How To Retire Early With 401(K)? Here Is How You Can Do It

You want to retire early using only your 401(k) but don’t know if it is feasible. And if it is possible, how do you retire early if all your money is in your 401(k)?

Employer-sponsored retirement accounts, such as 401(k) and 403(b), are a fantastic method to save for retirement because they are tax-deferred, and the investments in those accounts compound for decades until you need it. They also have a larger annual contribution limit than certain other tax-advantaged traditional retirement accounts, such as individual retirement account (IRA), Roth IRA, or Health Savings Account (HSA).

However, as you’ve discovered, early withdrawals from qualified retirement plans such as 401(k) before age 59.5 could result in a 10% early distribution penalty.

We’ll show you exactly how to retire early with 401(k) by accessing your retirement funds penalty-free.

At What Age Is 401(K) Withdrawal Tax Free?

Since your 401(k) contribution was tax-deductible, the 401(k) withdrawal will be taxed as ordinary income irrespective of your age. However, you can optimize your tax strategies to pay only the minimum amount of taxes required legally.

Suppose you only withdraw a limited amount every year from your retirement accounts. In that case, you can stay in the lowest tax bracket and ensure you pay the minimum or no taxes on your qualified retirement plan withdrawal. The ability to manipulate your marginal tax bracket in retirements is one of the main reasons I prefer Traditional 401(k) vs. Roth 401(k).

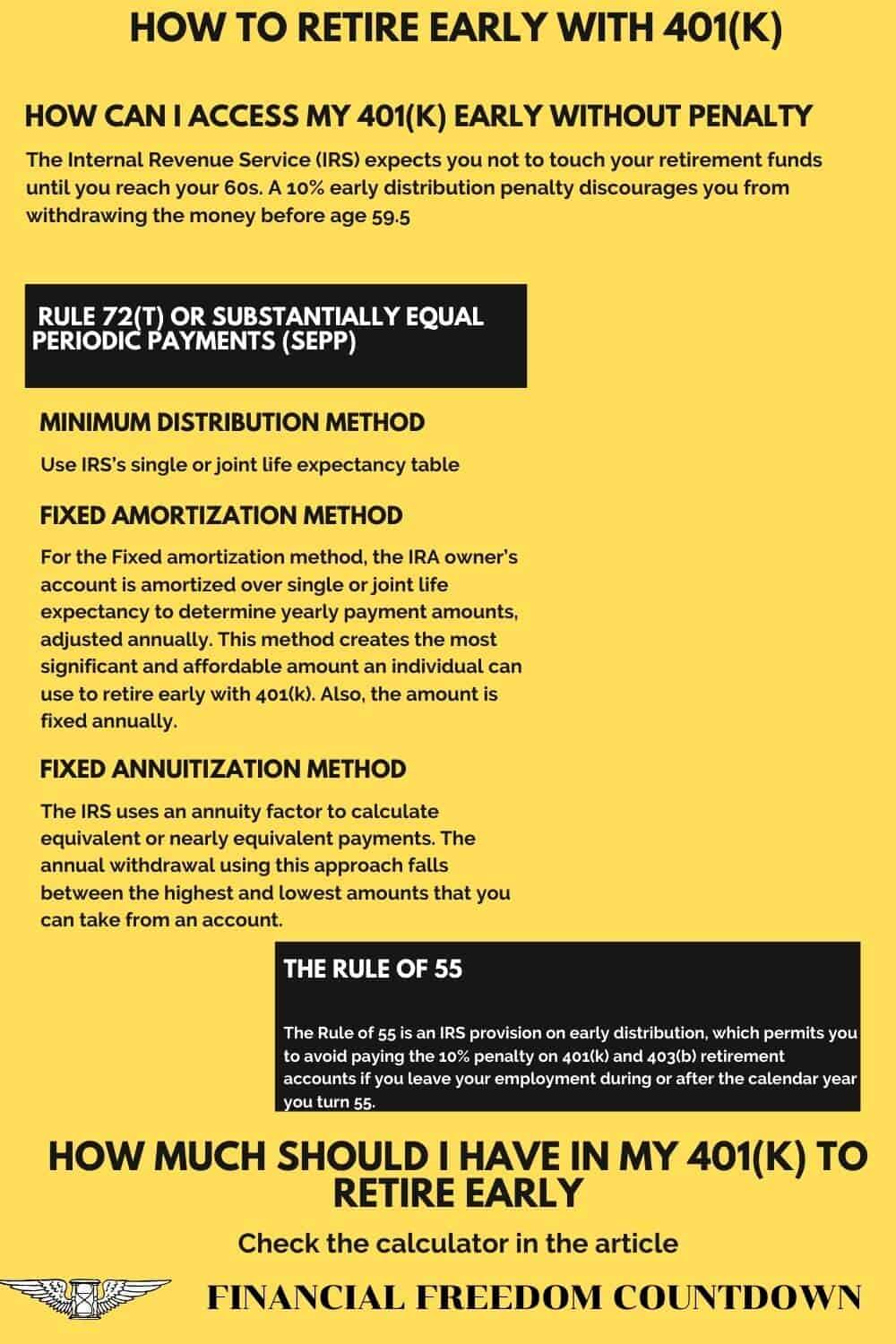

The Internal Revenue Service (IRS) expects you not to touch your retirement funds until you reach your 60s. A 10% early distribution penalty discourages you from withdrawing the money before age 59.5 and misusing the tax advantages.

How Can I Access My 401(K) Early Without Penalty?

While 59.5 is the age at which you can withdraw 401(k) penalty-free, it is possible to access your 401(k) early without penalty.

To avoid paying the 10% early withdrawal penalty, consider accessing your retirement funds using either

- Rule of 55

- Rule 72(t) or Substantially Equal Periodic Payments (SEPP)

How To Retire Early With 401(K) Using The Rule Of 55?

Retirement accounts such as 401(k) or 403(b) are designed for withdrawal only after 59.5.

The Rule of 55 is an IRS provision on early distribution, which permits you to avoid paying the 10% penalty on 401(k) and 403(b) retirement accounts if you leave your employment during or after the calendar year you turn 55.

For state public safety employees like firefighters or police officers, the Rule of 55 is applicable even earlier – at age 50.

Also, government employees can withdraw penalty-free from their 457(b) account at any age. The distribution will be taxed as regular income because, like 401(k), you made the contributions with pretax money.

Check on your company’s policy for the age 55 rule to tap into the 401(k) without early distribution penalty.

One factor to consider when using the Rule of 55 is that only the money in the 401(k) at your current job is exempt from the 10% early withdrawal penalty. If you have 401(k) from prior employers, it might be better to roll it over to your current 401(k) before you quit. This way, you can access all the money to retire early with 401k under the Rule of 55.

If you start early distributions under the Rule of 55, you are not forced into early retirement. Suppose you want to return to part-time or full-time work later. In that case, you can continue the withdrawal from your retirement account without paying the 401(k) early withdrawal penalty—as long as the withdrawals come only from that account.

How To Retire Early With 401(K) Using Rule 72(t) Or Substantially Equal Periodic Payments (SEPP)

Rule 72(t) or Substantially Equal Periodic Payments (SEPP) allows you to take penalty-free early distributions from your 401(k) and 403(b) plans and also from other tax-advantaged accounts like an IRA.

You must take at least five substantially equal periodic payments (SEPPs) to take advantage of the 72(t) rule and create an early retirement income strategy. When you take SEPPs from a 401(k), 403(b), or traditional IRA, you must pay ordinary income taxes on the payments depending on your marginal tax bracket.

The amount of the payments is determined using one of three IRS approved methods

- Required minimum distribution method

- Fixed amortization method

- Fixed annuitization method

Required Minimum Distribution Method

To determine the amount of minimum distribution method, the IRS’s single or joint life expectancy table is used to calculate the dividing factor, which is then applied to the retirement account balance . This technique is considerably different from the amortization approach in that the amount withdrawn is the lowest possible. Also, the payments vary from one year to the next.

The minimum distribution method used to retire early with 401(k) is the same as the Required Minimum Distribution (RMD) you hear about where account holders with large IRA balances are forced to take a withdrawal after age 72.

Refer to IRS Publication 590-B for the life expectancy tables to calculate the distribution amount. As per the table, a 45-year-old individual has a remaining life expectancy of only 38 years. If that statistic isn’t one of the good reasons to retire, I am not sure what is!

Fixed Amortization Method

For the Fixed amortization method, the IRA owner’s account is amortized over single or joint life expectancy to determine yearly payment amounts, adjusted annually. This method creates the most significant and affordable amount an individual can use to retire early with 401(k). Also, the amount is fixed annually.

Fixed Annuitization Method

The final withdrawal strategy per the SEPP rule is the Fixed annuitization method. The IRS uses an annuity factor to calculate equivalent or nearly equivalent payments. The annual withdrawal using this approach falls between the highest and lowest amounts that you can take from an account.

The advantage of the 72(t) method over the Rule of 55 is that there are no age restrictions, and you can do it at any age. SEPP is very popular among early retirees. The drawback of 72(t) compared to Rule of 55 is the lack of flexibility in the withdrawal amount and schedule. You need to stick to the payment schedule for five years or until you reach age 59.5, whichever comes later (unless you are disabled or die).

One way to obtain some flexibility with the 72(t) rule is to roll over the 401(k) assets into several IRAs. By splitting up your total 401(k) into many IRAs, you could apply the 72(t) to one IRA.

Although the SEPP provision lets you access your retirement accounts early, this strategy is only recommended for individuals with a substantial retirement balance. Do not treat your retirement accounts as an emergency fund.

Since the IRS rules for withdrawal are complex and harsh penalties are imposed for any withdrawal errors, consult a licensed professional to create your early retirement income strategy.

How Much Should I Have In My 401(K) To Retire Early?

Now that we know we can withdraw our 401(k) without an early withdrawal penalty using either the Rule of 55 or 72(t) rule let us figure out how much you should have in your 401(k) to achieve early retirement.

To maintain flexibility in our withdrawal options, let us go with the Rule of 55 to retire early with 401(k).

Since the IRS rules govern 401(k) plan contributions, the real question is what is the maximum I can have in my 401(k) plan by the time I turn 55.

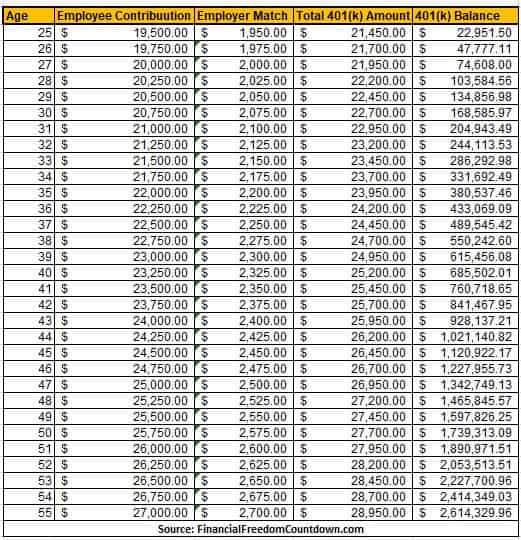

Consider Sandra, who starts working at age 25 and decides to max out her 401(k) every year. Since 401(k) contribution limits increase every other year, I assumed the future 401(k) contribution limits based on historical data. Since no one knows the exact limits in the future, we have to make some assumptions.

Also, let us assume that Sandra receives a 10% match from her employer and her 401(k) returns 7% annually.

After 30 years, Sandra now has a whopping $2.6M in her 401(k). The retirement nest egg should let Sandra retire early with 401(k).

Although the $2.6M seems like a large number, you have to remember that this amount is in future dollars 30 years from now. Using the Present value calculator and a 2% inflation rate, we arrive at the present value of $1,443,295.47

Assuming inflation averages out 2% annually, Sandra should expect to have a spending power of $1.4M in today’s dollars.

Using the 4% safe withdrawal rule, Sandra should anticipate an approximate retirement budget of $56,000 annually in today’s dollars. If Sandra can live on a monthly budget of $4,500 today, she could technically retire early with 401(k).

Please note that I am not a tax professional, certified financial advisor, or certified financial planner. Kindly consult a licensed professional for your needs.

How Much Does The Average Person Retire With?

As per the Federal Reserve Report, the median value of retirement accounts is only $65,000. Compared to how much the average person retires with, Sandra is doing exceptionally well by planning to retire with 401(k). And her nest egg is in addition to Social Security which she would receive, having worked for 30 years.

But we know that inflation is running higher than average, with the US Treasury I-Bonds yielding over 5%. And if we get started down the MMT path, we have no idea how high inflation might spike.

Besides maxing out her 401(k) contributions, Sandra can take several steps to a more comfortable retirement.

Contribute to other retirement accounts such as Traditional IRA, Roth IRA, or HSA in addition to your 401(k). Or even a taxable account.

Traditional IRAs have a smaller contribution limit than 401(k), but they have the same 401(k) advantages except for the employer match. Tax benefits of maxing out both a 401(k) and a Traditional IRA are significant. A 50-year-old individual in a 22% income tax bracket contributing $33,000 between the traditional IRA and 401(k) can reduce their tax bill by $7,260. Of course, income limits apply to a traditional IRA contribution if you have access to a 401(k).

Roth IRAs are individual retirement accounts in which you contribute post-tax dollars. Your Roth contributions grow tax-free, and you can withdraw both earnings and contributions with no taxes or penalties after age 59.5, and the account has been open for 5 years.

Individuals who retire with very large 401(k) balances also employ Roth conversion strategies since they are in lower tax brackets after retirement. However, with the 5-year waiting period, you need to plan for Roth conversions and have funds available outside of retirement accounts to live off for 5 years. By rolling over a limited amount every year, you can build a Roth conversion ladder. The advantage of the Roth conversion ladder is the flexibility in accessing your retirement funds early. The limited amount converted ensures your taxes are less due to the lower marginal tax brackets.

If you obtain your health insurance through the healthcare marketplace, be aware that Roth IRA conversions will raise your Annual Gross Income (AGI), which is likely to decrease or even eliminate your Affordable Care Act subsidies. Given that they may be worth thousands of dollars in some cases ensure you run the numbers before proceeding with Roth conversions.

Many 401(k) plans can make additional after-tax 401(k) contributions and roll it over into a Roth account, also known as Mega backdoor Roth. The after-tax 401(k) contribution option is not available in every 401(k) plan, but if you have it, definitely go for it.

If your employer offers a Deferred Contribution Plan, sign up for it as well.

As the name implies, taxable brokerage accounts consist of accounts you invest with your already taxed money. And any gains after selling are also taxed. If you have already maxed out all the tax-advantaged accounts listed above, investing in taxable accounts can be a great option to generate additional retirement income.

Taxable accounts have the most flexibility in terms of what you can invest in. Besides the regular index funds and ETFs, you can also pick individual stocks and build your moonshot portfolio. Qualified dividends provide consistent cash flow as passive income. And long-term capital gains tax rate is lower than income tax rates. And you also have the opportunity to do tax-loss harvesting, reducing your tax liability against your taxable income.

Platforms like M1Finance have low-cost index ETFs and individual stocks available for automatic investments with zero fees. You can pick a pre-built portfolio or create your own and start investing as low as $100. Read my M1Finance Review for details on how I invest for retirement.

HSA accounts provide a triple tax advantage since your HSA contributions lower your taxes, and the account grows tax-free. And you don’t pay tax on withdrawals for medical expenses. You can make HSA account contributions only when enrolled in a High Deductible Health Plan (HDHP).

If you want diversity in your investments, real estate could be another option; especially comparing the historical performance of real estate vs. stocks. The article on how to invest in real estate with little or no money has 20 different ideas.

Alternatively, if you want to invest in real estate but lack the expertise or want to avoid the hassle, you can invest in real estate crowdfunding.

Contributing to all the other accounts after maxing out your 401(k) contributions can seem overwhelming. I would suggest starting small and figuring out ways to gradually increase your savings rate.

How Do You Retire Early If All Your Money Is In Your 401(k)?

Early retirement is still possible even if all your money is in your 401(k). There are ways to access retirement funds to create an early retirement income strategy.

You can use the Rule of 55 to access your 401(k) starting at age 55 and avoid the early withdrawal penalty. Or at age 50, if you are a public safety employee like a policeman, firefighter, etc.

Although age 55 might seem far away, you are still retiring a decade earlier than the average retirement age. However, with stories of individuals retiring in their 40s or even 30s, I am sure you wonder when I can retire?.

If you do not want to wait for your 50s to retire early, you can use the 72(t) or SEPP rule to access your retirement accounts like traditional IRA, 401(k), 403(b), etc., at any age without the early distribution penalty.

Since IRS limits the annual 401(k) contribution amounts, if you want to retire early with 401(k), your retirement nest egg is dependent on your employer match and the growth of the portfolio. You might need to plan your retirement budget very carefully by examining your current expenses.

I use free tools like Personal Capital to analyze my current spending and also my future expenses. Once you link all your accounts, the software creates a budget based on your everyday spend which you can modify. You can read my Personal Capital review and how to make your retirement budget.

Besides your retirement budget, you might also need to plan for one-time expenses in your retired life. Run your numbers using several free retirement calculators to ensure you have covered all your needs and wants.

Readers, are you planning to retire early with 401(k)? Does Sandra’s plan seem feasible, or are there other ways we could optimize it further?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.