Real Estate Note Investing: How To Generate Passive Income Using Mortgage Notes

Real estate investors often start their journey by purchasing their primary residence—some branch out into active investing such as flipping houses while others decide on wholesaling real estate. Passive investors focus on evaluating rental properties for BRRRR or buy and hold.

Real estate note investing can be a great way to build generational wealth and create income. Investing in real estate notes has a lot of advantages and provides unique possibilities. But with so many different sorts of mortgage notes, real estate note investing tactics, and, most importantly, risks to consider, where do you begin? In this article, you’ll discover all the critical information you need to get started on your real estate note investing path!

What is Real Estate Note Investing or Mortgage Note Investing?

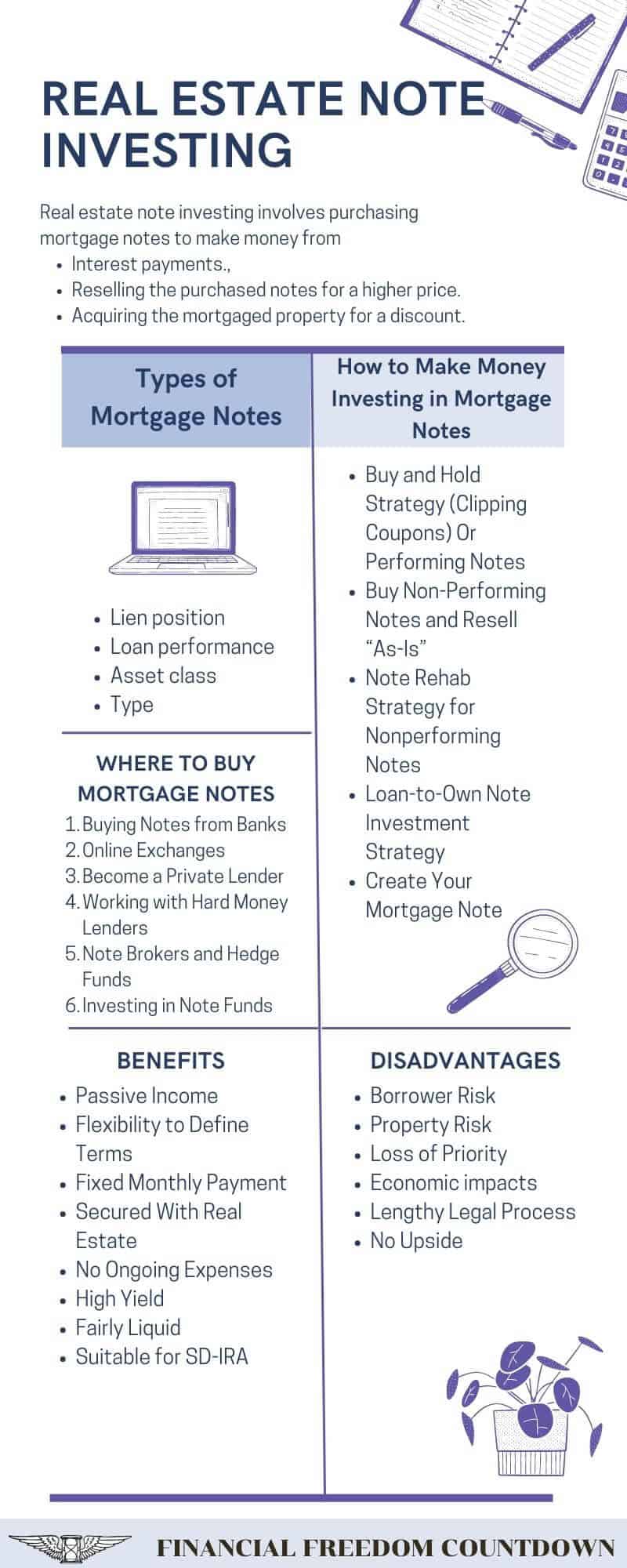

Real estate note investing involves purchasing mortgage notes to make money from

- Interest payments.

- Reselling the purchased notes for a higher price.

- Acquiring the mortgaged property for a discount.

If you have ever purchased a property, you might have noticed that sometimes the lending institution you signed at closing differs from the one now holding your mortgage.

The most common reasons for investors to invest in notes are:

- Receive regular monthly income based on the interest rate of the note

- Rehab the nonperforming note to a performing note and resell at a higher price

- Notes are secured against physical real estate.

- Notes can be purchased at a discount on the unpaid balance.

- Real estate note investing is not limited to accredited investors. It is open to all investors.

- Investing in real estate notes can have high returns without any of the hassles of property ownership. After all, lenders take interest payments from borrowers. They don’t have to deal with houses or tenants or pay property taxes.

Since mortgage notes generate high interest and the interest payments are taxed at the income tax level, a self-directed IRA is the most tax-efficient way to invest.

Mortgage Note

A mortgage note, also known as a real estate lien note or borrower’s note, is the document you sign when you take a mortgage. In this case, a mortgage is a legal contract that allows you to obtain a loan while using your home or real estate as collateral.

The mortgage note contains the terms of how you will repay your loan and how your home will be used as collateral if you fail to pay back the loan. The mortgage also contains the borrowers’ names, property addresses, and legal identification by the parcel number or lot number.

In some states, the mortgage is also known as Deed Of Trust or Security Deed.

Promissory Note

In most cases, the mortgage note is usually accompanied by another note that outlines the conditions of paying back the lending institution. This particular note is known as a promissory note. The borrower, which in this case is you, signs the promissory note and promises to pay back the debt.

The promissory note is the IOU that contains the promise to repay the loan.

A promissory note outlines the following:

- How much money was borrowed

- The interest rate of the borrowed loan

- What happens in case the borrower defaults on the loan

- Which party borrowed money (mortgagor), and which party lent the money (mortgagee)

- The period of paying back the loan and the repayment schedule

- Date and location it was signed

- What would happen if you default

- Other terms of the loan such as balloon payment, pre-payment penalties, etc.

In a nutshell, the promissory note captures the loan terms and conditions; the mortgage or deed of trust guarantees it with the property you’re buying.

Types of Mortgage Notes or Real Estate Notes

There are various types of mortgage notes in different categories. The four leading real estate note investing categories include lien position, loan performance, asset class, and type. Here is a breakdown of the categories.

Lien position

The lien position refers to the position of the claim of the lender to the asset. Additionally, the lien position determines which lender will get paid first if the borrower defaults on paying the loan.

There are first position mortgages, second lien, third, and so forth. The first position mortgages have the highest claim while any other consecutive loans taken after the first will fall under second, third, and the following position. A second position lien is considered as a subordinate mortgage note, also known as a junior lien. 2nd position note investing is considerably riskier and typically provides a higher interest rate than a senior lien.

Property tax liens, federal or state tax liens, HOA liens, and mechanics liens could be a higher priority than even the 1st lien holders.

Here is an example to help you understand further. Assume that you borrow a $500,000 loan from bank A and use your house as collateral. The bank lends you the money, and you agree to be making specific monthly payments for a particular period. After a while, you visit bank B to borrow another loan of around $50,000 for a financial emergency that you had not overseen. Bank B agrees to lend you the money, and as usual, you agree to make specific monthly payments for a particular amount of time.

If by any chance you suddenly defaulted paying the loans, both bank A and B will come for your house since you borrowed from both. After selling your home, Bank A would have the priority in the proceeds since it was in the first lien. On the other hand, bank B would get the remaining amount after bank A since it was in the second lien position.

A home equity line of credit (HELOC) is an example of a second mortgage. After the financial crisis, banks are reluctant to take on the second lien position. If you are not approved for HELOC, companies like HomeTap offer loans in exchange for equity.

Loan performance

Another categorization of a mortgage note is by its payment history or loan performance.

If the borrower usually pays their mortgage on time and never misses any payment, the mortgage note will be classified as performing. Performing notes are a fantastic method to diversify your portfolio and earn passive monthly income with little risk.

If a borrower has defaulted paying the loan, their mortgage note will be classified under 30 days, 60 days, 90 days, or 180+ days late. If a borrower fails to pay the loan payments for more than 90 days, their mortgage note is categorized under nonperforming.

Lenders and investors sell their nonperforming debts at a discount to cash out quickly and avoid time-consuming foreclosure procedures.

When a nonperforming loan is purchased, the new lender will attempt to renegotiate the terms of the note with the borrower for them to return to payments at some level. It would convert the nonperforming note into a performing note.

Or if negotiations fail, foreclose and sell the property. These steps take time, effort, and resources, and dealing with defaulted borrowers isn’t easy. However, it can also be very profitable.

Asset class

Under this category, the mortgage note is classified according to its underlying asset class. The asset class refers to the type of real estate used as a mortgage when borrowing the loan. It could be commercial real estate or residential real estate notes. Commercial real estate can be further broken down into malls, industrial buildings, etc., while residential includes townhomes, apartment complexes, single-family homes, multi-family houses.

Type

Under type, mortgage loans are classified under several subcategories. They include:

Secured loans

These are collateralized loans that are tied to tangible assets. In this case, the actual investment is a real estate property. If the borrower defaults paying the loan, the lender is obligated by the law to take legal action and gain the title of the asset property or the real estate. By doing so, ownership of the real estate is transferred from the borrower to the lender. If you had mortgaged your house to borrow money from the bank, the bank takes ownership of the property and may sell it off when you fail to pay back the loan.

Unsecured loans

It is advisable to avoid unsecured notes even if they offer a very high-interest rate. Because when the borrower defaults, you have no collateral to seize.

Private loan

Under this category, the mortgage is created by an individual instead of a financial institution like a bank. It means that instead of borrowing money from the bank, you borrowed the lump sum from a private lender, a colleague, family member, or friend. Although the personal loan may be from someone you know, it will still have a mortgage note. However, such documents are not as heavily regulated as the mortgage notes from financial institutions. Hard money lenders typically are involved with private notes.

Institutional loan

An institutional loan simply means that it was lent to the borrower by an institution. It could be a bank or any other type of institution. Unlike private loans, the underwriting of institutional loans has strict guidelines and laws. After the housing bubble, all institutions must comply with the CFTC Dodd-Frank Act and Consumer Financial Protection Bureau (CFPB) regulations.

All new mortgages must meet basic standards that safeguard consumers from taking on debt they cannot afford to repay under the Ability-to-Repay regulation.

- Borrower’s financial information must be supplied and confirmed.

- To pay back a loan, a borrower must have enough assets or income.

- Teaser rates should not obscure the actual cost of a mortgage.

Requirements of a Qualified Mortgage are

- There are no additional upfront points and costs.

- There are no toxic loan attributes.

- Limit on how much income may be used toward debt also known as Debt-to-Income (DTI) ratio

How to Make Money Investing in Mortgage Notes

Investing in mortgage notes, otherwise known as real estate note investing, is an innovative and safe way that investors use to make money from real estate investments. Instead of buying, selling, or owning a house, the investor buys the mortgage loan attached to the house. In the United States, mortgage notes are traded on a secondary market that is worth billions.

When a lender lends a mortgage loan to a borrower, the lender may sell the loan to an investor looking to invest in an asset that pays regular income. If the borrower makes timely payments to the mortgage, the investor is buying a performing mortgage note.

In case the borrower defaults on paying the loan, the lender can still sell the defaulted loan to an investor. Most lenders opt to sell defaulted loans, also known as nonperforming notes, to investors at a discount to avoid time-consuming and costly foreclosure proceedings.

There are several strategies that investors can use in real estate note investing.

Buy and Hold Strategy (Clipping Coupons) Or Performing Notes

The buy and hold strategy of performing notes is an investment strategy whereby the investor buys performing mortgage notes from the lender. If a borrower makes timely monthly payments of the mortgage to the lender, the investor can buy the mortgage note from the lender and receive the monthly payments from the borrower.

The payments would therefore be a source of real estate passive income to the investor.

Well-seasoned performing notes with a first lien, good collateral, and a solid borrower are considered the most stable assets. These notes will trade closer to the remaining mortgage balance, also known as unpaid principal balance (UPB) or unpaid mortgage balance since investors will pay a high price for them. You can purchase performing notes for a small discount (5-10%) off the remaining mortgage balance.

Buy Non-Performing Notes and Resell “As-Is”

Investors can also buy discounted nonperforming notes from lenders. If the borrower defaults payment, banks and financial lending institutions will often avoid time, effort, resources, and risk by selling the mortgage note at a low price to an interested investor.

Investors make money by buying the discounted notes in bulk from lenders and then reselling the discounted notes to other individual investors “as-is.”

Reasons for the real estate note trading at a significant discount to the unpaid mortgage balance include

- Your current lender may need immediate cash.

- The borrower is in default (a nonperforming loan).

- Uncooperative borrower not responding to the lender.

- Questionable assets (the quality of the property has most likely deteriorated since the loan was approved)

- There are additional liens on the property (the borrower has fallen into a debt trap).

- Property taxes, HOA dues, Federal taxes are overdue (since they are a higher priority to even the first lien; the 1st position mortgage note would now trade at a discount)

If your Real estate note investing strategy involves nonperforming notes, be sure to do your homework and discover why it is sold at a discount: the greater the deal, the more significant the issue.

Note Rehab Strategy for Nonperforming Notes

Sometimes the investors might themselves rehab the nonperforming note before selling to other investors.

Rehabbing a mortgage note refers to adjusting the terms of the loan with the borrower. Just as an investor in real estate would rehabilitate an old house by fixing it, a mortgage note investor will revise the broken terms of loan repayment with the borrower. It could be extending the time needed to pay the loan, lowering the monthly payments, or a combination.

If the borrower agrees to the new terms and conditions, they will make regular payments, and the loan will become a performing note. The investor will then gain from the monthly payments that the borrower will pay.

Let us look at an example of how to rehab a nonperforming real estate note.

The lender has a note against a property valued at $1,200,000, with the borrower making $4,000 monthly mortgage payments and the mortgage balance of $1,000,000. Automation resulted in robots taking his job. The borrower can’t make the monthly payment, and now the note is nonperforming.

As an investor, you buy the note from the bank at a 30% discount on the remaining mortgage balance. Now you have purchased the mortgage note for $700,000 (30% discount).

Because you have purchased the note at a discount; you can afford to go back to the borrower and ask him to pay you $3,000 a month instead of $4,000

You also decide to extend the loan term from 15 years to 30 years, further lowering the monthly payment to $2,400 and extending the loan’s maturity.

The term refers to the amount of time it would take for the entire balance of the mortgage note to become due, while maturity refers to the specific due date of the mortgage note.

The borrower will pay more interest over the life of the loan, but now his monthly payments are lower since the repayment period is doubled. Most cash-out refinancing strategies generally rely on a similar idea of extending the loan term if the underlying asset hasn’t appreciated significantly.

Refinancing changes the amortization schedule, which defines how the loan will be repaid over time, including the principal amount and interest. An amortized note consists of a monthly payment that includes a portion of the principal loan and the interest.

The amortization schedule is created such that your monthly payments are the same for the life of the loan. A higher portion of the monthly payment is used towards interest payment at the start of the loan compared to the later years.

The loan is now classified as a performing note and is collateralized against a $1.2M property. You can resell the real estate note as a performing note after rehab.

To resell a rehabbed note for the highest value, you should season it for some time before selling it. Seasoning is the amount of time a loan borrower has been making payments on a mortgage note. Note investors are more attracted to well-seasoned mortgage notes because they depict the payment history of the borrower.

Loan-to-Own Note Investment Strategy

Another way that an investor can earn from note investing is by eventually taking ownership of the real estate property. It mainly occurs with nonperforming notes. The investor may buy a nonperforming note from a lender and choose to modify the loan terms so that the borrower can afford to continue making monthly payments.

However, sometimes the borrower may reject the new terms or fail to contact the investor. If this happens, the investor would have no choice but to take ownership of the property.

After foreclosure, the lender can sell the property and recover their investment with a profit.

Lenders utilize assignments and endorsements to transfer mortgages, deeds of trust, and promissory notes from one bank to another.

Make sure you follow all the legal recording procedures while buying and selling real estate mortgage notes.

Create Your Mortgage Note

If you are a real estate investor planning to sell some of your rental properties which you own “free and clear” with no mortgage, you can create your mortgage note. Real estate investors commonly refer to it as “seller financing.”

Banks typically have strict lending guidelines, and often many borrowers may not qualify. You can set your loan terms and create your mortgage note when selling the property, so you are now the bank, and the borrower pays you the monthly mortgage.

Often, landlords who want to exit the real estate business will find that they wish to get monthly income from real estate but no longer deal with tenants or toilets. Real estate note investing in the form of creating your mortgage note could be the solution.

It is worth investing in notes depending on your strategy and the time and effort you are willing to dedicate.

How Much Does a Mortgage Note Cost?

For the price of a mortgage note to be determined, several factors need to be considered. They include:

- Interest rate

- Down payment

- Term

- Payment amount

- Credit rating of the buyer

- The payment history of the buyer’s mortgage

- Value of the mortgaged property

- Condition of the mortgaged property

- Type of the property

Before lenders hand out loans to borrowers, they always vet the borrowers first. By vetting borrowers, lenders can find out important information like the credit history and value of the mortgaged property. After considering all the factors, the value of the mortgage note is established.

Out of all these factors, the value of the mortgaged property is the most critical. Because a nonperforming note on a $1M property trading at 50% discount would still cost $500,000.

Where to Buy Mortgage Notes?

Investing in mortgage notes is a very profitable business venture, especially when you know where to buy high-quality mortgage notes. Below is a comprehensive list of platforms where you can purchase mortgage notes.

Buying Notes from Banks

Banks are a good source of performing and nonperforming mortgage notes for investors looking to buy. If you are an investor thinking about note investing, we recommend that you start building relationships at the bank. Hundreds of people borrow mortgage loans at the bank every day, so a bank will most likely sell the notes to you. Visit your local bank and find out what options they offer for buying mortgage loans.

Online Exchanges

Another platform where you can invest in mortgage notes is on online exchanges. Various online platforms connect note buyers to note sellers. The note sellers primarily consist of institutions, banks, and private investors.

In addition to dedicated note exchanges, many real estate crowdfunding platforms offer debt investing, which is the same as the “clipping coupons” strategy of mortgage note investing. I have invested in several debt deals with PeerStreet.

Become a Private Lender

Another option you can consider is lending out loans to borrowers in the same way banks do and having the borrowers list their real estate property as collateral. You will effectively become the bank from the outset, which means you get to dictate the loan agreement terms. Private lending provides flexibility to both the lender and the borrower in structuring the note meeting your objectives.

The borrower will make the monthly payments directly to you. If the borrower defaults paying the loan, you can take ownership of their property or sell their property for proceeds.

Working with Hard Money Lenders

Professional lenders who give loans to real estate investors for acquisitions and remodels are hard money lenders. They frequently utilize their assets as well as investor cash to provide loans for flipping houses. Therefore they’re constantly seeking for passive investors to collaborate with.

You may lend money to the hard money lender, who will use it to make a loan to a real estate investor. Alternatively, in some situations, you will provide the loan directly to the borrower. Hard money lenders profit by taking advantage of the difference in upfront fees and interest rates between funding sources.

Note Brokers and Hedge Funds

There are cases when an investor can come across hedge funds and note brokers offering notes (performing notes) for sale. Such notes are usually rehabbed nonperforming notes that have revised terms. As an investor, we recommend taking extreme care when buying rehabbed notes from hedge funds because their long-term sustainability may not be reliable.

Investing in Note Funds

A note fund is a corporate entity run by a fund manager who takes part in mortgage investing. Generally, the work of the fund is to raise money by selling shares. The money is then used to buy mortgages in the secondary market or is loaned out to different borrowers.

Funds are a fantastic hands-off method to get into note investing, but each fund is unique. Each has its mandate, investing in a variety of mortgages and borrowers. The fees charged by fund managers also differ significantly from one note fund to the next.

The availability and liquidity of mortgage note funds are two factors to consider. Typically, only individuals meeting the accredited investor qualifications have access to these note funds. Also, you can sell individual mortgage notes quickly if you need to liquidate them. However, shares in a note fund are often subject to stringent limitations on sale and are not traded.

Benefits of Real Estate Note Investing

If you are wondering if buying mortgage notes is a good investment, then the answer is “it depends on your overall strategy.”

Below are some of the advantages of real estate note investing

Passive Income

Unlike most of the active strategies we talked about in how to invest in real estate with little or no money, real estate mortgage note investing is truly passive income. The investor earns monthly payments without needing to deal with tenants or toilets.

Flexibility to Define Terms

When you rehab a note or create your mortgage note, you can define your own payments terms, including points that pay an upfront interest. Hard money lenders mostly use points as a way of increasing their ROI (return on investment).

Points are calculated as a percentage of the loan amount, with 1 point equaling 1% of the loan. You should combine points into total interest to get an accurate picture of the overall ROI from a note investment.

Fixed Monthly Payment

Unless you buy a balloon payment or adjustable-rate note, most mortgage notes are fixed-rate mortgage notes which provide predictable fixed income every month. You do not have the variability of monthly payment as with other real estate strategies. Increases in property taxes or monthly expenses have no impact on your cash flow.

Secured With Real Estate

Real estate note investing involves a lien against a property. Real estate investment risks do exist. In case of non-payment, you have the option to foreclose and recover your money and hence considered low risk.

No Ongoing Expenses

Besides the loan servicing company you might hire if you don’t want to deal with several notes, real estate note investing does not incur any recurring expenses. As a note investor, you can collect the monthly mortgage payments from borrowers directly.

However, if you bought several mortgage notes from lenders, it could be challenging to keep up with each borrower to collect the payments. In such a case, you can hire a loan servicing company to manage the monthly mortgage payments from borrowers on your behalf. In case of late payments, the loan servicing company has the time and resources to pursue and keep track of such borrowers.

High Yield

Note investing allows investors to make higher returns on investment because they can dictate the loan’s interest rates. The yields are higher than the ordinary low-yield bonds and superior to most stock dividends.

Fairly Liquid

Real estate notes are not as liquid as I-bonds, but since there is a large secondary market, they are considered to have sufficient liquidity generally. You cannot suddenly sell your rental property without going through the entire listing, inspection, escrow, title search, a closing process that could take weeks, if not months. On the other hand, you can sell the real estate note reasonably quickly.

Suitable for SDIRA

This investment allows investors to put their self-directed traditional IRA to good use.

When evaluating the best assets to buy, real estate note investing has a lot of favorable characteristics in terms of liquidity, availability, risk vs. return ratio.

Disadvantages of Real Estate Note Investing

There are several real estate investment risks so one should have an appropriate risk mitigation plan in place. Some of the risks associated with note investing include:

Borrower Risk

The homeowner may default on paying back the loan, which may risk the investor’s money. Unlike other fixed-income investments guaranteed by the government, mortgage notes are not insured by the FDIC (Federal Deposit Insurance Commission) or the U.S. Treasury.

Property Risk

In some cases, the borrower’s real estate property may go to auction, and the investor may lose a lot of money, primarily if the property sells for a low value.

To protect against property risk, always check for Loan to Value (LTV) and Investment to Value (ITV). The LTV is the face value of the borrowed loan as a percentage of the value of the collateral property. If the LTV is low, it indicates that the lender’s risk of incurring capital loss is low.

The ITV, on the other hand, indicates the purchase price of the real estate note as a percentage of the value of the collateral property. The lower the ITV rate, the less risk a note investor will incur if the property undergoes a foreclosure.

When buying notes at a discount, your ITV will be much lower than LTV.

Loss of Priority

Even if your real estate note is in the first position if the borrower defaults on property taxes or federal taxes or has a mechanics’ lien placed on the property, your note is now in 2nd position.

Economic impacts

Macro challenges such as the Housing bubble could cause many defaults, and the delinquency rate (measured by the STL Fed) could go higher. When buying notes, I emphasize the LTV ratio as the primary filtering criteria in my checklist to evaluate crowdfunded real estate.

Online platforms like PeerStreet, which offer real estate note investing, provide LTV and Stressed LTV, which indicate what the LTV would be if the worst-case scenario (like the housing crash) happens again. Make sure you look at both and make your investment decision accordingly. PeerStreet is for individuals satisfying the accredited investor qualifications and has a minimum investment of only $1,000.

Lengthy Legal Process

Real estate note investing in a judicial foreclosure state like New York could involve extra delay if the note becomes nonperforming and you need to foreclose. Always filter states accordingly when deciding on the best states for real estate investors.

You can avoid lengthy foreclosure by cash for keys, also known as “deed in lieu,” where you encourage a borrower to vacate a property in exchange for its deed. The benefit for the borrower is that there is no foreclosure on their record. And you get possession of your property sooner.

No Upside

You get fixed payments monthly when you invest in real estate notes unless you are actively involved with rehabbing nonperforming notes. You do not profit from the increase in property value when you hold the note. Owning rental property gives you the upside if home prices increase, but you have to deal with tenants and toilets. As with all decisions, there are trade-offs.

How to Deal with Non-Performing Notes

Even if your real estate note investing strategy doesn’t involve nonperforming notes, you must understand how to deal with them.

Your performing note could at any point turn into a nonperforming note. A great way of fixing a nonperforming mortgage note is by rehabbing it then offering the borrower new loan repayment terms and maturity. In most cases, the borrower will accept the terms because it will give them more time to pay back the loan, thereby increasing their credit score and securing their home.

After making a nonperforming note as a performing note, you can sell it to other investors who prefer to invest only in performing notes. Or you can continue to hold it in your portfolio.

How to Get Started in Note Investing

As we stated earlier, there are several sources of mortgage notes that you can get started on if you desire to invest in notes.

- You can approach your local bank and find out what options they offer to note investors.

- Additionally, you can visit online note exchange sites which match note sellers with note buyers.

- You consider investing in mortgage notes as part of more enormous note funds such as hedge funds and private equity funds.

- You could also invest in debt deals on crowdfunded sites like PeerStreet, where you own the note with several other investors.

In terms of funding sources, you can also use your retirement funds as long as it is in a Self Directed IRA. Regular brokerage firms like Vanguard, Fidelity, Schwab only let you invest in stock and bond markets. You can always rollover your IRA or 401(k) funds to Self Directed IRA providers like AltoIRA and use it for real estate note investing.

Final Thoughts On Real Estate Note Investing

As real estate prices continue to rise, real estate note investing is becoming more popular. Real estate mortgage notes let you receive a regular stream of money without the hassles of being a landlord. Mortgage notes are one of the safest investments for monthly income.

Or you may buy and sell the note later to another investor for a substantial profit. It can also be a method to acquire real estate for less than market value.

Investors are turning to alternative investments to make up for lost income, as interest rates remain at historic lows with raging inflation.

Real estate mortgage notes are a fantastic method for real estate investing without putting forth much effort beyond the initial search and purchase. However, like any investment, it’s not without its risks. Before determining if this type of investment strategy is for you, potential investors should weigh the advantages, and disadvantages of real estate note investing!

Readers, have you considered real estate note investing? If you have invested in this asset class, what was your experience?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.