Asset Location: How to Lower Your Tax Liability

You’ve probably heard that you’re supposed to invest, but it can be hard to know where to start with so many different types of accounts.

Asset location helps lower the tax liability on your investment profits by strategically placing assets in different accounts. Asset location should not be confused with asset allocation, a mix of different types of investments held in an investment portfolio.

Learn what the different types of accounts are and what assets should be placed in which account to avoid huge tax bills and have more money for yourself.

What is Asset Location?

The distribution of assets among savings vehicles such as taxable accounts, tax-exempt accounts, tax-deferred accounts, trust accounts, variable life insurance policies, foundations, and onshore versus offshore accounts is referred to as asset location.

The primary objective of asset location is to minimize taxes. You can also achieve other goals, such as privacy, creditor protection, reduction in risk of government seizure, etc., with proper asset location.

Investors are most concerned about making money and lowering the amount they pay the government taxes. Investing isn’t just about opening an account at a brokerage firm and buying stocks, bonds, and funds. Where you keep your assets will impact your annual tax bill and the taxes you will have to pay when you start to withdraw your money.

Why is Asset Location Important?

The location of your assets will minimize taxes and increase the tax efficiency of your securities and fixed income portfolio. And this can affect how much you will earn on your investments after taxes over time and should increase your investment earnings.

The investment strategy of asset location is sorting your various investments into various types of tax-advantaged accounts.

Using all or some of these accounts could drastically reduce the taxes you will have to pay. Reduced taxes increases the amount of money you will have when you reach the time you start withdrawing your money.

You might think, why not put all investments into a tax-friendly account. The answer is that there are monetary limits as to how much you can invest in these accounts each year.

That is why it is essential to know where you should locate your assets. You don’t want to run out of monetary room in your tax-deferred and tax-exempt accounts by placing assets in them you don’t need to.

Not all of your investments have to go into tax-friendly accounts. Some of your money can go into regular taxable brokerage accounts, money market accounts, certificates of deposit or savings accounts.

Another reason for planning where to keep your investments is if you need money quickly. For example, if you lose your job or need cash quickly, you don’t want to take money out of your retirement accounts because that can incur penalties.

Tapping into your investments for quick cash is a good reason to place your more tax-efficient assets in a regular brokerage account. Tax-managed funds and stocks held for over a year are best kept in a regular brokerage account if you should need money quickly.

Various types of investments are also taxed differently. Real estate investment trusts (REITs) will be taxed differently than your stock holdings. Municipal bonds are taxed differently than stocks. A municipal bond fund can be tax-free if you live in the state where these bonds are issued. Should you keep these different investments be kept in a regular taxable account, a Roth IRA, a traditional IRA, or where exactly?

Besides tax optimization, different types of accounts also offer different levels of creditor protection.

Retirement savings, for example, are exempt from creditors under federal bankruptcy and the Employee Retirement Income Security Act (ERISA) of 1974. Although investments in 401(k) and IRAs might be treated similarly for tax purposes, they have different levels of asset protection.

Furthermore, many states provide a limited amount of home equity in a primary residence (homestead) as an exemption. Having the appropriate amount of liquid net worth in your homestead could be another asset location strategy.

Asset Location Optimization Based on Tax Treatment of Accounts

Where investors store their investments will usually be a brokerage firm. But there are several locations at a brokerage firm where you can place your assets that include:

- A taxable account like your regular brokerage account

- A tax-deferred account, like a 401(k), 403(b), annuities, or an IRA account

- A tax-exempt account, like a Roth 401(k), Roth 403(b), or a Roth IRA account

- A Health Savings Account (HSA) for individuals with a High Deductible Health Plan (HDHP)

Regular Taxable Account

No tax break on contributions and requires

1) ordinary income taxes be paid annually for ordinary dividends, interest, and short-term gains and

2) favorable capital gains tax rates to be paid on qualified dividends and long-term capital gains when assets are sold.

In a regular taxable account, you can be taxed on capital gains when you sell an investment at a profit. These investments can be stocks, bonds, exchange-traded funds (ETFs), closed-end funds, equity mutual funds, and fixed-income investments. You can also be taxed each year for the dividends you receive.

Tax-Deferred Account

In a tax-deferred account, you receive a tax break on contributions which lowers your current taxable income. Assets grow tax-free. The taxes are deferred until you make qualified withdrawals from the account. When you withdraw your money, it is taxed as ordinary income.

The benefits of a tax-deferred account for your assets are to minimize taxes when you start to withdraw your money around retirement age. Your tax bracket should be lower and raise the amount of retirement income you receive.

An investor will usually earn less money once they have retired from their job, lowering their tax bracket. The money you have been saving all of these years in a tax-deferred account will then be taxed in the lower tax bracket.

Tax-Exempt Account

A tax-exempt account like a Roth IRA or a Roth 401k account is made with after-tax dollars. Since you’ve already paid taxes on the contributions, you will not be taxed further on this money.

The best thing about a Roth is that earnings accumulate tax-free, and you can withdraw the money without paying taxes on qualified distributions. You do not get a deduction on your taxes for contributions into a Roth IRA, and you don’t report contributions on your tax returns.

Health Savings Account

Another type of tax-exempt account that an investor can take advantage of is a health savings account.

With a flexible saving account (FSA), you have to use the money in the account by the end of the year or you lose the money. Unlike FSA, a health savings account (HSA) is not a “use or lose it” type of account.

A health savings account allows you to invest your money for future medical expenses. HSA accounts are becoming more popular with employers. Some employers will even add money to your HSA account throughout the year.

Even if your employer doesn’t offer you a health savings account, you can open one for yourself at a brokerage firm or through a bank if you have a high deductible health plan. As with other forms of tax-deferred and tax-exempt plans, there are monetary limits on how much money you can place in them each year.

Your contributions to your HSA reduce your taxable income and grow tax-free. Any withdrawals you make from the HSA are also tax-free. But this money has to be used for qualified medical expenses. Because of the tax benefits, HSA accounts are triple tax-advantaged – contributions, growth, and withdrawal.

A health savings account is one more place you can take advantage of for your asset location strategy planning and lower your tax liability.

There are contribution limits to investing in the tax-advantaged accounts. Make sure you understand the dollar amount you can invest in each of these accounts. And these limits can change each year.

Investment Portfolio Asset Location Based on Types of Investments

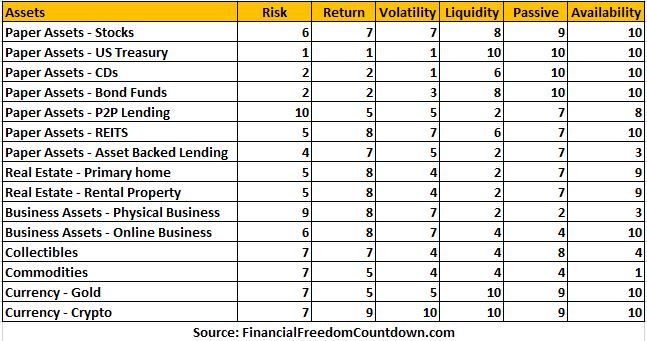

There are various types of investments like stocks, bonds, exchange-traded funds, closed-end funds, mutual funds, real estate investment trusts (REITs), etc.

They can be taxed differently, but it also depends on how long you hold an investment before selling for a gain.

Just because you have a diversified portfolio consisting of various types of investments doesn’t mean that they all have to be kept in a single type of account. Some of your holdings can be in a tax-advantaged account, and some can be held in a taxable account.

Investments that are considered the most tax-advantaged and offer the most tax benefits include:

- Individual stocks that are held longer than one year. Stocks held longer than a year has the tax advantage of being taxed at the lower capital gains tax. Anything held for less than one year is taxed at the higher short-term capital gains rate if sold for a profit. Short-term capital gains taxes will subtract from your overall gains.

- Tax-managed stock funds. These funds have to state that their goal is tax management. And it is up to the fund’s managers to abide by the stated goal.

- Stock index mutual funds and stock index exchange-traded funds are usually tax-advantaged since turnover is minimized.

- U.S. Savings Bonds, municipal bonds, and government bond funds can be tax-advantaged. If you live in the state where the municipal bonds are issued, you could receive special tax treatment and not be taxed.

- Corporate bonds offering low-interest rates don’t have any tax benefits for investors. However, due to the low amount of taxable interest generated, they can be placed in taxable accounts.

As a general rule, the following are tax-inefficient assets:

- Actively managed equity or stock funds with a high turnover rate of the underlying securities. A high turnover rate means there is a lot of buying and selling in the fund, which can generate capital gain distributions, which you will have to pay taxes on. These gains can also include short-term capital gains.

- High-interest rate individual bonds, bond funds, and other fixed-income investments, except U.S. savings bonds, and municipal bonds, generate interest payments taxed at your ordinary tax rate.

- REITs can distribute high dividends taxed at your current ordinary income tax rate.

How you divide your investments between accounts will usually depend on your overall asset allocation. Are you heavier in bonds than stocks, or do you have mainly index funds or some other mix?

Is Asset Location the Best Strategy?

Before you start switching asset locations, you should first look at your financial situation and decide if this is the best strategy for you today and in the future.

There are several criteria to look at, but the four main factors that will help you decide if this is the best investment strategy are:

This strategy should maximize after-tax returns if you are currently in a high tax rate bracket. The higher your marginal income tax rate is, the more this way of investing will help you. And your taxation rate can change several times throughout your working years.

Any time you get a wage or salary increase, you could find yourself in a higher tax bracket. Even though you might enjoy your pay increase, paying more taxes will take a bite out of your raise.

If you expect to pay a lower income tax rate in the future, this strategy will help. Many people will earn less money after retiring from their job, which will cause them to be in a lower tax bracket.

Asset locating strategies will allow you to defer paying taxes on your investment gains and lower your tax bill in the future. Anyone with a retirement plan should consider placing their assets in tax-deferred accounts—one of the primary reasons why individuals prefer 401(k) vs. real estate.

If you currently have a significant amount invested in taxable accounts, consider moving them to more tax-efficient accounts. Investments like REITs and bonds paying high interest are some of the most inefficient assets to hold in taxable accounts. These investments will benefit from being stored in a tax-deferred account.

Suppose your investment plans are for long-term and retirement. These tax strategies work best for investors over time, with long-term investing as your goal, not trading in and out of investments. You could see small advantages each year, but the real savings will be seen in the long term because the tax savings you will see each year are compounded year after year.

Factors for Implementing Asset Location in Your Own Portfolio

Asset Allocation

Define your asset allocation first. What assets are you comfortable holding and investing. Also, plan for assets you might obtain in the future.

Limit of Each Type of Accounts

Determine how much limit you have in each tax-advantaged account. There are annual limits on how much money can be contributed annually to tax-deferred accounts like 401(k), IRAs, and tax-exempt accounts like Roth IRAs. Although annual limits are small, if you have been maxing out your 401(k) every year, you have a more significant limit in your tax-deferred accounts than others who have not been maxing out these accounts.

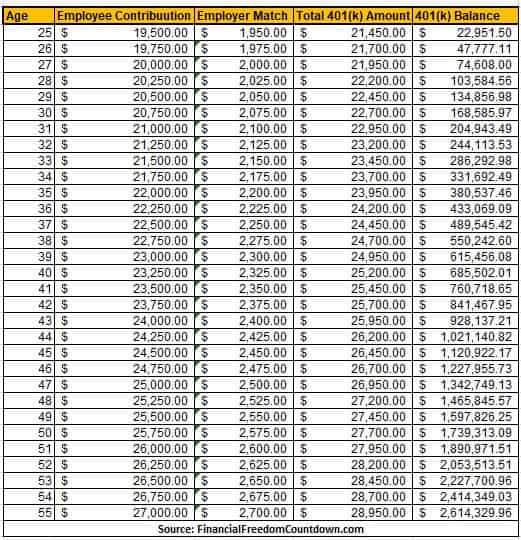

For example, Sam has maxed her accounts since she started working at age 25.

In less than four decades, she has almost $2.6 million in her 401(k)

If you do not have a high limit in your tax-advantaged account, do not despair. You can start a business and save most of the additional income in tax-advantaged accounts.

Many might gravitate towards real estate investing, but there are nuances.

IRS considers rental property investment as passive income even if you spend hours evaluating a rental property. So passive landlords can’t usually contribute to tax-advantaged accounts unless they are married to a real estate professional defined by IRS rules.

But if you are working on flipping a house or wholesaling properties, it is considered active income.

If you want a more straightforward way to generate active income, you could start a website.

Your website could be related to your day job. Or you could create one talking about your hobbies. Given the digital economy, no matter which path you pick, more and more of our world will be moving online. Automated tools make it easy to start a website in 10 minutes with zero computer programing skills. Here is my Bluehost affiliate link to get started with a monthly cost of only $2.95.

Of course, all businesses involve work compared to passive income ideas.

Tax Efficiency of Investments

Consider the tax efficiency of your various investments, and allocate them to accounts that will minimize your tax liabilities.

You can improve the overall tax efficiency of your investments by putting tax-inefficient assets in tax-deferred or tax-exempt accounts rather than taxable ones.

Bonds generate interest which is taxed as ordinary income. One school of thought is to place interest-bearing assets in tax-advantaged accounts.

Rate of Return

The same asset class can have multiple financial instruments with varied rates of return.

For example, when considering bonds, you have to make different decisions based on the rate of return.

U.S. Government and safe corporate bonds generally have low rates of return. Even I-Bonds, which now have over 8% return, only track inflation. The real return after considering inflation for I-Bonds is almost zero.

However, asset-backed bonds such as real estate mortgage notes have higher interest rates and may be candidates for tax advantaged accounts like self-directed IRA (SDIRA).

Growth Potential of Investments

Let us take a simple example of stocks and bonds. Ideally, bonds generate interest income, and from a pure tax efficiency standpoint, one might place them in tax-advantaged accounts.

But remember that tax-advantaged accounts have limited space. If you place bonds in your Roth, you have no room for stocks.

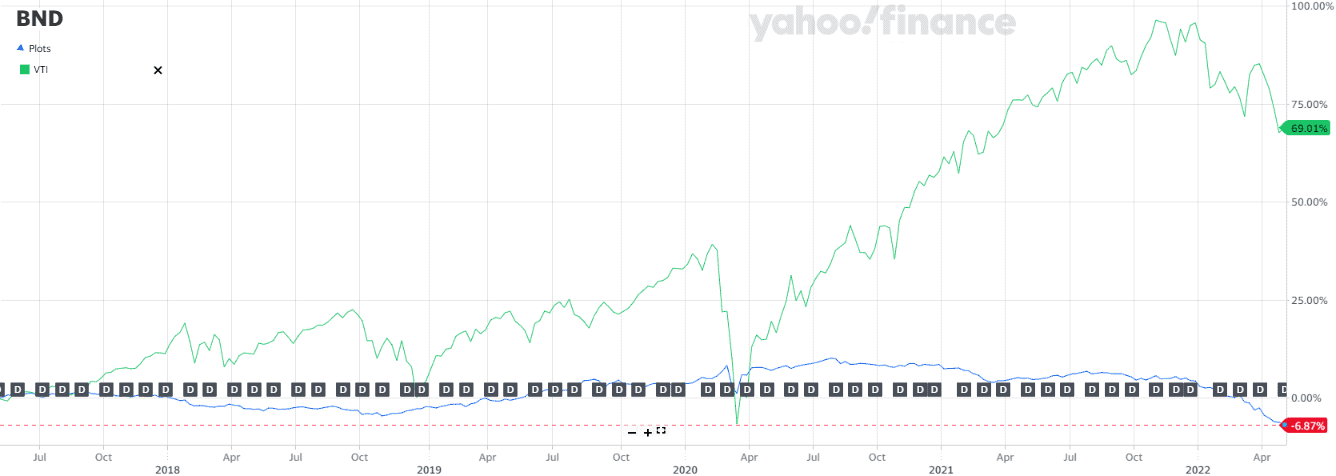

The potential for U.S. Government bond returns is lower compared to stocks. Here is a chart of $10,000 invested in BND vs. VTI for the last 5 years.

Although long-term capital gains of stock index funds are taxed favorably, would you not prefer to keep them in your Roth, so you have a higher average net worth at age 60?

The growth potential for investments is one of the considerations which drives individuals who believe in higher future prices of cryptocurrencies toward crypto IRA.

Volatility of Investments

A volatile instrument is best suited in a taxable account. If a price of an asset moves rapidly, having the asset in a taxable account enables you to do tax-loss harvesting.

With tax-loss harvesting, you sell an asset that has declined in price, book losses on your tax return, and buy another asset that is not similar to the asset just sold, avoiding the wash sale rule. For example, you could sell your Nasdaq index fund QQQ for a loss and immediately buy Vanguard Total Market fund VTI. IRS has not issued any firm guidance on what constitutes “substantially identical,” so check with your tax advisor.

Tax-loss harvesting is a great reason to invest in cryptocurrency in taxable accounts since it is a volatile asset. Also, since IRS classifies Bitcoin as property, wash sale rules currently do not apply. Congress might change the laws in the future so check with your CPA on the latest tax rules.

Foreign Stocks

If you own foreign stocks, they pay more dividends than U.S. Total Index funds to complicate matters further. But if the dividends are taxed in the home country, you could receive a foreign tax credit in the U.S. when held in taxable accounts.

However, you cannot deduct foreign taxes paid on assets held in a tax-deferred retirement account.

So one could argue that the location of foreign stocks is hard to optimize.

Determine Retirement Income Strategy

Based on what we discussed, I would place REITs in tax-advantaged accounts.

But if I learned how to retire early, should I rebalance REITs to my taxable account to provide my retirement income? Rebalancing assets in taxable accounts often triggers a taxable event. It is better to employ dollar-cost averaging to achieve the same.

REITs in my tax-advantaged accounts are perfect for my working career since I have a high tax bracket. But with lower tax brackets in retirement, should I use the REITs in taxable accounts to provide income?

Required Minimum Distribution (RMD)

Individuals who have large tax-deferred accounts and other taxable sources of income in retirement must consider the effect of RMDs. Even if you do not want the money, RMDs force you to move assets out of your tax-deferred account and into their taxable account against your will. RMDs are taxed as income. The potential increase in taxable income due to forced distribution could impact your Medicare and Social Security.

Hence while it is good to have money in tax-deferred accounts, keep an eye on it and ensure it does not get too large. One of the many reasons I advocate also investing in your taxable accounts.

Taxable accounts also provide more investment options, such as farmland investing, investing in art, real estate crowdfunding, etc. which are not easily accessible in tax-advantaged accounts. Of course, few of these investments could be restricted to individuals meeting the accredited investor qualifications but most are open to all.

Legacy Plans

Do you plan to liquidate all your assets during your lifetime, or do you have legacy plans in terms of generational wealth?

If you want to pass assets to your heirs besides creating a revocable living trust, consider which assets receive a step-up basis.

Also, with the recently passed SECURE Act, the government eliminated the Stretch-IRA rule. The balance of inherited IRAs must be disbursed within ten years of the second spouse’s death. Does it make sense to have a lot of assets in your IRA compared to your taxable account?

Most retirement calculators rely on the generic 4% safe withdrawal rate rule and fail to consider the location and types of assets involved.

Utilize a financial advisor who can help you make informed decisions about asset location and optimize the performance of your portfolio over time.

Monitor your investment portfolio regularly, and consider changing your asset location strategy as your circumstances change.

Asset location is a tool that you can use to help you minimize your tax liability and maximize the performance of your investment portfolio. By working with a financial advisor, you can ensure that your assets are best positioned to achieve your financial goals.

List of Asset Location To Enhance After-Tax Returns

As a starting point, you will want to put the most tax-advantaged assets in taxable accounts like a regular brokerage account. And it would be best if you considered putting the least tax-advantaged assets into tax-deferred accounts like your tax-exempt Roth IRA, 401(k), traditional IRA, or a deferred annuity.

With so many types of assets to invest in, it can be hard to know which location is the best, especially if you are new to this strategy. The following is a list of various asset types and if they should be kept in taxable accounts, tax-deferred accounts, or tax-exempt accounts.

Since tax advantaged accounts have limited space, first start adding the tax-inefficient assets and then move to tax-efficient assets.

| Assets | Taxable | Tax-deferred | Tax-exempt |

|---|---|---|---|

| Equities held longer than a year | Great | Neutral | Neutral |

| Index funds | Great | Neutral | Neutral |

| Tax-managed funds | Great | Neutral | Neutral |

| Equities held less than a year | Poor | Great | Great |

| Actively managed funds | Poor | Great | Great |

| Muni or low interest rate bonds | Great | Neutral | Neutral |

| High interest rate bonds | Poor | Great | Great |

| Mortgage notes | Poor | Great | Great |

| REITs | Poor | Great | Great |

| Crypto | Great | Great | Great |

| Foreign stocks | Neutral | Neutral | Neutral |

- Equity securities held one year or longer for growth are taxed at long-term capital gain rates and can be held in any account.

- Equity index funds and ETFs are taxed at long-term capital gain rates and can be kept in any account.

- Tax-managed funds should be held in a taxable account. Pay attention to the fees in managed funds.

- Municipal mutual funds and municipal bonds are usually exempt from tax, especially if you live in the state where they are issued. It would help if you held these bonds in a taxable account.

- Equity mutual funds and stock exchange-traded funds that distribute returns mainly as short-term gains should be kept in tax-deferred or tax-exempt accounts.

- Low interest yielding fully taxable bonds and bond funds, usually corporate bonds, are taxed as ordinary income. But since the interest rate is low, you can keep them in taxable.

- High interest-yielding bonds and mortgage notes should be kept in a tax-deferred or tax-exempt account.

- REITs receive different tax treatments. Most REIT dividends are taxed as ordinary income should be kept in a tax-deferred or tax-exempt account.

Make sure you take advantage of all plans available to you personally and through your employment. Even if you work for yourself or own a small business, you should look into opening a SEP IRA or Simplified Employee Pension Plan.

You will also need to keep up with the current contribution limits. If you’re over a certain age, you can add more money into these accounts to catch it up.

Final Thoughts on Asset Location

As an investor, you are always looking for a lower tax bill and higher retirement income. Asset location is about reducing your overall tax bill each year and when you start withdrawing your money based on where you locate your investments.

Asset location will help you make the most of your investments over time. By investing the tax-inefficient assets into tax-deferred and tax-exempt accounts, your money will have grown substantially more over the years than if you held it in a taxable account.

If your personal financial goal is to lower your tax liability now and in the future, knowing where to locate your various investments is the best way to increase the tax efficiency of your securities portfolio.

A financial advisor can also help you decide on the best account types for the most tax-efficient portfolio considering your risk tolerance.

Please note that these stock names are used as examples and should be considered as recommendation to buy, sell or trade. Always consult a licensed professional. Nothing in this article should be construed as tax advice. The author or Financial Freedom Countdown are not licensed professionals or investment advisors.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.