HCOL vs. LCOL Areas: Which One Is Right for You?

Deciding where to live is a big decision, and choosing between the high cost of living (HCOL) and low cost of living (LCOL) areas can be overwhelming. On the one hand, HCOL areas offer exciting urban environments with world-class amenities and job opportunities.

On the other hand, LCOL areas offer a lower cost of living, a slower pace of life, and a more relaxed lifestyle. Here’s a look at the HCOL vs. LCOL debate, including what factors lead an area to be HCOL vs. LCOL, what the benefits of each region are, and how you can make that decision.

What Is the Difference Between LCOL and HCOL Areas

HCOL stands for High Cost of Living, and LCOL stands for Low Cost of Living. These terms differentiate locations based on the average cost of living in certain areas.

Some of us are luckier than others when deciding where to live because we have more choices.

Some people choose where to live based on family location or where a job is. Others are more attracted to certain parts of the country than others, leading them to choose a new home based on the specific part of the country that they fall in love with.

However, there is no question that the cost of living in an area often leads to living location decisions. This leads to a debate between HCOL vs. LCOL areas of the country.

If given a chance, most people would default to living in a low-cost-of-living area, right?

Not so fast – it’s complicated.

You know what the acronyms stand for, but the truth is that this isn’t enough to understand what factors actually go into the cost of living in a specific area.

Cost of living refers to how expensive it is to live in a place. As you are probably well aware, living in some places is more expensive than living in others, meaning that a dollar earned in one area of the country will go further than a dollar earned in another location.

The higher cost of living diminishes your ability to save in the long term. However, to match the higher cost of living, HCOL areas typically have higher-paying jobs, while LCOL areas tend to have lower-paying ones. The ideal, of course, is to work in an HCOL area while living in an LCOL one, but that isn’t always an option.

The advent of remote work has provided opportunities for individuals with high-income skills to dictate where they can live.

What Qualifies As HCOL

What factors make an area a high-cost versus a low-cost-of-living one? As you would expect, there are many factors. High cost of living areas tends to have:

Higher Housing Prices

Indeed, this is often a chief metric of what makes an area too expensive. House prices in these areas are often highly unaffordable to the average American. At the same time, this drives up rent prices, meaning you must have a high-paying job to afford rent.

Higher Paying Jobs

These higher-paying jobs are necessary to recruit talent who can live in an area. Of course, this isn’t a bad thing at all, and when matched with the most affordable living situation possible, working in an HCOL area can unquestionably benefit an individual’s financial future.

While it is not always the cost, an HCOL area often has a hotter job market than an LCOL area. HCOL areas are often filled with high-paying jobs in hot industries, like technology and finance.

Higher Overall Living Expenses

The high cost of living in these areas is reflected in how much it costs to buy various goods, including essential products and services. Food, gas, clothing, and all essentials are more expensive in an HCOL area than in an LCOL area.

Higher Taxes

It includes income taxes, sales tax, and property tax. Indeed, there is often a direct correlation between taxes and HCOL areas.

Governments try to level the playing field for their lower-income residents. At the same time, they may also need higher taxes to generate revenue for government staff and pay for services their citizens are requesting.

Where Are the HCOL vs. LCOL Areas

First, it is essential to remember that the following are general statements in the HCOL vs. LCOL debate. There is plenty of wiggle room even within these areas, and even some HCOL cities have neighborhoods with a lower cost of living areas and vice versa.

That being said, HCOL areas tend to be located along the coast or in major cities like New York, Los Angeles, and San Francisco. These HCOL cities tend to be the most extreme when managing living costs such as housing or rent.

Of course, HCOL areas are not found exclusively on the coast, and many other cities – such as Chicago, Denver, and Austin – are also expensive.

LCOL areas tend to be more rural and isolated from other population centers.

List of LCOL States

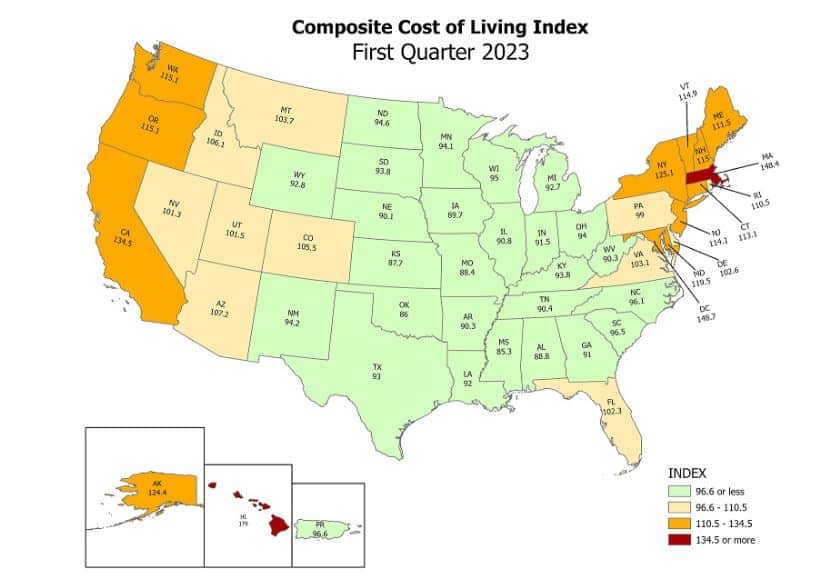

According to the 2023 Cost of Living Index designed by the Missouri Economic Research and Information Center, the five cheapest states to live in are Mississippi, Oklahoma, Kansas, Missouri, and Alabama.

All of these areas tend to be more rural and have lower populations, and living in these areas can allow you to save money.

Most of these states are also on the list of places where the government offers free land to attract residents.

| Rank | State | Index | Grocery | Housing | Utilities | Transportation | Health | Misc. |

|---|---|---|---|---|---|---|---|---|

| 1 | Mississippi | 85.3 | 97.1 | 68.6 | 86.1 | 88.6 | 97.6 | 91.0 |

| 2 | Oklahoma | 86.0 | 93.8 | 68.0 | 98.2 | 92.3 | 91.8 | 91.5 |

| 3 | Kansas | 87.7 | 96.8 | 69.4 | 107.5 | 88.3 | 97.1 | 91.9 |

| 4 | Missouri | 88.4 | 94.8 | 77.2 | 97.7 | 90.3 | 89.9 | 91.6 |

| 5 | Alabama | 88.8 | 96.4 | 70.4 | 103.6 | 92.0 | 86.9 | 96.2 |

As with anything, there is a wide array of variances within this HCOL vs. LCOL conversation. Cities tend to be more expensive to live in than rural areas.

City residents typically enjoy a higher quality of life and more public and private amenities, which tend to drive up the cost of living. As a result, urban residents often face real pressure on their wallets.

At the same time, only some things are less expensive when living in LCOL areas. Yes, many states have, on average, lower cost of living.

However, these lower living costs often paper over the actual expenses of certain metro areas within the state that may have higher prices on average.

List of HCOL States

The usual suspects of Hawaii, Massachusetts, California, New York, and Alaska top the HCOL state list.

| Rank | State | Index | Grocery | Housing | Utilities | Transportation | Health | Misc. |

|---|---|---|---|---|---|---|---|---|

| 48 | New York | 125.1 | 103.0 | 173.3 | 102.5 | 106.7 | 104.5 | 109.0 |

| 49 | California | 134.5 | 112.3 | 186.5 | 124.8 | 124.1 | 106.4 | 110.9 |

| 50 | Massachusetts | 148.4 | 105.0 | 219.5 | 126.1 | 127.5 | 112.6 | 125.8 |

| 51 | District of Columbia | 148.7 | 106.9 | 241.8 | 110.2 | 107.9 | 104.7 | 117.7 |

| 52 | Hawaii | 179.0 | 125.6 | 309.7 | 141.1 | 140.3 | 118.4 | 123.8 |

Furthermore, it is essential to remember that the HCOL vs. LCOL conversation isn’t just a conversation that should be looked at from the perspective of immediate and short-term costs.

For example, let’s say that an LCOL area has lower taxes. As a result, they have less robust government regulatory programs, enabling specific industries to pollute the air more and cause long-term health issues for residents.

If this were the case, residents may get sick and need expensive medical care, which could severely and negatively impact their health and wallet.

In other words: average household income is essential in this debate. However, it is only one consideration, and you and your family should consider more than costs when considering where to live.

Medium Cost of Living Areas

Finally, it is worth noting that there is also an MCOL, or medium cost of living area. As the name implies, medium-cost-of-living locations fall between high and low-cost regions regarding their overall cost of living.

An HCOL state could have MCOL cities. For example, Sacramento can be considered an MCOL city in the HCOL California state. Fresno is an example of an LCOL city in California.

Benefits of Living in an HCOL Area

As noted above, conversations about HCOL vs. LCOL areas often paper over critical considerations, and there are many instances where living in HCOL cities may hold real benefits – despite the high cost of living in a particular area.

Better Job Prospects

High-cost cities and states often have extremely robust economies specializing in specific sectors, like medicine, education, or technology. Living in one of these areas is a requirement if you have an educational background in particular fields and pursuing a 7 figure job.

As centers of commerce, living here may benefit networking and career advancement significantly. The gains you can see financially offset any added expenses of living in a more expensive, high-cost area, even if you have to pay more in property or income taxes.

Human capital is your biggest asset when starting your career. You should leverage it to earn the most, especially if you want high-paying jobs.

Quality of Life

Next, HCOL cities are often important centers of commerce, culture, and public life. Take big cities like New York, San Francisco, Los Angeles, Washington D.C., or Chicago. These cities are costly and have among the country’s highest real estate values, rents, and overall costs.

At the same time, they also boost significant benefits. Anyone in these high-cost-of-living areas can take advantage of public parks, libraries, museums, and more.

Living in these areas provides significant benefits unavailable in LCOL areas and may be well worth the price difference, even if it means having to endure higher living costs.

Better Facilities

Finally, these HCOL areas often have facilities that are unavailable in LCOL areas. Consider health care and education. HCOL areas tend to be among the more technologically advanced in the country.

Living in such a location may ensure that an individual has access to world-class educational opportunities and the chance to enrich and protect one’s life.

Disadvantages of HCOL Areas

As you would expect, there are extensive disadvantages to living in a high-cost-of-living area, and these disadvantages must weigh heavily on you when deciding where to locate yourself and your family.

Harder To Save Money

Living in the HCOL area can make it much harder to achieve financial independence or retire early. Early retirement means you have the resources necessary to stop working at a time of your choosing.

Living in an HCOL area means you cannot save as much money. As a result, you may be forced to work for a more extended period to deal with high home prices, taxes, and other living necessities.

Yes, it is possible to retire early with only 401(k), but rising inflation may hamper your retirement lifestyle.

Increased Income Inequality

The benefits of living in an HCOL area are often more felt by people who can afford the higher cost of living. The law of supply and demand requires that higher income will also drive costs higher, as the market can support these price increases.

While these higher costs may be absorbable by individuals making more money, they are much more challenging to manage for people who don’t have access to the same type of income as these higher-income individuals.

As a result, HCOL areas tend to promote income inequality if you do not have a high-paying job. Of course, if you are pursuing a low-stress retirement job, you could be okay in an HCOL area.

Inability To Access Benefits

The benefits of living in high-cost-of-living areas tend to be slanted towards the wealthier and people who can afford it. Living near world-class hospitals isn’t worth anything if you cannot afford access to the healthcare system. Even with excellent healthcare insurance, out-of-pocket expenses arise—one of the many reasons everyone should take advantage of the triple tax-advantaged Health Savings Accounts.

If you have a high deductible health plan, consider Lively HSA to invest. It is free and has no hidden fees. Also, Lively won’t charge you any fees to roll over or transfer your HSA to them. You can move your full or partial balance directly to Lively from your existing provider. Lively will contact your previous provider and handle the transfer on your behalf.

The public education system is another excellent example. As in many cases, the public education system of HCOL areas needs to be improved for the population.

While many public amenities are available to all – like parks and museums – they tend to be located in areas where higher-income people live. If you are lower income and do not have free time, you may find yourself out of luck.

Lower Net Worth

HCOL areas have higher housing costs. If you own your primary home, whether a starter home or a forever home, your average net worth by age is higher than your peers.

Unfortunately, your liquid net worth would be lower since you can only access some money in an emergency.

Higher Taxes

The very high cost of living in expensive cities would mean you can command a larger salary. However, federal tax brackets do not consider the cost of living. As a result, you might receive a smaller after-tax compensation compared to individuals in many LCOL cities.

Consequently, you would not have additional money to invest.

Adjusted salaries might avoid penalizing big city residents, but your salary is still an expense for the company. Someone who can work from an LCOL city will eventually replace you.

Benefits of Living in an LCOL Area

Ability To Save Money

You can save a ton of money by living in a low-cost-of-living area. Everything – from groceries to rent to taxes – will be less expensive. Indeed, this reduced cost of housing means one of two things – you can get more living space than you could in a high-cost-of-living area or save extensively on your mortgage by spending less on housing.

Lower Taxes

These advantages carry over to your taxes in some impactful ways. Sometimes, you may not even have to pay income or sales taxes. This is the case in at least a few states that do not levy such a tax. You might also have lower property taxes since home prices would be lower.

Investment Opportunities

You can save more money and potentially invest that money in other areas. For example, living in a low-cost area means redirecting money into income-producing assets or investing in retirement savings or loan repayment. You can achieve significant financial goals faster. Living in a low-cost-of-living area can dramatically impact your entire financial picture.

However, you must be willing to stomach the disadvantages of living in these circumstances.

Disadvantages of Living in an LCOL Area

Despite the apparent advantages of living in an LCOL area, you have to consider the disadvantages – and there may be several.

Loss of Career Opportunities

Living in a lower-cost area may mean more money in your pocket, but as the old expression goes, you get what you pay for. Indeed, while you may save on living expenses, you will likely lose other career advancement opportunities.

Quality of Life

The low-cost areas often have slower job markets, fewer cultural amenities, and reduced government services. Indeed, part of the reason the housing or rent is so inexpensive may be that no one wants to live in the area.

This may not only be bad for your overall quality of life but may hurt the investment you put into your home in the long run. Homes in the rust belt have appreciated less than homes in the HCOL cities.

These challenges extend well beyond the quality of life and a potential lack of lovely parks or fun museums: They may even negatively impact future generations.

For example, when moving into an area, you have to ask yourself about the quality of schools. A low cost of living may mean that the schools in a smaller city have fewer resources, rigor, and amenities than schools in higher-quality areas throughout the country.

If this is the case, you’ve got a double whammy: Your children may not be able to get as robust of an education, and your home values may decrease over time – or at least not increase as much.

You may find yourself in a situation that can best be described as penny-wise but pound-foolish: You may create a less prosperous future for your kids, hampering their generational wealth.

Kids Moving Away

Your kids might gravitate towards bigger cities for education, a higher-paying job, or a lifestyle. Consequently, you would be geographically separated from them and unable to see them as often as desired.

How To Decide Between HCOL and LCOL Areas

So, what is the best option for you and your family regarding the HCOL vs. LCOL debate? Ultimately, that is up to you. While no one wants to spend more money in an HCOL area for the same services that they could get in an LCOL area, many people find that dealing with these fixed expenses is worth it for the benefits an HCOL area offers.

Your decision ultimately comes down to various factors, including numerous financial ones.

You have to be aware of the cost of living in an area before you move into it, as well as what the benefits of an HCOL may be. Doing so will allow you to make a more informed decision about how you will seek to achieve financial independence and live the most comfortable financial life possible.

Income Potential

Is your job in one of the high-income areas? Specific high-paying jobs are tied to big cities. For example, New York is great for the financial sector, LA for the film industry, and San Francisco Bay Area for technology jobs.

Although your yearly income might not let you save money initially, your career advancement can accelerate your potential income.

Conversely, if you work at a minimum wage job, it might be better to reside in an LCOL city. Yes, minimum wages are higher in cities, but after paying higher income taxes and rent, you might not have enough money to achieve financial freedom.

Finances

To better understand the expenses associated with relocating, investigate the living expenses of the locations you’re considering. Examine the housing market in those regions to determine the availability of lodging options and reasonable pricing. Are there possible housing subsidies?

Ensure that your income is sufficient to live without struggling, and avoid living from one paycheck to another. Also, ensure that there is enough money left each month after expenses for saving or investing.

Life Events

Certain life events can have a large impact on the decision to relocate.

Young Professional

As a young professional, the decision to move to a high-cost-of-living (HCOL) or low-cost-of-living (LCOL) area can significantly impact your lifestyle and financial goals.

The benefits of living in an HCOL area include access to top-tier job opportunities, world-class cultural amenities, and an exciting urban lifestyle. However, the cost of living is much higher in these areas, meaning you may need to sacrifice living space, savings, and disposable income to make ends meet.

Conversely, LCOL areas are much more affordable, allowing you to enjoy a higher standard of living for less money. However, the job market may be less competitive, and fewer cultural amenities and entertainment options may be available.

Starting a Family

Starting a family is a significant decision, and choosing the right location to raise your children is crucial. There are pros and cons to starting a family in both HCOL and LCOL areas.

In an HCOL area, you are more likely to earn a higher income, which could provide a significant advantage if you want to send your children to private schools or cover higher education expenses. Additionally, you may have access to better healthcare facilities and a more comprehensive range of cultural and entertainment options.

However, the cost of living in an HCOL area can be extremely high, which could stress your finances, and you might need both spouses to work. In contrast, an LCOL area could offer more affordable living costs, and one partner can even stay home with the kids.

Though you may have to compromise on job availability and cultural amenities, you may be able to provide a more comfortable and financially stable life for your family. Ultimately, deciding where to start a family is subjective and depends on your priorities and preferences.

Planning for Retirement

The large number of baby boomers retiring is one of the factors influencing the list of states losing population.

Deciding where to retire can be a tough choice, as there are benefits and drawbacks to the high cost of living (HCOL) and low cost of living (LCOL) areas. On the one hand, HCOL areas have more amenities, such as cultural events and high-quality healthcare, but they can also be more expensive.

LCOL areas, on the other hand, might have lower housing costs and a slower pace of life but may not offer the same level of healthcare or cultural opportunities.

Ultimately, the decision should be based on personal preferences and financial considerations. Consider if being near loved ones or quickly traveling back for special occasions is your priority. Building an active social circle, even in retirement, is one of the significant factors in deciding when to retire.

It’s crucial to weigh the pros and cons of each option carefully before making a decision that will shape your golden years.

Personal Factors

When searching for a new place to move, make sure to check if there are activities or amenities that you’ll enjoy. While saving money is important, living in an area without things you like may not be enjoyable.

It is crucial to prioritize your happiness when choosing where to live, even though saving money is also essential. Look for a place that suits your lifestyle while providing some familiar comforts of home. While change can be good, finding a place that will make you happy is important.

Would you prefer to live in a big city with constant activity and hustle and bustle, or would you feel more comfortable in rural towns with a slower pace of life?

When choosing a new home, it is essential to consider lifestyle preferences, as they are just as important as finances, if not more, in making it feel like home.

Should You Move From HCOL to LCOL Areas or Vice-Versa

Deciding whether to move from a high-cost-of-living (HCOL) area to a low-cost-of-living (LCOL) area is a big decision and requires careful consideration. Before making the move, individuals should evaluate their financial situation and career goals.

Define Your Why

Why do you want to make the move? Do you miss your family and friends? Does the new location offer amenities you are not receiving in the current location? Would it benefit your career?

Relocation has financial and emotional cost associated with it. Having mental clarity on the reason for relocation will help you overcome challenges.

Run the Numbers

Having realistic expectations for your income and expenses in both HCOL and LCOL locations is essential. Additionally, individuals should consider the lifestyle they want and how that will be affected by either HCOL or LCOL living.

For example, if you live in the city, you might not have car expenses due to the excellent public transportation. But in a rural LCOL city, you should consider the total cost of car ownership. Yes, you can save money on gas as part of your budget, but you must consider car payments and insurance.

If you do not have an existing budget, sign up for Personal Capital, which tracks your expenses and automatically creates a custom budget.

You can use the created budget and modify the categories based on your new location. Check out my Personal Capital Review for tips on how I use it.

Revisit Your Assumptions

If your reason for moving was to save money, and after running the numbers, you realize the expected savings won’t materialize, you might be better off staying in your current location.

Ultimately, deciding whether to move from an HCOL to an LCOL area requires careful consideration of personal finances, career goals, and lifestyle preferences. This will help to ensure that the move is successful and meets your needs for the long term.

How Can Low-Income Earners Survive in HCOL Areas

Yes, it is undoubtedly possible for low-income earners to survive in HCOL areas through frugality. Although living expenses may be higher than in LCOL areas, there are still ways to save money while living in an HCOL area.

Reduce Housing Costs

Low-income earners should consider finding a roommate or sharing accommodation costs with family members using house-hacking techniques.

Alternatively, some work in HCOL areas – and thus take advantage of the economic opportunities of living here – while driving home to their lower-cost residence. However, this is challenging.

If you are considering trying to do this in a metro area, it is essential to remember that you will be one of many attempting to find this balance in your life. This often means that roads will be crowded, and you will spend ample time sitting in traffic.

Frugal Budgeting

Additionally, taking advantage of discounts offered by local businesses and shopping around for the lowest prices can help to keep costs down.

Government Programs

Lastly, looking into government assistance programs or subsidies may be beneficial in lowering living expenses. For example, teachers in many cities of the Bay Area have subsidized housing opportunities.

With careful budgeting and research, low-income earners can survive in HCOL areas despite the higher cost of living. However, you would live paycheck to paycheck and always be stressed.

Furthermore, remember that today’s medium cost of living may not be forever. The cost of living is not static. It often changes over time, responding to market demands. If you want to live in a low-cost area but work in a high-cost one, the economy may change over time.

As such, while personal factors often come into play in deciding where to live, you also have to consider medium- and long-term questions: How likely is it that an area’s economy will change over time? How will that impact your budget and ability to reach financial independence? How will that help – or hinder – your long-term financial goals?

Is HCOL or LCOL Right for You

As this post has highlighted, individuals must weigh the pros and cons when deciding between living in an HCOL or LCOL area. In particular, when starting out with a career, beginning a family, and entering their retirement phase, both HCOL and LCOL locations offer advantages or drawbacks depending on one’s circumstances.

Therefore, evaluate all aspects carefully in determining which location is the most suitable for your present lifestyle.

It is also important to consider differences in earning potential, job market availability per area, and cost of living expenses to make an informed decision. Ultimately, knowing what works best for you is the key to successfully transitioning into any community.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.