7 Techniques on Raising Capital for Real Estate Projects: Step-By-Step Guide on How to raise capital

Real estate investing is unquestionably one of the most lucrative income-producing assets due to leverage. However, securing the necessary financing for a real estate project can be difficult, especially in today’s market.

Even experienced developers and real estate professionals find funding for their projects challenging. Banks are hesitant to lend money for anything other than the most established and secure ventures.

When done right, raising capital for real estate projects and investing that money in real estate investments can reap a healthy profit.

Learn the seven techniques for raising capital for real estate projects and the pros and cons. Also, explore a step-by-step guide on how to raise money.

What Is Capital Raising in Real Estate Investing?

Real estate capital raising is soliciting and securing investment capital from individuals, institutions, or other sources to finance the purchase, development, or renovation of real estate property.

One can raise capital through various methods, including private placement, crowdfunding, public offering, and joint venture.

Raising capital for real estate is vital because the advantages of real estate are amplified by using other people’s money (OPM).

A skilled real estate investor might use OPM at the start of their career when investing in real estate with little or no money. Or much later in life when they want to tackle commercial real estate investing.

Raising money, rather than using just your own money, is critical to any real estate investing, and you have to know how to pitch your project as an investment opportunity for others. It means learning the secrets to attract investors.

Thankfully, a series of techniques can be used to raise money from real estate investors meeting the accredited investor qualifications. Here is a review of the various methods used for real estate investing.

Techniques To Raise Capital for a Real Estate Investment Property

There are seven methods to raise capital for real estate investing. Depending on the real estate industry niche, you need to decide on the optimal approach for buying the investment property.

Hard Money Lenders

Hard money lending is a short-term real estate loan obtained from private investors or individuals at rates higher than traditional lenders based on the value of the property instead of the borrower’s creditworthiness. Hard money loans are the types of loans that do not come from a financial institution, like a bank or credit union.

Hard money loans are often used for real estate investing and to build investment capital. Hard money loans are a more popular and common way to raise money for investment capital.

The pros of hard money loans are

- Availability – Relatively easy to get and a common form of financing for private money as opposed to institutional funding.

- No credit history is needed. You can get a hard money loan based solely on the value of your property, no matter if you have an excellent credit score or not.

- Speed – Compared to bank loans or conventional financing, hard money loans come fast. Conventional loans can take two months, even if things go perfectly. Hard money loans may be deposited in a borrower’s bank account within a few days.

- Higher Loan To Value (LTV) – The available loan amount is usually as high as the property value.

- Payment Flexibility – Many hard money loans have highly flexible payment options.

- Deal Validation – Hard money lenders are well versed in evaluating deals because they fund many other investors and can recognize a profitable deal from a “money-pit.” If several hard money lenders decline to fund your deal, it is time to be cautious since experienced investors anticipate potential risks.

The cons of hard money loans are

- Short repayment periods – You will be expected to repay the money you borrow as quickly as six months or several years.

- Higher interest rate: Hard money loans come with much higher interest rates. The base interest rates range much higher than other forms of funding typically found in corporate finance loans, such as the Federal Housing Administration (FHA) loans.

Private Money Lenders

Private money loans are similar to hard money loans with a few minor differences. Private money loans are backed by a real estate asset and used for flipping a house, rehabbing an investment property, or raising capital for real estate purchasing.

Compared to hard money lenders who are involved with raising private money as their day job, the private lenders are “mom and pop” individuals looking for higher yield on their spare cash. With the low-interest rates on fixed-income investments, private lenders want to invest their money in the most profitable businesses backed by a specific real estate asset.

Raising private money would involve some education of other investors compared to hard money lenders who are well versed in real estate.

The best way to obtain private money is to inform your friends and family when you start raising capital to purchase the property.

Private money loans are also usually interest-only, with the loan balance being paid when a property is sold, or an investment is completed.

Self-Directed Accounts

Self-directed accounts are retirement accounts, such as an IRA, used to purchase real estate property or investments. These are typically managed by individuals or money managers. As you can imagine, these are far less common than other forms of retirement accounts, and that can make them more challenging to find.

Investors with no proven track record of successfully investing in stocks typically roll over their 401(k) or IRAs from traditional brokerages into self-directed IRAs (SDIRA). They can lend the money in SDIRA to real estate entrepreneurs to purchase commercial real estate or even investments in alternative assets like crypto IRA.

Profits generated by loaning money for commercial properties are returned to the same account and sheltered from taxes making it an effective tax strategy.

Remember to check IRS rules on retirement plan investments and validate with your CPA.

Private Placement Memorandum (PPM)

A PPM is a disclosure document that outlines the various steps for acquiring or investing in a real estate property. Many templates for a private placement memorandum are relatively common in many real estate deals.

FHA Investment Loan

The Federal Housing Administration (FHA) developed FHA loans to assist low- to moderate-income people purchase houses. If the property is the applicant’s primary residence, FHA loans may be utilized to invest.

A typical application for an FHA loan is purchasing a duplex, triplex, or fourplex and living in one unit while renting out the other. House hacking in this fashion provides privacy while permitting individuals to utilize the raised capital to start their generational wealth creation.

In addition to the traditional FHA loan, owner-occupied properties can also benefit from an FHA construction loan. The FHA construction loans allow you to combine the costs of constructing or upgrading an investment property with an FHA mortgage.

The construction loan covers land acquisition, building materials, labor, and licensing fees. The two types of FHA construction loans are FHA construction-to-permanent loans and FHA 203(k) loans.

Peer-to-Peer Loan

A peer-to-peer real estate loan, also known as a P2P loan, is a type of financing that allows borrowers to receive funding from individual investors rather than traditional financial institutions. Because there is no intermediary, P2P loans tend to have lower interest rates and fees than conventional loans.

In addition, P2P loans are often more flexible, with terms tailored to the borrower’s needs. For these reasons, P2P loans have become increasingly popular in recent years. However, it’s important to remember that not all P2P lenders are created equal.

Before taking out a P2P loan, be sure to do your research and choose a reputable lender. These are useful for investment opportunities that cannot be funded in another way and are often used as a last-possible alternative.

Crowdfunding

A relatively new phenomenon, real estate crowdfunding usually uses a third-party platform to raise money to purchase a property. In crowdfunding, many investors can invest their capital into a property which is then used to generate interest payments or income when a property is sold.

There are two main crowdfunding options based on the capital stack for those interested in crowdfunding real estate projects.

- Debt real estate crowdfunding

- Equity real estate crowdfunding

We have discussed how you can be an investor lending to others on such platforms. And how to use a checklist to evaluate real estate crowdfunding deals. In this case, you are the borrower and should use the list to make your property attractive to investors.

Platforms such as Groundfloor Lending permit real estate investors to borrow funds as part of their capital raising efforts.

The Pros of Raising Capital for Real Estate Investing

There are unquestionably many positives of raising capital. Chief among them:

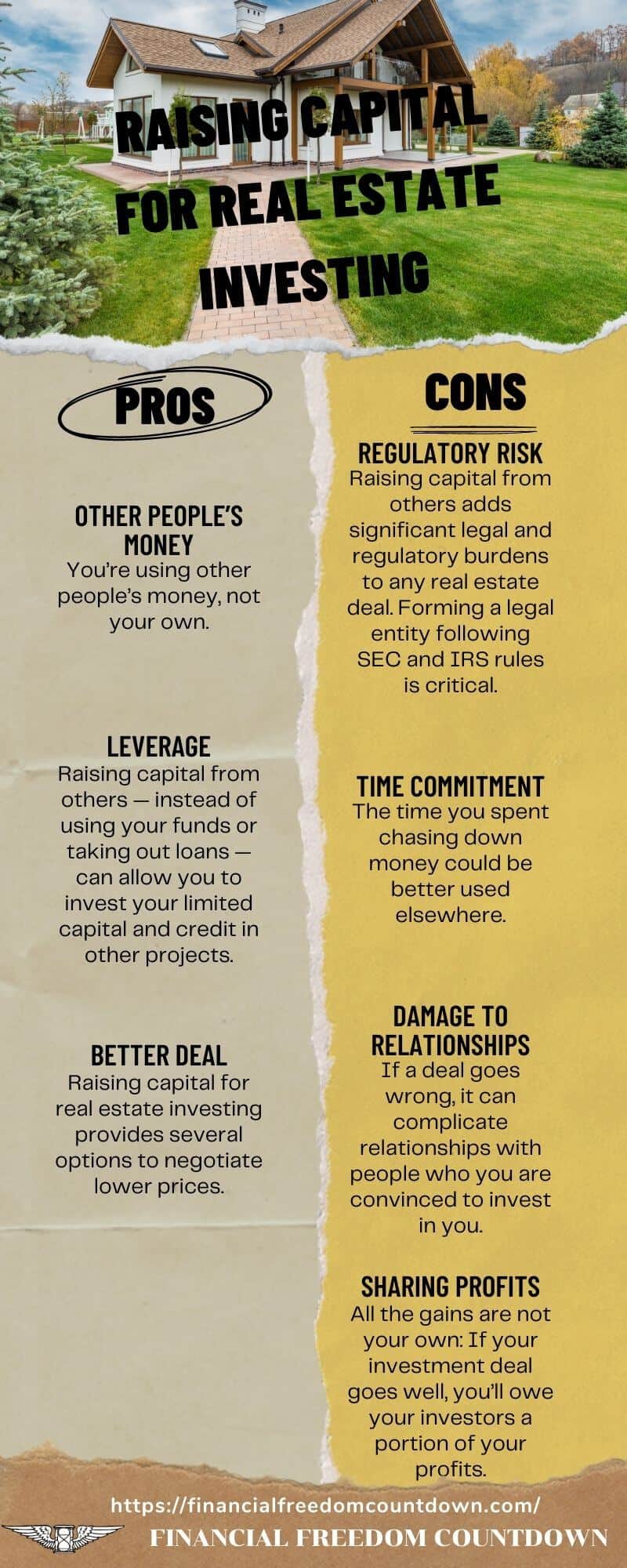

Other People’s Money

You’re using other people’s money, not your own. It can limit your risk. Furthermore, as long as you are open and transparent with your investors, they will know the risks and understand the stakes. It means that you can use other people’s money guilt-free.

Leverage

There is no question about it: Raising capital from others — instead of using your funds or taking out loans — can allow you to invest your limited capital and credit in other projects. In turn, this can allow you to generate additional passive income streams and rental income, thus potentially expanding the money you can get out of the real estate business.

Better Deal

Depending on your savviness and familiarity with the market, you can potentially set yourself up for a great deal. Raising capital for real estate investing provides several options to negotiate lower prices.

If you buy below-market rate or time your purchase right, you can achieve abnormal returns in more traditional markets. Raising capital can help you make significant purchases and improve your long-term return.

The Cons of Raising Capital for Real Estate Investing

There are several real estate investment risks so one should have an appropriate risk mitigation plan in place. No question raising capital comes with cons which include:

Regulatory Risk

Raising capital from others adds significant legal and regulatory burdens to any real estate deal. Forming a legal entity following SEC and IRS rules is critical.

Time Commitment

Furthermore, you’ll have to spend valuable and irreplaceable time working with your investors and ensuring they understand the deal and are satisfied with its current direction. Real estate investing is time-consuming – working with others to raise capital makes it even harder.

Investment capital is difficult in the real estate industry, mainly for commercial real estate investors. The time you spent chasing down money could be better used elsewhere.

Damage to Relationships

If a deal goes wrong, it can complicate relationships with people who you are convinced to invest in you. It can be particularly relevant and problematic if you are trying to raise investment capital from friends or a family member. Indeed, this is why many real estate professionals attempt to avoid raising money from friends, choosing instead to solicit other private investors.

Sharing Profits

All the gains are not your own: If your investment deal goes well, you’ll owe your investors a portion of your profits. Technically, it is not such a huge negative because it is better to have 30% of a great deal vs. 100% of no deal.

How To Raise Capital for Real Estate Investing

Okay! You’re ready to start the process of capital raising and become a successful real estate entrepreneur. It is fantastic!

However, many investors think they can begin raising and spending money. That’s not how it works. Even if you already have investors interested, remember, you’re not there yet. There are a few other things that you need to keep in mind.

The Right Mindset

Having the right mindset for capital raising means that you are prepared, patient, but ready to strike at the right moment. You must be willing to take risks but not be too aggressive with money.

It would be best to keep your eye on a particular investment that you may be interested in but not be so fixated that you lose track of other opportunities. You have to be willing to raise private capital but not spurn more traditional money opportunities.

In short, you have to be ready for anything.

Network and Create a Potential Investors List

A capital raise can come from anywhere, but it is more likely to come from a place if you have already created a potential investors list. It is essential if you struggle to find traditional lenders for your deal.

Building relationships is critical in all things in life – including capital fundraising. Raising funds with minimal debt is only possible if you work with experienced investors with a successful track record. They may be able to help to show you the ropes of a reasonable investment deal and become a successful business partner.

Don’t Wait for an Active Deal

Sometimes, you can’t wait for a big “for sale” sign regarding real estate investment. Instead, keep an eye on alternative sources of information.

Look for properties late in paying their property taxes, and see if the seller may be interested in turning their property over to you for the right price. Avoiding tax auctions could be beneficial to you and the sellers.

Try to create a deal by being proactive and reaching out to real estate investors. Accredited investors want to 1031 their existing real estate syndication and move to more critical deals. Selling ownership in their current commercial real estate would provide capital for their next venture, so it is a win-win situation for all parties.

Create a Sample Deal Package

A huge part of becoming a real estate entrepreneur is ensuring you market your investment property appropriately. You need to work with other real estate professionals who can help you put together a prospectus on the deal package.

Highlight what prospective real estate investors can expect, what the potential returns are, what the risks are, and what the mitigation plans are for if things go wrong.

Furthermore, you’ll have to create an adequate private placement memorandum (PPM) highlighting your experience and why private money lenders should give you investment capital.

Demonstrate Your Experience

One of the most important things you can do in any real estate investment opportunity is to make sure you lay out your experience. Remember, in most cases, the investors you are talking to will have ample places they can potentially put their limited funds. As such, you must position yourself as an expert, trustworthy investment.

Even if you do not have experience in real estate syndication, talk about your past deals with commercial properties. Real estate investing has different aspects, such as flipping houses, wholesaling homes, apartment investing, the BRRRR method, etc.

Demonstrate your knowledge of how to evaluate a real estate property. Private money lenders need to be comfortable trusting you with their investment capital for the real estate deals.

Define Your Team Structure

When you raise capital, potential investors want to know who is on your team.

It means you will need to lay out everyone who is working on the investment and what their various responsibilities will be. When designing a marketing piece, you should describe who is on the team, their roles, and what relevant experience they have.

Remember, the goal of defining your team structure is to give investors comfort and peace of mind that you will protect their investment.

Explain the Benefits of the Opportunity

Some of the benefits are obvious: An investor can potentially earn a return on their investment. However, there may be other benefits as well. Are there tax benefits? Long-term cash flow potential? Rental income? Charitable or community goodwill? You’ll need to lay out these benefits, financial or otherwise.

Promise Realistic Returns

“DOUBLE YOUR MONEY IN A YEAR!” may sound great, but investors are not idiots. You have to keep your return promises realistic, or an investor will laugh you off literally.

However, if you can offer greater returns than an investor expects, you should explain exactly how this will happen. If your returns compare favorably to other potential similar investments, you should note that.

Get a Great Deal

Raising capital for real estate will only be a success if you can get a great deal on the property you are purchasing, keeping your expenses and costs as low as possible.

However, there may be ways that you can structure the deal to further your return, including by obtaining favorable financing terms or structuring your mortgage in a way that best suits the investment capital you are raising.

Every deal is different, particularly if you purchase one multi-family unit or a massive commercial property. As such, get the best deal you can, and remember how any potential financing or sale will impact the capital you are attempting to raise.

Use value add real estate strategies to create additional income streams.

Update Sample Deal Package

When creating a sample deal package, there are a few things you want to keep in mind and ensure that you accurately include them in your deal.

Protect Investor Capital

At a bare minimum, you always must ensure that you adequately protect your investor capital in any real estate investment. You should also ensure that you inform your investors of how you will protect their capital and investment. It can include incorporating the following strategies:

- Adequately insure the property for at least its current value.

- A robust corporate structure – like an LLC – will ensure that creditors can’t touch personal assets in the event of a lawsuit or bankruptcy.

- Create a trust to protect assets and investors better.

- Work with local or state officials to identify any risks or specific plans that you can incorporate into an investment strategy.

Define Risks and Mitigation Plan

Again, remember: Your investors will have seen deals like yours before. They will likely be able to see through marketing gibberish and identify potential risks in your plan. They also will not trust you if you don’t do the same. As such, you have to make sure to identify any investment risks. It may include:

- Possibility of construction or rehab issues due to permits, approvals, ESG concerns, etc.

- Reasonable risks for damage or loss to the property, including potential weather-related issues.

- Inflationary increase in input cost

- Rental market variability or issues with local supply and demand.

You will be expected to reasonably state the odds of these risks and how to prepare for and mitigate them if they occur.

Be Upfront About Capital Calls

A capital call is part of an investment project when it is agreed to by all parties and may occur under certain circumstances. If the need may arise for a capital call, you should be upfront and transparent about it. Furthermore, you will need to let your investors know the maximum potential capital call and under what circumstances it may occur.

Define Deal Structure

Many potential deals, real estate fees, rental, and financing structures exist. There is not necessarily a right or wrong structure. However, it would help if you defined what funding mechanisms you will use and how this may impact any potential investors.

Financials With an Attractive Waterfall Structure

Regarding financing, a real estate waterfall equity structure means that real estate syndicators’ goals are aligned with investors. Your job is to create the proper incentives between General Partners (GP) and Limited Partners (LP) with a higher-tiered waterfall structure. It can incentivize people to protect their risks better.

Keep Investors Updated Regularly

If an investor is going to invest serious amounts of capital into your real estate project, you need to be prepared to provide them updates regularly.

There are two types of updates you should provide them with. First, on at least a quarterly basis, communicate with them. Let them know the progress of construction, renovation, or leasing. If you have a heavy investor taking on an exceptionally high share of the risk for this project, or if you don’t have a lot of investors, you may want to take more time to communicate with them more frequently.

Second, you should be prepared to inform your investors about a significant piece of good or bad news. It can include major events like completion of construction, licensure issues, etc. You will always want to ensure that your investors know about significant events within your real estate projects.

Promote Relationship Building

Say this repeatedly: If you think raising the money is the end of your relationship with an investor, you’re wasting opportunities. How much an investor likes and trusts you will not only impact this deal but will impact your ability to raise capital in the future.

Remember, the investor community is a relatively small one. They talk. And the deal you are currently putting together hopefully won’t be the last.

As such, you’ll want to do whatever you can to promote and maintain solid relationships with your investors. Stay in touch with them. Let them know your progress. And make sure they are satisfied with your job performance

.

Summary of Raising Capital for Real Estate Projects

Capital raising is the process of securing funding for real estate projects. Capital raising is essential for any real estate development, as it allows developers to cover the costs of land acquisition, construction, and other associated expenses. Without adequate funding, many real estate projects would not be possible. As a result, capital raising is a critical part of the real estate industry.

Raising capital for real estate projects can be difficult, complex, and time-consuming. Of course, raising the money necessary to pull off a real estate deal properly is not easy. If it were, everyone would be doing it! The ability to raise capital for real estate investing combines several high-income skills.

In most cases, real estate developers will work with a capital-raising firm to identify potential investors, secure funding, or undertake the capital-raising themselves. In either case, it is crucial to understand the steps involved and the various techniques used for raising money.

Raising capital for a real estate project can be a great way to gather the necessary money for a solid deal. It has many pros and cons, and it isn’t easy, but if you raise capital right, you can significantly impact the amount of money you ultimately earn.

Several factors can impact the success of a capital-raising effort, including the type of property being developed, the location of the project, and the overall strength of the real estate market. However, with careful planning and execution, real estate developers can raise the necessary capital to finance even the most ambitious projects.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.