasuries. Investing in TIPS means you will benefit from semi-annual, fixed-rate payments (coupon payments). As the invested principal follows inflation changes and is multiplied by a fixed interest rate, your income automatically adjusts with rising prices. TIPS have terms of 5, 10, or 30 years.

The Treasury Savings Bonds (Series E.E.) are not suitable for individuals with average net worth because they are fixed-interest bonds and double only after 20 years. However, if you redeem any time before 20 years, you will only receive a tiny amount of interest, often lower than the inflation rate. For example, for savings bonds issued from November 1, 2022, to April 30, 2023, the interest rate is only 2.1%. Avoid the Series E.E. bonds unless you are a billionaire, and instead focus on other Treasury bonds. Interest is compounded semiannually.

No matter which type of Treasury you choose, you can rest assured that the full faith and credit of the U.S. government backs your investment.

Unlike T-bills, Treasury notes, Treasury bonds, and TIPS offer a semi-annual interest payout.

| Treasury Bills | Treasury Notes | Treasury Bonds | TIPS | |

|---|---|---|---|---|

| Duration | Less than a year | Two to ten years | 20 or 30 years | 5,10 or 30 years |

| Interest Payment | At maturity | Semi-annual interest | Semi-annual interest | Semi-annual interest |

| Inflation protected | No | No | No | Yes |

Key Questions To Ask Before Investing in a Treasury

Before investing in a Treasury, weighing the benefits and risks associated with the investment is essential.

- One question to consider is the length of the investment period. Is it a short-term or a long-term investment?

- Another aspect to consider is how safe the investment is. The creditworthiness of the Treasury is unmatched since the U.S. government backs it.

- Of course, it is not a seizure-resistant asset like Bitcoin or crypto investments.

- Additionally, learning about potential gains from the investment regarding the interest you receive is crucial.

- Finally, keep a close eye on market trends and economic indicators that can affect your investment, especially if the Fed raises interest rates.

With this critical information, investors can make informed decisions about the best options for their financial portfolios.

How Does the Interest Rate Affect Your Investment Returns With Treasuries

As an investor, it’s crucial to understand the relationship between interest rates and investment returns. When it comes to investing in Treasuries, changes in interest rates can have a significant impact on your returns.

Essentially, bond prices move inversely to interest rates. This means that bond prices go down if interest rates go up, and vice versa. If you purchased a Treasury bond before interest rates increased, its value could decline, and you could potentially lose money if you need to sell before the bond matures.

On the other hand, if you purchase a Treasury bond after interest rates have increased, you could earn higher returns when the bond matures. Keeping an eye on interest rates and their potential impact on your Treasuries can help you make informed investment decisions.

No matter how the interest rate changes, if you hold the Treasury to maturity, you will get what you expected.

Are Treasury Bills a Good Investment

Any investment depends on your financial goals. Depending on your time frame and risk profile, there are several income-generating assets to invest.

T-Bills are the safest assets when held to maturity, and as a result, the returns are much lower than investing in stocks or real estate investments. It might even be lower than other fixed-income investments.

Do not expect to get rich by investing in T-Bills.

Besides the opportunity cost of parking a lot of money in T-Bills, rising inflation is a significant risk since Treasury Bills, unlike TIPS or I-Bonds, are not indexed to inflation.

However, bonds can have a place in every portfolio when you want to safely store your money for a specific goal, such as a starter home down payment, college tuition, or a business purchase.

Because the payout is not monthly, early retirees cannot use it for monthly expenses. Instead, they may need to rely on investments for monthly income.

FDIC Deposits are insured only up to $250,000 per depositor, per FDIC-insured bank, per ownership category, while T-Bills go as high as $10 million.

Consider T-bills as a part of your diversified portfolio for return of principal and not return on principal.

From a tax strategy standpoint, it is essential to note that T-Bills incur federal taxes on earned income while being exempt from state and local taxes.

The best part about T-Bills is that anyone with an SSN can create a TreasuryDirect account and invest. Unlike some real estate crowdfunding platforms there is no need of meeting the accredited investor qualifications.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.