Saving vs. Investing: What Is the Difference, and Which Is Better?

People are often unsure about what to do with their money. They know they need to save for the future but are unsure if they should invest or put their money in a savings account.

It’s tough to make the right decision regarding your personal finances. You don’t want to risk your money by investing in something that might not pan out, but you also don’t want to miss out on potential earnings by keeping all your money in a low-interest savings account.

Saving vs. investing is difficult, but it doesn’t have to be. Let us explore the similarities and differences between savings and investing. And how you can figure out which option is best for you and start progressing towards your financial goals today.

Similarities Between Saving and Investing

In financial planning, the terms saving and investing are often used interchangeably. Both savings and investments help you accumulate money for use in the future.

Instead of spending all your money immediately, you allocate your budget to keep your savings and investment money aside.

Ultimately, whether you save or invest (or both) will depend on your objectives. However, both options can play an essential role in helping you reach your long-term goals, including financial freedom.

Differences Between Saving and Investing

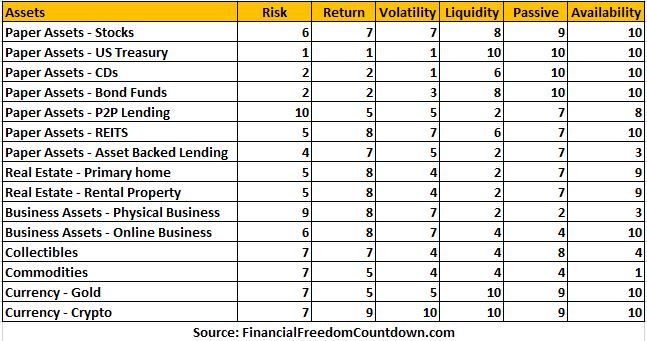

The risk level is the most significant distinction between saving vs. investing. Saving results in a lower return but comes with little to no risk. In contrast, investing enables you to earn a greater return while incurring the danger of loss.

However, there are some other essential distinctions comparing savings vs. investing.

Risk

We must understand risks before we get into saving vs. investing. When someone puts cash in a member FDIC bank, it is insured by the FDIC.

The cash put into savings in a member FDIC bank is insured for up to $250,000 per account or ownership category. That saved money is free of risk from theft, fraud, or if the financial institution should go bankrupt. Savings in a bank account carry minimal risk, especially in an FDIC-insured bank.

Similarly, the cash put into a savings account at a credit union is insured by the National Credit Union Administration (NCUA). It is also insured for amounts up to $250,000 per account.

Money saved in fixed-income investments like government bonds is protected by the full faith of the U.S. Treasury.

Investing is riskier than savings in a bank account. When a person invests, it is usually in stocks or real estate. There is a risk of losing their capital, but it is rare for someone to lose all their money by investing in stocks. It can happen if it is a penny stock or a brand new company instead of a broad-based low-cost index fund.

There is no insurance against loss when investing in the stock market due to stock prices falling. Brokerage firms are insured by the Securities Investor Protection Corporation (SIPC), which protects investors against fraud if a brokerage firm goes bankrupt.

The Securities Investor Protection Corporation insures up to $500,000 coverage for cash and securities like stocks, bonds, and mutual funds. Insurance for cash deposits is covered up to $250,000.

However, most investors lose money due to the fall in the value of the invested mutual funds and not the bankruptcy of brokerage firms.

No federal government agency covers investment and insurance products for loss of value.

Volatility

Savings are typically held in cash or cash equivalents, while investments are placed in assets that have the potential to grow in value over time. But investments can also drop in value. The significant difference in savings vs. investing is that savings do not change value significantly while assets experience volatility with changes in value.

Yes, investing in S&P 500 has shown tremendous growth over decades. But the change has been accompanied by volatility.

Return Expectations

Investors should earn a fixed and steady interest on savings accounts. When interest rates are low, bank accounts will not pay very much. Investing in stocks creates a potential for higher returns or more significant losses.

Liquidity

Savings are generally more liquid, meaning you can access them more easily. You can access the cash in savings immediately. You must sell stocks and other investments first, and then the cash is put into the account before you can get your money.

Some investments are more liquid than others. For example, investing in crypto is very liquid since crypto markets are global and operate 24*7 every day. In contrast, investing in art is not liquid. NFTs, on the other hand, can be considered more liquid than physical art, but lower adoption can make it challenging to find a buyer. Collectibles like gold and precious metals can be considered liquid, but finding a buyer when you need cash is challenging.

Real estate investing is not liquid, especially for apartment investing or real estate syndications. On the other hand, publicly-traded REITs have the same liquidity as stocks. Real estate mortgage notes are liquid and contingent on finding a quick buyer.

Objectives

A person’s objective is the most significant difference between saving and investing. Savings are for emergencies like unexpected costs and short-term financial goals. Investments are for longer-term needs.

Saving and investing is essential for building long-term wealth, but they serve different purposes. Savings are typically used for short-term goals, such as buying a new car, taking a vacation, or even making a down payment on a home.

Investments primarily focus on achieving long-term financial security, such as early retirement or funding children’s education. As such, it’s crucial to have a mix of savings and investments to reach your goals.

Inflation Protection

During high inflation, your cash value in a bank account will drop, and your purchasing power will drop if money is kept in savings. Investments are typically good financial products to protect against inflation over the long term.

Accessible

Savings instruments are easy to understand and accessible to everyone. Most investing opportunities are available to everyone. However, some alternative investments are restricted to only investors meeting the accredited investor qualifications.

| Savings | Investing | |

|---|---|---|

| Risk | None on FDIC and NCUA accounts | Varies depending on the investment |

| Volatility | Not volatile | Volatile depending on the investment |

| Return Expectations | Low | Could be higher or lower |

| Liquidity | High | Varies depending on the investment |

| Objectives | Short term goals | Long term goals |

| Inflation Protection | Only few like I-Bonds | Usually |

| Accessible | Available to anyone and easy to understand | Requires some knowledge of the investment |

What Is Saving?

Savings is the cash a person puts into a bank or a similar financial institution. That is safe from loss because it is insured by the Federal Deposit Insurance Corporation (FDIC). Other money-saving ways include certificates of deposit (CDs), money market accounts, or government bonds.

The Pros and Cons of Saving

One of the most critical personal finance decisions is whether to save or spend. Both have benefits and drawbacks, and the best decision for each person depends on their financial situation.

Saving money has several advantages:

- It provides a cushion in case of unexpected expenses or income disruptions.

- It can help you reach your long-term goals, such as retirement or buying a home.

- Saving money can give you peace of mind and financial security.

However, there are also some downsides to saving.

- If you have high-interest debt, you may be better off using your extra cash to pay down your balances rather than saving it.

- If you save too much, you may miss opportunities to invest in potentially profitable ventures.

- Finally, saving can sometimes lead to feelings of anxiety and deprivation. Saving too much money can prevent you from enjoying life in the present and lead to regrets later on. One of the most popular budgeting tools, the 50/30/20 rule, helps you balance saving and spending.

Ultimately, whether to save or spend is a personal decision. There is no right or wrong answer, but it is essential to consider all the pros and cons before deciding. You can ensure that you make the best choices for your financial future.

When To Save Money

Once someone has emergency savings safely tucked away, they can start to save for goals. Goals can be a down payment on a house, a planned vacation, paying a credit card balance, or debts, especially high-interest debt.

A financial plan is helpful when saving for financial goals. If you believe you will need the money in three or five years, you should keep the money in an account with a low risk of losing the money. Saving for short-term goals is not the time or place for investing in stocks.

If your short-term goal savings accounts are invested in stocks, the market could be in a bear market when you need the money. And if you were to sell your investments when you need them during a bear market, you will most likely sell your stocks for a loss.

The rule for savings and investing is that the shorter your time frame is to achieve financial goals, the less risk you should take. If you need the money in 20 years or more, you can take more risks because you will have time to compensate for any losses.

If you think you will need the money in a few years for specific goals or retirement is nearing, you do not want this money tied up in something risky that could lose money.

Save money for short term financial goals

- Emergency Fund

- Credit Card Debt

- Monthly Bills

- Wedding

- Dream Vacation

How To Save Money

Everyone should have a savings account before they start investing. To begin with, everyone needs an emergency fund to be ready for unforeseen future events. A rule of thumb is that an emergency fund should have enough money for three to six months of living expenses or a similar time frame shortly.

An emergency fund should be held in an FDIC savings account that can be gotten to immediately. You can have other types of savings in accounts like:

- Certificates of deposit

- Money markets

- U.S. Treasury bonds

Money from a money market account is the easiest to liquidate if you need the money. Certificates of Deposit usually carry a penalty if you cash them in before they mature.

If U.S. Treasury bonds are cashed before the maturity date, an investor could lose some of their principle, depending on the bond market. These investments are best for a savings account because they are virtually risk-free and backed by the United States government. And they usually pay better interest than savings accounts at a bank currently pay.

Most of these investment options are pegged to the current interest rate. But other U.S. Treasuries, like the I-Bond, are pegged to inflation and can pay a much better interest rate.

What Is Investing?

When it comes to investing, there are several important factors to consider. One of the most important is your goals.

Are you looking to grow your wealth over the long term, or are you more interested in generating income in the short term?

Another critical factor is your risk tolerance. How much are you willing to lose in pursuit of potential gains?

Once you understand your goals and risk tolerance, you can start to create your asset allocation plan.

You can determine your asset location plan to shelter various income-producing assets depending on your tax strategy. Multiple options are available, from stocks and bonds to real estate and collectibles. Each has risks and rewards, so you must do your homework before making any decisions.

Ultimately, the best way to approach investing is to diversify your portfolio and stay disciplined with your strategy. These steps can help minimize your risk while allowing you to achieve your goals.

Investing should not be confused with savings. A savings account should not have any risk of principle loss with it. Investing carries the risk of the loss of money. Some investments are riskier than other types of investments.

The Pros and Cons of Investing

After carefully considering the risks and rewards involved, one should make any decision to invest in property, stocks, or alternative investments.

On the plus side, investing can provide a way to grow your wealth over time, giving you the potential to achieve financial independence. It can also offer greater control over your finances than relying on savings alone.

However, it’s important to remember that investment markets can be volatile, and your capital is at risk of loss.

Before making investment decisions, seeking professional advice and understanding the risks is essential.

When To Invest Money

Invest money for long term financial goals

- Retirement Planning

- Saving for a College Education

How To Invest Money

Investing With Stocks

Stocks are one of the best investment vehicles to accumulate money. The most common form of investing is the 401(k) retirement account. Putting money into a 401(k) account can be done automatically from your paycheck.

Many employers will match a percentage of what you put into your 401(k) plan. If an employer does offer a matching program, everyone should take full advantage of this free money. Yes, it is possible to retire early with 401(k).

If you do not have access to 401(k) at work or desire more outstanding investment options in your retirement accounts, you can open a traditional IRA or Roth IRA. Investors can also buy bitcoin in retirement using a crypto IRA account, depending on their risk profile.

There are also individual retirement accounts for the self-employed known as SEP IRAs.

529 plans are a great place to save for a college fund.

There are mutual funds and ETFs for all sorts of market categories that investors can choose from, including:

- Income paying, which focuses on good dividend-paying stocks

- Growth stocks, including moonshot stocks

- Value stocks

- Sector funds allow an investor to invest in one of the major market sectors, like technology, health, energy, or even ESG funds

- Market index funds allow investors to invest in a primary market index like the Dow Jones Industrial Average, the S&P 500, the Nasdaq, or numerous other indexes

- Retirement or target funds that will tailor investments to meet an investors strategy towards retirement targeted for a specific year

- Closed-end funds

Stocks, mutual funds, and ETFs usually pay a dividend that can be reinvested or put into a money market account or some other account.

Investing With Bonds

Investing in highly rated corporate bonds is usually safer than stocks and will pay interest. The difference between stocks and bonds is that you are buying a piece of the company when buying a stock. When you buy a bond, you are loaning the company money.

Investors can buy bonds from companies, cities, states, and the U.S. government. Bonds are rated from investment grade down to junk status. The lower the quality, the more risk there is for the bond to default, but the higher the interest.

Investing With Real Estate

There are many ways to invest in real estate. Some active methods are flipping houses, wholesaling homes, and the BRRRR strategy.

Or you could use real estate passive income strategies such as turnkey property, triple net lease, mobile homes, REITs, Hard money lending, farmland investing, and real estate crowdfunding.

Using crowdfunded real estate platforms like Fundrise, you can start investing in real estate with a minimum of $100.

Don’t let the lack of funding hold you back. There are several ways to invest in real estate with little or no money.

Final Thoughts on Saving or Investing

Prudent wealth management can help you create generational wealth over the long term. Everyone has a different financial situation, and a person’s investment objectives will dictate how much capital should go towards savings and how much towards investment.

One difference between investment and savings is that savings should be kept in accounts with a low risk of loss. Investments will have a higher risk of loss. The closer a person is to retirement, the less risky the investment should be. Personal circumstances can also dictate when to move investments to less risky holdings.

One of the primary key takeaways is that saving money is relatively straightforward. Investing takes more thought, and getting investment advice is helpful. When you buy investments, seek financial advisors that will help you make the right investment choices since they specialize in wealth management.

Everyone has their own goals based on their current financial position and hopes for their financial future, and their investment decisions will be based on those factors.

The time frame in which a person will need their cash will dictate their financial decisions if they should put the accumulated money into savings or investments. The cash put into member FDIC banks is protected from loss from fraud or bankruptcy. And cash put in a credit union is protected by the National Credit Union Administration from similar losses.

Stock investments in brokerage firms are insured by SIPC against fraud, and if a brokerage firm fails . Always know where you are putting your investment dollars when making financial decisions.

When deciding which type of investments to put your hard-earned money into, remember that past performance is not a good indicator of future price movements. Before investing your saved money, understand what you are investing in.

Investing money in long term investments that produce cash flow and appreciation could be considered both saving and investing because you get both capital and the possibility of growth. Examples of investing saving hybrid opportunities are cash-flowing rental properties or dividend-paying stocks. Dividends are taxed at your ordinary-income tax rate. But when you sell a stock for a profit, you will be taxed at the capital gains tax rate.

Since savings and investment have different purposes, you should ideally pursue both. Leverage your human capital and increase your income at work. Or start an online business using your high-income skills so you can fund both savings and investing accounts.

Accumulating wealth through savings and investments is all about wealth management. Learn as much as you can, and invest wisely. Use debt wisely and avoid high-interest debt because it can rob you of your capital.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to very low minimums and fees, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.