How to Invest in the S&P 500 And What Are The Pros and Cons

Are you looking for a way to invest your money? Investing in the stock market can be intimidating, especially if you don’t know where to start.

It’s tough to know how to invest your money, and it’s even harder to figure out what stocks are worth buying. You don’t want to risk your hard-earned money on a bad investment.

It’s no secret that investing in stocks is one of the most brilliant things you can do for your future, but it’s hard to get started if you don’t know where to begin.

The S&P 500 is one of the most popular ways to invest, and for a good reason. It’s a low-risk investment that has yielded high returns and is the easiest way to invest in stocks.

If we look back at a 20-year time frame, from 2001 to 2021, there were three bear markets and three bull markets in the stock market. The bear markets were caused by black swan events that included the dot com bust, the 2001 attacks, the financial crisis of 2008, and the pandemic’s start.

Even with all those adverse events, if someone had invested $10,000 in the S&P 500 stock market index in 2001, they would have had $50,900 in two decades. The S&P 500 returned a total annual return of 8.06%, with all dividends reinvested.

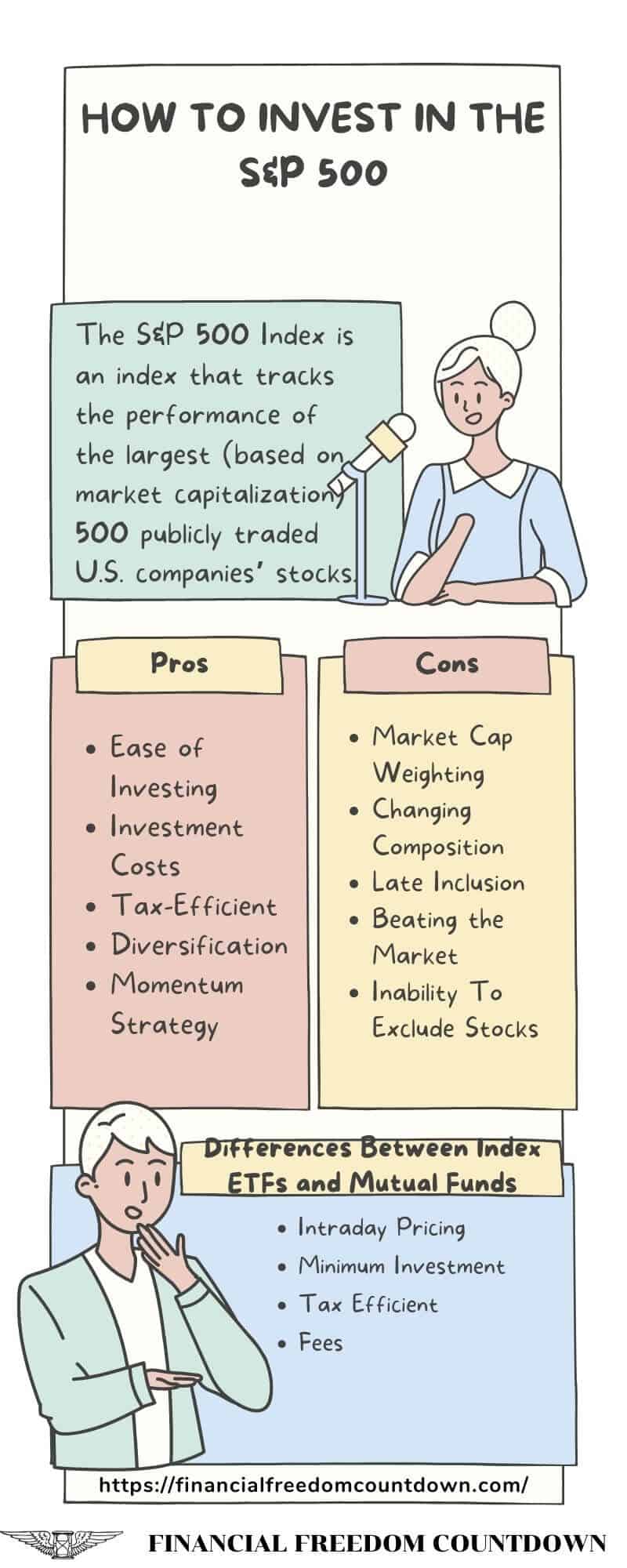

What Is the S&P 500 Index?

The S&P 500 Index is an index that tracks the performance of the largest (based on market capitalization) 500 publicly traded U.S. companies’ stocks.

The S&P500 Index includes the largest 500 companies. And when you invest in this index, you are investing in all the stocks in the index. The index consists of companies that trade on any exchanges, but it is not limited to just the New York Stock Exchange. Looking at the S&P 500 index, you will recognize many listed companies. Currently, the largest companies in the S&P 500 by index weight, not price-weighted) include:

- Apple (AAPL)

- Microsoft (MSFT)

- Amazon (AMZN)

- Tesla (TSLA)

- Alphabet Class A (GOOGL)

The S&P 500 is just a portion of the entire market of publicly traded companies. The S&P 500 index sometimes has more than 500 stocks since some companies issue more than one class of shares.

The S&P 500 Index is used to track this group of stocks and gauge how well large-company stocks are doing. This index can be invested in and traded like individual stocks are traded.

The S&P 500 index is called a benchmark index since the index gauges many other investments. For example, all stocks have what is called a Beta. The beta of a stock or fund measures its volatility compared to the benchmark.

If a stock has a beta below 1, it is considered less volatile than the S&P 500 benchmark index. If a stock or fund has a beta above 1, it is considered more volatile than the S&P 500. Volatility measures the volatility of a stock’s price movement. A low beta means that the stock will drop less than the S&P 500 index and increase less in an upmarket. A higher beta above 1 means it could go higher in a bull market than comparable stocks and drop more in a down market.

Besides the S&P 500, there are many other indexes that traders and investors watch. Most people have heard of the Dow Jones Industrial Average (DJIA or Dow) index, a large-cap stocks index of the 30 largest companies that trade publicly.

Another stock index is the NASDAQ 100, which consists of the top 100 companies that trade on the NASDAQ exchange. Other indexes cover small-cap stocks, mid-cap stocks, and a large portion of the market, like the Wilshire 2000 Index.

There are several large exchanges and many minor exchanges. The largest exchanges are the NASDAQ, the New York Stock Exchange, and the American Stock Exchange.

Legendary investor Warren Buffett has instructed his trustee to invest 90% of his money into the S&P 500 for his wife after he dies. “I just think that the best thing to do is buy 90% in S&P 500 index fund.”

Warren Buffett’s quote advocated the merits of investing in a low cost S&P 500 fund in a 2016 Berkshire Hathaway shareholder letter. Buffett said, “Over the years, I’ve often been asked for investment advice, and in the process of answering, I’ve learned a good deal about human behavior. My regular recommendation has been a low-cost S&P 500 fund.”

What Are Index Funds or ETFs?

Index funds are a basket of stocks that trade based on a particular index. Instead of buying individual shares of a company, investors can invest in index funds. Some people are afraid to invest in the stock market. Worried, they will make bad decisions and lose all of their money. Or every time the stock market goes down, they panic and wonder, “should I sell my stocks“?

Some people feel they lack the knowledge or time to pick their stocks, so they don’t bother. An index fund allows investors to participate in the stock market without picking individual stocks since the index tracks the S&P 500 benchmark.

Investing in the benchmark eliminates the worry of picking individual companies and being wrong. Investing in an index fund is also an excellent way to diversify a portfolio with a broad exposure to the markets and spread the risk among many different stocks.

Most index funds are either exchange-traded funds (ETFs) or mutual funds. And there are numerous funds that investors can choose.

How To Buy S&P 500

A common question among those when they begin investing is how to buy the S&P 500. The simple answer is to buy an index mutual fund or ETF. When an individual investor buys an index fund, they buy a basket of stocks representing the underlying index.

If a person buys a NASDAQ 100 index fund, they buy a stock basket that represents that index. And if someone buys a fund that uses the S&P 500 as the underlying index, they buy the S&P 500.

Before buying the index, an investor would open a brokerage account. To find the best brokerage accounts, look at costs, the ease of buying and selling, and other factors that you will need, like investment advice.

The brokerage firm might offer advisory or brokerage services. Most investors don’t need brokerage services or a broker’s advice to buy an index fund.

Buying an index fund is relatively straightforward since they only follow the underlying benchmark, and paying for advice is usually unnecessary.

The only advice a beginning investor might want to look at is how much the index fund’s expense ratio is, and it really should not be more than 0.10%. Investing in index funds is known as passive investing because an investor is buying an index fund, and there are no decisions to be made about which stocks to buy and sell.

However, some individual investors could use the help of financial advisors to make their financial decisions around asset allocation.

Differences Between Index ETFs and Index Mutual Funds

Intraday Pricing

ETFs are similar to mutual funds, but there are differences. The main difference is an index ETF, like all other ETFs, can be sold throughout the day as long as the market is open. The price of an ETF or an exchange-traded fund will fluctuate all day.

Like all mutual funds, an index mutual fund can be bought and sold throughout the day, but the price doesn’t fluctuate during the day. A mutual fund will change prices at the end of the day, not during the day. This difference is not very important to investors, even though it might make a difference for traders who trade in and out of funds intraday.

Minimum Investment

ETFs will usually have a lower minimum investment than index mutual funds. Some mutual funds require a minimum of $3,000 or higher to be able to buy into them. An ETF trades more like stocks, and you can buy as few shares as you want.

Tax Efficient

ETFs are usually more tax-efficient than mutual funds because of their structure. Selling an ETF is just like selling the shares of stock. When you sell an ETF, you sell it to someone who wants to buy it. The capital gains taxes on the sale are yours alone to pay.

With a mutual fund, you redeem the index fund shares from the fund or the fund manager. To pay you for your shares, the fund will sell other shares to get the cash to pay you for your sale. When the sale nets a capital gain, these net gains are passed on to all other investors who own shares in the mutual fund. Because of this, you could owe capital gains taxes at the end of the year without even selling your shares.

Taxes are usually not a significant problem with index mutual funds because they are not actively managed. Index funds are passively managed.

Actively managed funds could have this tax concern and need appropriate tax planning strategies. How this affects, you will depend on your personal financial situation.

Fees

The expense ratio is something all investors take a look at before deciding on which S&P 500 index fund to buy. Since an index fund is passively managed versus actively managed, the ratio is usually low for an index ETF and an index mutual fund. Actively managed funds will have higher expenses because they have to pay the fund managers.

The expense ratio goes towards running the fund and paying the fund manager. The expense ratio is as low as 0.02% for passively run funds, and some might even have lower expense ratios. But mutual funds can have other costs known as front-end loads and back-end loads.

The front-end load is paid upon buying the mutual fund, and the back-end load is paid when the fund is sold. And many funds do not have either of these charges and are known as no-load mutual funds.

Vanguard mutual funds are the most well-known family of no-load funds. Vanguard founder John Bogle didn’t believe in high fees and was the first to offer low-cost funds so the average investor could participate in the markets.

He was also a big believer in index funds and commission-free trading, which didn’t endear him to the rest of the industry. But most investors loved it.

Advantages of Investing in S&P 500 Index Funds

Ease of Investing

The most significant advantage of investing in an S&P 500 index fund is the ease of investing. You don’t have to spend time researching stocks, trying to figure out which will go up and which are going to go down.

You invest your money with an index fund, and the fund tracks the S&P 500. It’s that simple.

Compared to the time and effort involved with other income-producing assets, such as real estate investing or crypto investments, you can rely on index investing in providing you with all the performance benefits of stock investing.

Investment Costs

Another advantage of index funds is that investment costs are usually lower than mutual funds and other investments. Index funds are passively managed, so there are no fund managers to pay.

Additionally, many index funds have low minimum investments, and if you decide to buy the ETF version of the S&P 500, many don’t even have minimums.

Tax-Efficient

Index funds are also more tax-efficient than mutual funds. In general, holding an ETF in a taxable account will result in fewer tax obligations than having a similar mutual fund.

A mutual fund manager must sell securities to balance the fund, either accommodating shareholders’ redemptions or re-allocating assets. Even for investors who have an unrealized loss on the overall mutual fund investment, the sale of stocks within the portfolio generates capital gains for the mutual fund holders.

On the other hand, an ETF manager manages investment inflows and outflows by issuing or redeeming “creation units,” which are combinations of assets that approximate the whole ETF exposure. Consequently, the investor is not subject to capital gains on any single security in the underlying structure.

A tax advisor can help you decide if you want your investments in a taxable brokerage account or a non-taxable one based on your asset location strategy. You could also invest in the S&P 500 in your retirement accounts based on available options.

Diversification

One of the advantages of investing in S&P 500 index funds is it gives investors a broadly diversified portfolio with just one fund. With an index fund or index ETF, an investor will be investing in 500 companies and all of the different sectors. The diversification will help to limit risk.

If one sector drops, other sectors in the S&P 500 might go up, limiting the downside risk. There are 11 different sectors in the S&P 500 index. When you invest in an index fund, you invest in each sector. And it is unlikely that all 11 sectors would fall at the same time. The 11 sectors in this index are in order by weighting:

- Information technology – 28.1%

- Healthcare – 13.3%

- Consumer discretionary – 11.8%

- Financials – 11.5%

- Communication services – 9.6%

- Industrials – 8%

- Consumer staples – 6.2%

- Energy – 3.7%

- Real Estate – 2.6%

- Materials – 2.6%

- Utilities – 2.6%

Momentum Strategy

One of the S&P 500 index criticisms is that it is a market-cap-weighted index.

However, market-cap weighting is the best momentum strategy. Because a market-cap weighted index is designed to give weight to the largest corporations, its performance will be influenced by a winner-take-all phenomenon. The best-run companies get a more significant weighting in the index resulting in a self-cleaning mechanism where losers are kicked out and winners are retained.

Disadvantages of Investing in S&P 500 Index Funds

Market Cap Weighting

The S&P 500 is a market value-weighted index, which means companies are weighted in the index in proportion to their market capitalizations. A cap-weighted index values the stocks by market capitalization or total market value (the number of outstanding shares times the current market price).

Since currently, the technology firms (Apple, Microsoft, Alphabet, Amazon) have some of the largest market capitalizations, they might significantly impact the index’s performance. In other words, a dip in their price can create a significant drop in the index as a whole.

The S&P 500 had more Financials or Energy companies weighing heavily on the index in the past.

Since the global economy is moving towards automation, the S&P 500 is weighted more heavily towards information technology than the other sectors. The technology sector includes companies like:

- Apple

- Adobe Systems

- Advanced Micro Devices

- Broadcom

- Cisco Systems

- Hewlett Packard

- International Business Machines (IBM)

- Intel

- Microsoft

- Nvidia

The DJIA is a price-weighted index, not a market-cap-weighted one, such as the S&P 500.

Changing Composition

The index has changed over the years, and it will change again. Next year, certain companies currently in the technology sector like Visa, PayPal Holdings, and Mastercard will move to the financials sector.

Late Inclusion

The S&P “Index Committee” considers quantitative and qualitative criteria to determine which businesses should be included. One of the most recent controversies was regarding the addition of Tesla in Dec 2021 after Tesla reported its fourth straight quarter of profits.

The announcement sent Tesla shares higher since Tesla’s addition to the index meant that managers would be forced to buy the stock at any price to accommodate the new index composition.

Companies have been added or removed when they had smaller market caps, and Tesla was one of the few additions after the share price was already high. Many index investors felt that they were forced to buy Tesla at the peak due to the S&P index inclusion.

Beating the Market

Another disadvantage of an index fund is you can never beat the market because the index is passively managed and follows the S&P 500. On the other hand, you will not do worse than the overall market.

Finance professor Hendrik Bessembinder of Arizona State University authored the SSRN paper “Do Stocks Outperform Treasury Bills?” As per the research, only 4% of listed equities were responsible for the rest of the net gain in the U.S. stock market, from 1926 through 2015. The other 96% collectively matched one-month Treasury bills over their lifetimes.

The difficulty in finding the winning stocks convinced him to be a buy-and-hold investor with only equity index funds and fixed income investments in his portfolio.

Significantly only a few hedge fund managers like Jim Simmons and his Medallion fund have outperformed the S&P 500 over an extensive period by picking individual stocks and short-term trading.

Inability To Exclude Stocks

One other disadvantage is that an investor cannot pick and choose which stocks to own.

With the rise of ESG investing, or Socially Responsible Investing, some investors have decided not to buy certain stocks for various reasons. They may want to avoid oil companies or tobacco manufacturers. Index investing using the S&P 500 does not exclude specific stocks.

Investors can buy other such funds that invest in particular stocks that align with their beliefs.

How To Invest in the S&P 500 With ETFs

There are many great passively managed S&P 500 ETF index funds. Since they all do the same thing, most investors choose the index funds with the lowest expense ratio. But not always. Some investors will favor a certain fund company over another. Here is a list of the top S&P 500 index funds and their current expense ratios:

- SPDR S&P 500 ETF Trust (SPY) from State Street Global Advisors – 0.095% ratio

- iShares Core S&P 500 ETF (IVV) – 0.03%

- Vanguard 500 ETF (VOO) – 0.01%

It is advisable to pick the ETF with the lowest expense ratio as the performance should be similar, tracking the same index.

How To Invest in the S&P 500 With a Mutual Fund

The same thing that applies to ETFs also applies to mutual funds. You want to look at the ratios and the dividend yield they pay. Here are the three best S&P 500 mutual funds and their current yield.

- Fidelity 500 (FXAIX): 0.02% expense ratio with a $0 minimum investment that currently pays a 1.33% dividend yield

- Schwab S&P 500 Index Fund (SWPPX): 0.02% expense ratio with a $0 minimum investment paying 1.35%

- Vanguard S&P 500 Index Fund Admiral Shares (VFIAX): 0.04% expense ratio with a minimum of $3,000 and a yield of 1.45%.

The minimum amount needed to pay for some mutual funds could be different depending on if they are in a taxable or a non-taxable account like your employer’s 401(k). To help make financial decisions, you can search for S&P 500 index funds on websites like Yahoo Finance or websites with comparison tools and interactive tools that will help you find the best S&P 500 index fund. The expense ratios and dividend yields change, so refer to the respective fund prospectus for the latest numbers.

Should I Invest in the S&P 500 With Index Funds or ETFs?

Either mutual funds or ETFs would be a good choice.

There are a few reasons I prefer investing using ETFs compared to Mutual Funds

1) Expense Ratios are generally lower with an ETF than with a mutual fund.

2) The ETFs are easier to buy fractions than mutual funds and have a lower minimum investment. For example, The Vanguard mutual fund has a minimum investment of $3,000 which means you need to save before investing in stocks.

I use M1Finance, a no-fee platform that automates everything from investing to rebalancing for free. Read my M1 Finance Review to see why I prefer it over the larger brokerages such as Vanguard, Fidelity, and Schwab. Use a set-it and forget-it approach.

Summary of How To Invest in the S&P 500

Investors have to endure ups and downs and bull and bear markets. Between November 1968 and December 2020, the average bull market lasted 58 months, while the average bear market lasted 11.5 months.

An investor would have made money in the equity market during a more extended portion of this period than they would have lost money as long as they continued to invest for the long term and dollar cost average into the index. Some of these bull markets have shown tremendous growth in stock prices. Remember that past performance does not always predict future results.

Investing in the S&P 500 with ETFs and index funds gives investors good coverage of the largest publicly traded companies in all market sectors. It allows investors to invest without having to choose their stocks. There are other financial products to choose from, but index funds are easy to understand and carry less risk than an individual stock.

Investors have the choice of mutual funds and ETFs for their index portfolio. ETFs are similar to mutual funds, but ETFs might provide a slight tax advantage and have lower fees. If investors want to cover all market capitalization, they can invest in an S&P 500 index fund, small-cap funds, and mid-cap funds. These funds are based on the market cap of the stocks in the fund.

Frequently Asked Questions

Investing is not an easy process, but once you get started, it becomes easier. Investing in index funds is one of the easiest ways to get your investment portfolio started, but there are some common questions.

How Does the S&P 500 Compare to the DOW?

There are many more stocks in the S&P 500 than in the DOW. The DOW or the Dow Jones Industrial Average is an index that contains the 30 largest stocks in the market. The 30 stocks in the DOW are also in the S&P 500 index.

The main difference between the two indexes is that the S&P 500 is a float-adjusted market-cap-weighted index. In other words, the stocks in the S&P 500 are weighted based on market value instead of their stock prices.

The market cap is calculated by multiplying the stock’s price by the number of outstanding shares, adjusted for a public float. The public float is the number of shares available to the public.

They do it this way to ensure that a 10% change in a $20 stock will affect the index the same way a 10% change in a $50 stock affects it.

The Dow Jones Indices is a price-weighted index. Because of this, price changes in the higher-priced stocks will have a more significant impact on the DOW level than price changes in lower-priced stocks. The S&P 500 is more meaningful than the handful of 30 stocks on the Dow Jones Indices when watching the daily market.

Does the S&P 500 Pay Dividends?

Yes. Both the S&P 500 index funds and ETFs pay a dividend. However, the amount of dividend received would be lower compared to a dividend focused strategy such as the Dividend Aristocrats. Factor the amount of dividends if you are looking for investments for monthly income.

How Much Does It Cost to Invest in the S&P 500?

You can use M1Finance, a no-fee platform that automates everything from investing to rebalancing for free to invest in the S&P 500 for $100. Select one of the S&P 500 ETFs in your M1 Finance pie, and you are set.

The advantage of M1Finance is they allow Dividend Reinvestment Plans (DRIPS). A DRIP automatically reinvests all the money you receive from dividends. And you can also invest directly and automatically each month by having money taken from your paycheck or account and invested. Your money will accumulate over time and help you reach the goal of financial freedom.

You can read my M1 Finance Review to see why I prefer it over the larger brokerages such as Vanguard, Fidelity, and Schwab.

Is Investing in the Stock Market Risky?

The market will go up and down, but bull markets usually last longer than bear markets. Over time, the stock market is still the best way to increase your average net worth and accumulate generational wealth.

Index funds are excellent investment choices for those with a low-risk tolerance. For many investors, an index fund was their very first ETF.

The other primary asset class is real estate, and there is still a debate between investing in stocks or real estate.

Is Investing in the S&P 500 a Good Idea?

Yes. The S&P 500 is an excellent index to invest in. It gives investors broad exposure to the market and will diversify a stock portfolio. Of course, past performance is no guarantee of future performance. Any investment decision should be based on your financial goals.

Is the S&P 500 the Best Stock Market Index Fund?

It is one of many indexes and is considered the best index for large-cap companies. Another index to consider is the Nasdaq 100, which consists of the top 100 companies in the Nasdaq composite and is more technology-focused. Other indexes cover the top mid-cap companies and small-cap companies.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.